by Calculated Risk on 6/14/2012 03:54:00 PM

Thursday, June 14, 2012

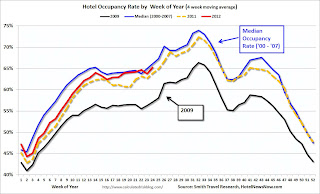

Hotels: Occupancy Rate close to Pre-Recession Levels

From HotelNewsNow.com: Luxury hotels on top in weekly results

Overall, the U.S. hotel industry’s occupancy ended the week with a 1.3% increase to 68.5%, ADR increased 5.1% to $107.48 and RevPAR rose 6.5% to $73.59.Hotel occupancy, ADR and RevPAR have improved from 2011, and occupancy is back close to normal. ADR is now back to precession levels.

Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

The following graph shows the seasonal pattern for the hotel occupancy rate using a four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2012, yellow is for 2011, blue is "normal" and black is for 2009 - the worst year since the Great Depression for hotels.

Looking forward, leisure travel usually increases over the summer months, and occupancy rates will probably average 70% for the next couple of months. So far it looks like 2012 will have higher occupancy than 2011, and be close to the pre-rececession median. Hotels have come a long way since 2008 when I was writing about The Coming Hotel Bust. But it will be sometime before investment increases again.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com