by Calculated Risk on 10/29/2012 12:20:00 PM

Monday, October 29, 2012

No Decision yet on delaying October Jobs Report

From the WSJ: Labor Department May Delay Jobs Report

The U.S. Labor Department on Monday said it hasn’t made a decision yet on whether to delay Friday’s October jobs report ... The U.S. Census Bureau also said it hasn’t made a decision on whether to delay economic reports it plans to release this week, including construction spending on Thursday and factory orders on Friday.This is minor compared to other storm related issues, but I'll check up on this. They will probably know any schedule changes by Wednesday. Stay safe.

Update: For anyone interested, the WSJ online is free today.

Dallas Fed: Regional Manufacturing Activity expands slowly in October

by Calculated Risk on 10/29/2012 10:30:00 AM

From the Dallas Fed: Texas Manufacturing Activity Expands but at a Slower Pace

Texas factory activity increased in October, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, dipped from 10 to 7.9, indicating slightly slower growth.This was at expectations of a reading of 2 for the general business activity index. Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Most other measures of current manufacturing activity also suggested growth in October, although new orders declined. The capacity utilization index edged up from 9.3 to 11.4, with more than one-quarter of manufacturers noting an increase. The shipments index held steady at 4.7, suggesting shipments rose at about the same pace as in September. The new orders index fell from 5.3 to –4.5, reaching its lowest level this year and indicating a decrease in demand.

Perceptions of general business conditions improved slightly in October. The general business activity index rose to 1.8, registering its first positive reading since June. The company outlook index was positive for the sixth month in a row and remained unchanged at 2.4.

Labor market indicators reflected slow but steady labor demand growth and shrinking workweeks. The employment index was 5.2 in October, largely unchanged from last month but well below the higher levels seen earlier in the year. About 15 percent of firms reported hiring new workers, while 10 percent reported layoffs. The hours worked index fell back into negative territory with a reading of –5.9, down from 2.8 in September.

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through October), and five Fed surveys are averaged (blue, through October) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through September (right axis).

The ISM index for October will be released Thursday, Nov 1st, and these surveys suggest another weak reading close to 50.

Personal Income increased 0.4% in September, Spending increased 0.8%

by Calculated Risk on 10/29/2012 08:30:00 AM

The BEA released the Personal Income and Outlays report for September:

Personal income increased $48.1 billion, or 0.4 percent ... in September, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $87.9 billion, or 0.8 percent.The following graph shows real Personal Consumption Expenditures (PCE) through September (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.4 percent in September, compared with an increase of 0.1 percent in August. ... The price index for PCE increased 0.4 percent in September, the same increase as in August. The PCE price index, excluding food and energy, increased 0.1 percent in September, the same increase as in August.

...

Personal saving -- DPI less personal outlays -- was $395.0 billion in September, compared with $445.1 billion in August. The personal saving rate -- personal saving as a percentage of disposable personal income -- was 3.3 percent in September, compared with 3.7 percent in August.

Click on graph for larger image.

Click on graph for larger image.This graph shows real PCE by month for the last few years. The dashed red lines are the quarterly levels for real PCE. The September pickup in PCE is clear.

A key point is the PCE price index has only increased 1.7% over the last year, and core PCE is up only 1.7%. In August, core PCE increased at a 1.4% annualized rate.

Sunday, October 28, 2012

Monday: Personal Income and Spending, Senior Loan Officer Survey

by Calculated Risk on 10/28/2012 09:50:00 PM

UPDATE: US Markets closed on Monday. From NBC abd Reuters: NYSE and Nasdaq to close on Monday due to Hurricane Sandy

U.S. stock trading will be closed on Monday and possibly Tuesday in response to Hurricane Sandy, NYSE Euronext said late on Sunday.To all in the path of Sandy: Stay safe and dry!

NYSE Euronext, which runs the New York Stock Exchange, had previously said that electronic trading would remain open and that only the exchange's trading floor would close.

In a statement, the company said that "the dangerous conditions developing as a result of Hurricane Sandy will make it extremely difficult to ensure the safety of our people and communities, and safety must be our first priority."

Nasdaq said it would also close all U.S. equity and derivatives exchanges, as well as the Nasdaq/FINRA TRF on Monday, CNBC reported late Sunday night. It is likley the markets will also be closed on Tuesday, according to the statement from the exchange.

Monday:

• At 8:30 AM ET, the Personal Income and Outlays report for September is expected to be released. The consensus is for a 0.4% increase in personal income in September, and for 0.6% increase in personal spending. And for the Core PCE price index to increase 1.7% year-over-year.

• At 10:30 AM, the Dallas Fed Manufacturing Survey for October. The consensus is for a reading of 2, up from -0.9 last month. This is the last of the regional survey for October.

• At 2:00 PM, The Federal Reserve is expect to release the October 2012 Senior Loan Officer Opinion Survey on Bank Lending Practices.

• Expected: the National Multi Housing Council (NMHC) Quarterly Apartment Survey. This is a key survey for apartment vacancy rates and rents.

The Asian markets are mixed tonight, with the Nikkei up 0.3%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 2 and DOW futures are down 10.

Oil prices are down recently with WTI futures at $86.28 per barrel and Brent down to $110.12 per barrel.

Weekend:

• Summary for Week Ending Oct 26th

• Schedule for Week of Oct 28th

Three more questions this week for the October economic prediction contest and four question for the November contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Sandy: D.C. Government Offices closed to Public, NYSE Trading Floor Closed

by Calculated Risk on 10/28/2012 06:15:00 PM

Stay safe! Here is the National Hurricane Center website.

From the U.S. Office of Personnel Management: Monday, October 29, 2012, FEDERAL OFFICES in the Washington, DC, area are CLOSED TO THE PUBLIC.

From the NY Times: N.Y.S.E. Plans to Close Its Trading Floor

The New York Stock Exchange plans to close its trading floor on Monday as Hurricane Sandy approaches, in its first weather-related closure in 27 years. Trading operations will be conducted through its electronic market instead.I think the economic releases scheduled for Monday will still be released (Personal Income and Spending, Senior Loan Officer Survey), but there could be delays.

...

Clients should not notice any differences in the way their orders are executed, Duncan L. Niederauer, the chief executive of NYSE Euronext, said by telephone on Sunday.

Yesterday:

• Summary for Week Ending Oct 26th

• Schedule for Week of Oct 28th

The S&P 500 change following Presidential Elections

by Calculated Risk on 10/28/2012 01:45:00 PM

For fun on a Sunday: I've been asked frequently how investors will react to the election. First, every election is different. Sometimes it is obvious who is going to win, and the election results are completely expected (like Reagan in 2004 or Clinton in 1996). Other times the election is close (this election is close although I expect President Obama to be reelected).

Sometimes the economy is clearly headed into recession like in 2008. The 2000 election was during the ongoing decline following the stock bubble, and the election was especially unsettling because the Supreme Court made the final decision.

There are always some partisan analysts who predict doom if their candidate doesn't win (see Bruce Bartlett's Partisan Bias and Economic Forecasts). But any "doom" related to the election will be in the intermediate or long term, not in 2013.

The following graph shows the change in the S&P 500 from election day through the end of the year for all elections since 1952. Note: The number of trading days varied mostly because of the timing of the election.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The two worst performing years - no surprise - were 2000 and 2008. The 2000 election followed the stock market bubble, and the economy was collapsing in 2008.

The other elections with a slight negative change were 1956, 1964, and 1984. These were all presidents being reelected and the results were obvious in advance: Eisenhower won reelection with 57.4% of the vote, Johnson won with 61.1%, and Reagan with 58.8%.

But most of the time the market has increased following the election, and the median increase from election day to the end of the year was 3.6%. Every election is different and this is NOT investment advice!

Some "Principal Relief" on Fannie Mae and Freddie Mac Loans

by Calculated Risk on 10/28/2012 09:44:00 AM

From Kathleen Pender at the San Francisco Chronicle: Principal relief for stressed homeowners

A limited number of underwater homeowners in California will soon be able to get principal reductions of up to $100,000 apiece on Fannie Mae and Freddie Mac loans through the federally funded Keep Your Home California program.This is a fairly small program, but this will provide some principal relief for a few borrowers.

...

... in mid-September, Fannie and Freddie told servicers they could immediately begin accepting money for principal reductions from programs financed by the U.S. Treasury's Hardest Hit Fund, including Keep Your Home California.

Fannie's and Freddie's willingness to accept money from Hardest Hit Funds does not signal a change of heart on the part of their regulator, the Federal Housing Finance Agency. ... Fannie Mae spokesman Andrew Wilson says, "This in fact for us is not a principal reduction. It's a principal payment. It's as if your grandmother wanted to give you $50,000 to apply to your mortgage. In this case, the grandmother, as it were, was the Hardest Hit Fund."

...

The fund was set up in 2010 to provide $17 billion in homeowner assistance to 18 states hardest hit by the housing crisis. ... The California Housing Finance Agency set up four programs under the Keep Your Home name to distribute California's share - $1.9 billion. It allocated $772 million to principal reduction ...

...

To qualify for principal reduction in California, homeowners must live in the home, owe more than it is worth, be of low-to-moderate income, and be delinquent or have some hardship that puts them in imminent risk of default.

...

To date, 2,511 homeowners have received principal reductions totaling $185.6 million - or roughly $74,000 apiece.

Earlier:

• Summary for Week Ending Oct 26th

• Schedule for Week of Oct 28th

Saturday, October 27, 2012

Schedule for Week of Oct 28th

by Calculated Risk on 10/27/2012 03:55:00 PM

Earlier:

• Summary for Week Ending Oct 26th

The key report this week is the October employment report to be released on Friday. Other key reports include the August Case-Shiller house price index on Tuesday, October auto sales on Thursday, and the October ISM manufacturing index, also on Thursday.

There are two interesting surveys that will be released on Monday; the Fed's Senior Loan Officer Survey that might show some slight increase in loan demand or loosening of lending standards, and the NMHC apartment survey that tends to lead other indicators of changes in the apartment market.

10:30 AM: Dallas Fed Manufacturing Survey for October. This is the last of the regional survey for October.

2:00 PM: The October 2012 Senior Loan Officer Opinion Survey on Bank Lending Practices from the Federal Reserve.

Expected: National Multi Housing Council (NMHC) Quarterly Apartment Survey. This is a key survey for apartment vacancy rates and rents.

9:00 AM: S&P/Case-Shiller House Price Index for August. Although this is the August report, it is really a 3 month average of June, July and August.

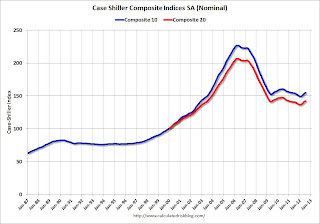

9:00 AM: S&P/Case-Shiller House Price Index for August. Although this is the August report, it is really a 3 month average of June, July and August. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through May 2012 (the Composite 20 was started in January 2000).

The consensus is for a 2.1% year-over-year increase in the Composite 20 prices (NSA) for August. The Zillow forecast is for the Composite 20 to increase 1.7% year-over-year, and for prices to increase 0.2% month-to-month seasonally adjusted. The CoreLogic index increased 0.2% in August (NSA).

10:00 AM: Conference Board's consumer confidence index for October. The consensus is for an increase to 72.0 from 70.3 last month.

10:00 AM: Q3 Housing Vacancies and Homeownership report from the Census Bureau. This report is frequently mentioned by analysts and the media to track the homeownership rate, and the homeowner and rental vacancy rates. However, based on the initial evaluation, it appears the vacancy rates are too high. The Census Bureau is looking into the differences between the HVS, the ACS, and the decennial Census, and until the issues are resolved, this survey probably shouldn't be used to estimate the excess vacant housing supply.

9:45 AM: Chicago Purchasing Managers Index for October. The consensus is for an increase to 51.7, up from 49.7 in September.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 365 thousand from 369 thousand.

8:30 AM: Productivity and Costs for Q3. The consensus is for a 1.3% increase in unit labor costs.

10:00 AM ET: ISM Manufacturing Index for October.

10:00 AM ET: ISM Manufacturing Index for October. Here is a long term graph of the ISM manufacturing index. The ISM index indicated expansion in September, after three consecutive months of contraction. The consensus is for a decrease to 51.0, up from 51.5 in September. (above 50 is expansion).

10:00 AM: Construction Spending for September. The consensus is for a 0.7% increase in construction spending.

All day: Light vehicle sales for October. The consensus is for light vehicle sales to increase to 15.0 million SAAR in October (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the September sales rate.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the September sales rate. TrueCar is forecasting:

The October 2012 forecast translates into a Seasonally Adjusted Annualized Rate (“SAAR”) of 14.9 million new car sales, up from 13.3 million in October 2011 and down from 14.94 million in September 2012Edmunds.com is forecasting:

Edmunds.com ... forecasts that 1,132,878 new cars will be sold in October for an estimated Seasonally Adjusted Annual Rate (SAAR) this month of 14.8 million light vehicles.

8:30 AM: Employment Report for October. The consensus is for an increase of 120,000 non-farm payroll jobs in October; there were 114,000 jobs added in September.

8:30 AM: Employment Report for October. The consensus is for an increase of 120,000 non-farm payroll jobs in October; there were 114,000 jobs added in September.The consensus is for the unemployment rate to increase to 7.9% in October, up from 7.8% in September.

This second employment graph shows the percentage of payroll jobs lost during post WWII recessions through September.

The economy has added 5.2 million private sector jobs since employment bottomed in February 2010 including preliminary benchmark revision (4.6 million total jobs added including all the public sector layoffs).

The economy has added 5.2 million private sector jobs since employment bottomed in February 2010 including preliminary benchmark revision (4.6 million total jobs added including all the public sector layoffs).There are still 3.7 million fewer private sector jobs now than when the recession started in 2007 (including benchmark revision).

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for September. The consensus is for a 4.0% decrease in orders.

Unofficial Problem Bank list declines to 864 Institutions

by Calculated Risk on 10/27/2012 01:11:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Oct 26, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

The FDIC released its actions through September 2012 and closed a bank this week. There were five removals and four additions leaving the Unofficial Problem Bank List with 864 institutions with assets of $330.4 billion. A year ago, the list had 985 institutions with assets of $406.6 billion. For the month, changes included 11 action terminations, four failures, one unassisted merger, and six additions. Overall, it was a quiet month as it was the fewest action terminations since February 2012 and the fewest additions since the publication of the list.CR Note: The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public. (CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.)

Actions were terminated against Metro Bank, Lemoyne, PA ($2.4 billion Ticker: METR); Heritage Bank of Central Illinois, Trivoli, IL ($308 million); Minnwest Bank South, Tracy, MN ($213 million); and Freedom Bank, Sterling, IL ($76 million). The failure was Nova Bank, Berwyn, PA ($483 million), which the FDIC could not find a buyer for.

The additions were First State Financial, Inc., Pineville, KY ($395 million); Golden Eagle Community Bank, Woodstock, IL ($152 million); Signature Bank of Georgia, Sandy Springs, GA ($136 million); and Talbot State Bank, Woodland, GA ($72 million). Who would have guessed there are still some unidentified problem banks in Georgia.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

When the list was increasing, the official and "unofficial" counts were about the same. Now, with the number of problem banks declining, the unofficial list is lagging the official list. This probably means regulators are changing the CAMELS rating on some banks before terminating the formal enforcement actions.

Earlier:

• Summary for Week Ending Oct 26th

Summary for Week Ending Oct 26th

by Calculated Risk on 10/27/2012 08:09:00 AM

There was some disappointing data last week - mostly from some regional manufacturing surveys, but also mortgage delinquencies increased - but overall this was the fourth week in a row with somewhat better than expected data, and this suggests a little pickup in economic activity.

Once again housing beat expectations. New home sales increased to 389,000, a pace well above the 306,000 sales in 2011, and the highest level since the tax credit related spike in April 2010. Q3 GDP was weak, but slightly above expectations - and residential investment was a fairly strong contributor to growth.

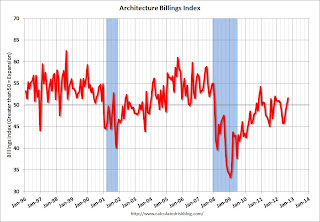

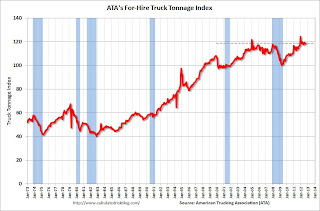

The Architecture Billings Index is now showing expansion (an indicator for commercial real estate including apartments). And the trucking index increased in September (although this index has been moving sideways this year).

On the downside, the Richmond and Kansas City Fed manufacturing surveys were weak and indicated contraction in October. The recent trend is continuing: housing is improving, but manufacturing is struggling.

Here is a summary of last week in graphs:

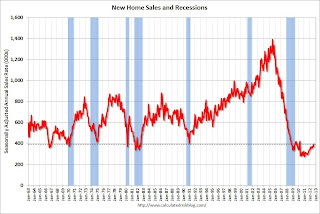

• New Home Sales at 389,000 SAAR in September

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The Census Bureau reported New Home Sales in September were at a seasonally adjusted annual rate (SAAR) of 389 thousand. This was up from a revised 368 thousand SAAR in August (revised down from 373 thousand). This is the highest level since April 2010 (tax credit related bounce).

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Starting in 1973 the Census Bureau broke inventory down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale was at a record low 38,000 units in September. The combined total of completed and under construction is just above the record low since "under construction" is starting to increase.

Even though sales are still very low, new home sales have clearly bottomed. New home sales have averaged 364 thousand SAAR over the first 9 months of 2012, after averaging under 300 thousand for the previous 18 months. Sales are finally above the lows for previous recessions too.

This was slightly above expectations of 385,000, and was another fairly solid report. This indicates an ongoing recovery in residential investment.

• Real GDP increased 2.0% annual rate in Q3

This graph shows the quarterly real GDP growth (at an annual rate) for the last 30 years.

This graph shows the quarterly real GDP growth (at an annual rate) for the last 30 years.The Red column (and dashed line) is the advance estimate for Q3 GDP.

The Q3 GDP report was weak, with 2.0% annualized real GDP growth, but slightly better than expected. Final demand increased in Q3 as personal consumption expenditures increased at a 2.0% annual rate (up from 1.5% in Q2), and residential investment increased at a 14.4% annual rate (up from 8.5% in Q2).

Investment in equipment and software was flat in Q3, and investment in non-residential structures was negative. However, it appears the drag from state and local governments will end soon (after declining for 3 years).

The next graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 6 quarters (through Q3 2012).

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 6 quarters (through Q3 2012).However the drag from state and local governments is ongoing, although the drag in Q3 was very small. State and local governments have been a drag on GDP for twelve consecutive quarters. Although not as large a negative as the worst of the housing bust (and much smaller spillover effects), this decline has been relentless and unprecedented. The good news is the drag appears to be ending.

In real terms, state and local government spending is now back to 2001 levels, even with a larger population.

Residential Investment as a percent of GDP is up from the record lows during the housing bust. Usually RI bounces back quickly following a recession, but this time there is a wide bottom because of the excess supply of existing vacant housing units.

Residential Investment as a percent of GDP is up from the record lows during the housing bust. Usually RI bounces back quickly following a recession, but this time there is a wide bottom because of the excess supply of existing vacant housing units. Last year the increase in RI was mostly from multifamily and home improvement investment. Now the increase is from most categories including single family. I'll break down Residential Investment (RI) into components after the GDP details are released this coming week. Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

The key story is that residential investment is continuing to increase, and I expect this to continue (although the recovery in RI will be sluggish compared to previous recoveries). Since RI is the best leading indicator for the economy, this suggests no recession this year or in 2013 (with the usual caveats about Europe and policy errors in the US).

• AIA: Architecture Billings Index increased in September

This graph shows the Architecture Billings Index since 1996. The index was at 51.6 in September, up from 50.2 in August. Anything above 50 indicates expansion in demand for architects' services.

This graph shows the Architecture Billings Index since 1996. The index was at 51.6 in September, up from 50.2 in August. Anything above 50 indicates expansion in demand for architects' services.This increase is mostly being driven by demand for design of multi-family residential buildings - and this suggests there are more apartments coming (there are already quite a few apartments under construction). Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests increase in CRE investment next year (it will be some time before investment in offices and malls increases).

• ATA Trucking Index increased in September

From ATA: ATA Truck Tonnage Index Rose 0.4% in September

From ATA: ATA Truck Tonnage Index Rose 0.4% in SeptemberNote: ATA Chief Economist Bob Costello says, for trucking, the pickup in housing is offsetting the "flattening in manufacturing output".

Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index. The index is above the pre-recession level and up 2.4% year-over-year - but has been mostly moving sideways in 2012.

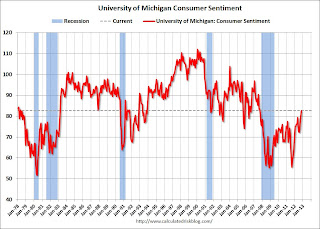

• Final October Consumer Sentiment at 82.6

The final Reuters / University of Michigan consumer sentiment index for October declined to 82.6 from the preliminary reading of 83.1, and was up from the September reading of 78.3.

The final Reuters / University of Michigan consumer sentiment index for October declined to 82.6 from the preliminary reading of 83.1, and was up from the September reading of 78.3.This was slightly below the consensus forecast of 83.1. Overall sentiment is still weak - probably due to a combination of the high unemployment rate and the sluggish economy - but consumer sentiment has been improving.