by Calculated Risk on 6/15/2012 05:15:00 PM

Friday, June 15, 2012

Lawler: Early Read on Existing Home Sales in May

From economist Tom Lawler:

Based on local realtor/MLS reports I’ve seen so far, I estimate that existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of about 4.66 million, up 0.9% from April’s pace and up 12.3% from last May’s SA pace. For folks watching unadjusted data, May’s YOY sales gain almost certainly exceeded April’s by a far amount. However, this April’s seasonal factor was lower than last year’s (meaning SA sales YOY rose by more than NSA sales), while this May’s seasonal factor (due mainly to a higher business day count) will be higher than last May’s (meaning SA sales YOY will rise by less than NSA sales).

On the inventory side, various reports tracking listings across metro areas across the country suggest that the inventory of existing homes for sale in May were up 1-2% on the month and down 20-22%from a year ago. However, NAR inventory data month to month don’t track these “listings” reports very closely, with the monthly “differences” having a distinct seasonal component. (Every April, e.g., the NAR’s inventory number shows a much larger gain than folks who track listings.)

My “best guess” is that the NAR’s inventory estimate in May will be down about 20.8% from last May. That would imply an estimate of about 2.48 million, which would be down 2.4% from April. Of course, the inventory of existing homes for sale did not really decline 2.4% from April to May, just as the inventory didn’t increase 9.5% from March to April. But listings data seem to track NAR data best if one looks at YOY data, and ignore the strange monthly “quirks” in the NAR estimates.

On median sales prices, my “best guess” using regional data and a sales-weighting scheme is that the median existing SF home sales price this May will be up about 6.6% from last May. However, I should note that last month I was only looking for a YOY increase of 5.5%, and NAR’s report showed a 10.4% YOY increase. After getting in more local data, for the life of me I can’t figure out how the NAR’s number came in so high last month. The regional data were even wackier, with the 10.9% YOY increase in the median SF sales price in the Northeast looking almost inconceivable given reported YOY increases in the various states in the Northeast. I say “almost” because the “mix” of sales can produce “strange” results, but my gut is that the NAR’s number was ... well, simply wrong (would not be the first time!)

CR Note: The NAR is scheduled to release their May existing home sales report next Thursday, June 21st. The consensus forecast is for sales of 4.57 million (seasonally adjusted annual rate).

Based on Lawler's estimate of 4.66 million SAAR and inventory at 2.48 million, months-of-supply would decline to 6.4 months from 6.6 months in April. That would be the lowest months-of-supply for May since 2005.

LA area Port Traffic: Imports down YoY, Exports mostly unchanged in May

by Calculated Risk on 6/15/2012 03:01:00 PM

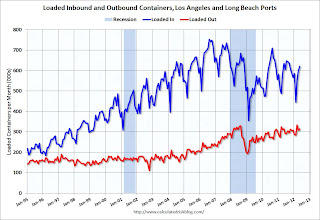

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for May. LA area ports handle about 40% of the nation's container port traffic.

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic is down about 0.2%, and outbound traffic is unchanged compared to April.

In general, inbound and outbound traffic has been moving sideways recently.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

For the month of May, loaded outbound traffic was down 2.4% compared to May 2011, and loaded inbound traffic was unchanged compared to May 2011.

For the month of May, loaded outbound traffic was down 2.4% compared to May 2011, and loaded inbound traffic was unchanged compared to May 2011.

This suggests imports from Asia might be down a little in May, and exports mostly unchanged. (Note: the dollar value of oil imports will be down in May too, so the trade deficit should decline).

State Unemployment Rates little changed in May

by Calculated Risk on 6/15/2012 11:47:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were little changed in May. Eighteen states recorded unemployment rate increases, 14 states and the District of Columbia posted rate decreases, and 18 states had no change, the U.S. Bureau of Labor Statistics reported today. Forty-nine states and the District of Columbia registered unemployment rate decreases from a year earlier, while only one state experienced an increase.

...

Nevada continued to record the highest unemployment rate among the states, 11.6 percent in May [down from 11.7% in April]. Rhode Island and California posted the next highest rates, 11.0 and 10.8 percent, respectively [down from 11.2% and 10.9%]. North Dakota again registered the lowest jobless rate, 3.0 percent, followed by Nebraska, 3.9 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). Every state has some blue - indicating no state is currently at the maximum during the recession.

The states are ranked by the highest current unemployment rate. Only three states still have double digit unemployment rates: Nevada, Rhode Island, and California. This is the fewest since January 2009. In early 2010, 18 states and D.C. had double digit unemployment rates.

It appears some of the "sand states", with the largest housing bubbles, are starting to see faster declines in the unemployment rate (Arizona, Florida, California and Nevada).

Consumer Sentiment declines in June to 74.1

by Calculated Risk on 6/15/2012 09:55:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for June declined to 74.1, down from the May reading of 79.3.

This was below the consensus forecast of 77.5 and the lowest level this year. Overall sentiment is still weak - probably due to a combination of the high unemployment rate and the sluggish economy.

Industrial Production down in May, Capacity Utilization declined

by Calculated Risk on 6/15/2012 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production edged down 0.1 percent in May after having gained 1.0 percent in April. A decrease of 0.4 percent for manufacturing production in May partially reversed a large increase in April. Outside of manufacturing, the output of mines advanced 0.9 percent in May, while the output of utilities rose 0.8 percent. At 97.3 percent of its 2007 average, total industrial production in May was 4.7 percent above its year-earlier level. Capacity utilization for total industry declined 0.2 percentage point to 79.0 percent, a rate 1.3 percentage points below its long-run (1972--2011) average.

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 12.2 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 79.0% is still 1.3 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 80.6% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production declined in May to 97.3. This is 16.6% above the recession low, but still 3.4% below the pre-recession peak.

The consensus was for no change in Industrial Production in April, and for no change in Capacity Utilization at 79.2%. This was below expectations.

NY Fed: Regional manufacturing activity "expanded slightly" in June Survey

by Calculated Risk on 6/15/2012 08:30:00 AM

From the NY Fed: Empire State Manufacturing Survey

The June Empire State Manufacturing Survey indicates that manufacturing activity expanded slightly over the month. The general business conditions index fell fifteen points, but remained positive at 2.3. The new orders index declined six points to 2.2, and the shipments index fell a steep nineteen points to 4.8. Price indexes were markedly lower, with the prices paid index falling eighteen points to 19.6 and the prices received index dropping eleven points to 1.0. Employment indexes also retreated, though they still indicated a small increase in employment levels and a slightly longer average workweek.The employment index declined to 12.4 from 20.5.

This is the first regional manufacturing survey released for June, and this was well below the consensus forecast of 13.8.

Thursday, June 14, 2012

Look Ahead: Industrial Production, Consumer Sentiment and more

by Calculated Risk on 6/14/2012 09:58:00 PM

It seems like it is all about Europe, but there are several US economic indicators to be released tomorrow:

• At 8:30 AM ET, The NY Fed Empire Manufacturing Survey for June will be released. The consensus is for a reading of 13.8, down from 17.1 in May (above zero is expansion).

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for May. The consensus is for no change in Industrial Production in May, and for Capacity Utilization to be unchanged at 79.2%.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (preliminary for June) will be released. The consensus is for sentiment to decline to 77.5 from 79.3 in May.

• At 10:00 AM, the BLS will release the Regional and State Employment and Unemployment report for May 2012.

But most of the discussion tomorrow will be about Greece, Spain, Italy and the rest of Europe.

Greece: Election results expected at 2:30 PM ET Sunday, Unemployment Rate hits Record 22.6%

by Calculated Risk on 6/14/2012 06:21:00 PM

My understanding is the Greek polls close at noon ET on Sunday. According to the Athens News: First safe election estimation to be given at 21.30 on Sunday

The first "safe" estimate of the result of Sunday's repeat general elections is expected to be released at around 9:30 on Sunday night, according the IT firm Singular Logic, which has been assigned the job of collecting and transmitting the results of voting throughout the country.9:30 PM Athens time is 2:30 PM ET.

And from the Athens News: Quarterly unemployment hits record 22.6%

Unemployment hit a record high in the first quarter of 2012, data showed on Thursday ... The jobless rate hit 22.6 percent in the first three months of the year - double the euro zone average ... The statistics service said the number officially unemployed reached 1.12 million in the first quarter, up 57.3 percent year-on-year

Hotels: Occupancy Rate close to Pre-Recession Levels

by Calculated Risk on 6/14/2012 03:54:00 PM

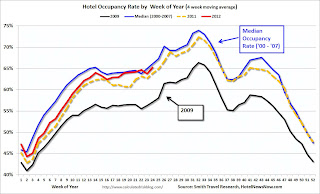

From HotelNewsNow.com: Luxury hotels on top in weekly results

Overall, the U.S. hotel industry’s occupancy ended the week with a 1.3% increase to 68.5%, ADR increased 5.1% to $107.48 and RevPAR rose 6.5% to $73.59.Hotel occupancy, ADR and RevPAR have improved from 2011, and occupancy is back close to normal. ADR is now back to precession levels.

Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

The following graph shows the seasonal pattern for the hotel occupancy rate using a four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2012, yellow is for 2011, blue is "normal" and black is for 2009 - the worst year since the Great Depression for hotels.

Looking forward, leisure travel usually increases over the summer months, and occupancy rates will probably average 70% for the next couple of months. So far it looks like 2012 will have higher occupancy than 2011, and be close to the pre-rececession median. Hotels have come a long way since 2008 when I was writing about The Coming Hotel Bust. But it will be sometime before investment increases again.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Key Measures show slowing inflation in May

by Calculated Risk on 6/14/2012 12:47:00 PM

Earlier today the BLS reported:

The Consumer Price Index for All Urban Consumers (CPI-U) decreased 0.3 percent in May on a seasonally adjusted basis ... The gasoline index declined 6.8 percent in May, leading to a sharp decrease in the energy index and the decline in the all items index. ... The index for all items less food and energy rose 0.2 percent in May, the third consecutive such increase..The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.1% (1.5% annualized rate) in May. The 16% trimmed-mean Consumer Price Index increased 0.1% (1.1% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for May here.

...

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers decreased 0.3% (-3.4% annualized rate) in May. The CPI less food and energy increased 0.2% (2.4% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.3%, the trimmed-mean CPI rose 2.1%, and core CPI rose 2.3%. Core PCE is for April and increased 1.9% year-over-year.

Most of these measures show inflation on a year-over-year basis are still above the Fed's 2% target, but it appears the inflation rate is slowing. On a monthly basis (annualized), most of these measure were below the Fed's target; median CPI was at 1.5%, trimmed-mean CPI was at 1.1%, and Core PCE for April was at 1.6% - although core CPI was at 2.4%.

With the unemployment rate well above the Fed's goal, and inflation slowing, this opens the door for further Fed action, possibly even at the Fed meeting next week.