by Calculated Risk on 4/27/2012 03:03:00 PM

Friday, April 27, 2012

WSJ on Housing: "Bidding wars are back"

Earlier today from Nick Timiraos at the WSJ: Stunned Home Buyers Find the Bidding Wars Are Back

A new development is catching home buyers off guard as the spring sales season gets under way: Bidding wars are back.Housing economist Tom Lawler sent me this comment on Timiraos' article:

...

From California to Florida, many buyers are increasingly competing for the same house. Unlike the bidding wars that typified the go-go years and largely reflected surging sales, today's are a result of supply shortages.

...

"We very much believe we've hit bottom," said Ivy Zelman, chief executive of a research firm, who was among the first to warn of a downturn seven years ago.

...

The Wall Street Journal's quarterly survey found that the inventory of homes listed for sale declined sharply in all 28 markets tracked. ...

Increased competition is frustrating buyers and their agents. "We're writing a record number of offers, but we're not seeing a record number of closings and that's because it's so competitive," said Glenn Kelman, chief executive of real-estate brokerage Redfin Corp. in Seattle with offices in 14 states.

The above [article] highlights a trend many realtors have been talking about – in many parts of the country homes listed for sale are not just receiving multiple offers, but are selling above list price. In many markets the “catalysts” for this “new” trend are sharply lower inventories of homes listed for sale; moderate increases in “traditional” home buying, spurred by low interest rates, rising rents, and a growing view that home prices may have finally stopped declining; and intense demand by investors for “distressed” properties they plan to rent out. Of course, the article cautions that housing markets face “headwinds” – still high (but much lower) REO inventories, still high (but somewhat lower) numbers of mortgages either seriously delinquent or in foreclosure, still lots of current homeowners “underwater,” and historically “sorta tough” mortgage lending standards. Still, the article is consistent with local realtor reports and other incoming data that home prices in many parts of the country are rebounding, and this trend should be reflected in many widely followed home price indexes a few months from now.

Q1 GDP: Comments and Investment

by Calculated Risk on 4/27/2012 12:11:00 PM

The GDP report was weaker than expected, however, on a positive note, final demand was decent. Personal consumption expenditures increased at a 2.9% annual rate in Q1, and residential investment increased at a 19.1% annual rate. Weather probably provided a boost to GDP - and PCE growth at this rate is not sustainable without more income growth - but this was still decent.

Investment in equipment and software slowed down to a 1.7% annual rate in Q1, but this slowdown is probably temporary. The largest quarterly contributions to GDP from equipment and software in this recovery have probably already happened, but I expect equipment investment to continue at a reasonable pace.

And investment in non-residential structures was negative in Q1. The details will be released next week, but this probably means investment in energy and power structures slowed in Q1 (this has been the main driver for non-residential structure investment over the last couple of years). However, based on the architecture billing index, I expect the drag from other non-residential categories (offices, malls) to end mid-year, so this negative contribution will probably end.

And there was another negative contribution from government spending at all levels. However, it appears the drag from state and local governments will end mid-year (after declining for almost 3 years).

A negative was that some of the increase in GDP was related to a positive contribution from changes in private inventories (this added 0.59 percentage points to Q1 GDP). This will probably be a drag for a quarter or two (swings in inventory are normal).

Overall this was a weak report, but it appears some of the drags will diminish over the course of the year - and that is a positive.

The following graph shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter centered average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

For the following graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Click on graph for larger image.

Click on graph for larger image.

Residential Investment (RI) made a positive contribution to GDP in Q1 for the fourth consecutive quarter. Usually residential investment leads the economy, but that didn't happen this time because of the huge overhang of existing inventory, but now RI is contributing. Sure - some of the boost could be weather related, but RI has clearly bottomed.

The contribution from RI will probably continue to be sluggish compared to previous recoveries, but the ongoing positive contribution to GDP is a significant story.

Equipment and software investment has made a positive contribution to GDP for eleven straight quarters (it is coincident). However the contribution from equipment and software investment in Q1 was the weakest since the recovery started.

The contribution from nonresidential investment in structures was negative in Q1. Nonresidential investment in structures typically lags the recovery, however investment in energy and power has masked the ongoing weakness in office, mall and hotel investment (the underlying details will be released next week).

Residential Investment as a percent of GDP is still near record lows, but it is increasing. Usually RI bounces back quickly following a recession, but this time there is a wide bottom because of the excess supply of existing vacant housing units.

Residential Investment as a percent of GDP is still near record lows, but it is increasing. Usually RI bounces back quickly following a recession, but this time there is a wide bottom because of the excess supply of existing vacant housing units.

Last year the increase in RI was mostly from multifamily and home improvement investment. Now the increase is probably from most categories including single family. I'll break down Residential Investment (RI) into components after the GDP details are released this coming week. Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

The last graph shows non-residential investment in structures and equipment and software.

The last graph shows non-residential investment in structures and equipment and software.

Equipment and software investment had been increasing sharply, however the growth slowed over the last two quarters.

Non-residential investment in structures decreased in Q1 and is still near record lows as a percent of GDP. The recent small increase has come from investment in energy and power. I'll add details for investment in offices, malls and hotels next week.

The key story is that residential investment is continuing to increase, and I expect this to continue all year (although the recovery in RI will be sluggish compared to previous recoveries). Since RI is the best leading indicator for the economy, this suggests no recession this year.

Earlier ...

• Real GDP increased 2.2% annual rate in Q1

Consumer Sentiment increases slightly in April to 76.4

by Calculated Risk on 4/27/2012 09:55:00 AM

Click on graph for larger image.

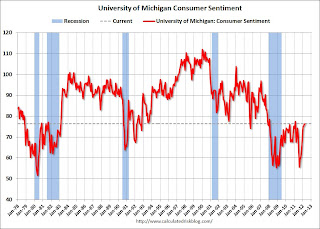

The final Reuters / University of Michigan consumer sentiment index for April increased slightly to 76.4, up from the preliminary reading of 75.7, and up from the March reading of 76.2.

This was above the consensus forecast of 75.7. Overall sentiment is still fairly weak - probably due to a combination of the high unemployment rate, high gasoline prices and sluggish economy - however sentiment has rebounded from the decline last summer.

Real GDP increased 2.2% annual rate in Q1

by Calculated Risk on 4/27/2012 08:44:00 AM

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 2.2 percent in the first quarter of 2012 (that is, from the fourth quarter to the first quarter), according to the "advance" estimate released by the Bureau of Economic Analysis.

The increase in real GDP in the first quarter primarily reflected positive contributions from personal consumption expenditures (PCE), exports, private inventory investment, and residential fixed investment that were partly offset by negative contributions from federal government spending, nonresidential fixed investment, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, increased.

The deceleration in real GDP in the first quarter primarily reflected a deceleration in private inventory investment and a downturn in nonresidential fixed investment that were partly offset by accelerations in PCE and in exports.

Click on graph for larger image.

A few key numbers:

• Real personal consumption expenditures increased 2.9 percent in the first quarter, compared with an increase of 2.1 percent in the fourth.

• Investment growth slowed, except residential investment: "Real nonresidential fixed investment decreased 2.1 percent in the first quarter, in contrast to an increase of 5.2 percent in the fourth. Nonresidential structures decreased 12.0 percent, compared with a decrease of 0.9 percent. Equipment and software increased 1.7 percent, compared with an increase of 7.5 percent. Real residential fixed investment increased 19.1 percent, compared with an increase of 11.6 percent."

• Government spending continued to be a drag at all levels, but at a slower pace: "Real federal government consumption expenditures and gross investment decreased 5.6 percent in the first quarter, compared with a decrease of 6.9 percent in the fourth. ... Real state and local government consumption expenditures and gross investment decreased 1.2 percent, compared with a decrease of 2.2 percent."

This was below expectations. I'll have more on GDP later ...

Thursday, April 26, 2012

"Private money coming back into the housing finance market"

by Calculated Risk on 4/26/2012 09:17:00 PM

Mortgage broker Soylent Green is People sent me an example today of private money coming back into the mortgage market:

Second mortgage purchase mortgage lending above 80% loan to value has begun to creep back into the market. Prudent Underwriting standards and deep risk analysis have convinced some private money to come back into the housing finance market of late. We’ve added an 80 / 10 / 10 product recently that has no Private Mortgage Insurance.CR note: As I mentioned yesterday, when house prices stop falling, private lenders will become more confident and reenter the market. This is just the beginning.

700 FICO minimum.

SFD, and Condos - providing that the project has 75% Owner Occupancy ratios

90% CLTV to $750,000

Interest Only minimum payment HELOC, Prime + 1.99%. No prepayment penalty.

Qualifying at index, margin, plus .125, fully amortized.

45% Absolute debt to income ratio maximum.

Let’s take a $333,400 priced home. Most FHA buyers will put less down, but for comparison purposes assume a 10 percent down payment. An FHA 30 fixed borrower pays 1.75% for the FHA Up Front Mortgage Insurance Premium PLUS 1.20% per year in Mortgage Insurance. Assuming a 3.75% rate and a $300,000 balance, the payment plus MI runs $1,690. A similarly structured Conventional Conforming loan at 3.875% runs $1,532 An 80/10/10 combined payment comes in at $1,437, principal and interest.

That’s quite a payment spread for the typical home buyer to choose from. As more of these risk tolerant companies enter the market, the share of FHA loans will finally diminish.

Some expanded prudent private lending makes sense, but we never want to see Alt-A and stated income loans again!

Contest Question: Will real GDP be above or below consensus?

by Calculated Risk on 4/26/2012 07:17:00 PM

For those entering the monthly contest ...

From MarketWatch: Q1 GDP report to show economy 'plugging along'

Economists polled by MarketWatch expect a 2.7% growth rate in the first quarter, slightly slower than the 3.0% rate in the fourth quarter.Bloomberg is showing the consensus at 2.5%.

There was a wide range of forecasts, from just above a 2% growth rate up to a 3.2%.

Lawler: Builder Reports Exceed Expectations

by Calculated Risk on 4/26/2012 03:16:00 PM

From economist Tom Lawler:

The Ryland Group, the 8th largest US home builder in 2010, reported that net home orders (including discontinued operations) in the quarter ended March 31st totaled 1,357, up 40.5% from the comparable quarter of 2011. The company’s sales cancellation rate, expressed as a % of gross orders, was 18.0% last quarter, down from 18.2% year ago. Home closings totaled 848 last quarter, up 23.3% from the comparable quarter of 2011. The company’s order backlog on 3/31/12 totaled 2,023, up 38.1% from last March. Ryland noted that sales incentives and price concessions totaled 10.9% last quarter, down from 11.7% a year ago.

PulteGroup, the 2nd largest US home builder in 2010, reported that net home orders in the quarter ended March 31st totaled 4,991, up 14.9% from the comparable quarter of 2011. The sales gain came despite a 6% decline in community count. The company’s sales cancellation rate, expressed as a % of gross orders, was 15% last quarter, down form 16% a year ago. Home closings last quarter totaled 3,117, down 0.8% from the comparable quarter of 2011. The company’s order backlog on 3/31/12 totaled 5,798, up 11.8% from last March. Pulte noted that while “(w)e are only one quarter into the year, but the start has exceeded our internal estimates and has us cautiously optimistic that housing demand may have reached a positive inflection point."

Meritage Homes, the 10th largest US home builder in 2010, reported that net home orders in the quarter ended March 31st totaled 1,144, up 36.2% from the comparable quarter of 2011. Home closings last quarter totaled 759, up 11.9% from the comparable quarter of 2011. The company’s order backlog as of 3/31/12 totaled 1,300, up 38.3% from last March. Meritage noted that “(o)ur spring selling season got off to a strong start, as evidenced by our 36% increase in sales in the first quarter,” and that “(a)s demand has strengthened, we've begun to raise prices in most of our communities this year.”

M/I Homes, the 15th largest US home builder in 2010, reported that net home orders in the quarter ended March 31st totaled 764, up 16.8% from the comparable quarter of 2011. The company’s sales cancellation rate, expressed as a % of gross orders, was 14% last quarter, down from 16% a year ago. Home closings last quarter totaled 507, up 15.5% from the comparable quarter of 2011. The company’s order backlog on 3/31/12 totaled 933, up 24.9% from last March. M/I noted that “(o)ur first quarter results reflect what we believe to be slowly improving housing condition.”

All of the publicly-traded builders who have reported results for the quarter ended 3/31/12 so have shown YOY increases in average home sales prices, though in many cases this reflected a change in the mix of homes sold as opposed to overall price increases. By the same token, however, pricing vs. a year ago appears to have been pretty stable, and there appears to have been less price discounting.

Below is a summary of selected stats for the six publicly-traded builders who have released results for the quarter ended in March.

| Settlements | Net Orders | Backlog | |||||||

|---|---|---|---|---|---|---|---|---|---|

| 3/2012 | 3/2011 | 3/2010 | 3/2012 | 3/2011 | 3/2010 | 3/2012 | 3/2011 | 3/2010 | |

| D.R. Horton | 4,240 | 3,516 | 4,260 | 5,899 | 4,943 | 6,438 | 6,189 | 5,281 | 6,314 |

| NVR | 1,924 | 1,634 | 1,919 | 3,157 | 2,403 | 2,940 | 4,909 | 3,685 | 4,552 |

| PulteGroup | 3,117 | 3,141 | 3,795 | 4,991 | 4,345 | 4,320 | 5,798 | 5,188 | 6,456 |

| The Ryland Group | 848 | 688 | 984 | 1,357 | 966 | 1,167 | 2,023 | 1,465 | 1,915 |

| Meritage Homes | 759 | 678 | 808 | 1,144 | 840 | 1,064 | 1,300 | 940 | 1,351 |

| M/I Homes | 507 | 439 | 475 | 764 | 654 | 765 | 933 | 747 | 936 |

| Total | 11,395 | 10,096 | 12,241 | 17,312 | 14,151 | 16,694 | 21,152 | 17,306 | 21,524 |

| YOY % change | 12.9% | -17.5% | 22.3% | -15.2% | 22.2% | -19.6% | |||

On Tuesday the Commerce Department estimated that new SF home sales last quarter were up 16% (not seasonally adjusted) from the comparable quarter of last year. Recently, of course, there has been a pattern of upward revisions to preliminary, and historically during improving markets such revisions are commonplace (and in declining markets, downward revisions are common). I’d bet that when the April new home sales report is released, March’s sales estimate will be revised higher.

CR note: Net orders are above Q1 2010 too when sales average a 358,000 seasonally adjusted annual rate. There has been some consolidation, and cancellations are down, but I think Tom is correct about coming upward revisions.

NMHC Apartment Survey: Market Conditions Tighten in Q1 2012

by Calculated Risk on 4/26/2012 01:07:00 PM

From the National Multi Housing Council (NMHC): Market Conditions Improve For Apartment Industry

Optimism continues for the apartment industry, according to the latest results of the National Multi Housing Council (NMHC) Quarterly Survey of Apartment Market Conditions. The findings reflect a gradual recovery for the multifamily sector that faced a 50-year low in apartment starts in 2009.

The Q1 2012 survey’s four indexes measuring Market Tightness (74), Sales Volume (57), Equity Financing (62) and Debt Financing (65) remained above 50 for the eighth time in the past nine quarters. Any number above 50 indicates quarter-to-quarter growth.

"Market conditions improved across the board, even from the rather strong level of three months ago,” said NMHC Chief Economist Mark Obrinsky. “Demand for apartment residences – and apartment properties – continues to grow. We anticipate this increasing further in the coming years due in part to the large number of younger households moving into the housing market and a greater preference shown for renting.”

...

The Market Tightness Index increased to 74 from 60. Nearly half (49 percent) reported tighter markets – reflecting lower vacancy rates and/or higher rents – compared to only one percent reporting looser markets.

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tightening from the previous quarter. The index has indicated tighter market conditions for the last nine quarters and suggests falling vacancy rates and or rising rents.

This fits with the recent Reis data showing apartment vacancy rates fell in Q1 2012 to 4.9%, down from 5.2% in Q4 2011, and 9.0% at the end of 2009. This is the lowest vacancy rate in the Reis survey in over 10 years.

This survey indicates demand for apartments is still strong. And even though multifamily starts increased in 2011, completions of apartments were near record lows - so supply was constrained. There will be more completions in 2012, but it looks like another strong year for the apartment industry.

A final note: This index helped me call the bottom for effective rents (and the top for vacancy rate) early in 2010.

Misc: Kansas City Fed index weakens, Mortgage Rates near record low, Radar Logic house prices

by Calculated Risk on 4/26/2012 11:20:00 AM

From the Kansas City Fed: Growth in Tenth District Manufacturing Eased Further but Activity Remained Expansionary

“Factories in our region report continued growth, especially in employment, but at somewhat slower rates than in previous months, when unseasonably warm weather may have helped boost activity” said Wilkerson. “Expectations for the rest of the year notched down a bit as well, but remained positive.”Most of the regional surveys were weaker in April, but they also showed an increase in employment.

Growth in Tenth District manufacturing eased further in April, but activity remained expansionary and well above year-ago levels. The majority of producers reported some negative effects from elevated gasoline prices, and nearly half of all respondents noted difficulties finding workers. Price indexes were mixed, with slight easing in some materials price indexes and fewer producers planning to raise selling prices.

The month-over-month composite index was 3 in April, down from 9 in March and 13 in February ... However, the employment index jumped from 23 to 31 – its highest level since early 2007.

From Freddie Mac: Fixed Mortgage Rates Hold Near Record Lows

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates down slightly and hovering just above their record lows as markets waited for the Federal Reserve's monetary policy announcement. The 30-year fixed-rate mortgage averaged 3.88 percent and has been below 4 percent all but one week in 2012. The 15-year fixed, a popular refinancing choice, averaged 3.12 percent.From Radar Logic: Home Prices Strengthened Considerably in February, But the Strength May Not Last

30-year fixed-rate mortgage (FRM) averaged 3.88 percent with an average 0.7 point for the week ending April 26, 2012, down from last week when it averaged 3.90 percent. Last year at this time, the 30-year FRM averaged 4.78 percent.

According to the February 2012 RPX Monthly Housing Market Report released today by Radar Logic Incorporated, the RPX Composite price, which tracks home prices in 25 major US metropolitan areas, increased 1.9 percent over the month ending February 16, 2012.The Radar Logic report includes a graph of future prices that suggests investors think prices will bottom in early 2013.

Notwithstanding the strength exhibited by home prices in February, the RPX Composite price was 3.18 percent lower than it was in February 2011. Transaction activity in the 25 MSAs increased 16 percent on a year-over-year basis. ... Investment buying and mild weather likely contributed to the strength in the housing market during February. Unfortunately, the positive impact of both these factors will probably be temporary.

NAR: Pending home sales index increased in March

by Calculated Risk on 4/26/2012 10:00:00 AM

From the NAR: March Pending Home Sales Rise, Market Recovering

The Pending Home Sales Index, a forward-looking indicator based on contract signings, rose 4.1 percent to 101.4 in March from an upwardly revised 97.4 in February and is 12.8 percent above March 2011 when it was 89.9. The data reflects contracts but not closings.This was above the consensus of a 1.0% increase for this index.

The index is now at the highest level since April 2010 when it reached 111.3.

...

The PHSI in the Northeast slipped 0.8 percent to 78.2 in March but is 21.1 percent above March 2011. In the Midwest the index declined 0.9 percent to 93.3 but is 16.9 percent higher than a year ago. Pending home sales in the South rose 5.9 percent to an index of 114.1 in March and are 10.6 percent above March 2011. In the West the index increased 8.7 percent in March to 108.0 and is 9.0 percent above a year ago.

Contract signings usually lead sales by about 45 to 60 days, so this is for sales in April and May.