by Calculated Risk on 8/24/2012 03:59:00 PM

Friday, August 24, 2012

Lawler: Updated Distressed Home Sales Share Table

CR Note: Tom Lawler thanks everyone for voting his horse "Dealer" to victory in the best pet contest. My congratulations to Rosemary and Tom who are celebrating their anniversary today!

Economist Tom Lawler sent me the table below for several more distressed areas. For almost of these areas (except Rhode Island), the share of distressed sales is down from July 2011 - and for the areas that break out short sales, the share of short sales has increased (except Minneapolis, and Lee County, FL) and the share of foreclosure sales are down. In most areas, short sales are higher than foreclosures, and for some areas like Phoenix, Reno and Las Vegas, short sales are now double the rate of foreclosures.

From Lawler: For the combined markets below showing the “total” distressed share of home sales, total home sales in July were up 8.7% from last July, but “non-distressed” sales were up by over 30%!

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-July | 11-July | 12-July | 11-July | 12-July | 11-July | |

| Las Vegas | 40.0% | 20.2% | 20.7% | 50.2% | 60.7% | 70.4% |

| Reno | 38.0% | 28.0% | 15.0% | 37.0% | 53.0% | 65.0% |

| Phoenix | 29.5% | 23.6% | 14.6% | 43.1% | 44.1% | 66.7% |

| Sacramento | 32.0% | 22.3% | 22.4% | 39.0% | 54.4% | 61.3% |

| Minneapolis | 9.3% | 11.0% | 24.8% | 34.4% | 34.1% | 45.4% |

| Mid-Atlantic (MRIS) | 11.3% | 10.2% | 8.7% | 15.1% | 20.0% | 25.2% |

| Orlando | 28.2% | 29.4% | 23.7% | 28.2% | 51.9% | 57.6% |

| California (DQ) | 19.0% | 17.3% | 22.0% | 34.5% | 41.0% | 51.8% |

| Lee County, FL | 17.3% | 18.8% | 15.9% | 30.6% | 33.2% | 49.4% |

| Hampton Roads VA | 29.1% | 30.3% | ||||

| Northeast Florida | 39.0% | 44.1% | ||||

| Sarasota | 32.4% | 38.0% | ||||

| Chicago | 36.1% | 36.7% | ||||

| Rhode Island | 24.8% | 20.3% | ||||

| Miami-Dade | 47.0% | 52.0% | ||||

| Memphis | 26.7% | 31.9% | ||||

| Birmingham AL | 27.2% | 28.4% | ||||

| Houston | 16.3% | 19.6% | ||||

Merkel and Samaras Press Conference

by Calculated Risk on 8/24/2012 01:29:00 PM

From the Athens News: Merkel lays down the law

“We expect Greece to deliver all that has been promised,” Merkel declared. In remarks that were unusually sharp for a joint news conference, she stressed that Berlin has heard words in the past but now expects deeds.Here is a transcript in Greek from the Greek government.

The tough talk contrasted sharply with the head of state honours and diplomatic smiles with which Samaras was received on his first official visit, complete with red carpet and band.

Merkel said that Samaras’ visit is a sign of the “very close ties” between the two countries, only to add later that each side had lost credibility in the eyes of the other and that trust must be regained.

“Our aim is for Greece to remain in the eurozone, despite all the problems that exist,” Merkel said, noting that the euro is more than a currency, that it is the embodiment of European unification.

Moreover, Merkel noted the tremendous sacrifices that the Greek people have made over the last years, underlining that the weaker classes have borne the brunt of austerity and that those who profited during previous years of prosperity have not done their part.

The remark was a thinly veiled barb against the handling of austerity measures by successive Greek governments, which have done nothing to combat rampant tax evasion among the higher income brackets, opting instead for repeated horizontal wage and pension cuts.

...

For his part, Samaras pledged that his government will pursue reforms on a strict timetable and that he is determined to “bring results”.

“I am certain that the troika report will signal that the new coalition government will deliver,” he said.

“We are eliminating two deficits at once – the country’s budget deficit and the credibility deficit,” he said.

But the prime minister underlined that “a revival of the economy and growth is of crucial importance to meet our obligations soon”.

And a google translation.

BLS: Displaced Workers Summary

by Calculated Risk on 8/24/2012 10:13:00 AM

This is an interesting biennial survey that tracks people who lost jobs that they had held for 3+ years ...

From the BLS: Displaced Workers Summary

From January 2009 through December 2011, 6.1 million workers were displaced from jobs they had held for at least 3 years, the U.S. Bureau of Labor Statistics reported today. This was down from 6.9 million for the survey period covering January 2007 to December 2009. In January 2012, 56 percent of workers displaced from 2009-11 were reemployed, up by 7 percentage points from the prior survey in January 2010.Some improvement for the previous survey (that included 2008). But, as of January 2012, only 56 percent of these workers had found new employment. And about 1/3 of those who were reemployed, took 20%+ pay cuts. From the survey:

Of the 3.0 million displaced workers who lost full-time wage and salary jobs during the 2009-11 period and were reemployed, 2.4 million had full-time wage and salary jobs in January 2012. Of these reemployed full-time workers who reported earnings on their lost job, 46 percent were earning as much or more in January 2012 as they did at their lost job. About one-third reported earnings losses of 20 percent or more.

Durable Goods orders increase 4.2% in July

by Calculated Risk on 8/24/2012 08:30:00 AM

Durable goods is always very volatile. This increase was related to a large increase in aircraft orders (Nondefense aircraft and parts increased 14.1%), Ex-transportation, orders fell 0.4% in July.

From the Census Bureau: Advance Report on Durable Goods Manufacturers’ Shipments, Inventories and Orders

January 2012

New orders for manufactured durable goods in July increased $9.4 billion or 4.2 percent to $230.7 billion, the U.S. Census Bureau announced today. This increase, up three consecutive months, followed a 1.6 percent June increase. Excluding transportation, new orders decreased 0.4 percent. Excluding defense, new orders increased 5.7 percent.Expectations were for a 1.9% increase in orders.

Transportation equipment, up five of the last six months, had the largest increase, $9.9 billion or 14.1 percent to $80.4 billion.

Thursday, August 23, 2012

Friday: Durable Goods, Europe, and requesting a favor

by Calculated Risk on 8/23/2012 09:04:00 PM

First, my friend Tom Lawler has been very kind and allowed me to excerpt pieces from his daily newsletter to share with everyone. The Lawler's beloved horse "Dealer" has had some lameness issues this year, and to cheer up his wife (and himself) Tom entered Dealer in a local best pet contest and hopes to surprise his wife with "Dealer" being named best pet. Right now Dealer is trailing in the voting, and Tom needs your help. If you could spare a few seconds, please go to this site and vote for "Dealer". Thank you so much!

A few articles on global issues ...

From the NY Times: French and German Leaders Meet as Fresh Signs Point to Regional Recession

Returning to business after their summer breaks, the German and French leaders met here Thursday to discuss the continuing crisis in the euro zone, even as fresh economic data reinforced fears that the region was sliding into recession.From the NY Times: China Confronts Mounting Piles Of Unsold Goods

After three decades of torrid growth, China is encountering an unfamiliar problem with its newly struggling economy: a huge buildup of unsold goods that is cluttering shop floors, clogging car dealerships and filling factory warehouses.From the Financial Times: Athens and Berlin in spat over funds

The glut of everything from steel and household appliances to cars and apartments is hampering China’s efforts to emerge from a sharp economic slowdown. It has also produced a series of price wars and has led manufacturers to redouble efforts to export what they cannot sell at home.

Leaders in Athens and Berlin wrangled publicly over how to deal with Greece’s plea for further assistance as fears of a renewed eurozone recession mounted yesterday.On Friday:

...

Wolfgang Schäuble, finance minister, said on German radio that there was “understanding” for Athens’ predicament, but giving it more time was “not the solution”, adding: “More time implies . . . more money.”

excerpt with permission

• At 8:30 AM ET, Durable Goods Orders for July from the Census Bureau. The consensus is for a 1.9% increase in durable goods orders.

• At 10:00 AM, the Worker Displacement report from the BLS for January 2012 will be released. This report will probably receive some attention because of weak labor market.

• Europe Note: the Spanish Government is expected to announce the details of the bank bailout. Also on Friday, Greek Prime Minister Samaras and German Chancellor Merkel will meet in Berlin with a press conference to follow.

Earlier:

• New Home Sales increase in July to 372,000 Annual Rate

• New Home Sales and Distressing Gap

• New Home Sales graphs

Misc: Negative Equity declines, FHFA house prices increase, Flash PMI

by Calculated Risk on 8/23/2012 04:44:00 PM

• From Zillow: Negative Equity Falls in Second Quarter; Nearly Half of Borrowers Under 40 Remain Underwater

Negative equity declined in the second quarter, with 30.9 percent of U.S. homeowners with mortgages – or 15.3 million – underwater, according to the second quarter Zillow® Negative Equity Report. That was down from 31.4 percent of homeowners with mortgages, or 15.7 million, underwater in the first quarter.That is a decline of about 400,000 borrowers (I expect a larger decline when CoreLogic reports). Zillow chief economist Stan Humphries has more: Negative Equity Declines Slightly on the Back of Modest Home Value Gains

The total amount of negative equity in the country declined by $42 billion in the second quarter to $1.15 trillion.

While roughly one out of every three homeowners with mortgages is underwater, 91 percent of these homeowners are current on their mortgage and continue to make payments.

Click on graph for larger image.

Click on graph for larger image.Humphries provided this chart of Zillow's estimate of the Loan-to-Value (LTV) for homeowners with a mortgage. From Humphries:

Over 40 percent of underwater homeowners (12.5 percent of all homeowners with a mortgage), owe between 1 and 20 percent more than their home is worth. On the other end of the spectrum, about 2.2 million underwater homeowners (4.5 percent of all homeowners with mortgages) owe more than double what their home is worthThe biggest concern are those homeowners deep underwater.

• From the FHFA: U.S. House Prices Rose 1.8 Percent From First Quarter to Second Quarter 2012

U.S. house prices rose 1.8 percent from the first quarter to the second quarter of 2012 according to the Federal Housing Finance Agency’s (FHFA) seasonally adjusted purchase-only house price index (HPI). The HPI is calculated using home sales price information from Fannie Mae and Freddie Mac mortgages. Seasonally adjusted house prices rose 3.0 percent from the second quarter of 2011 to the second quarter of 2012. FHFA’s seasonally adjusted monthly index for June was up 0.7 percent from May.The Case-Shiller index will for June will be released this coming Tuesday.

“Although some housing markets are still facing significant challenges, house prices were quite strong in most areas in the second quarter,” said FHFA Principal Economist Andrew Leventis. “The strong appreciation may partially reflect fewer homes sold in distress, but declining mortgage rates and a modest supply of homes available for sale likely account for most of the price increase.”

• From MarkIt: PMI continues to signal weak manufacturing expansion in August

The preliminary ‘flash’ PMI reading which is based on around 85% of usual monthly replies rose slightly from 51.4 in July to 51.9 ... Employment in the manufacturing sector rose further in August, but the rate of job creation slowed for the fifth month running to the weakest since December 2010.This was weak, but better than the expected 51.0.

Earlier:

• New Home Sales increase in July to 372,000 Annual Rate

• New Home Sales and Distressing Gap

• New Home Sales graphs

New Home Sales and Distressing Gap

by Calculated Risk on 8/23/2012 12:59:00 PM

As I mentioned earlier, new home sales have averaged 360,000 on an annual rate basis through July. That means sales are on pace to increase 18% from last year (I expect some upward revisions, and for sales to increase 20%+ this year).

Here is a table showing sales and the change from the previous year since the peak in 2005:

| Year | New Home Sales (000s) | Change |

|---|---|---|

| 2005 | 1,283 | |

| 2006 | 1,051 | -18% |

| 2007 | 776 | -26% |

| 2008 | 485 | -38% |

| 2009 | 375 | -23% |

| 2010 | 323 | -14% |

| 2011 | 306 | -5% |

| 20121 | 360 | 18% |

| 12012 pace through July. | ||

This is still a very low level of sales, but clearly new home sales have bottomed and are starting to recover. I don't expect sales to increase to 2005 levels, but something close to 800,000 is possible once the number of distressed sales declines to more normal levels.

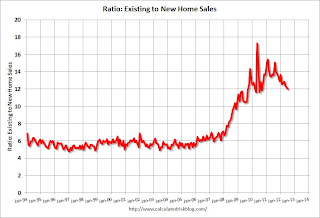

Here is an update to the distressing gap graph.

Click on graph for larger image.

Click on graph for larger image.This "distressing gap" graph that shows existing home sales (left axis) and new home sales (right axis) through June. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales has kept existing home sales elevated, and depressed new home sales since builders haven't been able to compete with the low prices of all the foreclosed properties.

I don't expect much of an increase in existing home sales (distressed sales will slowly decline and be offset by more conventional sales). But I do expect this gap to close - mostly from an increase in new home sales.

Another way to look at the same data is as a ratio of existing to new home sales. Historically this ratio has been around 6 (six times as many existing homes sold as new homes sold). I expect this ratio to tend back towards six over the next several years.

Another way to look at the same data is as a ratio of existing to new home sales. Historically this ratio has been around 6 (six times as many existing homes sold as new homes sold). I expect this ratio to tend back towards six over the next several years.Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Earlier:

• New Home Sales increase in July to 372,000 Annual Rate

• New Home Sales graphs

New Home Sales increase in July to 372,000 Annual Rate

by Calculated Risk on 8/23/2012 10:00:00 AM

The Census Bureau reports New Home Sales in July were at a seasonally adjusted annual rate (SAAR) of 372 thousand. This was up from a revised 359 thousand SAAR in June (revised up from 350 thousand). Sales in May were revised down.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Sales of new single-family houses in July 2012 were at a seasonally adjusted annual rate of 372,000 ... This is 3.6 percent above the revised June rate of 359,000 and is 25.3 percent above the July 2011 estimate of 297,000.

Click on graph for larger image in graph gallery.

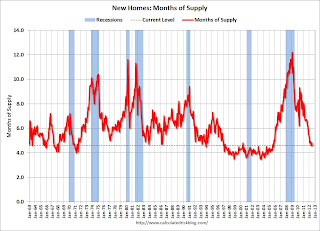

Click on graph for larger image in graph gallery.The second graph shows New Home Months of Supply.

Months of supply declined to 4.6 in July from 4.8 in June.

The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

This is now in the normal range (less than 6 months supply is normal).The seasonally adjusted estimate of new houses for sale at the end of July was 142,000. This represents a supply of 4.6 months at the current sales rate.On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale was at a record low 38,000 units in July. The combined total of completed and under construction is at the lowest level since this series started.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In July 2012 (red column), 34 thousand new homes were sold (NSA). Last year only 27 thousand homes were sold in July. This was the fourth weakest July since this data has been tracked. The high for July was 117 thousand in 2005.

Even though sales are still very low, new home sales have clearly bottomed. New home sales have averaged 360 thousand SAAR over the first 7 months of 2012, after averaging under 300 thousand for the previous 18 months. Most of the recent revisions have been up too.

Even though sales are still very low, new home sales have clearly bottomed. New home sales have averaged 360 thousand SAAR over the first 7 months of 2012, after averaging under 300 thousand for the previous 18 months. Most of the recent revisions have been up too.This was another fairly solid report and indicates an ongoing sluggish recovery in residential investment.

Weekly Initial Unemployment Claims increase to 372,000

by Calculated Risk on 8/23/2012 08:30:00 AM

The DOL reports:

In the week ending August 18, the advance figure for seasonally adjusted initial claims was 372,000, an increase of 4,000 from the previous week's revised figure of 368,000. The 4-week moving average was 368,000, an increase of 3,750 from the previous week's revised average of 364,250.The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 368,000.

This was above the consensus forecast of 365,000.

And here is a long term graph of weekly claims:

And here is a long term graph of weekly claims:The 4-week average post-bubble low is 363,000; this week the average was at 368,000.

Wednesday, August 22, 2012

Thursday: New Home Sales, Weekly Unemployment Claims

by Calculated Risk on 8/22/2012 08:41:00 PM

From Jon Hilsenrath and Kristina Peterson at the WSJ: Fed Moving Closer to Action

The Federal Reserve sent its strongest signal yet that it is preparing new steps to bolster the economic recovery, saying measures would be needed fairly soon unless growth substantially and convincingly picks up.Here is Tim Duy's take: It's All About The Data

Lots of possibilities at this point. If you were looking for additional asset purchases at the last FOMC meeting, you were not crazy. There was obviously widespread concern about the mid-year slowdown and its implications for the stability of the Fed's forecasts. Moreover, policymakers appear to have concluded that additional asset purchases could be effective. If the data had continued to progress as it had since the July/August meeting, I would say that another round of QE was a slam-dunk. But the data has not progressed in the same direction; rather than falling short of expectations, it has tended toward upside surprises. That of course could change over the next few weeks. In short, we need to ask ourselves what will constitute a "substantial and sustainable strengthening." If Lockhart is a guide, I am thinking we have seen such a shift already. If so, I would expect that on the basis of current data the Fed would delay action until closer to the end of Operation Twist II and to see if Congress has come to any agreement on the fiscal situation in 2013. If the change in the data has not reached the threshold of "substantial and sustainable strengthening" then we would expect action. It will be interesting to see if any of the doves back off on their dreary forecasts in the coming days; such shifts in tone would be telling. Also note that there is a middle ground in the possibility of further changes to the communication strategy; something that could placate both the doves and the hawks until a clearer image of the path of the US economy emerges.On Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 365 thousand from 366 thousand.

• At 9:00 AM, the Markit US PMI Manufacturing Index Flash. This is a new release and might provide hints about the ISM PMI for August. The consensus is for a reading of 51.0, down from 51.8 in July.

• At 10:00 AM, New Home Sales for July will be released by the Census Bureau. The consensus is for an increase in sales to 362 thousand Seasonally Adjusted Annual Rate (SAAR) in July from 350 thousand in June. Watch for upgrades to the sales rate for previous months.

• Alst at 10:00 AM, the FHFA House Price Index for June 2012 will be released. This is based on GSE repeat sales and the consensus is for a 0.6% increase in house prices.

Another question for the monthly economic prediction contest:

Europe Note: German Chancellor Merkel and French President Hollande will meet in Berlin