by Calculated Risk on 8/22/2012 11:42:00 AM

Wednesday, August 22, 2012

Existing Home Sales: Inventory and NSA Sales Graph

The NAR had some issues with the report this morning. Here is the press release: Existing-Home Sales Improve in July, Prices Continue to Rise

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, grew 2.3 percent to a seasonally adjusted annual rate of 4.47 million in July from 4.37 million in June, and are 10.4 percent above the 4.05 million-unit pace in July 2011.Based on historical turnover rates, I think "normal" sales would be in the 4.5 to 5.0 million range. So existing home sales are close to "normal" now, however, of course, "normal" would have very few distressed sales - so in that sense the market is a long ways from "normal". But no one should expect existing home sales to go back to 6 or 7 million per year. Instead the key to returning to "normal" is more conventional sales and fewer distressed sales.

...

Total housing inventory at the end July increased 1.3 percent to 2.40 million existing homes available for sale, which represents a 6.4-month supply at the current sales pace, down from a 6.5-month supply in June. Listed inventory is 23.8 percent below a year ago when there was a 9.3-month supply.

...

Distressed homes – foreclosures and short sales sold at deep discounts – accounted for 24 percent of July sales (12 percent were foreclosures and 12 percent were short sales), down from 25 percent in June and 29 percent in July 2011.

...

Given population and demographic demand, [Lawrence Yun, NAR chief economist] said existing-home sales could be in a normal range of 5 to 5.5 million if all conditions were optimal. “Sales may reach 5 million next year, but it will require more sensible lending standards and stronger job creation to push beyond that,” he said.

As I've noted before, what matters the most in the NAR's existing home sales report is inventory; and what matters the most in the new home sales report tomorrow is sales. It is active inventory that impacts prices (although the "shadow" inventory will keep prices from rising). Those looking at the number of existing home sales for a recovery in housing are looking at the wrong number. For existing home sales, look at inventory first and then at the percent of conventional sales.

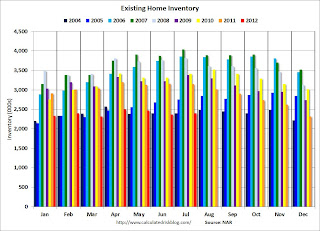

The NAR reported inventory increased to 2.40 million units in July, up slightly from June. This is down 23.8% from July 2011, and down 13% from the inventory level in July 2005 (mid-2005 was when inventory started increasing sharply). This is the same level for inventory as in July 2004.

Clearly inventory will be below the comparable month in 2005 for the rest of the year and will probably track close to the level in 2004. It looks like inventory peaked this year in April.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we compare inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

The following graph shows inventory by month since 2004. In 2005 (dark blue columns), inventory kept rising all year - and that was a clear sign that the housing bubble was ending.

Click on graph for larger image.

Click on graph for larger image.This year (dark red for 2012) inventory is at the lowest level for the month of July since 2004, and inventory is below the level in July 2005 (not counting contingent sales). However inventory is still elevated using months-of-supply, but I expect months-of-supply to be below 6 later this year.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA (red column) are above the sales for 2008, 2010 and 2011. Sales are well below the bubble years of 2005 and 2006.

Sales NSA (red column) are above the sales for 2008, 2010 and 2011. Sales are well below the bubble years of 2005 and 2006.Earlier:

• Existing Home Sales in July: 4.47 million SAAR, 6.4 months of supply99

• Existing Home Sales graphs

Existing Home Sales in July: 4.47 million SAAR, 6.4 months of supply

by Calculated Risk on 8/22/2012 10:00:00 AM

Note: The NAR had release issues this morning.

From the WSJ: Home Resales Jump

Existing-home sales increased 2.3% in July from a month earlier to a seasonally adjusted annual rate of 4.47 million, the National Association of Realtors said Wednesday. The month's sales were 10.4% above the same month a year earlier.

The sales pace for June was unrevised at 4.37 million per year.

The median sales price in July, meanwhile, was $187,300, up 9.4% from the same month a year earlier and the strongest year-over year gain since January 2006.

At the end of July, meanwhile, the inventory of previously owned homes listed for sale rose 1.3% to 2.4 million. That represented a 6.4 month supply at the current sales pace

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in July 2012 (4.47 million SAAR) were 2.3% higher than last month, and were 10.4% above the July 2011 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 2.4 million in July from 2.39 million in June. Inventory is not seasonally adjusted, and usually inventory increases from the seasonal lows in December and January to the seasonal high in mid-summer.

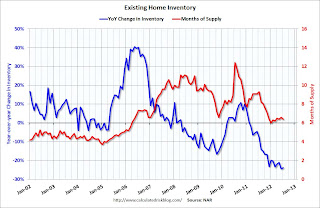

According to the NAR, inventory increased to 2.4 million in July from 2.39 million in June. Inventory is not seasonally adjusted, and usually inventory increases from the seasonal lows in December and January to the seasonal high in mid-summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 23% year-over-year in July from July 2011. This is the seventeenth consecutive month with a YoY decrease in inventory, and near the largest year-over-year decline reported.

Inventory decreased 23% year-over-year in July from July 2011. This is the seventeenth consecutive month with a YoY decrease in inventory, and near the largest year-over-year decline reported.Months of supply decreased to 6.4 months in July.

This was slightly below expectations of sales of 4.50 million. However, as I've noted before, those focusing on sales of existing homes, looking for a recovery for housing, are looking at the wrong number. For existing home sales, the key number is inventory - and the sharp year-over-year decline in inventory is a positive for housing. I'll have more later ...

MBA: Mortgage Refinance Activity declines as Rates Increase

by Calculated Risk on 8/22/2012 07:01:00 AM

From the MBA: Refinance Applications Decline as Rates Increase

The Refinance Index decreased 9 percent from the previous week to the lowest level since early July. The seasonally adjusted Purchase Index increased 0.9 percent from one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 3.86 percent from 3.76 percent, with points decreasing to 0.42 from 0.47 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index. The purchase index has been mostly moving sideways over the last two years.

Note: Yesterday Zillow reported "The 30-year fixed mortgage rate on Zillow(R) Mortgage Marketplace is currently 3.5 percent, up eight basis points from 3.42 percent at this same time last week."

The second graph shows the refinance index.

The second graph shows the refinance index.The refinance activity has declined for three straight weeks as mortgage rates have moved higher. This is still a fairly high level of activity.

Tuesday, August 21, 2012

Wednesday: July Existing Home Sales, FOMC Minutes

by Calculated Risk on 8/21/2012 09:07:00 PM

Europe is coming back from vacation, from the WSJ: Europe Pressures Intensify

After a summer lull, Greece is again Ms. Merkel's biggest headache.Merkel and Samaras will meet on Friday with a press conference following ... The following week ECB President Mario Draghi will speak at the Jackson Hole Economic Symposium on Saturday, Sept 1st at 10 AM.

The Greek government, struggling with depression-like conditions that have pushed the economy to the brink, is likely to need many billions of euros of additional aid to avoid bankruptcy.

... The chancellor is set to meet with French President François Hollande on Thursday and Greek Prime Minister Antonis Samaras on Friday, meetings the chancellor's aides say will help determine Berlin's course.

... The chancellor isn't likely to reach a decision for several weeks, German officials said. In part, they said, she is waiting for two developments that could expand or constrain her options: Germany's constitutional court is due to rule on Sept. 12 on whether the euro zone can launch its permanent bailout fund, and inspectors from the European Union and the IMF are due to report on the size of Greece's finance shortfall. The latter could take until October, some euro-zone officials say.

On Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

• At 10:00 AM, Existing Home Sales for July is scheduled for release by the National Association of Realtors (NAR). The consensus is for sales of 4.50 million on seasonally adjusted annual rate (SAAR) basis. Sales in June 2012 were 4.37 million SAAR.

• At 2:00 PM, the FOMC Minutes for the meeting of July 31-August 1, 2012 will be released. Once again the minutes will be closely scrutinized for hints about QE3.

Another question for the monthly economic prediction contest:

• During the day: The AIA's Architecture Billings Index for July (a leading indicator for commercial real estate) will be released.

FHFA: New Short Sale Guidelines for Fannie and Freddie

by Calculated Risk on 8/21/2012 05:10:00 PM

From the FHFA: New Standard Short Sale Guidelines for Fannie Mae and Freddie Mac

The Federal Housing Finance Agency (FHFA) today announced that Fannie Mae and Freddie Mac are issuing new, clear guidelines to their mortgage servicers that will align and consolidate existing short sales programs into one standard short sale program. The streamlined program rules will enable lenders and servicers to quickly and easily qualify eligible borrowers for a short sale.A few details:

The new guidelines, which go into effect Nov. 1, 2012, will permit a homeowner with a Fannie Mae or Freddie Mac mortgage to sell their home in a short sale even if they are current on their mortgage if they have an eligible hardship. Servicers will be able to expedite processing a short sale for borrowers with hardships such as death of a borrower or co-borrower, divorce, disability, or relocation for a job without any additional approval from Fannie Mae or Freddie Mac.

“These new guidelines demonstrate FHFA’s and Fannie Mae’s and Freddie Mac’s commitment to enhancing and streamlining processes to avoid foreclosure and stabilize communities,” said FHFA Acting Director Edward J. DeMarco. “The new standard short sale program will also provide relief to those underwater borrowers who need to relocate more than 50 miles for a job.”

Fannie Mae and Freddie Mac will waive the right to pursue deficiency judgments in exchange for a financial contribution when a borrower has sufficient income or assets to make cash contributions or sign promissory notes: Servicers will evaluate borrowers for additional capacity to cover the shortfall between the outstanding loan balance and the property sales price as part of approving the short sale.Short sales are already more common than foreclosures in many areas, and these new guidelines will probably lead to an even higher percentage of short sales next year (compared to foreclosures).

Offer special treatment for military personnel with Permanent Change of Station (PCS) orders: Service members who are being relocated will be automatically eligible for short sales, even if they are current on their existing mortgages, and will be under no obligation to contribute funds to cover the shortfall between the outstanding loan balance and the sales price on their homes.

Fannie Mae and Freddie Mac will offer up to $6,000 to second lien holders to expedite a short sale. Previously, second lien holders could slow down the short sale process by negotiating for higher amounts.

More from Fannie Mae: Fannie Mae Announces New Short Sale Guidelines

Under the new guidelines, servicers will be permitted to approve a short sale for borrowers who have certain hardships but have not yet gone into default. Those hardships include the death of a borrower or co-borrower, divorce or legal separation, illness or disability or a distant employment transfer. In addition, Fannie Mae is significantly reducing the documentation required to complete a short sale, including requiring no documentation of a borrower’s hardship 90 days or more delinquent and have a credit score lower than 620. This will remove barriers for those homeowners who are most in danger of foreclosure and increase servicer efficiency in completing a short sale.

Fannie Mae will also limit subordinate-lien payments to $6,000. Previously, subordinate lien holders often attempted to negotiate higher payments. The servicer will be able to offer the maximum payment of $6,000 in order to facilitate the transaction. By setting a standard payout amount and a limit for every transaction, Fannie Mae is removing the guess work and standardizing the transaction to help accelerate the short sale process.

... Fannie Mae completed 38,717 short sales through the first six months of 2012 and 70,025 in full year 2011.

Mortgage Delinquencies by State: Range and Current

by Calculated Risk on 8/21/2012 01:06:00 PM

Two weeks ago I posted a graph of mortgage delinquencies by state. This raised a question of how the current delinquency rate compares to before the crisis - and also a comparison to the peak of the delinquency crisis in each state.

The following graph shows the range of percent seriously delinquent and in-foreclosure for each state (dashed blue line) since 2007. The red diamond indicates the current serious delinquency rate (this includes 90+ days delinquent or in the foreclosure process).

Click on graph for larger image.

Click on graph for larger image.

Many states have seen declines, and several states have seen significant declines in the serious delinquency rate including Arizona, Michigan, Nevada and California. Other states, like New Jersey and New York, have made little or no progress in reducing serious delinquencies.

Arizona, Michigan, Nevada and California are all non-judicial foreclosure states. States with little progress like New Jersey and New York are judicial states. Florida is a judicial states - and has the highest serious deliquency rate - but Florida has seen some improvement.

The second graph shows total delinquencies (including less than 90 days) and in-foreclosure.

The second graph shows total delinquencies (including less than 90 days) and in-foreclosure.

Although some states have seen significant declines in delinquency rates, all states are still above the Q1 2007 levels - and some states have seen little progress.

Philly Fed: State Coincident Indexes in July show weakness

by Calculated Risk on 8/21/2012 10:17:00 AM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for July 2012. In the past month, the indexes increased in 22 states, decreased in 17, and remained stable in 11, for a one-month diffusion index of 10. Over the past three months, the indexes increased in 32 states, decreased in 14, and remained stable in four, for a three-month diffusion index of 36.Note: These are coincident indexes constructed from state employment data. From the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In July, 30 states had increasing activity, down from 35 in June. The last three months have been weak following eight months of widespread growth geographically. The number of states with increasing activity is at the lowest level since January 2010.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession. And the map was all green just just a few months ago.

Now there are a number of red states again.

German Official: "Small concessions are feasible" for Greece

by Calculated Risk on 8/21/2012 08:22:00 AM

From Bloomberg: Germany’s Barthle Says ‘Small Concessions’ Possible for Greece

“Small concessions are feasible provided they are strictly made within the framework of the second aid program,” [Norbert Barthle, the CDU budget spokesman in parliament] said. “For instance, the interest and maturity on loans could be adjusted, as in the case of the first aid package” for Greece. “What’s utterly important is the will of the Greeks to fulfil the terms of financial help. The ball is in the Greeks’ court.”On Friday, Greek Prime Minister Samaras and German Chancellor Merkel will meet in Berlin with a press conference to follow. Europe is about to take center stage once again ...

Monday, August 20, 2012

Research: Loan-to-income guidelines could have "forestalled much of the housing boom"

by Calculated Risk on 8/20/2012 07:34:00 PM

Fed Working Paper by Paolo Gelain, Norges Bank, Kevin Lansing, Federal Reserve Bank of San Francisco and Norges Bank, and Caterina Mendicino, Bank of Portugal: House Prices, Credit Growth, and Excess Volatility: Implications for Monetary and Macroprudential Policy

The researchers looked at the house bubble and several possible policy responses. It appears the most effective policy - for limiting the bubble - would have been to require lenders to focus more on loan-to-income.

From the paper:

Our final policy experiment achieves a countercyclical loan-to-value ratio in a novel way by requiring lenders to place a substantial weight on the borrower’s wage income in the borrowing constraint. As the weight on the borrower’s wage income increases, the generalized borrowing constraint takes on more of the characteristics of a loan-to-income constraint. Intuitively, a loan-to-income constraint represents a more prudent lending criterion than a loan-to-value constraint because income, unlike asset value, is less subject to distortions from bubble-like movements in asset prices. Figure 4 [see below] shows that during the U.S. housing boom of the mid-2000s, loan-to-value measures did not signal any significant increase in household leverage because the value of housing assets rose together with liabilities. Only after the collapse of house prices did the loan-to-value measures provide an indication of excessive household leverage. But by then, the over-accumulation of household debt had already occurred. By contrast, the ratio of U.S. household debt to disposable personal income started to rise rapidly about five years earlier, providing regulators with a more timely warning of a potentially dangerous buildup of household leverage.

We show that the generalized borrowing constraint serves as an “automatic stabilizer” by inducing an endogenously countercyclical loan-to-value ratio. In our view, it is much easier and more realistic for regulators to simply mandate a substantial emphasis on the borrowers’ wage income in the lending decision than to expect regulators to frequently adjust the maximum loan-to-value ratio in a systematic way over the business cycle or the financial/credit cycle.

...

... the most successful stabilization policy in our model calls for lending behavior that is basically the opposite of what was observed during U.S. housing boom of the mid-2000s. As the boom progressed, U.S. lenders placed less emphasis on the borrower’s wage income and more emphasis on expected future house prices. So-called “no-doc” and “low-doc” loans became increasingly popular. Loans were approved that could only perform if house prices continued to rise, thereby allowing borrowers to refinance. It retrospect, it seems likely that stricter adherence to prudent loan-to-income guidelines would have forestalled much of the housing boom, such that the subsequent reversal and the resulting financial turmoil would have been less severe.

Click on graph for larger image.

Click on graph for larger image.From the paper:

Figure 4: During the U.S. housing boom of the mid-2000s, loan-to-value measures did not signal a significant increase in household leverage because the value of housing assets rose together with liabilities. In contrast, the debt-to-income ratio provided a much earlier warning signal of a potentially dangerous buildup of household leverage.Something to remember when the next lending bubble comes along. Also note that debt-to-income is still very high and there is more deleveraging to come.

Leonhardt: Possible Causes of the Income Slump

by Calculated Risk on 8/20/2012 04:55:00 PM

David Leonhardt writes at Economix: The 14 Potential Causes of the Income Slump

Why has median household income just endured its worst 12-year stretch since the Great Depression?Leonhardt has a poll for readers to rank 14 potential causes on why American household income has stagnated including globalization, demographics, fiscal policy, innovation and much more. Leonhardt concludes:

The immediate answer to that question is that economic growth has slowed and inequality has risen. The pie isn’t growing very quickly, and the few new slices are going to a disproportionately small portion of the population.

But that answer is really just an accounting answer. The more important questions are why economic growth has slowed and why inequality has risen – not just over the last 12 years but, less severely, since the early 1970s as well.

In coming days, I’ll be writing posts about what economists see as the major causes.Should be in interesting series.