by Calculated Risk on 10/14/2012 09:13:00 AM

Sunday, October 14, 2012

Bernanke: On the international impact of US accommodative Monetary Policy

Bernanke's conclusion is: [US monetary] "policy not only helps strengthen the U.S. economic recovery, but by boosting U.S. spending and growth, it has the effect of helping support the global economy as well."

From Fed Chairman Ben Bernanke: U.S. Monetary Policy and International Implications.

Although the monetary accommodation we are providing is playing a critical role in supporting the U.S. economy, concerns have been raised about the spillover effects of our policies on our trading partners. In particular, some critics have argued that the Fed's asset purchases, and accommodative monetary policy more generally, encourage capital flows to emerging market economies. These capital flows are said to cause undesirable currency appreciation, too much liquidity leading to asset bubbles or inflation, or economic disruptions as capital inflows quickly give way to outflows.Update note: Emphasis added.

I am sympathetic to the challenges faced by many economies in a world of volatile international capital flows. And, to be sure, highly accommodative monetary policies in the United States, as well as in other advanced economies, shift interest rate differentials in favor of emerging markets and thus probably contribute to private capital flows to these markets. I would argue, though, that it is not at all clear that accommodative policies in advanced economies impose net costs on emerging market economies, for several reasons.

First, the linkage between advanced-economy monetary policies and international capital flows is looser than is sometimes asserted. Even in normal times, differences in growth prospects among countries--and the resulting differences in expected returns--are the most important determinant of capital flows. The rebound in emerging market economies from the global financial crisis, even as the advanced economies remained weak, provided still greater encouragement to these flows. Another important determinant of capital flows is the appetite for risk by global investors. Over the past few years, swings in investor sentiment between "risk-on" and "risk-off," often in response to developments in Europe, have led to corresponding swings in capital flows. All told, recent research, including studies by the International Monetary Fund, does not support the view that advanced-economy monetary policies are the dominant factor behind emerging market capital flows.1 Consistent with such findings, these flows have diminished in the past couple of years or so, even as monetary policies in advanced economies have continued to ease and longer-term interest rates in those economies have continued to decline.

Second, the effects of capital inflows, whatever their cause, on emerging market economies are not predetermined, but instead depend greatly on the choices made by policymakers in those economies. In some emerging markets, policymakers have chosen to systematically resist currency appreciation as a means of promoting exports and domestic growth. However, the perceived benefits of currency management inevitably come with costs, including reduced monetary independence and the consequent susceptibility to imported inflation. In other words, the perceived advantages of undervaluation and the problem of unwanted capital inflows must be understood as a package--you can't have one without the other.

Of course, an alternative strategy--one consistent with classical principles of international adjustment--is to refrain from intervening in foreign exchange markets, thereby allowing the currency to rise and helping insulate the financial system from external pressures. Under a flexible exchange-rate regime, a fully independent monetary policy, together with fiscal policy as needed, would be available to help counteract any adverse effects of currency appreciation on growth. The resultant rebalancing from external to domestic demand would not only preserve near-term growth in the emerging market economies while supporting recovery in the advanced economies, it would redound to everyone's benefit in the long run by putting the global economy on a more stable and sustainable path.

Finally, any costs for emerging market economies of monetary easing in advanced economies should be set against the very real benefits of those policies. The slowing of growth in the emerging market economies this year in large part reflects their decelerating exports to the United States, Europe, and other advanced economies. Therefore, monetary easing that supports the recovery in the advanced economies should stimulate trade and boost growth in emerging market economies as well. In principle, depreciation of the dollar and other advanced-economy currencies could reduce (although not eliminate) the positive effect on trade and growth in emerging markets. However, since mid-2008, in fact, before the intensification of the financial crisis triggered wide swings in the dollar, the real multilateral value of the dollar has changed little, and it has fallen just a bit against the currencies of the emerging market economies.

Conclusion

To conclude, the Federal Reserve is providing additional monetary accommodation to achieve its dual mandate of maximum employment and price stability. This policy not only helps strengthen the U.S. economic recovery, but by boosting U.S. spending and growth, it has the effect of helping support the global economy as well. Assessments of the international impact of U.S. monetary policies should give appropriate weight to their beneficial effects on global growth and stability.

Saturday, October 13, 2012

Unofficial Problem Bank list declines to 872 Institutions

by Calculated Risk on 10/13/2012 06:00:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Oct 13, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

As anticipated, minor changes were made to the Unofficial Problem Bank List this week. The First National Bank of Southern Kansas, Mount Hope, KS ($67 million) merged on an unassisted basis causing its removal. The other change was the Federal Reserve terminating the Prompt Corrective Action order against Sunrise Bank, Cocoa Beach, FL ($100 million).Earlier:

The list holds 872 institutions with assets of $334.9 billion. A year ago, the list had 979 institutions with assets of $403.8 billion.

Next week we anticipate the OCC will release its actions through mid-September 2012. Also, the FDIC will likely be back in the closure business before the month is over.

• Summary for Week Ending Oct 12th

• Schedule for Week of Oct 14th

Schedule for Week of Oct 14th

by Calculated Risk on 10/13/2012 01:05:00 PM

Earlier:

• Summary for Week Ending Oct 12th

This will be a very busy week for economic data. There are three key housing reports to be released this week: October homebuilder confidence on Tuesday, September housing starts on Wednesday, and September existing home sales on Friday.

Another key report is retail sales for September. For manufacturing, the October NY Fed (Empire state) and Philly Fed surveys, and the September Industrial Production and Capacity Utilization report will be released this week.

On prices, CPI for September will be released on Tuesday.

8:30 AM ET: Retail sales for September will be released.

8:30 AM ET: Retail sales for September will be released. This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales are up 22.7% from the bottom, and now 7.3% above the pre-recession peak (not inflation adjusted).

The consensus is for retail sales to increase 0.7% in September, and for retail sales ex-autos to increase 0.5%.

8:30 AM: NY Fed Empire Manufacturing Survey for October. The consensus is for a reading of minus 3, up from minus 10.4 in September (below zero is contraction).

10:00 AM: Manufacturing and Trade: Inventories and Sales for August (Business inventories). The consensus is for 0.5% increase in inventories.

8:30 AM: Consumer Price Index for September. The consensus is for CPI to increase 0.5% in September and for core CPI to increase 0.2%.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for September.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for September.This shows industrial production since 1967.

The consensus is for Industrial Production to increase 0.2% in September, and for Capacity Utilization to increase to 78.3%.

10:00 AM: The October NAHB homebuilder survey. The consensus is for a reading of 41, up from 40 in September. Although this index has been increasing lately, any number below 50 still indicates that more builders view sales conditions as poor than good.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

8:30 AM: Housing Starts for September.

8:30 AM: Housing Starts for September. Total housing starts were at 750 thousand (SAAR) in August, up 2.3% from the revised July rate of 733 thousand (SAAR). Single-family starts increased 5.5% to 535 thousand in August.

The consensus is for total housing starts to increase to 765,000 (SAAR) in September, up from 750,000 in August.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 365 thousand from 339 thousand.

10:00 AM: Philly Fed Survey for October. The consensus is for a reading of 0.5, up from minus 1.9 last month (above zero indicates expansion).

10:00 AM: Conference Board Leading Indicators for September. The consensus is for a 0.2% increase in this index.

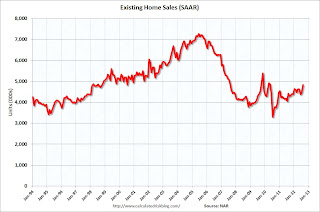

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for sales of 4.75 million on seasonally adjusted annual rate (SAAR) basis. Sales in August 2012 were 4.82 million SAAR.

A key will be inventory and months-of-supply.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for September 2012

Summary for Week Ending Oct 12th

by Calculated Risk on 10/13/2012 08:01:00 AM

This was a very light week for US economic data. Don't worry, there will be plenty of data next week!

Weekly initial unemployment claims dropped sharply, but a DOL official said the decline was mostly related to one state not reporting quarterly claims - so we might see a large upward revision next week.

From Kathleen Pender at the San Francisco Chronicle: California EDD denies it under-reported jobless claims

[A] DOL spokesman, who spoke on condition of anonymity ... said the department was expecting an 18.5 percent increase in new claims last week; instead it reported only an 8.6 percent increase. (These numbers are not seasonally adjusted; the seasonally adjusted jobless claims fell by 30,000 from the week before).Consumer sentiment was at the highest level since 2007 - still weak, but improving. The trade deficit is increased in August, and shows an ongoing structural imbalance.

Unadjusted claims often shoot up the first week of a new quarter ... state employment departments have to review certain unemployment recipients to make sure they are not collecting benefits when they have a job. They also have to check up on some people who are receiving federal extended benefits, which start after a person has exhausted their regular state benefits. Sometimes, people who are getting extended benefits and get a part-time job or freelance work have to start over with a new state claim. As part of their quarterly review, the states are supposed to weed these people out and put them on a new state claim, which for statistical purposes counts as a new jobless claim.

States normally do this at the end of a quarter, which contributes to a jump in new claims at the beginning of the next quarter. The labor department spokesman said, “One large state has not completed this process,” which is why the data reported [this week] was better than expected.

He would not name the state but said it would be clear when the department issues a state-by-state breakdown of this week’s report next week. EDD spokeswoman Loree Levy could not tell me whether California is the state that had not yet finished this task. “We have been completing this on a timely basis for years,” she said.

Here is a summary of last week in graphs:

• Trade Deficit increased in August to $44.2 Billion

The Department of Commerce reported:

The Department of Commerce reported: [T]otal August exports of $181.3 billion and imports of $225.5 billion resulted in a goods and services deficit of $44.2 billion, up from $42.5 billion in July, revised. August exports were $1.9 billion less than July exports of $183.2 billion. August imports were $0.2 billion less than July imports of $225.7 billion.July was revised from $42.0 billion. The trade deficit was larger than the consensus forecast of $44.0 billion.

Oil averaged $94.36 in August, up slightly from $93.83 per barrel in July. Import oil prices will probably increase further in September. The trade deficit with China decreased slightly to $28.7 billion in August, down from $29.0 billion in August 2011. Still, most of the trade deficit is due to oil and China.

The trade deficit with the euro area was $9.7 billion in August, up from $7.8 billion in August 2011.

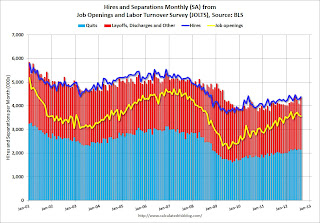

• BLS: Job Openings "essentially unchanged" in August, Up year-over-year

Jobs openings decreased in August to 3.561 million, down slightly from 3.593 million in July. The number of job openings (yellow) has generally been trending up, and openings are up about 13% year-over-year compared to August 2011.

Jobs openings decreased in August to 3.561 million, down slightly from 3.593 million in July. The number of job openings (yellow) has generally been trending up, and openings are up about 13% year-over-year compared to August 2011. Quits decreased slightly in August, and quits are up about 5% year-over-year. These are voluntary separations and more quits might indicate some improvement in the labor market. (see light blue columns at bottom of graph for trend for "quits").

This suggests a gradually improving labor market.

• Weekly Initial Unemployment Claims declined sharply to 339,000

The DOL reports:

The DOL reports:In the week ending October 6, the advance figure for seasonally adjusted initial claims was 339,000, a decrease of 30,000 from the previous week's revised figure of 369,000. The 4-week moving average was 364,000, a decrease of 11,500 from the previous week's revised average of 375,500.The previous week was revised up from 367,000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined sharply to 364,000. This is just above the cycle low for the 4-week average of 363,000 in March.

• Consumer Sentiment increased to 83.1, Highest since 2007

The preliminary Reuters / University of Michigan consumer sentiment index for October increased to 83.1, up from the September reading of 78.3.

This is still fairly weak, but this is the highest level since 2007.

Friday, October 12, 2012

Consumer Sentiment Graph

by Calculated Risk on 10/12/2012 09:44:00 PM

Notes: Looks like the FDIC took another week off! I'm back from the housing forum in San Francisco. I'll write down a few thoughts on the forum this weekend. Here is a graph of consumer sentiment released this morning.

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for October increased to 83.1, up from the September reading of 78.3.

This is still fairly weak, but this is the highest level since 2007.

Alphaville: A Grexit Delayed

by Calculated Risk on 10/12/2012 01:32:00 PM

An interesting article from David Keohane at Alphaville: A Grexit delayed if not deniedCiti are pushing that fateful day back:

We have held the view, since May 2012, that a Greek exit from the euro area (“Grexit”) in the next 12 to 18 months is a high-probability event (90%) which we assume, for the sake of argument, would happen on January 1 2013. We are now cutting the probability of Grexit over the next 12-18 months to 60% and judge that this event will probably happen later than we previously thought, most likely in 1H 2014.There is much more in the article.

It’s all about German politics, something we have gone over before and won’t do again now. ... But essentially, everything is pointing to a slower evolution of this crisis with both Spain and Greece edging towards decisions rather than careening.

Note: I'm at the Zillow housing forum in San Francisco. The first panel just concluded "Is it a good time to buy in California?". The consensus was yes, but mortgage / housing analyst Mark Hanson thought there was a new bubble developing in some areas like Phoenix (at the low end), and that the current improvement was just a "stimulus high" and that there would be a hangover to follow.

Misc: Consumer Sentiment increases to 83.1, JPMorgan on Housing

by Calculated Risk on 10/12/2012 09:55:00 AM

• JPMorgan's Jamie Dimon on housing:

Importantly, we believe the housing market has turned the corner. In our Mortgage Banking business, we were encouraged that credit trends continued to modestly improve, and, as a result, the Firm reduced the related loan loss reserves by $900 million. Despite this improvement, the absolute level of charge-offs remains elevated. We also expect to see high default-related expense for a while longer.• The Reuter's/University of Michigan's Consumer sentiment index (preliminary for October) increased to 83.1. This is the highest level since 2007. The consensus was for sentiment to be unchanged at 78.3. (I'll post a graph later after I return from housing forum).

BLS: Producer Prices increased 1.1% in September

by Calculated Risk on 10/12/2012 08:30:00 AM

The Producer Price Index for finished goods rose 1.1 percent in September, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Prices for finished goods advanced 1.7 percent in August and moved up 0.3 percent in July. At the earlier stages of processing, prices received by manufacturers of intermediate goods rose 1.5 percent in September, and the crude goods index advanced 2.8 percent. On an unadjusted basis, prices for finished goods climbed 2.1 percent for the 12 months ended September 2012, the largest rise since a 2.8-percent increase for the 12 months ended March 2012.The PPI is very volatile and is impacted by energy prices. Note the core PPI was unchanged. CPI will be released next Tuesday.

...

Finished energy: Prices for finished energy goods advanced 4.7 percent in September after rising 6.4 percent in August. A 9.8-percent jump in the gasoline index accounted for over eighty percent of the September increase. Advances in the indexes for diesel fuel and residential natural gas also contributed to the rise in finished energy goods prices.

...

Finished core: Prices for finished goods less foods and energy were unchanged in September after rising 0.2 percent a month earlier.

Thursday, October 11, 2012

Friday: PPI, Consumer Sentiment

by Calculated Risk on 10/11/2012 06:54:00 PM

Note: I'm in San Francisco attending the Zillow real estate forum. Best to all.

From Jim Hamilton at Econbrowser: Governor Brown solves California's gas price problem

California has separate gasoline requirements from the rest of the nation, and also requires a different, more-expensive fuel for summer sales relative to winter. Because refiners don't want to be stuck holding the summer blend through the winter, inventories of summer blend are intentionally low this time of year. That creates a problem when two of the main refineries producing the California summer blend get knocked out, as we just observed.On Friday:

...

But two important developments have changed the picture. First, the Torrance refinery was back in operation by Friday. Second, on Sunday Governor Jerry Brown (D-CA) directed the California Air Resources Board to allow use right now of the winter blend instead of waiting as usual until the first of November, a move that the Board has implemented. This allows existing stocks of the winter fuel to be sold to add to the supply of the summer blend. ...

Several reporters have asked me what economic effects this episode may have. My answer is they should be pretty limited-- I'm expecting the retail price to come down almost as quickly and dramatically as it went up.

• At 8:30 AM, the Producer Price Index for September will be released. The consensus is for a 0.8% increase in producer prices (0.2% increase in core).

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (preliminary for October) will be released. The consensus is for sentiment to be unchanged at 78.3.

Another question for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Redfin: House prices up 5% Year-over-year in September

by Calculated Risk on 10/11/2012 02:35:00 PM

From Redfin: Home Prices Dip Slightly from August to September, Still Up 5% from 2011 in Redfin Real-Time Home Price Tracker

Redfin today released its Real-Time Home Price Tracker for September 2012, showing an annual price gain of 5 percent across 19 major U.S. markets. From August to September, prices declined just 0.8% percent, which is a smaller decline than is typical at this time of year.This house price index is based on prices per sq ft. This is a reminder that prices will decline month-to-month in the fall and winter on the Case-Shiller and CoreLogic Not Seasonally Adjusted (NSA) indexes - and it will be important to watch the year-over-year change. Right now I'm guessing the CoreLogic index will report negative month-to-month price changes for August or September, and Case-Shiller for September or October.

...

Inventory still low: The number of homes for sale declined 29.3% from September 2011 to September 2012, and by 4.3% since August.

Homes selling quickly: The percentage of listings that sold within 14 days of their debut held steady in September at 27%.

Home sales up year-over-year, down since August: Home sales increased 4% from last year, and fell 17% since August—a typical seasonal decline.

"September is usually the month that real estate goes on sale, like Christmas toys in January," said Redfin CEO Glenn Kelman. "Whatever didn't sell in the summer gets marked down for a September closing. This September, we saw only a modest decline in prices, with inventory still dropping and demand fairly steady. In the most volatile markets, including Southern California, Phoenix and Las Vegas, we continued to see big price gains."

The reported 29.3% year-over-year decrease in inventory is similar to other sources and is a key driver for the year-over-year price increase.