by Calculated Risk on 4/03/2013 05:18:00 PM

Wednesday, April 03, 2013

Fannie Mae: Mortgage Serious Delinquency rate declined in February, Lowest since February 2009

Fannie Mae reported that the Single-Family Serious Delinquency rate declined in February to 3.13% from 3.18% in January. The serious delinquency rate is down from 3.82% in February 2012, and this is the lowest level since February 2009.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Earlier Freddie Mac reported that the Single-Family serious delinquency rate declined in February to 3.15% from 3.20% in January. Freddie's rate is down from 3.57% in February 2012, and this is the lowest level since July 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

Although this indicates some progress, the "normal" serious delinquency rate is under 1%. At the recent pace of improvement, it will take several years until the rates are back to normal. At the recent rate of improvement, the serious delinquency rate will be under 1% in 2017 or so.

Fed's Williams: Expects to Meet "test for substantial improvement in the outlook for the labor market by this summer"

by Calculated Risk on 4/03/2013 04:05:00 PM

From San Francisco Fed President John Williams: The Economy and the Federal Reserve: Real Progress, but Too Soon to Relax

In the statement issued following the March meeting, our policy committee, the Federal Open Market Committee, or FOMC, stated that it would continue its securities purchases “until the outlook for the labor market has improved substantially in a context of price stability.” It also stated that “in determining the size, pace, and composition of its asset purchases, the Committee will continue to take appropriate account of the likely efficacy and costs of such purchases as well as the extent of progress toward its economic objectives.”Williams is a key player on the FOMC and I always pay attention to his remarks. Of course the economy could weaken over the next few months, as Williams notes: "There are still obstacles to our progress, including the effects of budget cuts coming out of Washington and the sluggish recovery plaguing many of our trading partners abroad, especially in Europe." - but it is possible that the FOMC will start to reduce their asset purchases later this year.

So, what does that mean? I see the benefits of our asset purchases continuing to outweigh the costs by a large margin. I expect that continued asset purchases will be appropriate well into the second half of this year. In making this assessment, I don’t have a specific unemployment or job-gain threshold in mind for cutting back or ending these purchases. Instead, I’m looking for convincing evidence of sustained, ongoing improvement in the labor market and economy. The latest economic news has been encouraging. But it will take more solid evidence to convince me that it’s time to trim our asset purchases. An important rule in both forecasting and policymaking is not to overreact to what may turn out to be just a blip in the data. But, assuming my economic forecast holds true, I expect we will meet the test for substantial improvement in the outlook for the labor market by this summer. If that happens, we could start tapering our purchases then. If all goes as hoped, we could end the purchase program sometime late this year.

It’s important to note that tapering our purchases and even ending the purchase program doesn’t mean that we are removing all the monetary stimulus that comes from our longer-term securities holdings. Instead, even as we cut back our purchases, we’re still adding monetary accommodation and exerting greater downward pressure on interest rates. Economic theory and real-world evidence indicate that it’s not the pace at which we buy securities that matters for influencing financial conditions. Rather, it’s the size and composition of the assets we hold on our balance sheet. So, even when we stop adding to our portfolio, it doesn’t mean we’re tightening policy.

emphasis added

Reis: Apartment Vacancy Rate declined to 4.3% in Q1 2013

by Calculated Risk on 4/03/2013 01:06:00 PM

Reis reported that the apartment vacancy rate fell to 4.3% in Q1, down from 4.5% in Q4 2012. The vacancy rate was at 5.0% in Q1 2012 and peaked at 8.0% at the end of 2009.

Some data and comments from Reis VP of Research Victor Calanog:

Vacancy fell by 20 basis points in the first quarter, dipping to 4.3%. Over the last four quarters, national vacancies have declined by 70 basis points, a far faster pace than any other sector in commercial real estate. The vacancy rate has now fallen by 370 basis points since the cyclical peak of 8.0% observed right after the recession winded down in late 2009. By contrast, office sector vacancies have only fallen by a paltry 60 basis points since fundamentals began recovering five quarters ago.

The sector absorbed over 36,000 units in the first quarter, a relatively healthy rate comparable to the rise in occupied stock from one year ago (in 2012Q1). Deliveries have remained modest at 13,706 units, representing roughly the same pace of inventory growth as previous first quarter periods over the last two years.

Apartment landlords have another quarter or two to enjoy tight supply growth before a large number of new properties come online. Over 100,000 units are expected to enter the market, most scheduled to open their doors in the latter half of the year. With home prices recovering and mortgage rates staying low, it remains to be seen whether demand for apartments will continue to push vacancies down once inventory growth ramps up.

Asking and effective rents both grew by 0.5% during the first quarter. This is the slowest rate of growth for both asking and effective rents since the fourth quarter of 2011; every single quarterly data point in 2012 showed stronger asking and effective rent growth versus what was observed in the current quarter. What does this mean?

Optimists will point out that the first quarter tends to be weak, as most households move during the second and third quarters and bolster leasing activity and rent increases. The seasonal waxing and waning in rent growth was evident in the prior year, when the strongest periods centered around the second and third quarters.

However, given how tight vacancies have become, rent growth ought to be stronger (for perspective, in prior periods when vacancies were in the low to mid‐4s, annual rent growth was well above 4%). Analysts have wondered how rents could keep climbing when jobs are being created at a sluggish rate and wage growth has been relatively stagnant: all of Reis's major markets now boast rent levels well beyond peaks achieved prior to the recession. One answer is that the moribund housing market left households with little choice but to absorb rent hikes, but with the housing market now recovering, does that mean the tide is turning against landlords?

The next few quarters will test the robustness of apartment fundamentals in the face of rising supply growth and rent levels that may have climbed to unsustainable levels.

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

This was another strong quarter for apartments with the vacancy rate falling and rents rising. With more supply coming online later this year, the decline in the vacancy rate should slow.

Apartment vacancy data courtesy of Reis.

ISM Non-Manufacturing Index indicates slower expansion in March

by Calculated Risk on 4/03/2013 10:05:00 AM

The March ISM Non-manufacturing index was at 54.4%, down from 56.0% in February. The employment index decreased in March to 53.3%, down from 57.2% in February. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: March 2013 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in March for the 39th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI™ registered 54.4 percent in March, 1.6 percentage points lower than the 56 percent registered in February. This indicates continued growth at a slightly slower rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index registered 56.5 percent, which is 0.4 percentage point lower than the 56.9 percent reported in February, reflecting growth for the 44th consecutive month. The New Orders Index decreased by 3.6 percentage points to 54.6 percent, and the Employment Index decreased 3.9 percentage points to 53.3 percent, indicating growth in employment for the eighth consecutive month. The Prices Index decreased 5.8 percentage points to 55.9 percent, indicating prices increased at a slower rate in March when compared to February. According to the NMI™, 15 non-manufacturing industries reported growth in March. The majority of respondents' comments continue to be positive about business conditions; however, there is an underlying concern regarding the uncertainty of the future economy."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 56.0% and indicates slower expansion in March than in February.

CoreLogic: House Prices up 10.2% Year-over-year in February

by Calculated Risk on 4/03/2013 08:58:00 AM

Notes: This CoreLogic House Price Index report is for February. The recent Case-Shiller index release was for January. Case-Shiller is currently the most followed house price index, however CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Home Price Index Rises by 10.2 Percent Year Over Year in February: The Biggest Increase in Nearly Seven Years

Home prices nationwide, including distressed sales, increased 10.2 percent on a year-over-year basis by in February 2013 compared to February 2012. This change represents the biggest year-over-year increase since March 2006 and the 12th consecutive monthly increase in home prices nationally. On a month-over-month basis, including distressed sales, home prices increased by 0.5 percent in February 2013 compared to January 2013.

Excluding distressed sales, home prices increased on a year-over-year basis by 10.1 percent in February 2013 compared to February 2012. On a month-over-month basis, excluding distressed sales, home prices increased 1.5 percent in February 2013 compared to January 2013. Distressed sales include short sales and real estate owned (REO) transactions.

The CoreLogic Pending HPI indicates that March 2013 home prices, including distressed sales, are also expected to rise by 10.2 percent on a year-over-year basis from March 2012 and rise by 1.2 percent on a month-over-month basis from February 2013.

...

“The rebound in prices is heavily driven by western states. Eight of the top ten highest appreciating large markets are in California, with Phoenix and Las Vegas rounding out the list,” said Dr. Mark Fleming, chief economist for CoreLogic.

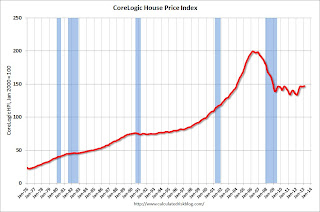

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 0.5% in February, and is up 10.2% over the last year.

The index is off 26.3% from the peak - and is up 10.2% from the post-bubble low set in February 2012.

The second graph is from CoreLogic. The year-over-year comparison has been positive for twelve consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for twelve consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).This is the largest year-over-year increase since 2006.

Since this index is not seasonally adjusted, it was expected to be flat or decline on a month-to-month basis in February - instead the index increased, and, considering seasonal factors, this month-to-month increase was very strong.

ADP: Private Employment increased 158,000 in March

by Calculated Risk on 4/03/2013 08:19:00 AM

Private sector employment increased by 158,000 jobs from February to March, according to the March ADP National Employment Report®, which is produced by ADP® ... in collaboration with Moody’s Analytics. The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis. Revisions to job gains in the two prior months were offsetting; February’s gain of 198,000 jobs was revised up by 39,000 to 237,000, and January’s 215,000 gain was revised down by 38,000 to 177,000.This was below the consensus forecast for 205,000 private sector jobs added in the ADP report. Note: The BLS reports on Friday, and the consensus is for an increase of 193,000 payroll jobs in March, on a seasonally adjusted (SA) basis.

...

Mark Zandi, chief economist of Moody’s Analytics, said, “Job growth moderated in March. Construction employment gains paused as the rebuilding surge in the wake of Superstorm Sandy ended. Anticipation of Health Care Reform may also be weighing on employment at companies with close to 50 employees. The job market continues to improve, but in fits and starts.”

Note: ADP hasn't been very useful in predicting the BLS report.

MBA: Mortgage Purchase Applications increase, Refinance Applications decrease

by Calculated Risk on 4/03/2013 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 6 percent from the previous week. The seasonally adjusted Purchase Index increased 1 percent from one week earlier.

...

“Total purchase applications increased last week, due to an almost 7 percent increase in purchase applications for government loans. This was likely driven by borrowers applying for loans prior to the scheduled increase in FHA premiums that took effect on April 1,” said Mike Fratantoni, MBA’s Vice President of Research and Economics. “On a year over year basis, purchase applications are up about 4 percent, in line with the trend we are seeing in home sales volumes.”

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.76 percent from 3.79 percent, with points decreasing to 0.43 from 0.44 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

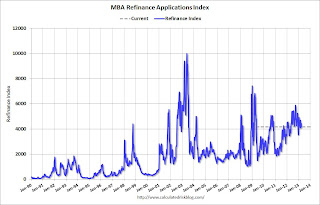

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

There has been a sustained refinance boom for over a year.

Refinance activity will probably slow in 2013.

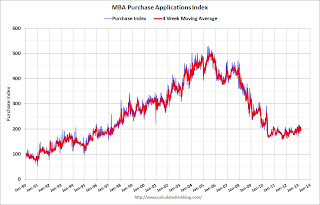

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up (slowly) over the last year.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up (slowly) over the last year.

Tuesday, April 02, 2013

Wednesday: ADP Employment, ISM Service, Apartment Vacancy Survey

by Calculated Risk on 4/02/2013 09:18:00 PM

On Europe from the NY Times: Unemployment in Euro Zone Reaches a Record 12%

The euro zone jobless rate rose to 12.0 percent in the first two months of the year, the latest in a series of record highs tracing to late 2011, Eurostat, the statistical agency of the European Union, reported Tuesday.In Europe, "self-evidently failing" apparently means more of the same.

The agency revised upward the January jobless rate for the euro zone from the previously reported 11.9 percent, itself a record. For the overall European Union, Eurostat said the February jobless rate rose to 10.9 percent from 10.8 percent in January, with more than 26 million people without work across the 27-nation bloc.

Both the jobless rates and the number of unemployed are the highest Eurostat has recorded in data that reach back to 1995, before the creation of the euro.

...

“Europe is pursuing a policy that is self-evidently failing.” [said Mark Cliffe, chief economist at ING Group].

Wednesday economic releases:

• 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• Early, Reis Q1 2013 Apartment survey of rents and vacancy rates will be released.

• At 8:15 AM, The ADP Employment Report for March. This report is for private payrolls only (no government). The consensus is for 205,000 payroll jobs added in March.

• At 10:00 AM, ISM non-Manufacturing Index for March. The consensus is for a reading of 56.0 unchanged from 56.0 in February. Note: Above 50 indicates expansion, below 50 contraction.

U.S. Light Vehicle Sales decreased to 15.3 million annual rate in March

by Calculated Risk on 4/02/2013 03:55:00 PM

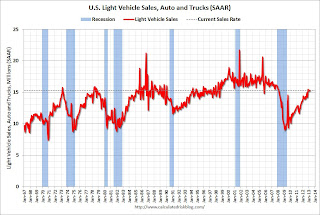

Based on an estimate from AutoData Corp, light vehicle sales were at a 15.27 million SAAR in March. That is up 8% from March 2012, and down slightly from the sales rate last month.

This was below the consensus forecast of 15.4 million SAAR (seasonally adjusted annual rate).

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for March (red, light vehicle sales of 15.27 million SAAR from AutoData).

Click on graph for larger image.

Click on graph for larger image.

This is a solid start to the new year. After three consecutive years of double digit auto sales growth, the growth rate will probably slow in 2013 - but this will still be another positive year for the auto industry.

Even if sales average the Q1 rate all year, Total sales would be up about 6% from 2012.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

This shows the huge collapse in sales in the 2007 recession, and that sales have increased significantly from the bottom.

Philly Fed: State Coincident Indexes increased in 45 States in February

by Calculated Risk on 4/02/2013 01:18:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for February 2013. In the past month, the indexes increased in 45 states, decreased in three (Alabama, Illinois, and New Mexico), and remained stable in two (Hawaii and Wyoming), for a one-month diffusion index of 84. Over the past three months, the indexes increased in 46 states, decreased in two (Illinois and Wyoming), and remained stable in two (Alaska and Alabama), for a three-month diffusion index of 88.Note: These are coincident indexes constructed from state employment data. From the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In February, 47 states had increasing activity, up from 45 in January (including minor increases). This measure has been and up down over the last few years since the recovery has been sluggish.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession. The map is mostly green again and suggests that the recovery is geographically widespread.