by Calculated Risk on 5/14/2013 08:41:00 AM

Tuesday, May 14, 2013

NFIB: Small Business Optimism Index increases in April

From the National Federation of Independent Business (NFIB): Small-Business Owner Roller Coaster Continues

After last month’s disappointing drop in small-business confidence, April’s Index of Small Business Optimism rose 2.6 points to 92.1, just above the recovery average of 90.7. ...In a little sign of good news, only 16% of owners reported weak sales as the top problem (lack of demand). During good times, small business owners usually complain about taxes and regulations - and taxes are now the top problem again.

April was another positive, albeit lackluster month for job creation. Small employers reported increasing employment an average of 0.14 workers per firm in April. This is a bit lower than March’s reading, but still the fifth positive sequential monthly gain. Job creation plans rose 6 points to a net six percent planning to increase total employment.

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986. The index increased to 92.1 in April from 89.5 in March.

Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

Monday, May 13, 2013

Tuesday: Quarterly Report on Household Debt and Credit

by Calculated Risk on 5/13/2013 09:37:00 PM

On inflation from the WSJ: Inflation Continues to Make Itself Scarce

This week will see the release of U.S. producer and consumer price indexes for April. Both will show further deceleration to 0.7% and 1.4% year on year, respectively, according to FactSet. Consumer prices are expanding at their slowest pace since summer 2010, when the Federal Reserve launched "QE2," its second round of bond buying.Those predicting inflation are still wrong. Actually the key concern with prices is that inflation is too low!

It isn't just the U.S. seeing disinflation. Consumer prices in the euro zone rose by just 1.73% year on year in March, the slowest since August 2010. Japan's renewed monetary exertions of recent months haven't yet reversed its outright deflation. Even Chinese inflation has dropped.

Tuesday economic releases:

• At 7:30 AM ET, NFIB Small Business Optimism Index for April. The consensus is for an increase to 90.5 from 89.5 in March.

• At 11:00 AM, The Q1 2013 Quarterly Report on Household Debt and Credit will be released by the Federal Reserve Bank of New York. From the NY Fed: "The Quarterly Report provides an updated snapshot of household trends in borrowing and indebtedness, including data about mortgages, student loans, credit cards, auto loans and delinquencies."

Labor Force Participation Rate Research

by Calculated Risk on 5/13/2013 06:04:00 PM

The participation rate has declined sharply since the recession started due both to cyclical reasons and also because of demographics (baby boomers retiring) and long term trends (more 16 to 24 year olds staying in school is an example). A key question is: How much of the recent decline is due to cyclical factors and how much of the decline was expected due to long term factors?

Note: The table at the bottom from Dr. Altig shows the relationship between the participation rate and the unemployment rate.

My view has been that there is a large long term factor, although I have expected some bounce back in the participation rate as the economy improves. Others think there are larger cyclical factors, but they only expect a small bounce back too ...

An FSFRB economic letter using state level data: Will Labor Force Participation Bounce Back?

The U.S. labor force participation rate has declined sharply since 2007, intensifying a downward trend that has been evident since about 2000. Distinguishing between long-term influences on the participation rate, such as demographics, and short-term cyclical effects is important because it helps us understand and predict the future path of macroeconomic variables such as the unemployment rate. Using state-level evidence on the relationship between changes in employment and labor force participation across recessions and recoveries, we find evidence, reinforcing other research, that the recent decline in participation likely has a substantial cyclical component. States that saw larger declines in employment generally saw larger declines in participation. A similar positive relationship was evident in past recessions and recoveries. In the current recovery, it will probably take a few years before cyclical components put significant upward pressure on the participation rate because payroll employment is still well below its pre-recession peak.And from Julie Hotchkiss at the Atlanta Fed: Behavior’s Place in the Labor Force Participation Rate Debate

emphasis added

Casselman, in an October 2012 WSJ article, cites work by my colleagues at the Chicago Fed, who find that while more than two-thirds of the decline in LFPR between 1999 and 2011 is accounted for by changes in the age distribution of the population, "…over the 2008-2011 period...only one-quarter of the...decline of actual LFPR...can be attributed to demographic factors."And from David Altig at the Atlanta Fed: Labor Force Participation and the Unemployment Threshold

This conclusion—that three-quarters of the decline in the LFPR since the beginning of the Great Recession can be attributed to cyclical factors—is supported by other research.

...

Our results suggest that relative to the the average LFPR over the years 2010–12, the average LFPR over the years 2015–17 will rise by about a third of a percentage point—again, if the labor market returns to prerecession conditions. Though higher than today, this level would still leave the LFPR considerably lower than it was before the recession, primarily reflecting the continued downward pressures of aging baby boomers.

[T]aking the Hotchkiss and Rios-Avila research onboard means the assumption of a constant labor force participation rate may not be justified. So, turning again to the Jobs Calculator, the following table answers this question: If we continue on the 208,000-per-month pace of job creation of the last six months, and the labor force participation rate is X, what would the unemployment rate be by June of next year? For reference, the first row of the table replicates the earlier result under the assumption that the participation rate will maintain its current level; the second row takes into account the Hotchkiss and Rios-Avila research; and the third assumes an even larger bounce back in participation:This table shows the impact of the participation rate. If the participation rate stays flat at 63.3% (the current level), than at the current pace of payroll jobs growth, the unemployment rate will fall to 6.5% by June 2014. However if the participation rate rises to 63.6% - with the same payroll assumptions - the unemployment rate will only decline to 7.0% by next June. A significant difference ...

Click on graph for larger image.

It is probably worth noting that the full increase in the Hotchkiss and Rios-Avila estimates happens in the 2015–17 timeframe, raising the interesting possibility that the threshold for considering interest rate increases could occur sometime before the unemployment rate moves back above the threshold. Also, it is not at all obvious that rising labor force participation would necessarily arrive along with a rising unemployment rate. From 1996 through 1999, for example, the participation rate rose by nearly by 0.7 percentage point (the difference between the rates in the first and third rows in the table above), even as the unemployment rate fell by just over 1½ percentage points. The key was the strong employment growth over that period—almost 260,000 payroll jobs per month on average.

I think the state level research is compelling, but I don't expect much of an increase in the participation rate over next few years. And I expect further declines in the overall participation rate over the next 15 to 20 years.

Fannie, Freddie, FHA REO inventory declines in Q1 2013

by Calculated Risk on 5/13/2013 01:36:00 PM

The combined Real Estate Owned (REO) by Fannie, Freddie and the FHA declined to 189,5291 at the end of Q1 2013, down from 192,720 in Q4 2012, and down 9% from 209,077 in Q1 2012. The peak for the combined REO of the F's was 295,307 in Q4 2010.

This following graph shows the REO inventory for Fannie, Freddie and the FHA.

This is only a portion of the total REO. There is also REO for private-label MBS, FDIC-insured institutions, VA and more. REO has been declining for those categories too.

Click on graph for larger image.

Click on graph for larger image.

Although REO was down for Fannie and Freddie in Q1 from Q4, REO increased for the FHA - this is something to watch.

1 The FHA is currently in the process of updating their reporting procedures, and the most recent data available online is for January 2013. I've obtained FHA REO data for April 2013 (not end of Q1).

When will payroll employment exceed the pre-recession peak?

by Calculated Risk on 5/13/2013 11:46:00 AM

The WSJ has an overview of several economic forecasts: Economic Road Clearing, but the Going Is Slow

The U.S. still employs more than 2.5 million fewer people than when the recession began. At 180,000 jobs a month, it will take until the middle of 2014 to close that gap. Adjust for population growth, and it will take nine more years to return to the prerecession level of employment at the current rate of growth, according to the Brookings Institution.Below is an update of the graph showing job losses from the start of the employment recession, in percentage terms, with a projection assuming the current rate of payroll growth will continue.

This suggests that employment will exceed the pre-recession peak around July 2014 (Private employment will reach a new high around March of 2014).

Of course, as the article notes, this doesn't include adjusting for population growth - but this will still be a major milestone.

Click on graph for larger image.

Click on graph for larger image.This graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is a projection based on recent payroll increases.

It looks like employment will reach a new high in mid-2014, about 78 months after the previous high.

Retail Sales increase 0.1% in April

by Calculated Risk on 5/13/2013 08:30:00 AM

On a monthly basis, retail sales increased 0.1% from March to April (seasonally adjusted), and sales were up 3.7% from April 2012. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for April, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $419.0 billion, an increase of 0.1 percent from the previous month, and 3.7 percent above April 2012. ... The February to March 2013 percent change was revised from -0.4 percent to -0.5 percent.

Click on graph for larger image.

Click on graph for larger image.Sales for February and March were revised up.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 26.4% from the bottom, and now 10.6% above the pre-recession peak (not inflation adjusted)

Retail sales ex-autos decreased 0.1%. Retail sales ex-gasoline increased 0.7%.

Excluding gasoline, retail sales are up 24.0% from the bottom, and now 11.4% above the pre-recession peak (not inflation adjusted).

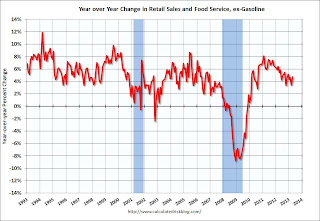

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.Retail sales ex-gasoline increased by 4.7% on a YoY basis (3.7% for all retail sales).

This was above the consensus forecast of 0.3% decline in retail sales. Retail sales ex-gasoline (gasoline prices declined in April) were up 0.7% .

Sunday, May 12, 2013

Monday: Retail Sales

by Calculated Risk on 5/12/2013 10:20:00 PM

Monday economic releases:

• At 8:30 AM ET, Retail sales for April will be released. The consensus is for retail sales to decline 0.3% in April, and to decline 0.1% ex-autos. Note: Some of the decline will be due to lower gasoline prices.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for March. The consensus is for a 0.3% increase in inventories.

Weekend:

• Mortgage Delinquencies by Loan Type in Q1

• Schedule for Week of May 12th

The Asian markets opened mostly red tonight, however the Nikkei is up over 1.0%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 4 and Dow futures are down 28 (fair value).

Oil prices are down slightly with WTI futures at $95.61 per barrel and Brent at $103.59 per barrel.

EIA: Gasoline Prices expected to average $3.53 per gallon this summer

by Calculated Risk on 5/12/2013 11:03:00 AM

Happy Mother's Day! (off topic: Sasha's Snoxx Socks venture is almost fully funded - you can preorder Snoxx here, or see her Snoxx website.)

From the EIA: Short-Term Energy Outlook

Falling crude oil prices contributed to a decline in the U.S. regular gasoline retail price from a year-to-date high of $3.78 per gallon on February 25 to $3.52 per gallon on April 29. EIA expects the regular gasoline price will average $3.53 per gallon over the summer (April through September), down $0.10 per gallon from last month's STEO. The annual average regular gasoline retail price is projected to decline from $3.63 per gallon in 2012 to $3.50 per gallon in 2013 and to $3.39 per gallon in 2014. Energy price forecasts are highly uncertain, and the current values of futures and options contracts suggest that prices could differ significantly from the projected levels.Last summer, gasoline prices averaged $3.76 per gallon during the April through September period - so this is a little good news for drivers.

According to Gasbuddy.com (see graph at bottom), gasoline prices are up to a national average of $3.58 per gallon. One year ago, prices were at $3.81 per gallon, and for the same week two years ago prices were just over $4.00 per gallon.

According to Bloomberg, WTI oil is at $96.04 per barrel, and Brent is at $103.91 per barrel. Using the calculator from Professor Hamilton, and the current price of Brent crude oil, the national average should be around $3.44 per gallon. That is about 14 cents below the current level according to Gasbuddy.com, so prices might fall a little.

Note: If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Saturday, May 11, 2013

Mortgage Delinquencies by Loan Type in Q1

by Calculated Risk on 5/11/2013 07:47:00 PM

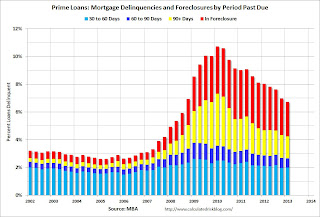

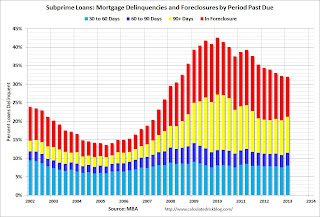

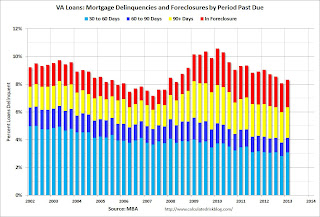

The following graphs show the percent of loans delinquent by loan type based on the MBA National Delinquency Survey: Prime, Subprime, FHA and VA. First a table comparing the number of loans in Q2 2007 and Q1 2013 so readers can understand the shift in loan types over the last several years.

Both the number of prime and subprime loans have declined over the last 5+ years; the number of subprime loans is down by about 33%. Meanwhile the number of FHA loans has more than doubled and VA loans have increased sharply.

Note: There are about 41 million first-lien loans in the survey, and the MBA survey is about 88% of the total.

For Prime and Subprime, a majority of the seriously delinquent loans were originated in the 2005 to 2007 period - and these loans are still in the process of being resolved through foreclosure or short sales. However, for the FHA, a large percentage of the seriously delinquent loans were originated in 2008 and 2009. That is the period when private capital disappeared, and the FHA share of the market increased sharply.

Luckily the FHA had a small market share in 2005 and 2006; however they did make quite a few bad loans in that period because of seller financed Downpayment Assistance Programs (DAPs). These were programs that allowed the seller to give the buyer the downpayment through a 3rd party "charity" (for a fee of course). The buyer had no money in the house and the default rates were absolutely horrible. (The DAPs were finally eliminated in late 2008).

| MBA National Delinquency Survey Loan Count | ||||

|---|---|---|---|---|

| Q2 2007 | Q1 2013 | Change | Q1 2013 Seriously Delinquent | |

| Prime | 33,916,830 | 28,008,431 | -5,908,399 | 1,134,341 |

| Subprime | 6,204,535 | 4,169,970 | -2,034,565 | 849,006 |

| FHA | 3,030,214 | 7,194,524 | 4,164,310 | 574,842 |

| VA | 1,096,450 | 1,645,556 | 549,106 | 68,291 |

| Survey Total | 44,248,029 | 41,018,481 | -3,229,548 | 2,626,480 |

Click on graph for larger image.

Click on graph for larger image.First a repeat for all loans: Loans 30 days delinquent increased to 3.21% from 3.04% in Q4. This is just above the long term average. This is seasonally adjusted, and the seasonal adjustment is difficult right now. Not Seasonally Adjusted basis (NSA) the 30 day delinquency rate declined in Q1 to 2.86% from 3.21%.

Delinquent loans in the 60 day bucket increased slightly to 1.17% in Q1, from 1.16% in Q4. (NSA was also down significantly for the 60 day bucket).

The 90 day bucket decreased slightly to 2.88% from 2.89%. This is still way above normal (around 0.8% would be normal according to the MBA).

The percent of loans in the foreclosure process decreased to 3.55% from 4.74% and is now at the lowest level since 2008.

Note: Scale changes for each of the following graphs.

The second graph is for all prime loans.

The second graph is for all prime loans. This is the category with the most seriously delinquent loans. Back in early 2007 when Fed Chairman Ben Bernanke said "the problems in the subprime market seems likely to be contained", my former co-blogger Tanta responded "We are all subprime!" - she was correct.

Since there are far more prime loans than any other category (see table above), about 43% of the loans seriously delinquent now are prime loans - even though the overall delinquency rate is much lower than other loan types.

This graph is for subprime. This category gets most of the attention - mostly because of all the terrible loans made through the Wall Street "originate-to-distribute" model and sold as Private Label Securities (PLS). Not all PLS was subprime, but the worst of the worst loans were packaged in PLS.

This graph is for subprime. This category gets most of the attention - mostly because of all the terrible loans made through the Wall Street "originate-to-distribute" model and sold as Private Label Securities (PLS). Not all PLS was subprime, but the worst of the worst loans were packaged in PLS.Although the delinquency rate is still very high, the number of subprime loans has declined sharply.

This graph is for FHA loans. It might surprise people, but the percent of FHA delinquent loans (not including in foreclosure) is at the lowest level in a decade. That is because the recently originated loans (2010 through 2013) are performing very well, and the FHA originated a large number of loans in that period.

This graph is for FHA loans. It might surprise people, but the percent of FHA delinquent loans (not including in foreclosure) is at the lowest level in a decade. That is because the recently originated loans (2010 through 2013) are performing very well, and the FHA originated a large number of loans in that period.Of course there are still a large number of loans in the foreclosure process, and the remaining DAPs and the loans originated in 2008 and 2009 are performing poorly.

The last graph is for VA loans. This is a fairly small but growing category (see table above).

The last graph is for VA loans. This is a fairly small but growing category (see table above).Overall there are still quite a few subprime loans that are in distress, but the real keys going forward are prime loans and FHA loans.

Schedule for Week of May 12th

by Calculated Risk on 5/11/2013 10:36:00 AM

A key report this week will be April retail sales to be released on Monday. Also there are two key housing reports to be released: the May homebuilder confidence survey on Wednesday, and April housing starts on Thursday.

For manufacturing, the April Industrial Production survey will be released on Wednesday. Also for manufacturing, the NY Fed (Empire State) and Philly Fed May surveys will be released this week.

For prices, PPI and CPI for April will be released.

Over in Europe, Eurozone GDP will be released on Wednesday (expected to show further contraction), the BOE Inflation Report also on Wednesday, and Japan GDP will be released Thursday (expected to show decent growth in Q1).

8:30 AM ET: Retail sales for April will be released.

8:30 AM ET: Retail sales for April will be released.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales are up 26.2% from the bottom, and now 11.2% above the pre-recession peak (not inflation adjusted)

The consensus is for retail sales to decline 0.3% in April, and to decline 0.1% ex-autos.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for March. The consensus is for a 0.3% increase in inventories.

7:30 AM ET: NFIB Small Business Optimism Index for April. The consensus is for an increase to 90.5 from 89.5 in March.

11:00 AM: The Q1 2013 Quarterly Report on Household Debt and Credit will be released by the Federal Reserve Bank of New York.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Producer Price Index for April. The consensus is for a 0.7% decrease in producer prices (0.2% increase in core).

8:30 AM: NY Fed Empire Manufacturing Survey for May. The consensus is for a reading of 3.75, up from 3.05 in April (above zero is expansion).

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for April.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for April.This graph shows industrial production since 1967.

The consensus is for a 0.2% decrease in Industrial Production in March, and for Capacity Utilization to decrease to 78.3%.

10:00 AM ET: The May NAHB homebuilder survey. The consensus is for a reading of 43, up from 42 in April. This index has decreased recently with some builders complaining about higher costs and lack of buildable land. Any number below 50 still indicates that more builders view sales conditions as poor than good.

8:30 AM: Housing Starts for April.

8:30 AM: Housing Starts for April. Total housing starts were at 1.036 million (SAAR) in March, 7.0 percent above the revised February estimate of 968 thousand. Single family starts declined slightly to 619,000 in March.

The consensus is for total housing starts to decrease to 969 thousand (SAAR) in April mostly because of a decline in multi-family starts.

8:30 AM: Consumer Price Index for April. The consensus is for a 0.3% decrease in CPI in April (due to lower gasoline prices) and for core CPI to increase 0.2%.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 330 thousand from 323 thousand last week.

10:00 AM: the Philly Fed manufacturing survey for May. The consensus is for a reading of 2.2, up from 1.3 last month (above zero indicates expansion).

12:30 PM: Speech by Fed Governor Sarah Bloom Raskin, Prospects for a Stronger Recovery, At the Society of Government Economists and National Economists Club, Washington, D.C

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for May). The consensus is for a reading of 78.0, up from 76.4.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for April 2013

12:30 PM: Speech by Fed Chairman Ben Bernanke, Economic Prospects for the Long Run, At the Bard College Commencement, Great Barrington, Massachusetts