by Calculated Risk on 4/25/2013 08:47:00 PM

Thursday, April 25, 2013

Friday: Q1 GDP

An interesting piece from Michelle Meyer at Merrill Lynch: Housing watch: Who are the buyers?

One of the common misconceptions is that the gain in housing demand owes primarily to investors and international buyers. In Q1, investors made up about 22% of sales, which is close to the average since mid-2010. International buyers made up about 2% of sales in Q1, which again matches the historical average over the past three years. Of course, in certain markets investors and international buyers play a bigger role. Investors buy a disproportionate share of distressed properties, making them more relevant in markets with high delinquencies. Similarly, in big cities such as New York, Miami and San Francisco, international buyers account for a much larger share of sales.Meyer argues a large percentage of the cash buyers are not investors.

Primary homebuyers are still the largest share of the market, by far. However, the constraint for primary homebuyers is tight credit conditions. This has resulted in a greater share of all-cash purchases. Over 20% of buyers who are looking to relocate (turnover) and 60% of second home buyers use only cash. First-time homebuyers are still reliant on financing as only 11% of sales are all cash among this cohort. And of course, the most extreme is investors and international buyers where about three-quarters of purchases are all-cash. All together, about a third of sales are made without financing. As credit conditions gradually ease, which we anticipate, the housing market will open to a wider range of buyers, particularly first-time owners.

emphasis added

Friday economic releases:

• At 8:30 AM ET, the BEA will release the advance Q1 GDP report. The consensus is that real GDP increased 3.1% annualized in Q1.

• At 9:55 AM, Reuter's/University of Michigan's Consumer sentiment index (final for April). The consensus is for a reading of 73.0, up from 72.3.

WSJ: "Unemployment Hits New Highs in Spain, France"

by Calculated Risk on 4/25/2013 05:59:00 PM

This is no surprise ... from the WSJ: Unemployment Hits New Highs in Spain, France

The jobless rate in Spain rose sharply to 27.2% of the workforce in the first quarter, the highest level since records began in the 1970s. In France, the number of registered job seekers who are fully unemployed rose to more than 3.2 million, topping a previous record set in 1997.Maybe, just maybe, policymakers in Europe will get the message that the almost singular focus on deficit reduction has been a policy mistake.

...

Last week, the International Monetary Fund joined the U.S. in saying the euro zone should ease up on belt-tightening, arguing it was holding back the global economic recovery and could end up being self-defeating. The head of the European Commission said Monday the policy had "reached its limits."

Zillow: Rate of Home Value Appreciation Slows Nationwide in Q1

by Calculated Risk on 4/25/2013 03:21:00 PM

From Zillow: Rate of Home Value Appreciation Slows Nationwide in Q1, But Pockets of Volatility Remain

Zillow’s first quarter Real Estate Market Reports, released today, show home values increased 0.5% from the fourth quarter of 2012 to the first quarter of 2013 to $157,600. This quarter marks five consecutive quarters of national home value appreciation. On an annual basis, the Zillow Home Value Index (ZHVI) rose 5.1% from March 2012 levels. While home values are still experiencing above normal annual home value appreciation we are seeing signs of deceleration. Monthly appreciation, albeit positive, has been continuously getting smaller, and national home values grew by only 0.1% for the past two months. This does not come as a surprise as appreciation rates have been unsustainable, especially in some of the markets harder hit by the housing recession. ...This report is through Q1, the most recent Case-Shiller release was for January.

According to the Zillow Home Value Forecast (ZHVF), we expect national home values to increase 3.2% over the next year (March 2013 to March 2014).

We are starting to see a little more inventory - probably in response to the recent price increases - and it would make sense that with more inventory, the pace of price increases would slow.

Note: Here are the Zillow Home Value Indexes by city.

Update: CoreLogic acquires Case-Shiller

by Calculated Risk on 4/25/2013 12:52:00 PM

Last night I mentioned that CoreLogic had acquired Case-Shiller house price index, and I wondered if there would be changes to how the index was released. The answer is nothing will change ...

From CoreLogic: CoreLogic Acquires Case-Shiller

CoreLogic® ... announced the acquisition of Case-Shiller® from Fiserv, Inc. ...Only the name (and ownership) has changed.

In addition to the widely recognized Case-Shiller Indexes, CoreLogic will continue to offer its CoreLogic HPI® ... The CoreLogic HPI and the Case-Shiller Indexes are complementary measures of home price trends utilizing the same baseline methodology of repeat home sales.

The Case-Shiller Indexes will be renamed the CoreLogic Case-Shiller Indexes. The S&P/Case-Shiller Home Price Indices will retain their brand name. The CoreLogic HPI, CoreLogic Case-Shiller Indexes, and S&P/Case-Shiller Home Price Indices reports will continue to be published and distributed on their customary time schedules and in their current formats.

Dr. David Stiff, chief economist for Case-Shiller, will continue to supervise the preparation of the CoreLogic Case-Shiller Indexes and comment on the findings of those indexes. Dr. Mark Fleming, chief economist for CoreLogic, will continue to supervise the preparation of the CoreLogic HPI reports and comment on the findings of those reports.

Kansas City Fed: Regional Manufacturing contracted "modestly" in April

by Calculated Risk on 4/25/2013 11:00:00 AM

So far all of the regional manufacturing surveys have indicated April was pretty weak. From the Kansas City Fed: Tenth District Manufacturing Survey Fell Modestly

The Federal Reserve Bank of Kansas City released the April Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity fell by a similar modest amount as last month, and producers' expectations moderated but remained positive overall.The last regional survey for April will be released next Monday (Dallas), and the ISM index for April will be released on Wednesday, May 1st. Based on the regional surveys, I expect a fairly weak reading for the ISM index (perhaps at or below 50).

"We saw another small decline in regional factory activity this month," said Wilkerson. "Some firms see signs of a pickup in activity later this year driven by pent up demand and new product offerings, but others have become more pessimistic recently as anticipated demand has failed to materialize."

The month-over-month composite index was -5 in April, equal to -5 in March but up from -10 in February ... The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Durable goods-producing plants reported a smaller decline in activity, but production at nondurable-goods plants fell after increasing last month, particularly for food and plastics products. Most other month-over-month indexes improved somewhat. The production index edged higher from -1 to 1, and the shipments index also increased, with both indexes moving into positive territory for the first time in 8 months. The employment index rebounded from -15 to -3, and the order backlog index also rose. The new orders and new orders for exports indexes were basically unchanged. Both inventory indexes fell further into negative territory after increasing last month.

Weekly Initial Unemployment Claims decline to 339,000

by Calculated Risk on 4/25/2013 08:35:00 AM

The DOL reports:

In the week ending April 20, the advance figure for seasonally adjusted initial claims was 339,000, a decrease of 16,000 from the previous week's revised figure of 355,000. The 4-week moving average was 357,500, a decrease of 4,500 from the previous week's revised average of 362,000.The previous week was revised up from 352,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 357,500.

Weekly claims were the lowest in six weeks and were below the 350,000 consensus forecast.

Wednesday, April 24, 2013

Thursday: Weekly Unemployment Claims

by Calculated Risk on 4/24/2013 07:50:00 PM

Interesting ... CoreLogic acquires Case-Shiller:

On March 20, 2013, the Company acquired Case-Shiller from Fiserv, Inc. for approximately $6.0 million. Case-Shiller, one of the most widely recognized experts in home price trends and property valuation services, is a highly complementary addition to CoreLogic’s existing residential property insights platform.Currently Case-Shiller is the most followed house price index, but I also use CoreLogic, Zillow and others ... it isn't clear what CoreLogic's plans are with this acquisition (will they release both or just focus on Case-Shiller?)

Thursday economic releases:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 350 thousand from 352 thousand last week. The "sequester" budget cuts might be starting to impact weekly claims.

• At 11:00 AM, Kansas City Fed regional Manufacturing Survey for April. The consensus is for a reading of minus 1, up from minus 5 in March (below zero is contraction).

Lawler: How Much Has the Single Family Housing Market Shifted to Rentals (in numbers)?

by Calculated Risk on 4/24/2013 04:05:00 PM

From economist Tom Lawler:

While good, reliable, consistent, and timely government data on the housing stock and housing tenure do not exist, the limited data available suggest that over the last few years (1) there has been a sizable increase in the number of SF housing units occupied by renters; (2) a decent-sized decline in the number of SF housing units occupied by owners; and (3) this trend began several years ago, and several years before widely-publicized “institutional” investor buying emerged.

Estimates of the SHARE of SF housing units occupied by owners vs. renters are available from the American Community Survey annually from 2006 through 2011 and biennially from the American Housing Survey through 2011, and “imprecise” estimates of the owner vs. renter share of “one-unit” structures can be derived from the detailed tables of the Housing Vacancy Survey through 2012 – though rental and homeowner vacancy rates for “one-unit” structures in the HVS include not just SF detached and attached homes but also manufactured/mobile homes. All three surveys show a substantial increase in the share of SF/one-units occupied homes occupied by renters from 2007 to 2011, and the HVS data show a continued share increase in 2012. Both the AHS and the HVS, however, appear to overstated significantly overall homeownership rates (based on a comparison to decennial Census results), while the ACS homeownership rates seem more consistent with decennial Census data. As such, I believe the ACS data on the renter share of the SF housing market is superior to the AHS and HVS data.

Click on graph for larger image.

Click on graph for larger image.

Note: The estimate for 2012 is based on the 2012 vs. 2011 change in the HVS estimate of the renter share of occupied “one-unit” structures.

Translating the ACS share data to numbers, however, requires a little work. First, the numbers for households in the annual ACS results are “benchmarked” to the latest available housing stock estimate for that year, and there have been significant upward revisions in housing stock estimates. Second, the latest available “official” housing stock estimates do not incorporate post-Census analyses of the estimated “undercount” of housing units in the “official” Census numbers. And finally, the ACS appears to overstate the overall housing vacancy rate, though by less than the HVS or AHS. Unfortunately, adjusted for this last factor is difficult, since the degree of the vacancy rate “overstatement” is only available for 2010. As such, I only adjusted the ACS estimates for more reasonable estimates of the housing stock (incorporating the Census 2000 HUCS and the Census 2010 CCM).

Making this adjustment, and using estimates for the 2012 ACS data based on HVS results, it would appear that from 2007 to 2012 the number of SF detached and attached homes that were occupied by renters increased by about 2.6 million, while the number of SF detached and attached homes that were occupied by owners declined by about 1.3 million. The largest increase in both the number and the share of renter-occupied SF homes appears to have been in 2009.

Since “active” investor buying of SF homes that were then rented out has been going on for many years, why has the media only recently begun to focus intently on this “trend?

First, investor buying in earlier years occurred when for-sale inventories (and REO inventories) and the pace of foreclosure were high, the economy in general and labor markets in particular were extremely weak, and there were no signs either of a housing “recovery” or improving home prices. Second, last year a number of large institutional firms very publicly announced plans to ramp up purchases of SF homes as rental properties. Third, their ramped-up buying came when overall inventories of existing home for sale, and especially “distressed”/REO properties for sale, had fallen sharply, as well as when an improved economy and record-low mortgage rates were producing a modest increase in potential demand from folks wanting to buy a home to live in. (Folks love anecdotal stories about how investors are “out-bidding” or “crowding out” first-time home buyers!)

And finally, their (and other) aggressive buying in the face of sharply lower inventories (large institutional investors appear to have lower “hurdle rates” than “traditional” investors) has helped fuel a significant recovery in home prices in many parts of the country (oh my, more “de-stickification!”)

| All-Cash Share of Home Sales (Yearly Totals) | |||||||

|---|---|---|---|---|---|---|---|

| Phoenix | Tucson | California* | Florida SF | Florida C/TH | Knoxville | Omaha | |

| 2007 | 11.6% | 12.6% | 10.3% | N/A | N/A | 12.4% | N/A |

| 2008 | 12.6% | 18.8% | 18.7% | 25.5% | 43.6% | 15.2% | 12.1% |

| 2009 | 37.2% | 23.9% | 26.3% | 36.8% | 64.0% | 17.8% | 11.8% |

| 2010 | 41.8% | 28.3% | 28.0% | 42.3% | 73.2% | 22.1% | 16.7% |

| 2011 | 46.9% | 34.6% | 30.4% | 45.5% | 76.6% | 24.5% | 20.2% |

| 2012 | 46.0% | 34.4% | 32.6% | 45.7% | 75.6% | 26.6% | 17.6% |

| *Derived from Dataquick chart; new and resale homes based on property records, all others MLS based. | |||||||

In 2010 there were 141,722 MLS-based home sales (SF and C/TH) in Florida that were all-cash transactions, while there were 79,779 foreclosure sales and 53,780 short sales. In 2012 there were 54,607 foreclosure sales and 63,250 short sales (or 117,867 “distressed” sales, down 15,692 from 2010), but all-cash transactions increased by 28,647 to 170,369.

From 2009 to 2012 MLS-based home sales in Florida increased by 24.2%. All-cash transactions increased by 54.1%, while mortgage-financed transactions were very slightly LOWER in 2012 compared to 2009.

April Vehicle Sales forecast to be above 15 million SAAR for Sixth Consecutive Month

by Calculated Risk on 4/24/2013 01:16:00 PM

Note: The automakers will report April vehicle sales on Wednesday, May 1st. Here are a couple of forecasts:

From J.D. Power: J.D. Power and LMC Automotive Report: Solid New-Vehicle Selling Rate in April Driven by Replacement Demand

Total light-vehicle sales in April 2013 are projected to reach 1,312,100 units, a 7 percent increase from April 2012. The selling rate is expected to remain above 15 million units for the sixth consecutive month [forecast is 15.2 million Seasonally Adjusted Annual Rate, SAAR].And from Kelley Blue Book: New-Car Sales Pace Above 15 Million Seasonally Adjusted Annual Rate for Sixth Consecutive Month

...

According to J.D. Power and Associates PIN data, strong sales are being complemented by increasing prices. When comparing year-to-date data for 2013 with the same period last year, consumer-facing transaction prices are up 3.1 percent, which equates to an extra $13.2 billion spent on new vehicles through the first 4 months of the year ($113 billion in total).

Through the first three weeks of April 2013, new-car sales are on pace to remain above a 15 million unit annual selling pace for the sixth consecutive month, according to Kelley Blue Book ... Kelley Blue Book projects light vehicle sales to surpass 1.3 million units by month end, which is an 11.4 percent annual gain.Note: In 2012, there were 1.18 million light vehicle sales in April or a 14.1 million SAAR. This year sales will probably be above 1.3 million, however there is one extra selling day in this year.

Two key points: 1) sales growth will slow in 2013, and 2) it appears auto sales are still solid in April (no signs of a consumer slowdown).

Most forecasts were for auto sales growth to slow in 2013 to around 4% growth or 15.0 million units. Based on the first several months of 2013, it appears sales will be somewhat stronger than expected this year, but not double digit growth like the last few years. This suggests auto sales will contribute less to GDP growth this year than in the previous three years.

| Light Vehicle Sales | ||

|---|---|---|

| Sales (millions) | Annual Change | |

| 2005 | 16.9 | 0.5% |

| 2006 | 16.5 | -2.6% |

| 2007 | 16.1 | -2.5% |

| 2008 | 13.2 | -18.0% |

| 2009 | 10.4 | -21.2% |

| 2010 | 11.6 | 11.1% |

| 2011 | 12.7 | 10.2% |

| 2012 | 14.4 | 13.4% |

| 20131 | 15.2 | 5.3% |

| 1Current sales rate | ||

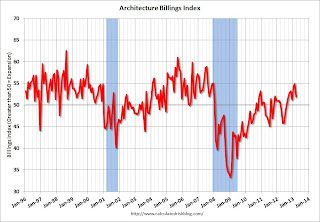

AIA: Architecture Billings Index indicates increasing demand for design services in March

by Calculated Risk on 4/24/2013 09:47:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: More Positive Momentum for Architecture Billings

The Architecture Billings Index (ABI) is reflecting a steady upturn in design activity. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the March ABI score was 51.9, down from a mark of 54.9 in February. This score reflects an increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 60.1, down from the reading of 64.8 the previous month.

“Business conditions in the construction industry have generally been improving over the last several months,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “But as we have continued to report, the recovery has been uneven across the major construction sectors so it’s not a big surprise that there was some easing in the pace of growth in March compared to previous months.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 51.9 in February, down from 54.9 in February. Anything above 50 indicates expansion in demand for architects' services, and this was the eight consecutive month with a reading above 50.

Every building sector is now expanding and new project inquiries are strongly positive (down from February, but still at 60.1). Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index suggests some increase in CRE investment in the second half of 2013.