by Calculated Risk on 3/21/2012 02:37:00 PM

Wednesday, March 21, 2012

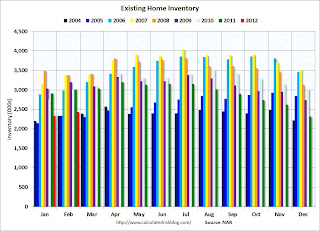

Existing Home Sales: Inventory and NSA Sales Graph

The NAR reported inventory increased seasonally to 2.43 million in February. This is down 19.3% from February 2011, and up 4% from the inventory level in February 2005 (mid-2005 was when inventory started increasing sharply). This decline in inventory has been a significant story over the last year.

There are several possible reasons for the decline:

• The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we comparing inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is down sharply year-over-year.

• There are probably a large number of sellers "waiting for a better market", and we could call this pent-up supply. When the market eventually improves, this pent-up supply will come on the market and probably keep prices from rising - but having less listed inventory now means less downward pressure on prices now.

• There is a seasonal pattern for inventory, and usually December and January have the lowest inventory levels for the year. Although there is some variability, usually inventory increases about 10% to 15% from January to mid-summer. That would put inventory at around 2.55 to 2.7 million by July (up from 2.33 million in January). At the current sales rate, this would push the months-of-supply measure up to 6.7 to 7.1 months from the current 6.4 months. The inventory increase from January to February was the normal seasonal increase.

• The number of completed foreclosures declined in 2011 and are expected to increase in 2012. This will probably lead to more REO (lender Real Estate Owned) listed for sale and some increase in the level of inventory.

I don't think this increase will be huge. My guess is that at most this will add 200 thousand listed REOs to the expected seasonal increase that would put listed inventory at 2.75 to 2.9 million in mid-summer - or about 7.2 to 7.6 months-of-supply at the current sales rate. That is higher than normal, but inventory would still be down 10% or more from 2011.

• Tom Lawler has pointed out that there has been a substantial increase in the number of SF homes purchased by investors with the explicit intention to rent the homes out for several years and this is probably another reason for the decline in invnetory.

The bottom line is the decline in listed inventory is a big deal, and will lead to less downward pressure on prices. Just like last year, inventory will be something to watch closely all year.

The following graph shows inventory by month since 2004. In 2005 (dark blue columns), inventory kept rising all year - and that was a clear sign that the housing bubble was ending.

Click on graph for larger image.

Click on graph for larger image.

This year (dark red for 2012) inventory is at the lowest level for a February since 2005. Inventory is still elevated - especially with the much lower sales rate - but lower inventory levels put less downward pressure on house prices (of course the level of distressed properties is still very high, and there is a significant shadow inventory).

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA (red column) are above the sales for the last four years (2008 through 2011), but well below the bubble years of 2005 and 2006.

Sales NSA (red column) are above the sales for the last four years (2008 through 2011), but well below the bubble years of 2005 and 2006.

The level of sales is still elevated due to investor buying. The NAR noted:

All-cash sales rose to 33 percent of transactions in February from 31 percent in January; they were 33 percent in February 2011. Investors account for the bulk of cash transactions.Earlier:

Investors purchased 23 percent of homes in February, unchanged from January; they were 20 percent in February 2011.

• Existing Home Sales in February: 4.59 million SAAR, 6.4 months of supply

• Existing Home Sales graphs

AIA: Architecture Billings Index indicated expansion in February

by Calculated Risk on 3/21/2012 12:21:00 PM

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

From AIA: Architecture Billings Index Remains Positive for Fourth Straight Month

Led by the commercial sector, the Architecture Billings Index (ABI) has remained in positive territory four months in a row. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the February ABI score was 51.0, following a mark of 50.9 in January. This score reflects a slight increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 63.4, up from mark of 61.2 the previous month and its highest reading since July 2007.

“This is more good news for the design and construction industry that continues to see improving business conditions,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “The factors that are preventing a more accelerated recovery are persistent caution from clients to move ahead with new projects, and a continued difficulty in accessing financing for projects that developers have decided to pursue.”

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 51.0 in February (slight expansion). Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So this suggests further declines in CRE investment in early 2012, but perhaps stabilizing mid-year.

Existing Home Sales in February: 4.59 million SAAR, 6.4 months of supply

by Calculated Risk on 3/21/2012 10:00:00 AM

The NAR reports: February Existing-Home Sales Slip But Up Strongly From a Year Ago

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, slipped 0.9 percent to a seasonally adjusted annual rate of 4.59 million in February from an upwardly revised 4.63 million in January [revised up from 4.57], but are 8.8 percent higher than the 4.22 million-unit level in February 2011.

...

Total housing inventory at the end of February rose 4.3 percent to 2.43 million existing homes available for sale, which represents a 6.4-month supply at the current sales pace, up from a 6.0-month supply in January. Even so, unsold listed inventory has trended down from a record 4.04 million in July 2007, and is 19.3 percent below a year ago.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in February 2012 (4.59 million SAAR) were 0.9% lower than last month, and were 8.8% above the February 2011 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 2.43 million in February from 2.33 million in January. Inventory is not seasonally adjusted, and usually inventory increases from the seasonal lows in December and January to the seasonal high in mid-summer.

According to the NAR, inventory increased to 2.43 million in February from 2.33 million in January. Inventory is not seasonally adjusted, and usually inventory increases from the seasonal lows in December and January to the seasonal high in mid-summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 19.3% year-over-year in February from February 2011. This is the twelfth consecutive month with a YoY decrease in inventory.

Inventory decreased 19.3% year-over-year in February from February 2011. This is the twelfth consecutive month with a YoY decrease in inventory.Months of supply increased to 6.4 months in February, up from 6.0 months in January.

This was close to expectations of sales of 4.61 million.

LPS: Percent of delinquent mortgage loans declined in February

by Calculated Risk on 3/21/2012 09:00:00 AM

LPS released their First Look report for February today. LPS reported that the percent of loans delinquent declined in February from January. However the percent of loans in the foreclosure process only declined slightly.

LPS reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) declined to 7.57% from 7.97% in January. This is the lowest delinquency rate since 2008; however the percent of delinquent loans is still way above the normal rate of around 4.5% to 5%. The percent of delinquent loans peaked at 10.97%, so delinquencies have fallen a little more than halfway back to normal.

The following table shows the LPS numbers for February 2012, and also for last month (Jan 2012) and one year ago (Feb 2012).

| LPS: Loans Delinquent and in Foreclosure | |||

|---|---|---|---|

| Feb-12 | Jan-12 | Feb-11 | |

| Delinquent | 7.57% | 7.97% | 8.80% |

| In Foreclosure | 4.13% | 4.15% | 4.15% |

| Less than 90 days | 2,059,000 | 2,226,000 | 2,495,000 |

| More than 90 days | 1,722,000 | 1,772,000 | 2,165,000 |

| In foreclosure | 2,065,000 | 2,084,000 | 2,196,000 |

| Total | 5,846,000 | 6,082,000 | 6,856,000 |

Note that the number of loans in the foreclosure process has only declined slightly year-over-year. This remains far above the "normal" level of around 0.5%.

MBA: Mortgage Refinance activity slows as rates rise, "Sand States" now "HARP states"

by Calculated Risk on 3/21/2012 08:01:00 AM

From the MBA: Interest Rates Highest Since December, Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 9.3 percent from the previous week. The seasonally adjusted Purchase Index decreased 1.0 percent from one week earlier.The purchase index was only off slightly - and this doesn't include the high percentage of cash buyers.

...

The refinance share of mortgage activity decreased to 73.4 percent of total applications, the lowest since July 2011, from 75.1 percent the previous week.

...

"With the rate increase last week, refinances are obviously slowing, and the refinance share at 73% is down to its lowest level since last July. With rate/term refinances falling as we go forward, HARP will be a bigger percentage of refinances but will be more concentrated in certain states," said Jay Brinkmann, MBA's Senior Vice President of Research and Education. Brinkmann continued, "Some of the largest institutions are reporting that the HARP share of their refinances remained at about 30% last week, but HARP volume is not equal across the country. The states that I started referring to years ago as the sand states that had the worst delinquencies we now should start calling the HARP states for mortgage refinances. We saw big state-level differences in refinance applications for February over January: Florida was up 49%, Arizona was up 61%, and Nevada was up 71%. Refinances in the rest of the country were generally flat or even down. For example, Texas had no change, Colorado was down 3%, Connecticut was up only 2%, and Virginia was up 1%. HARP clearly is a driving force in those states that saw the most defaults and the biggest drops in home equity."

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 4.19 percent from 4.06 percent,with points increasing to 0.47 from 0.43 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Tuesday, March 20, 2012

Greece: Parliament Approves Bailout

by Calculated Risk on 3/20/2012 09:23:00 PM

No surprise ... from the WSJ: Greek Parliament Approves Second Bailout

Greece's Parliament approved a new international bailout deal ... setting the stage for a round of harsh measures that the country's international creditors have set as a precondition for the funds.Next up is an election in late April or early May.

The approval came in the early hours of Wednesday, with 213 lawmakers supporting the loan deal, and with 79 deputies voting against it. Eight didn't cast a vote.

Earlier:

• Housing Starts decline slightly in February

• Starts and Completions: Multi-family and Single Family

Bernanke: "The Federal Reserve and the Financial Crisis" Part 1

by Calculated Risk on 3/20/2012 05:55:00 PM

Update: Here are the slides. Link to lecture series (next is on Thursday)

This is part 1 of 4 of a lecture series on the Federal Reserve. The first lecture (about 1 hour) discusses monetary policy history, the tools and goals of the reserve - and he spent some time on the gold standard.

There should be slides available soon at the Federal Reserve. Joe Weisenthal at Business Insider has some of the slides (and Bernanke's comments on the gold standard).

LPS: 91,086 completed foreclosures in January 2012

by Calculated Risk on 3/20/2012 04:18:00 PM

There has been some discussion on when activity would increase for completed foreclosures. Last month, LPS reported that foreclosure sales increased 29% month-over-month in January.

LPS Applied Analytis was kind enough to provide me their estimates of foreclosure sales, by month, since January 2008.

Note: The sequence is 1) a loan goes delinquent, 2) if it doesn't cure, after several months, the foreclosure process begins (this is called the "foreclosure inventory"), 3) then the foreclosure is completed "foreclosure sale" and becomes REO (lender Real Estate Owned), and then 4) the REO is sold. Sometimes during this process, the loan will cure or a short sale approved, and not all loans in the foreclosure inventory reach "foreclosure sales".

Click on graph for larger image.

Click on graph for larger image.

This graph shows the number of foreclosure sales per month since January 2008 according to LPS Applied Analytics.

There was a significant decline in foreclosure sales in late 2010 due to the foreclosure process issues.

There is plenty of month-to-month variability, but it appears foreclosure sales have picked up again (sales were up 29% compared to December 2011, and up 15% compared to January 2011).

This will be very useful data to track the expected increase in foreclosure activity.

Philly Fed State Coincident Indexes increased in January

by Calculated Risk on 3/20/2012 12:14:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for January 2012. In the past month, the indexes increased in 48 states, decreased in one (Alaska), and remained unchanged in one (Wisconsin) for a one-month diffusion index of 94. Over the past three months, the indexes increased in 48 states, decreased in one, and remained unchanged in one for a three-month diffusion index of 94.

Note: These are coincident indexes constructed from state employment data. From the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In January, 49 states had increasing activity, up from 47 in December. This is the highest level since January 2007.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession. Now only Alaska is red, and Wisconsin unchanged. The recovery may be sluggish, but it is widespread geographically.

Earlier:

• Housing Starts decline slightly in February

• Starts and Completions: Multi-family and Single Family

Starts and Completions: Multi-family and Single Family

by Calculated Risk on 3/20/2012 10:37:00 AM

For a couple of years I've been posting a graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

This month (second graph) I've added a graph for single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer.

These graphs use a 12 month rolling total for NSA starts and completions.

Click on graph for larger image.

Click on graph for larger image.

The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing since mid-2010. And completions (red line) are now following starts up.

It is important to emphasize that even with a strong increase in multi-family construction, it is 1) from a very low level, and 2) multi-family is a small part of residential investment (RI).

The blue line is for single family starts and the red line is for single family completions.

The blue line is for single family starts and the red line is for single family completions.

In February, the rolling 12 month total for starts is above completions for the first time since May 2006. This usually only happens at a bottom, although the recovery for single family starts will probably remain sluggish.