by Calculated Risk on 12/04/2012 09:01:00 AM

Tuesday, December 04, 2012

CoreLogic: House Prices up 6.3% Year-over-year in October, Largest increase since 2006

Notes: This CoreLogic House Price Index report is for October. The recent Case-Shiller index release was for September. Case-Shiller is currently the most followed house price index, however CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® Home Price Index Marks Eighth Consecutive Month of Year-Over-Year Gains

Home prices nationwide, including distressed sales, increased on a year-over-year basis by 6.3 percent in October 2012 compared to October 2011. This change represents the biggest increase since June 2006 and the eighth consecutive increase in home prices nationally on a year-over-year basis. On a month-over-month basis, including distressed sales, home prices decreased by 0.2 percent in October 2012 compared to September 2012*. Decreases in month-over-month home prices are expected as the housing market enters the offseason.

...

Excluding distressed sales, home prices nationwide also increased on a year-over-year basis by 5.8 percent in October 2012 compared to October 2011. On a month-over-month basis excluding distressed sales, home prices increased 0.5 percent in October 2012 compared to September 2012, the eighth consecutive month-over-month increase. Distressed sales include short sales and real estate owned (REO) transactions.

The CoreLogic Pending HPI indicates that November 2012 home prices, including distressed sales, are expected to rise by 7.1 percent on a year-over-year basis from November 2011 and fall by 0.3 percent on a month-over-month basis from October 2012 as sales exhibit a seasonal slowdown going into the winter.

...

“The housing recovery that started earlier in 2012 continues to gain momentum," said Mark Fleming, chief economist for CoreLogic. “The recovery is geographically broad-based with almost all markets experiencing some appreciation. Sand and energy states continue to experience the most robust appreciation and some judicial foreclosure states are even recording increasing prices.”

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was down 0.2% in October, and is up 6.3% over the last year.

The index is off 27% from the peak - and is up 9.6% from the post-bubble low set in February (the index is NSA, so some of the increase is seasonal).

The second graph is from CoreLogic. The year-over-year comparison has been positive for eight consecutive months suggesting house prices bottomed earlier this year on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for eight consecutive months suggesting house prices bottomed earlier this year on a national basis (the bump in 2010 was related to the tax credit).This is the largest year-over-year increase since 2006.

Since this index is not seasonally adjusted, it was expected to decline on a month-to-month basis in October, and will probably stay negative on a month-to-month basis until the March 2013 report is released. The key for the next several months will be to watch the year-over-year change.

Monday, December 03, 2012

Housing: Inventory down 22% year-over-year in early December

by Calculated Risk on 12/03/2012 09:07:00 PM

Tuesday economic releases:

• At 10:00 AM ET, Trulia Price & Rent Monitors for November. This is the index from Trulia that uses asking prices adjusted both for the mix of homes listed for sale and for seasonal factors.

Here is another update using inventory numbers from HousingTracker / DeptofNumbers to track changes in listed inventory. Tom Lawler mentioned this last year.

According to the deptofnumbers.com for (54 metro areas), overall inventory is down 22% year-over-year and probably at the lowest level since the early '00s.

This graph shows the NAR estimate of existing home inventory through October (left axis) and the HousingTracker data for the 54 metro areas through early December.

Click on graph for larger image.

Click on graph for larger image.

Since the NAR released their revisions for sales and inventory last year, the NAR and HousingTracker inventory numbers have tracked pretty well.

On a seasonal basis, housing inventory usually bottoms in December and January and then increases through the summer. So inventory will probably decline a little further over the next month or so, before increasing again next year.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the early December listings, for the 54 metro areas, declined 21.7% from the same period last year.

HousingTracker reported that the early December listings, for the 54 metro areas, declined 21.7% from the same period last year.

The year-over-year declines will probably start to get smaller since inventory is already very low. It seems very unlikely we will see 20%+ year-over-year declines next summer, but it does appear that inventory will be very low in 2013.

U.S. Light Vehicle Sales at 15.5 million annual rate in November, Highest Since 2007

by Calculated Risk on 12/03/2012 03:45:00 PM

Based on an estimate from Autodata Corp, light vehicle sales were at a 15.54 million SAAR in November. That is up 15% from November 2011, and up 9% from the sales rate last month. This is the highest level of sales since December 2007.

This was above the consensus forecast of 15.0 million SAAR (seasonally adjusted annual rate), however some of the increase was a bounce back from Hurricane Sandy that negatively impacted sales at the end of October.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for November (red, light vehicle sales of 15.54 million SAAR from Autodata Corp).

Click on graph for larger image.

Click on graph for larger image.

Sales have averaged a 14.4 million annual sales rate this year through November, up from 12.7 million rate for the same period of 2011. Last year sales were depressed for several months (May through August) due to supply chain issues related to the tsunami in Japan.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

This shows the huge collapse in sales in the 2007 recession.

Most (or all) of the month-to-month decline in October was related to Hurricane Sandy, and some of the sharp increase this month was a bounce back.

CoreLogic: 58,000 Completed Foreclosures in October

by Calculated Risk on 12/03/2012 01:59:00 PM

From CoreLogic: CoreLogic® Reports 58,000 Completed Foreclosures in October

CoreLogic ... today released its National Foreclosure Report for October that provides data on completed U.S. foreclosures and the overall foreclosure inventory. According to CoreLogic, there were 58,000 completed foreclosures in the U.S. in October 2012, down from 70,000 in October 2011 representing a year-over-year decrease of 17 percent. On a month-over-month basis, completed foreclosures fell from 77,000* in September 2012 to the current 58,000, representing a decrease of 25 percent. As a basis of comparison, prior to the decline in the housing market in 2007, completed foreclosures averaged 21,000 per month between 2000 and 2006. Completed foreclosures are an indication of the total number of homes actually lost to foreclosure. Since the financial crisis began in September 2008, there have been approximately 3.9 million completed foreclosures across the country.Note: The foreclosure inventory reported by CoreLogic is lower than the number reported by LPS of 3.61% of mortgages or 1.8 million in foreclosure.

Approximately 1.3 million homes, or 3.2 percent of all homes with a mortgage, were in the national foreclosure inventory as of October 2012 compared to 1.5 million, or 3.6 percent, in October 2011. Month-over-month, the national foreclosure inventory was down 1.3 percent from September 2012 to October 2012. The foreclosure inventory is the share of all mortgaged homes in any stage of the foreclosure process.

...

“As a result of completed foreclosures and alternative disposition methods, the foreclosure inventory has declined by 9 percent year-to-date. This is good news for housing markets as we look forward to 2013,” said Mark Fleming, chief economist for CoreLogic.

Many observers expected a "surge" in foreclosures this year, but that hasn't happened. However there are still a large number of properties in the foreclosure inventory in some states:

The five states with the highest foreclosure inventory as a percentage of all mortgaged homes were: Florida (11.1 percent), New Jersey (7.7 percent), New York (5.3 percent), Illinois (5.0 percent) and Nevada (4.8 percent).

Construction Spending increased in October

by Calculated Risk on 12/03/2012 11:27:00 AM

Three key construction spending themes:

• Residential construction is usually the largest category for construction spending, but there was a huge collapse in spending following the housing bubble (as expected). Looking forward, private residential construction spending will be the largest category again very soon - but spending is still very low (at 1998 levels not adjusted for inflation).

• Private non-residential construction spending picked up last year mostly due to energy spending (power and electric), but spending on office buildings, hotels and malls is still very low.

• Public construction spending declined for several years, but the decline appears to be mostly over. Note: Public construction spending is mostly state and local spending, and the drag from state and local cutbacks appears to be ending.

The Census Bureau reported that overall construction spending increased in October:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during October 2012 was estimated at a seasonally adjusted annual rate of $872.1 billion, 1.4 percent above the revised September estimate of $860.4 billion. The October figure is 9.6 percent above the October 2011 estimate of $795.7 billion.Both private and public construction spending increased:

Spending on private construction was at a seasonally adjusted annual rate of $592.1 billion, 1.6 percent above the revised September estimate of $582.7 billion. ... In October, the estimated seasonally adjusted annual rate of public construction spending was $280.1 billion, 0.8 percent above the revised September estimate of $277.7 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 57% below the peak in early 2006, and up 32% from the post-bubble low. Non-residential spending is 28% below the peak in January 2008, and up about 31% from the recent low.

Public construction spending is now 14% below the peak in March 2009 and just above the post-bubble low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is now up 21%. Non-residential spending is also up 11% year-over-year mostly due to energy spending (power and electric). Public spending is down 1% year-over-year.

ISM Manufacturing index declines in November to 49.5, Lowest since July 2009

by Calculated Risk on 12/03/2012 10:00:00 AM

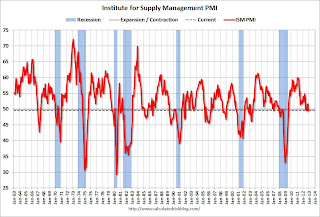

The ISM manufacturing index indicated contraction in November. PMI was at 49.5% in November, down from 51.7% in October. The employment index was at 48.4%, down from 52.1%, and the new orders index was at 50.3%, down from 54.2%.

From the Institute for Supply Management: November 2012 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector contracted in November following two months of modest expansion, while the overall economy grew for the 42nd consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The PMI™ registered 49.5 percent, a decrease of 2.2 percentage points from October's reading of 51.7 percent, indicating contraction in manufacturing for the fourth time in the last six months. This month's PMI™ reading reflects the lowest level since July 2009 when the PMI™ registered 49.2 percent. The New Orders Index registered 50.3 percent, a decrease of 3.9 percentage points from October, indicating growth in new orders for the third consecutive month. The Production Index registered 53.7 percent, an increase of 1.3 percentage points, indicating growth in production for the second consecutive month. The Employment Index registered 48.4 percent, a decrease of 3.7 percentage points, which is the index's lowest reading since September 2009 when the Employment Index registered 47.8 percent. The Prices Index registered 52.5 percent, reflecting a decrease of 2.5 percentage points. Comments from the panel this month generally indicate that the second half of the year continues to show a slowdown in demand; respondents also express concern over how and when the fiscal cliff issue will be resolved."

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was well below expectations of 51.7% and suggests manufacturing contracted in November.

Unofficial Problem Bank list declines to 856 Institutions

by Calculated Risk on 12/03/2012 08:44:00 AM

CR Note: Usually I post this on Saturday - sorry for the delay. The first unofficial problem bank list was published in August 2009 with 389 institutions. The number of unofficial problem banks grew steadily and peaked at 1,002 institutions on June 10, 2011. The list has been declining recently.

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Nov 30, 2012.

Changes and comments from surferdude808:

This week, the FDIC released its enforcement actions through October but did not release industry results for the third quarter. Changes to the Unofficial Problem Bank List include six removals and five additions that leave the list at 856 institutions with assets of $326.4 billion. A year ago, the list held 980 institutions with assets of $400.5 billion. For the month of November, the list declined by eight institutions after 13 action terminations, three failures, two unassisted mergers, and 10 additions.CR Note: The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public. (CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.)

The six removals were for action terminations against Johnson Bank, Racine, WI ($3.8 billion); NexBank, SSB, Dallas, TX ($607 million); Ohana Pacific Bank, Honolulu, HI ($94 million Ticker: OHPB): Lead Bank, Garden City, MO ($84 million); Prosper Bank, Prosper, TX ($64 million); and Millennium Bank, Des Plaines, IL ($44 million).

Additions this week were Inland Bank and Trust, Oak Brook, IL ($1.3 billion); Cornerstone Bank, Moorestown, NJ ($351 million Ticker: CFIC); Devon Bank, Chicago, IL ($250 million); First Citizens Bank of Georgia, Dawsonville, GA ($95 million); and Community State Bank, Norwalk, WI ($27 million).

Look for the FDIC to release industry third quarter results this Tuesday.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

When the list was increasing, the official and "unofficial" counts were about the same. Now with the number of problem banks declining, the unofficial list is lagging the official list. This probably means regulators are changing the CAMELS rating on some banks before terminating the formal enforcement actions.

Weekend:

• Summary for Week Ending Nov 30th

• Schedule for Week of Dec 2nd

Sunday, December 02, 2012

Monday: ISM Manufacturing, Auto Sales, Construction Spending

by Calculated Risk on 12/02/2012 08:43:00 PM

This will be another week of sausage making - uh, "fiscal cliff", or more accurately "austerity slope" - negotiations. The key question for the economy is: When and how much austerity will the US fiscal authorities enact?

My guess is an agreement will be reached in early January, and Federal austerity will subtract 1% to 1.5% from GDP in 2013. Note: There is no drop dead date – despite the silly countdown timers on some sites.

Monday economic releases:

• At 10:00 AM ET, the ISM Manufacturing Index for November will be released. The consensus is for be PMI to be unchanged at 51.7. (above 50 is expansion).

• Also at 10:00 AM, the Construction Spending for October. The consensus is for a 0.4% increase in construction spending.

• All day: Light vehicle sales for November. The consensus is for light vehicle sales to increase to 15.0 million SAAR in November (Seasonally Adjusted Annual Rate) from 14.2 million in October (October sales were impacted by Hurricane Sandy).

The Asian markets are mostly green tonight, with the Nikkei up 0.4% and the Shanghai Composite is up 0.8%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 2 and DOW futures are up 20.

Oil prices are down slightly with WTI futures at $88.82 per barrel and Brent at $111.18 per barrel.

Weekend:

• Summary for Week Ending Nov 30th

• Schedule for Week of Dec 2nd

Four more questions this week for the December economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Report: Germany to eventually consider Greek Losses

by Calculated Risk on 12/02/2012 03:12:00 PM

From the Financial Times: Merkel prepared to consider Greek losses

"If Greece one day handles its revenues again without taking on new debt, then we must take a look at the situation and assess it,” the [Chancellor Angela Merkel] told Germany’s Bild am Sonntag newspaper ... even Wolfgang Schäuble, Germany’s finance minister, last week hinted [a haircut on official debt] could come eventually.Eventually some of the official debt will have to be forgiven. This will not happen until after the German election next September, and probably not until 2014 at the earliest.

excerpt with permission

Note: Long term readers probably remember the "Lord of the Dark Matter" who provided excellent insights on the derivative market. We discussed Europe about a week ago, and his view was a "short of full blown restructuring, there is no solution". Maybe - just maybe - the Germans are starting to realize that there will have to an official restructuring for Greece - and that would be a positive step.

Impact of Sandy on Employment, November Contest Winners

by Calculated Risk on 12/02/2012 09:19:00 AM

A key question for the November employment report, to be released Friday, is the impact of Hurricane Sandy. Sandy hit New York city on October 29th.

Hurricane Katrina hit New Orleans on August 29, 2005, so it might be helpful to look back at the impact on employment in the months following Katrina for some clues. Here is the BLS report for September 2005 with a note on Katrina (I expect a note in the November report related to Sandy). Katrina was a much larger storm, and large areas were devastated, but Sandy struck an area with a much larger population - so the impact on employment might be similar.

The following table shows the average number of jobs added for the four months prior to the storm (both storms hit at the end of a month - after the BLS reference period). Following Katrina, employment gains dropped sharply for the next two months. Note: September 2005 (the first month following Katrina) was originally reported at -35,000, but was eventually revised up to +66,000.

| Total Nonfarm Jobs, 1 Month Net Change (000) | ||

|---|---|---|

| Katrina | Sandy | |

| Average (4 previous months) | 245 | 173 |

| Month After Storm | 66 | |

| 2nd Month After | 80 | |

| Average 3rd and 4th Month | 247 | |

The consensus is for an increase of 80,000 non-farm payroll jobs in November 2012.

Here are the winners for the November economic question contest:

1st: Terry Oldham

2nd: Pat MacAuley

3rd tie: Alexander Petrov, Daniel Brawdy

Congratulations all!

Yesterday:

• Summary for Week Ending Nov 30th

• Schedule for Week of Dec 2nd