by Calculated Risk on 2/26/2013 09:00:00 AM

Tuesday, February 26, 2013

Case-Shiller: Comp 20 House Prices increased 6.8% year-over-year in December

S&P/Case-Shiller released the monthly Home Price Indices for December and Q4 ("December" is a 3 month average of October, November and December).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities), and the quarterly National Index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Prices Closed Out a Strong 2012 According to the S&P/Case-Shiller Home Price Indices

Data through December 2012, released today by S&P Dow Jones Indices for its S&P/Case-Shiller1 Home Price Indices, the leading measure of U.S. home prices, showed that all three headline composites ended the year with strong gains. The national composite posted an increase of 7.3% for 2012. The 10- and 20-City Composites reported annual returns of 5.9% and 6.8% in 2012. Month-over-month, both the 10- and 20-City Composites moved into positive territory with gains of 0.2%; more than reversing last month’s losses.

In addition to the three composites, nineteen of the 20 MSAs posted positive year-over-year growth – only New York fell.

“Home prices ended 2012 with solid gains,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “Housing and residential construction led the economy in the 2012 fourth quarter. In December’s report all three headline composites and 19 of the 20 cities gained over their levels of a year ago. Month-over-month, 9 cities and both Composites posted positive monthly gains. Seasonally adjusted, there were no monthly declines across all 20 cities.

...

“Atlanta and Detroit posted their biggest year-over-year increases of 9.9% and 13.6% since the start of their indices in January 1991. Dallas, Denver, and Minneapolis recorded their largest annual increases since 2001. Phoenix continued its climb, posting an impressive year-over-year return of 23.0%; it posted eight consecutive months of double-digit annual growth.”

Click on graph for larger image.

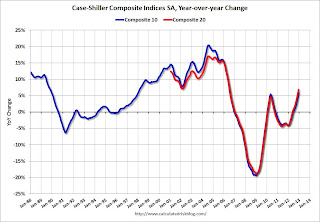

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 30.0% from the peak, and up 0.9% in December (SA). The Composite 10 is up 6.2% from the post bubble low set in March (SA).

The Composite 20 index is off 29.2% from the peak, and up 0.9% (SA) in December. The Composite 20 is up 7.0% from the post-bubble low set in March (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 5.9% compared to December 2011.

The Composite 20 SA is up 6.8% compared to December 2011. This was the seventh consecutive month with a year-over-year gain since 2010 (when the tax credit boosted prices temporarily). This was the largest year-over-year gain for the Composite 20 index since 2006.

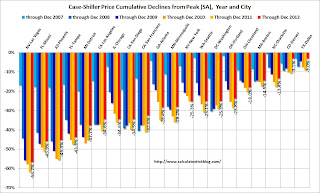

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 20 of the 20 Case-Shiller cities in December seasonally adjusted (also 19 of 20 cities increased NSA). Prices in Las Vegas are off 56.7% from the peak, and prices in Dallas only off 3.0% from the peak. Note that the red column (cumulative decline through December 2012) is above previous declines for all cities.

Prices increased (SA) in 20 of the 20 Case-Shiller cities in December seasonally adjusted (also 19 of 20 cities increased NSA). Prices in Las Vegas are off 56.7% from the peak, and prices in Dallas only off 3.0% from the peak. Note that the red column (cumulative decline through December 2012) is above previous declines for all cities.This was at the consensus forecast for a 6.8% YoY increase. I'll have more on prices later.

Monday, February 25, 2013

Tuesday: New Home Sales, Case-Shiller House Prices, Bernanke

by Calculated Risk on 2/25/2013 08:57:00 PM

Tomorrow will be busy ... but first from Tim Duy: ECB Should Pledge to Not Do Anything Stupid

Market participants were rattled today by the election news out of Italy, as it looks like the economically-challenged nation is now politically adrift. ...Tuesday economic releases:

...

Why should we be concerned that Italy backslides on its commitment to austerity? After all, evidence of the economic damage wrought by such policies continues to mount. If anything, a reversal of recent austerity should be welcome.

I suspect, however, that it is not the austerity that worries market participants. It is the fear that European Central Bank head Mario Draghi will threaten to pull his pledge to do whatever is takes to save the Euro in the face of Italian intransigence. The fear that European policymakers are about to partake in another grand game of chicken that once again will bring the sustainability of the single currency back into question. In short, I think that market participants fear tight monetary policy much more than loose fiscal policy. ...

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for December will be released. Although this is the December report, it is really a 3 month average of October, November and December. The consensus is for a 6.8% year-over-year increase in the Composite 20 index (NSA) for December. The Zillow forecast is for the Composite 20 to increase 6.7% year-over-year, and for prices to increase 0.7% month-to-month seasonally adjusted.

• Also at 9:00 AM, FHFA House Price Index for December 2012 will be released. This was original a GSE only repeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 0.7% increase in house prices.

• At 10:00 AM, New Home Sales for January will be released by the Census Bureau. The consensus is for an increase in sales to 381 thousand Seasonally Adjusted Annual Rate (SAAR) in January from 369 thousand in December.

• Also at 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for February. The consensus is for a a reading of minus 3 for this survey, up from minus 12 in January (Below zero is contraction).

• Also at 10:00 AM, the Conference Board's consumer confidence index for February. The consensus is for the index to increase to 61.0.

• Also at 10:00 AM, Fed Chairman Ben Bernanke will deliver the "Semiannual Monetary Policy Report to the Congress", Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

Existing Home Inventory up 3.6% year-to-date in late February

by Calculated Risk on 2/25/2013 05:57:00 PM

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'll be tracking inventory weekly for the next few months.

If inventory does bottom, we probably will not know for sure until late in the year. In normal times, there is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The NAR data is monthly and released with a lag. However Ben at Housing Tracker (Department of Numbers) kindly sent me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year.

In 2010 (blue), inventory followed the normal seasonal pattern, however in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

So far - through late February - it appears inventory is increasing at a sluggish rate.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

The key will be to see how much inventory increases over the next few months. In 2010, inventory was up 8% by early March, and up 15% by the end of March.

For 2011 and 2012, inventory only increased about 5% at the peak.

So far in 2013, inventory is up 3.6%. If inventory doesn't increase more soon, then the bottom for inventory might not be until 2014.

Market Update

by Calculated Risk on 2/25/2013 04:51:00 PM

Click on graph for larger image.

By request - following the sell off today - here are a couple of stock market graphs I haven't posted in several months. The first graph shows the S&P 500 since 1990 (this excludes dividends).

The dashed line is the closing price today. The S&P 500 was first at this level in March 2000; almost 13 years ago.

The second graph (click on graph for larger image) is from Doug Short and shows the S&P 500 since the 2007 high ...

LPS: House Price Index increased 0.1% in December, Up 5.8% year-over-year

by Calculated Risk on 2/25/2013 01:02:00 PM

Notes: I follow several house price indexes (Case-Shiller, CoreLogic, LPS, Zillow, FNC and more). The timing of different house prices indexes can be a little confusing. LPS uses December closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From LPS: U.S. Home Prices Up 0.1 Percent for the Month; Up 5.8 Percent Year-Over-Year

Lender Processing Services ... today released its latest LPS Home Price Index (HPI) report, based on December 2012 residential real estate transactions. The The LPS HPI combines the company’s extensive property and loan-level databases to produce a repeat sales analysis of home prices as of their transaction dates every month for each of more than 15,500 U.S. ZIP codes. The LPS HPI represents the price of non-distressed sales by taking into account price discounts for REO and short sales.The LPS HPI is off 21.9% from the peak in June 2006. Note: The press release has data for the 20 largest states, and 40 MSAs. LPS shows prices off 52.3% from the peak in Las Vegas, 44.2% off from the peak in Riverside-San Bernardino, CA (Inland Empire), and at a new peak in Austin!

Looking at the year-over-year price change throughout 2012 - in May, the LPS HPI turned positive and was up 0.4% year-over-year, in June the index was up 0.9% year-over-year, 1.8% in July, 2.6% in August, 3.6% in September, 4.3% in October, 5.1% in November, and now 5.8% in December. These steady increases on a year-over-year basis suggest prices bottomed early in 2012.

Note: Case-Shiller for December will be released Tuesday morning.

Dallas Fed: Regional Manufacturing Activity increases in February but at a Slower Pace

by Calculated Risk on 2/25/2013 10:39:00 AM

From the Dallas Fed: Texas Manufacturing Activity Increases but at a Slower Pace

Texas factory activity expanded in February, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, fell from 12.9 to 6.2, suggesting growth continued but at a slower pace.This was slightly below expectations of a reading of 4.0 for the general business activity index and suggest sluggish growth.

... The new orders index was positive for the second month in a row, although it fell from 12.2 to 2.8.

... The general business activity index was positive for the third month in a row, although it dipped from 5.5 to 2.2.

Labor market indicators were mixed in February. Hiring slowed with the employment index moving down to 2.0, and about 17 percent of employers reporting hiring and 15 percent noting layoffs. The average workweek index dipped into negative territory with a reading of –3.0, suggesting hours worked declined.

Expectations regarding future business conditions continued to reflect optimism. The index of future general business activity edged up from 9.2 to 10.8. The index of future company outlook remained unchanged at 20.1.

Chicago Fed: "Economic Growth Moderated in January"

by Calculated Risk on 2/25/2013 08:37:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Economic Growth Moderated in January

Led by declines in production-related indicators, the Chicago Fed National Activity Index (CFNAI) decreased to –0.32 in January from +0.25 in December. Three of the four broad categories of indicators that make up the index decreased from December, and only two of the four categories made positive contributions to the index in January.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, increased to +0.30 in January from +0.23 in December. Given the substantial upward revisions for November and December, January’s CFNAI-MA3 marked the third consecutive reading above zero. Additionally, January’s reading suggests that growth in national economic activity was somewhat above its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests limited inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity "moderated" in January, and growth was somewhat above its historical trend (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, February 24, 2013

Sunday Night Futures

by Calculated Risk on 2/24/2013 09:58:00 PM

I'm frequently asked about the "Sequester". Next week the "Sequester" budget cuts will begin if government does not take any action, and over the next 7 months the sequester will require $85 billion in cuts, about half from defense programs. This is one of those really dumb policies that is hard to stop. The cuts will not be catastrophic, but as we've discussed, the deficit will decline sharply this year already, and we really don't need additional deficit reduction in the near term. Here are a couple of articles on the cuts:

From the WaPo: The big sequester gamble: How badly will the cuts hurt? and White House releases state-by-state breakdown of sequester’s effects

Monday:

• At 8:30 AM ET, the Chicago Fed National Activity Index for January will be released. This is a composite index of other data.

• At 10:30 AM, the Dallas Fed Manufacturing Survey for February will be released. The consensus is a decrease to 4.0 from 5.5 in January (above zero is expansion).

Weekend:

• Summary for Week Ending Feb 22nd

• Schedule for Week of Feb 24th

The Asian markets are mostly up tonight with the Nikkei up 1.9%, and Shanghai Composite up 0.3%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 2 and DOW futures are down 20 (fair value).

Oil prices have moved down a little recently with WTI futures at $93.00 per barrel and Brent at $113.82 per barrel.

Gasoline Prices up over 50 Cents per Gallon since December

by Calculated Risk on 2/24/2013 07:36:00 PM

From CNN: Gas prices jump, but not as high, survey finds

Over the past two weeks, prices at the pump have jumped 20 cents, adding to a total rise of nearly 54 cents over the past nine weeks, according to the Lundberg Survey.In Los Angeles prices are around $4.30 per gallon.

... And now, prices may even start to drop, says publisher Trilby Lundberg.

"I don't mean that gasoline prices cannot go up further from here," she said Sunday. "But the chief causes of the rise are out of the picture."

Crude oil prices are now going down, and wholesale prices -- which marketers and retailers pay -- are "starting to tumble," she said.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are up over 50 cents per gallon from the low last December, and up 20 cents over the last two weeks. But it does appear the price increases have slowed.

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Forecast: Solid Auto Sales in February

by Calculated Risk on 2/24/2013 02:18:00 PM

Note: The automakers will report February vehicle sales this coming Friday, March 1st. The consensus is for sales of around 15.2 million SAAR.

From Edmunds.com: Despite Rising Gas Prices, February Auto Sales Strong at Estimated 15.5 Million SAAR, says Edmunds.com

Edmunds.com ... forecasts that 1,198,538 new cars and trucks will be sold in the U.S. in February for an estimated Seasonally Adjusted Annual Rate (SAAR) this month of 15.5 million light vehicles. The projected sales [NSA] will be a 14.9 percent increase from January 2013, and a 4.3 percent increase from February 2012.The following table shows annual light vehicle sales, and the change from the previous year. Light vehicle sales have seen double digit growth for three consecutive years. The 2013 forecast was from Edmunds.com, but it appears sales were above expectations in January and February - and the annual forecast will probably be increased.

“Car sales are persevering despite economic factors on people’s minds like rising gas prices and the implementation of the payroll tax,” says Edmunds.com Senior Analyst Jessica Caldwell. “Pent-up demand and widespread access to credit are keeping up car sales momentum.”

| Light Vehicle Sales | ||

|---|---|---|

| Sales (millions) | Annual Change | |

| 2005 | 16.9 | 0.5% |

| 2006 | 16.5 | -2.6% |

| 2007 | 16.1 | -2.5% |

| 2008 | 13.2 | -18.0% |

| 2009 | 10.4 | -21.2% |

| 2010 | 11.6 | 11.1% |

| 2011 | 12.7 | 10.2% |

| 2012 | 14.4 | 13.4% |

| 20131 | 15.0 | 3.7% |

| 1Forecast | ||