by Calculated Risk on 5/03/2012 08:37:00 AM

Thursday, May 03, 2012

Weekly Initial Unemployment Claims decline to 365,000

The DOL reports:

In the week ending April 28, the advance figure for seasonally adjusted initial claims was 365,000, a decrease of 27,000 from the previous week's revised figure of 392,000. The 4-week moving average was 383,500, an increase of 750 from the previous week's revised average of 382,750.The previous week was revised up to 392,000 from 388,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 383,500.

This is the highest level for the 4-week moving average since last December.

And here is a long term graph of weekly claims:

This was below the consensus of 378,000. However, even though weekly claims declined, the 4-week average has increased for four straight weeks and is at the highest level this year.

Wednesday, May 02, 2012

Look Ahead: Unemployment Claims, ISM Services, and ECB

by Calculated Risk on 5/02/2012 09:21:00 PM

The focus tomorrow will be on initial weekly unemployment claims, the ISM service index, and the ECB post-meeting press conference.

• Initial weekly unemployment claims will be released at 8:30 AM ET on Thursday. The four week average of weekly claims has been increasing over the last three weeks, possibly indicating some renewed weakness in the labor market, or possibly just noise. The consensus is for claims to decline to 378,000 from 388,000 last week.

• At 10:00 AM, the ISM non-Manufacturing Index (Serives) for April will be released. The consensus is for a slight decline in the index to 55.9 from 56.0 in March (over 50 is expansion). Given the weakness in the Chicago PMI, this index might disappoint (but the ISM service index doesn't move markets like the ISM manufacturing index).

• Also at 10:00 AM, the Trulia House Price & Rent Monitors for April will be released. This is a new index from Trulia that uses asking prices adjusted both for the mix of homes listed for sale and for seasonal factors. For those looking for signs of an inflection point for house prices this is an important index. Asking prices tend to lead the repeat sales indexes by two or more months. This index increased in both February and March (seasonally adjusted), but asking prices were still down 0.7% year-over-year in March. It will be an important change if this index is up year-over-year in April.

• Other data include Productivity and Costs for Q1, and the Ceridian-UCLA Pulse of Commerce Index™, a measure of diesel fuel index consumption for April.

• The European Central Bank (ECB) is meeting tomorrow and no change is expected to interest rates. However the post-meeting briefing might be interesting as ECB President Mario Draghi will probably be asked to clarify his recent support for a "growth pact".

Mortgage Equity Withdrawal update

by Calculated Risk on 5/02/2012 06:39:00 PM

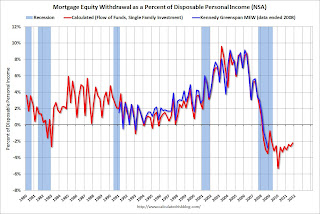

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW", but there is little MEW right now - and normal principal payments and debt cancellation.

For Q4 2011, the Net Equity Extraction was minus $64 billion, or a negative 2.2% of Disposable Personal Income (DPI). This is not seasonally adjusted.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

There are smaller seasonal swings right now, perhaps because there is a little actual MEW (this is heavily impacted by debt cancellation right now).

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding declined sharply in Q4. Mortgage debt has declined by $777 billion over the last four years. This decline is mostly because of debt cancellation per foreclosures and short sales, and some from modifications. There has also been some reduction in mortgage debt as homeowners paid down their mortgages so they could refinance. Note: most homeowners pay down their principal a little each month unless they have an IO or Neg AM loan, so with no new borrowing, equity extraction would always be slightly negative.

For reference:

Dr. James Kennedy also has a new method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.

Lawler: Update on Home Builder Sales

by Calculated Risk on 5/02/2012 02:31:00 PM

From economist Tom Lawler:

Standard Pacific Homes, the 12th largest US home builder in 2010, reported that net home orders (excluding jvs) in the quarter ended March 31st totaled 934, up 43.3% from the comparable quarter of 2011. SPF’s sales cancellation rate, expressed as a % of gross orders, was 13% last quarter, down from 14% a year ago. The company said that its average community count last quarter was up 14.5% from a year ago. Home deliveries (ex jvs) last quarter totaled 642, up 46.2% from the comparable quarter of 2011. The company’s order backlog on 3/31/12 was 973, up 55.2% from last March. The company’s CEO said that “(a)fter a strong finish to 2011, we are pleased to report that the positive momentum has continued into the first quarter,” and that “(w)e believe our solid first quarter results reflect the execution of our strategy and suggest that there may be some stabilization in the economy and the overall housing market." The company’s average selling price was up 4.9% from a year ago, which the company attributed to “general price increases and a product mix shift to move-up home deliveries.” Standard Pacific is one of several builder reporting moderate gains in pricing in some markets.

Beazer Homes, the 9th largest US home builder in 2010, reported that net home orders (including discontinued operations) in the quarter ended March 31sr totaled 1,511, up 26.0% from the comparable quarter of 2011. The company’s sales cancellation rate, expressed as a % of gross orders, was 22.5% last quarter, up from 20.0% a year ago. Home deliveries last quarter totaled 845, up 44.9% from the comparable quarter of last year. The company’s order backlog on 3/31/12 was 1,975, up 39.5% from last March. The company CEO said that the YOY increase in orders and closings reflected “both the initial operational benefits of our path-to-profitability strategies and gradually improving conditions in the housing market,” and he remains “hopeful, but cautious, about the prospects for a sustained market recovery.”

MDC Holdings, the 11th largest US home builder in 2010, reports results for the quarter ended 3/31/12 tomorrow.

Here is a summary of some stats reported by publicly traded home builders for last quarter.

| Settlements | Net Orders | Backlog | |||||||

|---|---|---|---|---|---|---|---|---|---|

| 3/2012 | 3/2011 | 3/2010 | 3/2012 | 3/2011 | 3/2010 | 3/2012 | 3/2011 | 3/2010 | |

| D.R. Horton | 4,240 | 3,516 | 4,260 | 5,899 | 4,943 | 6,438 | 6,189 | 5,281 | 6,314 |

| NVR | 1,924 | 1,634 | 1,919 | 3,157 | 2,403 | 2,940 | 4,909 | 3,685 | 4,552 |

| PulteGroup | 3,117 | 3,141 | 3,795 | 4,991 | 4,345 | 4,320 | 5,798 | 5,188 | 6,456 |

| The Ryland Group | 848 | 688 | 984 | 1,357 | 966 | 1,167 | 2,023 | 1,465 | 1,915 |

| Meritage Homes | 759 | 678 | 808 | 1,144 | 840 | 1,064 | 1,300 | 940 | 1,351 |

| M/I Homes | 507 | 439 | 475 | 764 | 654 | 765 | 933 | 747 | 936 |

| Beazer Homes | 854 | 583 | 852 | 1,511 | 1,199 | 1,673 | 1,975 | 1,416 | 1,781 |

| Standard Pacific | 642 | 439 | 537 | 934 | 652 | 759 | 973 | 627 | 821 |

| Total | 12,891 | 11,118 | 13,630 | 19,757 | 16,002 | 19,126 | 24,100 | 19,349 | 24,126 |

| YOY % change | 15.9% | -18.4% | 23.5% | -16.3% | 24.6% | -19.8% | |||

In the March New SF Home Sales Report, the Census Bureau’s preliminary estimate of new SF home sales in the quarter ended March 31st was up 16.0% (not seasonally adjusted) from the comparable quarter of 2011.

In looking at some history of Census new SF home sales and builder reports, it appears as if the timing of the “recording” of a sale by builders may be slightly ahead of the timing reported to Census as a sale. Stated another way, Census new SF home sales appear to be “correlated” to builder sales reported both in the current quarter and one quarter lagged.

While I’ll update this estimate following tomorrow’s MDC report, right now I estimate that revisions will lift Census’s estimates of new SF home sales last quarter from an average seasonally adjusted annual rate of 337,000 to a SAAR of 350,000.

CR Note: This was from housing economist Tom Lawler.

Over There: Euro zone unemployment rate rises to 10.9%

by Calculated Risk on 5/02/2012 12:32:00 PM

From Jack Ewing at the NY Times: Unemployment Reaches Record High in Euro Zone

Unemployment in the euro zone rose to a new high in March, according to figures released Wednesday, which come a few days before crucial elections in France and Greece, and which are likely to intensify calls for an easing of the region’s austerity drive.Here is the Eurostat data.

Unemployment in the 17 countries that belong to the euro zone rose to 10.9 percent in March from 10.8 percent in February, according to Eurostat, the European Union’s statistics agency. In March 2011, the rate was 9.9 percent, a number that illustrates the deterioration of the area’s economy during the past year.

Germany seems to be doing OK, but Atrios asks the key question: "I wonder who will buy German manufacturing goods when nobody else in Europe has any money."

This reminds me of a quote from someone at Volkswagen last year on the possible end of the euro: “The conclusion is that overall the impact would not be so negative to our company, as we are mainly an exporter ..."

My response was: Export to whom?

LPS: March Foreclosure Starts increase, Foreclosure Sales lowest since December 2010

by Calculated Risk on 5/02/2012 09:15:00 AM

Note: U.S. District Court Judge Collyer approved the consent orders for the mortgage servicer settlement on April 5th, so we still have to wait a little longer to see the impact of the agreement on delinquencies.

LPS released their Mortgage Monitor report for March today.

According to LPS, 7.09% of mortgages were delinquent in March, down from 7.57% in February, and down from 7.78% in March 2011.

LPS reports that 4.14% of mortgages were in the foreclosure process, up slightly from 4.13% in February, and down slightly from 4.15% in March 2011.

This gives a total of 11.23% delinquent or in foreclosure. It breaks down as:

• 1,888,000 loans less than 90 days delinquent.

• 1,643,000 loans 90+ days delinquent.

• 2,060,000 loans in foreclosure process.

For a total of 5,591,000 loans delinquent or in foreclosure in March. This is down from 6,333,000 in March 2011.

This following graph shows the total delinquent and in-foreclosure rates since 1995.

The total delinquency rate has fallen to 7.09% from the peak in January 2010 of 10.97%. A normal rate is probably in the 4% to 5% range, so there is a long ways to go.

The in-foreclosure rate was at 4.14%, down from the record high in October 2011 of 4.29%. There are still a large number of loans in this category (about 2.06 million).

Every year some people fail to pay their mortgage during the holidays, and then they catch up by March. This graph shows the usual decline in the delinquency rate from December to March, and the decline in 2012 was about normal (in percentage terms).

The third graph shows the break down of loans "in foreclosure" by process (judicial vs. non-judicial).

The foreclosure inventory in non-judicial states is much lower and has been slowly declining.

The last graph (all provided by LPS Applied Analytics) shows foreclosure starts and sales.

Foreclosure sales were at their lowest point since December of 2010.

This was before the mortgage servicer settlement was approved in early April, so it is still too early to see the impact of the settlement.

There is much more in the Mortgage Monitor report.

ADP: Private Employment increased 119,000 in April

by Calculated Risk on 5/02/2012 08:18:00 AM

ADP reports:

Employment in the U.S. nonfarm private business sector increased by 119,000 from March to April on a seasonally adjusted basis. The estimated gain from February to March was revised down modestly, from the initial estimate of 209,000 to a revised estimate of 201,000.This was significantly below the consensus forecast of an increase of 178,000 private sector jobs in April. The BLS reports on Friday, and the consensus is for an increase of 165,000 payroll jobs in April, on a seasonally adjusted (SA) basis.

Employment in the private, service-providing sector increased 123,000 in April, after rising 158,000 in March. Employment in the private, goods-producing sector declined 4,000 jobs in April. Manufacturing employment dropped 5,000 jobs, the first loss since September of last year.

Note: ADP hasn't been very useful in predicting the BLS report, but this suggests a weaker than consensus report.

Tuesday, May 01, 2012

New Short Sales Guidelines from Fannie and Freddie

by Calculated Risk on 5/01/2012 08:09:00 PM

I mentioned this announcement two weeks ago - Kathleen Pender at the San Francisco Chronicle has more: New guidelines are a tall order for short sales

Fannie Mae and Freddie Mac have issued new guidelines designed to speed up short sales and make them more consistent, but real estate agents question whether they are achievable in the real world.This doesn't seem realistic, and there doesn't appear to be any penalty for missing the deadlines. But apparently Fannie and Freddie will track the performance of servicers, and maybe they will introduces penalties.

...

Under the new guidelines, which take effect June 15, servicers have 30 days to review and respond to short sale offers or requests. If they need more than 30 days, they must provide the borrower weekly updates and a final response within 60 days.

If the borrower is requesting a short sale under the government's Home Affordable Foreclosure Alternative program, the clock starts ticking when the borrower submits a completed borrower response package requesting consideration of a short sale.

...

If the short sale is not under the government program, the clock starts ticking when the borrower submits a short sale offer from a potential buyer and a completed borrower response package.

...

With the average short sale nationwide taking about six months to complete, real estate agents are happy to see the new timetable but wonder if it's realistic.

One of the key reasons for the slow approval process is the servicer wants to make sure the transaction is arms-length, and that there are no under the table consideration (extended lease, cash, etc.) and that the price is somewhat reasonable. And that takes time ...

U.S. Light Vehicle Sales at 14.42 million annual rate in April

by Calculated Risk on 5/01/2012 04:30:00 PM

Based on an estimate from Autodata Corp, light vehicle sales were at a 14.42 million SAAR in April. That is up 9.8% from April 2011, and up 0.7% from the sales rate last month (14.3 million SAAR in March 2012).

This was at the consensus forecast of 14.4 million SAAR (seasonally adjusted annual rate).

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for April (red, light vehicle sales of 14.42 million SAAR from Autodata Corp).

Click on graph for larger image.

Click on graph for larger image.

April was above the August 2009 rate with the spike in sales from "cash-for-clunkers". Only February had a higher sales rates since early 2008.

Sales are running at over a 14 million annual sales rate through the first four months of 2012, up sharply from the same period of 2011.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

This shows the huge collapse in sales in the 2007 recession. This also shows the impact of the tsunami and supply chain issues on sales, especially in May and June of last year.

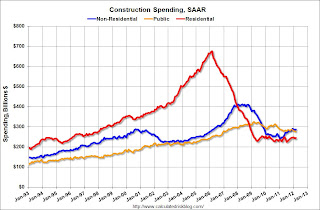

Construction Spending increases slightly in March

by Calculated Risk on 5/01/2012 12:09:00 PM

Catching up ... This morning the Census Bureau reported that overall construction spending increased slightly in March:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during March 2012 was estimated at a seasonally adjusted annual rate of $808.1 billion, 0.1 percent (±1.4%) above the revised February estimate of $807.3 billion. The March figure is 6.0 percent (±1.9%) above the March 2011 estimate of $762.6 billion.Private construction spending increased while public spending decreased:

Spending on private construction was at a seasonally adjusted annual rate of $531.9 billion, 0.7 percent (±1.3%) above the revised February estimate of $528.1 billion. Residential construction was at a seasonally adjusted annual rate of $244.1 billion in March, 0.7 percent (±1.3%) above the revised February estimate of $242.5 billion. Nonresidential construction was at a seasonally adjusted annual rate of $287.8 billion in March, 0.7 percent (±1.3%) above the revised February estimate of $285.7 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 64% below the peak in early 2006, and up 8.4% from the recent low. Non-residential spending is 30% below the peak in January 2008, and up about 18% from the recent low.

Public construction spending is now 15% below the peak in March 2009 and at a new post-bubble low.

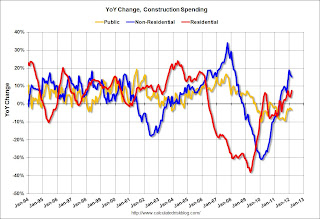

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, both private residential and non-residential construction spending are positive, but public spending is down on a year-over-year basis. The year-over-year improvements in private non-residential are mostly due to energy spending (power and electric).

The year-over-year improvement in private residential investment is an important change (the positive in 2010 was related to the tax credit), and this suggest the bottom is in for residential investment.