by Calculated Risk on 5/22/2012 12:08:00 PM

Tuesday, May 22, 2012

Existing Home Sales: Inventory and NSA Sales Graph

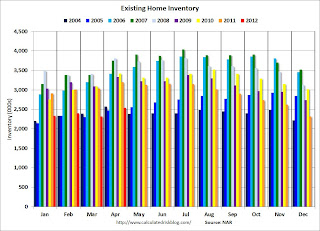

The NAR reported inventory increased to 2.54 million units in April, up 9.5% from the downwardly revised 2.32 million in March (revised down from 2.40 million). This is down 20.6% from April 2011, and up 2.7% from the inventory level in April 2005 (mid-2005 was when inventory started increasing sharply). Inventory was down slightly compared to April 2004 (see first graph below). This decline in inventory remains a significant story.

There is a seasonal pattern for inventory - usually inventory is the lowest in the winter months, and inventory usually peaks mid-summer. However most of the seasonal increase typically happens by April - so we could be close to the peak for this year.

Earlier this year, there were several analysts projecting that inventory would increase to 3 million by mid-summer. I thought that was too high, and it now looks like inventory will peak in the 2.6+ million range. That would be well below the inventory peak in 2005 of 2.9 million units.

At the current sales rate, 2.6 million units of inventory this would push the months-of-supply measure up to 6.7 to 6.8 months from the current 6.6 months. Note: Months-of-supply uses the seasonally adjusted sales rate, and the not seasonally adjusted inventory (even though there is a seasonal pattern for inventory). That would be the lowest seasonal peak for months-of-supply since 2005.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we comparing inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. However, in the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

The following graph shows inventory by month since 2004. In 2005 (dark blue columns), inventory kept rising all year - and that was a clear sign that the housing bubble was ending.

Click on graph for larger image.

Click on graph for larger image.

This year (dark red for 2012) inventory is at the lowest level for the month of April since 2005, and inventory is slightly below the level in April 2004 (not counting contingent sales). Sometime this summer, I expect inventory to be below the same month in 2005. However inventory is still elevated - especially with the much lower sales rate.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA (red column) are above the sales for the 2008, 2009 and 2011 (2010 was higher because of the tax credit). Sales are well below the bubble years of 2005 and 2006.

Sales NSA (red column) are above the sales for the 2008, 2009 and 2011 (2010 was higher because of the tax credit). Sales are well below the bubble years of 2005 and 2006.

Also it appears distressed sales were down in April. From the NAR:

Distressed homes – foreclosures and short sales sold at deep discounts – accounted for 28 percent of April sales (17 percent were foreclosures and 11 percent were short sales), down from 29 percent in March and 37 percent in April 2011.The increase in existing home sales, combined with fewer distressed sales, is a positive sign for the housing market.

Earlier:

• Existing Home Sales in April: 4.62 million SAAR, 6.6 months of supply

• Existing Home Sales graphs

Existing Home Sales in April: 4.62 million SAAR, 6.6 months of supply

by Calculated Risk on 5/22/2012 10:00:00 AM

The NAR reports: April Existing-Home Sales Up, Prices Rise Again

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, increased 3.4 percent to a seasonally adjusted annual rate of 4.62 million in April from a downwardly revised 4.47 million in March, and are 10.0 percent higher than the 4.20 million-unit level in April 2011.

...

Total housing inventory at the end of April rose 9.5 percent to 2.54 million existing homes available for sale, a seasonal increase which represents a 6.6-month supply at the current sales pace, up from a 6.2-month supply in March. Listed inventory is 20.6 percent below a year ago when there was a 9.1-month supply; the record for unsold inventory was 4.04 million in July 2007.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in April 2012 (4.62 million SAAR) were 3.4% higher than last month, and were 10.00% above the April 2011 rate.

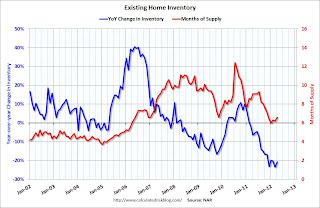

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 2.54 million in April from the downwardly revised 2.32 million in March (revised down from 2.40 million). Inventory is not seasonally adjusted, and usually inventory increases from the seasonal lows in December and January to the seasonal high in mid-summer.

According to the NAR, inventory increased to 2.54 million in April from the downwardly revised 2.32 million in March (revised down from 2.40 million). Inventory is not seasonally adjusted, and usually inventory increases from the seasonal lows in December and January to the seasonal high in mid-summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 20.6% year-over-year in April from April 2011. This is the fourteenth consecutive month with a YoY decrease in inventory.

Inventory decreased 20.6% year-over-year in April from April 2011. This is the fourteenth consecutive month with a YoY decrease in inventory.Months of supply was increased to 6.6 months in April.

This was slightly below expectations of sales of 4.66 million. I'll have more soon ...

New Push for Eurozone Bonds

by Calculated Risk on 5/22/2012 08:48:00 AM

From the Financial Times: OECD joins call for eurozone bonds

The Organization for Economic Co-operation and Development has joined French and EU officials in calling for a move towards jointly-guaranteed euro bonds ...Earlier from the Financial Times: France to push for eurozone bonds

Speaking to the Financial Times, Pier Carlo Padoan, the OECD deputy secretary general and chief economist, said fiscal consolidation alone without other elements of a “growth compact” could ruin chances of a longer-term economic union.

“We need to get on the path towards the issuance of euro bonds sooner rather than later,” he said.

excerpts with permission

France is determined to push the idea of jointly guaranteed bonds as a new form of borrowing for eurozone countries despite Germany’s opposition, Pierre Moscovici, finance minister, said in Berlin on Monday.Update: From the WSJ: IMF Chief, OECD Call For More Euro Debt Sharing

Speaking after a first intensive meeting with Wolfgang Schäuble, his German counterpart, Mr Moscovici confirmed that François Hollande, the newly elected French president, would include the concept as part of a package of growth measures to be debated by European leaders at an informal summit on Wednesday.

International Monetary Fund head Christine Lagarde Tuesday called on euro-zone governments to accept more common liability for each other's debts, saying that the region urgently needs to take further steps to contain the crisis.

"We consider that more needs to be done, particularly by way of fiscal liability-sharing, and there are multiple ways to do that," Ms. Lagarde told a press conference in London to mark the completion of a regular review of U.K. finances.

Monday, May 21, 2012

Look Ahead: Existing Home Sales

by Calculated Risk on 5/21/2012 09:31:00 PM

• Existing home sales for April will be released by the National Association of Realtors (NAR) at 10 AM ET. Existing home sales were at a 4.48 million seasonally adjusted annual rate in March, and the consensus is that sales increased to 4.66 million in April. Housing economist Tom Lawler is forecasting the NAR will report sales of 4.53 million.

Inventory will be closely watched. The NAR reported inventory at 2.37 million in March, and usually inventory increases sharply in April. The median increase from March to April over the last 10 years was 8%. Other sources suggest a smaller than normal seasonal increase, but as Tom Lawler noted last week: "for some reason the NAR’s inventory number in April has for many years shown a much larger monthly gain than listings data might suggest ...", and Lawler is projecting the NAR will report a 6.8% increase for April.

• Also at 10:00 AM, the Richmond Fed will release the regional Survey of Manufacturing Activity for May. The consensus is for a decrease to 11 for this survey from 14 in April (above zero is expansion).

For the monthly economic question contest:

LPS: Mortgage delinquencies increased slightly in April

by Calculated Risk on 5/21/2012 04:45:00 PM

LPS released their First Look report for April today. LPS reported that the percent of loans delinquent increased slightly in April from March, and declined year-over-year. The percent of loans in the foreclosure process was unchanged and remained at a very high level.

LPS reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) increased to 7.12% from 7.09% in March. The percent of delinquent loans is still significantly above the normal rate of around 4.5% to 5%. The percent of delinquent loans peaked at 10.97%, so delinquencies have fallen over half way back to normal. Note: There is a seasonal pattern for delinquencies, and it is not unusual to see an increase in April after a sharp decline in March.

The following table shows the LPS numbers for April 2012, and also for last month (March 2012) and one year ago (April 2011).

| LPS: Percent Loans Delinquent and in Foreclosure Process | |||

|---|---|---|---|

| Apr-12 | Mar-12 | Apr-11 | |

| Delinquent | 7.12% | 7.09% | 7.97% |

| In Foreclosure | 4.14% | 4.14% | 4.14% |

| Number of loans: | |||

| Loans Less than 90 days | 1,927,000 | 1,888,000 | 2,243,000 |

| Loans More than 90 days | 1,595,000 | 1,643,000 | 1,961,000 |

| Loans In foreclosure | 2,048,000 | 2,060,000 | 2,184,000 |

| Total | 5,570,000 | 5,591,000 | 6,388,000 |

The number of delinquent loans is down about 16% year-over-year (682,000 fewer mortgages delinquent), and the number of loans in the foreclosure process is down 136,000 year-over-year (the percent in foreclosure is unchanged, but the number of total loans has declined).

The percent of loans less than 90 days delinquent is about normal, but the percent (and number) of loans 90+ days delinquent and in the foreclosure process are still very high.

DOT: Vehicle Miles Driven increased 0.9% in March

by Calculated Risk on 5/21/2012 02:34:00 PM

The Department of Transportation (DOT) reported:

Travel on all roads and streets changed by +0.9% (2.3 billion vehicle miles) for March 2012 as compared with March 2011. Travel for the month is estimated to be 251.4 billion vehicle miles.The following graph shows the rolling 12 month total vehicle miles driven.

Even with the year-over-year increase in March, the rolling 12 month total is mostly moving sideways.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 52 months - and still counting.

The second graph shows the year-over-year change from the same month in the previous year.

This is the fourth consecutive month with a year-over-year increase in miles driven.

This is the fourth consecutive month with a year-over-year increase in miles driven.Even though gasoline prices were up sharply earlier this year, prices also increased quickly last year in March and April - so we might not see a year-over-year decline in miles driven in the coming months.

The lack of growth in miles driven over the last 4+ years is probably due to a combination of factors: the great recession and the lingering effects, the high price of gasoline - and the aging of the overall population.

As I noted last month, HS Dent has a graph of gasoline demand by age (see page 13 of Age of Consumer demand curves based on Census Bureau data) - and this data shows that gasoline demand peaks around age 50 and then starts to decline. So the flattening of miles driven is probably, at least partially, another impact from the aging of the baby boomers (ht Brian).

FNC: Residential Property Values increase 0.5% in March

by Calculated Risk on 5/21/2012 11:18:00 AM

In addition to Case-Shiller, CoreLogic, and LPS, I'm also watching the FNC, Zillow and RadarLogic indexes.

FNC released their March index data today. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values increased 0.5% in March (Composite 100 index). The other RPIs (10-MSA, 20-MSA, 30-MSA) increased about 0.8% in March. These indices are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

The year-over-year trends continued to show improvement in March, with the Composite 100 index down only 2.4% compared to March 2011. This is the smallest year-over-year decline in the FNC index since 2007.

The year-to-year declines in the largest housing markets, as indicated by the 10- and 30-MSA composites, are now below 3.0%, the slowest year-over-year decline since 2007.

Click on graph for larger image.

Click on graph for larger image.

This graph is based on the FNC index (four composites) through March 2012. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

The indexes are showing less of a year-over-year decline in March. If house prices have bottomed, the year-over-year decline should turn positive later this year or early in 2013.

The March Case-Shiller index will be released next Tuesday.

Chicago Fed: Economic growth near historical trend in April

by Calculated Risk on 5/21/2012 08:44:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows economic activity increased in April

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) rose to +0.11 in April from –0.44 in March. ...This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, ticked down to –0.06 in April from +0.02 in March, falling below zero for the first time since November 2011. April’s CFNAI-MA3 suggests that growth in national economic activity was near its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

Click on graph for larger image.

Click on graph for larger image.This suggests growth was near trend in April.

According to the Chicago Fed:

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, May 20, 2012

Sunday Night Futures

by Calculated Risk on 5/20/2012 10:49:00 PM

There are no major economic releases scheduled for Monday. Atlanta Fed President Dennis Lockhart speaks in Tokyo on monetary policy at 5:15 AM ET, and at 8:30 AM, the Chicago Fed National Activity Index for April is scheduled to be released.

The Asian markets are mixed tonight. The Nikkei is up about 0.3%, and the Shanghai Composite is down 0.4%. On China, here is a worrisome article from the Financial Times: China buyers defer raw material cargos

Chinese consumers of thermal coal and iron ore are asking traders to defer cargos and – in some cases – defaulting on their contracts, in the clearest sign yet of the impact of the country’s economic slowdown on the global raw materials markets.From CNBC: Pre-Market Data and Bloomberg futures: the S&P 500 futures are up about 5, and Dow futures are up 40.

The deferrals and defaults have only emerged in the last few days ...

Excerpt with permission

Oil: WTI futures are down to $91.49 (this is down from $109.77 in February) and Brent is at $107.24 per barrel.

Yesterday:

• Summary for Week Ending May 18th

• Schedule for Week of May 20th

For the monthly economic question contest (for data to be released Tuesday, Wednesday and Friday):

Comment: We need more and better data, not less

by Calculated Risk on 5/20/2012 02:32:00 PM

The Depression led to an effort to enhance and expand data collection on employment, and I was hoping the housing bubble and bust would lead to a similar effort to collect better housing related data. From the BLS history:

[T]he growing crisis [the Depression], spurred action on improving employment statistics. In July [1930], Congress enacted a bill sponsored by Senator Wagner directing the Bureau to "collect, collate, report, and publish at least once each month full and complete statistics of the volume of and changes in employment." Additional appropriations were provided.In the early stages of the Depression, policymakers were flying blind. But at least they recognized the need for better data, and took action. All business people know that when there is a problem, a key first step is to measure the problem. That is why I've been a strong supporter of trying to improve data collection on the number of households, vacant housing units, foreclosures and more.

But unfortunately some people want to eliminate a key source of data ...

From Matthew Philips at Businessweek: Killing the American Community Survey Blinds Business

On May 9 the House voted to kill the American Community Survey, which collects data on some 3 million households each year and is the largest survey next to the decennial census. The ACS—which has a long bipartisan history, including its funding in the mid-1990s and full implementation in 2005—provides data that help determine how more than $400 billion in federal and state funds are spent annually. Businesses also rely heavily on it to do such things as decide where to build new stores, hire new employees, and get valuable insights on consumer spending habits. Check out this video of Target (TGT) executives talking about how much they use ACS data.From Catherine Rampell at the NY Times: The Beginning of the End of the Census?

“This is a program that intrudes on people’s lives, just like the Environmental Protection Agency or the bank regulators,” said Daniel Webster, a first-term Republican congressman from Florida who sponsored the relevant legislation.The good news is this vote is being criticized across the political spectrum ...

“We’re spending $70 per person to fill this out. That’s just not cost effective,” he continued, “especially since in the end this is not a scientific survey. It’s a random survey.”

In fact, the randomness of the survey is precisely what makes the survey scientific, statistical experts say.

From the WSJ: Republicans try to kill data collection that helps economic growth

The House voted 232 to 190 to abolish the Census's American Community Survey, or ACS, which is the new version of the long-form questionnaire and is conducted annually. Republicans claim the long form—asking about everything from demographics to income to commuting times—is prying into private life and is unconstitutional.From the NY Times: Operating in the Dark

In fact, the ACS provides some of the most accurate, objective and granular data about the economy and the American people, in something approaching real time. Ideally, Congress would use the information to make good decisions. Or economists and social scientists draw on the resource to offer better suggestions. Businesses also depend on the ACS's county-by-county statistics to inform investment and hiring decisions. As the great Peter Drucker had it, you can't manage or change what you don't measure.

...

Since the political class is attempting to define the GOP as insane and redefine "moderation" as anything President Obama favors, Republicans do themselves no favors by targeting a useful government purpose.

The Web site of Representative Daniel Webster, Republican of Florida, instructs visitors to click on a link for “Census data for the 8th district” to learn about the area’s economy, businesses, income, employment, homeownership and other important features. And yet, on Wednesday, Mr. Webster declared that the Census Bureau’s American Community Survey — the source for much of that data — is an unconstitutional breach of privacy.From AEI's Norman Ornstein at Roll Call: Research Cuts Are Akin to Eating Seed Corn

significant was the House vote to eliminate the annual American Community Survey and the Economic Census to provide basic information on the state of businesses and industries in the country and data used for generating quarterly gross domestic product estimates.From the WaPo: The American Community Survey is a count worth keeping

If ever we need evidence of ideology run rampant, these actions become exhibit A. Learning about the population and about the economy are fundamental for a society to understand where it has been and where it is going ...

Every year, the Census Bureau asks 3 million American households to answer questions on age, race, housing and health to produce timely information about localities, states and the country at large. This arrangement began as a bipartisan improvement on the decennial census. Yet last week the Republican-led House voted to kill the ACS. This is among the most shortsighted measures we have seen in this Congress, which is saying a lot.And from Menzie Chinn at Econonbrowser: The War on Data Collection

Pretty sad. The only good news is this vote was condemned across the political spectrum.