by Calculated Risk on 5/20/2013 03:37:00 PM

Monday, May 20, 2013

Existing Home Inventory is up 17.7% year-to-date on May 20th

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm tracking inventory weekly in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for March). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory increased more than the normal seasonal pattern, and finished the year up 7%. However in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

So far in 2013, inventory is up 17.7%. This is well above the peak percentage increases for 2011 and 2012 and suggests to me that inventory is near the bottom. It now seems likely - at least by this measure - that inventory bottomed early this year (it could still happen early next year).

It is important to remember that inventory is still very low, and is down 15.1% from the same week last year according to Housing Tracker. Once inventory starts to increase (more than seasonal), buyer urgency will wane, and I expect price increases to slow.

Lumber Prices decline Sharply over last month

by Calculated Risk on 5/20/2013 01:12:00 PM

Just over a month ago I mentioned that lumber prices were nearing the housing bubble highs. Since then prices have declined sharply, with prices off about 20% from the recent highs.

Some of the decline could be related to additional supply coming on the market, and some due to less buying from China (several sources are reporting that China has pulled back significantly on buying North American lumber).

On additional supply, two months ago the WSJ had an article about some producers increasing supply:

Georgia-Pacific, the largest U.S. producer of plywood ... plans to invest about $400 million over the next three years to boost softwood plywood and lumber capacity by 20%.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows two measures of lumber prices (not plywood): 1) Framing Lumber from Random Lengths through last week (via NAHB), and 2) CME framing futures.

Lumber prices are now 20% off the recent highs.

DOT: Vehicle Miles Driven decreased 1.5% in March

by Calculated Risk on 5/20/2013 10:37:00 AM

The Department of Transportation (DOT) reported:

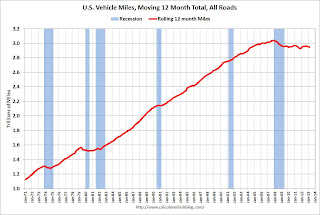

Travel on all roads and streets changed by -1.5% (-3.7 billion vehicle miles) for March 2013 as compared with March 2012. Travel for the month is estimated to be 248.8 billion vehicle miles.

The following graph shows the rolling 12 month total vehicle miles driven.

The rolling 12 month total is still mostly moving sideways.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 64 months - over 5 years - and still counting.

The second graph shows the year-over-year change from the same month in the previous year.

Gasoline prices were down in March compared to March 2012. In March 2013, gasoline averaged of $3.78 per gallon according to the EIA. In 2012, prices in March averaged $3.91 per gallon. But even with the year-over-year decline in gasoline prices, miles driven decreased.

Gasoline prices were down in March compared to March 2012. In March 2013, gasoline averaged of $3.78 per gallon according to the EIA. In 2012, prices in March averaged $3.91 per gallon. But even with the year-over-year decline in gasoline prices, miles driven decreased.This is because gasoline prices are just part of the story. The lack of growth in miles driven over the last 5 years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

With all these factors, it might take several more years before we see a new peak in miles driven.

Chicago Fed: "Economic Activity Slower in April"

by Calculated Risk on 5/20/2013 08:36:00 AM

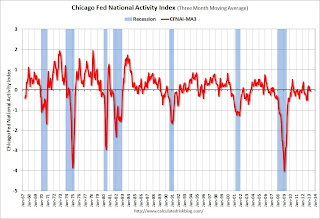

The Chicago Fed released the national activity index (a composite index of other indicators): Economic Activity Slower in April

Led by declines in production-related indicators, the Chicago Fed National Activity Index (CFNAI) decreased to –0.53 in April from –0.23 in March. Three of the four broad categories of indicators that make up the index decreased from March, and none of the categories made a positive contribution to the index in April.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, ticked up to –0.04 in April from –0.05 in March. April’s CFNAI-MA3 suggests that growth in national economic activity was very near its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity slowed in April, and growth was near the historical trend (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, May 19, 2013

Sunday Night Futures

by Calculated Risk on 5/19/2013 10:15:00 PM

Monday:

• At 8:30 AM ET, the Chicago Fed National Activity Index for April will be released. This is a composite index of other data.

Weekend:

• Schedule for Week of May 19th

The Asian markets are green tonight with the Nikkei up 1.0%, and Shanghai Composite up 0.2%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down slightly and DOW futures are down 6 (fair value).

Oil prices have moved sideways recently with WTI futures at $95.99 per barrel and Brent at $104.62 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are up 17 cents per gallon over the last two weeks to $3.67 per gallon. Based on Brent prices and the calculator at Econbrowser, I expect gasoline prices to fall soon.

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Report: Wells Fargo, JPMorgan Chase and Citigroup "nearly halt foreclosure sales"

by Calculated Risk on 5/19/2013 08:00:00 PM

From Scott Reckard at the LA Times: 3 big banks nearly halt foreclosure sales after U.S. tweaks orders

Sales of homes in foreclosure by Wells Fargo & Co., JPMorgan Chase & Co. and Citigroup Inc. ground nearly to a halt after regulators revised their orders on treatment of troubled borrowers during the 60 days before they lose their homes.This will probably be a temporary delay. Here is the new Operating standards for scheduled foreclosure sales, but I'm not sure what was changed.

The banks said they paused the sales on May 6 to make sure that their late-stage foreclosure procedures were in accordance with the guidelines.

...

"We are in the process of complying and following the directive set forth in the OCC guidance," Citigroup said.

Wells, saying the latest OCC bulletin had "slight changes from the previous," declared that it "wanted to be absolutely sure that our interpretation of the language was the same as our regulators."

Research Notes: Fiscal Drag and Upward Revisions to Q2 GDP

by Calculated Risk on 5/19/2013 11:02:00 AM

Some brief excerpts from two research notes released this week. The fiscal drag is hitting hard right now and is expected to fade towards the end of the year. Right now it looks like Q2 is tracking close to 2% GDP growth.

From economist Alec Phillips at Goldman Sachs:

Earlier this year, we expected fiscal policy to weigh on growth most heavily in Q2 and Q3, when sequestration, other federal spending reductions, and the recent tax increases looked likely to have their greatest combined effect. It now looks like the fiscal drag will be somewhat more spread out than we anticipated.From Ethan Harris at Merrill Lynch:

The main reason is the 15% (annualized) drop in federal spending in Q4, followed by the 8% drop in Q1. This reduces the amount of fiscal drag from federal spending cuts we think is still in the pipeline, though it doesn't eliminate it. The chart below shows the drag on growth ...

Click on graph for larger image.

The upshot is that the amount of fiscal drag we expect is fairly similar in Q1, Q2, and Q3. This is consistent with our current growth forecast: we expect Q1 GDP to come in slightly lower than the 2.5% advance reading, at 2.3%, while we see Q2 tracking at 2.1% and we forecast growth in Q3 of 2.0%. In Q4, when we expect the drag from fiscal policy to fade somewhat, we expect real GDP growth to pick up to 2.5% at an annual rate.

Despite significant fiscal tightening, the US economy continues to grow at a trendlike pace. Last fall we had expected growth to be weak in both 1Q and 2Q. As the better data came in, we assumed the shock was hitting with longer lags and we moved the “soft patch” to 2Q and 3Q. We argued that investors should look at two indicators for signs of weakness: soft retail sales and rising jobless claims. Instead, the “control” measure of retail sales continues to grow at about a 4% annualized pace and claims have fallen.

This week we are “marking to market” our 2Q forecast: we now see growth of 1.8%, up from 1.3% and roughly in line with the consensus. We have not changed our forecast for coming quarters. The economy has shown a lot more resilience than we had thought, but the full impact of the fiscal shock has not arrived yet and some kind of soft patch still appears likely.

Saturday, May 18, 2013

Unofficial Problem Bank list declines to 770 Institutions

by Calculated Risk on 5/18/2013 03:51:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for May 17, 2013.

Changes and comments from surferdude808:

As anticipated, the OCC released its enforcement action activity through mid-April 2013 this Friday. What we did not anticipate was an early week failed-bank closure of another Capitol Bancorp's banking subsidiaries after two were closed last Friday. Along with the failure, there were two other removals and two additions to the Unofficial Problem List this week. After changes, the list has 770 institutions with assets of $284.1 billion. A year ago, the list held 928 institutions with assets of $361.9 billion.

The OCC terminated actions against Liberty Savings Bank, F.S.B., Wilmington, OH ($552 million) and First Federal Community Bank, Paris, TX ($344 million); and issued actions against Mid-Southern Savings Bank, FSB, Salem, IN ($218 million) and Midwest Federal Savings and Loan Association of St Joseph, Saint Joseph, MO ($35 million Ticker: SJBA).

In a rare Tuesday closing, the Arizona Department of Financial Institutions shuttered Central Arizona Bank, Scottsdale, AZ ($33 million Ticker: CBCRQ). The state banking department was prevented from closing the bank last Friday because of a legal challenge by Capitol Bancorp. By Tuesday, the state banking department was able to prevail, in part, because the bank's Tier 1 leverage ratio had apparently fallen much lower than the 2.13 percent reported in the bank's March 2013 Call Report. Meanwhile in Nevada, the Nevada Department of Business and Industry's Financial Institutions Division was prevented from closing 1st Commerce Bank, North Las Vegas ($24 million) through another legal action by Capitol Bancorp. Reportedly, a preliminary hearing on the injunction stopping the closing will be held next Thursday. SNL Securities is reporting that Capitol Bancorp, in a bankruptcy filing, sold its remaining interest in Capitol National Bank, Lansing, MI ($145 million) in April 2013 with the proceeds being held in escrow until the FDIC issues a cross-guaranty liability waiver.

Bernanke: "Economic Prospects for the Long Run"

by Calculated Risk on 5/18/2013 12:47:00 PM

This is a from commencement speech today by Fed Chairman Ben Bernanke: Economic Prospects for the Long Run

Now here's a question--in fact, a key question, I imagine, from your perspective. What does the future hold for the working lives of today's graduates? The economic implications of the first two waves of innovation, from the steam engine to the Boeing 747, were enormous. These waves vastly expanded the range of available products and the efficiency with which they could be produced. Indeed, according to the best available data, output per person in the United States increased by approximately 30 times between 1700 and 1970 or so, growth that has resulted in multiple transformations of our economy and society.1 History suggests that economic prospects during the coming decades depend on whether the most recent revolution, the IT revolution, has economic effects of similar scale and scope as the previous two. But will it?CR Note: I think the pace of innovation will accelerate and I'm very optimistic about the future!

I must report that not everyone thinks so. Indeed, some knowledgeable observers have recently made the case that the IT revolution, as important as it surely is, likely will not generate the transformative economic effects that flowed from the earlier technological revolutions.2 As a result, these observers argue, economic growth and change in coming decades likely will be noticeably slower than the pace to which Americans have become accustomed. Such an outcome would have important social and political--as well as economic--consequences for our country and the world.

This provocative assessment of our economic future has attracted plenty of attention among economists and others as well. Does it make sense? Here's one way to think more concretely about the argument that the pessimists are making: Fifty years ago, in 1963, I was a nine-year-old growing up in a middle-class home in a small town in South Carolina. As a way of getting a handle on the recent pace of economic change, it's interesting to ask how my family's everyday life back then differed from that of a typical family today. Well, if I think about it, I could quickly come up with the Internet, cellphones, and microwave ovens as important conveniences that most of your families have today that my family lacked 50 years ago. Health care has improved some since I was young; indeed, life expectancy at birth in the United States has risen from 70 years in 1963 to 78 years today, although some of this improvement is probably due to better nutrition and generally higher levels of income rather than advances in medicine alone. Nevertheless, though my memory may be selective, it doesn't seem to me that the differences in daily life between then and now are all that large. Heating, air conditioning, cooking, and sanitation in my childhood were not all that different from today. We had a dishwasher, a washing machine, and a dryer. My family owned a comfortable car with air conditioning and a radio, and the experience of commercial flight was much like today but without the long security lines. For entertainment, we did not have the Internet or video games, as I mentioned, but we had plenty of books, radio, musical recordings, and a color TV (although, I must acknowledge, the colors were garish and there were many fewer channels to choose from).

The comparison of the world of 1963 with that of today suggests quite substantial but perhaps not transformative economic change since then. But now let's run this thought experiment back another 50 years, to 1913 (the year the Federal Reserve was created by the Congress, by the way), and compare how my grandparents and your great-grandparents lived with how my family lived in 1963. Life in 1913 was simply much harder for most Americans than it would be later in the century. Many people worked long hours at dangerous, dirty, and exhausting jobs--up to 60 hours per week in manufacturing, for example, and even more in agriculture. Housework involved a great deal of drudgery; refrigerators, freezers, vacuum cleaners, electric stoves, and washing machines were not in general use, which should not be terribly surprising since most urban households, and virtually all rural households, were not yet wired for electricity. In the entertainment sphere, Americans did not yet have access to commercial radio broadcasts and movies would be silent for another decade and a half. Some people had telephones, but no long-distance service was available. In transportation, in 1913 Henry Ford was just beginning the mass production of the Model T automobile, railroads were powered by steam, and regular commercial air travel was quite a few years away. Importantly, life expectancy at birth in 1913 was only 53 years, reflecting not only the state of medical science at the time--infection-fighting antibiotics and vaccines for many deadly diseases would not be developed for several more decades--but also deficiencies in sanitation and nutrition. This was quite a different world than the one in which I grew up in 1963 or in which we live today.

The purpose of these comparisons is to make concrete the argument made by some economists, that the economic and technological transformation of the past 50 years, while significant, does not match the changes of the 50 years--or, for that matter, the 100 years--before that. Extrapolating to the future, the conclusion some have drawn is that the sustainable pace of economic growth and change and the associated improvement in living standards will likely slow further, as our most recent technological revolution, in computers and IT, will not transform our lives as dramatically as previous revolutions have.

Well, that's sort of depressing. Is it true, then, as baseball player Yogi Berra said, that the future ain't what it used to be? Nobody really knows; as Berra also astutely observed, it's tough to make predictions, especially about the future. But there are some good arguments on the other side of this debate.

First, innovation, almost by definition, involves ideas that no one has yet had, which means that forecasts of future technological change can be, and often are, wildly wrong. A safe prediction, I think, is that human innovation and creativity will continue; it is part of our very nature. Another prediction, just as safe, is that people will nevertheless continue to forecast the end of innovation. The famous British economist John Maynard Keynes observed as much in the midst of the Great Depression more than 80 years ago. He wrote then, "We are suffering just now from a bad attack of economic pessimism. It is common to hear people say that the epoch of enormous economic progress which characterised the 19th century is over; that the rapid improvement in the standard of life is now going to slow down."3 Sound familiar? By the way, Keynes argued at that time that such a view was shortsighted and, in characterizing what he called "the economic possibilities for our grandchildren," he predicted that income per person, adjusted for inflation, could rise as much as four to eight times by 2030. His guess looks pretty good; income per person in the United States today is roughly six times what it was in 1930.

Second, not only are scientific and technical innovation themselves inherently hard to predict, so are the long-run practical consequences of innovation for our economy and our daily lives. Indeed, some would say that we are still in the early days of the IT revolution; after all, computing speeds and memory have increased many times over in the 30-plus years since the first personal computers came on the market, and fields like biotechnology are also advancing rapidly. Moreover, even as the basic technologies improve, the commercial applications of these technologies have arguably thus far only scratched the surface. Consider, for example, the potential for IT and biotechnology to improve health care, one of the largest and most important sectors of our economy. A strong case can be made that the modernization of health-care IT systems would lead to better-coordinated, more effective, and less costly patient care than we have today, including greater responsiveness of medical practice to the latest research findings.4 Robots, lasers, and other advanced technologies are improving surgical outcomes, and artificial intelligence systems are being used to improve diagnoses and chart courses of treatment. Perhaps even more revolutionary is the trend toward so-called personalized medicine, which would tailor medical treatments for each patient based on information drawn from that individual's genetic code. Taken together, such advances could lead to another jump in life expectancy and improved health at older ages

Other promising areas for the application of new technologies include the development of cleaner energy--for example, the harnessing of wind, wave, and solar power and the development of electric and hybrid vehicles--as well as potential further advances in communications and robotics. I'm sure that I can't imagine all of the possibilities, but historians of science have commented on our collective tendency to overestimate the short-term effects of new technologies while underestimating their longer-term potential.

Finally, pessimists may be paying too little attention to the strength of the underlying economic and social forces that generate innovation in the modern world. Invention was once the province of the isolated scientist or tinkerer. The transmission of new ideas and the adaptation of the best new insights to commercial uses were slow and erratic. But all of that is changing radically. We live on a planet that is becoming richer and more populous, and in which not only the most advanced economies but also large emerging market nations like China and India increasingly see their economic futures as tied to technological innovation. In that context, the number of trained scientists and engineers is increasing rapidly, as are the resources for research being provided by universities, governments, and the private sector. Moreover, because of the Internet and other advances in communications, collaboration and the exchange of ideas take place at high speed and with little regard for geographic distance. For example, research papers are now disseminated and critiqued almost instantaneously rather than after publication in a journal several years after they are written. And, importantly, as trade and globalization increase the size of the potential market for new products, the possible economic rewards for being first with an innovative product or process are growing rapidly.6 In short, both humanity's capacity to innovate and the incentives to innovate are greater today than at any other time in history.

Schedule for Week of May 19th

by Calculated Risk on 5/18/2013 09:33:00 AM

The key reports this week are the April existing home sales on Wednesday, and the April new home sales report on Thursday.

On Wednesday, Fed Chairman Ben Bernanke will provide testimony on the Economic Outlook, before the Joint Economic Committee, U.S. Congress. Also on Wednesday, the FOMC minutes for the most recent meeting will be released.

8:30 AM ET: Chicago Fed National Activity Index for April. This is a composite index of other data.

No economic releases scheduled.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Existing Home Sales for April from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for sales of 5.00 million on seasonally adjusted annual rate (SAAR) basis. Sales in March were at a 4.92 million SAAR. Economist Tom Lawler is estimating the NAR will report a April sales rate of 5.03 million.

A key will be inventory and months-of-supply.

10:00 AM: Testimony by Fed Chairman Ben Bernanke, Economic Outlook, Before the Joint Economic Committee, U.S. Congress

2:00 PM: FOMC Minutes for Meeting of April 30-May 1, 2013

During the day: The AIA's Architecture Billings Index for April (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 345 thousand from 360 thousand last week.

9:00 AM: FHFA House Price Index for March 2013. This was original a GSE only repeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 0.9% increase

9:00 AM: The Markit US PMI Manufacturing Index Flash for May. The consensus is for a decrease to 50.8 from 52.0 in April.

10:00 AM: New Home Sales for April from the Census Bureau.

10:00 AM: New Home Sales for April from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the March sales rate.

The consensus is for an increase in sales to 425 thousand Seasonally Adjusted Annual Rate (SAAR) in April from 417 thousand in March.

11:00 AM: Kansas City Fed regional Manufacturing Survey for May. The consensus is for a reading of minus 2, up from minus 5 in April (below zero is contraction).

8:30 AM: Durable Goods Orders for April from the Census Bureau. The consensus is for a 1.1% increase in durable goods orders.

SIFMA recommends 2:00 PM market close on Friday in Observance of the Memorial Day Holiday.