by Calculated Risk on 7/14/2012 08:01:00 AM

Saturday, July 14, 2012

Summary for Week ending July 13th

This was a very light week for economic news. The only significant report was the trade deficit for May, and that was at expectations. Import oil prices will fall further in June, so the downtrend in the deficit will probably continue for another month. Interestingly, exports to the euro area were actually up year-over-year for May, but that will probably be short lived.

Weekly initial unemployment claims were down sharply last week, but that was due to onetime factors. Consumer sentiment was down – and so was small business confidence – but those are fairly minor reports.

Enjoy the weekend and rest up - next week will be very busy with several key reports and testimony from Fed Chairman Ben Bernanke. Luckily there are a few housing reports next week, so all the data will not be grim (still seems weird to be writing about the housing recovery after all those years of being a housing Grizzly bear!).

Here is a summary of last week in graphs:

• Trade Deficit declines in May to $48.7 Billion

Click on graph for larger image.

Click on graph for larger image.

The trade deficit was at the consensus forecast of $48.7 billion.

Oil averaged $107.91 per barrel in May, down from $109.94 per barrel in April. This will decline further in June. The trade deficit with China increased to $26 billion in May, up from $24.9 billion in May 2011. Once again most of the trade deficit is due to oil and China.

Exports to the euro area were $17 billion in May, up from $16.4 billion in May 2011; so the euro area recession didn't lead to less US exports to the euro area in May.

• BLS: Job Openings increased in May

Job openings increased in May to 3.642 million, up from 3.447 million in April. The number of job openings (yellow) has generally been trending up, and openings are up about 18% year-over-year compared to May 2011.

Job openings increased in May to 3.642 million, up from 3.447 million in April. The number of job openings (yellow) has generally been trending up, and openings are up about 18% year-over-year compared to May 2011.

Quits increased slightly in May, and quits are now up about 6% year-over-year. These are voluntary separations and more quits might indicate some improvement in the labor market. (see light blue columns at bottom of graph for trend for "quits").

• NFIB: Small Business Optimism Index declines in June

This graph shows the small business optimism index since 1986. The index decreased to 91.4 in June from 94.4 in May.

This graph shows the small business optimism index since 1986. The index decreased to 91.4 in June from 94.4 in May.This index remains low, and once again, lack of demand is the biggest problem for small businesses. (In the survey, the "single most important problem" was "poor sales".

Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy and that has contributed to this index remaining low.

• Weekly Initial Unemployment Claims decline to 350,000 due to onetime factors

From MarketWatch: "onetime factors such as fewer auto-sector layoffs than normal likely caused the sharp decline, the Labor Department said Thursday".

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 376,500.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 376,500.The sharp decline was probably due to onetime factors, plus this included the holiday week.

This was well below the consensus forecast of 375,000. With the holiday week and onetime factors, it is difficult to tell if there is any improvement - but this is the lowest level for the four week average since May.

• Consumer Sentiment declines in July to 72.0

The preliminary Reuters / University of Michigan consumer sentiment index for July declined to 72.0, down from the June reading of 73.2.

This was below the consensus forecast of 73.5 and the lowest level this year. Overall sentiment is still weak - probably due to a combination of the high unemployment rate and the sluggish economy.

• Other Economic Stories ...

• CoreLogic: Negative Equity Decreases in Q1 2012

• WSJ: The U.S. Housing Bust Is Over

• Q1 2012: Mortgage Equity Withdrawal strongly negative

• LPS: Mortgages in Foreclosure still near record high, Much higher in Judicial States

Friday, July 13, 2012

Libor Scandal: Old Articles

by Calculated Risk on 7/13/2012 11:13:00 PM

First, from the NY Times today: New York Fed Was Aware of False Reporting on Rates

The Federal Reserve Bank of New York learned in April 2008, as the financial crisis was brewing, that at least one bank was reporting false interest rates.Oh my. Really? In April 2008? We were discussing this in 2007! Here are a few of the articles I linked to years ago ...

At the time, a Barclays employee told a New York Fed official that “we know that we’re not posting um, an honest” rate, according to documents released by the regulator on Friday. The employee indicated that other big banks made similarly bogus reports, saying that the British institution wanted to “fit in with the rest of the crowd.”

From the Financial Times in September 2007:

“The Libor rates are a bit of a fiction. The number on the screen doesn’t always match what we see now,” complains the treasurer of one of the largest City banks.From the WSJ in April 2008: Bankers Cast Doubt On Key Rate Amid Crisis

...

The screen will say one thing but people are actually quoting a different level, if they are quoting at all,” says one senior banker.

The concern: Some banks don't want to report the high rates they're paying for short-term loans because they don't want to tip off the market that they're desperate for cash. The Libor system depends on banks to tell the truth about their borrowing rates. Fibbing by banks could mean that millions of borrowers around the world are paying artificially low rates on their loans. That's good for borrowers, but could be very bad for the banks and other financial institutions that lend to them.From Bloomberg in May 2008: Libor Set for Overhaul as Credibility Is Doubted

"The Libor numbers that banks reported to the BBA were a lie," said Tim Bond, head of global asset allocation at Barclays Capital in London. "They had been all the way along. The BBA has been trying to investigate them and that's why banks have started to report the right numbers."The only new news is that the banks are finally paying fines ...

Bank Failure #33 in 2012: Glasgow Savings Bank, Glasgow, Missouri

by Calculated Risk on 7/13/2012 05:44:00 PM

Not so with Clan Missouri

Penny, pound foolish

by Soylent Green is People

From the FDIC: Regional Missouri Bank, Marceline, Missouri, Assumes All of the Deposits of Glasgow Savings Bank, Glasgow, Missouri

As of March 31, 2012, Glasgow Savings Bank had approximately $24.8 million in total assets and $24.2 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $0.1 million. ... Glasgow Savings Bank is the 33rd FDIC-insured institution to fail in the nation this year, and the first in Missouri.A small one ... but it is Friday! On pace for around 60 bank failures this year, the fewest since 25 banks failed in 2008.

Market Update: More than a Lost Decade

by Calculated Risk on 7/13/2012 04:23:00 PM

Click on graph for larger image.

I haven't posted these graphs in a few months. The first graph shows the S&P 500 since 1990 (this excludes dividends).

The dashed line is the closing price today. The S&P 500 was first at this level in April 1999; over 13 years ago.

The second graph (click on graph for larger image) from Doug Short shows the S&P 500 since the 2007 high ...

Hotels: Occupancy Rate declines in latest weekly survey

by Calculated Risk on 7/13/2012 01:05:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 7 July

In year-over-year comparisons for the week, occupancy ended the week with a 3.7-percent decrease to 61.4 percent, average daily rate increased 3.0 percent to US$101.67 and revenue per available room ended the week virtually flat with a 0.8-percent decrease to US$62.37.The decline in occupancy last week was due to the timing of July 4th (and probably impacted by the mid-week holiday). The 4-week average is still above last year, and is close to the pre-recession levels.

Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

The following graph shows the seasonal pattern for the hotel occupancy rate using a four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2012, yellow is for 2011, blue is "normal" and black is for 2009 - the worst year since the Great Depression for hotels.

Looking forward, leisure travel usually increases over the summer months, and occupancy rates will probably average 70% for the next couple of months. It looks like 2012 will have higher occupancy than 2011, and be close to the pre-recession median. But it will be sometime before investment increases again.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Consumer Sentiment declines in July to 72.0

by Calculated Risk on 7/13/2012 09:55:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for July declined to 72.0, down from the June reading of 73.2.

This was below the consensus forecast of 73.5 and the lowest level this year. Overall sentiment is still weak - probably due to a combination of the high unemployment rate and the sluggish economy.

PPI increases 0.1%, JPMorgan reports $4.4 billion CIO Loss

by Calculated Risk on 7/13/2012 08:46:00 AM

From MarketWatch: U.S. wholesale prices rise 0.1% in June

U.S. wholesale prices rose a seasonally adjusted 0.1% in June as higher costs for food, light trucks and appliances offset another decline in energy costs, the Labor Department said Friday. Excluding the volatile categories of food and energy, core wholesale prices rose a slightly faster 0.2%.Press release from JPMorgan: JPMORGAN CHASE REPORTS SECOND-QUARTER 2012 NET INCOME OF $5.0 BILLION, OR $1.21 PER SHARE, ON REVENUE OF $22.9 BILLION

...

Over the past year wholesale prices have risen an unadjusted 0.7%.

"$4.4 billion pretax loss ($0.69 per share after-tax reduction in earnings) from CIO trading losses and $1.0 billion pretax benefit ($0.16 per share after-tax increase in earnings) from securities gains in CIO’s investment securities portfolio in Corporate"

Much more at FT/alphaville: US Markets Live, Jamie beaches the Whale special edition and 'CIO Risk Management was ineffective in dealing with Synthetic Credit Portfolio’

Thursday, July 12, 2012

Friday: JPMorgan Results, PPI, Consumer sentiment

by Calculated Risk on 7/12/2012 09:17:00 PM

• At 7:00 AM ET, J.P. Morgan will report second Quarter 2012 Financial Results. The press release and conference call will provide an update on the CIO losses. ft.com/alphaville will be following the conference call on US Markets Live starting at 7:30 AM.

The WSJ Deal Journal will also be blogging the 2 hour conference call (2 hour call?). From the WSJ: J.P. Morgan Earnings: What to Watch

The bank is so full of news that Chairman and CEO Jamie Dimon, along with his CFO Doug Braunstein, will host a 2-hour conference call tomorrow morning at 7:30 a.m., shortly after the results hit.I've seen CIO loss estimates as high as $6.5 billion.

WSJ has reported the bank expects the loss to be about $5 billion, and many analysts are looking for that number too.

Analysts expect total revenue to fall 20% to $21.9 billion for the bank.

• At 8:30 AM, the Producer Price Index for June will be released. The consensus is for a 0.4% decrease in producer prices (0.2% increase in core).

• At 9:55 AM, the preliminary Reuter's/University of Michigan's Consumer sentiment index will be released. The consensus is for sentiment to increase slightly to 73.5 from 73.2 in June.

For the economic question contest:

Foreclosure Report: California "Homebuyers should brace themselves for significantly less inventory next year"

by Calculated Risk on 7/12/2012 05:47:00 PM

Two foreclosure reports: one national predicting an increase in distressed sales; the other regional (west) predicting less foreclosure inventory. Both could be correct ... (Update: the reports have conflicting data for California - on that one is probably wrong!)

RealtyTrac released their midyear foreclosure report this morning: 1 Million Properties With Foreclosure Filings in First Half of 2012

Overall foreclosure activity was down in the second quarter, driven primarily by a drop in bank repossessions (REOs), but 311,010 properties started the foreclosure process during the quarter, a 9 percent increase from the previous quarter and a 6 percent increase from the second quarter of 2011 — the first year-over-year increase in quarterly foreclosure starts since the fourth quarter of 2009.And from Foreclosure Radar (just a few states): Foreclosure Inventory Continues To Decline

A total of 31 states posted year-over-year increases in foreclosure starts in the second quarter — 17 judicial foreclosure states and 14 non-judicial foreclosure states.

"Additional scrutiny on how lenders and servicers process foreclosures, along with aggressive foreclosure prevention efforts by the federal government and several state governments, continue to keep a lid on the foreclosure problem at a national level,” said Brandon Moore, CEO of RealtyTrac. “Still, foreclosure starts began boiling over in more markets in the first half of the year, particularly in the second quarter, when rising foreclosure starts spread from primarily judicial foreclosure states in the first quarter to more than half of all non-judicial foreclosure states in the second quarter.

“Lenders and servicers are slowly but surely catching up with the backlog of delinquent loans that under normal circumstances would have started the foreclosure process last year, and that catching up is why the average time to complete the foreclosure process started to level off or decrease in some states in the second quarter,” Moore added. “The increases in foreclosure starts in the first half of the year will likely translate into more short sales and bank repossessions in the second half of the year and into next year.”

June 2012 Foreclosure Sales were significantly down in the three largest foreclosure states in our coverage area. California Foreclosure Sales were down 13.4 percent over last month, and down 48.8 percent vs. June 2011. Arizona Foreclosure Sales were down 18.5 percent over last month, and down 42.1 percent vs. June 2011. Nevada Foreclosure Sales were down 14.6 percent over last month, and down 72.1 percent vs. June 2011 driven by the new regulation that took effect in October 2011. In addition, Foreclosure Filings are flat to down in all states in our coverage area, both on a month over month basis and vs. previous year. Arizona Notice of Sales were down 27.7 percent over last month, Nevada Notice of Defaults were down 22.7 percent over last month, and California Notice of Defaults were basically flat, being down 0.9 percent over last month.

... with the declining level of Foreclosure Sales the inventory will continue to decrease. In California, banks take on average 272 days to resell properties they take back at auction, thus, Realtors, investors, and homebuyers should brace themselves for significantly less inventory in next years' selling season.

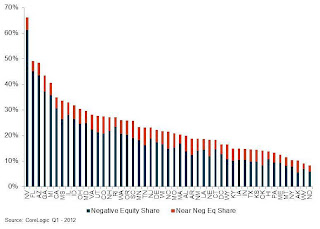

CoreLogic: Negative Equity Decreases in Q1 2012

by Calculated Risk on 7/12/2012 03:05:00 PM

From CoreLogic: CORELOGIC® Reports Negative Equity Decreases in First Quarter of 2012

CoreLogic ... today released new data showing that 11.4 million, or 23.7 percent, of all residential properties with a mortgage were in negative equity at the end of the first quarter of 2012. This is down from 12.1 million properties, or 25.2 percent, in the fourth quarter of 2011. An additional 2.3 million borrowers had less than 5 percent equity, referred to as near-negative equity, in the first quarter.Note: CoreLogic revised their methodology, and they provided revised historical data here.

Together, negative equity and near-negative equity mortgages accounted for 28.5 percent of all residential properties with a mortgage nationwide in the first quarter, down from 30.1 percent in Q4 2011. More than 700,000 households regained a positive equity position in the Q1 2012. Nationally, negative equity decreased from $742 billion in Q4 2011 to $691 billion in the first quarter, a fall of $51 billion in large part due to an improvement in house price levels.

“In the first quarter of 2012, rebounding home prices, a healthier balance of real estate supply and demand, and a slowing share of distressed sales activity helped to reduce the negative equity share,” said Mark Fleming, chief economist for CoreLogic. “This is a meaningful improvement that is driven by quickly improving outlooks in some of the hardest hit markets. While the overall stagnating economic recovery will likely slow housing market recovery in the second half of this year, reducing the number of underwater households is an important step toward reducing future mortgage default risk.”

Click on graph for larger image.

Click on graph for larger image.This graph shows the break down of negative equity by state. Note: Data not available for some states. From CoreLogic:

"Nevada had the highest negative equity percentage with 61 percent of all mortgaged properties underwater, followed by Florida (45 percent), Arizona (43 percent), Georgia (37 percent) and Michigan (35 percent). These top five states combined have an average negative equity share of 44.5 percent, while the remaining states have a combined average negative equity share of 15.9 percent."

The second graph shows the historical negative equity share using the new CoreLogic methodology.

The second graph shows the historical negative equity share using the new CoreLogic methodology.More from CoreLogic: "As of Q1 2012, there were 1.9 million borrowers who were only 5 percent underwater. If home prices continue increasing over the next year, these borrowers could move out of a negative equity position."

This is some improvement, but there are still 11.4 residential properties with negative equity.