by Calculated Risk on 8/28/2012 08:37:00 PM

Tuesday, August 28, 2012

Wednesday: Q2 GDP update, Pending Home Sales, Beige Book

First an excerpt from a research note by Jan Hatzius at Goldman Sachs:

At a minimum, we expect an extension of the forward rate guidance to "mid-2015" at the September 12-13 FOMC meeting. We also expect an eventual return to QE, although in terms of timing we believe that either December or early 2013 is still more likely than September.On Wednesday:

...

The tone of the data has clearly improved a bit since the [last FOMC] meeting. ... we estimate that Q3 GDP is on track for a 2.4% annualized gain versus an advance estimate of 1.5% for Q2.

However, a return to QE in September is clearly possible if the upcoming data, especially the August employment report released on September 7, fall short of expectations or if financial conditions tighten again--e.g., in the wake of any disappointment around the European situation and the ECB meeting on September 6.

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

• At 8:30 AM, the BEA will release the 2nd estimate of Q2 GDP. The consensus is that real GDP increased 1.7% annualized in Q2, revised up from 1.5% in the advance release.

• At 10:00 AM, the Pending Home Sales Index for August will be released. The consensus is for a 1.0% increase in the index.

• At 11:00 AM, the New York Fed will release the Q2 2012 Report on Household Debt and Credit

• 2:00 PM, the Federal Reserve Beige Book will be released. This is an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

A question for the August economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Housing: Two Bearish Views on House Prices and Foreclosures

by Calculated Risk on 8/28/2012 05:04:00 PM

First a couple of bearish views on house prices - clearly residential investment has bottomed, but some analysts think house prices will fall further.

• From RadarLogic: Apparent Strength in Home Price Metrics Driven by Decline in Distressed Sales

A decline in sales of homes in bank inventories, coupled with an increase in the rate of all other sales, helped drive the 25 metropolitan area RPX Composite price to a year-over-year gain in June, according to the June 2012 RPX Monthly Housing Market Report ...• From Mark Hanson posted at the Big Picture: Hanson On Case Shiller

"The absence of real price appreciation when distressed sales are excluded from the analysis suggests that traditional home buyers remain hesitant to return to the market in strength," said Michael Feder, Radar Logic's CEO. "We continue to be concerned that this negative psychology could be the biggest risk threatening any real recovery in housing values. If it continues, the resultant imbalance between supply and demand could trigger another decline in home values."

The gains of the first half of 2012 could be short lived. They were the result of seasonal factors and REO disposition strategies that could reverse in the fall. The unusually rapid price appreciation could give way to equally rapid declines in the second half of the year.

[T]oday’s CS is disappointing…a YoY 15% increase in purchasing power and 25% decrease in foreclosure resales and still the CS-20 NSA only managed a 0.5% gain over last year. To me, normalized, that means real house prices are still falling.My view is house prices probably bottomed early this year (back when I wrote "The Bottom is Here").

And on foreclosures: CoreLogic® Reports 58,000 Completed Foreclosures in July

According to the report, there were 58,000 completed foreclosures in the U.S. in July 2012 down from 69,000 in July 2011 and 62,000* in June 2012. Since the financial crisis began in September 2008, there have been approximately 3.8 million completed foreclosures across the country. Completed foreclosures are an indication of the total number of homes actually lost to foreclosure.Earlier:

...

“Completed foreclosures were down again in July, this time by 16 percent versus a year ago, as servicers increasingly rely on alternatives to the foreclosure process, such as short sales and modifications,” said Mark Fleming, chief economist for CoreLogic. “Completed foreclosures remain concentrated in five states, California, Florida, Michigan, Texas and Georgia, accounting for 48 percent of all completed foreclosures nationwide in July.”

• Case-Shiller: House Prices increased 0.5% year-over-year in June

• House Price Comments, Real House Prices, Price-to-Rent Ratio

• All Current House Price Graphs

FDIC reports Fewer Problem banks, REO Declines; Total REO Declines in Q2

by Calculated Risk on 8/28/2012 02:50:00 PM

The FDIC released the Quarterly Banking Profile for Q2 today.

Commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) reported aggregate net income of $34.5 billion in the second quarter of 2012, a $5.9 billion improvement from the $28.5 billion in profits the industry reported in the second quarter of 2011. This is the 12th consecutive quarter that earnings have registered a year-over-year increase. Lower provisions for loan losses and higher gains on sales of loans and other assets accounted for most of the year-over-year improvement in earnings. Also noteworthy was an increase in loan balances for the fourth time in the last five quarters.The FDIC reported the number of problem banks declined:

The number of "problem" institutions fell for the fifth quarter in a row. The number of "problem" institutions declined from 772 to 732. This is the smallest number of "problem" banks since year-end 2009. Total assets of "problem" institutions declined from $292 billion to $282 billion. Fifteen insured institutions failed during the second quarter. This is the smallest number of failures in a quarter since the fourth quarter of 2008, when there were 12. Another nine banks have failed so far in the third quarter, bringing the total for the year to date to 40. At this point last year, there had been 68 failures.

Click on graph for larger image.

Click on graph for larger image.And the dollar value of Real Estate Owned (REOs, foreclosure houses) declined from $11.1 billion in Q1 to $9.5 billion in Q2. This is the lowest level of REOs since Q1 2008.

This graph shows the dollar value of Residential REO for FDIC insured institutions. Note: The FDIC reports the dollar value and not the total number of REOs.

The next graph is from Tom Lawler and shows the total REO for Fannie, Freddie, FHA, Private Label (PLS) and FDIC insured institutions. This isn't all the REO, as Lawler noted before, it "excludes non-FHA government REO (VA, USDA, etc.), credit unions, finance companies, non-FDIC-insured banks and thrifts", but it is probably over 90%.

Some comments from Tom Lawler:

Some comments from Tom Lawler:On the SF REO front, the “carrying value” of 1-4 family REO properties of FDIC-insured institutions at the end of last quarter was $9.5302 billion, down from $11.0819 billion at the end of the first quarter and $12.0895 billion a year ago. The FDIC does not report (or even collect) data on the number of 1-4 family REO properties held by FDIC-insured institutions, which is annoying.

Assuming that the carrying value of SF REO properties held by FDIC-insured institutions is 50% higher than the average of Fannie and Freddie, here is a chart showing trends in the SF REO inventories of Fannie, Freddie, FHA, private-label securities (from Barclays Capital), and FDIC-insured institutions.

Combined REO inventories last quarter were down about 21% from a year ago, and were at the lowest level since 2007.

House Price Comments, Real House Prices, Price-to-Rent Ratio

by Calculated Risk on 8/28/2012 11:56:00 AM

Case-Shiller reported the first year-over-year (YoY) gain in their house price indexes since 2010 - and the increase back in 2010 was related to the housing tax credit. Excluding the tax credit, this is the first YoY increase since 2006. The YoY increase in June suggests that house prices probably bottomed earlier this year (the YoY change lags the turning point for prices).

Since there is a seasonal pattern for house prices, we should expect the month-over-month change to turn negative later this year (probably in the report for August or September). The key will be to watch the YoY change and also compare to the seasonal lows in March 2012. In June, the Case-Shiller Composite 20 index Not Seasonally Adjusted (NSA) was 6.0% above the March 2012 low.

No one should expect the strong price increases to continue. The Case-Shiller Composite 20 index NSA was up 2.3% in June from May. However a large portion of that increase was seasonal. On a Seasonally Adjusted (SA) basis, the Composite 20 index was up 0.9%. That is a 11% annualized rate - and that will not continue. I suspect much of the increase over the last few months was a "bounce off the bottom" and I don't expect prices to increase at this pace.

Here is another update to a few graphs: Case-Shiller, CoreLogic and others report nominal house prices, and it is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio. Real prices, and the price-to-rent ratio, are back to late 1999 to 2000 levels depending on the index.

Nominal House Prices

Click on graph for larger image.

Click on graph for larger image.

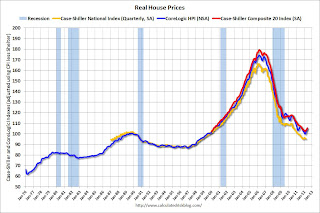

The first graph shows the quarterly Case-Shiller National Index SA (through Q2 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through June) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to Q1 2003 levels (and also back up to Q4 2010), and the Case-Shiller Composite 20 Index (SA) is back to July 2003 levels, and the CoreLogic index (NSA) is back to November 2003.

Real House Prices

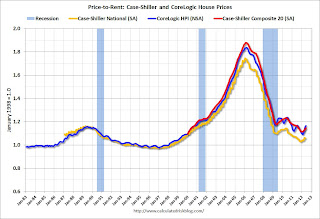

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to mid-1999 levels, the Composite 20 index is back to June 2000, and the CoreLogic index back to October 2000.

As we've discussed before, in real terms, all of the appreciation early in the last decade is still gone.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q3 1999 levels, the Composite 20 index is back to June 2000 levels, and the CoreLogic index is back to August 2000.

In real terms - and as a price-to-rent ratio - prices are mostly back to late 1990s or early 2000 levels.

Case-Shiller: House Prices increased 0.5% year-over-year in June

by Calculated Risk on 8/28/2012 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for June (a 3 month average of April, May and June).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the quarterly national index.

Note: Case-Shiller reports NSA, I use the SA data.

From S&P: Home Prices Rose in the Second Quarter of 2012 According to the S&P/Case-Shiller Home Price Indices

Data through June 2012, released today by S&P Dow Jones Indices for its S&P/Case-Shiller Home Price Indices ... showed that all three headline composites ended the second quarter of 2012 with positive annual growth rates for the first time since the summer of 2010. The national composite was up 1.2% in the second quarter of 2012 versus the second quarter of 2011, and was up 6.9% versus the first quarter of 2012. The 10- and 20-City Composites posted respective annual returns of +0.1% and +0.5% in June 2012. Month-over-month, average home prices in the 10-City Composite were up 2.2% and in the 20-City Composite were up 2.3% versus May. For the second consecutive month, all 20 cities and both Composites recorded positive monthly gains. Eighteen of the 20 MSAs and both Composites posted better annual returns in June as compared to May 2012 – only Charlotte and Dallas saw a deceleration in their annual rates.

...

“Home prices gained in the second quarter,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “In this month’s report all three composites and all 20 cities improved both in June and through the entire second quarter of 2012. All 20 cities and both monthly Composites rose for the second consecutive month. It would have been a third consecutive month had we not seen home prices fall in Detroit back in April."

Click on graph for larger image.

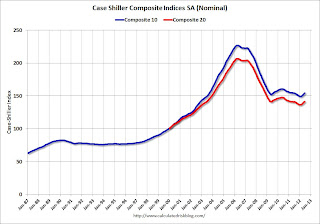

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 32.0% from the peak, and up 1.0% in June (SA). The Composite 10 is up 3.5% from the post bubble low set in March (SA).

The Composite 20 index is off 31.6% from the peak, and up 0.9% (SA) in June. The Composite 20 is up 3.6% from the post-bubble low set in March (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 0.1% compared to June 2011.

The Composite 20 SA is up 0.5% compared to June 2011. This was the first year-over-year since 2010 (when the tax credit boosted prices temporarily).

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 18 of the 20 Case-Shiller cities in June seasonally adjusted (all 20 cities increased NSA). Prices in Las Vegas are off 60.0% from the peak, and prices in Dallas only off 6.0% from the peak. Note that the red column (cumulative decline through June 2012) is above previous declines for all cities.

Prices increased (SA) in 18 of the 20 Case-Shiller cities in June seasonally adjusted (all 20 cities increased NSA). Prices in Las Vegas are off 60.0% from the peak, and prices in Dallas only off 6.0% from the peak. Note that the red column (cumulative decline through June 2012) is above previous declines for all cities.This was better than the consensus forecast and the change to a year-over-year increase is significant. I'll have more on prices later.

Report: ECB President Draghi to Skip Jackson Hole

by Calculated Risk on 8/28/2012 08:42:00 AM

From Reuters: Draghi Skips Jackson Hole Ahead of Pivotal ECB Meeting

European Central Bank President Mario Draghi will not attend the annual Jackson Hole meeting of central bankers at the end of this week due to a heavy workload, the ECB said on Tuesday as its policymakers gear up for a critical meeting on Sept. 6.No speech on Saturday (Bernanke speaks on Friday at the Jackson Hole Economic Symposium).

Draghi had been expected to speak at the Jackson Hole gathering, but the retreat in the U.S. state of Wyoming falls just as ECB policymakers are hammering out the details of a new bond-buying plan aimed at tackling the euro zone debt crisis.

When asked whether Draghi was no longer planning to attend the Jackson Hole meeting, an ECB spokesman said: "That's correct ... He has a very heavy workload in the coming days."

Monday, August 27, 2012

Tuesday: Case-Shiller House Price index

by Calculated Risk on 8/27/2012 09:11:00 PM

First, tropical storm Isaac is forecast to reach hurricane strength soon, and is expected to make landfall near New Orleans on Tuesday night. Here is the NHC website with the forecast track and satellite images. It appears Isaac will be slow down as it makes landfall and will be over New Orleans for an extended period.

The big news tomorrow will be the release of the Case-Shiller house price index for June that I expect will to show a year-over-year increase for the first time since the housing bust started (except a brief increase in 2010 related to the housing tax credit).

On Tuesday:

• At 9:30 AM ET, the S&P/Case-Shiller House Price Index for June (and the national index for Q2) will be released. The consensus is for a no change year-over-year in the Composite 20 prices (NSA) for June. The Zillow forecast is for the Composite 20 to increase 0.3% year-over-year, and for prices to increase 0.9% month-to-month seasonally adjusted.

• At 10:00 AM, the Conference Board's consumer confidence index for August is scheduled for release. The consensus is for a decrease to 65.0 from 65.9 last month.

• Also at 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for August will be released. The consensus is for an increase to -10 for this survey from -17 in July (above zero is expansion).

A question for the August economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

DOT: Vehicle Miles Driven increased 0.4% in June

by Calculated Risk on 8/27/2012 04:49:00 PM

The Department of Transportation (DOT) reported today:

Travel on all roads and streets changed by 0.4% (1.1 billion vehicle miles) for June 2012 as compared with June 2011. Travel for the month is estimated to be 257.6 billion vehicle miles.The following graph shows the rolling 12 month total vehicle miles driven.

Cumulative Travel for 2012 changed by 1.1% (15.6 billion vehicle miles).

The rolling 12 month total is still mostly moving sideways.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 55 months - and still counting.

The second graph shows the year-over-year change from the same month in the previous year.

Gasoline prices peaked in April at close to $4.00 per gallon, and then started falling.

Gasoline prices peaked in April at close to $4.00 per gallon, and then started falling.Gasoline prices were down in June to an average of $3.60 per gallon according to the EIA. Last year, prices in June averaged $3.74 per gallon, so it makes sense that miles driven are up year-over-year in June.

Just looking at gasoline prices suggest miles driven will be up in July too, but then decline year-over-year in August with the recent increase in prices.

However, as I've mentioned before, gasoline prices are just part of the story. The lack of growth in miles driven over the last 4+ years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 50 drivers drive fewer miles) and changing driving habits of young drivers. With all these factors, it may be years before we see a new peak in miles driven.

Fed's Pianalto discusses Benefits and Costs of QE3

by Calculated Risk on 8/27/2012 01:08:00 PM

From Cleveland Fed President Sandra Pianalto: The Federal Reserve and Monetary Policy

I am expecting the U.S. economy to continue to grow, but at a moderate pace. I expect economic growth of about 2 percent this year. And with this moderate GDP growth forecast, my outlook is for very slow improvement in the jobless rate. I expect the pace of GDP growth to pick up gradually through 2014, and for the unemployment rate to remain above 7 percent through 2014. Given my outlook for slow economic growth, I also expect slow wage growth, and I anticipate that core inflation will remain near the FOMC's 2 percent long-term objective over the next few years. While inflation remains close to our objective, unemployment is still well above the FOMC's estimate of the longer-term normal rate. The monetary policy debate is whether the FOMC should take further actions to stimulate today's slow-growth economy to bring down unemployment.Pianalto is a voting member of the FOMC and her views are considered to be in the middle. Her concern about "a meaningful deterioration in securities market functioning" was addressed in the last meeting in a staff report, from the FOMC minutes:

Monetary policy should do what it can to support the recovery, but there are limits to what monetary policy can accomplish. Monetary policy cannot directly control the unemployment rate. It can only foster conditions in financial markets that are conducive to growth and a lower unemployment rate. At times, significant obstacles can get in the way.

...

... large-scale asset purchases can be effective. But our experience with these programs is limited, and as a result, they justify more analysis. For example, as the structure of interest rates has moved lower over time, it is possible that future large-scale asset purchase programs will yield somewhat smaller interest-rate declines than past programs. A related issue to evaluate is whether further reductions in longer-term interest rates would stimulate economic activity to the same degree as they have in the past.

Let me now turn to some of the potential costs. It is conceivable that, at some point, policies designed to promote further declines in rates could interfere with financial stability. Some financial institutions find themselves challenged today by the low-interest-rate environment, and they might take actions to remain profitable that could affect risk in the financial system. ...

Finally, it is also conceivable that, at some point, the Federal Reserve's presence in certain securities markets would become so large that it would distort market functioning. It is important to have good estimates of how large the Federal Reserve's participation would have to be to cause a meaningful deterioration in securities market functioning, and to better understand the potential costs of such deterioration for the economy as a whole.

The bottom line is this: I am supportive of actions that provide economic benefits with manageable risks. The FOMC's policy actions to date have been important economic stabilizers and have acted to support the expansion. Yet today, we still find ourselves in a challenging economic environment – one in which we continue to rely on nontraditional policy tools. These new tools come with benefits and with risks ... and we must constantly weigh both in our efforts to meet our dual mandate of maximum employment and stable prices.

In reviewing the costs that such a program might entail, some participants expressed concerns about the effects of additional asset purchases on trading conditions in markets related to Treasury securities and agency MBS, but others agreed with the staff's analysis showing substantial capacity for additional purchases without disrupting market functioning.Some reports will probably focus on Pianalto's comment that "there are limits to what monetary policy can accomplish", but she clearly outlined the dual mandate, noted that unemployment was forecast to be very high for years, while inflation is forecast to be "close" to the FOMC objective - and there has already been a staff report addressing her concern about market functioning. My guess is she is leaning towards additional accommodation.

Dallas Fed: "Growth Slows" in August Regional Manufacturing Activity

by Calculated Risk on 8/27/2012 10:30:00 AM

From the Dallas Fed: Texas Manufacturing Growth Slows but Six-Month Expectations Improve

Texas factory activity increased but at a slower pace in August, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, fell from 12 to 6.4, suggesting softer output growth.This was above expectations of a -6.0 reading for the general business activity index.

The general business activity index remained negative but climbed nearly 12 points from -13.2 to -1.6.

...

Labor market indicators reflected stronger labor demand but unchanged workweeks. Employment growth picked up in August, with the index rising to 14.2, its highest reading in five months. Twenty-four percent of firms reported hiring new workers, while 10 percent reported layoffs. The hours worked index was near zero, suggesting little change in workweek length.

So far all of regional manufacturing surveys have been weak in August.