by Calculated Risk on 3/20/2012 12:14:00 PM

Tuesday, March 20, 2012

Philly Fed State Coincident Indexes increased in January

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for January 2012. In the past month, the indexes increased in 48 states, decreased in one (Alaska), and remained unchanged in one (Wisconsin) for a one-month diffusion index of 94. Over the past three months, the indexes increased in 48 states, decreased in one, and remained unchanged in one for a three-month diffusion index of 94.

Note: These are coincident indexes constructed from state employment data. From the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In January, 49 states had increasing activity, up from 47 in December. This is the highest level since January 2007.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession. Now only Alaska is red, and Wisconsin unchanged. The recovery may be sluggish, but it is widespread geographically.

Earlier:

• Housing Starts decline slightly in February

• Starts and Completions: Multi-family and Single Family

Starts and Completions: Multi-family and Single Family

by Calculated Risk on 3/20/2012 10:37:00 AM

For a couple of years I've been posting a graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

This month (second graph) I've added a graph for single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer.

These graphs use a 12 month rolling total for NSA starts and completions.

Click on graph for larger image.

Click on graph for larger image.

The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing since mid-2010. And completions (red line) are now following starts up.

It is important to emphasize that even with a strong increase in multi-family construction, it is 1) from a very low level, and 2) multi-family is a small part of residential investment (RI).

The blue line is for single family starts and the red line is for single family completions.

The blue line is for single family starts and the red line is for single family completions.

In February, the rolling 12 month total for starts is above completions for the first time since May 2006. This usually only happens at a bottom, although the recovery for single family starts will probably remain sluggish.

Housing Starts decline slightly in February

by Calculated Risk on 3/20/2012 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in February were at a seasonally adjusted annual rate of 698,000. This is 1.1 percent (±15.9%)* below the revised January estimate of 706,000 (revised up from 699,000), but is 34.7 percent(±16.7%) above the February 2011 rate of 518,000.

Single-family housing starts in February were at a rate of 457,000; this is 9.9 percent (±11.4%)* below the revised January figure of 507,000. The February rate for units in buildings with five units or more was 233,000.

Building Permits:

Privately-owned housing units authorized by building permits in February were at a seasonally adjusted annual rate of 717,000. This is 5.1 percent (±1.2%) above the revised January rate of 682,000 and is 34.3 percent (±3.1%) above the February 2011 estimate of 534,000.

Single-family authorizations in February were at a rate of 472,000; this is 4.9 percent (±1.2%) above the revised January figure of 450,000. Authorizations of units in buildings with five units or more were at a rate of 219,000 in February.

Click on graph for larger image.

Click on graph for larger image.Total housing starts were at 698 thousand (SAAR) in February, down 1.1% from the revised January rate of 706 thousand (SAAR). Note that January was revised up from 699 thousand.

Single-family starts declined 9.9% to 457 thousand in February. Permits moved higher, so single family starts will probably increase in March.

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after sideways for about two years and a half years. Total starts are up 34.7% from a year ago.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after sideways for about two years and a half years. Total starts are up 34.7% from a year ago.This was slightly below expectations of 700 thousand starts in February.

Monday, March 19, 2012

Market Update: Still a Lost Decade

by Calculated Risk on 3/19/2012 07:01:00 PM

Click on graph for larger image.

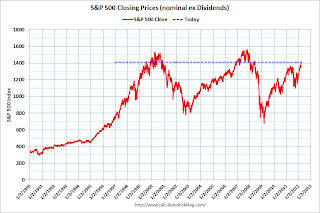

The first graph shows the S&P 500 since 1990 (this excludes dividends).

The dashed line is the closing price today. The S&P 500 was first at this level in July 1999; almost 13 years ago.

The second graph (click on graph for larger image) from Doug Short shows the sharp increase over the last few months.

Lawler on FHA: Number of Seriously Delinquent SF Loans Down Slightly in February, Way Up from Year Ago

by Calculated Risk on 3/19/2012 03:53:00 PM

Some interesting data from economist Tom Lawler (the FHA remains a significant problem):

Updated data from the FHA’s early warning system shows that the number of FHA-insured SF loans serviced by entities with a combined FHA SF servicing portfolio of almost 7.4 million loans totaled 722,030 at the end of February, down from 732,775 in January. While this report doesn’t always exactly match other FHA reports, it tracks the “official” numbers pretty closely. Here, e.g., are the reported number of seriously delinquent FHA-insured SF loans from the EWS and from the FHA’s monthly Outlook Report.

| Seriously Delinquent FHA-Insured SF Loans | ||

|---|---|---|

| EWS | Outlook | |

| Oct-11 | 657,552 | 661,554 |

| Nov-11 | 690,271 | 689,346 |

| Dec-11 | 713,793 | 711,082 |

| Jan-12 | 732,775 | 733,844 |

| Feb-12 | 722,030 | |

Assuming the EWS numbers are reasonable estimates for February’s SDQ total, here is some historical data. In the table on the next page, the FHA insurance in force is number of loans, and is from the Monthly Report to the FHA Commissioner. These numbers differ from those in the FHA Outlook Report, for reasons unclear to me. The data on the number of SDQ loans in the Commissioner report and the Outlook report are the same save for March 2011, and I believe the Commissioner report has an incorrect number, so I used the March 2011 number from the Outlook report (aarrgh!).

| FHA SF Insured Portfolio | Seriously Delinquent | SDQ Rate | |

|---|---|---|---|

| 10/31/2010 | 6,658,560 | 532,938 | 8.00% |

| 11/30/2010 | 6,724,304 | 588,947 | 8.76% |

| 12/31/2010 | 6,813,888 | 598,140 | 8.78% |

| 1/31/2011 | 6,889,701 | 612,443 | 8.89% |

| 2/28/2011 | 6,933,260 | 619,712 | 8.94% |

| 3/31/2011 | 6,984,580 | 580,480 | 8.31% |

| 4/30/2011 | 7,036,153 | 575,950 | 8.19% |

| 5/31/2011 | 7,079,820 | 578,933 | 8.18% |

| 6/30/2011 | 7,152,140 | 584,822 | 8.18% |

| 7/31/2011 | 7,203,809 | 598,921 | 8.31% |

| 8/31/2011 | 7,260,598 | 611,822 | 8.43% |

| 9/30/2011 | 7,288,440 | 635,096 | 8.71% |

| 10/31/2011 | 7,342,712 | 661,554 | 9.01% |

| 11/30/2011 | 7,378,126 | 689,346 | 9.34% |

| 12/31/2011 | 7,415,002 | 711,082 | 9.59% |

| 1/31/2012 | 7,464,533 | 733,844 | 9.83% |

| 2/29/2012 | 7,499,802 | 722,030 | 9.63% |

CR Note: Fannie and Freddie serious delinquencies are down year-over-year, but the FHA delinquencies are up from 8.94% in Feb 2011 to 9.63%.

Desktop Underwriter® Refi Plus and Wells Fargo

by Calculated Risk on 3/19/2012 01:08:00 PM

Over the weekend I noted that Fannie Mae has updated Desktop Underwriter® (DU) so that lenders can now use the automated system. There are several advantages to the automated system, one was that borrowers would now be able to apply for a "HARP 2.0" refinance with lenders other than the lender for their original mortgage.

This morning I read the Wells Fargo "Amended DU Refi PlusTM Policy and Effective Dates".

First, Wells Fargo has decided to limit HARP 2.0 to loans that Wells services. If Wells is not the current servicer, then Wells will limit LTV to 105% - the same as HARP 1.0 guidelines. Well Fargo wrote:

"After further assessment of the new parameters for DU Refi Plus transactions, and the current market environment, Wells Fargo has reconsidered our policy regarding loans not currently serviced by Wells Fargo. As a result we will not offer unlimited LTV/CLTV options for Loans not currently serviced by Wells Fargo."This is a significant change from just a few weeks ago.

On timing of DU Refi Plus:

"Loans with the expanded parameters defined above may not be submitted for Prior Approval underwriting until April 23, 2012, when loans can be delivered to Wells Fargo."So any increase in refinance activity associated with the automated DU system, will start in late April for Wells Fargo.

NAHB Builder Confidence index unchanged in March

by Calculated Risk on 3/19/2012 10:00:00 AM

The National Association of Home Builders (NAHB) reports the housing market index (HMI) was unchanged in March at 28 (February was revised dwon from 29). Any number under 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Unchanged in March

Builder confidence in the market for newly built, single-family homes was unchanged in March from a revised level of 28 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. This means that following five consecutive months of gains, the HMI is now holding at its highest level since June of 2007.

“While builders are still very cautious at this time, there is a sense that many local housing markets have started to move in the right direction and that prospects for future sales are improving,” said Barry Rutenberg, chairman of the National Association of Home Builders (NAHB) and a home builder from Gainesville, Florida. “This is demonstrated by the fact that the HMI component measuring builder expectations continued climbing for a sixth straight month in March, to its highest level in more than four years.”

“Builder confidence is now twice as strong as it was six months ago, and the West was the only region to experience a decline this month following an unusual spike in February,” observed NAHB Chief Economist David Crowe. “That said, many of our members continue to cite obstacles on the road to recovery, including persistently tight builder and buyer credit and the ongoing inventory of distressed properties in some markets.”

While the HMI component gauging current sales conditions declined one point to 29 in March, the component gauging sales expectations in the next six months gained two points to 36 and the component gauging traffic of prospective buyers held unchanged at 22.

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the March release for the HMI and the January data for starts (February housing starts will be released tomorrow).

Both confidence and housing starts had been moving sideways at a very depressed level for several years - but confidence has been moving up recently, and it appears starts are increasing a little too.

This is still very low, but this is the highest level since June 2007.

Residential Remodeling Index increases 11% year-over-year in January

by Calculated Risk on 3/19/2012 08:35:00 AM

From BuildFax:

Residential remodels authorized by building permits in the United States in January were at a seasonally-adjusted annual rate of 2,998,000. This is 13 percent above the revised December rate of 2,653,000 and is 11 percent above the January 2011 estimate of 2,705,000.

“Residential remodeling this winter is as strong as it has been in more than five years. We expect residential remodeling to continue to grow throughout 2012,” said Joe Emison, Vice President of Research and Development at BuildFax.

The BuildFax Remodeling Index (BFRI) is based on construction permits for residential remodeling projects filed with local building departments across the country. The index estimates the number of properties permitted. The national and regional indexes are based upon a subset of representative building departments in the U.S. and population estimates from the U.S. Census.

Click on graph for larger image.

Click on graph for larger image.This graph shows the Remodeling Index since January 2000 on a seasonally adjusted basis. Earlier release were not seasonally adjusted.

Remodeling is below the peak levels of the housing boom - with all the equity extraction - but up 29% from the bottom in May 2009.

Note: Permits are not adjusted by value, so this doesn't mean there is more money being spent, just more permit activity. Also some smaller remodeling projects are done without permits and the index will miss that activity.

For residential investment, multi-family construction and home improvement have already picked up, and it appears single family construction will increase in 2012.

Sunday, March 18, 2012

HARP Update: Fannie Mae updates Desktop Underwriter® (DU)

by Calculated Risk on 3/18/2012 08:29:00 PM

This is significant ...

Back in October, the FHFA announced some changes to HARP to allow homeowners with GSE loans and with negative or near negative equity - and who are current on their mortgages - to refinance into lower interest rate loans.

The key to this program for the lenders was that the lender was not responsible for any of the representations and warranties associated with the original loan (this is huge for the lenders). The elimination of Reps and warrants for the original loans applies to the automated Desktop Underwriter® (DU) (see Selling Guide Announcement SEL-2011-12)

According to Fannie Mae, the updates to Desktop Underwriter® were completed yesterday. Now lenders can use the automated system (and borrowers will now be able to apply for a "HARP 2.0" refinance with lenders other than the lender for their original mortgage).

I expect having the automated system - with the elimination of reps and warrants - will lead to surge in refinance activity.

Note: We will not see the increase in the MBA refinance index reported this week, because that was for last week. We will have to wait until the end of March to see if there is a surge in refinance activity.

Oil and Gasoline Prices

by Calculated Risk on 3/18/2012 05:25:00 PM

From MarketWatch: Gasoline prices rise for 9th straight day

The national average price for a gallon of gas rose to $3.838, according to motorist group AAA’s fuel gauge report.From the WSJ: No Relief in Sight at Pump

That’s up from about $3.53 a month ago.

...

The nation’s record high of $4.11 was set in July 2008, [CNN] said.

U.S. gasoline prices jumped 6% in February, and market experts predict they will climb higher because critical refining operations in the Northeast are shutting down.From the WSJ: Economy Hasn't Slipped on Oil Prices—Yet

...

Gasoline futures on the New York Mercantile Exchange are up 22% this year, and settled Friday at a 10-month high of $3.3569 a gallon. Average pump prices tend to follow futures by a few weeks, averaging about 70 cents a gallon more, after taxes and transport costs. Based on futures, retail prices should average above $4 a gallon soon.

Professor Hamilton had some thoughts earlier this month on the impact on the economy: Oil prices and the U.S. economy

Although the prices of oil and gasoline have risen significantly from their values in October, they are still not back to the levels we saw last spring or in the summer of 2008. There is a good deal of statistical evidence ... that an oil price increase that does no more than reverse an earlier decline has a much more limited effect on the economy than if the price of oil surges to a new all-time high.It definitely hurts at the pump!

One reason for this is that much of the impact on the economy of an increase in oil prices comes from abrupt changes in the patterns of consumer spending. ... ut if consumers have recently seen even higher prices than they're paying at the moment, their spending plans and firms' production plans are likely already to have incorporated that reality.

... based on what has happened to oil prices so far, I find myself in the unusual position of being less concerned about the impact of oil prices on the U.S. economy than many other analysts.

Note: The graph below shows oil prices for WTI; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Yesterday:

• Summary for Week ending March 16th

• Schedule for Week of March 18th