by Calculated Risk on 2/27/2013 09:17:00 PM

Wednesday, February 27, 2013

Thursday: Q4 GDP, Unemployment Claims

From the WaPo: Obama to meet congressional leaders on ways to avoid sequester impact

President Obama will meet with congressional leaders Friday at the White House to discuss a way to avoid the fallout of deep spending cuts ...This will not have a huge negative impact (defaulting on the debt would have been serious), but this is still unnecessary.

Among the sequester’s possible impacts, the head of the Federal Aviation Administration warned Wednesday, are major flight delays and the closure of hundreds of air traffic control towers at smaller airports across the country.

“Flights to major cities like New York, Chicago and San Francisco could experience delays, in some instances up to 90 minutes during peak hours, because we’ll have fewer controllers on staff,” FAA administrator Michael P. Huerta said in a speech to an American Bar Association forum in Washington. ... Should the cuts occur as scheduled, travelers would begin to notice the impact in mid-April, according to the [National Air Traffic Controllers Association].

Thursday economic releases:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 360 thousand from 362 thousand last week.

• Also at 8:30 AM, Q4 GDP (second estimate). This is the second estimate of GDP from the BEA. The consensus is that real GDP increased 0.5% annualized in Q4, revised up from a negative 0.1% in the advance report.

• At 9:45 AM, the Chicago Purchasing Managers Index for February. The consensus is for a decrease to 55.0, down from 55.6 in January.

• At 11:00 AM, the Kansas City Fed regional Manufacturing Survey for February will be released. This is the last of the regional surveys for February, and most of the surveys have indicated expansion.

• Also at 11:00 AM, The Federal Reserve Bank of New York will release the Q4 2012 Quarterly Report on Household Debt and Credit

Lawler: A few highlights from the Q4 FDIC Quarterly Banking Profile

by Calculated Risk on 2/27/2013 03:39:00 PM

From economist Tom Lawler:

Yesterday the FDIC released its “Quarterly Banking Profile” for Q4/2012. Some of the “headline highlights” from the report, which reflects the activity at and performance of FDIC-insured financial institutions, were:

“Net Income Is More Than a Third Higher Than in Fourth Quarter 2011” despite the fact that “Banks See (Net Interest) Margins Erode,” as net income was “(bolstered by higher noninterest income and lower provisions for loan losses.” The jump in noninterest income was driven “primarily by higher gains on loan sales (up $2.4 billion, or 132.4 percent, over fourth quarter 2011), increased trading revenue (up $1.9 billion, or 75.3 percent), and reduced losses on sales of foreclosed property (down $1.2 billion, or 72 percent).” The higher gains on loans sales were driven by gains on sales of mortgages – partly reflecting higher origination volumes, but mainly reflecting extraordinarily large mortgage origination margins, which in turn partly reflected the unintended consequences of current government policy.

According to the report, the percent of loans and leases that were “noncurrent” last quarter fell to 3.60% -- the lowest rate since the end of 2008 – from 3.68% in the previous quarter and 4.19% in the fourth quarter of 2011. The % of loans secured by one-to-four family residential properties that were noncurrent last quarter was actually up from the fourth quarter of 2011, partly reflecting higher default rates on junior mortgage loans.

| % of Loans & Leases Noncurrent, FDIC-Insured Financial Institutions | |||||

|---|---|---|---|---|---|

| 2012:Q4 | 2012:Q3 | 2012:Q2 | 2012:Q1 | 2011:Q4 | |

| Total Loans & Leases | 3.60% | 3.86% | 3.90% | 4.11% | 4.19% |

| Loans Secured by 1-4 Family Res. Mortgages | 7.82% | 8.07% | 7.80% | 7.84% | 7.70% |

| Closed-End First Lien 1-4 Family Residential Mortgages | 9.49% | 9.88% | 9.75% | 9.87% | 10.00% |

| Closed-End 2nd Lien 1-4 Family Residential Mortgages | 5.09% | 5.47% | 3.86% | 3.76% | 3.50% |

| Home Equity Lines of Credit | 2.88% | 2.88% | 2.62% | 2.65% | 1.83% |

| Other Loans & Leases | 1.62% | 1.84% | 2.01% | 2.28% | 2.44% |

Click on graph for larger image.

Click on graph for larger image.On the REO front, the report showed that the carrying value of one-to-four family REO properties at FDIC institutions declined to $8.3375 billion at the end of December, down from $8.7663 billion at then end of September and $11.6376 billion at the end of 2011.

Bernanke: Sequester could lead to "less deficit reduction"

by Calculated Risk on 2/27/2013 11:46:00 AM

At this point the biggest downside risk to the US economy is from cutting the deficit too quickly. The deficit is already declining and will continue to decline for the next few years. Additional short term deficit reduction will probably be counter productive (the focus should be on long term deficit reduction, especially health care costs). The "sequester" is bad policy - but it will probably happen anyway. Dumb.

From Brad Plumer at the WaPo Wonkblog: Bernanke: The sequester could make it harder to reduce the deficit, not easier

Federal Reserve Chairman Ben Bernanke had something to say about sequestration during his testimony before the House Banking Committee on Tuesday. He thinks the looming spending cuts could actually make it harder, not easier, to reduce the deficit. Why? They’ll hurt growth:

The CBO estimates that deficit-reduction policies in current law will slow the pace of real GDP growth by about 1-1/2 percentage points this year, relative to what it would have been otherwise.The logic here is simple enough. The sequestration cuts will drag down economic growth this year, which will mean that fewer Americans will have jobs and less tax revenue will pour in. Nothing cures deficits like stronger economic growth. And right now, Congress’s policies are standing in the way of stronger growth.

A significant portion of this effect is related to the automatic spending sequestration that is scheduled to begin on March 1, which, according to the CBO’s estimates, will contribute about 0.6 percentage point to the fiscal drag on economic growth this year. Given the still-moderate underlying pace of economic growth, this additional near-term burden on the recovery is significant.

Moreover, besides having adverse effects on jobs and incomes, a slower recovery would lead to less actual deficit reduction in the short run for any given set of fiscal actions.

Pending Home Sales index increased in January

by Calculated Risk on 2/27/2013 10:14:00 AM

From the NAR: January Pending Home Sales Up in All Regions

The Pending Home Sales Index, a forward-looking indicator based on contract signings, increased 4.5 percent to 105.9 in January from a downwardly revised 101.3 in December and is 9.5 percent above January 2012 when it was 96.7. The data reflect contracts but not closings.Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in February and March.

The January index is the highest reading since April 2010 when it hit 110.9, just before the deadline for the home buyer tax credit. Aside from spikes induced by the tax credits, the last time there was a higher reading was in February 2007 when it reached 107.9.

The PHSI in the Northeast rose 8.2 percent to 84.8 in January and is 10.5 percent higher than January 2012. In the Midwest the index increased 4.5 percent to 105.0 in January and is 17.7 percent above a year ago. Pending home sales in the South rose 5.9 percent to an index of 119.3 in January and are 11.3 percent higher January 2012. In the West the index edged up 0.1 percent in January to 102.1 but is 1.5 percent below a year ago.

emphasis added

Also the NAR economist lowered his forecast for sales in 2013 to 5.0 million. With limited inventory at the low end, and fewer foreclosures, we might see flat or even declining existing home sales this year. The key for sales is that the number of conventional sales is increasing while foreclosure and short sales decline.

MBA: Mortgage Applications Decrease

by Calculated Risk on 2/27/2013 09:09:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 3 percent from the previous week. The seasonally adjusted Purchase Index decreased 5 percent from one week earlier and is at its lowest level since the week ending December 28, 2012.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.77 percent from 3.78 percent, with points increasing to 0.48 from 0.40 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

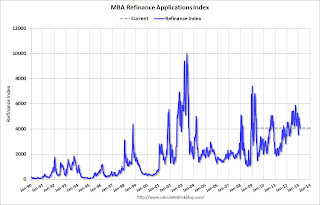

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance activity is down over the last five weeks. Activity is still very high, but is declining from the levels of 2012.

There has been a sustained refinance boom for over a year, and 77 percent of all mortgage applications are for refinancing.

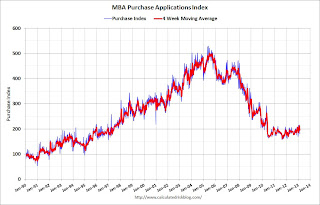

The second graph shows the MBA mortgage purchase index. The purchase index was at the low for the year last week, but the 4-week average of the index has generally been trending up over the last six months.

The second graph shows the MBA mortgage purchase index. The purchase index was at the low for the year last week, but the 4-week average of the index has generally been trending up over the last six months.This index will probably continue to increase as conventional home purchase activity increases.

Tuesday, February 26, 2013

Wednesday: Durable Goods, Pending Home Sales, Bernanke

by Calculated Risk on 2/26/2013 09:40:00 PM

This is interesting, from the WSJ: Miami Condo Loan Marks Milestone

[A] group of lenders led by Birmingham, Ala.-based Regents Financial Corp. has agreed to lend $160 million to the developers of the Mansions at Acqualina, an ultraluxury, 47-story tower under construction in Sunny Isles Beach, near Miami.This is a pretty low risk loan - with the large number of presales and 50% downpayments - but it means lenders are a little more willing to make loans.

...

The loan is the first debt deal of more than $100 million for a new condo development since the housing boom ... The lender required the builder to have completed $320 million in presales, and stipulated 50% downpayments from buyers as a condition of the loan

Wednesday economic releases:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• Also at 8:30 AM, Durable Goods Orders for January from the Census Bureau. The consensus is for a 4.0% decrease in durable goods orders.

• At 10:00 AM, Pending Home Sales Index for January. The consensus is for a 3.0% increase in the index.

• Also at 10:00 AM, Repeat to House: Fed Chairman Ben Bernanke will deliver the "Semiannual Monetary Policy Report to the Congress", Before the Committee on Financial Services, U.S. House of Representatives

Misc: Sales Ratio Existing to New Home Sales, FHFA House Prices, Richmond Fed Mfg Survey

by Calculated Risk on 2/26/2013 06:01:00 PM

A couple of earlier released ... another index shows house prices increased in 2012, and the Richmond Fed survey suggested regional manufacturing expanded in February.

• From the FHFA: U.S. House Prices Rose 1.4 Percent in Fourth Quarter 2012

U.S. house prices rose 1.4 percent from the third quarter to the fourth quarter of 2012 according to the Federal Housing Finance Agency’s (FHFA) seasonally adjusted purchase-only house price index (HPI). The HPI is calculated using home sales price information from Fannie Mae and Freddie Mac mortgages. Seasonally adjusted house prices rose 5.5 percent from the fourth quarter of 2011 to the fourth quarter of 2012. FHFA’s seasonally adjusted monthly index for December was up 0.6 percent from November.• From the Richmond Fed: Manufacturing Activity Rebounded In February; Expectations Rose

“The fourth quarter was another strong one for house prices, as it was the third consecutive quarter where U.S. price growth exceeded one percent,” said FHFA Principal Economist Andrew Leventis. “While a significant number of homes remained in the foreclosure pipeline, the actual number of homes available for sale was very low and fell over the course of the quarter.”

FHFA’s expanded-data house price index, a metric introduced in August 2011 that adds transaction information from county recorder offices and the Federal Housing Administration to the HPI data sample, rose 1.6 percent over the latest quarter. Over the latest four quarters, that index is also up 5.5 percent.

emphasis added

In February, the seasonally adjusted composite index of manufacturing activity — our broadest measure of manufacturing — gained eighteen points, settling at 6 from January's reading of −12. Among the index's components, shipments rose twenty-one points to 10, the gauge for new orders moved up seventeen points to end at 0, and the jobs index increased thirteen points to 8.• Earlier I posted a graph that shows the "distressing gap" between new and existing home sales. I've argued that this gap has been mostly caused by distressed sales (foreclosures and short sales) and that eventually the gap would close.

Other indicators also suggested strengthening in February. The index for capacity utilization moved higher, adding twenty-nine points to 11, and the index for backlogs of orders gained seven points to end at −12. The delivery times index stabilized, picking up four points to end at 4, while both our gauges for inventories were lower in February. The raw materials inventory index lost seven points to finish at 16, and the finished goods inventories moved down eleven points to end at 12.

Hiring activity at District plants was mixed in February. The manufacturing employment index moved up thirteen points to settle at 8, while the average workweek indicator remained weak, tacking on just two points to end at −2. However, the wage index held steady at 11.

Another way to look at this is a ratio of existing to new home sales.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

Click on graph for larger image.

Click on graph for larger image.In general the ratio has been trending down, and I expect this ratio to trend down over the next several years as the number of distressed sales declines and new home sales increase.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Earlier on New Home Sales:

• New Home Sales at 437,000 SAAR in January

• A few Comments on New Home Sales

• New Home Sales graphs

Earlier on House Prices:

• Case-Shiller: Comp 20 House Prices increased 6.8% year-over-year in December

• Real House Prices and Price-to-Rent Ratio

• All Current House Price Graphs

Real House Prices and Price-to-Rent Ratio

by Calculated Risk on 2/26/2013 02:41:00 PM

For December, Case-Shiller reported the seventh consecutive year-over-year (YoY) gain in their house price indexes since 2010 - and the increase back in 2010 was related to the housing tax credit. Excluding the tax credit, the previous YoY increase was back in 2006. The YoY increase in December suggests that house prices probably bottomed earlier in 2012 (the YoY change lags the turning point for prices).

The following table shows the year-over-year increase for each month in 2012.

| Case-Shiller Composite 20 Index | |

|---|---|

| Month | YoY Change |

| Jan-12 | -3.9% |

| Feb-12 | -3.5% |

| Mar-12 | -2.6% |

| Apr-12 | -1.7% |

| May-12 | -0.5% |

| Jun-12 | 0.6% |

| Jul-12 | 1.1% |

| Aug-12 | 1.9% |

| Sep-12 | 2.9% |

| Oct-12 | 4.2% |

| Nov-12 | 5.5% |

| Dec-12 | 6.8% |

I expect the year-over-year change will slow going forward, but the lack of inventory might push prices up more than I expect in 2013. That is why I'm watching inventory closely.

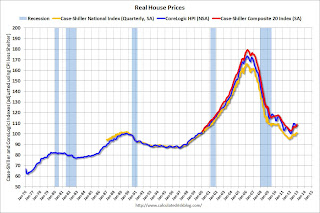

Here are some updates to a few graphs ... Case-Shiller, CoreLogic and others report nominal house prices, and it is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio.

As an example, if a house price was $200,000 in January 2000, the price would be close to $275,000 today adjusted for inflation.

Nominal House Prices

The first graph shows the quarterly Case-Shiller National Index SA (through Q4 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through December) in nominal terms as reported.

The first graph shows the quarterly Case-Shiller National Index SA (through Q4 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through December) in nominal terms as reported.In nominal terms, the Case-Shiller National index (SA) is back to Q2 2003 levels (and also back up to Q3 2010), and the Case-Shiller Composite 20 Index (SA) is back to October 2003 levels, and the CoreLogic index (NSA) is back to January 2004.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to October 1999 levels, the Composite 20 index is back to October 2000, and the CoreLogic index back to February 2001.

In real terms, most of the appreciation in the last decade is gone.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q4 1999 levels, the Composite 20 index is back to October 2000 levels, and the CoreLogic index is back to February 2001.

In real terms - and as a price-to-rent ratio - prices are mostly back to early 2000 levels.

A few Comments on New Home Sales

by Calculated Risk on 2/26/2013 12:36:00 PM

1) January is seasonally the weakest month of the year for new home sales, so January has the largest positive seasonal adjustment. Also this was just one month with a sales rate over 400 thousand - and we shouldn't read too much into one month of data. But this was the highest level since July 2008 and it is clear the housing recovery is ongoing.

2) Although there was a large increase in the sales rate, sales are still near the lows for previous recessions. This suggest significant upside over the next few years (based on estimates of household formation and demographics, I expect sales to increase to 750 to 800 thousand over the next several years).

3) Housing is historically the best leading indicator for the economy, and this is one of the reasons I think The future's so bright, I gotta wear shades. Note: The key downside risk is too much austerity too quickly, but that is a different post.

Note: For 2013, estimates are sales will increase to around 450 to 460 thousand, or an increase of around 22% to 25% on an annual basis for the 367 thousand in 2012.

And here is another update to the "distressing gap" graph that I first started posting over four years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to start to close over the next few years.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through January. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Click on graph for larger image.

Click on graph for larger image.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales kept existing home sales elevated, and depressed new home sales since builders weren't able to compete with the low prices of all the foreclosed properties.

I don't expect much of an increase in existing home sales (distressed sales will slowly decline and be offset by more conventional sales). But I do expect this gap to close - mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Earlier:

• New Home Sales at 437,000 SAAR in January

• New Home Sales graphs

New Home Sales at 437,000 SAAR in January

by Calculated Risk on 2/26/2013 10:00:00 AM

NOTE: Federal Reserve Chairman Ben Bernanke testimony Testimony by Chairman Bernanke on the Semiannual Monetary Policy Report to the Congress

Here is the C-Span Link

On New Home Sales:

The Census Bureau reports New Home Sales in January were at a seasonally adjusted annual rate (SAAR) of 437 thousand. This was up from a revised 378 thousand SAAR in December (revised up from 369 thousand).

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

"Sales of new single-family houses in January 2013 were at a seasonally adjusted annual rate of 437,000 ... This is 15.6 percent above the revised December rate of 378,000 and is 28.9 percent above the January 2012 estimate of 339,000."

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The second graph shows New Home Months of Supply.

The months of supply decreased in January to 4.1 months from 4.8 months in December.

The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

This is now in the normal range (less than 6 months supply is normal)."The seasonally adjusted estimate of new houses for sale at the end of January was 150,000. This represents a supply of 4.1 months at the current sales rate."On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale was just above the record low. The combined total of completed and under construction is also just above the record low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In January 2013 (red column), 31 thousand new homes were sold (NSA). Last year only 23 thousand homes were sold in January. This was the ninth weakest January since this data has been tracked. The high for January was 92 thousand in 2005.

This was above expectations of 381,000 sales in January. This is the strongest sales rate since 2008. This was another solid report. I'll have more soon ...