by Calculated Risk on 10/03/2012 07:01:00 AM

Wednesday, October 03, 2012

MBA: Mortgage Refinance Applications increases sharply, Highest Since 2009

From the MBA: Mortgage Refinance Applications Highest Since 2009 as Rates Reach Record Lows in Latest MBA Weekly Survey

The Refinance Index increased 20 percent from the previous week. This was the highest Refinance Index recorded in the survey since April of 2009. The seasonally adjusted Purchase Index increased 4 percent from one week earlier.

“Refinance application volume jumped to the highest level in more than three years last week as each of the five mortgage rates in MBA's survey dropped to new record lows in the survey,” said Mike Fratantoni, MBA’s Vice President of Research and Economics. “Financial markets continue to adjust to QE3, as the ongoing presence of the Federal Reserve as a significant buyer of mortgage-backed securities applies downward pressure on rates."

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.53 percent from 3.63 percent, with points decreasing to 0.35 from 0.41 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance activity is at the highest level since 2009. Refinance activity has been generally moving up over the last year, and really took off last week.

The second graph shows the MBA mortgage purchase index. The purchase index is up 5% over the last two weeks.

The second graph shows the MBA mortgage purchase index. The purchase index is up 5% over the last two weeks.However the purchase index has been mostly moving sideways over the last two years.

Tuesday, October 02, 2012

Wednesday: Apartment Vacancy Rate, ISM Service Index, ADP Employment

by Calculated Risk on 10/02/2012 09:16:00 PM

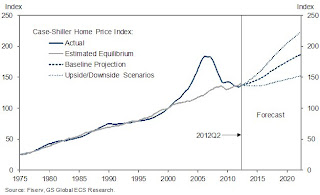

Goldman Sachs released a research note today on house prices: "House Price News Continues to Be Good". In the note, economists Hui Shan and Sven Jari Stehn provide some projections:

[W]e provide an upside and a downside scenario for house prices in addition to our baseline projection. ... We construct the upside and downside cases by incorporating both economic scenarios and modeling uncertainties. ... Although our methodology does not allow us to precisely estimate the probability of each constructed scenario, one can roughly consider the upside and downside as the one standard deviation above and below the baseline.

[Our] model now projects house price gains of 2.0% from mid-2012 to mid-2013, and 2.8% in the year thereafter (Exhibit 1). This baseline forecast is broadly in line with the latest consensus forecast. Exhibit 1 also shows our scenario analysis, pointing to house price appreciation of 9.1% (4.1% for 2012Q2-2013Q2 and 5.0% for 2013Q2-2014Q2) and -0.4% (-0.2% for 2012Q2-2013Q2 and -0.2% for 2013Q2-2014Q2) over the next two years, respectively, for the upside and downside alternative scenarios.

Click on graph for larger image.

Click on graph for larger image.Here is exhibit 1 from the research note showing Goldman's baseline forecast, and upside and downside scenarios.

On Wednesday:

• Early: Reis will release the Q3 2012 Apartment vacancy rates. Last quarter Reis reported that the apartment vacancy rate declined to 4.7% in Q2 from 4.9% in Q1 2012. This was the lowest vacancy rate since Q4 2001.

• At 7:00 AM, The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. Excerpt a surge in refinance activity with low mortgage rates.

• At 8:15 AM, the ADP Employment Report for September will be released. This report is for private payrolls only (no government). The consensus is for 140,000 payroll jobs added in August, down from the 201,000 reported last month.

• At 10:00 AM, the ISM non-Manufacturing Index for September will be released. The consensus is for a decrease to 53.5 from 53.7 in August. Note: Above 50 indicates expansion, below 50 contraction.

Another question for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Housing: Inventory down 21% year-over-year in early October

by Calculated Risk on 10/02/2012 07:25:00 PM

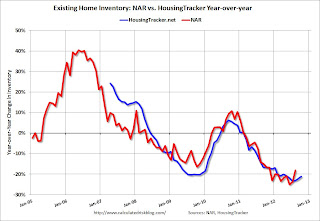

Here is another update using inventory numbers from HousingTracker / DeptofNumbers to track changes in listed inventory. Tom Lawler mentioned this last year.

According to the deptofnumbers.com for (54 metro areas), inventory is off 21.4% compared to the same week last year. Unfortunately the deptofnumbers only started tracking inventory in April 2006.

This graph shows the NAR estimate of existing home inventory through August (left axis) and the HousingTracker data for the 54 metro areas through early October.

Click on graph for larger image.

Click on graph for larger image.

Since the NAR released their revisions for sales and inventory last year, the NAR and HousingTracker inventory numbers have tracked pretty well.

On a seasonal basis, housing inventory usually bottoms in December and January and then increases through the summer. Inventory only increased a little this spring and has been declining for the last five months by this measure. It looks like inventory peaked early this year.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the early October listings, for the 54 metro areas, declined 21.4% from the same period last year.

HousingTracker reported that the early October listings, for the 54 metro areas, declined 21.4% from the same period last year.

The year-over-year declines will probably start to get smaller since inventory is already pretty low. I doubt we will see 20% year-over-year declines next summer!

U.S. Light Vehicle Sales at 14.96 million annual rate in September, Highest since Feb 2008

by Calculated Risk on 10/02/2012 03:47:00 PM

Based on an estimate from Autodata Corp, light vehicle sales were at a 14.96 million SAAR in September. That is up 14% from September 2011, and up 3% from the sales rate last month.

This was above the consensus forecast of 14.5 million SAAR (seasonally adjusted annual rate).

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for September (red, light vehicle sales of 14.96 million SAAR from Autodata Corp).

Click on graph for larger image.

Click on graph for larger image.

Sales have averaged a 14.25 million annual sales rate through the first nine months of 2012, up from 12.5 million rate for the same period of 2011. Last year sales were depressed for several months (May through August) due to supply chain issues related to the tsunami in Japan. By September 2011, the supply chain issues were mostly resolved, and this year-over-year increase for September is significant.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

This shows the huge collapse in sales in the 2007 recession.

It looks like auto sales were up about 2.7% in Q3 compared to Q2, and auto sales will make another small positive contribution to GDP. However it appears there is a shift to smaller cars, so total revenue might not increase much.

Auto Sales: Small Car Sales Strong

by Calculated Risk on 10/02/2012 02:03:00 PM

Note: I'll post an estimate of the total sales rate around 4 PM ET after all the results are reported. It looks like consumers are responding to high gasoline prices and buying smaller cars ...

From MarketWatch: Chrysler’s September sales soar; GM, Ford flat

It was a mixed bag for U.S. auto makers in September as Chrysler Group LLC reported Tuesday some of its best sales increases in years, while results for Ford Motor Co. and General Motors Co. were largely flat.

Foreign car makers were pretty much up across the board, with Toyota’s sales surging 42% and Volkswagen’s jumping 34%.

Overall, sales have been “slightly better than expected,” said Jesse Toprak, analyst at Truecar.com.

...

The pace of sales wasn’t so brisk for Ford ... One bright spot for the company however, was in small cars.

...

Sales of GM’s mini, small and compact cars rose a combined 97%, the company said.

Sam Zell's Poor Forecasting Record

by Calculated Risk on 10/02/2012 12:23:00 PM

I've been writing about real estate for years, and I've received several emails over the years saying "Sam Zell disagrees with you, and he knows!". Hmmm ... well, one of us has been wrong.

Sam Zell was on CNBC today arguing the US economy is heading back into recession:

"Nobody wants to make commitments beyond tomorrow," Zell said during a"Squawk Box" interview. "One of these (recession) triggers is when enterprise projects start getting delayed. We're heading for a recession and that's exactly what you're looking at now. You're looking at capital expenditures across the board being deferred for a reason: There's no confidence."Actually a recession is unlikely right now. Of course Zell's economic forecasting track record is very poor. A few examples ...

Sam Zell in April 2005 at the Milken Institute Global Conference:

"The housing bubble has been created more by the business press than reality," said Sam Zell, chairman of Equity Office Properties Trust and Equity Group Investments LLC. "You can't have a crash without oversupply."According to Sam Zell there was no housing bubble, and there would be no crash. How did that work out?

And from my notes at the April 2008 Milken conference:

Commercial [real estate] will be fine in his view (not my view). Also Zell thinks losses are overstated for investment banks and CDOs.Actually losses for investment banks were understated (ask Lehman) and commercial real estate was about to be hit hard (look at the office vacancy rate released this morning).

And here is Sam Zell calling the price bottom for houses in 2009:

[T]he residential real estate market has reached an equilibrium where prices will stop falling, said Sam Zell, founder and chairman of Equity Group Investments.According to Case-Shiller house prices declined another 5% in nominal terms and about 11% adjusted for inflation.

Obviously Zell was a very successful commercial real estate investor, but I rarely agree with him on the economy.

CoreLogic: House Price Index increased in August, Up 4.6% Year-over-year

by Calculated Risk on 10/02/2012 09:58:00 AM

Notes: This CoreLogic House Price Index report is for August. The Case-Shiller index released last week was for July. Case-Shiller is currently the most followed house price index, however CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® August Home Price Index Rises 4.6 Percent Year-Over-Year

Home prices nationwide, including distressed sales, increased on a year-over-year basis by 4.6 percent in August 2012 compared to August 2011. This change represents the biggest year-over-year increase since July 2006. On a month-over-month basis, including distressed sales, home prices increased by 0.3 percent in August 2012 compared to July 2012. The August 2012 figures mark the sixth consecutive increase in home prices nationally on both a year-over-year and month-over-month basis. The HPI analysis from CoreLogic shows that all but six states are experiencing price gains.

Excluding distressed sales, home prices nationwide increased on a year-over-year basis by 4.9 percent in August 2012 compared to August 2011. On a month-over-month basis excluding distressed sales, home prices increased 1 percent in August 2012 compared to July 2012, also the sixth consecutive month-over-month increase. Distressed sales include short sales and real estate owned (REO) transactions.

The CoreLogic Pending HPI indicates that September 2012 home prices, including distressed sales, are expected to rise by 5 percent on a year-over-year basis from September 2011 and fall by 0.3 percent on a month-over-month basis from August 2012 as the summer buying season closes out. Excluding distressed sales, September 2012 house prices are poised to rise 6.3 percent year-over-year from September 2011 and by 0.6 percent month-over-month from August 2012

“Again this month prices rose on a year-over-year basis and our expectation is for that to continue in September based on our pending HPI forecast,” said Mark Fleming, chief economist for CoreLogic. “The housing markets gains are increasingly geographically diverse with only six states continuing to show declining prices.”

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 0.3% in August, and is up 4.6% over the last year.

The index is off 26.7% from the peak - and is up 10.1% from the post-bubble low set in February (the index is NSA, so some of the increase is seasonal).

The second graph is from CoreLogic. The year-over-year comparison has been positive for six consecutive months suggesting house prices bottomed earlier this year on a national basis.

The second graph is from CoreLogic. The year-over-year comparison has been positive for six consecutive months suggesting house prices bottomed earlier this year on a national basis.Excluding the tax credit bump in 2010, these are the first year-over-year increases since 2006 - and this is the largest year-over-year increase since 2006.

On a month-to-month basis, this index will probably turn negative in September (normal seasonal decline); the key will be the year-over-year change.

Reis: Office Vacancy Rate declines slightly in Q3 to 17.1%

by Calculated Risk on 10/02/2012 08:36:00 AM

From Reuters: U.S. office market barely gains in third quarter

[T]he vacancy rate dipped in the third quarter by a scant 0.1 percentage point to 17.2 percent from the second quarter. The vacancy rate declined by just 0.30 percentage points compared with a year earlier.

...

[T]he average asking rent for U.S. office space rose only 1.4 percent over the past 12 months and just 0.2 percent to $28.23 per square foot from the second quarter.

Effective rent, which takes into account months of free rent and other perks landlords offer to lure or keep tenants, rose 0.3 percent to $22.78 per square foot.

...

"We're stuck," said Ryan Severino, senior economist for Reis Inc, which released its third-quarter office report on Tuesday.

Reis also sees no significant improvement for the rest of the year.

"The office market is not going to move in the right direction until the labor market starts to move in the right direction," Severino said. "Nobody is going to lease space until they're hiring, and nobody is going to hire until they feel more confident about the direction of the economy."

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis is reporting the vacancy rate declined in Q3 to 17.1%, down slightly from 17.2% in Q2, and down from 17.4% in Q3 2011. The vacancy rate peaked in this cycle at 17.6% in Q3 and Q4 2010.

This is a sluggish recovery for office space.

Monday, October 01, 2012

Tuesday: Office Vacancy Rate, Auto Sales

by Calculated Risk on 10/01/2012 07:38:00 PM

First, from Reuters: JPMorgan Sued for Fraud by NY Attorney General

New York Attorney General Eric Schneiderman on Monday filed a lawsuit against JPMorgan Chase for fraud over faulty mortgage-backed securities packaged and sold by the former Bear Stearns.Some of those Bear Stearns deals were really ugly. I remember an Ambac presentation about a Bear Stearns deal in 2008 with "100 people in the round ... 82 have walked out and not paid you a whole lot back". Ouch. It probably ended up with close to 100 out of 100 walking ...

The Residential Mortgage-Backed Securities Working Group was formed to probe the pooling and sale of risky mortgages in the run-up to the 2008 financial crisis.

On Tuesday:

• Early: Reis Q3 2012 Office vacancy rates. Last quarter Reis reported that the office vacancy rate was unchanged at 17.2%.

• All day: Light vehicle sales for September. The consensus is for light vehicle sales to be unchanged at 14.5 million SAAR in September (Seasonally Adjusted Annual Rate).

A question for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Lawler: Some Home Builder Results

by Calculated Risk on 10/01/2012 02:54:00 PM

From economist Tom Lawler:

Below is a table showing reported net home orders for the quarter ended August 31st, 2012 from the third, fifth, and seventh largest US home builders in 2012. Hovnanian Enterprises, of course, reported operating results for the quarter ended July 31st, 2012, but in its quarterly presentation it included net order results for August, 2012 as well.

| Net Home Orders, Quarter Ended: | ||

|---|---|---|

| 8/31/2012 | 8/31/2011 | |

| Lennar Corporation | 4,198 | 2,914 |

| Hovnanian | 1,419 | 1,180 |

| KB Home | 1,900 | 1,838 |

| Total of above | 7,517 | 5,932 |

| % Chg | 26.7% | |

For the quarter ended June 30th, 2012, nine publicly traded home builders reported combined net home orders of 20,375, up 27.3% from the comparable quarter of 2011.

Here are some excerpts from Lennar’s press release.

“Stuart Miller, Chief Executive Officer of Lennar Corporation, said, "The housing market has stabilized and the recovery is well underway."And here are some excerpts from KB Home’s press release.

“While materials and labor costs are moving higher, sales price increases and incentive reductions should continue to offset the impact of increasing costs. “The average sales price of homes delivered increased to $258,000 in the third quarter of 2012 from $247,000 in the same period last year. Sales incentives offered to homebuyers were $26,100 per home delivered in the third quarter of 2012, or 9.2% as a percentage of home sales revenue, compared to $33,600 per home delivered in the same period last year, or 12.0% as a percentage of home sales revenue, and $29,800 per home delivered in the second quarter of 2012, or 10.7% as a percentage of home sales revenue.”

"We are pleased to report a profit for the third quarter," said Jeffrey Mezger, president and chief executive officer. "During the quarter, we continued to generate improvement in several key financial and operating metrics. The favorable year-over-year performance in our deliveries; revenues; operating income; net orders; and backlog were particularly encouraging as we operated with fewer communities. These trends illustrate that the strategic repositioning of our operations to restore profitability is starting to yield tangible results, as we also saw significant increases in our overall average selling price and gross profit margin, and substantial improvement in our selling, general and administrative expense ratio. At the same time, it is clear that the recovery in housing is gaining momentum across the country as inventory levels are declining and home prices are on the rise. In particular, we are seeing dramatic improvement in California, where we are the state's largest homebuilder, as the continued strengthening in the coastal markets is now spreading inland to Sacramento, the Central Valley and the Inland Empire."Finally, here is an excerpt from Hovnanian’s press release (from early last month).

“Unlike the past few years, the market for new homes has been resilient through both the spring selling season and throughout the summer months this year. We believe the housing market's recent overall strength and our significantly improved sales pace this year indicates that the market for new homes has bounced off the bottom and is already in a period of gradual recovery.”The “verbiage” from publicly-traded home builders was in general significant more upbeat in their latest quarterly releases than was the case last year and earlier this year. Moreover, several builders have recently raised capital for “general corporate purposes,” mainly because of the improved outlook. This suggests to me that the pace of SF home building is likely to pick up both during the remainder of this and into 2013.