by Calculated Risk on 12/21/2012 02:52:00 PM

Friday, December 21, 2012

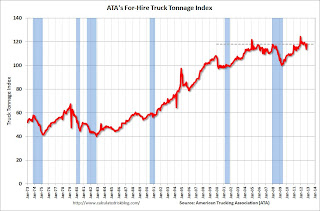

ATA Trucking Index rebounds in November

This is a minor indicator that I follow. Truck tonnage was negatively impacted by Hurricane Sandy in October, and bounced back in November.

From ATA: ATA Truck Tonnage Index Rebounds 3.7% in November

The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index jumped 3.7% in November erasing October’s 3.7% drop. (The 3.7% decrease in October was revised from a 3.8% contraction ATA reported on November 20, 2012.) November’s gain was the first since July of this year. As a result, the SA index equaled 118.0 (2000=100) in November versus 113.8 in October. Compared with November 2011, the SA index was up 1%, after contracting 2.1% on a year-over-year basis in October. Year-to-date, compared with the same period last year, tonnage was up 2.8%.Note from ATA:

...

“Sandy impacted both October’s and November’s tonnage readings,” ATA Chief Economist Bob Costello said. “But it was still good to see tonnage snap back in November.” Costello said he expects a boost to flatbed tonnage from the rebuilding in the areas impacted by Sandy, but most of that won’t happen until the spring when the money starts flowing and the weather is conducive to building.

“Outside of Sandy, if the fiscal cliff isn’t fixed in time, expect a slowdown in tonnage early next year as paychecks shrink for all households,” Costello said. “Since trucks account for the vast majority of deliveries in the retail supply, any reduction in consumer spending will hurt.” Costello added that even if we don’t go off the fiscal cliff, he expects slower tonnage growth in 2013 than 2012 as better housing starts and auto sales will be offset by slower factory output and consumer spending.

emphasis added

Trucking serves as a barometer of the U.S. economy, representing 67% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9.2 billion tons of freight in 2011. Motor carriers collected $603.9 billion, or 80.9% of total revenue earned by all transport modes.

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

Overall the index has been mostly moving sideways this year due to the slowdown in manufacturing.

State Unemployment Rates decreased in 45 States in November

by Calculated Risk on 12/21/2012 11:55:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally lower in November. Forty-five states and the District of Columbia recorded unemployment rate decreases and five states had no change, the U.S. Bureau of Labor Statistics reported today.

...

Nevada continued to record the highest unemployment rate among the states, 10.8 percent in November, followed by Rhode Island at 10.4 percent. North Dakota again registered the lowest jobless rate, 3.1 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement - Michigan and Ohio have seen the most improvement - New Jersey and Connecticut are the laggards.

The states are ranked by the highest current unemployment rate. Only two states still have double digit unemployment rates: Nevada and Rhode Island. In early 2010, 18 states and D.C. had double digit unemployment rates.

Last month I wrote: "I expect the unemployment rate in California to fall below 10% very soon" and sure enough the unemployment rate in California fell to 9.8% in November, the lowest level since January 2009.

Even though Nevada still has the highest unemployment rate, the rate has declined in recent months, falling from 12.1% in August to 10.8% in November.

LPS: Mortgage delinquencies increased in November, "In Foreclosure" Declines

by Calculated Risk on 12/21/2012 10:55:00 AM

LPS released their First Look report for November today. LPS reported that the percent of loans delinquent increased in November compared to October, and declined about 9% year-over-year. Also the percent of loans in the foreclosure process declined further in November and are the lowest level since 2009.

LPS reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) increased to 7.12% from 7.03% in October. Note: the normal rate for delinquencies is around 4.5% to 5%.

The percent of loans in the foreclosure process declined to 3.51% from 3.61% in October.

The number of delinquent properties, but not in foreclosure, is down about 10% year-over-year (434,000 fewer properties delinquent), and the number of properties in the foreclosure process is down 18% or 388,000 year-over-year.

The percent (and number) of loans 90+ days delinquent and in the foreclosure process is still very high, but the number of loans in the foreclosure process is now declining.

LPS will release the complete mortgage monitor for November in early January.

| LPS: Percent Loans Delinquent and in Foreclosure Process | |||

|---|---|---|---|

| Nov 2012 | Oct 2012 | Nov 2011 | |

| Delinquent | 7.12% | 7.03% | 7.83% |

| In Foreclosure | 3.51% | 3.61% | 4.20% |

| Number of properties: | |||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,999,000 | 1,957,000 | 2,250,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 1,584,000 | 1,543,000 | 1,767,000 |

| Number of properties in foreclosure pre-sale inventory: | 1,767,000 | 1,800,000 | 2,155,000 |

| Total Properties | 5,350,000 | 5,300,000 | 6,172,000 |

Final December Consumer Sentiment declines to 72.9

by Calculated Risk on 12/21/2012 09:55:00 AM

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for December declined to 72.9, down from the preliminary reading of 74.5, and was down from the November reading of 82.7.

This was below the consensus forecast of 75.0. The recent decline in sentiment is probably related to Congress and the so-called "fiscal cliff". This is similar to the sharp decline in 2011 when Congress threatened to force the US to default (not pay the bills).

I still think an agreement will be reached in early January - there is no drop dead date - but you never know.

Personal Income increased 0.6% in November, Spending increased 0.4%

by Calculated Risk on 12/21/2012 08:30:00 AM

The BEA released the Personal Income and Outlays report for November:

Personal income increased $85.8 billion, or 0.6 percent ... in November, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $41.3 billion, or 0.4 percent..The following graph shows real Personal Consumption Expenditures (PCE) through November (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.6 percent in November, in contrast to a decrease of 0.2 percent in October. ... The price index for PCE decreased 0.2 percent in November, in contrast to an increase of 0.1 percent in October. The PCE price index, excluding food and energy, increased less than 0.1 percent, compared with an increase of 0.1 percent.

...

Personal saving -- DPI less personal outlays -- was $436.7 billion in November, compared with $404.6 billion in October. The personal saving rate -- personal saving as a percentage of disposable personal income -- was 3.6 percent in November, compared with 3.4 percent in October.

Click on graph for larger image.

Click on graph for larger image.This graph shows real PCE by month for the last few years. The dashed red lines are the quarterly levels for real PCE. Personal income increased more than expected in November and PCE for October was revised up.

The "two month method" for estimating Q4 PCE suggests PCE will increase close to 2.2% in Q4 - more growth than most expect - although this estimate is probably a little high because PCE was strong in September. Still better than expected ...

Thursday, December 20, 2012

Friday: November Personal Income and Outlays, Durable Goods, Consumer Sentiment

by Calculated Risk on 12/20/2012 07:45:00 PM

On household formation from Cardiff Garcia at FT Alphaville: Another look at US household formation, and why it matters

James Sweeney of Credit Suisse has written one of the more optimistic (and convincing) notes we’ve come across about the near-term trajectory for US housing.And from the Credit Suisse research note:

Its optimism is based mainly on its analysis of expected household formation growth, which Sweeney finds has been underestimated by most observers. The note includes a good discussion of the ways in which healthy household formation growth can have powerful multiplicative effects throughout the rest of the economy. ...

But the two really interesting points in the Sweeney note are that 1) household formation growth can grow meaningfully even under relatively pessimistic assumptions for the US economy, and 2) even modest assumptions of household formation growth can have an have an unexpectedly big impact on the rest of the economy.

So how many households will form? A reasonable estimate, in our view, is somewhere between the strong and base case views, meaning 6-8 million over the next five years. Demographics alone should create 5.7 million, with the rest driven by a labor market recovery that falls short of our strong scenario.I'll revisit household formation soon, but I think we will see even higher household formation than the Credit Suisse estimate. But even with 1.1 million households per year (plus 2nd home buying and demolitions), means housing starts will have to increase to 1.4 to 1.5 million in a few years (once the excess is absorbed). That is almost double from the 770 or so thousand this year.

We need not assume such high numbers to demonstrate the powerful forces formation can unleash. Even the base case scenario of 5.7 million will drive a substantial pick-up in residential investment. The extremely low levels of housing starts and permits over the past few years means a large number of new housing units will likely need to be built.

And here is Business Insider's list of the most important charts for 2012. They include two of my charts - the first showing the beginning of the recovery for housing, and the second that the drag from state and local governments is near the end.

Friday economic releases:

• At 8:30 AM ET, Durable Goods Orders for November from the Census Bureau. The consensus is for a 0.5% increase in durable goods orders.

• Also at 8:30 AM, Personal Income and Outlays for November. The consensus is for a 0.3% increase in personal income in November, and for 0.4% increase in personal spending. And for the Core PCE price index to increase 0.1%. This will give us a preliminary estimate for Q4 PCE.

• Also at 8:30 AM, the Chicago Fed National Activity Index for November. This is a composite index of other data.

• At 9:55 AM, the final Reuter's/University of Michigan's Consumer sentiment index for December. The consensus is for a reading of 75.0.

• At 10:00 AM, Regional and State Employment and Unemployment (Monthly) for October 2012.

• At 11:00 AM, Kansas City Fed regional Manufacturing Survey for December. The consensus is for a reading of -3, up from -6 in November (below zero is contraction).

Existing Home Sales: The Increase in Conventional Sales

by Calculated Risk on 12/20/2012 03:34:00 PM

There are two keys to the existing home sales report: 1) inventory, and 2) the number of conventional sales. I've written extensively about the decline in inventory, but here is more data on conventional sales. First, on distressed sales from the NAR (the inverse of conventional):

Distressed homes - foreclosures and short sales sold at deep discounts - accounted for 22 percent of November sales (12 percent were foreclosures and 10 percent were short sales), down from 24 percent in October and 29 percent in November 2011.Unfortunately the NAR uses an unscientific survey to estimate distressed sales. However CoreLogic estimates the percent of distressed sales each month - and they were kind enough to send me their series. The first graph below shows CoreLogic's estimate of the distressed share starting in October 2007.

Note that the percent distressed increases every winter. This is because distressed sales happen all year, and conventional sales follow the normal seasonal pattern of stronger in the spring and summer, and weaker in the winter.

Click on graph for larger image.

Click on graph for larger image.The seasonal impact of distressed sales is why the Case-Shiller seasonal adjustment increased in recent years.

Also note that the percent of distressed sales over the last 6 months is at the lowest level since mid-2008, but still very high. This is the lowest percent of distressed sales for November since 2007.

The second graph shows the NAR existing home series using the CoreLogic share of distressed sales.

If we just look at conventional sales (blue), sales declined from over 7 million in 2005 (graph starts in 2007) to a low of under 2.5 million.

If we just look at conventional sales (blue), sales declined from over 7 million in 2005 (graph starts in 2007) to a low of under 2.5 million.Using this method (NAR's estimate for sales, CoreLogic estimate of share), conventional sales have recovered significantly. The NAR reported total sales were up 14.5% year-over-year in November, but using this method, conventional sales were up almost 20.9% year-over-year.

Earlier:

• Existing Home Sales in November: 5.04 million SAAR, 4.8 months of supply

• Existing Home Sales: Another Solid Report

• Existing Home Sales graphs

Misc: Philly Fed Mfg Shows Expansion, Q3 GDP Revised Up, FHFA House Prices increase

by Calculated Risk on 12/20/2012 01:30:00 PM

Here are a few more releases from this morning:

• From the Philly Fed: December Manufacturing Survey

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased from a reading of ‑10.7 in November to 8.1 this month. This is the highest reading since April and is slightly above the reading before the post-storm decline in November.

Labor market conditions at the reporting firms improved marginally this month. The current employment index, at 3.6, registered its first positive reading in six months ...

The survey’s future indicators suggest improved optimism among the reporting manufacturers. The future general activity index increased from 20.0 to 30.9, its highest reading in three months. emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through December. The ISM and total Fed surveys are through November.

The average of the Empire State and Philly Fed surveys increased in December, but is just back to 0. This is the highest combined level since May, but still suggests another weak reading for the ISM manufacturing index.

• Earlier this morning the BEA reported Q3 GDP increased at a 3.1% annualized rate, higher than the 2.7% estimated earlier. The upward revision was due to increases in the estimate of personal consumption expenditures (PCE), trade, and state and local governments. Although the revision for state and local governments was small, it moved to a positive contribution for the first time since Q3 2009.

This graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 6 quarters (through Q3 2012).

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 6 quarters (through Q3 2012).The red bars are for state and local governments. Although not as large a negative as the worst of the housing bust (and much smaller spillover effects), this decline has been relentless and unprecedented. The good news is the drag appears to be ending.

I don't expect state and local governments will contribute much to GDP growth in 2013, but just stopping the drag will help.

• From the FHFA: FHFA House Price Index Up 0.5 Percent in October

U.S. house prices rose 0.5 percent on a seasonally adjusted basis from September to October, according to the Federal Housing Finance Agency’s monthly House Price Index (HPI). The previously reported 0.2 percent increase in September was revised downward to a 0.0 percent change. For the 12 months ending in October, U.S. prices rose 5.6 percent. The U.S. index is 15.7 percent below its April 2007 peak and is roughly the same as the July 2004 index level.

Existing Home Sales: Another Solid Report

by Calculated Risk on 12/20/2012 11:29:00 AM

This was another solid report. Based on historical turnover rates, I think "normal" sales would be close to 5.0 million, so existing home sales at 5.04 million are pretty close to normal.

However a "normal" market would have very few distressed sales, so there is still a long ways to go. One key to returning to "normal" are more conventional sales and fewer distressed sales. Not all areas report the percentage of distressed sales, but the areas that do have shown a sharp decline in distressed sales, and a sharp increase in conventional sales.

The NAR reported total sales were up 14.5% from November 2011, but conventional sales are probably up more than 20% from November 2011 (and distressed sales down).

And what matters the most in the NAR's existing home sales report is inventory. It is active inventory that impacts prices (although the "shadow" inventory will keep prices from rising). For existing home sales, look at inventory first and then at the percent of conventional sales.

The NAR reported inventory decreased to 2.03 million units in November, down from 2.11 million in October. This is down 22.5% from November 2011, and down 30% from the inventory level in November 2005 (mid-2005 was when inventory started increasing sharply). This is the lowest level for the month of November since 2000. Inventory will be even lower in December and January - the normal seasonal pattern - and then start increasing in February.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we compare inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

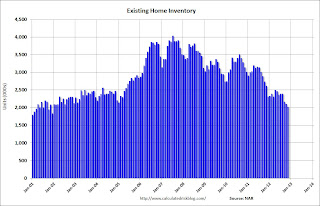

Click on graph for larger image.

Click on graph for larger image.

This graph shows inventory by month since 2004. In 2005 (dark blue columns), inventory kept rising all year - and that was a clear sign that the housing bubble was ending.

This year (dark red for 2012) inventory is at the lowest level for the month of November since 2000, and inventory is sharply below the level in November 2005 (not counting contingent sales). The months-of-supply has fallen to 4.8 months. Since months-of-supply uses Not Seasonally Adjusted (NSA) inventory, and Seasonally Adjusted (SA) sales, I expect months-of-supply to fall further over the next couple of months before increasing in February.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA in November (red column) are above last year. Sales are well below the bubble years of 2005 and 2006.

Sales NSA in November (red column) are above last year. Sales are well below the bubble years of 2005 and 2006.

Earlier:

• Existing Home Sales in November: 5.04 million SAAR, 4.8 months of supply

• Existing Home Sales graphs

Existing Home Sales in November: 5.04 million SAAR, 4.8 months of supply

by Calculated Risk on 12/20/2012 10:00:00 AM

The NAR reports: November Existing-Home Sales and Prices Maintain Uptrend

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, rose 5.9 percent to a seasonally adjusted annual rate of 5.04 million in November from a downwardly revised 4.76 million in October, and are 14.5 percent higher than the 4.40 million-unit pace in November 2011. Sales are at the highest level since November 2009 when the annual pace spiked at 5.44 million.

...

Total housing inventory at the end of November fell 3.8 percent to 2.03 million existing homes available for sale, which represents a 4.8-month supply 4 at the current sales pace; it was 5.3 months in October, and is the lowest housing supply since September of 2005 when it was 4.6 months.

Listed inventory is 22.5 percent below a year ago when there was a 7.1-month supply. Raw unsold inventory is now at the lowest level since December 2001 when there were 1.89 million homes on the market.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in November 2012 (5.04 million SAAR) were 5.9% higher than last month, and were 14.5% above the November 2011 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory declined to 2.03 million in November down from 2.11 million in October. This is the lowest level of inventory since December 2001. Inventory is not seasonally adjusted, and usually inventory decreases from the seasonal high in mid-summer to the seasonal lows in December and January.

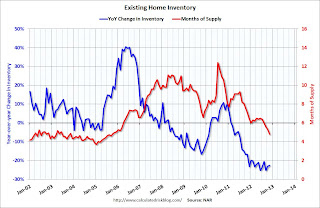

According to the NAR, inventory declined to 2.03 million in November down from 2.11 million in October. This is the lowest level of inventory since December 2001. Inventory is not seasonally adjusted, and usually inventory decreases from the seasonal high in mid-summer to the seasonal lows in December and January.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 22.5% year-over-year in November from November 2011. This is the 21st consecutive month with a YoY decrease in inventory.

Inventory decreased 22.5% year-over-year in November from November 2011. This is the 21st consecutive month with a YoY decrease in inventory.Months of supply declined to 4.8 months in November.

This was above expectations of sales of 4.90 million. For existing home sales, the key number is inventory - and the sharp year-over-year decline in inventory is a positive for housing. I'll have more later ...