by Calculated Risk on 3/30/2013 07:14:00 PM

Saturday, March 30, 2013

Unofficial Problem Bank list declines to 791 Institutions

Here is the unofficial problem bank list for Mar 29, 2013.

Changes and comments from surferdude808:

As anticipated, the FDIC released its enforcement action activity through February 2013 this week, which led to several changes to the Unofficial Problem Bank List. For the week, there were eight removals and two additions leaving the list at 791 institutions with assets of $290.0 billion. A year ago, the list held 948 institutions with assets of $377.6 billion. For the month of March 2013, the list shrank by a net 18 institutions and assets fell by $12.8 billion. It is the third time over the past year the list has experienced a monthly net decline of 18 institutions.Earlier:

Enforcement actions were terminated against Intervest National Bank, New York, NY ($1.7 billion Ticker: IBCA); Citizens Bank and Trust Company, Chillicothe, MO ($824 million); First American International Bank, Brooklyn, NY ($527 million); American Gateway Bank, Baton Rouge, LA ($404 million); Greer State Bank, Greer, SC ($360 million Ticker: GRBS); The State Bank, Fenton, MI ($308 million Ticker: FETM); The Harbor Bank of Maryland, Baltimore, MD ($249 million Ticker: HRBK); and East Dubuque Savings Bank, Dubuque, IA ($158 million).

Added this week were Marathon Savings Bank, Wausau, WI ($180 million) and Trust Company Bank, Mason, TN ($34 million). Trust Company Bank entered the list in an unusual manner through a Prompt Corrective Action order. Normally, an institution will first receive an enforcement action such as a Consent Order or Written Agreement that seeks corrective action for many operational areas. In contrast, a Prompt Corrective Action order solely addresses capital inadequacy. This is only the eleventh institution out of more than 1,600 to enter the list in this unusual manner.

The other change to the list this week is the FDIC issuing a Prompt Corrective Action order against Bank of Wausau, Wausau, WI ($53 million).

The Treasury recently released its monthly update to Congress on the Troubled Asset Relief Program (TARP) for February 2013. Treasury reported that 113 banking companies failed to make their required TARP dividend payment on February 15th. There are 85 institutions or their parent holding companies on the Unofficial Problem Bank List that failed to make the February 15th dividend payment (see spreadsheet). Within this group, 54 institutions have missed 10 or more quarterly dividend payments. There are 13 banks that did not make the February 15th dividend payment, but have been released from a formal enforcement action. Interestingly, the enforcement action terminations this week against Intervest National Bank, New York, NY ($4.6 million in non-current dividends); Greer State Bank, Greer, SC ($1.2 million in non-current dividends); and The Harbor Bank of Maryland, Baltimore, MD ($935 thousand in non-current dividends) occurred although the companies were unable to make the February 15th required dividend payment. While TARP was supposed to only flow to healthy banks, there are two banks that missed the latest payment that were under an enforcement action before receipt of TARP. Metropolitan National Bank, Little Rock, AR, which has missed 14 payments in a cumulative amount of $4.8 million, was under a Formal Agreement on May 28, 2008 but did not receive TARP until January 30, 2009. OneUnited Bank, Boston, MA, which has missed 16 payments in an amount of $2.4 million, has been operating under a Cease & Desist order since October 27, 2008 but received TARP on December 19, 2008. Many readers may recall OneUnited Bank because of the House Ethics Committee investigation of Representative Maxine Water’s ties to the bank (see, Ethics panel set to clear Rep. Maxine Waters).

• Summary for Week Ending March 29th

• Schedule for Week of March 31st

Schedule for Week of March 31st

by Calculated Risk on 3/30/2013 01:12:00 PM

Earlier:

• Summary for Week Ending March 29th

The key report this week is the March employment report on Friday.

Other key reports include the ISM manufacturing index on Monday, vehicle sales on Tuesday, ISM service index on Wednesday, and the Trade Balance report on Friday.

Also Reis will release their Q1 2013 Office, Mall and Apartment vacancy rate surveys this week. Last quarter Reis reported falling vacancy rates for apartments, malls, and offices.

10:00 AM ET: ISM Manufacturing Index for March.

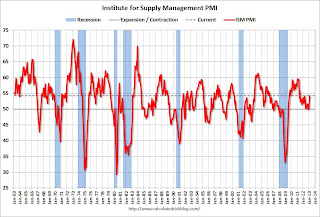

10:00 AM ET: ISM Manufacturing Index for March. Here is a long term graph of the ISM manufacturing index. The ISM manufacturing index indicated expansion in February at 54.2% (dashed line). The employment index was at 52.6%, and the new orders index was at 57.8%. The consensus is for PMI to decrease to 54.0%. (above 50 is expansion).

10:00 AM: Construction Spending for February. The consensus is for a 1.1% increase in construction spending.

Early: Reis Q1 2013 Office survey of rents and vacancy rates.

All day: Light vehicle sales for March. The consensus is for light vehicle sales to be at 15.4 million SAAR in March (Seasonally Adjusted Annual Rate) unchanged from 15.4 SAAR in February.

All day: Light vehicle sales for March. The consensus is for light vehicle sales to be at 15.4 million SAAR in March (Seasonally Adjusted Annual Rate) unchanged from 15.4 SAAR in February.This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the February sales rate.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for February. The consensus is for a 2.9% increase in orders.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

Early: Reis Q1 2013 Apartment survey of rents and vacancy rates.

8:15 AM: The ADP Employment Report for March. This report is for private payrolls only (no government). The consensus is for 205,000 payroll jobs added in March.

10:00 AM: ISM non-Manufacturing Index for March. The consensus is for a reading of 56.0 unchanged from 56.0 in February. Note: Above 50 indicates expansion, below 50 contraction.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 350 thousand from 357 thousand last week. The "sequester" budget cuts appear to be impacting weekly claims.

Early: Reis Q1 2013 Mall Survey of rents and vacancy rates.

10:00 AM: Trulia Price Rent Monitors for March. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

5:00 PM: Speech by Fed Vice Chair Janet Yellen, Communication in Monetary Policy, At the 50th Anniversary Conference of the Society of American Business Editors and Writers, Washington, D.C.

8:30 AM: Employment Report for March. The consensus is for an increase of 193,000 non-farm payroll jobs in March; the economy added 236,000 non-farm payroll jobs in February.

8:30 AM: Employment Report for March. The consensus is for an increase of 193,000 non-farm payroll jobs in March; the economy added 236,000 non-farm payroll jobs in February. The consensus is for the unemployment rate to be unchanged at 7.7% in March.

The second employment graph shows the percentage of payroll jobs lost during post WWII recessions through January.

The economy has added 6.35 million private sector jobs since employment bottomed in February 2010 (5.7 million total jobs added including all the public sector layoffs).

The economy has added 6.35 million private sector jobs since employment bottomed in February 2010 (5.7 million total jobs added including all the public sector layoffs).There are still 2.5 million fewer private sector jobs now than when the recession started in 2007.

8:30 AM: Trade Balance report for February from the Census Bureau.

8:30 AM: Trade Balance report for February from the Census Bureau. Exports decreased in January, and imports increased (most of the increase was petroleum).

The consensus is for the U.S. trade deficit to increase to $44.8 billion in February from $44.4 billion in January.

3:00 PM: Consumer Credit for February from the Federal Reserve. The consensus is for credit to increase $16.0 billion in February.

Summary for Week ending March 29th

by Calculated Risk on 3/30/2013 08:54:00 AM

This was another week of solid economic data, although we might be seeing some impact of the sequestration budget cuts on initial unemployment claims. It looks like GDP growth in Q1 will be solid, with personal consumption expenditures on track to increase in the 3.0% to 3.5% range.

Although the February new home sales report was a little below expectations, this was still solid growth from 2012. According to the Census Bureau, there have been 63 thousand new homes sold so far in 2013 (NSA), up about 19% from the 53 thousand sold in January and February of 2012.

Here is a summary of last week in graphs:

• New Home Sales at 411,000 SAAR in February

The Census Bureau reports New Home Sales in February were at a seasonally adjusted annual rate (SAAR) of 411 thousand. This was down from a revised 431 thousand SAAR in January (revised down from 437 thousand).

The Census Bureau reports New Home Sales in February were at a seasonally adjusted annual rate (SAAR) of 411 thousand. This was down from a revised 431 thousand SAAR in January (revised down from 437 thousand).

This graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

On inventory, according to the Census Bureau:

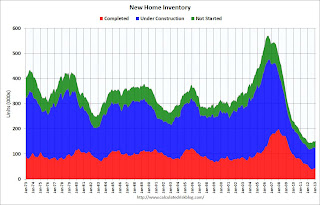

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale is just above the record low. The combined total of completed and under construction is also just above the record low.

This was below expectations of 425,000 sales in February, but still a fairly solid report.

• Case-Shiller: Comp 20 House Prices increased 8.1% year-over-year in January

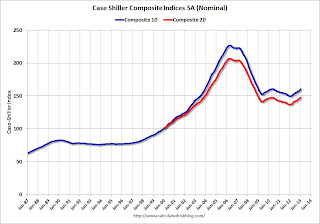

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).The Composite 10 index is off 29.3% from the peak, and up 1.0% in January (SA). The Composite 10 is up 7.3% from the post bubble low set in Feb 2012 (SA).

The Composite 20 index is off 28.4% from the peak, and up 1.0% (SA) in January. The Composite 20 is up 8.1% from the post-bubble low set in Jan 2012 (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 7.3% compared to January 2012.

The Composite 20 SA is up 8.1% compared to January 2012. This was the eight consecutive month with a year-over-year gain since 2010 (when the tax credit boosted prices temporarily). This was the largest year-over-year gain for the Composite 20 index since 2006.

Prices increased (SA) in 20 of the 20 Case-Shiller cities in January seasonally adjusted (prices increased in 9 of 20 cities NSA). Prices in Las Vegas are off 55.9% from the peak, and prices in Denver only off 2.0% from the peak.

This was close to the consensus forecast for a 8.2% YoY increase.

• Personal Income increased 1.1% in February, Spending increased 0.7%

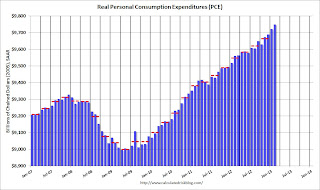

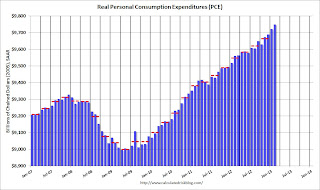

This graph shows real Personal Consumption Expenditures (PCE) through February (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

This graph shows real Personal Consumption Expenditures (PCE) through February (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

The dashed red lines are the quarterly levels for real PCE. Both income and spending were above expectations in February, although some of the increase in spending was related to higher gasoline prices.

Using the two-month method to estimate Q1 PCE growth (first two months of the quarter), PCE was increasing at a 3.5% annual rate in Q1 2013 (using mid-month method, PCE was increasing at 3.2% rate). This suggests upward revisions to Q1 GDP forecasts.

• Real House Prices, Price-to-Rent Ratio, City Prices relative to 2000

Case-Shiller, CoreLogic and others report nominal house prices, and it is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio.

Case-Shiller, CoreLogic and others report nominal house prices, and it is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio. This graph shows the Case-Shiller National and Composite-20, and the CoreLogic index, in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to October 1999 levels, the Composite 20 index is back to December 2000, and the CoreLogic index back to February 2001.

In real terms, most of the appreciation in the last decade is gone.

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q4 1999 levels, the Composite 20 index is back to December 2000 levels, and the CoreLogic index is back to February 2001.

In real terms - and as a price-to-rent ratio - prices are mostly back to early 2000 levels.

Nominal Prices: Cities relative to Jan 2000

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.As an example, at the peak, prices in Phoenix were 127% above the January 2000 level. Then prices in Phoenix fell slightly below the January 2000 level, and are now up 27% above January 2000 (I'll look at this in real terms later). Some cities - like Denver - are close to the peak level. Other cities, like Atlanta and Detroit, are below the January 2000 level.

• Weekly Initial Unemployment Claims increase to 357,000

From the DOL: "In the week ending March 23, the advance figure for seasonally adjusted initial claims was 357,000, an increase of 16,000 from the previous week's revised figure of 341,000."

From the DOL: "In the week ending March 23, the advance figure for seasonally adjusted initial claims was 357,000, an increase of 16,000 from the previous week's revised figure of 341,000."This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 343,000 - still near the post-recession low.

Weekly claims were above the 340,000 consensus forecast. Note: This might be the beginning of unemployment claims being impacted by the "sequestration" budget cuts.

• March Consumer Sentiment increases to 78.6

The final Reuters / University of Michigan consumer sentiment index for March increased to 78.6 from the preliminary reading of 71.8, and up from the February reading of 77.6.

The final Reuters / University of Michigan consumer sentiment index for March increased to 78.6 from the preliminary reading of 71.8, and up from the February reading of 77.6. This was well above the consensus forecast of 72.5, but still fairly low. There are a number of factors that impact sentiment including unemployment, gasoline prices and, for 2013, the payroll tax increase and even politics (sequestration, default threats, etc).

The preliminary decline was probably related to both high gasoline prices and policy concerns. According to Reuters, concerns about policy have abated, and consumers expect "employment will accelerate through the rest of 2013".

Friday, March 29, 2013

Report: Slow to Foreclose in Ireland

by Calculated Risk on 3/29/2013 07:29:00 PM

An interesting article in the NY Times: Irish Legacy of Leniency on Mortgages Nears an End

Although there are more than 143,000 delinquent home mortgages in Ireland, foreclosures have been so politically and legally difficult that, in the last three months of last year, they numbered 38.To put this in perspective, in the US there are about 5.1 million delinquent mortgages (from 30 days to in-foreclosure), and there were probably several hundred thousand foreclosures and short sales last quarter (Fannie and Freddie alone foreclosed on 60,000 properties last quarter). I'd expect thousand of foreclosure per quarter in Ireland, not 38.

In Ireland at the end of last December, nearly 95,000 mortgage accounts on private homes were delinquent more than 90 days ...And now Nevada is recovering quickly. Thee unemployment rate in Nevada has fallen from 14.0% in late 2010, to 12.1% in August 2012, to 9.6% in February 2013. Of course Ireland has additional problems - being tied to the euro - but clearing out the delinquent mortgages is part of the process (modifications and short sales are alternatives to foreclosure).

By international standards, Ireland has been slow to act on the problem. An analysis last year by Davy Research, part of a company that provides stock brokerage, wealth management and financial advisory services, estimated a 54 percent peak-to-trough drop in house prices and unemployment of 14 percent.

That was approximately parallel to one of the worst-hit real estate markets in the United States — the state of Nevada — where housing prices declined by more than 55 percent and unemployment hit 14 percent. But in Nevada, Davy found, the peak rate of delinquent mortgages hit 9.3 percent in the fourth quarter of 2009.

“The current Irish arrears rate of 10.2 percent and rising is now well above peak rates in comparable United States housing busts,” the report said. “A key difference between the U.S. and Ireland is the number of foreclosures” — 10 times higher in Nevada, the report said.

Restaurant Index declines in February

by Calculated Risk on 3/29/2013 02:02:00 PM

From the National Restaurant Association: Restaurant Performance Index Fell Below 100 in February as Sales and Traffic Levels Declined

Due in large part to softer same-store sales and customer traffic levels, the National Restaurant Association’s Restaurant Performance Index (RPI) slipped below 100 in February. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 99.9 in February, down 0.8 percent from January’s five-month high. February represented the fourth time in the last five months that the RPI stood below 100, which signifies contraction in the index of key industry indicators.

“The Restaurant Performance Index decline was due largely to softer sales and traffic results, which fell in February amid higher gas prices and the impact of the payroll tax hike,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “In addition, sales and traffic comparisons were more difficult due to the extra day in February 2012 as a result of Leap Year.”

“Despite the sales and traffic declines in February, restaurant operators remain generally optimistic about business conditions in the months ahead, which suggests they feel the setbacks will be temporary,” Riehle added.

...

The Current Situation Index, which measures current trends in four industry indicators (same-store sales, traffic, labor and capital expenditures), stood at 98.3 in February – down 1.4 percent from January’s level. In addition, the Current Situation Index stood below 100 for the 6th consecutive month, which signifies contraction in the current situation indicators.

Click on graph for larger image.

Click on graph for larger image.The index decreased to 99.9 in February, down from 100.6 in January. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month.

BLS: Unemployment Rate declined in 22 States in February

by Calculated Risk on 3/29/2013 11:19:00 AM

From the BLS: Jobless rates down in 22 states, up in 12 in Feb.; payroll jobs up in 42 states, down in 8

Regional and state unemployment rates were little changed in February. Twenty-two states had unemployment rate decreases, 12 states had increases, and 16 states and the District of Columbia had no change, the U.S. Bureau of Labor Statistics reported today.

...

California, Mississippi, and Nevada had the highest unemployment rates among the states in February, 9.6 percent each. North Dakota again had the lowest jobless rate, 3.3 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement - Michigan and Nevada have seen the largest declines - New Jersey is the laggard.

The states are ranked by the highest current unemployment rate. No state has double digit unemployment and the unemployment rate is above 9% in only seven states: Mississippi, California, Nevada, Illinois, North Carolina, Rhode Island and New Jersey. In early 2010, almost half the states had an unemployment rate above 9%.

The unemployment rate is falling quickly in some states like Nevada and California. As an example, the unemployment rate in Nevada has fallen from 12.1% in August 2012 to 9.6% in February 2013.

March Consumer Sentiment increases to 78.6

by Calculated Risk on 3/29/2013 10:12:00 AM

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for March increased to 78.6 from the preliminary reading of 71.8, and up from the February reading of 77.6.

This was well above the consensus forecast of 72.5, but still fairly low. There are a number of factors that impact sentiment including unemployment, gasoline prices and, for 2013, the payroll tax increase and even politics (sequestration, default threats, etc).

The preliminary decline was probably related to both high gasoline prices and policy concerns. According to Reuters, concerns about policy have abated, and consumers expect "employment will accelerate through the rest of 2013".

Personal Income increased 1.1% in February, Spending increased 0.7%

by Calculated Risk on 3/29/2013 08:46:00 AM

The BEA released the Personal Income and Outlays report for February:

Personal income increased $143.2 billion, or 1.1 percent ... in February, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $77.2 billion, or 0.7 percent.The following graph shows real Personal Consumption Expenditures (PCE) through February (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.3 percent in February, the same increase as in January. ... PCE price index -- The price index for PCE increased 0.4 percent in February, compare with an increase of less than 0.1 percent in January. The PCE price index, excluding food and energy, increased 0.1 percent, compared with an increase of 0.2 percent.

...

Personal saving -- DPI less personal outlays -- was $310.9 billion in February, compared with $262.5 billion in January. The personal saving rate -- personal saving as a percentage of disposable personal income -- was 2.6 percent in February, compared with 2.2 percent in January.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE. Both income and spending were above expectations in February, although some of the increase in spending was related to higher gasoline prices.

Using the two-month method to estimate Q1 PCE growth (first two months of the quarter), PCE was increasing at a 3.5% annual rate in Q1 2013 (using mid-month method, PCE was increasing at 3.2% rate). This suggests upward revisions to Q1 GDP forecasts.

Thursday, March 28, 2013

Friday: Personal Income and Outlays, Consumer Sentiment

by Calculated Risk on 3/28/2013 09:54:00 PM

Note: Markets Closed will be closed Friday in observance of the Good Friday Holiday.

Earlier the Chicago ISM reported:

The Chicago Purchasing Managers reported the Chicago Business Barometer veered downward, falling 4.4 points to 52.4 in March. After a strong start to the year, the Business Barometer was knocked back by steep declines in New Orders, Production, and another disappointing dip in Order Backlogs. All other Business Activity measures also declined in March, the exception being supplier lead times, which lengthened considerably.The employment index declined slightly to 55.1 from 55.7, and new orders were down sharply to 53.0 from 60.2 in February (above 50 is expansion).

Also, Catherine Rampell at the NY Times Economix brings us another reminder that the middle class is struggling: Median Household Income Down 7.3% Since Start of Recession

Median annual household income in February 2013 was $51,404, about 1.1 percent (or $590) lower than the January 2013 level of $51,994. The numbers are all pretax, and are adjusted for both inflation and seasonal changes.Friday economic releases:

February’s median annual household income was 5.6 percent lower than it was in June 2009, the month the recovery technically began; 7.3 percent lower than in December 2007, when the most recent recession officially started; and 8.4 percent lower than in January 2000, the earliest date that this statistical series became available.

• At 8:30 AM ET, Personal Income and Outlays for February. The consensus is for a 0.9% increase in personal income in February (following the sharp increase in December due to some people taking income early to avoid higher taxes, and then the subsequent sharp decline in January), and for 0.6% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 9:55 AM, Reuter's/University of Michigan's Consumer sentiment index (final for March). The consensus is for a reading of 72.5.

• At 10:00 AM, the Regional and State Employment and Unemployment (Monthly) for February 2013 will be released.

Comments on Q4 GDP and Investment

by Calculated Risk on 3/28/2013 05:01:00 PM

The third estimate of Q4 GDP report was released this morning, and although GDP was revised up, growth was still very weak at a 0.4% annualized real rate in Q4. Personal consumption expenditures (PCE) were at a 1.8% annualized real growth rate; the third consecutive quarter with a sub 2% growth rate.

There were two significant drags on GDP in Q4, the changes in private inventories subtracted 1.52 percentage points, and government spending subtracted 1.41 percentage points. Inventories will probably rebound in Q1, but government spending (especially at the Federal level) will remain under pressure all year.

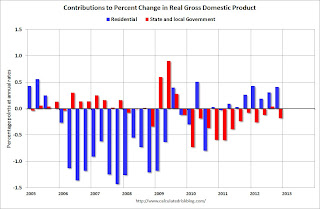

Overall this was a weak report, but with some underlying positives especially related to investment (a leading indicator). The following graph shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter centered average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

For the following graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Click on graph for larger image.

Click on graph for larger image.

Residential Investment (RI) made a positive contribution to GDP in Q4 for the seventh consecutive quarter. Usually residential investment leads the economy, but that didn't happen this time because of the huge overhang of existing inventory, but now RI is contributing. The good news: Residential investment has clearly bottomed.

The ongoing positive contribution from RI to GDP is a significant story.

Equipment and software investment increased solidly in Q4, after decreasing in Q3. This followed twelve consecutive quarters with a positive contribution.

The contribution from nonresidential investment in structures was revised to a positive in Q4. Nonresidential investment in structures typically lags the recovery, however investment in energy and power has masked the ongoing weakness in office, mall and hotel investment (the underlying details will be released next week).

The increase in investment is a key positive looking forward.

The second graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 7 quarters (through Q4 2012).

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 7 quarters (through Q4 2012).

However the drag from state and local governments is ongoing. Although not as large a negative as the worst of the housing bust (and much smaller spillover effects), this decline in state and local government spending has been relentless and unprecedented. I expect the drag from state and local governments to end, but the drag from Federal spending will be ongoing.

The key story is that residential investment is continuing to increase, and I expect this to continue. The change in private inventories will rebound in Q1, and I expect GDP to be closer to 3% this quarter. Since RI is the best leading indicator for the economy, this suggests no recession this year or in 2014 (with the usual caveats about Europe and policy errors in the US).