by Calculated Risk on 5/02/2013 07:07:00 PM

Thursday, May 02, 2013

Friday: Employment Report

A couple more previews ...

From the Sudeep Reddy at the WSJ: What to Expect From the Jobs Report

UBS economists forecast payroll growth of 130,000 jobs in April but warn that it’s because of “technical oddities rather than fundamental weakening” in the labor market. The gap between the Labor Department’s March and April surveys — four weeks instead of five weeks — “has historically been associated with April payrolls about 60,000 below the surrounding trend,” they write.From Forbes: April Jobs Report: Economy To Add Only 100K On Falling Consumption, Unemployment To Hit 7.5%, Nomura Says

The April jobs report promises to be another disappointing data point, according to Nomura, which expects a meager job gain of only 100,000 as consumer spending wanes and manufacturing activity slows.Friday economic releases:

• At 8:30 AM ET, the BLS will release the Employment Report for April. The consensus is for an increase of 153,000 non-farm payroll jobs in April; the economy added 88,000 non-farm payroll jobs in March. The consensus is for the unemployment rate to be unchanged at 7.6% in April.

• At 10:00 AM, the ISM non-Manufacturing Index for April. The consensus is for a reading of 54.0, down from 54.4 in March. Note: Above 50 indicates expansion, below 50 contraction.

• Also at 10:00 AM, the Manufacturers' Shipments, Inventories and Orders (Factory Orders) report for March will be released. The consensus is for a 2.8% decrease in orders.

Freddie Mac: Mortgage Rates decrease in latest Survey, 15-Year at All-Time Low

by Calculated Risk on 5/02/2013 03:42:00 PM

From Freddie Mac today: Mortgage Rates Keep Pushing Lower

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates moving lower for the fifth consecutive week amid the weaker than expected first quarter economic growth advance estimate. The 30-year fixed-rate mortgage at 3.35 percent is hovering just above its all-time record low of 3.31 percent set the week of November 21, 2012. The 15-year fixed-rate mortgage set a new all-time record low this week at 2.56 percent, eclipsing the record set last week.

30-year fixed-rate mortgage (FRM) averaged 3.35 percent with an average 0.7 point for the week ending May 2, 2013, down from last week when it averaged 3.40 percent. Last year at this time, the 30-year FRM averaged 3.84 percent.

15-year FRM this week averaged 2.56 percent with an average 0.7 point, down from last week when it averaged 2.61 percent. A year ago at this time, the 15-year FRM averaged 3.07 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the the 30 year and 15 year fixed rate mortgage interest rates from the Freddie Mac Primary Mortgage Market Survey®.

The Freddie Mac survey started in 1971 and 30 year mortgage rates are currently near the record low set last November.

Employment Situation Preview

by Calculated Risk on 5/02/2013 11:44:00 AM

On Friday, at 8:30 AM ET, the BLS will release the employment report for April. The consensus is for an increase of 153,000 non-farm payroll jobs in April, and for the unemployment rate to be unchanged at 7.6%.

Here is a summary of recent data:

• The ADP employment report showed an increase of 119,000 private sector payroll jobs in April. This was below expectations of 155,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month. In general this suggests employment growth below expectations.

• The ISM manufacturing employment index decreased in April to 50.2% from 54.2% in March. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS reported payroll jobs for manufacturing decreased by close to 20,000 in April. The ADP report indicated a 10,000 decrease in manufacturing jobs.

The ISM non-manufacturing (service) employment index will be released on Friday after the employment report.

• Initial weekly unemployment claims averaged about 342,500 in April. This was down from 355,000 in March, and the lowest average for a month this year.

For the BLS reference week (includes the 12th of the month), initial claims were at 355,000; up from 341,000 in March.

• The final April Reuters / University of Michigan consumer sentiment index decreased to 76.4, down from the March reading of 78.6. This is frequently coincident with changes in the labor market, but also strongly related to gasoline prices and other factors. Note: the preliminary index dipped mid-month suggesting some weakness during the reference period (we saw the same pattern in March with the preliminary reading lower).

• The small business index from Intuit showed 20,000 payroll jobs added, up from 15,000 in March. This index remains disappointing.

• And on the unemployment rate from Gallup: Seasonally Unadjusted Unemployment Declines in April

Gallup's unadjusted unemployment rate for the U.S. workforce was 7.4% for the month of April, down more than half a point since March 2013, and nearly a one-point drop from April 2012. This is the second-lowest monthly employment rate Gallup has measured since it began tracking employment in 2010. ...Note: So far the Gallup numbers haven't been very useful in predicting the BLS unemployment rate.

Gallup's seasonally adjusted U.S. unemployment rate for April was 7.8%, unchanged from March 2013, but down almost a full point compared with April 2012.

• Conclusion: The employment related data was mostly disappointing in April. The ADP and ISM manufacturing reports suggest a decrease in hiring (the ISM service report will not be released until after the BLS report), the small business index increased but was still weak, and weekly claims for the reference week were higher in April than in March (although claims for the month were lower).

There is always some randomness to the employment report, but my guess is the BLS will report somewhat below the consensus of 153,000 jobs added in April.

Trade Deficit declined in March to $38.8 Billion

by Calculated Risk on 5/02/2013 09:27:00 AM

The Department of Commerce reported:

[T]otal March exports of $184.3 billion and imports of $223.1 billion resulted in a goods and services deficit of $38.8 billion, down from $43.6 billion in February, revised. March exports were $1.7 billion less than February exports of $186.0 billion. March imports were $6.5 billion less than February imports of $229.6 billion.The trade deficit was lower than the consensus forecast of $42.4 billion.

The first graph shows the monthly U.S. exports and imports in dollars through March 2013.

Click on graph for larger image.

Click on graph for larger image.Exports declined slightly in March, and imports declined even more, so the deficit declined.

Exports are 11% above the pre-recession peak and unchanged compared to March 2012; imports are 4% below the pre-recession peak, and down 6% compared to March 2012.

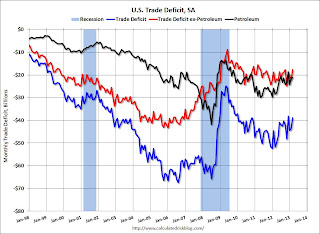

The second graph shows the U.S. trade deficit, with and without petroleum, through March.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil averaged $96.95 in March, up from $95.96 per barrel in February, but down from $107.95 in March 2012. Oil import prices should start falling in April.

The trade deficit with the euro area was $8.3 billion in March, down slightly from $8.8 billion in March 2012.

The trade deficit with China decreased to $17.9 billion in March, up from $21.7 billion in March 2012. Note: The decline in the trade deficit with China was related to the timing of the Chinese New Year.

Weekly Initial Unemployment Claims decline to 324,000

by Calculated Risk on 5/02/2013 08:30:00 AM

The DOL reports:

In the week ending April 27, the advance figure for seasonally adjusted initial claims was 324,000, a decrease of 18,000 from the previous week's revised figure of 342,000. The 4-week moving average was 342,250, a decrease of 16,000 from the previous week's revised average of 358,250.The previous week was revised up from 339,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 342,250.

Weekly claims were the lowest since 2008, and the 4-week average is just above the low for the year. Claims were below the 345,000 consensus forecast.

Wednesday, May 01, 2013

Thursday: Trade Deficit, Unemployment Claims

by Calculated Risk on 5/01/2013 09:32:00 PM

Last night I was asked if the FOMC would do anything bold today (the statement was released earlier today). I said it was pretty clear that the FOMC would not change policy at this meeting, but they could express more concern about inflation being too low or - if they were really feeling bold - warn about fiscal policy.

On inflation, the FOMC kept the phrase "Inflation has been running somewhat below the Committee's longer-run objective ..." so there wasn't any additional emphasis on inflation.

However, on fiscal policy, the FOMC added the phrase "fiscal policy is restraining economic growth." This was severe criticism of short term deficit cutting.

As we all know, the deficit is declining rapidly (probably too rapidly).

Public employment is down sharply over the last four years, and this morning the Census Bureau reported that public construction spending was at the lowest level since 2001 in real terms (and has declined for four years). Not as much austerity as in Europe, but still too much given the high unemployment rate.

In the short term, U.S. policymakers should not be looking to cut the deficit further, instead they should be focused on unemployment (longer term deficit reduction is a different topic). Eliminating the sequester budget cuts would be good policy since these cuts were an obvious mistake.

As Bernanke noted two months ago, the sequester budget cuts might actually lead to less deficit reduction:

"The CBO estimates that deficit-reduction policies in current law will slow the pace of real GDP growth by about 1-1/2 percentage points this year, relative to what it would have been otherwise.Unfortunately certain policymakers remain impervious to data ...

A significant portion of this effect is related to the automatic spending sequestration that is scheduled to begin on March 1, which, according to the CBO’s estimates, will contribute about 0.6 percentage point to the fiscal drag on economic growth this year. Given the still-moderate underlying pace of economic growth, this additional near-term burden on the recovery is significant.

Moreover, besides having adverse effects on jobs and incomes, a slower recovery would lead to less actual deficit reduction in the short run for any given set of fiscal actions.

Thursday economic releases:

• At 8:30 AM ET: the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 345 thousand from 339 thousand last week.

• Also at 8:30 AM, the Trade Balance report for March from the Census Bureau. The consensus is for the U.S. trade deficit to decrease to $42.4 billion in March from $43.0 billion in February.

Fannie Mae, Freddie Mac: Mortgage Serious Delinquency rates declined in March

by Calculated Risk on 5/01/2013 06:09:00 PM

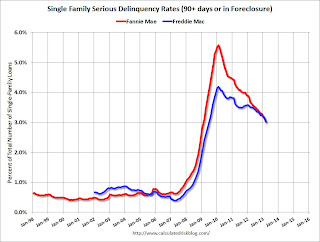

Fannie Mae reported that the Single-Family Serious Delinquency rate declined in March to 3.02% from 3.13% in February. The serious delinquency rate is down from 3.67% in March 2012, and this is the lowest level since February 2009.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate declined in March to 3.03% from 3.15% in February. Freddie's rate is down from 3.51% in March 2012, and this is the lowest level since June 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

Although this indicates some progress, the "normal" serious delinquency rate is under 1%.

At the recent rate of improvement, the serious delinquency rate will not be under 1% until 2017 or later.

U.S. Light Vehicle Sales decreased to 14.9 million annual rate in April

by Calculated Risk on 5/01/2013 03:51:00 PM

Based on an estimate from AutoData Corp, light vehicle sales were at a 14.92 million SAAR in April. That is up 6% from April 2012, and down 2% from the sales rate last month.

This was below the consensus forecast of 15.3 million SAAR (seasonally adjusted annual rate).

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for April (red, light vehicle sales of 14.92 million SAAR from AutoData).

Click on graph for larger image.

Click on graph for larger image.

This was the lowest sales rate in six months.

After three consecutive years of double digit auto sales growth, the growth rate will probably slow in 2013 - but this will still be another positive year for the auto industry.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

Unlike residential investment, auto sales bounced back fairly quickly following the recession and have been a key driver of the recovery. Looking forward, growth will slow for auto sales. If sales average the recent pace for the entire year, total sales will be up about 5% from 2012.

FOMC Statement: "fiscal policy is restraining economic growth", "prepared to increase or reduce the pace of its purchases"

by Calculated Risk on 5/01/2013 02:00:00 PM

The key changes:

1) "fiscal policy is restraining economic growth."

2) "The Committee is prepared to increase or reduce the pace of its purchases to maintain appropriate policy accommodation as the outlook for the labor market or inflation changes."

The FOMC is clearly signaling that fiscal policy is hurting the economy ...

FOMC Statement:

Information received since the Federal Open Market Committee met in March suggests that economic activity has been expanding at a moderate pace. Labor market conditions have shown some improvement in recent months, on balance, but the unemployment rate remains elevated. Household spending and business fixed investment advanced, and the housing sector has strengthened further, but fiscal policy is restraining economic growth. Inflation has been running somewhat below the Committee's longer-run objective, apart from temporary variations that largely reflect fluctuations in energy prices. Longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with appropriate policy accommodation, economic growth will proceed at a moderate pace and the unemployment rate will gradually decline toward levels the Committee judges consistent with its dual mandate. The Committee continues to see downside risks to the economic outlook. The Committee also anticipates that inflation over the medium term likely will run at or below its 2 percent objective.

To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee decided to continue purchasing additional agency mortgage-backed securities at a pace of $40 billion per month and longer-term Treasury securities at a pace of $45 billion per month. The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. Taken together, these actions should maintain downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative.

The Committee will closely monitor incoming information on economic and financial developments in coming months. The Committee will continue its purchases of Treasury and agency mortgage-backed securities, and employ its other policy tools as appropriate, until the outlook for the labor market has improved substantially in a context of price stability. The Committee is prepared to increase or reduce the pace of its purchases to maintain appropriate policy accommodation as the outlook for the labor market or inflation changes. In determining the size, pace, and composition of its asset purchases, the Committee will continue to take appropriate account of the likely efficacy and costs of such purchases as well as the extent of progress toward its economic objectives.

To support continued progress toward maximum employment and price stability, the Committee expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens. In particular, the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee's 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored. In determining how long to maintain a highly accommodative stance of monetary policy, the Committee will also consider other information, including additional measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; James Bullard; Elizabeth A. Duke; Charles L. Evans; Jerome H. Powell; Sarah Bloom Raskin; Eric S. Rosengren; Jeremy C. Stein; Daniel K. Tarullo; and Janet L. Yellen. Voting against the action was Esther L. George, who was concerned that the continued high level of monetary accommodation increased the risks of future economic and financial imbalances and, over time, could cause an increase in long-term inflation expectations

Residential Construction Spending increased in March, Non-Residential and Public Spending Decreased

by Calculated Risk on 5/01/2013 11:07:00 AM

The Census Bureau reported that overall construction spending decreased in March:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during March 2013 was estimated at a seasonally adjusted annual rate of $856.7 billion, 1.7 percent below the revised February estimate of $871.2 billion. The March figure is 4.8 percent above the March 2012 estimate of $817.8 billion.Both private construction and public construction spending decreased (residential increased, non-residential decreased):

Spending on private construction was at a seasonally adjusted annual rate of $598.4 billion, 0.6 percent below the revised February estimate of $602.0 billion. Residential construction was at a seasonally adjusted annual rate of $294.9 billion in March, 0.4 percent above the revised February estimate of $293.8 billion. Nonresidential construction was at a seasonally adjusted annual rate of $303.5 billion in March, 1.5 percent below the revised February estimate of $308.2 billion. ...

In March, the estimated seasonally adjusted annual rate of public construction spending was $258.3 billion, 4.1 percent below the revised February estimate of $269.2 billion.

Click on graph for larger image.

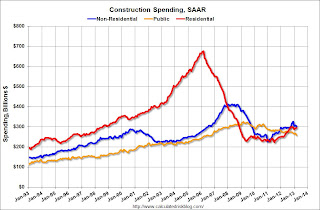

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 56% below the peak in early 2006, and up 33% from the post-bubble low. Non-residential spending is 27% below the peak in January 2008, and up about 34% from the recent low.

Public construction spending is now 21% below the peak in March 2009 and at the lowest level since 2006 (not inflation adjusted).

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is now up 18%. Non-residential spending is up 3% year-over-year mostly due to energy spending (power and electric). Public spending is down 5.4% year-over-year.

A few key themes:

1) Private residential construction is usually the largest category for construction spending, but there was a huge collapse in spending following the housing bubble (as expected). Private residential is now about even with private non-residential, and residential will probably be the largest category of construction spending in 2013. Usually private residential construction leads the economy, so this is a good sign going forward.

2) Private non-residential construction spending usually lags the economy. There was some increase this time, mostly related to energy and power - but the key sectors of office, retail and hotels are still at very low levels.

3) Public construction spending has declined to 2006 levels (not adjusted for inflation). This has been a drag on the economy for 4 years. In real terms, this is the lowest level of public construction spending since February 2001.