by Calculated Risk on 5/12/2013 10:20:00 PM

Sunday, May 12, 2013

Monday: Retail Sales

Monday economic releases:

• At 8:30 AM ET, Retail sales for April will be released. The consensus is for retail sales to decline 0.3% in April, and to decline 0.1% ex-autos. Note: Some of the decline will be due to lower gasoline prices.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for March. The consensus is for a 0.3% increase in inventories.

Weekend:

• Mortgage Delinquencies by Loan Type in Q1

• Schedule for Week of May 12th

The Asian markets opened mostly red tonight, however the Nikkei is up over 1.0%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 4 and Dow futures are down 28 (fair value).

Oil prices are down slightly with WTI futures at $95.61 per barrel and Brent at $103.59 per barrel.

EIA: Gasoline Prices expected to average $3.53 per gallon this summer

by Calculated Risk on 5/12/2013 11:03:00 AM

Happy Mother's Day! (off topic: Sasha's Snoxx Socks venture is almost fully funded - you can preorder Snoxx here, or see her Snoxx website.)

From the EIA: Short-Term Energy Outlook

Falling crude oil prices contributed to a decline in the U.S. regular gasoline retail price from a year-to-date high of $3.78 per gallon on February 25 to $3.52 per gallon on April 29. EIA expects the regular gasoline price will average $3.53 per gallon over the summer (April through September), down $0.10 per gallon from last month's STEO. The annual average regular gasoline retail price is projected to decline from $3.63 per gallon in 2012 to $3.50 per gallon in 2013 and to $3.39 per gallon in 2014. Energy price forecasts are highly uncertain, and the current values of futures and options contracts suggest that prices could differ significantly from the projected levels.Last summer, gasoline prices averaged $3.76 per gallon during the April through September period - so this is a little good news for drivers.

According to Gasbuddy.com (see graph at bottom), gasoline prices are up to a national average of $3.58 per gallon. One year ago, prices were at $3.81 per gallon, and for the same week two years ago prices were just over $4.00 per gallon.

According to Bloomberg, WTI oil is at $96.04 per barrel, and Brent is at $103.91 per barrel. Using the calculator from Professor Hamilton, and the current price of Brent crude oil, the national average should be around $3.44 per gallon. That is about 14 cents below the current level according to Gasbuddy.com, so prices might fall a little.

Note: If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Saturday, May 11, 2013

Mortgage Delinquencies by Loan Type in Q1

by Calculated Risk on 5/11/2013 07:47:00 PM

The following graphs show the percent of loans delinquent by loan type based on the MBA National Delinquency Survey: Prime, Subprime, FHA and VA. First a table comparing the number of loans in Q2 2007 and Q1 2013 so readers can understand the shift in loan types over the last several years.

Both the number of prime and subprime loans have declined over the last 5+ years; the number of subprime loans is down by about 33%. Meanwhile the number of FHA loans has more than doubled and VA loans have increased sharply.

Note: There are about 41 million first-lien loans in the survey, and the MBA survey is about 88% of the total.

For Prime and Subprime, a majority of the seriously delinquent loans were originated in the 2005 to 2007 period - and these loans are still in the process of being resolved through foreclosure or short sales. However, for the FHA, a large percentage of the seriously delinquent loans were originated in 2008 and 2009. That is the period when private capital disappeared, and the FHA share of the market increased sharply.

Luckily the FHA had a small market share in 2005 and 2006; however they did make quite a few bad loans in that period because of seller financed Downpayment Assistance Programs (DAPs). These were programs that allowed the seller to give the buyer the downpayment through a 3rd party "charity" (for a fee of course). The buyer had no money in the house and the default rates were absolutely horrible. (The DAPs were finally eliminated in late 2008).

| MBA National Delinquency Survey Loan Count | ||||

|---|---|---|---|---|

| Q2 2007 | Q1 2013 | Change | Q1 2013 Seriously Delinquent | |

| Prime | 33,916,830 | 28,008,431 | -5,908,399 | 1,134,341 |

| Subprime | 6,204,535 | 4,169,970 | -2,034,565 | 849,006 |

| FHA | 3,030,214 | 7,194,524 | 4,164,310 | 574,842 |

| VA | 1,096,450 | 1,645,556 | 549,106 | 68,291 |

| Survey Total | 44,248,029 | 41,018,481 | -3,229,548 | 2,626,480 |

Click on graph for larger image.

Click on graph for larger image.First a repeat for all loans: Loans 30 days delinquent increased to 3.21% from 3.04% in Q4. This is just above the long term average. This is seasonally adjusted, and the seasonal adjustment is difficult right now. Not Seasonally Adjusted basis (NSA) the 30 day delinquency rate declined in Q1 to 2.86% from 3.21%.

Delinquent loans in the 60 day bucket increased slightly to 1.17% in Q1, from 1.16% in Q4. (NSA was also down significantly for the 60 day bucket).

The 90 day bucket decreased slightly to 2.88% from 2.89%. This is still way above normal (around 0.8% would be normal according to the MBA).

The percent of loans in the foreclosure process decreased to 3.55% from 4.74% and is now at the lowest level since 2008.

Note: Scale changes for each of the following graphs.

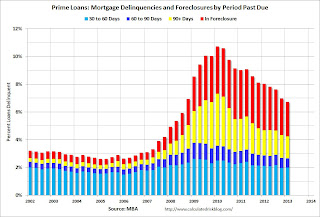

The second graph is for all prime loans.

The second graph is for all prime loans. This is the category with the most seriously delinquent loans. Back in early 2007 when Fed Chairman Ben Bernanke said "the problems in the subprime market seems likely to be contained", my former co-blogger Tanta responded "We are all subprime!" - she was correct.

Since there are far more prime loans than any other category (see table above), about 43% of the loans seriously delinquent now are prime loans - even though the overall delinquency rate is much lower than other loan types.

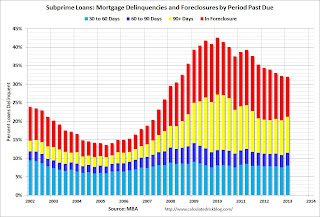

This graph is for subprime. This category gets most of the attention - mostly because of all the terrible loans made through the Wall Street "originate-to-distribute" model and sold as Private Label Securities (PLS). Not all PLS was subprime, but the worst of the worst loans were packaged in PLS.

This graph is for subprime. This category gets most of the attention - mostly because of all the terrible loans made through the Wall Street "originate-to-distribute" model and sold as Private Label Securities (PLS). Not all PLS was subprime, but the worst of the worst loans were packaged in PLS.Although the delinquency rate is still very high, the number of subprime loans has declined sharply.

This graph is for FHA loans. It might surprise people, but the percent of FHA delinquent loans (not including in foreclosure) is at the lowest level in a decade. That is because the recently originated loans (2010 through 2013) are performing very well, and the FHA originated a large number of loans in that period.

This graph is for FHA loans. It might surprise people, but the percent of FHA delinquent loans (not including in foreclosure) is at the lowest level in a decade. That is because the recently originated loans (2010 through 2013) are performing very well, and the FHA originated a large number of loans in that period.Of course there are still a large number of loans in the foreclosure process, and the remaining DAPs and the loans originated in 2008 and 2009 are performing poorly.

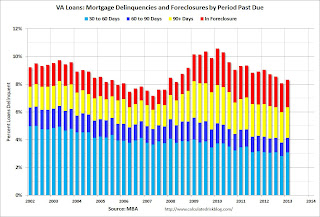

The last graph is for VA loans. This is a fairly small but growing category (see table above).

The last graph is for VA loans. This is a fairly small but growing category (see table above).Overall there are still quite a few subprime loans that are in distress, but the real keys going forward are prime loans and FHA loans.

Schedule for Week of May 12th

by Calculated Risk on 5/11/2013 10:36:00 AM

A key report this week will be April retail sales to be released on Monday. Also there are two key housing reports to be released: the May homebuilder confidence survey on Wednesday, and April housing starts on Thursday.

For manufacturing, the April Industrial Production survey will be released on Wednesday. Also for manufacturing, the NY Fed (Empire State) and Philly Fed May surveys will be released this week.

For prices, PPI and CPI for April will be released.

Over in Europe, Eurozone GDP will be released on Wednesday (expected to show further contraction), the BOE Inflation Report also on Wednesday, and Japan GDP will be released Thursday (expected to show decent growth in Q1).

8:30 AM ET: Retail sales for April will be released.

8:30 AM ET: Retail sales for April will be released.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales are up 26.2% from the bottom, and now 11.2% above the pre-recession peak (not inflation adjusted)

The consensus is for retail sales to decline 0.3% in April, and to decline 0.1% ex-autos.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for March. The consensus is for a 0.3% increase in inventories.

7:30 AM ET: NFIB Small Business Optimism Index for April. The consensus is for an increase to 90.5 from 89.5 in March.

11:00 AM: The Q1 2013 Quarterly Report on Household Debt and Credit will be released by the Federal Reserve Bank of New York.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Producer Price Index for April. The consensus is for a 0.7% decrease in producer prices (0.2% increase in core).

8:30 AM: NY Fed Empire Manufacturing Survey for May. The consensus is for a reading of 3.75, up from 3.05 in April (above zero is expansion).

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for April.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for April.This graph shows industrial production since 1967.

The consensus is for a 0.2% decrease in Industrial Production in March, and for Capacity Utilization to decrease to 78.3%.

10:00 AM ET: The May NAHB homebuilder survey. The consensus is for a reading of 43, up from 42 in April. This index has decreased recently with some builders complaining about higher costs and lack of buildable land. Any number below 50 still indicates that more builders view sales conditions as poor than good.

8:30 AM: Housing Starts for April.

8:30 AM: Housing Starts for April. Total housing starts were at 1.036 million (SAAR) in March, 7.0 percent above the revised February estimate of 968 thousand. Single family starts declined slightly to 619,000 in March.

The consensus is for total housing starts to decrease to 969 thousand (SAAR) in April mostly because of a decline in multi-family starts.

8:30 AM: Consumer Price Index for April. The consensus is for a 0.3% decrease in CPI in April (due to lower gasoline prices) and for core CPI to increase 0.2%.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 330 thousand from 323 thousand last week.

10:00 AM: the Philly Fed manufacturing survey for May. The consensus is for a reading of 2.2, up from 1.3 last month (above zero indicates expansion).

12:30 PM: Speech by Fed Governor Sarah Bloom Raskin, Prospects for a Stronger Recovery, At the Society of Government Economists and National Economists Club, Washington, D.C

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for May). The consensus is for a reading of 78.0, up from 76.4.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for April 2013

12:30 PM: Speech by Fed Chairman Ben Bernanke, Economic Prospects for the Long Run, At the Bard College Commencement, Great Barrington, Massachusetts

Unofficial Problem Bank list declines to 771 Institutions

by Calculated Risk on 5/11/2013 08:09:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for May 10, 2013.

Changes and comments from surferdude808:

Surprisingly, the FDIC cranked up the closing machine today. The only changes to the Unofficial Problem Bank List this week were the two failures. After removal, the list holds 771 institutions with assets of $284.8 billion. A year ago, the list held 924 institutions with assets of $361.1 billion.

Caught in the FDIC closing machine were two banks -- Sunrise Bank, Valdosta, GA ($66 million) and Pisgah Community Bank, Asheville, NC ($25 million) - controlled by Capitol Bancorp LTD (Ticker: CBCRQ). We have probably spilled more ink on the travails of Capital Bancorp than any other banking organization since the publication of this list in August 2009. Here is a sampling over the past two years: June 3, 2011, February 24, 2012, August 10, 2012, February 15, 2013, and February 22, 2013.

After controlling more than 50 banks at its peak, Capitol Bancorp has reduced its subsidiary count to 12 banks through intra-company mergers and divestitures to outside parties. Primarily, the mergers and sales are designed to raise capital or avert a failure. A failure of any one bank subsidiary could trigger the failure of all banking subsidiaries. Through statute referred to as Cross-Guaranty, the FDIC can demand reimbursement for the cost of a failure against any of Capitol Bancorp's still open banking subsidiaries. To facilitate the divestitures, the FDIC has issued at least 16 Cross-Guaranty waivers. Some observers may question the cost effectiveness of issuing the waivers.

The FDIC has declined to comment if it will assess other banking units of Capitol Bancorp for the estimated $26.2 million cost of the failures. In a report by SNL Securities, " FDIC spokeswoman LaJuan Williams-Young said "I don't have anything to say about that right now" in response to an enforcement of a cross-guaranty liability. In a separate report in the American Banker, Ralph "Chip" MacDonald, a partner at Jones Day, stated "They [FDIC] also have a long time to assert it. My guess is that it will hold off until they evaluated the situation more closely." Given that Capitol Bancorp has been in troubled condition for many years with several near brushes with a subsidiary failing, some observers may question why the FDIC would need more time to evaluate the situation. Of Capitol Bancorp's remaining bank subsidiaries, seven with aggregate assets of $1.4 billion are on the Unofficial Problem Bank List. It will be worth watching to see if the FDIC pulls the cross-guaranty trigger against any of these.

Next week, we anticipate the OC C will release its enforcement actions through mid-April 2013.

Friday, May 10, 2013

Bank Failures #11 & 12 in 2013: North Carolina and Georgia

by Calculated Risk on 5/10/2013 06:36:00 PM

As of March 31, 2013, Pisgah Community Bank had approximately $21.9 million in total assets and $21.2 million in total deposits. ... The FDIC estimates that cost to the Deposit Insurance Fund will be $8.9 million. ... Pisgah Community Bank is the 11th FDIC-insured institution to fail in the nation this year, and the second in North Carolina.From the FDIC: Synovus Bank, Columbus, Georgia, Assumes All of the Deposits of Sunrise Bank, Valdosta, Georgia

As of March 31, 2013, Sunrise Bank had approximately $60.8 million in total assets and $57.8 million in total deposits. ... The FDIC estimates that cost to the Deposit Insurance Fund will be $17.3 million. ... Sunrise Bank is the 12th FDIC-insured institution to fail in the nation this year, and the third in Georgia.Two more ...

Lawler: Table of Distressed Sales and Cash buyers for Selected Cities in April

by Calculated Risk on 5/10/2013 02:45:00 PM

Economist Tom Lawler sent me the preliminary table below of short sales, foreclosures and cash buyers for several selected cities in April.

Look at the two columns in the table for Total "Distressed" Share. In every area that has reported distressed sales so far, the share of distressed sales is down year-over-year - and down significantly in some areas.

Also there has been a decline in foreclosure sales in all of these cities. Also there has been a shift from foreclosures to short sales. In all of these areas - except Minneapolis- short sales now out number foreclosures.

Tom Lawler writes:

Note that in Vegas the foreclosure sales share last month way down from a year, and the total “distressed” sales share in down a lot as well, but the all-cash share of sales was higher, which appears to imply sharply higher purchases of non-foreclosure and even non-distressed homes by institutional and other investors. While the “all-cash” share of sales last month was down a bit from a year ago in Phoenix, the drop was significantly lower than the decline in distressed sales – again apparently reflecting sharply higher non-foreclosure and non-distressed home purchases by institutional and other investors.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| 13-Apr | 12-Apr | 13-Apr | 12-Apr | 13-Apr | 12-Apr | 13-Apr | 12-Apr | |

| Las Vegas | 32.5% | 29.9% | 10.0% | 36.9% | 42.5% | 66.8% | 59.3% | 54.9% |

| Reno | 33.0% | 32.0% | 8.0% | 26.0% | 41.0% | 58.0% | ||

| Phoenix | 12.7% | 25.2% | 11.3% | 18.8% | 24.1% | 44.0% | 42.0% | 47.6% |

| Minneapolis | 7.4% | 10.7% | 24.2% | 32.0% | 31.6% | 42.7% | ||

| Mid-Atlantic (MRIS) | 9.9% | 12.2% | 8.6% | 11.0% | 18.5% | 23.2% | 19.4% | 19.4% |

| Memphis* | 24.8% | 34.9% | ||||||

| *share of existing home sales, based on property records | ||||||||

Report: Advanced Bookings suggest Strong Summer Season

by Calculated Risk on 5/10/2013 10:53:00 AM

From HotelNewsNow.com: Hoteliers gear up for busy summer

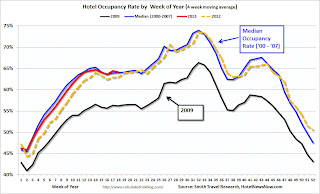

If early indications ring true, it’s going to be a busy summer for hotels across the U.S. as both families and business travelers are expected to hit the road in droves.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Several hoteliers reported to HotelNewsNow.com that advanced bookings are up dramatically year over year, backing up a new forecast by STR that predicts strong performance metrics for June, July and August. STR is the parent company of HotelNewsNow.com.

Not only is demand up, but most hoteliers said pricing power has returned and they are finally able to push rate without experiencing consequential declines in occupancy.

According to STR, average occupancy at U.S. hotels for June, July and August combined is expected to be 70%, up 1% from last year. Average daily rate is expected to be $112.21, up 4.4% from 2012, and revenue per available room is expected to be $78.50, up 5.4% from 2012.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2013, yellow is for 2012, blue is "normal" and black is for 2009 - the worst year since the Great Depression for hotels.

Through the beginning of May, the 4-week average of the occupancy rate has improved from the same period last year and is tracking the pre-recession levels. The occupancy rate will probably move sideways for several more weeks until the summer vacation travel starts.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Bernanke: "Monitoring the Financial System"

by Calculated Risk on 5/10/2013 09:47:00 AM

From Fed Chairman Ben Bernanke: Monitoring the Financial System

Ongoing monitoring of the financial system is vital to the macroprudential approach to regulation. Systemic risks can only be defused if they are first identified. That said, it is reasonable to ask whether systemic risks can in fact be reliably identified in advance; after all, neither the Federal Reserve nor economists in general predicted the past crisis. To respond to this point, I will distinguish, as I have elsewhere, between triggers and vulnerabilities. The triggers of any crisis are the particular events that touch off the crisis--the proximate causes, if you will. For the 2007-09 crisis, a prominent trigger was the losses suffered by holders of subprime mortgages. In contrast, the vulnerabilities associated with a crisis are preexisting features of the financial system that amplify and propagate the initial shocks. Examples of vulnerabilities include high levels of leverage, maturity transformation, interconnectedness, and complexity, all of which have the potential to magnify shocks to the financial system. Absent vulnerabilities, triggers might produce sizable losses to certain firms, investors, or asset classes but would generally not lead to full-blown financial crises; the collapse of the relatively small market for subprime mortgages, for example, would not have been nearly as consequential without preexisting fragilities in securitization practices and short-term funding markets which greatly increased its impact. Of course, monitoring can and does attempt to identify potential triggers--indications of an asset bubble, for example--but shocks of one kind or another are inevitable, so identifying and addressing vulnerabilities is key to ensuring that the financial system overall is robust. Moreover, attempts to address specific vulnerabilities can be supplemented by broader measures--such as requiring banks to hold more capital and liquidity--that make the system more resilient to a range of shocks.And on current activities:

Two other related points motivate our increased monitoring. The first is that the financial system is dynamic and evolving not only because of innovation and the changing needs of the economy, but also because financial activities tend to migrate from more-regulated to less-regulated sectors. ...

The second motivation for more intensive monitoring is the apparent tendency for financial market participants to take greater risks when macro conditions are relatively stable. Indeed, it may be that prolonged economic stability is a double-edged sword. To be sure, a favorable overall environment reduces credit risk and strengthens balance sheets, all else being equal, but it could also reduce the incentives for market participants to take reasonable precautions, which may lead in turn to a buildup of financial vulnerabilities. Probably our best defense against complacency during extended periods of calm is careful monitoring for signs of emerging vulnerabilities and, where appropriate, the development of macroprudential and other policy tools that can be used to address them.

emphasis added

So, what specifically does the Federal Reserve monitor? In the remainder of my remarks, I'll highlight and discuss four components of the financial system that are among those we follow most closely: systemically important financial institutions (SIFIs), shadow banking, asset markets, and the nonfinancial sector.For details on each of the four components, see Bernanke's speech.

As Bernanke notes - and economist Hyman Minsky pointed out years ago - long periods of stability lead to increased speculation and eventually a financial crisis. Currently regulators are vigilant, but unfortunately over time policymakers and regulators will become less cautious.

Thursday, May 09, 2013

Friday: Bernanke "Monitoring Finance"

by Calculated Risk on 5/09/2013 08:41:00 PM

This has been a very light week for economic data. On Friday at 9:30 AM ET, Fed Chairman Ben Bernanke will speak, "Monitoring Finance", At the 49th Annual Conference on Bank Structure and Competition, Chicago, Illinois

And on the deficit from the WSJ: Falling Deficit Alters Debate

Rising government revenue from tax collections and bailout paybacks are shrinking the federal deficit faster than expected, delaying the point when the government will reach the so-called debt ceiling and altering the budget debate in Washington.The "debt ceiling" is really about paying the bills and will be raised. That is a given (although some politicians apparently missed the memo).

...

The debt ceiling is estimated to be reached May 19—though the Treasury Department likely would have been able to take emergency steps to continue paying bills until July or August. Now, thanks to the improved fiscal picture, analysts at Goldman Sachs Group Inc. GS and other firms believe the Treasury Department can maneuver until September or October without congressional help. The Treasury Department so far has declined to provide its own forecast.