by Calculated Risk on 3/15/2013 12:34:00 PM

Friday, March 15, 2013

Key Measures of inflation in February

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.9% annualized rate) in February. The 16% trimmed-mean Consumer Price Index rose 0.2% (2.6% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for February here. Motor fuel increased at a 180% annualized rate in February! That was a sharp increase, but prices have fallen a little in March.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.7% (8.5% annualized rate) in February. The CPI less food and energy increased 0.2% (2.1% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.9%, and the CPI less food and energy rose 2.0%. Core PCE is for January and increased 1.3% year-over-year.

On a monthly basis, median CPI was at 2.9% annualized, trimmed-mean CPI was at 2.6% annualized, and core CPI increased 2.1% annualized. Also core PCE for January increased 1.8% annualized.

The Fed has been clear that their 2% inflation target is not a ceiling, and that they will tolerate some short term increases in inflation as long as the unemployment rate remains elevated and inflation expectations remain "well anchored". From the recent FOMC statement: "the Committee ... currently anticipates that this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee’s 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored".

The Fed will meet next week, and with this level of inflation and the current high level of unemployment, I expect the Fed will keep the "pedal to the metal".

Preliminary March Consumer Sentiment declines to 71.8

by Calculated Risk on 3/15/2013 09:55:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for March declined to 71.8 from the February reading of 77.6.

This was well below the consensus forecast of 77.7, and very low. There are a number of factors that impact sentiment including unemployment, gasoline prices and, for 2013, the payroll tax increase and even politics (sequestration, default threats, etc).

In this case, the decline was probably related to both high gasoline prices and policy concerns. According to Reuters, a record 34 percent of those surveyed were negative about government economic policies (sequestration, etc.). Reuters also reports that buying plans were essentially unchanged.

Fed: Industrial Production increased 0.7% in February

by Calculated Risk on 3/15/2013 09:36:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.7 percent in February after having been unchanged in January. Manufacturing output rose 0.8 percent in February, and the index revised up for the previous two months. In February, the output of utilities advanced 1.6 percent, as temperatures for the month were near their seasonal norms after two months of unseasonably warm weather. The production at mines declined 0.3 percent, its third consecutive monthly decrease. At 99.5 percent of its 2007 average, total industrial production in February was 2.5 percent above its level of a year earlier. The capacity utilization rate for total industry increased to 79.6 percent, a rate that is 0.6 percentage point below its long-run (1972--2012) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 12.8 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 79.6% is still 0.6 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.6% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in February to 99.5. This is 19.2% above the recession low, but still 1.2% below the pre-recession peak.

The monthly change for both Industrial Production and Capacity Utilization were above expectations.

CPI increases 0.7% in February, Core CPI 0.2%, NY Fed Manufacturing indicates expansion

by Calculated Risk on 3/15/2013 08:30:00 AM

• From the Bureau of Labor Statistics (BLS): Consumer Price Index - February 2013

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.7 percent in February on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.0 percent before seasonal adjustment. The gasoline index rose 9.1 percent in February to account for almost three-fourths of the seasonally adjusted all items increase.On a year-over-year basis, CPI is up 2.0 percent, and core CPI is up also up 2.0 percent. Both are at the Fed's target. This was above the consensus forecast of a 0.5% increase for CPI (due to gasoline prices), and a 0.2% increase in core CPI.

...

The index for all items less food and energy increased 0.2 percent in February.

I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

• From the NY Fed: Empire State Manufacturing Survey

The general business conditions index was positive for a second consecutive month and, at 9.2, was little changed. ... Employment indexes suggested that labor market conditions were sluggish, with little change in employment levels and the length of the average workweek. Indexes for the six-month outlook pointed to an increasing level of optimism about future conditions, with the future general business conditions index rising to its highest level in nearly a year.This is the first of the regional manufacturing surveys for March. This was at the consensus forecast of a reading of 8.5.

Thursday, March 14, 2013

Friday: Industrial Production, CPI, Consumer Sentiment

by Calculated Risk on 3/14/2013 07:57:00 PM

First, here is a price index for commercial real estate that I follow. CoStar reported that their value weighted index is up 4.8% year-over-year, and the equal weighted index is up 5.5% from January 2012. Also the volume of distressed sales is continuing to decline.

From CoStar: Commercial Real Estate Pricing Levels Off In January Following Year-End Surge

The U.S. Value-Weighted Composite Index, which weights each repeat-sale by transaction size or value (and therefore is heavily influenced by larger transactions), ticked up by 0.7% in January, and has now increased 38% from its trough in 2010. The U.S. Equal-Weighted Composite Index, which weights each repeat-sale by transaction equally (and therefore is heavily influenced by numerous smaller transactions), began 2013 with a 2.9% monthly loss, largely due to a seasonal slowdown in trading activities after the year-end sales surge. However, thanks to its steady recovery throughout 2012, the equal-weighted index has increased 5.5% since January 2012.

...

Distressed sales as a percentage of total transactions have been following a declining trend since the start of 2011. Although this percentage ticked up in January 2013 due to the seasonal slowdown in total transactions, the number of repeat sales involving distress assets was the lowest in January 2013 since the summer of 2009.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the Value-Weighted and Equal-Weighted indexes. As CoStar noted, the Value-Weighted index is up 38.5% from the bottom (showing the demand for higher end properties) and up 4.8% year-over-year. However the Equal-Weighted index is only up 9.0% from the bottom, and up 5.5% year-over-year.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

Friday economic releases:

• At 8:30 AM ET, the Consumer Price Index for February will be released. The consensus is for a 0.5% increase in CPI in February (due to higher gasoline prices) and for core CPI to increase 0.2%.

• Also at 8:30 AM, the NY Fed Empire Manufacturing Survey for March. The consensus is for a reading of 8.5, down from 10.0 in February (above zero is expansion).

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for February. The consensus is for a 0.3% increase in Industrial Production in February, and for Capacity Utilization to increase to 79.3%.

• At 9:55 AM, the preliminary March Reuter's/University of Michigan's Consumer sentiment index will be released. The consensus is for a reading of 77.5, down from 77.6.

Freddie Mac: Mortgage Rates increase in latest Survey

by Calculated Risk on 3/14/2013 04:15:00 PM

From Freddie Mac today: Mortgage Rates up on Signs of Improving Economy

The 30-year fixed averaged 3.63 percent, its highest reading since the week of August 23, 2012. The 30-year fixed hit its average all-time record low of 3.31 percent the week of November 21, 2012. ...

30-year fixed-rate mortgage (FRM) averaged 3.63 percent with an average 0.8 point for the week ending March 14, 2013, up from last week when it averaged 3.52 percent. Last year at this time, the 30-year FRM averaged 3.92 percent.

15-year FRM this week averaged 2.79 percent with an average 0.8 point, up from last week when it averaged 2.76 percent. A year ago at this time, the 15-year FRM averaged 3.16 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA's refinance index (monthly average) and the the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey®.

The Freddie Mac survey started in 1971 and mortgage rates are currently near the record low for the last 40 years.

This shows the recent small increase in mortgage rates. This probably means refinance activity will slow in 2013. Note: There has been an increase in refinance activity due to HARP.

Here is an update to an old graph - by request - that shows the relationship between the 10 year Treasury Yield and 30 year mortgage rates.

Here is an update to an old graph - by request - that shows the relationship between the 10 year Treasury Yield and 30 year mortgage rates. Currently the 10 year Treasury yield is 2.02% and 30 year mortgage rates are at 3.63%. If the ten year yield stay in this range, 30 year mortgage rates might move up a little from here.

The third graph shows the 15 and 30 year fixed rates from the Freddie Mac survey since the Primary Mortgage Market Survey® started in 1971 (15 year in 1991).

The third graph shows the 15 and 30 year fixed rates from the Freddie Mac survey since the Primary Mortgage Market Survey® started in 1971 (15 year in 1991).The recent increase in rates is pretty small on this long term graph.

Note: Mortgage rates were at or below 5% back in the 1950s.

Report: Housing Inventory declines 16% year-over-year in February

by Calculated Risk on 3/14/2013 01:54:00 PM

From Realtor.com: Spring Home Buying Season Starts Early According to realtor.com®'s February Trend Data

In February, the total number of single-family homes, condos, townhomes and co-ops for sale in the U.S. (1,494,218) increased by 1.15 percent month-over-month. On an annual basis, however, inventory was down by 15.97 percent.Note: Realtor.com reports the average number of listings in a month, whereas the NAR uses an end-of-month estimate. Since inventory usually starts to come back on the market early in the year, the NAR will probably report a larger month-to-month increase in inventory for February than Realtor.com.

The median age of inventory of for sale listings fell to 98 days in February, down 9.26 percent from January and 11.71 percent below the median age one year ago (February 2012).

Nearly all of the markets with the largest year-over-year declines in their for sale inventories in February were in California, where declines averaged 48 percent. The list includes Sacramento, Stockton, Oakland, San Jose, Orange County, Los Angeles, Seattle, San Francisco, Riverside and Ventura. These markets also experienced a dramatic decline in the median age of inventory, falling to an average of just 31 days, or 53 percent lower than it was one year ago.

Inventory decreased year-over-year in 141 of the 146 markets realtor.com tracks, and by more than 20% year-over-year in 43 markets.

The NAR is scheduled to report February existing home sales and inventory on Thursday, March 21st.

FNC: Residential Property Values increased 5.7% year-over-year in January

by Calculated Risk on 3/14/2013 10:35:00 AM

In addition to Case-Shiller, CoreLogic, FHFA and LPS, I'm also watching the FNC, Zillow and several other house price indexes.

From FNC: FNC Index: January Home Prices Rise 0.3%

The latest FNC Residential Price Index® (RPI) indicates that U.S. property values continued to recover through January—the 11th consecutive month of rising prices. Despite the uneven pace of price gains across different geographical markets, there are clear signs that the housing recovery is increasingly widespread.The year-over-year change continued to increase in January, with the 100-MSA composite up 5.7% compared to January 2012. The FNC index turned positive on a year-over-year basis in July, 2012.

A limited housing supply and declining foreclosure sales are contributing to the recovery of underlying property values. The average list-to-sale price ratio increased to 93.5 in January, compared to 90.3 during the same period a year ago; in other words, the average asking price discount dropped to 6.5% from 9.7%. Foreclosures, as a percentage of total home sales, were 20.2% in January, down from 26.9% a year ago.

Based on recorded sales of non-distressed properties (existing and new homes) in the 100 largest metropolitan areas, the FNC 100-MSA composite index shows that January home prices rose 0.3% from the previous month and were up 5.7% on a year-over-year basis from the same period in 2012. The 30-MSA and 10-MSA composite indices show similar trends of rising prices, with the 10-MSA composite accelerating more rapidly at 0.8% month-over-month and 7.2% year-over-year.

...

Although home prices have improved significantly in the last 12 months, a six-year price comparison shows that current prices remain well below their near-peak levels. On average, today’s home prices are about 27.5% below January 2007. In hard-hit markets such as Las Vegas, Orlando, Miami, and Riverside, Calif., home prices are only half of what they were six years ago.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for the FNC Composite 10, 20, 30 and 100 indexes. Note: The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

The key is the indexes are now showing a year-over-year increase indicating prices probably bottomed early in 2012.

Weekly Initial Unemployment Claims decrease to 332,000

by Calculated Risk on 3/14/2013 08:35:00 AM

The DOL reports:

In the week ending March 9, the advance figure for seasonally adjusted initial claims was 332,000, a decrease of 10,000 from the previous week's revised figure of 342,000. The 4-week moving average was 346,750, a decrease of 2,750 from the previous week's revised average of 349,500.The previous week was revised up from 340,000.

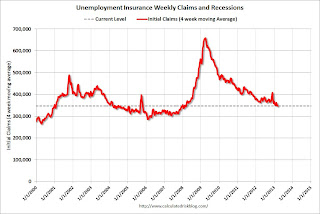

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 346,750 - this is the lowest level since early March 2008.

Weekly claims were below the 350,000 consensus forecast. Claims might increase over the next few months due to the "sequestration" budget cuts, but right now initial unemployment claims suggest an improving labor market.

Wednesday, March 13, 2013

Thursday: Unemployment Claims, PPI

by Calculated Risk on 3/13/2013 08:23:00 PM

On the declining deficit from MarketWatch: February budget deficit $203.5 billion: Treasury

The U.S. government ran a budget deficit of $203.5 billion in February, down 12% from the same month last year, the Treasury Department reported on Wednesday. The narrowing of the gap between spending and revenue in February is further indication that the deficit is on track to improve this fiscal year which ends Sept. 30. If lawmakers hold fiscal policy steady, the deficit for this year will total $845 billion, about $240 billion less than the fiscal 2012 deficit and the first deficit below a trillion since fiscal 2008, according to the Congressional Budget Office projections.The Congressional Budget Office (CBO) is projecting the deficit will decline to $845 billion in fiscal 2013 (the current budget year), and that the deficit will be about 5.3% of GDP.

Click on graph for larger image.

Click on graph for larger image.This graph shows the actual (purple) budget deficit each year as a percent of GDP, and an estimate for the next ten years based on estimates from the CBO.

The CBO projects the deficit will decline to 3.7% of GDP in fiscal 2014, and 2.4% of GDP in fiscal 2015. After 2015, the deficit will start to increase again according to the CBO.

Thursday economic releases:

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 350 thousand from 340 thousand last week.

• Also at 8:30 AM, the Producer Price Index for February. The consensus is for a 0.6% increase in producer prices (0.1% increase in core).