by Calculated Risk on 4/05/2012 08:30:00 AM

Thursday, April 05, 2012

Weekly Initial Unemployment Claims decline to 357,000

The DOL reports:

In the week ending March 31, the advance figure for seasonally adjusted initial claims was 357,000, a decrease of 6,000 from the previous week's revised figure of 363,000. The 4-week moving average was 361,750, a decrease of 4,250 from the previous week's revised average of 366,000.The previous week was revised up to 363,000 from 359,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 361,750.

The 4-week moving average is at the lowest level since early 2008 (including revisions).

And here is a long term graph of weekly claims:

Slow and steady improvement. This is the lowest level for claims since early 2008.

Reis: Office Vacancy Rate declines slightly in Q1 to 17.2%

by Calculated Risk on 4/05/2012 12:22:00 AM

From Reuters: Sluggish job growth crimps US office market rebound

The national vacancy rate slipped to 17.2 percent in the first quarter, a slight improvement from 17.3 percent in the 2011 fourth quarter, according to preliminary figures from Reis. A year earlier the vacancy rate was 17.6 percent. ... The national vacancy rate has risen to levels not seen since 1993 and remains well above the cyclical low of 12.5 percent posted in 2007 ...

The average U.S. office asking rent rate rose to $28.10 per square foot in the first quarter, up 0.5 percent from the 2011 fourth quarter. ...

Overall, the national office market has posted five quarters of improvement, leading Reis to believe the market is in the midst of a slow recovery. ... "The lack of new supply has been the saving grace for the office sector," Severino said. "The levels of demand that we're seeing right now, while they're positive, they're not really significant. It pales in comparison with cycles past."

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1991.

Reis is reporting the vacancy rate declined to 17.2% in Q1, down from 17.3% in Q4. The vacancy rate was at a cycle high of 17.6% in Q3 and Q4 2010. It appears the office vacancy rate peaked in 2010 and is declining very slowly.

As Reis noted, there are very few new office buildings being built in the US, and new construction will probably stay low for several years.

Wednesday, April 04, 2012

Jamie Dimon's "Brain Freeze" and Comments on Housing

by Calculated Risk on 4/04/2012 08:27:00 PM

The WSJ has JPM CEO Jamie Dimon's letter to shareholders (ht Brian) A couple of excerpts:

I suspect that the mortgage crisis will be the worst financial catastrophe of our lifetime. What the world experienced was almost a collective brain freeze ... It was a disaster hidden by rising home prices and false expectations, and once that price bubble burst, we all were in trouble.Some people didn't experience a "brain freeze", but unfortunately most lenders did. I think lender's will forget again, but hopefully not for some time.

We need to write a letter to the next generation that says, “Never forget: 80% loan to value and verify appropriate income.”

...

But [JP Morgan] did participate in this disaster by originating mortgages that wouldn’t have been given a decade earlier (and won’t be given a decade later).

And on housing:

There has been a tremendous focus on the fact that housing prices remain depressed and, in fact, are still going down some. The large “shadow inventory” of homes in delinquency or foreclosure that has not yet hit the sale market adds to the fears that this will continue for a long time. New home construction still is very depressed – so, to most, the future looks bleak. However, if one looks at the leading indicators, all signs are flashing green – the turn is coming if it is not here already. We don’t want to be blindly optimistic, but the facts are the facts:

• America has never stopped growing. The United States has added 3 million people a year since the crisis began four years ago. We will add 30 million people in the next 10 years.

• This population growth normally would create a need for 1.2 million additional housing units each year. Household formation has been half of that for the past four years. Our economists believe that there is huge pent-up demand and that household formation will return to 1.2 million a year as job conditions improve.

• Job conditions have been improving, albeit slowly. In the last 24 months, 3.45 million jobs have been created.

• On average, only 845,000 new U.S. housing units were built annually over the last four years – and the destruction of homes from demolition, disaster and dilapidation has averaged 250,000 a year. The growth of new households, even at a reduced rate, has been able to absorb all of this new supply, and more. [CR note: I wonder about the source for the number of homes demolished?]

• The total inventory of single-family homes and condos for sale currently is 2.7 million units, down from a peak of 4.4 million units in May 2007. It now would take only six months to sell all of the houses for sale at existing sales rates, down from 12 months two years ago. (This low of an inventory number normally would be considered a positive sign for future housing prices.)

• While the shadow inventory mentioned above still is significant, it has shown a visible declining trend since peaking at the end of 2009, when the number of loans delinquent 90+ days or in foreclosure was 5.1 million homes. It now totals 3.9 million, and we estimate it could be 3 million in 12 months. The shadow inventory also may move more quickly as mortgage servicers get better at packaged sales and short sales and as real money investors start to buy foreclosed homes and rent them out for a good profit. Home prices still are going down a little bit, and they will stay depressed for a while. Distressed sales (short sales, foreclosure sales, real estate-owned sales) still are 25% of all sales, and these sales typically are priced 30% lower than non-distressed sales. As the percentage of distressed sales comes down over the next 12-24 months, their negative effect on housing prices will start to diminish.

...

• It now is cheaper to buy than to rent in half of the markets in America – this has not been true for more than 15 years. Relatively high rental prices can be a precursor to increasing home prices.

• At the same time, American consumers are finding more solid financial footing relative to their debt. The household debt service ratio, which is the ratio of mortgage plus consumer debt payments to disposable personal income, stands at its lowest level since 1994. This is a result of rapid consumer deleveraging – household mortgage debt now is down $1 trillion from its 2008 peak. (Reported U.S. mortgage data do not remove mortgage debt from an individual’s debt obligations until there is an actual foreclosure. It is estimated that $600 billion of the $9 trillion in currently outstanding mortgage debt is not paying interest today and effectively could be removed now from these numbers.)

• Recent senior loan officer surveys by the Federal Reserve show that, while there are not yet clear signs of credit loosening for new mortgages, at least the rush to tighten mortgage lending standards has abated.

...

More jobs, more households, more Americans, good value – it’s just a matter of time.

FHFA's DeMarco: FHFA to make decision on GSE Principal Reductions this month

by Calculated Risk on 4/04/2012 04:50:00 PM

From a speech today by FHFA acting director Edward DeMarco:

On a nationwide basis, Fannie Mae and Freddie Mac own or guarantee 60 percent of the mortgages outstanding, but they account for only 29 percent of seriously delinquent loans, obviously a much lower proportion than their share of the market.CR Note: I'd like to see the data on "payment reduction, not loan-to-value, is the key indicator of success in loan modifications".

Even though the Enterprises have a smaller share of seriously delinquent loans than other market participants, they account for just over half of all Home Affordable Modification Program, or HAMP modifications. Between HAMP modifications and their own proprietary loan modifications, Fannie Mae and Freddie Mac have completed more than 1.1 million loan modifications since the fourth quarter of 2008.

It has been well-publicized that there is one form of loan modification that FHFA has not embraced, that being principal forgiveness. To be clear, the disagreement is not about helping borrowers. FHFA, with the Enterprises, has been making great efforts to assist troubled homeowners with underwater mortgages who have the ability to make a mortgage payment and a willingness to do so. While we are currently evaluating the recent Treasury changes to HAMP regarding principal forgiveness, I would like to explain the position we have taken to date.

The fundamental point of a loan modification is to adjust the borrower’s monthly payment to an affordable level. We have seen repeatedly that what matters most in successfully helping borrowers is a meaningful reduction in the monthly payment to an amount that helps stabilize the family’s finances. Indeed, we have found that payment reduction, not loan-to-value, is the key indicator of success in loan modifications.

For many underwater borrowers, we achieve this by forbearing on principal – that is, charging a zero rate of interest on the forbearance amount and deferring its repayment. This focus on making the monthly mortgage payment affordable is an efficient way to provide assistance to the borrower and keep them in their home. If the borrower remains successful in this modified loan, this approach preserves for taxpayers an ultimate recovery on the debt.

Stated differently, the principal forbearance mod being used by Fannie Mae and Freddie Mac produces the same, lower monthly payment as a modification based on principal forgiveness. If the borrower ends up defaulting even with the modification, the loss to the taxpayer is the same either way. But if the borrower is successful, the taxpayer retains the opportunity to benefit from the upside – a reasonable deal given the support the taxpayer has provided to assist the family in keeping their home.

Moreover, this approach recognizes that three out of every four deeply underwater borrowers in Fannie Mae’s and Freddie Mac’s book of business today are current on their loans. These borrowers are demonstrating a continued willingness to meet their mortgage obligations. This should be recognized and encouraged, not dampened with incentives for people to not continue paying. As I have stated previously, we are currently evaluating the recent Treasury Department proposal to HAMP regarding principal forgiveness and expect a decision this month.

DeMarco makes a key point that "three out of every four deeply underwater borrowers in Fannie Mae’s and Freddie Mac’s book of business today are current on their loans". The key problem with a principal reduction program is that even if it makes sense for an individual borrower, it might not makes sense overall if a large number of current borrowers decide to default hoping for a principal reduction.

One way around this problem - that has been effective for some banks - is to sell underwater loans to a 3rd party, and let them do the principal reduction. Since the biggest risk is that the word gets out, and everyone underwater stops making payments, selling to a 3rd party allows the bank (or GSE) to say they don't do principal reductions, but they would still get most of the benefit (with some shared with the 3rd party).

It sounds like the FHFA will make a decision this month. I hope they release the internal studies first.

More: Apartment Vacancy Rate falls to 4.9% in Q1

by Calculated Risk on 4/04/2012 03:05:00 PM

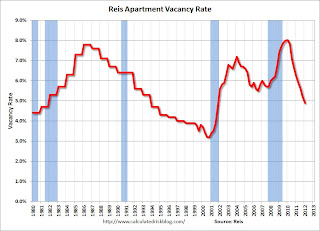

Early this morning I noted that Reis reported the apartment vacancy rate (82 markets) fell to 4.9% in Q1 from 5.2% in Q4 2011. The vacancy rate was at 6.1% in Q1 2010 and peaked at 8.0% at the end of 2009.

Here are a few more comments and a long term graph from Reis.

Comments from Ries:

The strong performance of the apartment sector has yet to show signs of letting up; national vacancies fell by 30 basis points in the first quarter to 4.9%, a level last observed more than ten years ago, back in 4Q2001. It is also significant to note that national vacancies have improved beyond the benchmark 5% level used as a rule of thumb by apartment landlords: for most markets, once vacancies tighten below 5%, effective rents tend to spike as landlords perceive that tight market conditions allow for greater pricing power.

...

Net absorption, or the net change in occupied stock, remained strong, with 36,484 units leasing up. As the economy begins to show signs of slow but steady improvement, households are flocking to rentals as expectations of single‐family home prices remain flat over the next year or two.

...

With demand for rentals benefiting from the continued moribund state of the for‐sale housing market, tight supply conditions are helping boost the performance of apartment properties around the nation. Only 7,342 apartment units came online in the first quarter – the lowest quarterly figure for new completions since Reis began publishing quarterly data in 1999. Risks may manifest later in the year, however. With multifamily remaining one of the few shining starts in commercial real estate, developers have begun building properties to take advantage of rising incomes. Unless there are delays, Reis expects about 70,000 units to come online in 2012. That is about double the rate of supply growth in 2011. Even more units are slated to come online in 2013, somewhere in the order of 150,000 to 200,000 units in the 79 main markets that Reis tracks.

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980 (prior to 1999 the data is annual). Back in the early '80s, there was overbuilding in the apartment sector (just like for offices) with the very loose lending that led to the S&L crisis. Once the lending stopped, starts of built-for-rent units slowed, and the vacancy rate started to decline.

Following the financial crisis, starts and completions of multi-family units fell to record lows (there were a record low number of completions last year). Builders have increased construction, but it usually takes over a year to complete a multi-family building, so this new supply hasn't reached the market yet. As Reis noted, the number of completions will increase this year, but the vacancy rate will probably decline further.

This will also impact on house prices. The upward pressure on rents will make the price-to-rent ratio a little more favorable for buying.

Data courtesy of Reis.

Ceridian-UCLA: Diesel Fuel index increased 0.3% in March

by Calculated Risk on 4/04/2012 12:21:00 PM

This is the UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce Index Increased 0.3 Percent in March, Compared to March 2011, the Pulse is Down 2.2 Percent

The Ceridian-UCLA Pulse of Commerce Index® (PCI®), issued today by the UCLA Anderson School of Management and Ceridian Corporation, rose 0.3 percent in March following the 0.7 percent increase in February and the 1.7 percent decrease in January.This puts the index down 2.2% from March 2011. Note: For comparison, the ATA Trucking index was up 5.1% year-over-year in February.

Click on graph for larger image.

Click on graph for larger image.This graph shows the index since January 2000.

This index has been weaker than the ATA trucking index and reports for rail traffic. It is possible that the high cost of fuel is shifting some long haul traffic from trucks to rail (intermodal) - but it is unclear why this index is weaker than the trucking index.

ISM Non-Manufacturing Index indicates slower expansion in March

by Calculated Risk on 4/04/2012 10:00:00 AM

The March ISM Non-manufacturing index was at 56.0%, down from 57.3% in February. The employment index increased in March to 56.7%, up from 55.7% in February. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: March 2012 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in March for the 27th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI registered 56 percent in March, 1.3 percentage points lower than the 57.3 percent registered in February, and indicating continued growth at a slower rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index registered 58.9 percent, which is 3.7 percentage points lower than the 62.6 percent reported in February, reflecting growth for the 32nd consecutive month. The New Orders Index decreased by 2.4 percentage points to 58.8 percent, and the Employment Index increased by 1 percentage point to 56.7 percent, indicating continued growth in employment at a slightly faster rate. The Prices Index decreased 4.5 percentage points to 63.9 percent, indicating prices increased at a slower rate in March when compared to February. According to the NMI, 16 non-manufacturing industries reported growth in March. Respondents' comments remain mostly optimistic about business conditions. They indicate that increased discretionary spending reflects the increased confidence level of businesses and consumers. There is continued concern about cost pressures and the instability of fuel prices."

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 56.7% and indicates slightly slower expansion in March than in February.

CoreLogic: House Price Index falls to new post-bubble low in February, Rate of decline slows

by Calculated Risk on 4/04/2012 09:00:00 AM

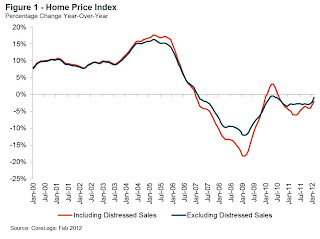

Notes: This CoreLogic House Price Index report is for February. The Case-Shiller index released last week was for January. Case-Shiller is currently the most followed house price index, however CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average of the last three months and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® February Home Price Index Reports Month-Over-Month Increase, When Excluding Distressed Sales

[CoreLogic February Home Price Index (HPI®) report] shows national home prices, including distressed sales, declined on a year-over-year basis by 2.0 percent in February 2012 and by 0.8 percent compared to January 2012, the seventh consecutive monthly decline.

Excluding distressed sales, month-over-month prices increased 0.7 percent in February from January. The CoreLogic HPI® also showed that year-over-year prices declined by 0.8 percent in February 2012 compared to February 2011. Distressed sales include short sales and real estate owned (REO) transactions.

“House prices, based on data through February, continue to decline, but at a decreasing rate. The deceleration in the pace of decline is a first step toward ultimately growing again,” said Mark Fleming, chief economist for CoreLogic. “Excluding distressed sales, we already see modest price appreciation month over month in January and February.”

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was down 0.8% in February, and is down 2.0% over the last year.

The index is off 34.4% from the peak - and is now at a new post-bubble low.

The second graph is from CoreLogic. As Mark Fleming noted, the year-over-year declines are getting smaller - this is the smallest year-over-year decline since 2010 when prices were impacted by the housing tax credit.

The second graph is from CoreLogic. As Mark Fleming noted, the year-over-year declines are getting smaller - this is the smallest year-over-year decline since 2010 when prices were impacted by the housing tax credit. Some of this decline was seasonal (the CoreLogic index is NSA) and month-to-month price changes will probably remain negative through March.

ADP: Private Employment increased 209,000 in March

by Calculated Risk on 4/04/2012 08:15:00 AM

ADP reports:

Employment in the U.S. nonfarm private business sector increased by 209,000 from February to March on a seasonally adjusted basis. Estimated gains for previous months were revised higher; the gain from December to January was revised up by 9,000 to 182,000, and the gain from January to February was revised up by 14,000 to 230,000.This was slightly above the consensus forecast of an increase of 208,000 private sector jobs in March. The BLS reports on Friday, and the consensus is for an increase of 201,000 payroll jobs in March, on a seasonally adjusted (SA) basis.

Employment in the private, service-providing sector increased 164,000 in March, after rising a revised 183,000 in February. Employment in the private, goods-producing sector rose 45,000 in March. Manufacturing employment added 23,000 jobs.

Government payrolls have been shrinking, so the ADP report suggests close to 200,000 nonfarm payroll jobs added in March. Note: ADP hasn't been very useful in predicting the BLS report.

Reis: Apartment Vacancy Rate falls to 4.9% in Q1

by Calculated Risk on 4/04/2012 12:12:00 AM

Reis reported that the apartment vacancy rate (82 markets) fell to 4.9% in Q1 from 5.2% in Q4 2011. The vacancy rate was at 6.1% in Q1 2010 and peaked at 8.0% at the end of 2009.

From Reuters: U.S. apartment vacancy rate falls to decade low

The U.S. apartment vacancy rate in the first quarter fell to its lowest level in more than a decade, and rents posted their biggest jump in four years ...

The national vacancy rate fell 0.30 percentage points in the first quarter to 4.9 percent, the lowest level since the fourth quarter 2001, according to preliminary results Reis released Wednesday.

...

Stripping away months of free rent and other perks designed to lure or retain tenants, effective rent rose to $1,018 per month, up 0.9 percent, the largest increase since the first quarter 2008, Reis said.

"I think that rent growth will accelerate this year," said Victor Calanog, head of Research & Economics at Reis.

But that may be short lived. About 150,000-200,000 new units are expected be built next year. That supply likely will dampen rent growth next year ...

"Once that supply hits the market next year, we may find that this is the year rent growth peaked," he said. "It's still going to be a great year for apartment landlords."

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 2005.

Reis is just for large cities, but this decline in vacancy rates is happening just about everywhere.