by Calculated Risk on 4/11/2013 04:45:00 PM

Thursday, April 11, 2013

Freddie Mac: Mortgage Rates decrease slightly in latest Survey

From Freddie Mac today: Mortgage Rates Edge Down for Second Week

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates edging down for the second consecutive week following weak employment reports.

30-year fixed-rate mortgage (FRM) averaged 3.43 percent with an average 0.8 point for the week ending April 11, 2013, down from last week when it averaged 3.54 percent. Last year at this time, the 30-year FRM averaged 3.88 percent.

15-year FRM this week averaged 2.65 percent with an average 0.7 point, down from last week when it averaged 2.74 percent. A year ago at this time, the 15-year FRM averaged 3.11 percent.

Click on graph for larger image.

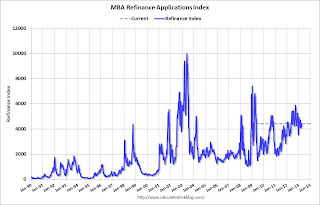

Click on graph for larger image.This graph shows the MBA's refinance index (monthly average) and the the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey®.

The Freddie Mac survey started in 1971 and mortgage rates are currently near the record low for the last 40 years.

Zillow forecasts Case-Shiller House Price index to increase 8.9% Year-over-year for February

by Calculated Risk on 4/11/2013 01:53:00 PM

The Case-Shiller house price indexes for February will be released Tuesday, April 30th. Zillow has started forecasting the Case-Shiller a month early - and I like to check the Zillow forecasts since they have been pretty close.

Zillow Zillow Anticipates Strengthening Appreciation in February Case-Shiller Index

[W]e predict that next month’s Case-Shiller data (February 2013) will show that the 20-City Composite Home Price Index (non-seasonally adjusted [NSA]) increased 8.9 percent on a year-over-year basis, while the 10-City Composite Home Price Index (NSA) increased 8.0 percent on a year-over-year basis. The seasonally adjusted (SA) month-over-month change from January to February will be 0.7 percent for the 20-City Composite and 0.6 percent for the 10-City Composite Home Price Indices (SA). All forecasts are shown in the table below. Officially, the Case-Shiller Composite Home Price Indices for February will not be released until Tuesday, April 30.Zillow also just released their city by city forecasts for the next year: Zillow Home Value Forecast for February 2014

...

To forecast the Case-Shiller indices we use past data from Case-Shiller, as well as the Zillow Home Value Index (ZHVI), which is available more than a month in advance of Case-Shiller numbers, paired with foreclosure resale numbers, which we also have available more than a month prior to Case-Shiller numbers. ...

The ZHVI does not include foreclosure resales and shows home values for February 2013 up 5.8 percent from year-ago levels. We expect home value appreciation to moderate in 2013, rising only 3.2 percent from February 2013 to February 2014. Further details on our forecast can be found here ...

The following table shows the Zillow forecast for February.

| Zillow February Forecast for Case-Shiller Index | |||||

|---|---|---|---|---|---|

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | Feb 2012 | 146.64 | 149.46 | 134.09 | 136.98 |

| Case-Shiller (last month) | Jan 2013 | 158.72 | 160.73 | 146.14 | 147.86 |

| Zillow Forecast | YoY | 8.0% | 8.0% | 8.9% | 8.9% |

| MoM | -0.2% | 0.6% | -0.1% | 0.7% | |

| Zillow Forecasts1 | 158.4 | 161.4 | 146.0 | 149.0 | |

| Current Post Bubble Low | 146.46 | 149.46 | 134.07 | 136.77 | |

| Date of Post Bubble Low | Mar-12 | Feb-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 8.1% | 8.0% | 8.9% | 9.0% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

"The Rapidly Shrinking Federal Deficit"

by Calculated Risk on 4/11/2013 11:58:00 AM

From a research note by Goldman Sachs chief economist Jan Hatzius: The Rapidly Shrinking Federal Deficit

The federal budget deficit is shrinking rapidly. ...[I]n the 12 months through March 2013, the deficit totaled $911 billion, or 5.7% of GDP. In the first three months of calendar 2013--that is, since the increase in payroll and income tax rates took effect on January 1--we estimate that the deficit has averaged just 4.5% of GDP on a seasonally adjusted basis. This is less than half the peak annual deficit of 10.1% of GDP in fiscal 2009.It shocks people when I tell them the deficit as a percent of GDP is already close to being cut in half (this doesn't seem to ever make headlines). As Hatzius notes, the deficit is currently running under half the peak of the fiscal 2009 budget and will probably decline further over the next few years with no additional policy changes.

There are three main reasons for the sharp reduction in the deficit:

1. Lower spending. On a 12-month average basis, federal outlays have fallen by a total of 4% in the past two years, the first decline in nominal dollar terms over a comparable period since the demobilization from the Korean War in the mid-1950s.

2. Higher tax rates. The increase in payroll tax rates in January 2013 has boosted federal receipts by around $120 billion (annualized), or about 0.8% of GDP.

3. Economic improvement. Although real GDP has only grown at a sluggish 2%-2.5% pace since the end of the 2007-2009 recession, this has been enough to generate a sizable improvement in tax receipts, over and above the more recent impact of higher tax rates. Even prior to the tax hike that took effect in early 2013, total federal receipts had grown by 7% (annualized) from the 2009 bottom, nearly twice the growth rate of nominal GDP.

We expect the deficit to continue to decline and are forecasting a deficit of 3% of GDP or less in fiscal 2015. Some of this is policy-related. ... But the more important reason, in our view, is that there is still a great deal of room for the economic recovery to reduce the deficit for cyclical reasons. ...

In our view, the most important implication from the reduction in the budget deficit for the near-term economic outlook is reduced pressure for further fiscal retrenchment. Partly for this reason, we expect the drag from fiscal policy on real GDP growth to decline sharply from around 2% of GDP in 2013 to around 0.5% in coming years. This is a key reason for our expectation that real GDP growth will accelerate from around 2% (annualized) in Q2/Q3 2013 to 3%-3.5% in 2014-2016.

Weekly Initial Unemployment Claims decline to 346,000

by Calculated Risk on 4/11/2013 08:36:00 AM

The DOL reports:

In the week ending April 6, the advance figure for seasonally adjusted initial claims was 346,000, a decrease of 42,000 from the previous week's revised figure of 388,000. The 4-week moving average was 358,000, an increase of 3,000 from the previous week's revised average of 355,000.The previous week was revised up from 385,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 358,000 - the highest level since February.

Weekly claims were below the 365,000 consensus forecast.

Wednesday, April 10, 2013

Thursday: Initial Weekly Unemployment Claims

by Calculated Risk on 4/10/2013 08:59:00 PM

An update on the California budget: Controller Releases March Cash Update

State Controller John Chiang today released his monthly report covering California's cash balance, receipts and disbursements in March 2013. Total revenues for the month were $395.5 million above (7.2 percent) estimates found in the Governor's proposed 2013-14 State budget.So far so good, although as Chiang noted, the next two weeks are worth watching to see if the "uptick is solid". The Controller has a website showing daily income tax collections compared to last year ...

Total revenues for the fiscal year through the end of March were $4.7 billion ahead of the Governor’s estimates.

“While the first nine months of revenue far exceeded expectation, income tax deposits over the next two weeks will show whether that uptick is solid or fleeting,” Chiang said. “The Governor and lawmakers have exercised discipline by waiting to make spending decisions until we can explain whether this surge reflects economic growth, or simply means that taxpayers paid their taxes earlier than usual.”

Thursday economic releases:

• 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 365 thousand from 385 thousand last week. The "sequester" budget cuts appear to be impacting weekly claims.

LPS: Mortgage Delinquencies decline in February

by Calculated Risk on 4/10/2013 06:34:00 PM

LPS released their Mortgage Monitor report for February today. According to LPS, 6.80% of mortgages were delinquent in February, down from 7.03% in January, and down from 7.28% in February 2012.

LPS reports that 3.38% of mortgages were in the foreclosure process, down from 3.41% in January, and down from 4.20% in February 2012.

This gives a total of 10.18% delinquent or in foreclosure. It breaks down as:

• 1,927,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,483,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 1,694,000 loans in foreclosure process.

For a total of 5,104,000 loans delinquent or in foreclosure in February. This is down from 5,854,000 in February 2012.

This following graph from LPS shows Foreclosure Starts and Foreclosure Sales.

Click on graph for larger image.

Click on graph for larger image.

From LPS:

The February Mortgage Monitor report released by Lender Processing Services found an increase in loan “cure” rates (those loans that were delinquent in the prior month and are now current). The majority of cures were on loans one-to-two months delinquent, with approximately 500,000 loans curing in February alone. As LPS Applied Analytics Senior Vice President Herb Blecher explained, these cures were not unusual, but rises seen in loans three-to-five months delinquent and foreclosure-initiated categories were unexpected.

“Historically, we see these seasonal increases in cure rates in February and March each year,” Blecher said. “What stood out in this month’s data was where that increase was centered. February’s rise in cures was driven almost entirely by FHA loans, representing a 29 percent increase from January, and likely driven by revived modification activity related to the revisions to the FHA’s Loss Mitigation Home Retention options released late last year.

“We also looked at loan modification data released in the Office of the Comptroller of the Currency’s Mortgage Metrics report (aggregated by LPS) and saw that, after two years of steady decline, modification volume increased substantially in the last half of 2012, with about 280,000 modifications occurring during that time,” Blecher continued. “The majority of the increases in both Q3 and Q4 occurred in proprietary modifications as opposed to through the Home Affordable Modification Program. Given the current FHA activity, along with the FHFA’s recent announcement of its Streamlined Modification Initiative, we could see continued strength in modification volumes in the future.”

The second graph from LPS shows 90 day default percentage by vintage. Clearly new loans are performing much better than the loans made during the bubble years. This is even true for loans with similar risk attributes (same credit score, LTV). Of course it helps that new borrowers are not "under water".

The second graph from LPS shows 90 day default percentage by vintage. Clearly new loans are performing much better than the loans made during the bubble years. This is even true for loans with similar risk attributes (same credit score, LTV). Of course it helps that new borrowers are not "under water".From LPS:

• More restrictive underwriting guidelines have led to extremely low default rates relative to “bubble” vintagesThere is much more in the mortgage monitor.

• The improvement in recent vintages extends to loans with similar risk attributes

• FHA is still supporting lower quality borrowers with higher default rates as a result

Lawler: Table of Short Sales and Foreclosures for Selected Cities in March

by Calculated Risk on 4/10/2013 03:01:00 PM

Economist Tom Lawler sent me the table below of short sales and foreclosures for several selected cities in March.

Look at the right two columns in the table below (Total "Distressed" Share for March 2013 compared to March 2012). In every area that has reported distressed sales so far, the share of distressed sales is down year-over-year - and down significantly in most areas.

Also there has been a decline in foreclosure sales just about everywhere. Look at the middle two columns comparing foreclosure sales for March 2013 to March 2012. Foreclosure sales have declined in all these areas, and some of the declines have been stunning (the Nevada sales were impacted by the new foreclosure law).

Also there has been a shift from foreclosures to short sales. In all of these areas - except Minneapolis- short sales now out number foreclosures.

This is worth repeating: Imagine that the number of total existing home sales doesn't change or even declines over the next year - some people would argue that is "bad" news and the housing market isn't recovering. But also imagine that the share of distressed sales declines sharply, and conventional sales increase significantly. That would be a positive sign - and that is what is now happening.

An example would be Sacramento (I posted data on Sacramento earlier today). In Sacramento, total sales were down 17% in March 2013 compared to March 2012, but conventional sales were up 29%! That is a positive sign.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 13-Mar | 12-Mar | 13-Mar | 12-Mar | 13-Mar | 12-Mar | |

| Las Vegas | 33.3% | 26.6% | 11.2% | 40.7% | 44.5% | 67.3% |

| Reno | 32.0% | 34.0% | 9.0% | 32.0% | 41.0% | 66.0% |

| Phoenix | 15.1% | 25.7% | 11.6% | 21.1% | 26.8% | 46.8% |

| Sacramento | 27.0% | 29.0% | 10.5% | 30.7% | 37.5% | 59.7% |

| Minneapolis | 9.3% | 12.4% | 28.6% | 36.5% | 37.9% | 48.9% |

| Mid-Atlantic (MRIS) | 11.4% | 13.2% | 10.7% | 14.7% | 22.1% | 27.9% |

Sacramento: Conventional Sales over 62% of Housing Market in March, Highest percentage in Years

by Calculated Risk on 4/10/2013 12:29:00 PM

Several years ago I started following the Sacramento market to look for changes in the mix of houses sold (conventional, REOs, and short sales). For some time, not much changed. But over the last 2 years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market. Other distressed markets are showing similar improvement.

Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In March 2013, 37.5% of all resales (single family homes and condos) were distressed sales. This was down from 43.8% last month, and down from 59.6% in March 2012. This is the lowest percentage of distressed sales - and therefore the highest percentage of conventional sales - since the association started tracking the data.

The percentage of REOs decreased to 10.5%, and the percentage of short sales decreased to 27.0%.

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional sales recently, and there were almost three times as many short sales as REO sales in March.

Active Listing Inventory for single family homes declined 37.8% from last March. Cash buyers accounted for 36.4% of all sales (frequently investors), and median prices were up 30% year-over-year (the mix has changed). UPDATE: I recommend using the repeat sales indexes for prices as opposed to the median price calculated by the local MLS.

Total sales were down 17% from March 2012, but conventional sales were up 29% compared to the same month last year. This is exactly what we expect to see in an improving distressed market - flat or even declining overall sales as distressed sales decline, and conventional sales increase.

We are seeing a similar pattern in other distressed areas, with a move to more conventional sales, and a shift from REO to short sales. This is a sign of a recovering housing market.

MBA: Mortgage Applications Increase, Conventional Purchase Applications highest since October 2009

by Calculated Risk on 4/10/2013 10:09:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 6 percent from the previous week. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier.

...

“Although total purchase application volume fell last week, there was a significant divergence between the conventional and government markets,” said Mike Fratantoni, MBA’s Vice President of Research and Economics. “Following the April 1 increase in FHA mortgage insurance premiums, government purchase applications fell by almost 14 percent, to their lowest level since February 2013. On the other hand, applications for conventional purchase loans increased by more than 5 percent, bringing the conventional purchase index to its highest level since October 2009 and the highest level since the expiration of the homebuyer tax credit. With these changes, the government share of all purchase loans fell to 30 percent, the lowest level since we began tracking this series in 2011.”

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.68 percent, the lowest rate since January 2013, from 3.76 percent, with points remaining unchanged at 0.43 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

There has been a sustained refinance boom for over a year.

Refinance activity will probably slow in 2013.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up (slowly) over the last year.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up (slowly) over the last year. As Fratantoni noted, conventional purchase activity is at the highest level since the expiration of the homebuyer tax credit.

FOMC Minutes: Benefits of QE "outweigh the likely costs and risks"

by Calculated Risk on 4/10/2013 09:19:00 AM

From the Fed: Minutes of the Federal Open Market Committee, March 19-20, 2013. A few excerpts:

The staff provided presentations covering the efficacy of the Federal Reserve's asset purchases, the effects of the purchases on security market functioning, the ways in which asset purchases might amplify or reduce risks to financial stability, and the fiscal implications of purchases. In their discussion of this topic, meeting participants generally judged the macroeconomic benefits of the current purchase program to outweigh the likely costs and risks, but they agreed that an ongoing assessment of the benefits and costs was necessary. Pointing to academic and Federal Reserve staff research, most participants saw asset purchases as having a meaningful effect in easing financial conditions and so supporting economic growth. ...There is some disagreement, but the committee generally views the benefits of QE outweighing the costs.

A range of views was expressed regarding the economic and labor market conditions that would call for an adjustment in the pace of purchases. Many participants emphasized that any decision to reduce the pace of purchases should reflect both an improvement in their overall outlook for labor market conditions, as implied by a wide range of available indicators, and their confidence in the sustainability of that improvement. A couple of these participants noted that if progress toward the Committee's economic goals were not maintained, the pace of purchases might appropriately be increased. A number of participants suggested that the Committee could change the mix of its policy tools if necessary to increase or maintain overall accommodation, including potentially adjusting its forward guidance or its balance sheet policies.

emphasis added