by Calculated Risk on 4/09/2013 10:05:00 AM

Tuesday, April 09, 2013

BLS: Job Openings increased in February, Most since May 2008

From the BLS: Job Openings and Labor Turnover Summary

There were 3.9 million job openings on the last business day of February, up from 3.6 million in January, the U.S. Bureau of Labor Statistics reported today. The hires rate (3.3 percent) and separations rate (3.1 percent) were little changed in February. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... The number of quits (not seasonally adjusted) rose over the 12 months ending in February for total nonfarm and was essentially unchanged for total private and government.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for February, the most recent employment report was for March.

Click on graph for larger image.

Click on graph for larger image.Notice that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in February to 3.925 million, up from 3.611 million in January. The number of job openings (yellow) has generally been trending up, and openings are up 11% year-over-year compared to February 2012. This is most job openings since May 2008.

Quits were unchanged in February, and quits are up 7% year-over-year and at the highest level since 2008. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Not much changes month-to-month in this report, but the trend suggests a gradually improving labor market.

NFIB: Small Business Optimism Index declines in March

by Calculated Risk on 4/09/2013 08:42:00 AM

From the National Federation of Independent Business (NFIB): Small Business Optimism Down in March

After three months of sustained growth, the March NFIB Index of Small Business Optimism ended its slow climb, declining 1.3 points and landing at 89.5. In the 44 months of economic expansion since the beginning of the recovery in July 2009, the Index has averaged 90.7, putting the March reading below the mean for this period. ...In a small sign of good news, only 17% of owners reported weak sales as the top problem (lack of demand). During good times, small business owners usually complain about taxes and regulations - and taxes are now the top problem again.

Job creation in the small-business sector was perhaps the only bright spot in the March report. The fourth consecutive month of positive job growth, owners reported increasing employment an average of 0.19 workers per firm in the month of March. This is the best reading NFIB has recorded in a year.

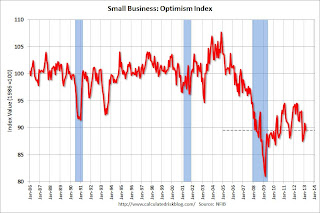

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986. The index decreased to 89.5 in March from 90.8 in February.

Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

Monday, April 08, 2013

Tuesday: Small Business Confidence, Job Openings

by Calculated Risk on 4/08/2013 09:24:00 PM

From Fed Chairman Ben Bernanke: Stress Testing Banks: What Have We Learned?

[T]he banking system is much stronger since the implementation of the SCAP four years ago, which in turn has contributed to the improvement in the overall economy. The use of supervisory stress tests--a practice now codified in statute--has helped foster these gains. Methodologically, stress tests are forward looking and focus on unlikely but plausible risks, as opposed to "normal" risks. Consequently, they complement more conventional capital and leverage ratios. The disclosure of the results of supervisory stress tests, coupled with firms' disclosures of their own stress test results, provide market participants deeper insight not only into the financial strength of each bank but also into the quality of its risk management and capital planning. Stress testing is also proving highly complementary to supervisors' monitoring and analysis of potential systemic risks. We will continue to make refinements to our implementation of stress testing and our CCAR process as we learn from experience.I was an early advocate of stress testing, and I think these tests played a key role in understanding the impact of the financial crisis on large banks.

As I have noted, one of the most important aspects of regular stress testing is that it forces banks (and their supervisors) to develop the capacity to quickly and accurately assess the enterprise-wide exposures of their institutions to diverse risks, and to use that information routinely to help ensure that they maintain adequate capital and liquidity. The development and ongoing refinement of that risk-management capacity is itself critical for protecting individual banks and the banking system, upon which the health of our economy depends.

Tuesday economic releases:

• 7:30 AM ET, NFIB Small Business Optimism Index for March. The consensus is for a decrease to 90.6 from 90.8 in February.

• At 10:00 AM, The BLS will released the Job Openings and Labor Turnover Survey for February. The number of job openings (yellow) has generally been trending up, and openings were up 8% year-over-year in January.

• Also at 10:00 AM, Monthly Wholesale Trade: Sales and Inventories for February. The consensus is for a 0.5% increase in inventories.

Existing Home Inventory is up 8.5% year-to-date on April 8th

by Calculated Risk on 4/08/2013 06:25:00 PM

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm tracking inventory weekly this year.

In normal times, there is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The NAR data is monthly and released with a lag. However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory mostly followed the normal seasonal pattern, however in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

So far - through April 8th - inventory is increasing faster than in 2011 and 2012.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

In 2010, inventory was up 15% by the end of March, and close to 20% by the end of April.

For 2011 and 2012, inventory only increased about 5% at the peak and then declined for the remainder of the year.

So far in 2013, inventory is up 8.5% (above the peak percentage increase for 2011 and 2012). Right now I think inventory will not bottom until 2014, but it is still possible that inventory will bottom this year.

This graph shows the NAR estimate of existing home inventory through February (left axis) and the HousingTracker data for the 54 metro areas through early April.

This graph shows the NAR estimate of existing home inventory through February (left axis) and the HousingTracker data for the 54 metro areas through early April.

Since the NAR released their revisions for sales and inventory in 2011, the NAR and HousingTracker inventory numbers have tracked pretty well.

The third graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the early April listings, for the 54 metro areas, declined 20.0% from the same period last year.

HousingTracker reported that the early April listings, for the 54 metro areas, declined 20.0% from the same period last year.

The year-over-year declines will probably start to get smaller since inventory is already very low.

Lawler: Goldman's Pretty Weak Argument that “National” Home Prices Last Year “Really” Increased by 3-4%

by Calculated Risk on 4/08/2013 05:38:00 PM

From housing economist Tom Lawler:

In Goldman Sach’s weekly “Mortgage Analyst” report (April 4), Goldman analysts argue that the 7-8% “national” home price growth rate in 2012 suggested by some “major” home price indexes overstated the likely “true” growth rate in US home prices, and that “national” home prices more likely increased 3-4%” last year. Here is a quote from the piece.

“(W)e argue that national indices weighted by transactions (flow weighted) rather than housing stock (stock weighted) inflate the measured growth rate. If one controls for the “weighting effect” as well as the effect of a declining share of distressed sales, national house prices more likely increased 3-4% than 7-8% in 2012.”Interestingly, the piece includes a table showing the 2012 growth rates in a number of different “national” home price indexes, some of which include distressed sales but others that don’t; some of which are “flow” based; some of which are housing stock based; some of which are “hedonic”; and one of which (the S&P Case-Shiller “national” HPI is a “flow/stock hybrid” (flow based for Census Division HPIs, but stock based (in value) when aggregating the Census Divisions into a “national” HPI).

Click on table for larger image.

Click on table for larger image.What Goldman analysts don’t explain, however, is if “national” home prices adjusted for adjusted for shifting “distressed” sales shares and “stock vs. flow” weighting “really” increased by 3.4%, then why did EVERY HPI that excludes distressed (or at least foreclosure) sales and which is “stock” weighted increase by MORE than 3-4%?

The piece does, in a sloppy way, make a good point (which I’ve made many times): how one “builds up” local home price indexes to “national” home price indexes (e.g., unit vs. value stock weights, granularity of geographic HPIs, etc.) can have a substantial impact on the “national” HPI. But it’s estimate of “true” national home price growth last year is way too low.

CR Note: This is a great summary table, although, as usual, ignore the NAR's median sales price. This suggests to me that "national prices" increased about 6% to 7% in 2012, after falling about 4% in 2011.

Labor Force Participation Rate Update

by Calculated Risk on 4/08/2013 12:43:00 PM

A key point: The recent decline in the participation rate was mostly expected, and most of the decline in the participation rate was due to changing demographics (and long term trends), as opposed to economic weakness.

A few key long terms trends include:

• A decline in participation for those in the 16 to 24 age groups. This is mostly due to higher enrollment rate in school (see the graph at Get the Lead Out Update). This is great news for the future and is directly related to removing lead from the environment (see from Brad Plumer at the WaPo: Study: Getting rid of lead does wonders for school performance)

• There is a general long term trend of declining participation for those in the key working years (25 to 54). See the second graph below.

• There has been an increase in participation among older age groups. This is probably a combination of financial need (not good news) and many workers staying healthy or engaged in less strenuous jobs.

Of course, even though the participation rate is increasing for older age groups, there are more people moving into those groups so the overall participation rate falls.

As an example, the participation rate for those in the "55 to 59" group has increased from 71.8% ten years ago, to 73.4% now. And the participation rate for those in the "60 to 64" age group has increased from 50.1% to 55% now. But even though the participation rate for each age group is increasing, when people move from the "55 to 59" age group to the "60 to 64" group, their participation rate falls (from 73.4% to 55%). And right now a large cohort is moving into these older age groups, and this is pushing down the overall participation rate.

Here is an update to a few graphs I've posted before. Tracking the participation rate for various age groups monthly is a little like watching grass grow, but the trends are important.

Click on graph for larger image.

Click on graph for larger image.

Here is a repeat of the graph I posted Friday showing the participation rate and employment-to-population ratio.

The Labor Force Participation Rate decreased to 63.3% in March (blue line). This is the percentage of the working age population in the labor force.

Here is a look at some of the long term trends (updating graphs through March 2013):

This graph shows the changes in the participation rates for men and women since 1960 (in the 25 to 54 age group - the prime working years).

This graph shows the changes in the participation rates for men and women since 1960 (in the 25 to 54 age group - the prime working years).

The participation rate for women increased significantly from the mid 30s to the mid 70s and has mostly flattened out. The participation rate for women in March was 73.9% (the lowest level since the early '90s).

The participation rate for men decreased from the high 90s decades ago, to 88.5% in March.

This is just above the lowest level recorded for prime working age men. This declining participation is a long term trend.

This graph shows that participation rates for several key age groups.

This graph shows that participation rates for several key age groups.

There are a few key long term trends:

• The participation rate for the '16 to 19' age group has been falling for some time (red).

• The participation rate for the 'over 55' age group has been rising since the mid '90s (purple), although this has stalled out a little recently.

• The participation rate for the '20 to 24' age group fell recently too (more education before joining the labor force). This appears to have stabilized.

This graph shows the participation rate for several over 55 age groups. The red line is the '55 and over' total seasonally adjusted. All of the other age groups are Not Seasonally Adjusted (NSA).

This graph shows the participation rate for several over 55 age groups. The red line is the '55 and over' total seasonally adjusted. All of the other age groups are Not Seasonally Adjusted (NSA).

The participation rate is generally trending up for all older age groups.

The increase in participation of older cohorts might push up the '55 and over' participation rate over the next few years, however eventually the 'over 55' participation rate will start to decline as the oldest baby boomers move into even older age groups.

The key point is most of the decline in the participation rate was expected. For much more, see: Understanding the Decline in the Participation Rate and Update: Further Discussion on Labor Force Participation Rate.

Over There: Portugal

by Calculated Risk on 4/08/2013 09:30:00 AM

From the NY Times: New Trouble for Euro in Portugal

In an address to his beleaguered nation on Sunday, Prime Minister Pedro Passos Coelho warned that his government would be forced to cut spending more and that lives “will become more difficult” after a court on Friday struck down some of the austerity measures put in place after a bailout package two years ago.Europe will remain a downside risk to the US and global economy for some time.

...

A critical moment for the latest trouble took place on Friday, when Portugal’s Constitutional Court struck down four of nine contested austerity measures that the government introduced as part of a 2013 budget that included about 5 billion euros, or $6.5 billion, of tax increases and spending cuts. The ruling left the government short about 1.4 billion euros of expected revenue, or more than one-fifth of the 2013 austerity package.

And updates from the Telegraph: Eurozone debt crisis: Portugal bail-out under threat - live

The eurozone has been plunged into fresh turmoil as the Portuguese constitutional court blocked four out of nine austerity measures aimed at meeting bail-out conditions.

Sunday, April 07, 2013

Sunday Night Futures

by Calculated Risk on 4/07/2013 09:45:00 PM

An interesting article from Nick Timiraos at the WSJ: Housing Prices Are on a Tear, Thanks to the Fed

Prices of existing homes rose 10% in February nationally from a year ago. They have been rising during the seasonally slow winter months—and they show signs of jumping further as the spring buying season gets under way. What's going on?I'm not sure about the source of the household formation data, but there has definitely been a strong increase in demand.

First, inventories of homes available to buy have fallen to 20-year lows. Home builders have added little in the way of new construction since 2008. Banks are selling fewer foreclosures. Investors have scooped up more homes, converting them to rentals.

Many borrowers, meanwhile, aren't willing or able to sell at prices that are down sharply from their 2006 highs, despite a greater inclination among banks to approve short sales. Tight lending standards mean some owners will hold back from selling because they aren't sure they would qualify for a mortgage on their next home.

Demand has also revved up, first from investors ... and later as rising rents and falling interest rates encouraged more first-time buyers to purchase homes ...

Improving home-price expectations have also unleashed pent up demand. The U.S. added around 1.3 million households a year for the 10-year period ending in 2007, after which household formation fell to more than half that level. Household formation was lower in the five years following the housing bust than any period since the 1960s, according to Altos Research, an analytics firm in Mountain View, Calif.

But the population never stopped growing. Households simply doubled up. Between 2008 and 2010, the country had around two million households that "couldn't wait to launch on their own," says Mike Simonsen, chief executive of Altos Research. Many of those new households have been renters, but more are opting to buy.

Weekend:

• Summary for Week Ending April 5th

• Schedule for Week of April 7th

The Asian markets are mixed with the Nikkei up sharply, but the Shanghai composite down.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 2 and Dow futures are down 20 (fair value).

Oil prices are down over the last week with WTI futures at $92.76 per barrel and Brent at $104.43 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are down about 16 cents over the last six weeks after increasing more than 50 cents per gallon from the low last December.

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Graphs for Construction Employment, Duration of Unemployment, Unemployment by Education and Diffusion Indexes

by Calculated Risk on 4/07/2013 02:27:00 PM

Earlier on the employment report:

• March Employment Report: 88,000 Jobs, 7.6% Unemployment Rate

• Employment Report Comments and more Graphs

• All Employment Graphs

A few more employment graphs ...

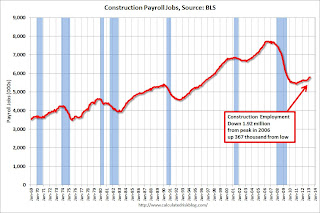

Construction is now a positive for the economy.

Construction is now a positive for the economy. Construction employment increased by 18,000 in March (up 91,000 in the first quarter). This still leaves construction with 1.92 million fewer payroll jobs compared to the peak in April 2006, but employment is up 367,000 from the low in January 2011.

I expect residential investment to make a solid positive contribution to GDP growth this year, and for construction employment to continue to increase.

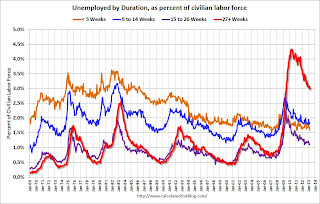

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.The general trend is down for all categories, but only the less than 5 weeks is back to normal levels.

The long term unemployed is just under 3.0% of the labor force - the lowest since June 2009 - however the number (and percent) of long term unemployed remains a serious problem.

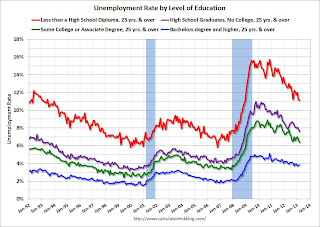

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment (all four categories are only gradually declining).

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This is a little more technical. The BLS diffusion index for total private employment was at 54.3 in March, down from 59.6 in February.

This is a little more technical. The BLS diffusion index for total private employment was at 54.3 in March, down from 59.6 in February.For manufacturing, the diffusion index decreased to 46.3, down from 54.3 in February.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.Job growth for both total private employment was fairly narrow for March. This is a not good sign and suggests only a few industries were hiring in March. For manufacturing, more companies were decreasing employment than adding jobs in March.

Earlier:

• Summary for Week Ending April 5th

• Schedule for Week of April 7th

Business Week on Jim the Realtor

by Calculated Risk on 4/07/2013 10:02:00 AM

I've been posting Jim the Realtor videos for years. The earlier videos were very funny as Jim toured REOs and drug houses. He also posted videos about short sale fraud, and recently on the buying frenzy in San Diego.

Peter Hong at the LA Times called Jim "The Hunter S. Thompson of real estate" and Nightline Truth in Advertising: One Realtor's Strategy to Sell Foreclosed Homes

Here is another story on Jim from Karen Weise at BusinessWeek: The 'Hunter S. Thompson of Real Estate' Chronicles the Bust—and Boom

Jim Klinge sighed as he made his way through a foreclosed home littered with empty bottles of rum and mattresses. It was 2008, and Klinge, a real estate agent, was filming a YouTube (GOOG) video for his blog documenting the housing crash in the cul-de-sacs and condos north of San Diego. As he opened a closet, daylight illuminated walls splattered with black mold spores, like a tie-dye project gone awry. “Oh, lovely,” Klinge said. “People were living in here like this, looks like. They were lucky to make it out alive.”There is much more in the article.

Five years later, Klinge’s videos tell a different story, one of limited inventory and jampacked open houses, bidding wars, and quick sales. ... He made the videos to shock sellers into lowering their unrealistic asking prices, but most clung to their illusions. Buyers, on the other hand, ate it up, as did economists and the press. The economics blog Calculated Risk began embedding Klinge’s videos, and in April 2009 the Los Angeles Times ran a front-page story calling Klinge “The Hunter S. Thompson of real estate.”

Here is an REO tour from Jim back in early 2009 (check on the difference in the MLS photos and Jim's video):