by Calculated Risk on 2/10/2013 06:29:00 PM

Sunday, February 10, 2013

Timiraos: "FHA Gets Scrutiny"

This is excellent article on the FHA from Nick Timiraos at the WSJ: FHA Gets Scrutiny as It Looks for a Hand

The Federal Housing Administration, a significant backer of new mortgage lending over the past five years, is facing billions of dollars in potential losses, as many loans that it guaranteed during the recession have soured. The agency's independent audit last fall showed that at its current pace, the FHA would exhaust its reserves and need $16 billion from the U.S. government to cover projected losses.The last two sentences refer to the owner financed "DAPs" or "downpayment assistance programs". I wrote extensively about DAPs during the bubble - were the owner "donated" the downpayment to the buyer through a third party "charity". The FHA tried to eliminate insuring those loans, the IRS called the programs a "scam", but Congress kept the program in place until 2008. Many of those loans went bad, significantly hurting the FHA's (and eventually taxpayers) finances. Of course the FHA also insured loans while house prices declined, and a large number of those loans defaulted too.

That would be a blow because since its creation in 1934, the agency has never required Treasury assistance. The FHA doesn't issue mortgages. Instead, it insures lenders against losses on loans that meet its standards. ...

... the FHA never relaxed its standards during the boom and didn't insure the toxic mortgages that inflated the housing bubble.

Before the bubble burst, lenders considered the FHA's standards too stringent, and in 2006 the agency's share of the home-purchase market fell below 5%. The FHA requires borrowers to prove they earn enough to make their monthly mortgage payment—thereby ruling out "liar loans." It backs mostly fixed-rate loans—meaning no teaser rates.

...

The most problematic loans are those insured from 2007-09, particularly from a program that allowed home sellers to make "gifts" of down payments to buyers through nonprofit groups. FHA officials belatedly prevailed on Congress to pull the plug on those risky lending programs in 2008.

Some of my posts on DAPs: from 2006: Housing: IRS Raps DAPs, 2007: FHA to Ban DAPs and 2008: Ding-Dong! The DAP Is Dead. And from Tanta in 2007: DAP for UberNerds. Tanta concluded:

Supporting DAPs means supporting property sellers--particularly but not limited to builders and developers--and the "entrepreneurs" who form "nonprofits" to extract fees from naive homebuyers, not to mention loan originators who pocket higher commissions, with the risk being carried by government insurance. It is, precisely, the kind of sleazy, conflict-ridden, self-serving "initiative," overtly "faith-based" or its sort-of secular equivalent "dream-based," that thrives in an environment where regulation is dismantled or unenforced and "government" is bashed with one hand and milked with the other. It is an "innovation" just like plainer, older-fashioned forms of money-laundering are "innovations." It takes a profound ideological blindness to march behind the DAP banner in the name of "helping first time homebuyers."And now we are seeing the consequences of that bad policy. DAPs aren't the only reason the FHA is facing a shortfall, but they played a key role in damaging the FHA's finances.

Gasoline Prices increase to $4 per gallon in California

by Calculated Risk on 2/10/2013 02:43:00 PM

The roller coaster ride for gasoline prices continues ...

From the Daily Democrat: Gas prices hit $4 in California

Gas prices are above or near an average of $4 a gallon statewide, and are already well over that dreaded mark in Southern California. GasBuddy.com showed gas selling for $4.01 on Thursday, while the AAA listed the state average at $3.99 -- a jump of three cents from Wednesday, 22 cents from a week ago and 37 cents from last month.Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are up over 30 cents per gallon from the low in January, and up sharply over the last two weeks.

... the record of $4.67 was reached on Oct. 9 [2012] ...

The skyrocketing prices could level off in a week or so, then ease for a few months before beginning their usual climb before Memorial Day.

"My forecast is for gasoline prices in California to level off, then go back down before Valentine's Day to an average of $3.90 per gallon," analyst Bob van der Valk said. "The good news is refineries are going to get back online in the next six weeks and gasoline prices will level off and perhaps go back down below $4 per gallon."

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

"Sequester" Budget Cuts appear more likely

by Calculated Risk on 2/10/2013 10:29:00 AM

A key policy goal right now is to minimize short term austerity since the deficit as a percent of GDP is already shrinking quickly, and the deficit should continue to shrink over the next few years. So my view has been that something would be worked out on the "sequester" that would minimize immediate spending cuts.

It appears I may be wrong, and the "sequester" cuts might happen on March 1st.

From the LA Times: Automatic budget cuts are almost certain

In less than a month, a budget ax is set to fall on the federal government, indiscriminately chopping funding for the military and slicing money for various programs, including preschools and national parks.This is a significant amount of short term drag, especially combined with the increase in payroll taxes (part of "fiscal agreement").

The $85 billion in cuts that would take effect from March 1 through September — the first installment of $1.2 trillion in reductions over the next decade — would strike just about every agency and service in an attempt to ease the budget deficit.

The slashing, part of an automatic process known as sequestration, would affect the economy, government workers and average Americans in ways big and small.

...

Economists project the budget cuts would reduce the nation's total economic output by about 0.6 percentage points this year, a significant hit when growth remains sluggish.

Brad Plumer at the WaPo describes how the sequester cuts would work:

The sequester, recall, will cut $85.3 billion from the federal budget in 2013 and affect everything except Social Security, Medicaid, a few targeted anti-poverty programs, and the ongoing wars. The Pentagon budget would face an immediate 7.3 percent cut and domestic discretionary programs would be cut by more than 5 percent. The key feature of the cuts is that they would affect all agencies and programs equally ...Here is the White House fact sheet on some of the cuts.

This is obviously bad policy. First, the US doesn't need immediate spending cuts (if anything, with a 7.9% unemployment rate, we need additional short term spending), and second, we don't need indiscriminate cuts. No one supports these specific cuts, but they might happen anyway ...

Saturday, February 09, 2013

Unofficial Problem Bank list declines to 820 Institutions

by Calculated Risk on 2/09/2013 04:55:00 PM

Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The number of unofficial problem banks grew steadily and peaked at 1,002 institutions on June 10, 2011. The list has been declining since then.

Here is the unofficial problem bank list for Feb 8, 2013.

Changes and comments from surferdude808:

Two publicly traded organizations announced this week the termination of enforcement actions issued by the FDIC. The removals leave the Unofficial Problem Bank list at 820 institutions with assets of $305.0 billion. A year ago, the list held 958 institutions with assets of $ 389.6 billion.CR Note: The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public. (CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.)

The removals were The Home Savings and Loan Company, Youngstown, OH ($1.8 billion Ticker: UCFC) and The Palmetto Bank, Greenville, SC ($1.1 billion Ticker: PLMT).

On Thursday, SNL securities published an interesting article “Private capital investments in failed banks rare, but cheaper for FDIC” that found private capital investors acquired 40 failed banks from the FDIC since it issued a policy statement on private capital acquiring failed banks on August 26, 2009. While private capital deals only cost the FDIC a median 25 cents on the dollar compared to 27 cents with existing bank buyers, private investor only acquired 11 percent of the 361 failures since the policy statement issuance. Thus, private capital has not been that successful in acquiring many failed banks from the FDIC.

Next week, we anticipate for the OCC to release its enforcement action activity through mid-January 2013.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

When the list was increasing, the official and "unofficial" counts were about the same. Now with the number of problem banks declining, the unofficial list is lagging the official list. This probably means regulators are changing the CAMELS rating on some banks before terminating the formal enforcement actions.

Earlier:

• Summary for Week Ending Feb 8th

• Schedule for Week of Feb 10th

Schedule for Week of Feb 10th

by Calculated Risk on 2/09/2013 01:11:00 PM

Earlier:

• Summary for Week Ending Feb 8th

The key reports for this week will be the January retail sales report on Wednesday, and January Industrial Production on Friday.

Also for manufacturing, the February NY Fed (Empire state) survey will be released on Friday.

1:00 PM ET: Speech by Fed Vice Chair Janet Yellen, "A Painfully Slow Recovery for America's Workers: Causes, Implications, and the Federal Reserve's Response"

7:30 AM ET: NFIB Small Business Optimism Index for January. The consensus is for an increase to 89.5 from 88.0 in December.

10:00 AM: Job Openings and Labor Turnover Survey for December from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for December from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased slightly in November to 3.676 million, up from 3.665 million in October. The number of job openings (yellow) has generally been trending up, and openings are up about 12% year-over-year compared to November 2011.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: Retail sales for January will be released.

8:30 AM ET: Retail sales for January will be released.This graph shows monthly retail sales and food service, seasonally adjusted (total and ex-gasoline) through December. Retail sales are up 25.4% from the bottom, and now 9.7% above the pre-recession peak (not inflation adjusted)

The consensus is for retail sales to increase 0.1% in January, and to increase 0.2% ex-autos.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for December. The consensus is for a 0.3% increase in inventories.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 360 thousand from 366 thousand last week.

8:30 AM: NY Fed Empire Manufacturing Survey for February. The consensus is for a reading of minus 2.0, up from minus 7.8 in January (below zero is contraction).

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for January.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for January.This shows industrial production since 1967 through December.

The consensus is for a 0.3% increase in Industrial Production in January, and for Capacity Utilization to increase to 78.9%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for February). The consensus is for a reading of 75.0, up from 73.8.

Summary for Week ending February 9th

by Calculated Risk on 2/09/2013 08:01:00 AM

This was a light week for economic data. The key release was the December trade report showing a smaller than expected trade deficit, and suggesting upwards revisions to the Q4 GDP report. From Brad Plumer at the WaPo: Good news! The economy probably didn’t shrink last quarter, after all

[N]ew trade data released Friday suggests that the U.S. economy actually grew between October and December.Not a big change, but probably a change in the sign! (minus to positive)

When the Bureau of Economic Analysis initially calculated fourth-quarter GDP, it assumed that the U.S. trade deficit had actually widened ... As a result, many analysts expect the government to show positive growth when the BEA revises its numbers next month. Capital Economics projects that the U.S. economy actually grew at a 0.2 percent annualized pace in the fourth quarter of 2012, while Macroeconomic Advisers is expecting 0.5 percent growth.

Other data was also positive: the 4-week average of initial weekly unemployment claims dropped to the lowest level in almost five years, and the ISM service survey showed expansion.

Not much data, but mostly positive.

And here is a summary of last week in graphs:

• Trade Deficit declined in December to $38.5 Billion

The Department of Commerce reported:

[T]otal December exports of $186.4 billion and imports of $224.9 billion resulted in a goods and services deficit of $38.5 billion, down from $48.6 billion in November, revised. December exports were $3.9 billion more than November exports of $182.5 billion. December imports were $6.2 billion less than November imports of $231.1 billion.The trade deficit was much smaller than the consensus forecast of $46.0 billion.

This graph shows the U.S. trade deficit, with and without petroleum, through December.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.The decrease in the trade deficit in December was due to both a decline in petroleum and non-petroleum products.

Oil averaged $95.16 in December, down from $97.45 per barrel in November. But most of the decline in the value of petroleum imports was due to a sharp decline in the volume of imports.

Notes: The trade deficit might have been skewed by the LA port strike that started in late November and ended in early December. This does suggest an upward revision to Q4 GDP.

• ISM Non-Manufacturing Index indicates expansion in January

From the Institute for Supply Management: January 2013 Non-Manufacturing ISM Report On Business®

The January ISM Non-manufacturing index was at 55.2%, down from 55.7% in December. The employment index increased in January to 57.5%, up from 55.3% in December. Note: Above 50 indicates expansion, below 50 contraction.

The January ISM Non-manufacturing index was at 55.2%, down from 55.7% in December. The employment index increased in January to 57.5%, up from 55.3% in December. Note: Above 50 indicates expansion, below 50 contraction. This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was slightly above the consensus forecast of 55.0% and indicates slightly slower expansion in January than in December.

• Weekly Initial Unemployment Claims at 366,000

The DOL reported:

The DOL reported:In the week ending February 2, the advance figure for seasonally adjusted initial claims was 366,000, a decrease of 5,000 from the previous week's revised figure of 371,000. The 4-week moving average was 350,500, a decrease of 2,250 from the previous week's revised average of 352,750.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 350,500.

Weekly claims were above the 360,000 consensus forecast, however the 4-week average is at the lowest level since early 2008.

Friday, February 08, 2013

Hotels: Occupancy Rate near pre-recession levels

by Calculated Risk on 2/08/2013 08:00:00 PM

Another update on hotels from HotelNewsNow.com: STR: US results for week ending 2 February

In year-over-year comparisons, occupancy was up 3.6 percent to 53.5 percent, average daily rate rose 6.0 percent to US$106.64 and revenue per available room increased 9.8 percent to US$57.06.The 4-week average of the occupancy rate is close to normal levels.

Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2013, yellow is for 2012, blue is "normal" and black is for 2009 - the worst year since the Great Depression for hotels.

The occupancy rate will continue to increase over the next couple of months as business travel picks up in the Spring. This is a key period for the hotel industry, and the occupancy rate has improved from the same period last year - and is close to pre-recession levels.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

AAR: Rail Traffic "mixed" in January

by Calculated Risk on 2/08/2013 02:57:00 PM

From the Association of American Railroads (AAR): AAR Reports Mixed Rail Traffic for January, and Week Ending February 2

Intermodal traffic in January 2013 totaled 1,168,630 containers and trailers, up 5.3 percent (58,303 units) compared with January 2012. Carloads originated in January totaled 1,339,604 carloads, down 6.3 percent (90,199 carloads) compared with the same month last year. Carloads excluding coal and grain were up 1.8 percent (12,731 carloads) in January 2013 over January 2012.

In January, six of the 20 commodity groups posted increases compared with the same month last year, including: petroleum and petroleum products, up 54.1 percent or 22,892 carloads; crushed stone, gravel and sand, up 6.1 percent or 4,732 carloads, and lumber and wood products, up 14.6 percent or 2,032 carloads. Commodities with carload declines in January were led by coal, down 14.5 percent or 91,593 carloads; grain, down 11 percent or 11,337 carloads, and iron and steel scrap, down 18.7 percent or 4,675 carloads.

“The New Year brought a continuation of an old pattern: weakness in coal, strength in intermodal and petroleum products, and mixed results for everything else,” said AAR Senior Vice President John T. Gray. “Railroads recently announced that they expect to reinvest significantly in 2013 — an estimated $24.5 billion for the year — back into their systems. They’re making these investments because they are confident that demand for freight transportation, over the long term, will continue to grow.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows U.S. average weekly rail carloads (NSA). Green is 2013.

In non-seasonally adjusted terms, U.S. railroads averaged 267,921 carloads per week in January 2013 — for a total of 1,339,604 carloads for the month — down 6.3% (90,199 carloads for the month) from January 2012. In percentage terms, it was the biggest year-over-year monthly decline since November 2009.Note that building related commodities were up.

If you’ve been paying any attention at all for the past year, you can probably guess the main reason why overall carloads were down in January. Coal carloads totaled 538,878 for the month, down 14.5% (91,593 carloads) from January 2012. ...

Excluding coal and grain, U.S. rail carloads were up 1.8% (12,731 carloads) in January 2013 over January 2012

The second graph is for intermodal traffic (using intermodal or shipping containers):

Graphs reprinted with permission.

Graphs reprinted with permission.Intermodal traffic is near peak levels (black line).

U.S. railroads originated 1,168,630 intermodal containers and trailers in January 2013, up 5.3% (58,303 units) over January 2012 and an average of 233,726 per week. That’s easily the highest weekly average of any January in history.Intermodal will probably set a new record in 2013.

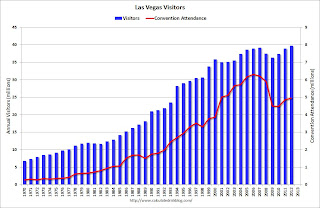

Las Vegas: Visitor Traffic at Record High in 2012, Convention Attendance Lags

by Calculated Risk on 2/08/2013 12:58:00 PM

Just an update ... during the recession, I wrote about the troubles in Las Vegas and included a chart of visitor and convention attendance: Lost Vegas.

Since then Las Vegas visitor traffic has recovered to a new record high in 2012.

However convention attendance was only up 1.6% from 2011 and is about 21% below the peak level in 2006. Here is the data from the Las Vegas Convention and Visitors Authority.

Click on graph for larger image.

Click on graph for larger image.

The blue bars are annual visitor traffic (left scale), and the red line is convention attendance (right scale).

There were 39,727,022 visitors to Las Vegas in 2012, just above the previous record of 39,196,761 in 2007.

Convention attendance was at 4,944,014 in 2012, still well below the record of 6,307,961 in 2006.

So it looks like the gamblers are back ...

Meyer on Construction Jobs

by Calculated Risk on 2/08/2013 10:31:00 AM

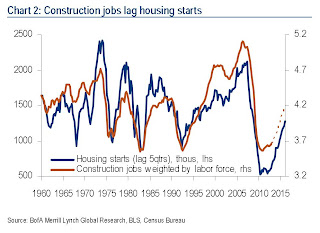

Last week I posted an article from Trulia chief economist Jed Kolko: Here are the “Missing” Construction Jobs. Here is another projection from Merrill Lynch economist Michelle Meyer: Construction Coming Back

One of the puzzles last year was the lack of hiring in the construction sector. Despite a 25% gain in housing starts, only a net 18,000 construction jobs were added for the year. This seemed too low, and we learned that evidently it was. The revisions yielded another 73,000 construction jobs in 2012 and 75,000 in 2011, bringing the total to 91,000 and 144,000, respectively.

We think construction hiring will ramp up this year. The best way to forecast construction jobs is to look at the lagged impact of housing starts or residential investment. This comparison is easiest if we adjust construction employment for the size of the labor force. We find that the correlation between construction jobs and housing starts is the highest at 72% when housing starts are lagged by five quarters (Chart 2). Since housing starts reached a trough in 1Q11, construction jobs should have turned higher last spring. We saw some gains, but only very modest ones (which we learned after last month’s revision). The gain in housing starts accelerated in 2012, suggesting a faster pickup in construction jobs this year.

Click on graph for larger image.

Click on graph for larger image.Timing the turn is much easier than estimating the magnitude, however. The historical comparison is imperfect because we are not controlling for variablessuch as the change in the average size of homes, types of properties (apartment vs. single family) and labor productivity. From the mid-1990s through the bubble, there was a shift toward greater single family homes, which tend to be more labor-intensive than apartments. During the last few years of the bubble, there was an increase in the share of “McMansions” that also required greater labor. As such, the gain in construction jobs outpaced housing starts during this period. We would argue the reverse is true today as households are looking to downsize, either into apartments or smaller single-family properties. The gain in construction jobs may therefore be slower than implied by the historical comparison.

Plugging in our forecast for housing starts through 2014 and lagging five quarters, we think it is reasonable to expect gains of about 225,000 to 250,000 construction jobs this year, which implies nearly 20,000 a month on average (again see Chart 2). We judge this to be a conservative estimate and see upside risk given improvement in renovation spending.