by Calculated Risk on 6/14/2012 10:28:00 AM

Thursday, June 14, 2012

CoreLogic: Existing Home Shadow Inventory declines 15% year-over-year

Note: there are different measures of "shadow" inventory. CoreLogic tries to add up the number of properties that are seriously delinquent, in the foreclosure process, and already REO (lender Real Estate Owned) that are NOT currently listed for sale. Obviously if a house is listed for sale, it is already included in the "visible supply" and cannot be counted as shadow inventory.

From CoreLogic: CoreLogic® Reports Shadow Inventory Fell in April 2012 to October 2008 Levels

CoreLogic ... reported today that the current residential shadow inventory as of April 2012 fell to 1.5 million units, representing a supply of four months. This was a 14.8 percent drop from April 2011, when shadow inventory stood at 1.8 million units, or a six-months’ supply, which is approximately the same level as the country was experiencing in October 2008.

...

“Since peaking at 2.1 million units in January 2010, the shadow inventory has fallen by 28 percent. The decline in the shadow inventory is a positive development because it removes some of the downward pressure on house prices,” said Mark Fleming, chief economist for CoreLogic. “This is one of the reasons why some markets that were formerly identified as deeply distressed, like Arizona, California and Nevada, are now experiencing price increases.”

...

CoreLogic estimates the current stock of properties in the shadow inventory, also known as pending supply, by calculating the number of distressed properties that are seriously delinquent, in foreclosure and held as real estate owned (REO) by mortgage servicers but not currently listed on multiple listing services (MLSs).

...

Of the 1.5 million properties currently in the shadow inventory, 720,000 units are seriously delinquent, 410,000 are in some stage of foreclosure, and 390,000 are already in REO.

Click on graph for larger image.

Click on graph for larger image.This graph from CoreLogic shows the breakdown of "shadow inventory" by category.

Note: The "shadow inventory" could be higher or lower using other numbers and methods; the key is that CoreLogic uses a consistent method (and removes properties currently listed) - and that their estimate of the shadow inventory is declining.

Weekly Initial Unemployment Claims increase to 386,000

by Calculated Risk on 6/14/2012 08:30:00 AM

The DOL reports:

In the week ending June 9, the advance figure for seasonally adjusted initial claims was 386,000, an increase of 6,000 from the previous week's revised figure of 380,000. The 4-week moving average was 382,000, an increase of 3,500 from the previous week's revised average of 378,500.The previous week was revised up from 377,000 to 380,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 382,000.

The average has been between 363,000 and 384,000 all year, and this is near the high for the year.

And here is a long term graph of weekly claims:

This was above to the consensus forecast of 375,000.

This was above to the consensus forecast of 375,000.Wednesday, June 13, 2012

Look Ahead: CPI, Weekly Unemployment Claims, Greece

by Calculated Risk on 6/13/2012 10:25:00 PM

The Greek election is this coming Sunday, and the polls will close at noon ET. The election will probably be very close between "New Democracy" and "Syriza".

The 1st place party gets a 50 seat bonus (out of 300 total seats) and the parties split the remaining seats by the percent of the vote (excluding all parties with less than 3% of the vote).

From Merrill Lynch today:

[T]he baseline scenario [is ]that Greece gets a pro-program government - most likely led by New Democracy and supported by Pasok ... the probability of a disorderly Greek exit from the Euro is significantly reduced.Sunday will be the new Monday once again!

...

Should the less likely scenario of an anti-program government led by Syriza materialize, however, our markets would probably trade as if Greece is on the path of a disorderly exit from the Euro.

On Thursday:

• At 8:30 AM ET, the Consumer Price Index for May will be released. The consensus is for headline CPI to decline 0.2% (with the decline in energy prices). The consensus is for core CPI to increase 0.2%.

• Also at 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for claims to decline to 375 thousand from 377 thousand last week.

DataQuick: SoCal home sales up in May

by Calculated Risk on 6/13/2012 07:49:00 PM

From DataQuick: More Gains for Southern California Home Sales and Median Prices

Last month’s total Southland sales rose nearly 21 percent compared with a year ago, and activity increased across the home-price spectrum. But the gains were strongest above $300,000. The volume of transactions in lower-cost markets has been restrained by, among other things, the dwindling inventories of homes for sale, especially foreclosures.The percent of distressed sales is still very high, but this is the lowest level since March 2008.

...

In May, a total of 22,192 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties. That was up 15.1 percent from 19,284 in April, and up 20.6 percent from 18,394 in May 2011.

...

On a year-over-year basis, Southland home sales have increased for five consecutive months, with last month’s 20.6 percent annual gain the largest in the series. Sales have also increased year-over-year in nine out of the last ten months. Still, last month’s sales were 14.5 percent lower than the average sales tally for all the months of May since 1988.

The month-to-month and year-over-year increases in sales last month would not have been as great if this May hadn’t had one extra business day on which sales could close. While last month had 22 business days, this April and May 2011 had 21 business days.

...

Distressed sales – the combination of foreclosure resales and short sales – made up 44.8 percent of last month’s resale market. That was the lowest level since the figure was 44.4 percent in March 2008.

The median price is being impacted by the mix and isn't useful for measuring house price changes (with fewer low end distressed sales, the median has increased).

The NAR is scheduled to report May existing home sales and inventory next week on Thursday, June 21st.

Tim Duy: "Is Anyone Answering the Phones at the ECB?"

by Calculated Risk on 6/13/2012 04:28:00 PM

From Professor Tim Duy: Is Anyone Answering the Phones at the ECB?. Excerpt:

It is never a good sign when the monetary authority - the lender of last resort - is no longer willing to buy your bonds. If the ECB sees only risk at these rates, why should private investors jump into the pool?

Honestly, I find it incomprehensible to believe that the ECB will not soon come to the aid of Spain and Italy with additional bond purchases. Only the most irresponsible policy body would take such a risk. To not do so almost guarantees the destruction of the Eurozone and a deepening recession if not depression throughout Europe. They cannot possibly believe that fiscal and structural reforms will bear sufficient fruit in any reasonable time frame. Nor can they possibly believe that Spain and Italy can implement a IMF-type structural reform program in the absence of the competitive boost provided by currency devaluation.

Or can they? If they do believe these things - that they can do no more, the job is entirely on the shoulders of fiscal policymakers - then we all need to be afraid, very afraid. Because when the ECB fully abdicates its role as a provider of financial stability for the Eurozone, all Hell is going to break loose.

Report: Housing Inventory declines 20.1% year-over-year in May

by Calculated Risk on 6/13/2012 01:40:00 PM

From Realtor.com: May 2012 Real Estate Data

On the national level, inventory of for-sale single family homes, condominiums, townhouses and co-ops declined by -20.07% in May 2012 compared to a year ago, and declined in all but two of the 146 markets covered by REALTOR.com.Realtor.com also reports that inventory was up 2.0% from the April level.

The median age of the inventory fell -9.78% on a year-over-year basis last month, and the median national list price increased 3.17% last month compared to May 2011.

Signs of recovery are evident in a growing number of markets that were once the epicenter of the housing crisis, and older industrialized areas in the Northeast and the Midwest are showing emerging signs of weaknesses. For example, the recovery process that began in Florida approximately one year ago has since spread to Phoenix and most recently California. At the same time, markets such as Reading, PA, Allentown, PA and Milwaukee, WI continue to lag behind the rest of the market.

The NAR is scheduled to report May existing home sales and inventory next week on Thursday, June 21st.

Redfin: House prices increased 2.2% Year-over-year in May

by Calculated Risk on 6/13/2012 11:51:00 AM

Another house price index, this one is based on price per sq ft ...

From Redfin: May Real Estate Prices Increase 2.2% as Inventory Continues to Fall

Redfin today released a new 19-market analysis of May home prices, sales volume and inventory levels. The Redfin Real-Time Price Tracker ... showed an annual price gain of 2.2% and a monthly gain of 2.7%. Inventory levels were down 23.5% compared to last year, and down 1.7% compared to last month. Sales volume was up 7.4% over this time last year, and pending sales were up even more, by 10.7%.There is limited historical data for this index. In 2011, sales were fairly weak in the May through July period, and a 7.4% increase in year-over-year sales would be less than the 10% year-over-year increase in April.

“We expected real estate to soften in May along with the larger economy, but we actually saw home prices continue to increase,” said Redfin CEO Glenn Kelman. “This trend seems likely to hold at least through mid-summer. Redfin’s business saw a stronger-than-expected rebound from Memorial Day weekend: with rates low and rents high more new home-buyers were touring homes last weekend, and more are now writing offers. The limit on sales volume is inventory. Not enough sellers have stepped in to provide the liquidity that once came from banks with foreclosures to sell.”

“The 2011 decline in inventory was seasonal and largely expected,” said Tim Ellis, Redfin’s real estate analyst. “But once the trend continued into the outset of 2012′s home-buying cycle, inventory shocks resulted in the first sharp price increases for many areas in five years.”

The reported 23.5% decrease in inventory is similar to other sources and is a key driver for the small year-over-year price increase.

Retail Sales decline 0.2% in May

by Calculated Risk on 6/13/2012 08:46:00 AM

On a monthly basis, retail sales were down 0.2% from April to May (seasonally adjusted), and sales were up 5.3% from May 2011. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for May, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $404.6 billion, a decrease of 0.2 percent from the previous month, but 5.3 percent above May 2011.Ex-autos, retail sales declined 0.4% in May.

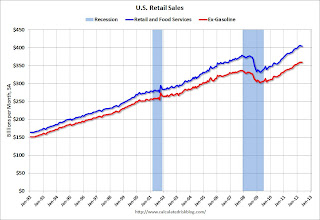

Click on graph for larger image.

Click on graph for larger image.Sales for April was revised down to a 0.2% decrease from a 0.1% increase.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 22.1% from the bottom, and now 6.8% above the pre-recession peak (not inflation adjusted)

The second graph shows the same data since 2006 (to show the recent changes). Excluding gasoline, retail sales are up 18.9% from the bottom, and now 6.8% above the pre-recession peak (not inflation adjusted).

The second graph shows the same data since 2006 (to show the recent changes). Excluding gasoline, retail sales are up 18.9% from the bottom, and now 6.8% above the pre-recession peak (not inflation adjusted).The third graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 5.9% on a YoY basis (5.3% for all retail sales). Retail sales ex-gasoline decreased 0.1% in May.

This was at the consensus forecast for retail sales of a 0.2% decrease in May, and below the consensus for a 0.1% decrease ex-auto.

This was at the consensus forecast for retail sales of a 0.2% decrease in May, and below the consensus for a 0.1% decrease ex-auto. MBA: Mortgage Applications Reach Highest Level Since 2009

by Calculated Risk on 6/13/2012 07:00:00 AM

From the MBA: Mortgage Applications Reach Highest Level Since 2009 in Latest MBA Weekly Survey

The Refinance Index increased over 19 percent from the previous week to the highest index level since April 2009. The seasonally adjusted Purchase Index increased around 13 percent from one week earlier.

“Mortgage application volume increased sharply last week. The increase was accentuated due to the comparison to the week including Memorial Day, but the level of refinance and total market activity is the highest since the spring of 2009,” said Michael Fratantoni, MBA's Vice President of Research and Economics. “Refinance volume increased as borrowers were able to lock in at mortgage rates below 4 percent, and purchase application volume was its highest level in over six months. HARP volume has been steady in recent weeks at about 28 percent of refinance applications.”

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 3.88 percent from 3.87 percent, with points decreasing to 0.43 from 0.46 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Click on graph for larger image.

Click on graph for larger image.The purchase index is still very weak, but appears to be moving up recently.

Refinance activity continues to increase as mortgage rates are near the record low set the previous week.

It usually takes around a 50 bps decline from the previous mortgage rate low to get a huge refinance boom - and rates have fallen about that far - and refinance activity is now at the highest level since 2009.

It usually takes around a 50 bps decline from the previous mortgage rate low to get a huge refinance boom - and rates have fallen about that far - and refinance activity is now at the highest level since 2009.According to the MBA, HARP volume was still at 28% of all refinance activity, so HARP activity is increasing at the same rate as overall refinance activity.

Tuesday, June 12, 2012

Look Ahead: Retail Sales

by Calculated Risk on 6/12/2012 09:45:00 PM

Over in Europe, eurozone industrial production will be released. The consensus is for a 1% decline.

As a reminder, the Greek election is this coming Sunday, and currently polls show no clear winner.

From Bloomberg: Greek Bank Deposit Outflows Said to Have Risen Before Elections

Daily withdrawals have increased to the upper end of a 100 million-euro ($125 million) to 500 million-euro range this month, one banker said, asking not to be identified because the figures aren't public. A second banker said the drawdown may have exceeded 700 million euros yesterday.• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. Expect record or near record low mortgage rates and a sharp increase in refinance activity.

• At 8:30 AM, Retail sales for May will be released. The consensus is for retail sales to decrease 0.2% in May, and for retail sales ex-autos to decrease 0.1%.

• Also at 8:30 AM, the Producer Price Index for May. The consensus is for a 0.6% decrease in producer prices due to the decline in oil prices (0.2% increase in core).

• At 10:00 AM, the Manufacturing and Trade: Inventories and Sales for April will be released (Business inventories). The consensus is for 0.3% increase in inventories.