by Calculated Risk on 4/09/2013 09:00:00 PM

Tuesday, April 09, 2013

Wednesday: FOMC Minutes

This is an actual quote today from the German Finance Minister Wolfgang Schauble:

"Nobody in Europe sees this contradiction between fiscal policy consolidation and growth,” Schauble said. “We have a growth-friendly process of consolidation, and we have sustainable growth, however you want to word it.”Obviously there is a contradiction between "fiscal policy consolidation and growth". And not everyone is blind to the obvious - some people in Europe see the obvious contradiction (just look at the data).

And a "growth friendly process"? "Sustainable growth"? Nonsense. Maybe Schauble should look at the data (here is the eurostat data on GDP and unemployment.

Comment: Obviously Schauble is the worst kind of policymaker. He believes in "austerity über alles" and can't be swayed by the results. Very sad.

Wednesday economic releases:

• 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 2:00 PM, the FOMC Minutes for the Meeting of March 19-20, 2013 will be released.

Job Openings and Nonfarm Payrolls

by Calculated Risk on 4/09/2013 05:32:00 PM

Reader Picosec suggests "An interesting graph would be a time series showing both Job Openings and Change in Payroll Jobs. [This] might indicate whether one was predictive of the other, and to what extent."

Sometimes I do requests ... Unfortunately the JOLTS time series for job openings is very limited (released for February this morning) and only has data back to December 2000.

We always have to be extra careful with limited data.

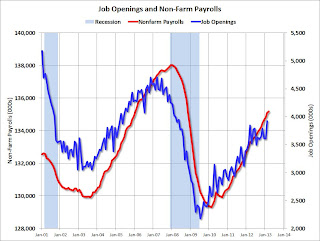

The following graph shows non-farm payroll (left axis) and job openings (right axis).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

In general the two series move together, although it appears job openings leads non-farm payroll at turning points. However the JOLTS is a noisy series, so we might not be able to tell at turning points - but if job openings turned down over several months, I'd be concerned about payrolls. Right now job openings are at the highest level since May 2008.

Las Vegas Real Estate: Conventional Sales up 40% year-over-year in March

by Calculated Risk on 4/09/2013 03:10:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports increase in local home prices, traditional sales

With local home prices up and inventory down, REALTORS® have been reporting more homes sold by "traditional" sellers – as opposed to lenders, who are responsible for the short sales and foreclosures that have dominated the market in recent years. In fact, for the first time in years, [GLVAR President Dave] Tina said "traditional" sales have accounted for more than half of all local home sales so far in 2013.A few key points:

In March, 33.3 percent of all existing local home sales were short sales, down from 37.9 percent in February. Meanwhile, another 11.2 percent of all local home sales were bank-owned, up from 10.2 percent in February. The remaining 55.5 percent of all sales are the traditional type, Tina said.

GLVAR said the total number of existing local homes, condominiums and townhomes sold in March was 3,642. That’s up from 3,232 in February, but down from 4,388 total sales in March 2012.

...

As for available homes listed for sale without any sort of pending or contingent offer by the end of March, GLVAR reported 2,839 single-family homes listed without any sort of offer. That’s down 6.8 percent from 3,047 such homes listed in February and down 42.1 percent from one year ago.

emphasis added

1) In March 2012, 67.3% of total sales were distressed. That declined to 44.5% in March 2013. So even though total sales declined year-over-year from 4,388 in March 2012 to 3,642 in March 2013, conventional sales were up about 40%. That is a sign of an improving market (it would be a mistake to focus only on the decline in total sales and miss the improvement in conventional sales).

2) Inventory of non-contingent homes is down 42.1% from a year ago to 2,839. That is a sharp decline and less than one months supply (not including homes with offers). Total inventory (including contingent offers) is down 24%.

3) Most distressed sales are now short sales. About 3 times as many homes were short sales as foreclosures.

Overall this is an improving distressed market. Note: The median price was up 30.9% from a year ago, but I suggest using the repeat sales indexes because the median is impacted by the mix and there are fewer low end homes being sold.

Lumber Prices near Housing Bubble High

by Calculated Risk on 4/09/2013 12:00:00 PM

Demand for lumber is increasing, but demand is still far below the levels during the housing bubble. However supply is lower than during the bubble years too. There are several factors impacting supply including a large number of sawmills still idled (it takes time to restart), the impact of the Mountain pine beetle, reduced maximum cuts in parts of Canada, and the permanent closure of high cost mills.

Note: Here is a great series on the mountain pine beetle from the Vancouver Sun: Pine Beetle

The B.C. government estimates that of the 2.3-billion cubic metres of merchantable lodgepole pine in the province, the beetles have claimed 726-million cubic metres over at least 17.5-million hectares.Last month the WSJ had an article about some producers increasing supply:

Georgia-Pacific, the largest U.S. producer of plywood ... plans to invest about $400 million over the next three years to boost softwood plywood and lumber capacity by 20%.Much more capacity is needed.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows two measures of lumber prices (not plywood): 1) Framing Lumber from Random Lengths through last week (via NAHB), and 2) CME framing futures.

Lumber prices are now near the housing bubble highs.

BLS: Job Openings increased in February, Most since May 2008

by Calculated Risk on 4/09/2013 10:05:00 AM

From the BLS: Job Openings and Labor Turnover Summary

There were 3.9 million job openings on the last business day of February, up from 3.6 million in January, the U.S. Bureau of Labor Statistics reported today. The hires rate (3.3 percent) and separations rate (3.1 percent) were little changed in February. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... The number of quits (not seasonally adjusted) rose over the 12 months ending in February for total nonfarm and was essentially unchanged for total private and government.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for February, the most recent employment report was for March.

Click on graph for larger image.

Click on graph for larger image.Notice that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in February to 3.925 million, up from 3.611 million in January. The number of job openings (yellow) has generally been trending up, and openings are up 11% year-over-year compared to February 2012. This is most job openings since May 2008.

Quits were unchanged in February, and quits are up 7% year-over-year and at the highest level since 2008. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Not much changes month-to-month in this report, but the trend suggests a gradually improving labor market.

NFIB: Small Business Optimism Index declines in March

by Calculated Risk on 4/09/2013 08:42:00 AM

From the National Federation of Independent Business (NFIB): Small Business Optimism Down in March

After three months of sustained growth, the March NFIB Index of Small Business Optimism ended its slow climb, declining 1.3 points and landing at 89.5. In the 44 months of economic expansion since the beginning of the recovery in July 2009, the Index has averaged 90.7, putting the March reading below the mean for this period. ...In a small sign of good news, only 17% of owners reported weak sales as the top problem (lack of demand). During good times, small business owners usually complain about taxes and regulations - and taxes are now the top problem again.

Job creation in the small-business sector was perhaps the only bright spot in the March report. The fourth consecutive month of positive job growth, owners reported increasing employment an average of 0.19 workers per firm in the month of March. This is the best reading NFIB has recorded in a year.

Click on graph for larger image.

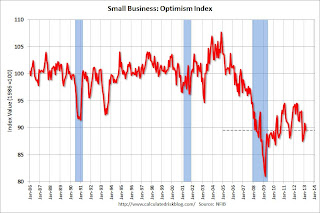

Click on graph for larger image.This graph shows the small business optimism index since 1986. The index decreased to 89.5 in March from 90.8 in February.

Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

Monday, April 08, 2013

Tuesday: Small Business Confidence, Job Openings

by Calculated Risk on 4/08/2013 09:24:00 PM

From Fed Chairman Ben Bernanke: Stress Testing Banks: What Have We Learned?

[T]he banking system is much stronger since the implementation of the SCAP four years ago, which in turn has contributed to the improvement in the overall economy. The use of supervisory stress tests--a practice now codified in statute--has helped foster these gains. Methodologically, stress tests are forward looking and focus on unlikely but plausible risks, as opposed to "normal" risks. Consequently, they complement more conventional capital and leverage ratios. The disclosure of the results of supervisory stress tests, coupled with firms' disclosures of their own stress test results, provide market participants deeper insight not only into the financial strength of each bank but also into the quality of its risk management and capital planning. Stress testing is also proving highly complementary to supervisors' monitoring and analysis of potential systemic risks. We will continue to make refinements to our implementation of stress testing and our CCAR process as we learn from experience.I was an early advocate of stress testing, and I think these tests played a key role in understanding the impact of the financial crisis on large banks.

As I have noted, one of the most important aspects of regular stress testing is that it forces banks (and their supervisors) to develop the capacity to quickly and accurately assess the enterprise-wide exposures of their institutions to diverse risks, and to use that information routinely to help ensure that they maintain adequate capital and liquidity. The development and ongoing refinement of that risk-management capacity is itself critical for protecting individual banks and the banking system, upon which the health of our economy depends.

Tuesday economic releases:

• 7:30 AM ET, NFIB Small Business Optimism Index for March. The consensus is for a decrease to 90.6 from 90.8 in February.

• At 10:00 AM, The BLS will released the Job Openings and Labor Turnover Survey for February. The number of job openings (yellow) has generally been trending up, and openings were up 8% year-over-year in January.

• Also at 10:00 AM, Monthly Wholesale Trade: Sales and Inventories for February. The consensus is for a 0.5% increase in inventories.

Existing Home Inventory is up 8.5% year-to-date on April 8th

by Calculated Risk on 4/08/2013 06:25:00 PM

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm tracking inventory weekly this year.

In normal times, there is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The NAR data is monthly and released with a lag. However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory mostly followed the normal seasonal pattern, however in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

So far - through April 8th - inventory is increasing faster than in 2011 and 2012.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

In 2010, inventory was up 15% by the end of March, and close to 20% by the end of April.

For 2011 and 2012, inventory only increased about 5% at the peak and then declined for the remainder of the year.

So far in 2013, inventory is up 8.5% (above the peak percentage increase for 2011 and 2012). Right now I think inventory will not bottom until 2014, but it is still possible that inventory will bottom this year.

This graph shows the NAR estimate of existing home inventory through February (left axis) and the HousingTracker data for the 54 metro areas through early April.

This graph shows the NAR estimate of existing home inventory through February (left axis) and the HousingTracker data for the 54 metro areas through early April.

Since the NAR released their revisions for sales and inventory in 2011, the NAR and HousingTracker inventory numbers have tracked pretty well.

The third graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the early April listings, for the 54 metro areas, declined 20.0% from the same period last year.

HousingTracker reported that the early April listings, for the 54 metro areas, declined 20.0% from the same period last year.

The year-over-year declines will probably start to get smaller since inventory is already very low.

Lawler: Goldman's Pretty Weak Argument that “National” Home Prices Last Year “Really” Increased by 3-4%

by Calculated Risk on 4/08/2013 05:38:00 PM

From housing economist Tom Lawler:

In Goldman Sach’s weekly “Mortgage Analyst” report (April 4), Goldman analysts argue that the 7-8% “national” home price growth rate in 2012 suggested by some “major” home price indexes overstated the likely “true” growth rate in US home prices, and that “national” home prices more likely increased 3-4%” last year. Here is a quote from the piece.

“(W)e argue that national indices weighted by transactions (flow weighted) rather than housing stock (stock weighted) inflate the measured growth rate. If one controls for the “weighting effect” as well as the effect of a declining share of distressed sales, national house prices more likely increased 3-4% than 7-8% in 2012.”Interestingly, the piece includes a table showing the 2012 growth rates in a number of different “national” home price indexes, some of which include distressed sales but others that don’t; some of which are “flow” based; some of which are housing stock based; some of which are “hedonic”; and one of which (the S&P Case-Shiller “national” HPI is a “flow/stock hybrid” (flow based for Census Division HPIs, but stock based (in value) when aggregating the Census Divisions into a “national” HPI).

Click on table for larger image.

Click on table for larger image.What Goldman analysts don’t explain, however, is if “national” home prices adjusted for adjusted for shifting “distressed” sales shares and “stock vs. flow” weighting “really” increased by 3.4%, then why did EVERY HPI that excludes distressed (or at least foreclosure) sales and which is “stock” weighted increase by MORE than 3-4%?

The piece does, in a sloppy way, make a good point (which I’ve made many times): how one “builds up” local home price indexes to “national” home price indexes (e.g., unit vs. value stock weights, granularity of geographic HPIs, etc.) can have a substantial impact on the “national” HPI. But it’s estimate of “true” national home price growth last year is way too low.

CR Note: This is a great summary table, although, as usual, ignore the NAR's median sales price. This suggests to me that "national prices" increased about 6% to 7% in 2012, after falling about 4% in 2011.

Labor Force Participation Rate Update

by Calculated Risk on 4/08/2013 12:43:00 PM

A key point: The recent decline in the participation rate was mostly expected, and most of the decline in the participation rate was due to changing demographics (and long term trends), as opposed to economic weakness.

A few key long terms trends include:

• A decline in participation for those in the 16 to 24 age groups. This is mostly due to higher enrollment rate in school (see the graph at Get the Lead Out Update). This is great news for the future and is directly related to removing lead from the environment (see from Brad Plumer at the WaPo: Study: Getting rid of lead does wonders for school performance)

• There is a general long term trend of declining participation for those in the key working years (25 to 54). See the second graph below.

• There has been an increase in participation among older age groups. This is probably a combination of financial need (not good news) and many workers staying healthy or engaged in less strenuous jobs.

Of course, even though the participation rate is increasing for older age groups, there are more people moving into those groups so the overall participation rate falls.

As an example, the participation rate for those in the "55 to 59" group has increased from 71.8% ten years ago, to 73.4% now. And the participation rate for those in the "60 to 64" age group has increased from 50.1% to 55% now. But even though the participation rate for each age group is increasing, when people move from the "55 to 59" age group to the "60 to 64" group, their participation rate falls (from 73.4% to 55%). And right now a large cohort is moving into these older age groups, and this is pushing down the overall participation rate.

Here is an update to a few graphs I've posted before. Tracking the participation rate for various age groups monthly is a little like watching grass grow, but the trends are important.

Click on graph for larger image.

Click on graph for larger image.

Here is a repeat of the graph I posted Friday showing the participation rate and employment-to-population ratio.

The Labor Force Participation Rate decreased to 63.3% in March (blue line). This is the percentage of the working age population in the labor force.

Here is a look at some of the long term trends (updating graphs through March 2013):

This graph shows the changes in the participation rates for men and women since 1960 (in the 25 to 54 age group - the prime working years).

This graph shows the changes in the participation rates for men and women since 1960 (in the 25 to 54 age group - the prime working years).

The participation rate for women increased significantly from the mid 30s to the mid 70s and has mostly flattened out. The participation rate for women in March was 73.9% (the lowest level since the early '90s).

The participation rate for men decreased from the high 90s decades ago, to 88.5% in March.

This is just above the lowest level recorded for prime working age men. This declining participation is a long term trend.

This graph shows that participation rates for several key age groups.

This graph shows that participation rates for several key age groups.

There are a few key long term trends:

• The participation rate for the '16 to 19' age group has been falling for some time (red).

• The participation rate for the 'over 55' age group has been rising since the mid '90s (purple), although this has stalled out a little recently.

• The participation rate for the '20 to 24' age group fell recently too (more education before joining the labor force). This appears to have stabilized.

This graph shows the participation rate for several over 55 age groups. The red line is the '55 and over' total seasonally adjusted. All of the other age groups are Not Seasonally Adjusted (NSA).

This graph shows the participation rate for several over 55 age groups. The red line is the '55 and over' total seasonally adjusted. All of the other age groups are Not Seasonally Adjusted (NSA).

The participation rate is generally trending up for all older age groups.

The increase in participation of older cohorts might push up the '55 and over' participation rate over the next few years, however eventually the 'over 55' participation rate will start to decline as the oldest baby boomers move into even older age groups.

The key point is most of the decline in the participation rate was expected. For much more, see: Understanding the Decline in the Participation Rate and Update: Further Discussion on Labor Force Participation Rate.