by Calculated Risk on 4/19/2013 06:14:00 PM

Friday, April 19, 2013

Bank Failures #7 & 8 in 2013: Both in Florida

From the FDIC: FirstAtlantic Bank, Jacksonville, Florida, Assumes All of the Deposits of Heritage Bank of North Florida, Orange Park, Florida

As of December 31, 2012, Heritage Bank of North Florida had approximately $110.9 million in total assets and $108.5 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $30.2 million. ... Heritage Bank of North Florida is the seventh FDIC-insured institution to fail in the nation this year, and the first in Florida.From the FDIC: First Federal Bank of Florida, Lake City, Florida, Assumes All of the Deposits of Chipola Community Bank, Marianna, Florida

As of December 31, 2012, Chipola Community Bank had approximately $39.2 million in total assets and $37.6 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $10.3 million. ... Chipola Community Bank is the eighth FDIC-insured institution to fail in the nation this year, and the second in Florida.That makes three so far today ... the FDIC back at work.

Bank Failure #6 in 2013: First Federal Bank, Lexington, Kentucky

by Calculated Risk on 4/19/2013 05:37:00 PM

From the FDIC: Your Community Bank, New Albany, Indiana, Assumes All of the Deposits of First Federal Bank, Lexington, Kentucky

As of December 31, 2012, First Federal Bank had approximately $100.1 million in total assets and $93.9 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $9.7 million. ... First Federal Bank is the sixth FDIC-insured institution to fail in the nation this year, and the first in Kentucky.Currently the FDIC is on pace to close around 20 banks in 2013. This will be the lowest number of failures since 2007 (or maybe 2008 if the pace picks up a little).

The following table shows the number of failures per year during the current cycle (this says nothing about the size of the failures):

| Year | Bank Failures |

|---|---|

| 2007 | 3 |

| 2008 | 25 |

| 2009 | 140 |

| 2010 | 157 |

| 2011 | 92 |

| 2012 | 51 |

| 20131 | 6 |

| 1 2013 so far | |

DataQuick on California Home Sales: Foreclosures lowest since September 2007

by Calculated Risk on 4/19/2013 03:20:00 PM

From DataQuick: California March Home Sales

An estimated 37,764 new and resale houses and condos sold statewide last month. That was up 31.5 percent from 28,719 in February, and up 0.8 percent from 37,481 sales in March 2012, according to San Diego-based DataQuick.Sales are still below the average level for the month of March, but the key is the percentage of distressed sales - especially foreclosures - is declining.

It’s normal for sales to shoot up between February and March. California March sales have varied from a low of 24,565 in 2008 to a high of 68,848 in 2005. Last month's sales were 13.5 percent below the average of 43,648 sales for all the months of March since 1988, when DataQuick's statistics begin.

...

Of the existing homes sold last month, 15.2 percent were properties that had been foreclosed on during the past year – the lowest level since foreclosure resales were 12.6 percent of the resale market in September 2007. Last month’s figure compares with 18.0 percent in February and 32.8 percent a year earlier. Foreclosure resales peaked at 58.8 percent in February 2009.

Short sales - transactions where the sale price fell short of what was owed on the property - made up an estimated 21.5 percent of the homes that resold last month. That was down from an estimated 22.4 percent the month before and 24.5 percent a year earlier.

...

Indicators of market distress continue to decline. Foreclosure activity remains well below year-ago and peak levels reached several years ago. Financing with multiple mortgages is low, while down payment sizes are stable, DataQuick reported.

emphasis added

The NAR will report March existing home sales next Monday, April 22nd.

BLS: Unemployment Rate declined in 26 States in March

by Calculated Risk on 4/19/2013 10:52:00 AM

From the BLS: Jobless rate down in 26 states, up in 7 in March; payroll jobs down in 26 states, up in 23

Regional and state unemployment rates were little changed in March. Twenty-six states and the District of Columbia had unemployment rate decreases, 7 states had increases, and 17 states had no change, the U.S. Bureau of Labor Statistics reported today.

...

Nevada had the highest unemployment rate among the states in March, 9.7 percent. The next highest rates were in Illinois (9.5 percent) and California and Mississippi (9.4 percent each). North Dakota again had the lowest jobless rate, 3.3 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement - Michigan and Nevada have seen the largest declines - New Jersey remains the laggard.

The states are ranked by the highest current unemployment rate. No state has double digit unemployment and the unemployment rate is at or above 9% in only seven states: Nevada, Mississippi, Illinois, California, North Carolina, Rhode Island and New Jersey. In early 2010, almost half the states had an unemployment rate above 9%.

Hotels: Occupancy Rate tracking pre-recession levels

by Calculated Risk on 4/19/2013 09:46:00 AM

Another update on hotels from HotelNewsNow.com: STR: US results for week ending 13 April

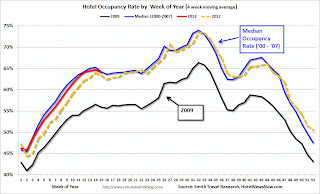

In year-over-year comparisons, occupancy was up 3.2 percent to 64.1 percent, average daily rate rose 7.2 percent to US$110.88 and revenue per available room increased 10.7 percent to US$71.04.The 4-week average of the occupancy rate is close to normal levels.

Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2013, yellow is for 2012, blue is "normal" and black is for 2009 - the worst year since the Great Depression for hotels.

The occupancy rate will probably move sideways until the summer vacation travel starts. The occupancy rate has improved from the same period last year - and is tracking the pre-recession levels.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Thursday, April 18, 2013

Friday: State Employment, Snoxx Socks!

by Calculated Risk on 4/18/2013 09:03:00 PM

Way off topic ... What are Snoxx socks? Long term readers know that Olympic figure skater Sasha Cohen is a family friend (wow - the 2006 Olympics is a long time ago). Well Sasha was tired of losing a sock from each pair of athletic socks, so she designed socks with a snap. Snoxx! You can read about the socks here.

Sasha has finished the design and is using KickStarter to get started with the manufacturing: Snoxx Socks: Colorful Athletic Socks With A Snap

Felix Salmon had an article about how KickStarter works today: Kickstarter funders aren’t angel investors

Kickstarter is not a store, but it’s definitely not a place to raise seed-round equity. The money that gets raised by a company on Kickstarter isn’t debt, and isn’t equity: it’s operating revenues. From a business-plan perspective, Kickstarter revenues are basically pre-orders.So if are interested in a pair (or three) of Snoxx, check out KickStarter or Sasha's website. There are big spender specials too - like the opportunity to skate with Sasha! Now back to economics ...

Friday economic releases:

• At 8:30 AM ET, the BLS will release Regional and State Employment and Unemployment (Monthly) for March 2013

NMHC Apartment Survey: Market Conditions Tighten in April

by Calculated Risk on 4/18/2013 04:36:00 PM

From the National Multi Housing Council (NMHC): Apartment Markets Resume Growth According to NMHC Survey

Apartment markets improved across all areas according to the National Multi Housing Council’s (NMHC) April Quarterly Survey of Apartment Market Conditions. All four indexes – Market Tightness (54), Sales Volume (55), Equity Financing (56) and Debt Financing (59) – came in above 50, which indicates improving conditions. This reverses last January’s findings, where Market Tightness and Sales Volume dipped below 50 for the first time since 2010.

“The apartment industry is operating on cruise control, as the expansion continues unabated,” said Mark Obrinsky, NMHC’s Vice President for Research and Chief Economist. “While concern about overbuilding has begun to crop up, demand for apartment residences remains strong. New construction may have finally recovered fully, but most units under construction won’t be delivered until 2014 or later. The dearth of recent completions has contributed to relatively low product availability. As deliveries increase, we expect to see an even greater pick-up in sales volume.”

...

Market Tightness Index rose to 54 from 45. The index has been above 50 for 12 of the past 13 quarters, with only January 2013 indicating contraction. One quarter of respondents saw markets as tighter, up from 16 percent last quarter.

emphasis added

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tightening from the previous quarter. This quarterly increase was small, but indicates tighter market conditions.

On supply: Even though multifamily starts have been increasing, completions lag starts by about a year - so the builders are still trying to catch up. There will be many more completions in 2013 and 2014, than in 2012, increasing the supply.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010. This survey now suggests vacancy rates might be nearing a bottom, although apartment markets are still tight, so rents will probably continue to increase.

Fed's Raskin: Low- and middle-income households hit hardest by Great Recession

by Calculated Risk on 4/18/2013 03:30:00 PM

From Fed Governor Sarah Bloom Raskin: Aspects of Inequality in the Recent Business Cycle. A few excerpts:

To isolate my proper subject here, I want to be clear that I am not engaging this afternoon with the concern that many Americans have that excessive inequality undermines American ideals and values. Nor will I be investigating the social costs associated with wide distributions of income and wealth. Rather, I want to zero in on the question of whether inequality itself is undermining our country's economic strength according to available macroeconomic indicators.This is an important topic - and Raskin argues that low and middle income households suffered the most during the Great Recession (continuing a long term trend).

...

I will argue that at the start of this recession, an unusually large number of low- and middle-income households were vulnerable to exactly the types of shocks that sparked the financial crisis. These households, which had endured 30 years of very sluggish real-wage growth, held an unusually large share of their wealth in housing, much of it financed with debt. As a result, over time, their exposure to house prices had increased dramatically. Thus, as in past recessions, suffering in the Great Recession--though widespread--was most painful and most perilous for low- and middle-income households, which were also more likely to be affected by job loss and had little wealth to fall back on.

Moreover, I am persuaded that because of how hard these lower- and middle-income households were hit, the recession was worse and the recovery has been weaker. The recovery has also been hampered by a continuation of longer-term trends that have reduced employment prospects for those at the lower end of the income distribution and produced weak wage growth.

...

[I]t is also relevant to consider whether the unusual circumstances--the outsized role of housing wealth in the portfolios of low- and middle-income households, the increased use of debt during the boom, and the subsequent unprecedented shocks to the housing market--may have attenuated the effectiveness of monetary policy during the depths of the recession. Households that have been through foreclosure or have underwater mortgages or are otherwise credit constrained are less able than other households to take advantage of the lower interest rates, either for homebuying or other purposes. In my view, these effects likely clogged some of the channels through which monetary policy traditionally works. As the housing market recovers, though, I think it is possible that accommodative monetary policy could be increasingly potent. As house prices rise, more and more households have enough home equity to gain renewed access to mortgage credit and the ability to refinance their homes at lower rates. The staff at the Federal Reserve Board has estimated that house price increases of 10 percent or less from current levels would be sufficient for about 40 percent of underwater homeowners to regain positive equity.

It is my view that understanding the long-run trends in income and wealth across different households is important in understanding the dynamics of the macroeconomy and thus also may be relevant for setting monetary policy to best reach our goals of maximum employment and price stability. I believe that the accommodative policies of the FOMC and the concerted effort we have made to ease conditions in the mortgage markets will help the economy continue to gain traction. And the resulting expansion in employment will likely improve income levels at the bottom of the distribution. However, given the long-standing trends toward greater income and wealth inequalities, it is unlikely that cyclical improvements in the labor markets will do much to reverse these trends.

CoStar: Commercial Real Estate prices up 5.1% Year-over-year in February

by Calculated Risk on 4/18/2013 01:09:00 PM

Here is a price index for commercial real estate that I follow.

From CoStar: Pricing Recovery for Commercial Property Continues in February Despite Seasonal Volatility

PRICING RECOVERY CONTINUES DESPITE SEASONAL VOLATILITY: The two broadest measures of aggregate pricing for commercial properties within the CCRSI—the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index—dipped by 0.7% and 1.4%, respectively, in the month of February 2013, reflecting a continuation of a seasonal pattern first observed in January, in which commercial real estate prices gave back some of the pricing gains from the surge in sales activity at the close of 2012. Despite the recent seasonal dip in activity, commercial real estate prices are still up significantly from year ago levels. The equal-weighted index increased 6.0% since February 2012, while value-weighted index expanded by 5.1% during the same period.

ABSORPTION POSTS SOLID GAINS IN THE FIRST QUARTER: The relative performance of the General Commercial and Investment Grade indices is tied to market fundamentals. Net absorption of available space for the three major property types – office, retail, and industrial – has been positive over the past three years. However, for the majority of that period, absorption has been stronger among properties in the Investment Grade segment as reflected by the faster pricing growth in this index since 2009. More recently though, the General Commercial segment has posted more robust gains in absorption as well, indicating a broader and more sustained commercial real estate recovery.

DISTRESS SALES DECLINE WITH IMPROVING FUNDAMENTALS: The percentage of commercial property selling at distressed prices dropped to 15.9% in February 2013 from over 18% for the previous month.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the Value-Weighted and Equal-Weighted indexes. As CoStar noted, the Value-Weighted index is up 36.7% from the bottom (showing the demand for higher end properties) and up 5.1% year-over-year. However the Equal-Weighted index is only up 7.1% from the bottom, and up 6.0% year-over-year.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

Philly Fed Manufacturing Survey Shows Slower Expansion in April

by Calculated Risk on 4/18/2013 10:09:00 AM

From the Philly Fed: April Manufacturing Survey

Manufacturers responding to the Business Outlook Survey reported near steady business activity in April. The indicator for overall activity remained slightly positive this month, but other broad indicators were mixed. Indicators for new orders and employment were weaker this month. The survey's broad indicators of future activity suggest that firms expect continued growth, but optimism waned compared with last month.Earlier in the week, the Empire State manufacturing survey also indicated slower expansion in April.

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, was 1.3, just slightly lower than the reading of 2.0 in March ... The demand for manufactured goods remained weak, with the current new orders index declining from 0.5 to -1.0.

Labor market conditions showed continued signs of weakness, with indexes suggesting lower employment overall. The employment index decreased from 2.7 in March to -6.8 this month, its first negative reading in three months.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through April. The ISM and total Fed surveys are through March.

The average of the Empire State and Philly Fed surveys decreased in April, but remained positive for the 2nd consecutive month after indicating contraction for 9 straight months. This suggests the ISM manufacturing index will show further expansion in April.