by Calculated Risk on 5/08/2013 09:15:00 PM

Wednesday, May 08, 2013

Thursday: Weekly Unemployment Claims

Earlier I mentioned the improvement in the California budget (a sign that the drag from state and local governments is ending). Of course the Federal budget deficit is falling quickly. Here is the CBO's monthly budget review:

The federal government ran a budget deficit of $489 billion in the first seven months of fiscal year 2013 (that is, from October 2012 through April 2013), according to CBO’s estimates. That amount is $231 billion less than the shortfall recorded during the same period last year, primarily because revenue collections have been much greater than they were at this point in 2012. In contrast, federal spending so far this year has been slightly lower than what it was last year at this time.I'd argue we should have - and still could spend more to address unemployment.

My view is the deficit is currently falling too quickly and slowing the economy, but that view doesn't seem to be getting any traction among policymakers. At the least there is no reason for further fiscal tightening over the next couple of years - the deficit is already falling fast (there are still longer term issues).

Thursday economic releases:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 335 thousand from 324 thousand last week.

• At 10:00 AM, Monthly Wholesale Trade: Sales and Inventories for March. The consensus is for a 0.4% increase in inventories.

Las Vegas Real Estate in April: Year-over-year Inventory decline slows

by Calculated Risk on 5/08/2013 06:29:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported Local home prices rise again, according to GLVAR report

GLVAR said the total number of existing local homes, condominiums and townhomes sold in April was 3,789. That’s up from 3,642 in March, but down from 3,924 total sales in April 2012. ...There are several key trends that we've been following:

...

Another trend is the decline in foreclosures and short sales – which occur when a lender agrees to sell a home for less than what the borrower owes on the mortgage. In April, 32.5 percent of all existing local home sales were short sales, down from 33.3 percent in March. Another 10.0 percent of all sales were bank-owned properties, down from 11.2 percent of all sales in March. The remaining 57.5 percent of all sales were the traditional type, which was up from 55.5 percent in March.

...

The total number of properties listed for sale on GLVAR’s Multiple Listing Service increased in April, with 13,881 single-family homes listed for sale at the end of the month. That’s up 1.4 percent from 13,693 single-family homes listed for sale at the end of March, but down 22.4 percent from one year ago.

As for available homes listed for sale without any sort of pending or contingent offer by the end of April, GLVAR reported 3,161 single-family homes listed without any sort of offer. That’s up 11.3 percent from 2,839 such homes listed in March, but still down 24.1 percent from one year ago.

...

In April, GLVAR reported that 59.3 percent of all existing local homes sold were purchased with cash. That’s up from 57.5 percent in March and approaching the peak of 59.5 percent in February.

emphasis added

1) Overall sales are down a little year-over-year, but ...

2) Conventional sales are up sharply. In April 2012, only 33.2% of all sales were conventional. This year, in April 2013, 57.5% were conventional. That is an increase in conventional sales of about 67% (of course this is heavily investor buying, but that is still quite an increase in non-distressed sales).

3) There is a shift from foreclosures to short sales.

4) and probably most interesting right now is that the decline in non-contingent inventory (year-over-year) has slowed sharply. This suggests inventory is near a bottom.

Update: California Revenues $4.6 Billion ahead of Projections through April

by Calculated Risk on 5/08/2013 03:21:00 PM

From California State Controller: Controller Releases April Cash Update

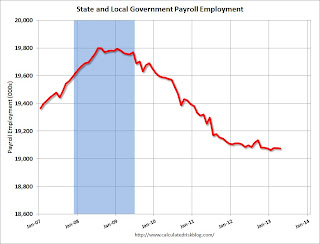

Through the first 10 months of the fiscal year, total revenues exceeded the Governor's January projections by $4.6 billion (+6.1 percent). ...This is just one state, but the drag from the cutbacks at the state and local governments levels are mostly over. Over the last four years, state and local governments have reduced budgets and employment substantially. Here are two graphs I've posted recently:

"We've reached an important milestone in California's economic recovery. For the first time in nearly six years, we closed out a month without borrowing from internal state funds to pay our bills," said Chiang. "But, there remains significant debt that must be shed before we can claim victory and these unanticipated revenues provide us with an important opportunity to take further steps toward long-term fiscal stability."

...

The State ended the last fiscal year with a cash deficit of $9.6 billion, and by April 30, 2013, that cash deficit narrowed to $5.8 billion. That deficit is being covered by $10 billion in external borrowing, which the State will begin repaying later this month.

Click on graph for larger image.

Click on graph for larger image.This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

In April 2013, state and local governments lost 3,000 jobs, however state and local employment is unchanged so far in 2013.

The second graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 8 quarters (through Q1 2013).

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 8 quarters (through Q1 2013).However the drag from state and local governments has continued. I was expecting the drag from state and local governments to end last year, but this unprecedented and relentless decline in state and local government spending has still been a drag on the economy in early 2013.

The good news is the drag has to end soon - in real terms, state and local government spending is back to early 2001 levels. And just ending the drag from state and local governments will be a positive for the economy.

Freddie Mac on Q1: $4.6 Billion Net Income, No Treasury Draw, REO Declines

by Calculated Risk on 5/08/2013 11:28:00 AM

From Freddie Mac: Freddie Mac Reports Net Income of $4.6 BILLION;

Freddie Mac today reported net income of $4.6 billion for the first quarter of 2013, compared to net income of $4.5 billion for the fourth quarter of 2012. ...

...

On a quarterly basis, the company determines whether a valuation allowance is necessary on its net deferred tax assets. After evaluating all available evidence, Freddie Mac continued to record a valuation allowance on a portion of its net deferred tax assets as of March 31, 2013. The valuation allowance as of March 31, 2013, was $30.1 billion. To the extent Freddie Mac releases the valuation allowance on its deferred tax assets in a future period, the amount released would be included as income in that period and would result in a corresponding increase in the company’s net worth as of the end of that period.

...

(Provision) benefit for credit losses was a benefit of $503 million for the first quarter of 2013, compared to a benefit of $700 million for the fourth quarter of 2012. The benefit for credit losses for the first quarter of 2013 was driven by continued improvement in national home prices combined with a further decrease in the volume of newly delinquent single-family loans.

Click on graph for larger image.

Click on graph for larger image.On Real Estate Owned (REO), Freddie acquired 17,882 properties in Q1 2013, and disposed of 18,895 and the total REO fell to 47,974 at the end of Q1. This graph shows REO inventory for Freddie.

From Freddie:

In 1Q13, REO dispositions continued to exceed the volume of REO acquisitions. The volume of our single-family REO acquisitions in recent periods has been significantly affected by the length of the foreclosure process and a high volume of foreclosure alternatives, which result in fewer loans proceeding to foreclosure, and thus fewer properties transitioning to REO.

The North Central region comprised 42 percent of our REO property inventory at March 31, 2013. This region generally has experienced more challenging economic conditions, and includes a number of states with longer foreclosure timelines due to the local laws and foreclosure process in the region.

MBA: Mortgage Applications Increase, Purchase index at highest level since May 2010

by Calculated Risk on 5/08/2013 08:31:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 8 percent from the previous week to the highest level since December 2012. The gain in the Refinance Index was due to increases in both the conventional and government refinance indices of 8.8 percent and 5.7 percent respectively. The seasonally adjusted Purchase Index increased 2 percent from one week earlier to the highest level since May 2010.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.59 percent, the lowest rate since December 2012, from 3.60 percent, with points increasing to 0.33 from 0.30 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

There has been a sustained refinance boom for over a year.

This was the highest level for the refinance index since last December.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the purchase index - and the 4-week average of the purchase index - are at the highest level since May 2010.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the purchase index - and the 4-week average of the purchase index - are at the highest level since May 2010.

Tuesday, May 07, 2013

Temporary Help Services and Employment

by Calculated Risk on 5/07/2013 06:07:00 PM

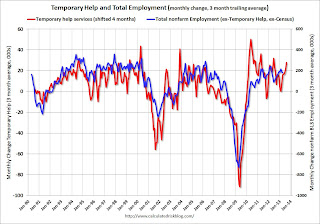

Back in 2010, some analysts took the surge in temporary help services as a leading indicator for a pickup in employment. I was skeptical back then, first because of the distortion caused by temporary Census workers, second because housing was still weak, and third because it appeared there had been a change in hiring practices.

Once again there has been a pickup in temporary help services. From the BLS report:

In April, employment rose in temporary help services (+31,000) ...Temporary help services has added an average of 28,000 jobs per month over the last three months.

The following graph was a favorite of those expecting a huge rebound in employment in 2010 (see the red spike in 2010). The graph is a little complicated - the red line is the three month average change in temporary help services (left axis). This is shifted four months into the future.

The blue line (right axis) is the three month average change in total employment (excluding temporary help services and Census hiring).

Click on graph for larger image.

Click on graph for larger image. Unfortunately the data on temporary help services only goes back to 1990, but it does appear that temporary help leads employment by about four months (although noisy).

The thinking is that before companies hire permanent employees following a recession, employers will hire temporary employees. But there is also evidence of a recent shift by employers to more temporary workers.

This graph does suggest temporary help services does lead general employment, but the magnitude of the swings is less useful - and I don't think this suggests an imminent pickup in overall hiring.

Existing Home Inventory is up 12.2% year-to-date on May 6th

by Calculated Risk on 5/07/2013 01:16:00 PM

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm tracking inventory weekly in 2013.

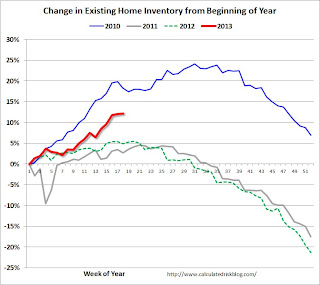

In normal times, there is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for March). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory mostly followed the normal seasonal pattern, however in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

In 2010, inventory was up 15% by the end of March, and close to 20% by the end of April.

For 2011 and 2012, inventory only increased about 5% at the peak and then declined for the remainder of the year.

So far in 2013, inventory is up 12.2%. This is well above the peak percentage increases for 2011 and 2012 and suggests to me that inventory is near the bottom. It is possible that inventory could bottom this year - especially if inventory is up 15% to 18% from the seasonal lows by mid-to-late summer.

It will probably be close. Inventory might have already bottomed in early 2013, or might bottom in early 2014. This will be important for price increases ... once inventory starts to increase (more than seasonal), buyer urgency will wane, and I expect price increases will slow.

Trulia: Asking House Prices increased in April, "Rent growth has slowed"

by Calculated Risk on 5/07/2013 11:46:00 AM

Press Release: Asking Home Prices Soared 8.3 Percent Year-Over-Year Nationwide, While Rents Rose Only 2.4 Percent

With the Spring house hunting season well underway, asking home prices rose 8.3 percent nationally year-over-year (Y-o-Y) in April. This time last year, asking prices fell 1.6 percent Y-o-Y. Seasonally adjusted, asking prices rose 1.3 percent month-over-month and 4.3 percent quarter-over-quarter. Regionally, asking prices were higher than one year ago in 95 of the 100 largest metros.On rents, this is similar to the quarterly Reis report on apartments. It appears that rent increases are slowing.

Strong job growth and the housing recovery go hand-in-hand. Nationally, job growth increased 1.5 percent Y-o-Y in March. In San Jose, Orange County, San Francisco, and Phoenix – where asking prices rose more than 18 percent Y-o-Y – job growth was well above the national average. In fact, only the Detroit suburb of Warren-Troy-Farmington Hills, MI was among the list of top 10 markets with the highest price gains without above average job growth.

Rents rose 2.4 percent Y-o-Y nationally, but rent growth has slowed. In 19 of the 25 largest rental markets, rent gains Y-o-Y was slower in April than in January. In some markets, rents and prices are moving in the opposite direction, or nearly so: the four metros with the slowest rent growth or even declines – San Francisco, Las Vegas, Sacramento, and Seattle – all had price gains of more than 15 percent Y-o-Y.

“Although some of the home-price growth is a bounce back from the housing bust, job growth is boosting housing demand and lifting home prices,” said Jed Kolko, Trulia’s Chief Economist. “Investors don’t deserve all the thanks – or blame – for rising prices. Households are doing their part, too, as the economy recovers and more people go back to work and get on more solid financial footing. Local markets with strong job growth will see home prices continue to recover even after investors decide to cash out their gains and exit the market.”

More from Jed Kolko: Not Just Investors: Local Job Growth Also Supporting Home Price Gains

Note: These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and this suggests further house price increases over the next few months on a seasonally adjusted basis.

BLS: Job Openings decreased slightly in March

by Calculated Risk on 5/07/2013 10:11:00 AM

From the BLS: Job Openings and Labor Turnover Summary

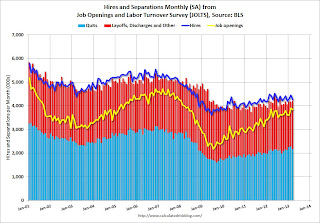

There were 3.8 million job openings on the last business day of March, little changed from 3.9 million in February, the U.S. Bureau of Labor Statistics reported today. The hires rate (3.2 percent) and separations rate (3.1 percent) were little changed in March....The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... The number of quits (not seasonally adjusted) was little changed over the 12 months ending in March for total nonfarm, total private, and government.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for March, the most recent employment report was for April.

Click on graph for larger image.

Click on graph for larger image.Notice that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased in March to 3.844 million, down from 3.899 million in February. The number of job openings (yellow) has generally been trending up, but openings are unchanged year-over-year compared to March 2012.

Quits were down in March, and quits are mostly unchanged year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Not much changes month-to-month in this report - and the data is noisy month-to-month, but the general trend suggests a gradually improving labor market.

CoreLogic: House Prices up 10.5% Year-over-year in March

by Calculated Risk on 5/07/2013 09:01:00 AM

Notes: This CoreLogic House Price Index report is for March. The recent Case-Shiller index release was for February. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Home Price Index Rises by 10.5 Percent Year Over Year in March

Home prices nationwide, including distressed sales, increased 10.5 percent on a year-over-year basis in March 2013 compared to March 2012. This change represents the biggest year-over-year increase since March 2006 and the 13th consecutive monthly increase in home prices nationally. On a month-over-month basis, including distressed sales, home prices increased by 1.9 percent in March 2013 compared to February 2013.

Excluding distressed sales, home prices increased on a year-over-year basis by 10.7 percent in March 2013 compared to March 2012. On a month-over-month basis, excluding distressed sales, home prices increased 2.4 percent in March 2013 compared to February 2013. Distressed sales include short sales and real estate owned (REO) transactions.

The CoreLogic Pending HPI indicates that April 2013 home prices, including distressed sales, are expected to rise by 9.6 percent on a year-over-year basis from April 2012 and rise by 1.3 percent on a month-over-month basis from March 2013. Excluding distressed sales, April 2013 home prices are poised to rise 12 percent year over year from April 2012 and by 2.7 percent month over month from March 2013.

...

“For the first time since March 2006, both the overall index and the index that excludes distressed sales are above 10 percent year over year,” said Dr. Mark Fleming, chief economist for CoreLogic. “The pace of appreciation has been accelerating throughout 2012 and so far in 2013 leading into the home buying season.”

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 1.9% in March, and is up 10.5% over the last year.

The index is off 25.1% from the peak - and is up 11.9% from the post-bubble low set in February 2012.

The second graph is from CoreLogic. The year-over-year comparison has been positive for thirteen consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for thirteen consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).This is the largest year-over-year increase since 2006.

This was another very strong month-to-month increase. I expect more inventory to come on the market and slow the price increases.