by Calculated Risk on 1/25/2013 08:57:00 AM

Friday, January 25, 2013

U.K. Economy Shrinks Again

From the WSJ: U.K. Economy Shrinks

The U.K. economy shrank in the final quarter of 2012, leaving Britain at risk of entering its third recession since 2008.A triple dip?

In its preliminary estimate, the Office for National Statistics said gross domestic product contracted 0.3% between October and December compared with the third quarter. On an annual basis economic output was flat.

"At the moment it remains too early to tell if the economy will triple-dip, but today's numbers have greatly increased the risk of a new recession and a downgrading of the U.K.'s triple-A credit rating," said Chris Williamson, chief economist at data providers Markit.

However it appears employment is doing better than GDP in the U.K., from Izabella Kaminska at FT Alphaville: Mismeasuring UK GDP

Thursday, January 24, 2013

Friday: New Home Sales

by Calculated Risk on 1/24/2013 08:47:00 PM

First, from Michelle Meyer at Merrill Lynch: Tale of the missing homes

One of the key developments for the housing market in 2012 was a significant decline in inventory. The number of existing homes on the market for sale plunged 22% from the end of 2011, reaching the lowest level since January 2001. At the current sales pace, it now only takes 4.4 months to clear the stock of homes for sale. This is the slowest pace since the heart of the housing bubble in mid-2005. The reduction in supply has underpinned home prices and created a need for construction yet again.CR note: Watching inventory - while not much more exciting than watching grass grow - will be key this year. My guess is inventory has bottomed, but even if there are further declines, the year-over-year declines will be much less in 2013 than in 2012.

The decline in supply can be explained by a few factors. Most significantly, the sharp decline in homebuilding translated to minimal growth in the housing stock. From 2009 to 2011, housing starts only slightly exceeded the pace of demolitions. The sluggish pace of new construction, of course, has a more direct impact on new inventory than it does on existing supply. Nonetheless, over time, it means fewer homes available for sale and hence slower turnover.

The latter – the decline in turnover – is the main reason for lean inventory of existing properties. This is a function of 1) falling home prices, which discouraged sellers; 2) tight credit, which reduced the number of move-up buyers; 3) negative equity that led to lock-in. As home prices increase and credit standards ease, some of this "pent-up" inventory will be unleashed. That said, if it is truly turnover – which means selling a property to buy a different one – it will also result in a gain in home sales. Months supply can therefore remain low.

Another source of inventory is from distressed properties – both current and previous. There is still a large pipeline of mortgages in foreclosure or seriously delinquent that needs to be processed. We think this will be gradual given the delays from states with a judicial foreclosure process. We can also see inventory from previously delinquent mortgages that had been purchased by investors. Many institutional investors bought distressed properties in bulk with the intention of renting them for a few years until prices appreciated. As prices rise, investors will look to take capital gains.

We advise some caution when interpreting the inventory data as there are big seasonal swings. Inventory typically falls at the end of the year and picks up again in Q1 in anticipation of the spring selling season. Extracting the seasonal factors from inventory shows that the biggest adjustments occur in December, when inventory is low, and August when inventory is high. We therefore expect a gain in inventory over Q1. This may very well be matched with a modest gain in sales in the spring, therefore making it a temporary rise in inventory.

Friday economic releases:

• At 10:00 AM ET, New Home Sales for December from the Census Bureau. The consensus is for an increase in sales to 388 thousand Seasonally Adjusted Annual Rate (SAAR) in December. This will put annual sales at around 367,000, an increase of around 20% from 2011.

DOT: Vehicle Miles Driven increased 0.8% in November

by Calculated Risk on 1/24/2013 04:11:00 PM

The Department of Transportation (DOT) reported:

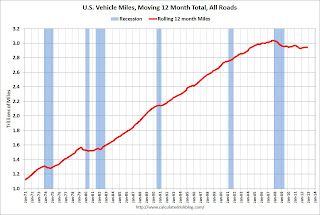

Travel on all roads and streets changed by +0.8% (1.9 billion vehicle miles) for November 2012 as compared with November 2011. Travel for the month is estimated to be 238.8 billion vehicle miles.The following graph shows the rolling 12 month total vehicle miles driven.

Cumulative Travel for 2012 changed by +0.6% (16.7 billion vehicle miles). The Cumulative estimate for the year is 2,702.9 billion vehicle miles of travel.

Traffic in the Northeast was down 0.9%, but there were gains in every other region. The rolling 12 month total is still moving sideways.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 60 months - 5 years - and still counting.

The second graph shows the year-over-year change from the same month in the previous year.

Gasoline prices were up in November compared to November 2011. In November 2012, gasoline averaged of $3.52 per gallon according to the EIA. Last year, prices in November averaged $3.44 per gallon.

Gasoline prices were up in November compared to November 2011. In November 2012, gasoline averaged of $3.52 per gallon according to the EIA. Last year, prices in November averaged $3.44 per gallon. However, as I've mentioned before, gasoline prices are just part of the story. The lack of growth in miles driven over the last 5 years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

With all these factors, it might take several more years before we see a new peak in miles driven.

Forecast: Solid Auto Sales in January

by Calculated Risk on 1/24/2013 02:32:00 PM

From Edmunds.com: January Auto Sales Suggest the Good Times Will Keep Rolling in 2013, says Edmunds.com

Edmunds.com ... forecasts that 1,045,587 new cars and trucks will be sold in the U.S. in January for an estimated Seasonally Adjusted Annual Rate (SAAR) of 15.3 million light vehicles. The projected sales will be ... a 14.5 percent increase from January 2012.It looks like auto sales are starting 2013 fairly strong.

“January’s numbers show that vehicle sales stayed strong, even after the holiday ads faded away and the replacement sales following Hurricane Sandy started to dry up,” says Edmunds.com Senior Analyst Jessica Caldwell. “These results certainly reinforce the exuberance and optimism that filled the air last week at the North American International Auto Show in Detroit.”

The following table shows annual light vehicle sales, and the change from the previous year. Light vehicle sales have seen double digit growth for three consecutive years, but the growth rate will probably slow in 2013.

| Light Vehicle Sales | ||

|---|---|---|

| Sales (millions) | Annual Change | |

| 2005 | 16.9 | 0.5% |

| 2006 | 16.5 | -2.6% |

| 2007 | 16.1 | -2.5% |

| 2008 | 13.2 | -18.0% |

| 2009 | 10.4 | -21.2% |

| 2010 | 11.6 | 11.1% |

| 2011 | 12.7 | 10.2% |

| 2012 | 14.4 | 13.4% |

Kansas City Fed: Regional Manufacturing Contracted Modestly in January

by Calculated Risk on 1/24/2013 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Survey Contracted Modestly

The Federal Reserve Bank of Kansas City released the January Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity contracted modestly again in January, but factories’ production expectations remained relatively optimistic for the months ahead.This follows contraction in the Richmond Fed survey earlier this week:

“Regional factory activity has now edged down for four straight months, as fiscal policy uncertainty continues to weigh on firms’ plans, said Wilkerson. On the positive side, expectations for new orders rose quite a bit in January, but hiring and capital spending plans were only modestly positive.”

The month-over-month composite index was -2 in January, largely unchanged from readings of -1 in December and -3 in November. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Manufacturing activity declined at most durable goods-producing plants, while nondurable producers noted a slight increase overall. Most other month-over-month indexes were below zero but higher than in December. The production index inched higher from -5 to -3, and the shipments, new orders, and order backlog indexes also rose somewhat but stayed in negative territory. In contrast, the employment index fell from -1 to -8, its lowest level since mid-2009, and the new orders for exports index also declined.

emphasis added

In January, the seasonally adjusted composite index of manufacturing activity — our broadest measure of manufacturing — lost seventeen points to settle at −12 from December's reading of 5. Among the index's components, shipments fell seventeen points to −11, the gauge for new orders moved down twenty-seven points to end at −17, and the jobs index slipped two points to −5.The NY Fed (Empire state) and Philly Fed surveys showed contraction last week.

However, the Markit Flash PMI was positive for January: Strongest manufacturing expansion since March 2011

The expansion of the U.S. manufacturing sector gained further momentum at the start of 2013, with the Markit Flash U.S. Manufacturing Purchasing Managers’ Index™ (PMI™) rising to 56.1 in January. Up from 54.0 in December, the ‘flash’ PMI reading, which is based on around 85% of usual monthly replies, signalled.The Markit Flash PMI is the opposite of the regional surveys. Go figure.

Manufacturing employment also rose strongly during January, with new jobs being created at the fastest rate for nine months. Firms generally linked job creation to fuller order books.

Weekly Initial Unemployment Claims decline to 330,000

by Calculated Risk on 1/24/2013 08:40:00 AM

The DOL reports:

In the week ending January 19, the advance figure for seasonally adjusted initial claims was 330,000, a decrease of 5,000 from the previous week's unrevised figure of 335,000. The 4-week moving average was 351,750, a decrease of 8,250 from the previous week's revised average of 360,000.The previous week was unrevised.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 351,750.

This is the lowest level for the 4-week average since early 2008. Note: Data for January has large seasonal adjustments - and can be very volatile, but this is still good news.

Weekly claims were below the 360,000 consensus forecast.

Wednesday, January 23, 2013

Thursday: Unemployment Claims

by Calculated Risk on 1/23/2013 08:00:00 PM

From Alejandro Lazo and Andrew Khouri at the LA Times: Number of homes entering foreclosure drops 22.1% to six-year low

California's foreclosure crisis eased considerably during the final quarter of last year, with the number of homes entering foreclosure dropping to a six-year low.Here is the DataQuick release: California: Foreclosure Starts Lowest Since 2006

The real estate research firm DataQuick reported a 22.1% decline in default notices during the final three months of 2012 compared with the previous quarter — and a 37.9% drop from a year earlier. A total of 38,212 default notices were logged on California houses and condominiums last quarter, the lowest number since the final quarter of 2006. A default notice is the first formal step in the state's foreclosure process.

Note: California is a non-judicial foreclosure state, and the non-judicial states are recovering quicker than many judicial states (the courts take time).

Thursday economic releases:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 360 thousand from 335 thousand last week.

• At 9:00 AM, The Markit US PMI Manufacturing Index Flash. This release might provide hints about the ISM PMI for January. This consensus is for a decrease to 54.0 from 54.2 in December. All of the regional surveys have been week so far, so this may decline more than the consensus.

• At 10:00 AM, the Conference Board Leading Indicators for December. The consensus is for a 0.4% increase in this index.

• At 11:00 AM, the Kansas City Fed regional Manufacturing Survey for January will be released. The consensus is for a reading of 2, up from -2 in December (below zero is contraction).

Lawler: Table of Short Sales and Foreclosures for Selected Cities in December

by Calculated Risk on 1/23/2013 03:52:00 PM

Economist Tom Lawler sent me the table below of short sales and foreclosures for several selected cities in December. This shows distressed sales are down just about everywhere, and there are more short sales than foreclosures in most areas (Minneapolis and Colorado are exceptions.

Look at the right two columns in the table below (Total "Distressed" Share for Dec 2012 compared to Dec 2011). In every area that reports distressed sales, the share of distressed sales is down year-over-year - and down significantly in most areas.

Also there has been a decline in foreclosure sales just about everywhere. Look at the middle two columns comparing foreclosure sales for Dec 2012 to Dec 2011. Foreclosure sales have declined in all these areas, and some of the declines have been stunning (the Nevada sales were impacted by a new foreclosure law). There will probably be an increase in foreclosure sales in some judicial states in 2013, but overall foreclosures will probably be down this year.

Also there has been a shift from foreclosures to short sales. In most areas, short sales now far out number foreclosures.

As a follow-up to the previous post, imagine that the number of total existing home sales doesn't change over the next year - some people would argue that is "bad" news and the housing market isn't recovering. But also imagine that the share of distressed sales declines 20%, and conventional sales increase to make up the difference. That would be a positive sign - and that is what appears to be happening.

Comments from Tom Lawler: Below is an updated “distressed sales” share report for

December (or, for

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-Dec | 11-Dec | 12-Dec | 11-Dec | 12-Dec | 11-Dec | |

| Las Vegas | 45.8% | 26.6% | 9.5% | 46.0% | 55.3% | 72.6% |

| Reno | 47.0% | 35.0% | 10.0% | 24.0% | 57.0% | 59.0% |

| Phoenix | 27.2% | 32.2% | 12.2% | 27.6% | 39.4% | 59.8% |

| Sacramento | 40.0% | 30.2% | 11.5% | 33.9% | 51.5% | 64.1% |

| Minneapolis | 12.3% | 14.6% | 26.6% | 35.8% | 38.9% | 50.4% |

| Mid-Atlantic (MRIS) | 13.0% | 14.3% | 9.7% | 15.4% | 22.7% | 29.7% |

| Orlando | 30.2% | 36.6% | 20.4% | 22.2% | 50.6% | 58.8% |

| California (DQ)* | 25.3% | 25.5% | 15.5% | 33.9% | 40.8% | 59.4% |

| So. California (DQ)* | 25.6% | 26.0% | 14.8% | 32.4% | 40.4% | 58.4% |

| Lee County, FL*** | 18.9% | 20.4% | 17.2% | 24.1% | 36.1% | 44.5% |

| Florida SF | 21.6% | 25.1% | 16.9% | 20.1% | 38.6% | 45.2% |

| Florida C/TH | 16.6% | 23.4% | 14.7% | 18.7% | 31.3% | 42.1% |

| Northeast Florida | 43.0% | 49.8% | ||||

| Chicago | 44.3% | 45.8% | ||||

| Charlotte | 15.6% | 17.7% | ||||

| Colorado** | 7.3% | 7.6% | 12.5% | 20.6% | 19.8% | 28.2% |

| Columbus OH** | 27.8% | 38.7% | ||||

| Atlanta | 26.0% | 47.0% | ||||

| Houston | 14.2% | 20.5% | ||||

| Memphis* | 26.9% | 30.2% | ||||

| Birmingham AL | 27.8% | 34.0% | ||||

| *share of existing home sales, based on property records | ||||||

| **Third Quarter | ||||||

| *** SF only | ||||||

Understanding the Existing Home Sales Report

by Calculated Risk on 1/23/2013 02:01:00 PM

The reporting on the Existing Home sales report was pretty negative yesterday even though I thought it was a solid report. And some of the positive reports were about prices - the NAR reported "The national median existing-home price for all housing types was $180,800 in December, which is 11.5 percent above December 2011" - and I completely ignore the median price. What gives?

First, on prices, the median is impacted by the mix, and the mix changed in 2012 with fewer low end foreclosures. I think the median price should be ignored during periods when the mix is changing (with all the repeat sales indexes available, I mostly ignore median prices all the time).

And on sales, the lead for many articles was that seasonally adjusted sales declined in December compared to November, and that sales were below the consensus forecast. There were some suggestions that this called into question the "housing recovery". Nonsense.

What is a "housing recovery"? There are really two recoveries: House prices and residential investment. Most people - homeowners and potential buyers - focus on prices, and for prices we should use the repeat sales indexes, and not the NAR median price (repeat sales indexes include Case-Shiller, CoreLogic, etc). What matters in the NAR report for prices is inventory and months-of-supply. And inventory is at the lowest level since January 2001, and months-of-supply fell to 4.4 months - the lowest since May 2005.

But for GDP and jobs, the key is what the Bureau of Economic Analysis (BEA) calls "residential investment" (RI) . For existing homes, only the broker's commission is part of GDP, but for new homes the entire sales price is part of GDP. There are some spillover effects from home sales (furniture, landscapting, etc), but those aren't included in RI.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the components for RI as a percent of GDP. According to the BEA, RI includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories (dormitories, manufactured homes).

Usually the most important components are investment in single family structures followed by home improvement.

Right now home improvement is the largest category, but new single family structures will be the largest component soon. Broker's commissions is usually the third largest category and is relatively small compared to single family investment and home improvement.

So if existing home sales decline there is a minor impact on RI and GDP. When we talk about the "housing recovery" for jobs and GDP, existing home sales are mostly irrelevant - the focus should be on new home sales, housing starts and home improvement.

On home improvement, from the NAHB: Remodeling Market Remains Strong in the Fourth Quarter

The Remodeling Market Index (RMI) reached 55 in the fourth quarter of 2012, increasing five points from the previous quarter, according to the National Association of Home Builders (NAHB). This is the highest reading since the first quarter 2004.Finally, as I mentioned yesterday, as the number of distressed sales decline, the number of total sales might decline too - but we need to look at the number of conventional sales - and conventional sales have been increasing. That is probably a sign of a healing market.

An RMI above 50 indicates that more remodelers report market activity is higher (compared to the prior quarter) than report it is lower. The overall RMI averages ratings of current remodeling activity with indicators of future remodeling activity.

“Remodelers are optimistic about the outlook for slow and steady market growth in the new year,” said 2013 NAHB Remodelers Chairman Bill Shaw, GMR, GMB, CGP, a remodeler from Houston. “Professional remodelers reported more work from large and small projects as well as overall home repair.”

I don't expect much of an increase in existing home sales in 2013, and I wouldn't be surprised by a decline depending on the number of foreclosures this year. But I think the housing recovery will remain fairly strong with new home sales and housing starts up sharply again this year.

AIA: "Fifth Consecutive Month of Gains in Architecture Billings Index"

by Calculated Risk on 1/23/2013 10:55:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Fifth Consecutive Month of Gains in Architecture Billings Index

Business conditions at architecture firms continue to improve. As a leading economic indicator of construction activity, the Architecture Billings Index (ABI) reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the December ABI score was 52.0, down from the mark of 53.2 in November. This score reflects an increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 59.4, down slightly from the 59.6 mark of the previous month.

“While it’s not an across the board recovery, we are hearing a much more positive outlook in terms of demand for design services,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “Moving into 2013 we are expecting this trend to continue and conditions improve at a slow and steady rate. That said, we remain concerned that continued uncertainty over the outcomes of budget sequestration and the debt ceiling could impact further economic growth.”

• Regional averages: Midwest (55.7), Northeast (53.1), South (51.2), West (49.6)

• Sector index breakdown: commercial / industrial (53.4), mixed practice (53.0), institutional (50.9), multi-family residential (50.5)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 52.0 in December, down from 53.2 in November. Anything above 50 indicates expansion in demand for architects' services.

Every building sector is now expanding and new project inquiries are strongly positive. Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests some increase in CRE investment in 2013.