by Calculated Risk on 3/27/2013 02:31:00 PM

Wednesday, March 27, 2013

Lawler: Single Family REO inventories down 23.4% in 2012

From economist Tom Lawler:

While Fannie Mae still hasn’t released its 2012 10-K, FHFA released its quarterly “Foreclosure Prevention Report” for Q4/2012, which includes data on foreclosure prevention activity, foreclosures, short sales/DILs, loan modifications, credit performance, and Real Estate Owned (REO) activity at Fannie Mae and Freddie Mac. ...

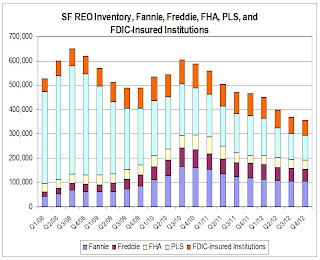

Here is a chart showing the SF REO Inventory of Fannie, Freddie, FHA, Private-Label Securities, and FDIC-Insured Institutions. For the latter, I assume that the average carrying value is 50% higher than that of the average for Fannie and Freddie.

Click on graph for larger image.

Click on graph for larger image.

SF REO inventories for these combined sectors were down 23.4% in 2012.

CR Note: Total REO is about half the level in 2008. In 2008 most of the REO was Private-Label Securities. The peak in 2010 was related to more foreclosure activity at Fannie, Freddie and the FHA.

The second graph is for just Fannie, Freddie and the FHA REO.

REO at the "Fs" peaked in 2010, and is down about 35% since then.

REO at the "Fs" peaked in 2010, and is down about 35% since then.

Freddie Mac Mortgage Serious Delinquency rate declined in February, Lowest since mid-2009

by Calculated Risk on 3/27/2013 12:38:00 PM

Freddie Mac reported that the Single-Family Serious Delinquency rate declined in February to 3.15% from 3.20% in January. The serious delinquency rate is down from 3.57% a year ago (February 2012), and this is the lowest level since mid-2009.

The Freddie Mac serious delinquency rate peaked in February 2010 at 4.20%.

Fannie Mae hasn't reported for February yet.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

Although this indicates some progress, the "normal" serious delinquency rate is under 1%. At the recent pace of improvement, it will take several years until the rates are back to normal.

NOTE: When Fannie Mae eventually releases their annual report for 2012, I'll post a graph of Real Estate Owned (REO) by Fannie, Freddie and the FHA (This is real estate that the agencies acquired through foreclosure or deed-in-lieu and haven't sold yet). Both Freddie and the FHA reported that their REO declined in Q4, and the combined total will be at the lowest level since 2009. Also the FDIC reported that the dollar value of REO for FDIC insured institutions declined in Q4, and it appears the private label REO declined too.

Pending Home Sales index declines in February

by Calculated Risk on 3/27/2013 10:05:00 AM

From the NAR: Pending Home Sales Slip on Constrained Inventory

The Pending Home Sales Index, a forward-looking indicator based on contract signings, slipped 0.4 percent to 104.8 in February from a downwardly revised 105.2 in January, but is 8.4 percent higher than February 2012 when it was 96.6. Contract activity has been above year-ago levels for the past 22 months; the data reflect contracts but not closings.Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in March and April.

...

The PHSI in the Northeast declined 2.5 percent to 82.8 in February but is 6.8 percent above February 2012. In the Midwest the index rose 0.4 percent to 103.6 in February and is 13.2 percent higher than a year ago. Pending home sales in the South slipped 0.3 percent to an index of 118.8 in February but are 12.1 percent above February 2012. In the West the index increased 0.1 percent in February to 101.4 but is 0.8 percent below a year ago.

"The volume of home sales appears to be leveling off with the constrained inventory conditions, and the leveling of the index means little change is likely in the pace of sales over the next couple months," [Lawrence Yun , NAR chief economist] said.

As I've noted several times, with limited inventory at the low end and fewer foreclosures, we might see flat or even declining existing home sales. The key is that the number of conventional sales is increasing while foreclosures and short sales decline - and that is a sign of an improving market, even if total sales decline.

MBA: Mortgage Applications increase in latest survey

by Calculated Risk on 3/27/2013 08:31:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 8 percent from the previous week. The seasonally adjusted Purchase Index increased 7 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.79 percent from 3.82 percent, with points increasing to 0.44 from 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

...

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,500) decreased to 3.90 percent from 3.95 percent, with points increasing to 0.42 from 0.36 (including the origination fee) for 80 percent LTV loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

There has been a sustained refinance boom for over a year.

Refinance activity will probably slow in 2013.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up (slowly) over the last year.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up (slowly) over the last year.

Tuesday, March 26, 2013

Wednesday: Pending Home Sales

by Calculated Risk on 3/26/2013 09:32:00 PM

The WSJ has an estimate of the losses for uninsured depositors in Cyprus: Cyprus Sets Bank Revamp Amid Protests

We are in no position to give you the exact amount this moment," [Central banker Panicos Demetriades] told reporters, referring to the amount that will be taken from large deposits at Bank of Cyprus, but he added "it's about 40%."Wednesday economic releases:

Based on estimates from government officials, the losses would affect some 19,000 deposit-holders at the Bank of Cyprus who, combined, hold some €8.01 billion ($10.30 billion) in uninsured deposits. Uninsured savers at Cyprus Popular Bank, who hold a combined €3.2 billion, will lose most of that.

"Realistically, very little will be returned," Finance Minister Michalis Sarris said in the interview broadcast on state television. "The amount [returned], could be 20%. Certainly, for depositors above €100,000 it could be a very significant blow," he said.

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Pending Home Sales Index for February. The consensus is for a 0.7% decrease in this index.

Earlier:

• Case-Shiller: Comp 20 House Prices increased 8.1% year-over-year in January

• Real House Prices, Price-to-Rent Ratio, City Prices relative to 2000

• New Home Sales at 411,000 SAAR in February

• A few comments on New Home Sales

Forecasts: Solid Vehicle Sales in March

by Calculated Risk on 3/26/2013 06:41:00 PM

Note: The automakers will report March vehicle sales this coming Monday, April 1st. Here are a few forecasts:

From Reuters: US industry March auto sales tracking above 15 mln -Toyota exec

"So far, this month of March looks to be very good for all manufacturers," [Bob Carter, Toyota's senior vice president for U.S. auto operations] told industry executives at a conference ahead of the New York auto show. He said industry sales are tracking up 6.6 percent in March, with an annual rate of 15.2 million to 15.3 million vehicles.From TrueCar: March 2013 New Car Sales Expected to Be Up Almost Five Percent According to TrueCar; March 2013 SAAR at 15.42M, Highest March SAAR Since 2007

The March 2013 forecast translates into a Seasonally Adjusted Annualized Rate ("SAAR") of 15.42 million new car sales ... up from 14.1 million in March 2012.From Kelley Blue Book: March New-Car Sales To Hit Highest Monthly Total Since August 2007 According To Kelley Blue Book

New-car sales will remain steady at a 15.2 million seasonally adjusted annual rate (SAAR) in March.And from Reuters: U.S. auto sales could rise 8 pct in March -research firms

Sales of new cars and trucks in March are expected to rise to 1,465,100 vehicles, while the annual sales pace is forecast to hit 15.3 million vehicles, J.D. Power and LMC said in a joint report released on Thursday. Since November, the annual rate has ranged from 15.3 million to 15.5 million.It appears auto sales were solid in March, and this suggests decent consumer spending growth in Q1.

Note: Most forecasts were for auto sales growth to slow in 2013 to around 4% growth or 15.0 million units. Based on the first few months, it appears sales will be stronger than expected this year.

Earlier:

• Case-Shiller: Comp 20 House Prices increased 8.1% year-over-year in January

• Real House Prices, Price-to-Rent Ratio, City Prices relative to 2000

• New Home Sales at 411,000 SAAR in February

• A few comments on New Home Sales

A few comments on New Home Sales

by Calculated Risk on 3/26/2013 02:56:00 PM

When the new home sales report was released for January, showing a large increase in the annualized sales rate, I cautioned not to read too much into that number. It was just one month of data, and January is seasonally the weakest month of the year with the largest positive seasonal adjustment.

Now that we have two months of data for 2013, one way to look at the growth rate is to use not seasonally adjusted (NSA) year-to-date data.

According to the Census Bureau, there have been 63 thousand new homes sold in 2013, up about 19% from the 53 thousand sold in January and February of 2012. That is a solid increase in sales. Note: For 2013, estimates are sales will increase to around 450 to 460 thousand, or an increase of around 22% to 25% on an annual basis from the 368 thousand in 2012.

As I mentioned last month, although there has been a large increase in the sales rate, sales are still near the lows for previous recessions. This suggest significant upside over the next few years (based on estimates of household formation and demographics, I expect sales to increase to 750 to 800 thousand over the next several years). Also housing is historically the best leading indicator for the economy, and this is one of the reasons I think The future's so bright, I gotta wear shades.

And here is another update to the "distressing gap" graph that I first started posting over four years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to start to close over the next few years.

Click on graph for larger image.

Click on graph for larger image.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through February 2013. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales kept existing home sales elevated, and depressed new home sales since builders weren't able to compete with the low prices of all the foreclosed properties.

I don't expect much of an increase in existing home sales (distressed sales will slowly decline and be offset by more conventional sales). But I do expect this gap to close - mostly from an increase in new home sales.

Another way to look at this is a ratio of existing to new home sales.

Another way to look at this is a ratio of existing to new home sales.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down, and I expect this ratio to trend down over the next several years as the number of distressed sales declines and new home sales increase.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Real House Prices, Price-to-Rent Ratio, City Prices relative to 2000

by Calculated Risk on 3/26/2013 12:12:00 PM

Case-Shiller, CoreLogic and others report nominal house prices, and it is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio.

As an example, if a house price was $200,000 in January 2000, the price would be close to $275,000 today adjusted for inflation. This is why economist also look at real house prices (inflation adjusted).

Nominal House Prices

The first graph shows the quarterly Case-Shiller National Index SA (through Q4 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through January) in nominal terms as reported.

The first graph shows the quarterly Case-Shiller National Index SA (through Q4 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through January) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to Q2 2003 levels (and also back up to Q3 2010), and the Case-Shiller Composite 20 Index (SA) is back to November 2003 levels, and the CoreLogic index (NSA) is back to January 2004.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to October 1999 levels, the Composite 20 index is back to December 2000, and the CoreLogic index back to February 2001.

In real terms, most of the appreciation in the last decade is gone.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q4 1999 levels, the Composite 20 index is back to December 2000 levels, and the CoreLogic index is back to February 2001.

In real terms - and as a price-to-rent ratio - prices are mostly back to early 2000 levels.

Nominal Prices: Cities relative to Jan 2000

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

As an example, at the peak, prices in Phoenix were 127% above the January 2000 level. Then prices in Phoenix fell slightly below the January 2000 level, and are now up 27% above January 2000 (I'll look at this in real terms later). Some cities - like Denver - are close to the peak level. Other cities, like Atlanta and Detroit, are below the January 2000 level.

New Home Sales at 411,000 SAAR in February

by Calculated Risk on 3/26/2013 10:18:00 AM

The Census Bureau reports New Home Sales in February were at a seasonally adjusted annual rate (SAAR) of 411 thousand. This was down from a revised 431 thousand SAAR in January (revised down from 437 thousand).

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

"Sales of new single-family houses in February 2013 were at a seasonally adjusted annual rate of 411,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 4.6 percent below the revised January rate of 431,000, but is 12.3 percent above the February 2012 estimate of 366,000.

Click on graph for larger image in graph gallery.

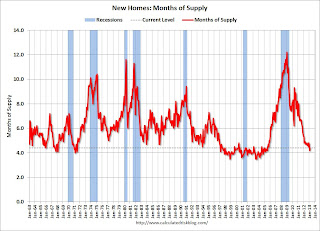

Click on graph for larger image in graph gallery.The second graph shows New Home Months of Supply.

The months of supply increased in February to 4.4 months from 4.2 months in January.

The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

This is now in the normal range (less than 6 months supply is normal)."The seasonally adjusted estimate of new houses for sale at the end of February was 152,000. This represents a supply of 4.4 months at the current sales rate."On inventory, according to the Census Bureau:

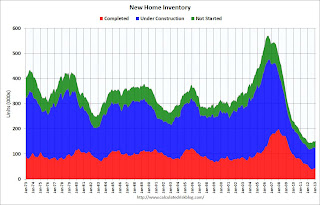

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale is just above the record low. The combined total of completed and under construction is also just above the record low.

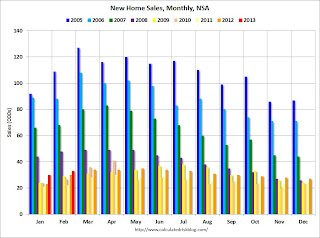

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In February 2013 (red column), 33 thousand new homes were sold (NSA). Last year 30 thousand homes were sold in February. This was the eight weakest February since this data has been tracked. The high for February was 109 thousand in 2005, and the low for February was 22 thousand in 2011.

This was below expectations of 425,000 sales in February, but still a fairly solid report. I'll have more soon ...

Case-Shiller: Comp 20 House Prices increased 8.1% year-over-year in January

by Calculated Risk on 3/26/2013 09:18:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for January ("January" is a 3 month average of November, December and January).

This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Prices Accelerate in January 2013 According to the S&P/Case-Shiller Home Price Indices

Data through January 2013, released today by S&P Dow Jones Indices for its S&P/Case-Shiller Home Price Indices ... showed average home prices increased 7.3% for the 10-City Composite and 8.1% for the 20-City Composite in the 12 months ending in January 2013.

“The two headline composites posted their highest year-over-year increases since summer 2006,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “This marks the highest increase since the housing bubble burst."

...

In January 2013, nine cities -- Atlanta, Charlotte, Las Vegas, Los Angeles, Miami, New York, Phoenix, San Francisco and Tampa -- and both Composites posted positive monthly returns. Dallas was the only MSAwhere the level remained flat.

Click on graph for larger image.

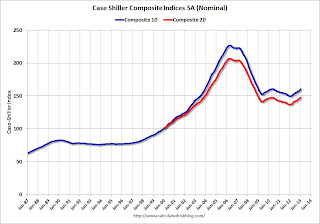

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 29.3% from the peak, and up 1.0% in January (SA). The Composite 10 is up 7.3% from the post bubble low set in Feb 2012 (SA).

The Composite 20 index is off 28.4% from the peak, and up 1.0% (SA) in January. The Composite 20 is up 8.1% from the post-bubble low set in Jan 2012 (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 7.3% compared to January 2012.

The Composite 20 SA is up 8.1% compared to January 2012. This was the eight consecutive month with a year-over-year gain since 2010 (when the tax credit boosted prices temporarily). This was the largest year-over-year gain for the Composite 20 index since 2006.

Prices increased (SA) in 20 of the 20 Case-Shiller cities in January seasonally adjusted (prices increased in 9 of 20 cities NSA). Prices in Las Vegas are off 55.9% from the peak, and prices in Denver only off 2.0% from the peak.

This was close to the consensus forecast for a 8.2% YoY increase. I'll have more on prices later.