by Calculated Risk on 4/14/2012 04:40:00 PM

Saturday, April 14, 2012

Unofficial Problem Bank list declines to 944 Institutions

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for April 13, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

We thought there was a chance for the OCC to release its actions through mid-March but we will have to wait until next week for that press release. As a result, it was quiet week for the Unofficial Problem Bank List with no failures, three removals, and one addition. These changes leave the list at 944 institutions with assets of $375.3 billion. A year-ago, the list held 978 institutions with assets of $429.4 billion. The three removals are for action termination and include Los Alamos National Bank, Los Alamos, NM ($1.5 billion); Empire National Bank, Islandia, NY ($340 million Ticker: EMPK); and Mountain Pacific Bank, Everett, WA ($118 million). The addition was Parke Bank, Sewell, NJ ($790 million Ticker: PKBK).Earlier:

• Summary for Week Ending April 13th

Schedule for Week of April 15th

by Calculated Risk on 4/14/2012 01:05:00 PM

Earlier:

• Summary for Week Ending April 13th

There are three key housing reports that will be released this week: April homebuilder confidence on Monday, March housing starts on Tuesday, and March existing home sales on Thursday.

Another key report is March retail sales. For manufacturing, the April NY Fed (Empire state) and Philly Fed surveys, and the March Industrial Production and Capacity Utilization report will be released this week.

The AIA's Architecture Billings Index for March will also be released on Wednesday.

All week: 2012 Spring Meetings of the International Monetary Fund and the World Bank Group in Washington, D.C.

8:30 AM: Retail Sales for March.

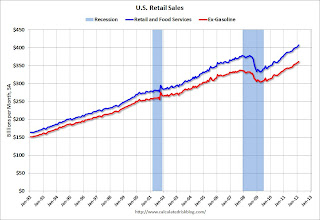

8:30 AM: Retail Sales for March. This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales are up 22.6% from the bottom, and now 7.8% above the pre-recession peak (not inflation adjusted).

The consensus is for retail sales to increase 0.3% in March, and for retail sales ex-autos to increase 0.6%.

8:30 AM ET: NY Fed Empire Manufacturing Survey for April. The consensus is for a reading of 18.0, down from 20.2 in March (above zero is expansion).

10:00 AM: Manufacturing and Trade: Inventories and Sales for February (Business inventories). The consensus is for 0.6% increase in inventories.

10:00 AM: The April NAHB homebuilder survey. The consensus is for a reading of 29, up slightly from 28 in March. Although this index has been increasing lately, any number below 50 still indicates that more builders view sales conditions as poor than good.

8:30 AM: Housing Starts for March.

8:30 AM: Housing Starts for March. This shows the huge collapse following the housing bubble, and that total housing starts have been increasing a little lately after mostly moving sideways for about two years and a half years. Housing starts might have been boosted by the favorable weather lately.

The consensus is for total housing starts to increase slightly to 700,000 (SAAR) in March from 698,000 in February.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for March.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for March. This shows industrial production since 1967.

The consensus is for a 0.3% increase in Industrial Production in March, and for Capacity Utilization to decrease to 78.6% (from 78.7%).

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been weak this year, although this does not include all the cash buyers.

During the day: The AIA's Architecture Billings Index for March (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 365,000 after increasing to 380,000 last week.

10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for sales of 4.62 million on seasonally adjusted annual rate basis.

A key will be inventory and months-of-supply.

10:00 AM: Philly Fed Survey for April. The consensus is for a reading of 12.0, down from 12.5 last month (above zero indicates expansion).

10:00 AM: Conference Board Leading Indicators for March. The consensus is for a 0.2% increase in this index.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for March 2012

Summary for Week ending April 13th

by Calculated Risk on 4/14/2012 08:05:00 AM

It was a light week for U.S. economic data. The trade deficit was smaller than expected, suggesting some upward revisions to Q1 GDP forecasts (the advance report for Q1 GDP will be released in two weeks on April 27th).

Other data disappointed a little. Initial weekly unemployment claims increased to 380,000, consumer sentiment dipped, and the NFIB small business survey declined slightly. After several months of stronger-than-expected data, the data flow is now coming in mostly at or below expectations.

In other news, recent Fed comments suggest QE3 is likely only if the economy falters. And overseas, the yield on Spanish bonds increased sharply with the 10 year almost up to 6%. Here comes another round of Euro worries – and elections.

There will be several housing reports released next week (builder confidence, housing starts and existing home sales), and we will see if there is any pickup in activity.

Here is a summary in graphs:

• Trade Deficit declined in February to $46 Billion

Click on graph for larger image.

Click on graph for larger image.

The Department of Commerce reported:

"[T]otal February exports of $181.2 billion and imports of $227.2 billion resulted in a goods and services deficit of $46.0 billion, down from $52.5 billion in January, revised. February exports were $0.2 billion more than January exports of $180.9 billion. February imports were $6.3 billion less than January imports of $233.4 billion".

The trade deficit was well below the consensus forecast of $51.7 billion.

Oil averaged $103.63 per barrel in February, down slightly from January. The decline in imports was a combination of less petroleum imports and less imports from China.

Exports to the European Union were $22.5 billion in February, up from $20.0 billion in February 2011.

• Key Measures of Inflation in March

This graph shows the year-over-year change for four key measures of inflation. On a year-over-year basis, the median CPI rose 2.4%, the trimmed-mean CPI rose 2.4%, and core CPI rose 2.3%. Core PCE is for February and increased 1.9% year-over-year.

This graph shows the year-over-year change for four key measures of inflation. On a year-over-year basis, the median CPI rose 2.4%, the trimmed-mean CPI rose 2.4%, and core CPI rose 2.3%. Core PCE is for February and increased 1.9% year-over-year.

These measures show inflation on a year-over-year basis is mostly still above the Fed's 2% target.

• Weekly Initial Unemployment Claims increased to 380,000

This graph shows the 4-week moving average of weekly claims since January 2000.

This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 368,500.

The 4-week moving average has been moving sideways at this level for about two months.

• BLS: Job Openings increased slightly in February

The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS. Jobs openings increased slightly in February, and the number of job openings (yellow) has generally been trending up, and are up about 16% year-over-year compared to February 2011.

Quits increased in February, and quits are now up about 9% year-over-year and quits are now at the highest level since 2008. These are voluntary separations and more quits might indicate some improvement in the labor market. (see light blue columns at bottom of graph for trend for "quits").

• NFIB: Small Business Optimism Index declined in March

This graph shows the small business optimism index since 1986. The index declined to 92.5 in March from 94.3 in February. This is slightly above the 91.9 reported in March 2011.

This graph shows the small business optimism index since 1986. The index declined to 92.5 in March from 94.3 in February. This is slightly above the 91.9 reported in March 2011.This index remains low - probably due to a combination of sluggish growth, and the high concentration of real estate related companies in the index. And the single most important problem remains "poor sales".

• Consumer Sentiment declines slightly in April to 75.7

The preliminary Reuters / University of Michigan consumer sentiment index for April declined slightly to 75.7, down from the final March reading of 76.2.

The preliminary Reuters / University of Michigan consumer sentiment index for April declined slightly to 75.7, down from the final March reading of 76.2.This was below the consensus forecast of 76.2. Overall sentiment is still fairly weak - probably due to a combination of the high unemployment rate, high gasoline prices and sluggish economy - however sentiment has rebounded from the decline last summer and is up from 69.8 in April 2011.

• Other Economic Stories ...

• LPS: House Price Index declined 0.9% in January

• US mortgage and foreclosure law

• Labor Force Participation Rate Projection Update

• Fed's Beige Book: Economic activity increased at "modest to moderate" pace, Residential real estate "activity improved"

Friday, April 13, 2012

More foreclosure thoughts: What's in a name?

by Calculated Risk on 4/13/2012 08:35:00 PM

Earlier I posted some thoughts and details on BofA suing BofA in a foreclosure case in Florida.

Here are some more details.

The condo was purchased in April 2005 for $210,000. The first was for $192,691.20. This was probably a 90% loan with costs rolled in (ht Z).

The HELOC was authorized in September 2006 for $150,000, although the borrower only used $75,000.

This suggests the property value increased by 60% to 70% in just over one year! Or BofA was giving out HELOCs with LTVs much greater than 100%. Either way, it makes me wonder ...

It does appear prices in Florida were still rising quickly during that period. According to Case-Shiller, prices in Miami increased 24% from April 2005 through September 2006, but that isn't close to 70%!

Maybe it was the name. This is a water front condo in buildings called "Wilshire East" and "Wilshire West". As I noted a few years ago, you could almost guess which projects would get in trouble by the name such as "Manhattan West" in Las Vegas and "Central Park West" in Irvine, California.

Here is a google map of the Florida building.

View Larger Map

Lawler: Expect NAR to report a 3% Year-over-year increase in the Median Price for March

by Calculated Risk on 4/13/2012 05:29:00 PM

Economist Tom Lawler wrote today: "Incoming data point to a YOY increase in the NAR’s Median Existing Home Sales Price of about 3% in March."

CR: Of course the median price is impacted by the mix, and the increase in the median is probably due to fewer foreclosures at the low end. Tom will probably send me a projection for March existing home sales early next week.

Tom also sent me an update to the following table for several distressed areas. For all of the areas, the share of distressed sales is down from March 2011, the share of short sales has mostly increased and the share of foreclosure sales are down - and down significantly in some areas.

Note: The table is a percentage of total sales.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-Mar | 11-Mar | 12-Mar | 11-Mar | 12-Mar | 11-Mar | |

| Las Vegas | 26.6% | 23.6% | 40.7% | 47.6% | 67.3% | 71.2% |

| Reno | 34.0% | 30.0% | 32.0% | 41.0% | 66.0% | 71.0% |

| Phoenix | 25.7% | 19.1% | 21.1% | 46.2% | 46.7% | 65.3% |

| Sacramento | 29.0% | 22.3% | 30.7% | 48.4% | 59.7% | 70.7% |

| Minneapolis | 12.4% | 12.8% | 36.8% | 45.9% | 49.2% | 58.7% |

| Mid-Atlantic (MRIS) | 13.2% | 13.1% | 14.7% | 26.3% | 27.9% | 39.5% |

BofA sues BofA in Foreclosure Filing: More "Robo foreclosure"?

by Calculated Risk on 4/13/2012 03:08:00 PM

Earlier this week, Zach Carter at the HuffPo wrote: Bank Of America Sues Itself In Unusual Foreclosure Case (ht T. Stone)

Over the past two years, the nation's largest banks and the Obama administration have repeatedly vowed to clean up the foreclosure fraud mess. ... But in Florida's Palm Beach County alone, Bank of America has sued itself for foreclosure 11 times since late March, according to foreclosure fraud activist Lynn Szymoniak, who forwarded one such foreclosure filing, dated March 29, 2012, to The Huffington Post.This sounds like BofA is making a mistake. Nope.

From the article:

"We are servicing the first mortgage on behalf of an investor and we own the second mortgage," Bank of America spokeswoman Jumana Bauwens told HuffPost. "Naming the second-lien holder in the suit is necessary to eliminate the junior interest," Bauwens said.Correct.

With a little digging (credit: reader Z dug up the supporting documents, and sent me the following bullet points and more), here are a few details:

• April 28, 2005: property purchased for $210,000 with a BofA purchase mortgage for $192,691.20

• September 29, 2006: BofA second-lien home-equity line-of-credit mortgage for $75,000

• May 27, 2010: condo association lien for delinquent 2010 condo fees ($8,185)

• June 30, 2011: condo association lien for delinquent 2011 condo fees ($9,699)

• March 29, 2012: BofA files lis pendens on the first-lien purchase mortgage and names defendants including, in order, the borrowers, BofA (itself), the condo association, and any tenants (#1-4) that may be present

Here is the BofA filing in Palm Beach, Florida.

There are two reasons this is OK. First, as anyone who read the excellent overview "US mortgage and foreclosure law" by Kimball and Willen, at The New Palgrave Dictionary of Economics, the top priority for BofA as servicer of the first lien is to clear title. Suing the other lien holders is part of the judicial process in Florida. If BofA owned both loans, they could probably avoid suing themselves, but clearing title is priority one - so who cares.

Second, in this specific case, it appears the purchase loan was placed in an MBS and BofA is now only the servicer of the loan. (The BofA spokeswoman said "We are servicing the first mortgage on behalf of an investor and we own the second mortgage"). As the servicer, BofA has a legal obligation to the MBS investors. In this specific case, to clear the publicly recorded second lien that BofA owns, BofA, as servicer of the first lien, is obligated to sue BofA, as holder of the second, to clear title.

This is not evidence of "robo foreclosure" or anything remotely close. Yawn.

Bernanke: "Some Reflections on the Crisis and the Policy Response"

by Calculated Risk on 4/13/2012 01:20:00 PM

Note: Bernanke didn't discuss current monetary policy.

From Fed Chairman Ben Bernanke: "Some Reflections on the Crisis and the Policy Response"

On the originate-to-distribute model:

Private-sector risk management also failed to keep up with financial innovation in many cases. An important example is the extension of the traditional originate-to-distribute business model to encompass increasingly complex securitized credit products, with wholesale market funding playing a key role. In general, the originate-to-distribute model breaks down the process of credit extension into components or stages--from origination to financing and to the postfinancing monitoring of the borrower's ability to repay--in a manner reminiscent of how manufacturers distribute the stages of production across firms and locations. This general approach has been used in various forms for many years and can produce significant benefits, including lower credit costs and increased access of consumers and small and medium-sized businesses to capital markets. However, the expanded use of this model to finance subprime mortgages through securitization was mismanaged at several points, including the initial underwriting, which deteriorated markedly, in part because of incentive schemes that effectively rewarded originators for the quantity rather than the quality of the mortgages extended. Loans were then packaged into securities that proved complex, opaque, and unwieldy; for example, when defaults became widespread, the legal agreements underlying the securitizations made reasonable modifications of troubled mortgages difficult. Rating agencies' ratings of asset-backed securities were revealed to be subject to conflicts of interest and faulty models. At the end of the chain were investors who often relied mainly on ratings and did not make distinctions among AAA-rated securities. Even if the ultimate investors wanted to do their own credit analysis, the information needed to do so was often difficult or impossible to obtain.CR Note: This wasn't just for subprime. Even worse were the Alt-A loans! Also I don't think Bernanke spent enough time on the failure of regulators to recognize the very loose lending.

I think the housing bubble (and subsequent bust) can be understood very well by looking at each step of originate-to-distribute model, and also at the willful lack of regulatory oversight. Bernanke suggests housing was just the trigger, but if the regulators couldn't see that loaning people 100+ LTV, with stated income, and a low teaser rate would end poorly, then there was no way they could see the systemic risk!

Bernanke concludes:

The financial crisis of 2007-09 was difficult to anticipate for two reasons: First, financial panics, being to a significant extent self-fulfilling crises of confidence, are inherently difficult to foresee. Second, although the crisis bore some resemblance at a conceptual level to the panics known to Bagehot, it occurred in a rather different institutional context and was propagated and amplified by a number of vulnerabilities that had developed outside the traditional banking sector. Once identified, however, the panic could be addressed to a significant extent using classic tools, including backstop liquidity provision by central banks, both here and abroad.I disagree that the crisis "was difficult to anticipate". I think the potential for the housing bust to lead to a financial crisis was fairly obvious (I first mentioned the possibility of a financial crisis as a result of the then coming housing bust in 2005).

Key Measures of Inflation in March

by Calculated Risk on 4/13/2012 11:54:00 AM

Earlier today the BLS reported:

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percent in March on a seasonally adjusted basis ... The index for all items less food and energy rose 0.2 percent in MarchThe Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.2% annualized rate) in March. The 16% trimmed-mean Consumer Price Index increased 0.2% (2.7% annualized rate) during the month.Note: The Cleveland Fed has the median CPI details for March here.

...

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers increased 0.3% (3.5% annualized rate) in March. The CPI less food and energy increased 0.2% (2.8% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.4%, the trimmed-mean CPI rose 2.4%, and core CPI rose 2.3%. Core PCE is for February and increased 1.9% year-over-year.

These measures show inflation on a year-over-year basis is mostly still above the Fed's 2% target.

Consumer Sentiment declines slightly in April to 75.7

by Calculated Risk on 4/13/2012 09:55:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for April declined slightly to 75.7, down from the final March reading of 76.2.

This was below the consensus forecast of 76.2. Overall sentiment is still fairly weak - probably due to a combination of the high unemployment rate, high gasoline prices and sluggish economy - however sentiment has rebounded from the decline last summer and is up from 69.8 in April 2011.

BLS: CPI increases 0.3% in March

by Calculated Risk on 4/13/2012 08:33:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percent in March on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.7 percent before seasonal adjustment.I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI. This was at the consensus forecast of a 0.3% increase in CPI and a 0.2% increase in core CPI.

...

The gasoline index continued to rise, more than offsetting a decline in the household energy index and leading to a 0.9 percent increase in the energy index. The food index rose 0.2 percent as the index for meats, poultry, fish, and eggs increased notably.

The index for all items less food and energy rose 0.2 percent in March after increasing 0.1 percent in February.