by Calculated Risk on 2/04/2013 02:00:00 PM

Monday, February 04, 2013

Fed: Some domestic banks "eased lending standards", Demand for some Loans "strengthened"

From the Federal Reserve: The January 2013 Senior Loan Officer Opinion Survey on Bank Lending Practices

In the January survey, generally modest fractions of domestic banks reported having eased their standards across major loan categories over the past three months on net. Domestic respondents indicated that demand for business loans, prime residential mortgages, and auto loans had strengthened, on balance, while demand for other types of loans was about unchanged. U.S. branches and agencies of foreign banks, which mainly lend to businesses, reported little change in their lending standards, while demand for their loans was reportedly stronger on net.

...

Within consumer lending, a moderate fraction of domestic banks reported an easing of standards on auto loans, on net, while standards on other types of consumer loans were about unchanged. On balance, banks indicated having eased selected terms on consumer loans over the survey period. A moderate fraction of respondents continued to experience stronger demand for auto loans, on net, while demand for credit card loans was reportedly unchanged.

...

The January survey also included three sets of special questions: The first set asked banks about lending to and competition from banks headquartered in Europe; the second set asked banks about changes in their lending policies on CRE loans over the past year; and the third set asked banks about their outlook for asset quality in major loan categories during 2013. In response to the first set, only a small fraction of domestic banks indicated that lending standards to European banks and their affiliates had been tightened, on net, while foreign respondents' standards were reportedly little changed for such institutions. In response to the second set, respondents indicated that they had eased selected CRE loan terms over the past 12 months on net, with the rest of the surveyed terms having been about unchanged. Finally, respondents' answers for the outlook for asset quality revealed that moderate to large fractions of banks expect improvements in credit quality in most major loan categories on balance.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are some charts from the Fed.

These two graphs shows the change in lending standards and demand for CRE (commercial real estate) loans.

Increasing demand and some easing in standards suggests some increase in CRE activity going forward.

In general this survey indicates lending standards are still tight, but some banks are loosening a little - and there is also increasing demand for certain loans.

Housing: Inventory down 22% year-over-year in early February

by Calculated Risk on 2/04/2013 12:39:00 PM

Inventory declines every year in December and January as potential sellers take their homes off the market for the holidays - and then starts increasing again in February. That is why it helps to look at the year-over-year change in inventory.

According to the deptofnumbers.com for (54 metro areas), overall inventory is down 22.2% year-over-year in early February and up slightly from January (on a monthly basis).

This graph shows the NAR estimate of existing home inventory through December (left axis) and the HousingTracker data for the 54 metro areas through early February.

Click on graph for larger image.

Click on graph for larger image.

Since the NAR released their revisions for sales and inventory in 2011, the NAR and HousingTracker inventory numbers have tracked pretty well.

On a seasonal basis, housing inventory usually bottoms during the holidays and then starts increasing in February - and peaks in mid-summer. So inventory will probably increase for the next 6+ months.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the early February listings, for the 54 metro areas, declined 22.2% from the same period last year.

HousingTracker reported that the early February listings, for the 54 metro areas, declined 22.2% from the same period last year.

The year-over-year declines will probably start to get smaller since inventory is already very low.

One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm also tracking inventory weekly this year.

If inventory does bottom, we probably will not know for sure until late in the year. Ben at Housing Tracker (Department of Numbers) has provided me weekly inventory data for the last several years and this is displayed on the graph below as a percentage change from the first week of the year.

In 2010 (blue), inventory followed the normal seasonal pattern, however in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

In 2010 (blue), inventory followed the normal seasonal pattern, however in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

Note: the data is a little weird for early 2011 (spikes down briefly).

The key will be to see how much inventory increases over the next few months. In 2010, inventory was up 8% by early March, and up 15% by the end of March.

For 2011 and 2012, inventory only increased about 5% at the peak.

So far in 2013, even with the slight decline last week (probably noise), inventory is already up 3.0%. The next few months will be very interesting for inventory!

Irwin: No Bond Bubble

by Calculated Risk on 2/04/2013 11:11:00 AM

I was going to write about this since I'm asked about a "bond bubble" all the time - but Neil Irwin at the WaPo beat me too it: No, there probably isn’t a bond bubble

One peculiar legacy of the financial crisis is that, among the financial commentariat, there is a tendency to see a bubble whenever the market for a particular asset rises.Yes - people see bubbles everywhere!

[N]o bubble fears are as widespread as the conviction that the markets for government bonds—in the United States in particular, but also in many other nations. It almost passes as a mark of seriousness to argue that Treasuries are the next big bubble to pop, the biggest in a long series that also included the stock market bubble of the late 1990s and the housing and mortgage securities bubble of the 2000s.This reminds me of discussions we had back in 2005 about "what is a bubble"? Back then we were discussing the housing bubble (See: Housing: Speculation is the Key). Here is what I wrote about housing in April 2005:

That kind of talk particular heats up whenever bond prices start to fall a bit, as they have in the last few weeks. (The phrase “bond bubble” appeared in major world publications included in the Nexis database 28 times in January—up from two in January 2012). And it is true that bonds have been in a remarkable 30 year rally, their prices climbing as interest rates have fallen almost constantly since the early 1980s.

It’s certainly true that bond prices could fall (and, conversely, longer-term interest rates rise). On balance, that is more likely to be for good reasons–because the economy is getting back on track–than for bad reasons, like inflation getting out of control.

But I’m not particularly worried that Treasury bonds are a bubble about to pop. Here’s why.

The first, and simplest reason to be skeptical of the bond bubble story is this: What defines a bubble is people buying an asset at ever-rising prices for speculative reasons, not based on the fundamental value of the asset, but because they are assuming somebody else will buy it at a higher price. I see no evidence of this behavior by buyers of Treasury bonds.

I have taken to calling the housing market a "bubble". But how do I define a bubble?With bonds, I don't see speculation, significant leveraged buying, "storage" or any of the other factors that defined a housing "bubble". I think Irwin is correct - there is no bond bubble, and when bond prices eventually fall (and interest rates rise) it will most likely "be for good reasons–because the economy is getting back on track".

A bubble requires both overvaluation based on fundamentals and speculation. It is natural to focus on an asset’s fundamental value, but the real key for detecting a bubble is speculation - the topic of this post. Speculation tends to chase appreciating assets, and then speculation begets more speculation, until finally, for some reason that will become obvious to all in hindsight, the "bubble" bursts.

Lawler: More Home Builder Results for Last Quarter

by Calculated Risk on 2/04/2013 09:09:00 AM

CR Note: the following comments and table are from economist Tom Lawler.

This table is for many of the public home builders as of Dec 2012.

This shows that combined net order are up 37% compared to Q4 2011. As Lawler notes, the combined backlog is up 57.1%!

From Tom Lawler:

The combined order backlog of these companies at the end of 2012 was 26,638, up 57.1% from the end of 2011.

While not all builders comment on pricing trends, those that do have reported increased prices, “pricing power,” and/or lower incentives/price concessions.

As one builder noted, “being able to sell homes at a price that is higher than what it costs to build them is ‘sweet’.”

| Net Orders | Settlements | Average Closing Price | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | Dec 2012 | Dec 2011 | % Chg | Dec 2012 | Dec 2011 | % Chg | Dec 2012 | Dec 2011 | % Chg |

| D.R. Horton | 5,259 | 3,794 | 38.6% | 5,182 | 4,118 | 25.8% | $236,067 | $214,740 | 9.9% |

| PulteGroup | 3,926 | 3,084 | 27.3% | 5,154 | 4,303 | 19.8% | $287,000 | $271,000 | 5.9% |

| NVR | 2,625 | 2,158 | 21.6% | 2,788 | 2,391 | 16.6% | $331,900 | $304,600 | 9.0% |

| The Ryland Group | 1,502 | 915 | 64.2% | 1,578 | 1,040 | 51.7% | $270,000 | $254,000 | 6.3% |

| Standard Pacific | 983 | 615 | 59.8% | 973 | 782 | 24.4% | $388,000 | $374,000 | 3.7% |

| Meritage Homes | 1,094 | 749 | 46.1% | 1,240 | 894 | 38.7% | $294,000 | $275,000 | 6.9% |

| MDC Holdings | 869 | 523 | 66.2% | 1,221 | 792 | 54.2% | $318,700 | $291,300 | 9.4% |

| M/I Homes | 673 | 505 | 33.3% | 887 | 667 | 33.0% | $273,000 | $257,000 | 6.2% |

| Total | 16,931 | 12,343 | 37.2% | 19,023 | 14,987 | 26.9% | $285,300 | $265,785 | 7.3% |

Sunday, February 03, 2013

Sunday Night Futures

by Calculated Risk on 2/03/2013 10:04:00 PM

Monday:

• At 10:00 AM ET, Manufacturers' Shipments, Inventories and Orders (Factory Orders) for December. The consensus is for a 2.2% increase in orders.

• At 2:00 PM, The January 2013 Senior Loan Officer Opinion Survey on Bank Lending Practices from the Federal Reserve. This might show some slight loosening in lending standards.

Weekend:

• Summary for Week Ending Feb 1st

• Schedule for Week of Feb 3rd

The Asian markets are green tonight with the Nikkei up 0.5%, and the Shanghai Composite index is up 0.4%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up slightly and DOW futures are up 10.

Oil prices have moved up recently WTI futures at $97.58 per barrel and Brent at $116.62 per barrel. Gasoline prices are up 20 cents over the last couple of weeks.

Below is a graph from Gasbuddy.com showing the recent increase in gasoline prices.

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Restaurant Performance Index: "Softer Sales, Traffic" in December

by Calculated Risk on 2/03/2013 02:32:00 PM

From the National Restaurant Association: December RPI declines due to softer sales, traffic

Due in large part to softer same-store sales and customer traffic levels, the National Restaurant Association's Restaurant Performance Index (RPI) declined in December. The RPI stood at 99.7 in December, down 0.2 percent from November, marking the third consecutive month in which the RPI stood below 100, which signifies contraction in the index of key industry indicators.

“Although restaurant operators reported softer same-store sales and customer traffic levels in December, they are cautiously optimistic about sales growth in the months ahead,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “However, operators remain decidedly pessimistic about the overall economy, with only 17 percent saying they expect business conditions to improve in the next six months.”

...

The Current Situation Index stood at 99.1 in December - down 0.7 percent from November and the lowest level in nearly two years. Although restaurant operators reported net positive same-store sales for the 19th consecutive month, December's results were much softer than the November performance.

Click on graph for larger image.

Click on graph for larger image.The index declined to 99.7 in December, down from 99.9 in November (below 100 indicates contraction).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month.

Earlier:

• Summary for Week Ending Feb 1st

• Schedule for Week of Feb 3rd

Graphs for Duration of Unemployment, Unemployment by Education and Diffusion Indexes

by Calculated Risk on 2/03/2013 10:20:00 AM

Earlier employment posts:

• January Employment Report: 157,000 Jobs, 7.9% Unemployment Rate

• Employment Report Comments and more Graphs

• All Employment Graphs

A few more employment graphs ...

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.The general trend is down for all categories, but only the less than 5 weeks is back to normal levels.

The the long term unemployed is at 3.0% of the labor force - and the number (and percent) of long term unemployed remains a serious problem.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment (all four categories are only gradually declining).

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This is a little more technical. The BLS diffusion index for total private employment was at 59.6 in January, down from 64.5 in December. For manufacturing, the diffusion index decreased to 48.1, down from 54.9 in December.

This is a little more technical. The BLS diffusion index for total private employment was at 59.6 in January, down from 64.5 in December. For manufacturing, the diffusion index decreased to 48.1, down from 54.9 in December. Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.Job growth for total private employment was fairly widespread in January, but not as much for manufacturing. Still the total private diffusion index is at a reasonable level.

Earlier:

• Summary for Week Ending Feb 1st

• Schedule for Week of Feb 3rd

Saturday, February 02, 2013

Unofficial Problem Bank list declines to 822 Institutions

by Calculated Risk on 2/02/2013 04:21:00 PM

Here is the unofficial problem bank list for Feb 1, 2013.

Changes and comments from surferdude808:

No failures this week as it looks like the FDIC will be watching the Super Bowl instead of determining insured depositors.Earlier:

There were three removals this week from the Unofficial Problem Bank List. The removals leave the list at 822 institutions with assets of $308 billion. A year ago, the list held 958 institutions with assets of $389.6 billion.

The Federal Reserve terminated actions against Security Financial Bank, Durand, WI ($314 million) and Oregon Community Bank & Trust, Oregon, WI ($161 million). The other removal was Community Bank, Staunton, VA ($490 million Ticker: CFFC), which merged on an unassisted basis. Next week should be as quiet as the OCC will likely wait until the week of February 15th to release its actions through mid-January 2013.

• Summary for Week Ending Feb 1st

• Schedule for Week of Feb 3rd

Schedule for Week of Feb 3rd

by Calculated Risk on 2/02/2013 01:11:00 PM

Earlier:

• Summary for Week Ending Feb 1st

This will be a light week for economic data. The key report for this week will be the December trade balance report on Friday.

Also the Fed's January Senior Loan Officer Survey will be released on Monday, and the ISM service index will be released on Tuesday.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for December. The consensus is for a 2.2% increase in orders.

2:00 PM: The January 2013 Senior Loan Officer Opinion Survey on Bank Lending Practices from the Federal Reserve. This might show some slight loosening in lending standards.

10:00 AM: ISM non-Manufacturing Index for January. The consensus is for a decrease to 55.0 from 55.7 in December. Note: Above 50 indicates expansion, below 50 contraction.

10:00 AM: Trulia Price Rent Monitors for January. This is the index from Trulia that uses asking prices adjusted both for the mix of homes listed for sale and for seasonal factors.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 360 thousand from 368 thousand last week.

3:00 PM: Consumer Credit for December from the Federal Reserve. The consensus is for credit to increase $14.5 billion in December.

8:30 AM: Trade Balance report for December from the Census Bureau.

8:30 AM: Trade Balance report for December from the Census Bureau. Both exports and imports increased in November. US trade has slowed recently.

The consensus is for the U.S. trade deficit to decrease to $46.0 billion in December from $48.7 billion in November.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for December. The consensus is for a 0.3% increase in inventories.

Summary for Week ending February 2nd

by Calculated Risk on 2/02/2013 08:01:00 AM

The big story of the week was the negative print for Q4 GDP. However the underlying details were better than the headline number and most analyst shrugged off the slight contraction as a combination of "one-off drags". And we are already starting to see upgraded forecasts for Q1 2013. As an example, from Jan Hatzius at Goldman Sachs:

"We now expect a rebound in real GDP growth to 2.6% in Q1 as the one-off drags unwind."The headline number for the employment report was a little below expectations, but the upward revisions to previous months more than offset the disappointment. November was revised up from +161,000 to +247,000 jobs added, and December was revised up from +155,000 to +196,000. Over the last 3 months, the economy has averaged 200,000 jobs per month - and that was above expectations.

For manufacturing, the ISM index was solidly above expectations, and the underlying details were also positive. As an example, the new orders index was at 53.3%, up from 49.7% in December (above 50 is expansion). This was much better than the regional surveys indicated.

Other positives includes construction spending (up solidly in December with upward revisions for prior months), and January auto sales (off to a solid start in 2013).

Overall the data still suggests sluggish growth. There will probably be more drag from the payroll tax hike - and possibly the "sequestration" cuts, but it appears the outlook is improving.

And here is a summary of last week in graphs:

• January Employment Report: 157,000 Jobs, 7.9% Unemployment Rate

Click on graph for larger image.

Click on graph for larger image.From the BLS:

Total nonfarm payroll employment increased by 157,000 in January, and the unemployment rate was essentially unchanged at 7.9 percentThe headline number was below expectations of 185,000. However employment for November and December were revised up sharply.

...

The change in total nonfarm payroll employment for November was revised from +161,000 to +247,000, and the change for December was revised from +155,000 to +196,000

[Benchmark revision:] The total nonfarm employment level for March 2012 was revised upward by 422,000 (424,000 on a not seasonally adjusted basis).

This graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.

This graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

This was another sluggish growth employment report, but with strong upward revisions to prior months.

• Real GDP decreased 0.1% Annualized in Q4

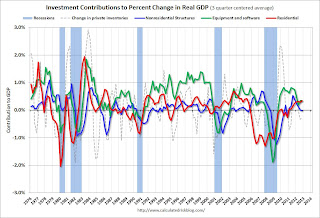

The Q4 GDP report was negative, with a 0.1% annualized decline in real GDP, and lower than the expected 1.0% annualized increase. Final demand increased in Q4 as personal consumption expenditures (PCE) increased at a 2.2% annual rate (up from 1.6% in Q3), and residential investment increased at a 15.3% annual rate (up from 13.5% in Q3).

The slight decline in GDP was related to changes in private inventories (subtracted 1.27 percentage points), less Federal Government spending (subtracted 1.25 percentage points), and a negative contribution from trade (subtracted 0.25 percentage points).

Overall this was a weak report, but with some underlying positives (the increase in PCE and private fixed investment). I expect the payroll tax increase to slow PCE growth in the first half of 2013 - and for additional government austerity - but I think the economy will continue to grow this year.

The following graph shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter centered average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

For the following graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Residential Investment (RI) made a positive contribution to GDP in Q4 for the seventh consecutive quarter. Usually residential investment leads the economy, but that didn't happen this time because of the huge overhang of existing inventory, but now RI is contributing. The good news: Residential investment has clearly bottomed.

The contribution from RI will probably continue to be sluggish compared to previous recoveries, but the ongoing positive contribution to GDP is a significant story.

Equipment and software investment increased solidly in Q4, after decreasing in Q3. This followed twelve consecutive quarters with a positive contribution.

The contribution from nonresidential investment in structures was slightly negative in Q4. Nonresidential investment in structures typically lags the recovery, however investment in energy and power has masked the ongoing weakness in office, mall and hotel investment (the underlying details will be released next week).

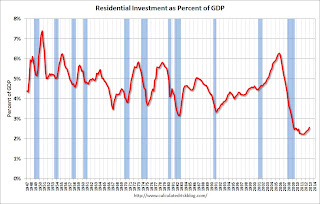

Residential Investment as a percent of GDP is up from the record lows during the housing bust. Usually RI bounces back quickly following a recession, but this time there is a wide bottom because of the excess supply of existing vacant housing units.

Residential Investment as a percent of GDP is up from the record lows during the housing bust. Usually RI bounces back quickly following a recession, but this time there is a wide bottom because of the excess supply of existing vacant housing units. In 2011, the increase in RI was mostly from multifamily and home improvement investment. Now the increase is from most categories including single family. I'll break down Residential Investment (RI) into components after the GDP details are released this coming week. Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

The key story is that residential investment is continuing to increase, and I expect this to continue. Since RI is the best leading indicator for the economy, this suggests no recession this year or in 2014.

• Case-Shiller: House Prices increased 5.5% year-over-year in November

S&P/Case-Shiller released the monthly Home Price Indices for November (a 3 month average of September, October and November).

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).The Composite 10 index is off 30.7% from the peak, and up 0.5% in November (SA). The Composite 10 is up 5.3% from the post bubble low set in March (SA).

The Composite 20 index is off 29.8% from the peak, and up 0.6% (SA) in November. The Composite 20 is up 6.0% from the post-bubble low set in March (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 4.5% compared to November 2011.

The Composite 20 SA is up 5.5% compared to November 2011. This was the sixth consecutive month with a year-over-year gain since 2010 (when the tax credit boosted prices temporarily). This was the largest year-over-year gain for the Composite 20 index since 2006.

This was slightly below the consensus forecast for a 5.8% YoY increase.

• ISM Manufacturing index increases in January to 53.1

The ISM manufacturing index indicated expansion in January. PMI was at 53.1% in January, up from 50.2% in December. The employment index was at 54.0%, up from 51.9%, and the new orders index was at 53.3%, up from 49.7% in December.

The ISM manufacturing index indicated expansion in January. PMI was at 53.1% in January, up from 50.2% in December. The employment index was at 54.0%, up from 51.9%, and the new orders index was at 53.3%, up from 49.7% in December.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 50.7% and suggests manufacturing expanded in January.

• Construction Spending increased in December

There are a few key themes:

1) Private residential construction is usually the largest category for construction spending, but there was a huge collapse in spending following the housing bubble (as expected). This is now the largest category once again. Usually private residential construction leads the economy, so this is a good sign going forward.

2) Private non-residential construction spending usually lags the economy. There was some increase this time, mostly related to energy and power - but the key sectors of office, retail and hotels are still at very low levels.

3) Public construction spending has declined to 2006 levels (not adjusted for inflation). This has been a drag on the economy for 3+ years.

This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.Private residential spending is 54% below the peak in early 2006, and up 39% from the post-bubble low. Non-residential spending is 26% below the peak in January 2008, and up about 35% from the recent low.

Public construction spending is now 17% below the peak in March 2009 and at the lowest level since 2006 (not inflation adjusted).

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is now up 24%. Non-residential spending is up 8% year-over-year mostly due to energy spending (power and electric). Public spending is down 6% year-over-year.

This was a fairly strong report - except for public construction spending - and this report suggests an upward revision to Q4 GDP.

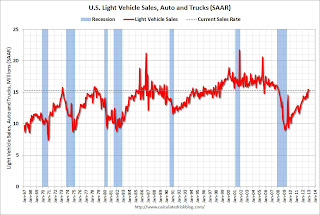

• U.S. Light Vehicle Sales at 15.3 million annual rate in January

Based on an estimate from AutoData Corp, light vehicle sales were at a 15.29 million SAAR in January. That is up 10% from January 2012, and down slightly from the sales rate last month.

Based on an estimate from AutoData Corp, light vehicle sales were at a 15.29 million SAAR in January. That is up 10% from January 2012, and down slightly from the sales rate last month.This was at the consensus forecast of 15.3 million SAAR (seasonally adjusted annual rate).

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for January (red, light vehicle sales of 15.29 million SAAR from AutoData).

This is a solid start to the new year. After three consecutive years of double digit auto sales growth, the growth rate will probably slow in 2013 - but this will still be another positive year for the auto industry.

Even if sales average this rate all year, sales would be up about 6% from 2012.

• Weekly Initial Unemployment Claims increased to 368,000

From the DOL "In the week ending January 26, the advance figure for seasonally adjusted initial claims was 368,000, an increase of 38,000 from the previous week's unrevised figure of 330,000. The 4-week moving average was 352,000, an increase of 250 from the previous week's unrevised average of 351,750."

From the DOL "In the week ending January 26, the advance figure for seasonally adjusted initial claims was 368,000, an increase of 38,000 from the previous week's unrevised figure of 330,000. The 4-week moving average was 352,000, an increase of 250 from the previous week's unrevised average of 351,750."The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased slightly to 352,000.

Weekly claims were above the 350,000 consensus forecast, however the 4-week average is near the levels of early 2008.