by Calculated Risk on 3/06/2013 07:00:00 AM

Wednesday, March 06, 2013

MBA: Mortgage Applications Increase Sharply in Latest Weekly Survey

From the MBA: Mortgage Applications Increase as Rates Drop in Latest MBA Weekly Survey

The Refinance Index increased 15 percent from the previous week and was at its highest level since mid-January. The seasonally adjusted Purchase Index also increased 15 percent from one week earlier and was at its highest level since the week ending February 1.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.70 percent from 3.77 percent, with points decreasing to 0.39 from 0.48 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

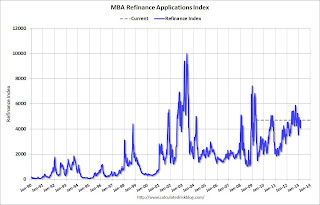

Click on graph for larger image.The first graph shows the refinance index.

There has been a sustained refinance boom for over a year, and 77 percent of all mortgage applications are for refinancing.

Refinance activity will probably slow in 2013.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up (slowly) over the last six months.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up (slowly) over the last six months.This index will probably continue to increase as conventional home purchase activity increases.

Tuesday, March 05, 2013

Wednesday: ADP Employment, Beige Book

by Calculated Risk on 3/05/2013 07:11:00 PM

Back in October, ADP revised their methodology for estimating changes in private employment. Here is a table of the four releases since the methodology was changed.

| Comparison of BLS Private Employment and ADP (000s) | ||||

|---|---|---|---|---|

| ADP Initial | Revised | BLS Initial (Private Only) | BLS Revised (Private) | |

| Oct-12 | 158 | 159 | 184 | 217 |

| Nov-12 | 118 | 173 | 147 | 256 |

| Dec-12 | 215 | 185 | 168 | 202 |

| Jan-13 | 192 | - | 166 | - |

In general it appears the new methodology is better, but it is still too early for a statistical analysis. With this small sample, it appears that the initial BLS report will be +/- 20% of the ADP number or so.

Wednesday economic releases:

• At 10:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for February. This report is for private payrolls only (no government). The consensus is for 173,000 payroll jobs added in February.

• At 10:00 AM, the Manufacturers' Shipments, Inventories and Orders (Factory Orders) for January. The consensus is for a 2.2% decrease in orders.

• At 2:00 PM, the Federal Reserve Beige Book will be released. This is an informal review by the Federal Reserve Banks of current economic conditions in their Districts. Analysts will look for signs of an impact from the recent tax increases.

Market Update

by Calculated Risk on 3/05/2013 04:45:00 PM

Click on graph for larger image.

By request - following the new high on the Dow today - here are a couple of stock market graphs. The first graph shows the S&P 500 since 1990 (this excludes dividends).

The dashed line is the closing price today. The S&P 500 was first at this level in July 2007, just before the recession started. We can't call it a "lost decade" for stocks any more.

Another note: A new high doesn't tell us much. Over the last 50 years (starting in 1963) there were 27 years with new highs. If we excluded the miserable '00s, there were new highs in 26 of 38 years. So new highs are not unusual.

The second graph (click on graph for larger image) is from Doug Short and shows the S&P 500 since the 2007 high ...

Trulia: Asking House Prices increased in February, Inventory not expected to bottom in 2013

by Calculated Risk on 3/05/2013 12:39:00 PM

Press Release: Trulia Reports Asking Home Price Gains Accelerating While Housing Inventory No Longer in Free Fall

Since bottoming 12 months ago, national asking home prices rose 7.0 percent year-over-year (Y-o-Y) in February. Seasonally adjusted, asking prices also increased 1.4 percent month-over-month (M-o-M) and 3.0 percent quarter-over-quarter (Q-o-Q) – marking two post-recession highs. Asking prices locally are up in 90 of the 100 largest U.S. metros, rising fastest in Phoenix, Las Vegas, and Oakland.More on inventory from Jed Kolko, Trulia Chief Economist: Rising Prices Mean Falling Inventory … in the Short Term

Meanwhile, rent increases are slowing down. In February, rents rose just 3.2 percent Y-o-Y. This is a notable decrease from three months ago, in November, when rents were up 5.4 percent Y-o-Y. Among the 25 largest rental markets, rents rose the most in Houston, Oakland, and Miami, while falling slightly in San Francisco and Las Vegas.

...

Inventory Will Not Turn Around in 2013 Even Though Decline Is Slowing Down

Inventory falls most sharply just after prices bottom, creating an “inventory spiral”: rising prices reduce inventory as would-be home sellers hold off in the hopes of selling later at a higher price, and falling inventory boosts prices further as buyers compete for a limited number of for-sale homes. Nationally, the annualized rate of inventory decline was 23 to 29 percent from March to September 2012, the months after home prices first bottomed one year ago, but has softened to a 14 to 21 percent rate since October [1]

emphasis added

Inventory and prices affect each other in three ways:These are important points on inventory, and I now think inventory will not bottom this year (this is why I've been tracking inventory weekly). This probably means more price appreciation in 2013 than most analysts expect (I think the consensus was around 3% price increase in 2013), and this is also positive for new home sales.

1.Less inventory leads to higher prices. That’s because buyers are competing for a limited number of for-sale homes.In the short term, the first two reasons create an “inventory spiral”: less inventory leads to higher prices, which leads to less inventory, and so on. But the inventory spiral can’t go on forever because eventually rising prices will encourage homeowners to sell and builders to build, which add to inventory and breaks the spiral. The critical question for the housing market – especially for buyers fighting over tight inventories – is how long until that kicks in? How long do prices have to rise before sellers and builders start adding to inventory?

2.Higher prices lead to less inventory – at least in the short term. Everyone wants to buy at the bottom; no one wants to sell at the bottom. When prices start to rise, buyers get impatient while many would-be sellers want to hold out in the hopes of selling later at a higher price.

3.Higher prices lead to more inventory – in the long term. As prices keep rising, more homeowners decide it’s worthwhile to sell, especially those who get back above water, which adds to inventory. Also, builders take rising prices as a cue to rev up construction activity, which also adds to inventory.

...

How long until inventory turns positive, rather than becoming just less negative? ... it could be at least another year until national inventory starts expanding. Of course, inventory will probably turn up this spring and summer because of the regular seasonal pattern, but the underlying trend will be less inventory than is typical for each season, not more.

Note: These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and this suggests further house price increases over the next few months on a seasonally adjusted basis.

ISM Non-Manufacturing Index indicates faster expansion in February

by Calculated Risk on 3/05/2013 10:00:00 AM

The February ISM Non-manufacturing index was at 56.0%, up from 55.2% in January. The employment index decreased in February to 57.2%, down from 57.5% in January. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: February 2013 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in February for the 38th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI™ registered 56 percent in February, 0.8 percentage point higher than the 55.2 percent registered in January. This indicates continued growth at a slightly faster rate in the non-manufacturing sector. This month's reading also reflects the highest NMI™ since February 2012, when the index registered 56.1 percent. The Non-Manufacturing Business Activity Index registered 56.9 percent, which is 0.5 percentage point higher than the 56.4 percent reported in January, reflecting growth for the 43rd consecutive month. The New Orders Index increased by 3.8 percentage points to 58.2 percent, and the Employment Index decreased 0.3 percentage point to 57.2 percent, indicating growth in employment for the seventh consecutive month. The Prices Index increased 3.7 percentage points to 61.7 percent, indicating prices increased at a faster rate in February when compared to January. According to the NMI™, 13 non-manufacturing industries reported growth in February. The majority of respondents' comments reflect a growing optimism about the trend of the economy and overall business conditions."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 55.0% and indicates faster expansion in February than in January.

CoreLogic: House Prices up 9.7% Year-over-year in January

by Calculated Risk on 3/05/2013 09:00:00 AM

Notes: This CoreLogic House Price Index report is for January. The recent Case-Shiller index release was for December. Case-Shiller is currently the most followed house price index, however CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Home Price Index Rises by Almost 10 Percent Year Over Year in January

Home prices nationwide, including distressed sales, increased on a year-over-year basis by 9.7 percent in January 2013 compared to January 2012. This change represents the biggest increase since April 2006 and the 11th consecutive monthly increase in home prices nationally. On a month-over-month basis, including distressed sales, home prices increased by 0.7 percent in January 2013 compared to December 2012. The HPI analysis shows that all but two states, Delaware and Illinois, are experiencing year-over-year price gains.

Excluding distressed sales, home prices increased on a year-over-year basis by 9.0 percent in January 2013 compared to January 2012. On a month-over-month basis, excluding distressed sales, home prices increased 1.8 percent in January 2013 compared to December 2012. Distressed sales include short sales and real estate owned (REO) transactions.

The CoreLogic Pending HPI indicates that February 2013 home prices, including distressed sales, are expected to rise by 9.7 percent on a year-over-year basis from February 2012 and fall by 0.3 percent on a month-over-month basis from January 2013, reflecting a seasonal winter slowdown.

...

“The HPI showed strong growth during the typically slow winter season,” said Mark Fleming, chief economist for CoreLogic.

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 0.7% in January, and is up 9.7% over the last year.

The index is off 26.4% from the peak - and is up 10.1% from the post-bubble low set in February 2012.

The second graph is from CoreLogic. The year-over-year comparison has been positive for eleven consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for eleven consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).This is the largest year-over-year increase since 2006.

Since this index is not seasonally adjusted, it was expected to decline on a month-to-month basis in January - instead the index increased, and, considering seasonal factors, this month-to-month increase was very strong.

Monday, March 04, 2013

Tuesday: ISM Service Index

by Calculated Risk on 3/04/2013 09:09:00 PM

The kids are alright! From the WSJ: Young Adults Retreat From Piling Up Debt

Young people are racking up larger amounts of student debt than ever before, but fresh data suggest they are becoming warier of borrowing in general: Total debt among young adults dropped in the last decade to the lowest level in 15 years.Student debt is a significant problem, but less overall debt is good news.

A typical young U.S. household—defined as one led by someone under age 35—had $15,000 in total debt in 2010, down from $18,000 in 2001 and the lowest since 1995, according to a recent Pew Research Center report and government data. Total debt includes mortgage loans, credit cards, auto lending, student loans and other consumer borrowing.

In addition, fewer young adults carried credit-card balances and 22% didn't have any debt at all in 2010—the most since government tracking began in 1983.

The lower overall debt comes despite an increase in student borrowing, which ballooned to $966 billion last year from $253 billion at the end of 2003, according to the Federal Reserve.

Tuesday economic releases:

• At 10:00 AM ET, Trulia Price Rent Monitors for February. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

• Also at 10:00 AM, ISM non-Manufacturing Index for February. The consensus is for a decrease to 55.0 from 55.2 in January. Note: Above 50 indicates expansion, below 50 contraction.

Existing Home Inventory is only up 3.4% year-to-date in early March

by Calculated Risk on 3/04/2013 03:24:00 PM

Dude, Where's my inventory?

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'll be tracking inventory weekly for the next few months.

If inventory does bottom, we probably will not know for sure until late in the year. In normal times, there is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

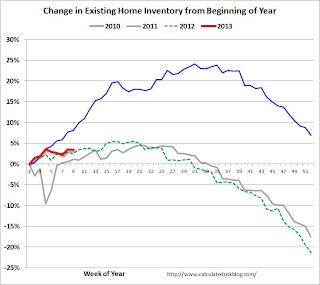

The NAR data is monthly and released with a lag. However Ben at Housing Tracker (Department of Numbers) kindly sent me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year.

In 2010 (blue), inventory followed the normal seasonal pattern, however in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

So far - through early March - it appears inventory is increasing at a sluggish rate. Housing Tracker reports inventory is down -23.2% compared to the same week in 2012 - still falling fast year-over-year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

The key will be to see how much inventory increases over the next few months. In 2010, inventory was up 8% by early March, and up 15% by the end of March.

For 2011 and 2012, inventory only increased about 5% at the peak and then declined for the remainder of the year.

So far in 2013, inventory is only up 3.4%. If inventory doesn't increase more soon, then the bottom for inventory might not be until 2014.

Fannie Mae Mortgage Serious Delinquency rate declined in January, Lowest since early 2009

by Calculated Risk on 3/04/2013 02:02:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate declined in January to 3.18% from 3.29% in December 2012. The serious delinquency rate is down from 3.90% in January 2012, and this is the lowest level since March 2009.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac has not reported for January yet.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

Although this indicates some progress, the "normal" serious delinquency rate is under 1%. At the recent pace of improvement, it will take several years until the rates are back to normal.

Update: Seasonal Pattern for House Prices

by Calculated Risk on 3/04/2013 09:53:00 AM

There has always been a clear seasonal pattern for house prices, but the seasonal differences have been more pronounced in recent years.

Even in normal times house prices tend to be stronger in the spring and early summer than in the fall and winter. Recently there has been a stronger than normal seasonal pattern because conventional sales are following the normal pattern (more sales in the spring and summer), but distressed sales (foreclosures and short sales) happen all year. So distressed sales have had a larger negative impact on prices in the fall and winter.

However, house prices - not seasonally adjusted (NSA) - have been pretty strong over the last few months - at the start of the normally weak months.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the month-to-month change in the CoreLogic and NSA Case-Shiller Composite 20 index since 2001 (both Case-Shiller and CoreLogic through December). The seasonal pattern was smaller back in the early '00s, and increased since the bubble burst.

The CoreLogic index was positive in both the November and December reports (CoreLogic is a 3 month weighted average, with the most recent month weighted the most).

Case-Shiller NSA turned negative month-to-month in the October report (also a three month average, but not weighted), but was only slightly negative in November and turned positive in the December report. This shows that the "off-season" for prices has been pretty strong this year.

The second graph shows the seasonal factors for the Case-Shiller composite 20 index. The factors started to change near the peak of the bubble, and really increased during the bust.

The second graph shows the seasonal factors for the Case-Shiller composite 20 index. The factors started to change near the peak of the bubble, and really increased during the bust.

Note: I was one of several people to question this change in the seasonal factor - and this led to S&P Case-Shiller reporting the NSA numbers.

It appears the seasonal factor has stopped increasing, and I expect that over the next several years - as the percent of distressed sales decline - the seasonal factors will slowly move back towards the previous levels.