by Calculated Risk on 2/20/2013 08:43:00 AM

Wednesday, February 20, 2013

Housing Starts decrease to 890 thousand SAAR in January, Single Family Starts Increase

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in January were at a seasonally adjusted annual rate of 890,000. This is 8.5 percent below the revised December estimate of 973,000, but is 23.6 percent above the January 2012 rate of 720,000.

Single-family housing starts in January were at a rate of 613,000; this is 0.8 percent above the revised December figure of 608,000. The January rate for units in buildings with five units or more was 260,000.

Building Permits:

Privately-owned housing units authorized by building permits in January were at a seasonally adjusted annual rate of 925,000. This is 1.8 percent above the revised December rate of 909,000 and is 35.2 percent above the January 2012 estimate of 684,000.

Single-family authorizations in January were at a rate of 584,000; this is 1.9 percent above the revised December figure of 573,000. Authorizations of units in buildings with five units or more were at a rate of 311,000 in January.

Click on graph for larger image.

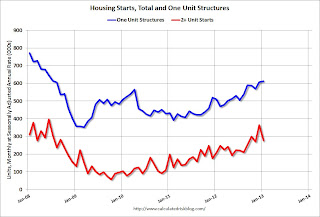

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased sharply in January.

Single-family starts (blue) increased to 613,000 thousand in January and are at the highest level since 2008.

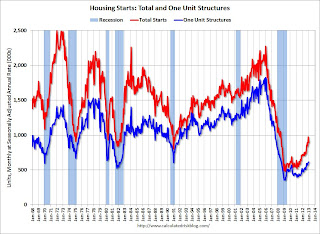

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that housing starts have been increasing lately after moving sideways for about two years and a half years.

This shows the huge collapse following the housing bubble, and that housing starts have been increasing lately after moving sideways for about two years and a half years. Total starts are up about 86% from the bottom start rate, and single family starts are up about 74 percent from the post-bubble low.

This was below expectations of 914 thousand starts in January due to the sharp decrease in the volatile multi-family sector. Starts in January were up 23.6% from January 2012. I'll have more later, but this was a solid report.

MBA: Mortgage Applications Decrease, Mortgage Rates increase

by Calculated Risk on 2/20/2013 07:07:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 2 percent from the previous week. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier.

...

The refinance share of mortgage activity decreased to 77 percent of total applications, the lowest level since May 2012, from 78 percent the previous week. The adjustable-rate mortgage (ARM) share of activity increased to 4 percent of total applications.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 3.78 percent, the highest rate since August 2012, from 3.75 percent, with points decreasing to 0.40 from 0.43 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance activity is down over the last four weeks, but activity is still very high - and has remained high for over a year.

There has been a sustained refinance boom, and 77 percent of all mortgage applications are for refinancing.

The second graph shows the MBA mortgage purchase index. The purchase index was off last week - and is still very low, but the index has generally been trending up over the last six months.

The second graph shows the MBA mortgage purchase index. The purchase index was off last week - and is still very low, but the index has generally been trending up over the last six months.This index will probably continue to increase as conventional home purchase activity increases.

Tuesday, February 19, 2013

Wednesday: Housing Starts, FOMC Minutes, PPI and more

by Calculated Risk on 2/19/2013 09:28:00 PM

Oh my. From Bondad Blog, via Invictus (Big Picture), here is a funny parody Hitler "Downfall" parody: ECRI learns that their recession call has blown up (foul language).

Wednesday economic releases:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM: Housing Starts for January will be released. The consensus is for total housing starts to decrease to 914 thousand (SAAR) in January, down from 954 thousand in December. Note: On a seasonally adjusted annual rate (SAAR) basis, starts in December were the highest since June 2008.

• At 8:30 AM: the Producer Price Index for January will be released. The consensus is for a 0.3% increase in producer prices (0.2% increase in core).

• During the day: The AIA's Architecture Billings Index for January (a leading indicator for commercial real estate).

• At 2:00 PM: FOMC Minutes for January 29-30, 2013.

Housing: No "Troubling Divergence" between Completions and Sales

by Calculated Risk on 2/19/2013 07:49:00 PM

Business Insider had an article on housing today: A Troubling Divergence In The US Housing Market

One of the few concerns about U.S. housing recovery is that building has been outpacing the sales of new homes. As such, there are fears that new home construction is only adding to the inventory of new homes ...The article included the following chart from TD Securities:

This chart from TD Securities shows just why some experts are worried.

Click on graph for larger image.

Click on graph for larger image.This chart compares cumulative housing completions and new home sales over the last 12 months. This is apparently the "troubling divergence".

However this is total completions (including apartments) and total completions is always higher than new home sales!

The second graph is a repeat of the above graph with the addition of single family completions over the last 12 months.

Just removing multi-family units reduces the "troubling divergence".

Just removing multi-family units reduces the "troubling divergence".But some single family homes are built by owner (with or without a contractor) and are not built for sale. Plus a few single family homes are built to rent. So this comparison is also incorrect.

Here is a repeat of a post from last November: We can't directly compare single family housing starts to new home sales. For an explanation, see from the Census Bureau: Comparing New Home Sales and New Residential Construction

We are often asked why the numbers of new single-family housing units started and completed each month are larger than the number of new homes sold. This is because all new single-family houses are measured as part of the New Residential Construction series (starts and completions), but only those that are built for sale are included in the New Residential Sales series.However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis.

The quarterly report released in November showed there were 104,000 single family starts, built for sale, in Q3 2012, and that was above the 96,000 new homes sold for the same quarter, so inventory increased a little (Using Not Seasonally Adjusted data for both starts and sales). Note: The Q4 report will be released tomorrow.

This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Click on graph for larger image.

Click on graph for larger image.Single family starts built for sale were up about 33% compared to Q3 2011. This is still very low, and only back to 2008 levels.

Owner built starts were unchanged from Q3 2011. And condos built for sale are just above the record low.

The 'units built for rent' has increased significantly and is up about 33% year-over-year.

The next graph shows quarterly single family starts, built for sale and new home sales (NSA).

In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. The difference on this graph is pretty small, but the builders were starting about 30,000 more homes per quarter than they were selling (speculative building), and the inventory of new homes soared to record levels. Inventory of under construction and completed new home sales peaked at 477,000 in Q3 2006.

In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. The difference on this graph is pretty small, but the builders were starting about 30,000 more homes per quarter than they were selling (speculative building), and the inventory of new homes soared to record levels. Inventory of under construction and completed new home sales peaked at 477,000 in Q3 2006.In 2008 and 2009, the home builders started far fewer homes than they sold as they worked off the excess inventory that they had built up in 2005 and 2006.

Now it looks like builders are starting a few more homes than they are selling, and the inventory of under construction and completed new home sales increased slightly to 122,000 in Q3 (this is still near record lows).

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions). This is not perfect because of the handling of cancellations, but it does suggest the builders are keeping inventories under control, and also suggests that the year-over-year increase in housing starts is directly related to an increase in demand and not renewed speculative building.

Update: Real Estate Agent Boom and Bust

by Calculated Risk on 2/19/2013 01:40:00 PM

Way back in 2005, I posted a graph of "the Real Estate Agent Boom". I updated the graph last year The Real Estate Agent Bust .

Below is another update to the long term graph of the number of real estate licensees in California.

The number of agents peaked at the end of 2007 (housing activity peaked in 2005, and prices in 2006).

Click on graph for larger image.

Click on graph for larger image.

The number of salesperson's licenses is off 31% from the peak, and is still declining. The number of salesperson's licenses has fallen to June 2004 levels.

However brokers' licenses are only off 8% and have only fallen to late 2006 levels.

Someday the number of licenses will start to increase again (probably a sign that people think they can money as an agent again), but for now the number is still declining.

Builder Confidence declines slightly in February to 46

by Calculated Risk on 2/19/2013 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) decreased 1 point in February to 46. Any number under 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Virtually Unchanged in February

Builder confidence in the market for newly built, single-family homes was virtually unchanged in February with a one-point decline to 46 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today.

...

“Having risen strongly in 2012, the HMI hit a slight pause in the beginning of this year as builders adjusted their expectations to reflect the pace at which consumers are moving forward on new-home purchases,” observed NAHB Chief Economist David Crowe. “The index remains near its highest level since May of 2006, and we expect home building to continue on a modest rising trajectory this year.”

...

Holding above the critical mid-point of 50 for a third consecutive month, the HMI component gauging current sales conditions fell by a single point to 51 in February. Meanwhile, the component gauging sales expectations in the next six months rose by one point, to 50, and the component gauging traffic of prospective buyers slipped four points, to 32.

Three-month moving averages for each region’s HMI score were mixed in February, with the Northeast up three points to 39 and the West up four points to 55 and the Midwest and South each down two points, to 48 and 47, respectively.

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the February release for the HMI and the December data for starts (January housing starts will be released tomorrow). This was below the consensus estimate of a reading of 48.

Residential Remodeling Index declines 6% in December

by Calculated Risk on 2/19/2013 09:12:00 AM

From BuildFax:

Residential remodels authorized by building permits in the United States in December were at a seasonally-adjusted annual rate of 2,725,000. This is 6 percent below the revised November rate of 2,895,000 and is 6 percent below the December 2011 estimate of 2,901,000.

Seasonally-adjusted annual rates of remodeling across the country in December 2012 are estimated as follows: Northeast, 636,000 (up 39% from November and up 37% from December 2011); South, 1,088,000 (down 13% from November and down 1% from December 2011); Midwest, 596,000 (down 8% from November and down 17% from December 2011); West, 777,000 (down 16% from November and down 8% from December 2011).

"Repairs from super-storm Sandy attributed to the influx of Northeastern residential remodeling in December," said Joe Emison, Chief Technology Officer at BuildFax. "The last time the Northeast broke 600,000 estimated residential remodels was five years ago. Unfortunately, the rest of the country saw both month-over-month and year-over-year declines in residential remodeling activity."

The BuildFax Remodeling Index (BFRI) is based on construction permits for residential remodeling projects filed with local building departments across the country. The index estimates the number of properties permitted.

Click on graph for larger image.

Click on graph for larger image.This graph shows the Remodeling Index since January 2008 on a seasonally adjusted basis.

This index has generally been trending up, but was down in December even with all the repairs in the Northeast. Note: Permits are not adjusted by value, so this doesn't indicate the value of remodeling activity. Also some smaller remodeling projects are done without permits and the index will miss that activity.

Monday, February 18, 2013

Tuesday: Homebuilder Confidence Survey

by Calculated Risk on 2/18/2013 09:15:00 PM

A couple of interesting stories ...

First, the prices for West Texas Intermediate (WTI) and Brent crude oil have diverged in recent years due to pipeline capacity issues. Jim Hamilton discusses the plans to build more pipelines: Planned crude oil pipelines. A pretty impressive amount of capaticy will be built over the next couple of years (See Hamilton's post).

And on California from the WaPo: Will higher taxes on the rich derail California’s economic comeback?

The tax increases approved in November are a big reason the state isn’t staring down another huge budget shortfall or the prospect of issuing IOUs to fill it. They include bumping the sales tax up slightly and raising the top income tax rate to 13.3 percent, which is four percentage points higher than the District of Columbia’s and more than double the rate in Virginia or Maryland.Tuesday economic releases:

Yet many economists and some young executives in the state say they don’t worry about that high rate chilling growth. Other factors loom much larger for California’s business and economic health, they say, including whether the state can maintain deep pools of highly skilled talent and, in complicated but important ways, the renewed upward march of home prices in the Bay Area and beyond.

“I don’t think we should be surprised that the state is growing, nor that California is growing faster than the national economy,” said Christopher Thornberg, an economist and the founding partner of Beacon Economics.

...

“The evidence is, from past tax increases, that it makes very little difference,” said Jerry Nickelsburg, a senior economist at the UCLA Anderson Forecast, who predicts only a slight scrape to state growth from the new rate increases. Since 1967, he added, tax hikes and cuts in the state have had a “second-order effect” on growth.

The bigger threat, other economists say, might be another run-up of housing prices, especially where the innovators live.

Housing prices are a much bigger factor in most people’s budgets than state tax rates, said Jed Kolko, chief economist for the online real estate site Trulia. If home prices rise quickly, he said, they constrain growth more than taxes do: “The skilled workforce that California presents as an advantage,” Kolko said, “is also threatened by higher housing prices.”

• At 10:00 AM ET, the February NAHB homebuilder survey. The consensus is for a reading of 48, up from 47 in January. Although this index has been increasing sharply, any number below 50 still indicates that more builders view sales conditions as poor than good.

Lawler: Early Look At January Existing Home Sales

by Calculated Risk on 2/18/2013 06:17:00 PM

From economist Tom Lawler:

While several MLS that I follow have been unusually late in releasing their monthly reports, based on the reports that I have seen I estimate that US existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of about 5.10 million in January, up about 3.2% from December’s seasonally-adjusted pace, and up 10.2% from last January’s seasonally-adjusted pace. January, of course, is seasonally by far the weakest month of the year for closed home sales, with the January “seasonal” factor (for total existing home sales) typically averaging about 67.5% (depending on the year’s calendar). The seasonal factor for a “neutral” month is, of course, 100%.

On the inventory front, my “best guess” is that the NAR’s existing home inventory estimate for January will be unchanged from December’s estimate.

CR Note: The NAR will report January existing home sales on Thursday, February 21st. The consensus is the NAR will report sales of 4.90 million on a seasonally adjusted annual rate (SAAR) basis.

Based on Lawler's estimates, the NAR will report inventory at around 1.82 million units for January (same as December), and months-of-supply around 4.3 months (down from 4.4 months in December). This would be the lowest months-of-supply since May 2005.

Existing Home Inventory up 2.3% year-to-date in mid-February

by Calculated Risk on 2/18/2013 04:21:00 PM

One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'll be tracking inventory weekly for the next few months.

If inventory does bottom, we probably will not know for sure until late in the year. In normal times, there is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The NAR data is monthly and released with a lag. However Ben at Housing Tracker (Department of Numbers) kindly sent me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year.

In 2010 (blue), inventory followed the normal seasonal pattern, however in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

So far - through mid-February - it appears inventory is increasing at a sluggish rate.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

The key will be to see how much inventory increases over the next few months. In 2010, inventory was up 8% by early March, and up 15% by the end of March.

For 2011 and 2012, inventory only increased about 5% at the peak.

So far in 2013, inventory is up 2.2%. If inventory doesn't increase soon, then the bottom for inventory might not be until 2014.