by Calculated Risk on 4/24/2013 07:50:00 PM

Wednesday, April 24, 2013

Thursday: Weekly Unemployment Claims

Interesting ... CoreLogic acquires Case-Shiller:

On March 20, 2013, the Company acquired Case-Shiller from Fiserv, Inc. for approximately $6.0 million. Case-Shiller, one of the most widely recognized experts in home price trends and property valuation services, is a highly complementary addition to CoreLogic’s existing residential property insights platform.Currently Case-Shiller is the most followed house price index, but I also use CoreLogic, Zillow and others ... it isn't clear what CoreLogic's plans are with this acquisition (will they release both or just focus on Case-Shiller?)

Thursday economic releases:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 350 thousand from 352 thousand last week. The "sequester" budget cuts might be starting to impact weekly claims.

• At 11:00 AM, Kansas City Fed regional Manufacturing Survey for April. The consensus is for a reading of minus 1, up from minus 5 in March (below zero is contraction).

Lawler: How Much Has the Single Family Housing Market Shifted to Rentals (in numbers)?

by Calculated Risk on 4/24/2013 04:05:00 PM

From economist Tom Lawler:

While good, reliable, consistent, and timely government data on the housing stock and housing tenure do not exist, the limited data available suggest that over the last few years (1) there has been a sizable increase in the number of SF housing units occupied by renters; (2) a decent-sized decline in the number of SF housing units occupied by owners; and (3) this trend began several years ago, and several years before widely-publicized “institutional” investor buying emerged.

Estimates of the SHARE of SF housing units occupied by owners vs. renters are available from the American Community Survey annually from 2006 through 2011 and biennially from the American Housing Survey through 2011, and “imprecise” estimates of the owner vs. renter share of “one-unit” structures can be derived from the detailed tables of the Housing Vacancy Survey through 2012 – though rental and homeowner vacancy rates for “one-unit” structures in the HVS include not just SF detached and attached homes but also manufactured/mobile homes. All three surveys show a substantial increase in the share of SF/one-units occupied homes occupied by renters from 2007 to 2011, and the HVS data show a continued share increase in 2012. Both the AHS and the HVS, however, appear to overstated significantly overall homeownership rates (based on a comparison to decennial Census results), while the ACS homeownership rates seem more consistent with decennial Census data. As such, I believe the ACS data on the renter share of the SF housing market is superior to the AHS and HVS data.

Click on graph for larger image.

Click on graph for larger image.

Note: The estimate for 2012 is based on the 2012 vs. 2011 change in the HVS estimate of the renter share of occupied “one-unit” structures.

Translating the ACS share data to numbers, however, requires a little work. First, the numbers for households in the annual ACS results are “benchmarked” to the latest available housing stock estimate for that year, and there have been significant upward revisions in housing stock estimates. Second, the latest available “official” housing stock estimates do not incorporate post-Census analyses of the estimated “undercount” of housing units in the “official” Census numbers. And finally, the ACS appears to overstate the overall housing vacancy rate, though by less than the HVS or AHS. Unfortunately, adjusted for this last factor is difficult, since the degree of the vacancy rate “overstatement” is only available for 2010. As such, I only adjusted the ACS estimates for more reasonable estimates of the housing stock (incorporating the Census 2000 HUCS and the Census 2010 CCM).

Making this adjustment, and using estimates for the 2012 ACS data based on HVS results, it would appear that from 2007 to 2012 the number of SF detached and attached homes that were occupied by renters increased by about 2.6 million, while the number of SF detached and attached homes that were occupied by owners declined by about 1.3 million. The largest increase in both the number and the share of renter-occupied SF homes appears to have been in 2009.

Since “active” investor buying of SF homes that were then rented out has been going on for many years, why has the media only recently begun to focus intently on this “trend?

First, investor buying in earlier years occurred when for-sale inventories (and REO inventories) and the pace of foreclosure were high, the economy in general and labor markets in particular were extremely weak, and there were no signs either of a housing “recovery” or improving home prices. Second, last year a number of large institutional firms very publicly announced plans to ramp up purchases of SF homes as rental properties. Third, their ramped-up buying came when overall inventories of existing home for sale, and especially “distressed”/REO properties for sale, had fallen sharply, as well as when an improved economy and record-low mortgage rates were producing a modest increase in potential demand from folks wanting to buy a home to live in. (Folks love anecdotal stories about how investors are “out-bidding” or “crowding out” first-time home buyers!)

And finally, their (and other) aggressive buying in the face of sharply lower inventories (large institutional investors appear to have lower “hurdle rates” than “traditional” investors) has helped fuel a significant recovery in home prices in many parts of the country (oh my, more “de-stickification!”)

| All-Cash Share of Home Sales (Yearly Totals) | |||||||

|---|---|---|---|---|---|---|---|

| Phoenix | Tucson | California* | Florida SF | Florida C/TH | Knoxville | Omaha | |

| 2007 | 11.6% | 12.6% | 10.3% | N/A | N/A | 12.4% | N/A |

| 2008 | 12.6% | 18.8% | 18.7% | 25.5% | 43.6% | 15.2% | 12.1% |

| 2009 | 37.2% | 23.9% | 26.3% | 36.8% | 64.0% | 17.8% | 11.8% |

| 2010 | 41.8% | 28.3% | 28.0% | 42.3% | 73.2% | 22.1% | 16.7% |

| 2011 | 46.9% | 34.6% | 30.4% | 45.5% | 76.6% | 24.5% | 20.2% |

| 2012 | 46.0% | 34.4% | 32.6% | 45.7% | 75.6% | 26.6% | 17.6% |

| *Derived from Dataquick chart; new and resale homes based on property records, all others MLS based. | |||||||

In 2010 there were 141,722 MLS-based home sales (SF and C/TH) in Florida that were all-cash transactions, while there were 79,779 foreclosure sales and 53,780 short sales. In 2012 there were 54,607 foreclosure sales and 63,250 short sales (or 117,867 “distressed” sales, down 15,692 from 2010), but all-cash transactions increased by 28,647 to 170,369.

From 2009 to 2012 MLS-based home sales in Florida increased by 24.2%. All-cash transactions increased by 54.1%, while mortgage-financed transactions were very slightly LOWER in 2012 compared to 2009.

April Vehicle Sales forecast to be above 15 million SAAR for Sixth Consecutive Month

by Calculated Risk on 4/24/2013 01:16:00 PM

Note: The automakers will report April vehicle sales on Wednesday, May 1st. Here are a couple of forecasts:

From J.D. Power: J.D. Power and LMC Automotive Report: Solid New-Vehicle Selling Rate in April Driven by Replacement Demand

Total light-vehicle sales in April 2013 are projected to reach 1,312,100 units, a 7 percent increase from April 2012. The selling rate is expected to remain above 15 million units for the sixth consecutive month [forecast is 15.2 million Seasonally Adjusted Annual Rate, SAAR].And from Kelley Blue Book: New-Car Sales Pace Above 15 Million Seasonally Adjusted Annual Rate for Sixth Consecutive Month

...

According to J.D. Power and Associates PIN data, strong sales are being complemented by increasing prices. When comparing year-to-date data for 2013 with the same period last year, consumer-facing transaction prices are up 3.1 percent, which equates to an extra $13.2 billion spent on new vehicles through the first 4 months of the year ($113 billion in total).

Through the first three weeks of April 2013, new-car sales are on pace to remain above a 15 million unit annual selling pace for the sixth consecutive month, according to Kelley Blue Book ... Kelley Blue Book projects light vehicle sales to surpass 1.3 million units by month end, which is an 11.4 percent annual gain.Note: In 2012, there were 1.18 million light vehicle sales in April or a 14.1 million SAAR. This year sales will probably be above 1.3 million, however there is one extra selling day in this year.

Two key points: 1) sales growth will slow in 2013, and 2) it appears auto sales are still solid in April (no signs of a consumer slowdown).

Most forecasts were for auto sales growth to slow in 2013 to around 4% growth or 15.0 million units. Based on the first several months of 2013, it appears sales will be somewhat stronger than expected this year, but not double digit growth like the last few years. This suggests auto sales will contribute less to GDP growth this year than in the previous three years.

| Light Vehicle Sales | ||

|---|---|---|

| Sales (millions) | Annual Change | |

| 2005 | 16.9 | 0.5% |

| 2006 | 16.5 | -2.6% |

| 2007 | 16.1 | -2.5% |

| 2008 | 13.2 | -18.0% |

| 2009 | 10.4 | -21.2% |

| 2010 | 11.6 | 11.1% |

| 2011 | 12.7 | 10.2% |

| 2012 | 14.4 | 13.4% |

| 20131 | 15.2 | 5.3% |

| 1Current sales rate | ||

AIA: Architecture Billings Index indicates increasing demand for design services in March

by Calculated Risk on 4/24/2013 09:47:00 AM

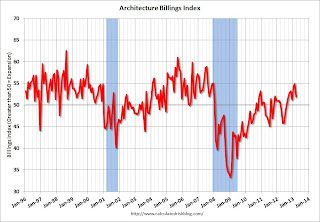

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: More Positive Momentum for Architecture Billings

The Architecture Billings Index (ABI) is reflecting a steady upturn in design activity. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the March ABI score was 51.9, down from a mark of 54.9 in February. This score reflects an increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 60.1, down from the reading of 64.8 the previous month.

“Business conditions in the construction industry have generally been improving over the last several months,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “But as we have continued to report, the recovery has been uneven across the major construction sectors so it’s not a big surprise that there was some easing in the pace of growth in March compared to previous months.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 51.9 in February, down from 54.9 in February. Anything above 50 indicates expansion in demand for architects' services, and this was the eight consecutive month with a reading above 50.

Every building sector is now expanding and new project inquiries are strongly positive (down from February, but still at 60.1). Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index suggests some increase in CRE investment in the second half of 2013.

MBA: Mortgage Applications Increase, Purchase Index highest since May 2010

by Calculated Risk on 4/24/2013 08:41:00 AM

From the MBA: Mortgage Applications Increase Slightly in Latest MBA Weekly Survey

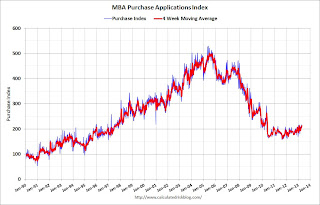

The Refinance Index increased 0.3 percent from the previous week. The seasonally adjusted Purchase Index increased 0.3 percent from one week earlier to the highest level since May 2010.

...

The HARP share of refinance applications increased from 31 percent last week to 32 percent this week, the highest level since MBA began tracking HARP applications in February 2012.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.65 percent from 3.67 percent, with points decreasing to 0.41 from 0.50 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

There has been a sustained refinance boom for over a year.

According to the MBA, the HARP program is contributing significant to the current level of refis.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the purchase index last week was at the highest level since May 2010.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the purchase index last week was at the highest level since May 2010.

Tuesday, April 23, 2013

Wednesday: Durable Goods, Architecture Billings Index

by Calculated Risk on 4/23/2013 09:22:00 PM

Some more data released today ... A house price index up sharply, another regional manufacturing survey indicating weakness, and the overall economy continue to expand ... a familiar story ...

From the FHFA: House Price Index Up 0.7 Percent in February

U.S. house prices rose 0.7 percent on a seasonally adjusted basis from January to February, according to the Federal Housing Finance Agency’s monthly House Price Index (HPI). For the 12 months ending in February, U.S. house prices rose 7.1 percent.From the Richmond Fed: Manufacturing Activity Pulled Back in April; Expectations Waned

In April, the seasonally adjusted composite index of manufacturing activity — our broadest measure of manufacturing — lost nine points, settling at −6 from March's reading of 3. Among the index's components, shipments fell seventeen points to −9, the gauge for new orders moved down four points to end at−8, and the jobs index subtracted six points to end at 3.And state coincident indexes from the Philly fed:

...

Hiring activity at Fifth District plants was mixed in April. The manufacturing employment index moved down six points to 3 and the average workweek indicator lost thirteen points to end at −3. In contrast, the wage index gained eight points to finish at 12.

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for March 2013. In the past month, the indexes increased in 47 states and remained stable in three (New Mexico, Nevada, and Wyoming), for a one-month diffusion index of 94. Over the past three months, the indexes increased in 47 states, decreased in one (Illinois), and remained stable in two (Hawaii and New Mexico), for a three-month diffusion index of 92.Wednesday economic releases:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Durable Goods Orders for March from the Census Bureau. The consensus is for a 2.8% decrease in durable goods orders.

• During the day: The AIA's Architecture Billings Index for March (a leading indicator for commercial real estate).

ATA Trucking Index increases in March

by Calculated Risk on 4/23/2013 04:59:00 PM

This is a minor indicator that I follow.

From ATA: ATA Truck Tonnage Index Increased 0.9% in March

The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index gained 0.9% in March after decreasing 0.7% in February. (The 0.7% loss in February was revised down from a 0.6% increase ATA reported on March 19, 2013.) Tonnage has now increased in four of the last five months. Specifically, since November 2012, the index is up 7.6%. In March, the SA index equaled 123.5 (2000=100) versus 122.3 in February. The highest level on record was December 2011 at 124.3. Compared with March 2012, the SA index was up a solid 3.8%, beating February’s 3.1% year-over-year gain.Note from ATA:

“Fitting with the expectation for solid gross domestic product growth in the first quarter, tonnage was strong in March and the quarter overall,” ATA Chief Economist Bob Costello said. “At 3.9% year-over-year growth, the first quarter increase was the best since the final quarter 2011.

“Expect freight tonnage will slow in the months ahead as the federal government sequester continues and households finish spending their tax returns,” he said. “The good news for tonnage is housing starts are growing and energy production is good – both of which generates heavy freight. However, these two sectors alone won’t be enough to keep the overall index growing at a 3.9% clip in the second quarter.”

emphasis added

Trucking serves as a barometer of the U.S. economy, representing 67% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9.2 billion tons of freight in 2011. Motor carriers collected $603.9 billion, or 80.9% of total revenue earned by all transport modes.

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index is fairly noisy, but is up solidly year-over-year.

DataQuick: Q1 California Foreclosure Starts Lowest Since Late 2005

by Calculated Risk on 4/23/2013 02:14:00 PM

From DataQuick: Golden State Foreclosure Starts Lowest Since Late 2005

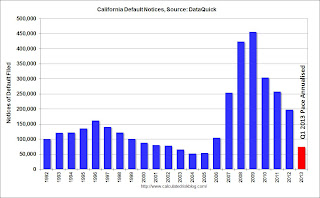

The number of California homeowners entering the foreclosure process plunged to the lowest level in more than seven years last quarter. The unusually sharp drop in the number of mortgage default notices filed by lenders stems mainly from rising home values, a strengthening economy and government efforts to reduce foreclosures, a real estate information service reported.

During first-quarter 2013 lenders recorded 18,567 Notices of Default (NoDs) on California houses and condos. That was down 51.4 percent from 38,212 during the prior three months, and down 67.0 percent from 56,258 in first-quarter 2012, according to San Diego-based DataQuick.

Last quarter's number was the lowest since 15,337 NoDs were recorded in fourth-quarter 2005. NoDs peaked in first-quarter 2009 at 135,431. DataQuick's NoD statistics go back to 1992.

"Foreclosure starts were already trending much lower late last year because of rising home prices, a stronger labor market and the settlement agreement between the government and some lenders. But it appears last quarter's drop was especially sharp because of a package of new state foreclosure laws - the 'Homeowner Bill of Rights' - that took effect January 1. Default notices fell off a cliff in January, then edged up. In recent years we've seen temporary lulls in foreclosure activity after new laws kick in and lenders adjust. It's certainly possible foreclosure starts will pick up at some point this year if lenders need to play a lot of catch-up," said John Walsh, DataQuick president.

...

Lenders' shift toward short sales as a foreclosure alternative has helped lower foreclosure activity in recent years. Short sales - transactions where the sale price fell short of what was owed on the property - made up an estimated 20.2 percent of the state's resale market last quarter. That was down from an estimated 24.2 percent the prior quarter and 24.8 percent a year earlier. However, the estimated number (rather than percentage) of short sales last quarter dipped just 1.5 percent from first-quarter 2012.

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of Notices of Default (NoD) filed in California each year. For 2013 (red), the bar is the Q1 rate annualized.

As John Walsh noted, the California "Homeowner Bill of Rights" slowed foreclosure activity in Q1, but the trend was already down - and this will probably be the lowest year for foreclosure starts since 2005.

A few comments on New Home Sales

by Calculated Risk on 4/23/2013 12:41:00 PM

Now that we have three months of data for 2013, one way to look at the growth rate is to use the "not seasonally adjusted" (NSA) year-to-date data.

According to the Census Bureau, there were 104 thousand new homes sold in Q1 2013, up about 19.5% from the 87 thousand sold in Q1 2012. That is a solid increase in sales, and this was the highest sales for Q1 since 2008.

Note: For 2013, estimates are sales will increase to around 450 to 460 thousand, or an increase of around 22% to 25% on an annual basis from the 369 thousand in 2012.

Although there has been a large increase in the sales rate, sales are still near the lows for previous recessions. This suggest significant upside over the next few years. Based on estimates of household formation and demographics, I expect sales to increase to 750 to 800 thousand over the next several years. Also housing is historically the best leading indicator for the economy, and this is one of the reasons I think The future's so bright, I gotta wear shades.

And here is another update to the "distressing gap" graph that I first started posting over four years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to start to close over the next few years.

Click on graph for larger image.

Click on graph for larger image.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through March 2013. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales kept existing home sales elevated, and depressed new home sales since builders weren't able to compete with the low prices of all the foreclosed properties.

I don't expect much of an increase in existing home sales (distressed sales will slowly decline and be offset by more conventional sales). But I do expect this gap to close - mostly from an increase in new home sales.

Another way to look at this is a ratio of existing to new home sales.

Another way to look at this is a ratio of existing to new home sales.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down, and I expect this ratio to trend down over the next several years as the number of distressed sales declines and new home sales increase.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales at 417,000 SAAR in March

by Calculated Risk on 4/23/2013 10:00:00 AM

The Census Bureau reports New Home Sales in March were at a seasonally adjusted annual rate (SAAR) of 417 thousand. This was up from 411 thousand SAAR in February.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

"Sales of new single-family houses in March 2013 were at a seasonally adjusted annual rate of 417,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 1.5 percent above the revised February rate of 411,000 and is 18.5 percent above the March 2012 estimate of 352,000."

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The second graph shows New Home Months of Supply.

The months of supply was unchanged in March at 4.4 months.

The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

This is now in the normal range (less than 6 months supply is normal)."The seasonally adjusted estimate of new houses for sale at the end of March was 153,000. This represents a supply of 4.4 months at the current sales rate."On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale is just above the record low. The combined total of completed and under construction is also just above the record low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In March 2013 (red column), 40 thousand new homes were sold (NSA). Last year 34 thousand homes were sold in March. This was the seventh weakest March since this data has been tracked. The high for March was 127 thousand in 2005, and the low for March was 28 thousand in 2011.

This was at expectations of 419,000 sales in March, and a fairly solid report. I'll have more soon ...