by Calculated Risk on 3/14/2012 12:09:00 PM

Wednesday, March 14, 2012

Las Vegas House sales up 13% YoY in February, Inventory off sharply

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities. Prices, as of the December report, were off 61.8% from the peak according to Case-Shiller, and off 8.9% over the last year.

Sales in 2011 were at record levels, more than during the bubble, and it looks like 2012 will be an even stronger year - even with some new rules that slow the foreclosure process.

From the LVGAR: GLVAR reports increasing home sales, prices, decreasing inventory. First on a record sales pace:

According to GLVAR, the total number of local homes, condominiums and townhomes sold in February was 3,794. That’s up from 3,591 in January, and up from 3,371 total sales in February 2011.And on the decline in inventory:

Compared to one year ago, single-family home sales during February increased by 17.8 percent, while sales of condos and townhomes decreased by 5.0 percent.

By the end of February, GLVAR reported 6,543 single-family homes listed without any sort of offer. That’s down 18.2 percent from 8,001 such homes listed in January and down 45.6 percent from one year ago. For condos and townhomes, the 1,598 properties listed without offers in February represented an 8.5 percent decline from 1,746 such properties listed without offers in January and a decrease of 45.6 percent from one year ago.And on the percent distressed:

Meanwhile, 29.3 percent of all existing local homes sold during February were short sales ... Bank-owned homes accounted for 42 percent of all existing home sales in February, down from 45.5 percent in January.So 71.3% of the sales were distressed, and over half were purchased with cash.

One of the keys is the decline in inventory. Note that the GLVAR reports both total inventory, and inventory excluding "contingent" listings (usually short sales). Total single family inventory was down 15.4% from a year ago, and excluding contingent listings, inventory was down 45.6%!

MBA: Mortgage Purchase Applications increase

by Calculated Risk on 3/14/2012 09:07:00 AM

Purchase activity has picked up a little from the beginning of the year. Refinance activity fell, but HARP refinance activity is picking up ...

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 4.1 percent from the previous week to its lowest level since January 6, 2012. This is the fourth consecutive weekly decline in the Refinance Index.

The seasonally adjusted Purchase Index increased 4.4 percent from one week earlier to its highest level since January 13, 2012.

...

“Applications for home purchase increased again last week, coinciding with another strong job market report. Purchase applications are now almost 12 percent above the level one month ago, even after adjusting for typical seasonal patterns. However, this level of purchase activity, adjusted or unadjusted, was essentially unchanged when compared to the same time last year. Purchase activity remains subdued and within the narrow range we have seen since the expiration of the homebuyer tax credit in 2010,” said Michael Fratantoni, MBA’s Vice President of Research and Economics. “Refinance application volume fell last week. Although rates were unchanged on average, they trended up through the course of the week, and this likely discouraged many potential refinance applicants. HARP volume continued to grow as a share of total refinance volume, reaching roughly 30 percent of refinance activity in the last two weeks. Typical HARP loans had loan-to-value ratios above 90 percent, indicating that lenders are reaching out to underwater borrowers.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) remained unchanged at 4.06 percent ...

Tuesday, March 13, 2012

Ceridian-UCLA: Diesel Fuel index increased 0.7% in February

by Calculated Risk on 3/13/2012 10:37:00 PM

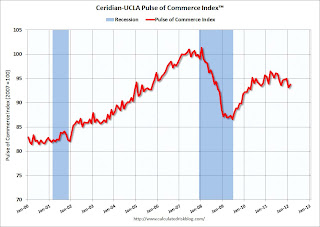

This is the UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce Index Increased 0.7 Percent in February

The Ceridian-UCLA Pulse of Commerce Index® (PCI®), issued today by the UCLA Anderson School of Management and Ceridian Corporation, rose 0.7 percent in February but was not enough to offset the 1.7 percent decline in the previous month. The most recent three-month period from December to February is lower than the previous three months from September to November 2011 by 3.2 percent at an annualized rate.

...

“The continuing weakness of the PCI is signaling that, perhaps, the recovery in home building has not yet taken hold. The recent improvement in building permits and housing starts may get building going again and therefore, trucking as well, as it has been said that it takes 17 truckloads to build a home. If we get the saws and hammers going again, we will have a real recovery with much healthier job growth,” said Ed Leamer, chief economist for the Ceridian-UCLA Pulse of Commerce Index and Director of the UCLA Anderson Forecast.

Click on graph for larger image.

Click on graph for larger image.This graph shows the index since January 2000.

This index has been weaker than the ATA trucking index and the reports for rail traffic. It is possible that the high cost of fuel is shifting some long haul traffic from trucks to rail (intermodal).

Fed: 15 of 19 Banks passed adverse stress test scenario

by Calculated Risk on 3/13/2012 04:44:00 PM

Update from FT Alphaville: Citi fails Fed stress test. They say Citi, SunTrust, Ally and MetLife all failed. Hard to believe BofA passed.

From the Fed: Federal Reserve announces summary results of latest round of bank stress tests

The Federal Reserve on Tuesday announced summary results of the latest round of bank stress tests, which show that the majority of the largest U.S. banks would continue to meet supervisory expectations for capital adequacy despite large projected losses in an extremely adverse hypothetical economic scenario.

Reflecting the severity of the stress scenario--which includes a peak unemployment rate of 13 percent, a 50 percent drop in equity prices, and a 21 percent decline in housing prices--losses at the 19 bank holding companies are estimated to total $534 billion during the nine quarters of the hypothetical stress scenario. The aggregate tier 1 common capital ratio, which compares high-quality capital to risk-weighted assets, falls from 10.1 percent in the third quarter of 2011 to 6.3 percent in the fourth quarter of 2013 in the hypothetical stress scenario. That number incorporates the firms' proposals for planned capital actions such as dividends, share buybacks, and share issuance.

Despite the large hypothetical declines, the post-stress capital level in the test exceeds the actual aggregate tier 1 common ratio for the 19 firms prior to the government stress tests conducted in the midst of the financial crisis in early 2009, and reflects a significant increase in capital during the past three years. In fact, despite the significant projected capital declines, 15 of the 19 bank holding companies were estimated to maintain capital ratios above all four of the regulatory minimum levels under the hypothetical stress scenario, even after considering the proposed capital actions, such as dividend increases or share buybacks.

Fed to Release Stress Test Results Today at 4:30PM ET

by Calculated Risk on 3/13/2012 04:22:00 PM

From the WSJ: J.P. Morgan Spurs Fed to Move Up Stress-Test Results

The Federal Reserve will release the results of its latest stress tests today at 4:30 p.m. Eastern time, two days before it had planned to unveil the sensitive review of big banks.The stress test scenario was announced last November and is outlined here. Here is a look at the house price scenario (the Fed uses CoreLogic).

The schedule change came after J.P. Morgan Chase & Co . sent out a news release announcing it had passed the stress test. ... Bankers were scrambling Tuesday after the unexpected timing of J.P. Morgan's announcement. ...

The Fed had planned to release the results of this year's Comprehensive Capital Analysis and Review, or stress tests, on Thursday afternoon. It decided to move up the timing after some banks had disclosed their results, the Fed said.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the nominal prices for the CoreLogic index. The adverse scenario was for prices to bottom in Q1 2014 at about 17% below the current price (it was 20% further when the stress tests were announced, but prices have fallen).

For the baseline scenario (not shown) prices would bottom in Q3 2011 at close to the current level.

The second graph shows what would happen to the price-to-rent ratio for the adverse scenario assuming a 1.5% annual increase in Owners' equivalent rent (OER).

The second graph shows what would happen to the price-to-rent ratio for the adverse scenario assuming a 1.5% annual increase in Owners' equivalent rent (OER). This would put the price-to-rent ratio about 15% below historic lows. Three words: Not. Gonna. Happen.

The "adverse" scenario was severe.

FOMC Statement: No changes, economy "expanding moderately"

by Calculated Risk on 3/13/2012 02:16:00 PM

Information received since the Federal Open Market Committee met in January suggests that the economy has been expanding moderately. Labor market conditions have improved further; the unemployment rate has declined notably in recent months but remains elevated. Household spending and business fixed investment have continued to advance. The housing sector remains depressed. Inflation has been subdued in recent months, although prices of crude oil and gasoline have increased lately. Longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects moderate economic growth over coming quarters and consequently anticipates that the unemployment rate will decline gradually toward levels that the Committee judges to be consistent with its dual mandate. Strains in global financial markets have eased, though they continue to pose significant downside risks to the economic outlook. The recent increase in oil and gasoline prices will push up inflation temporarily, but the Committee anticipates that subsequently inflation will run at or below the rate that it judges most consistent with its dual mandate.

To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee expects to maintain a highly accommodative stance for monetary policy. In particular, the Committee decided today to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that economic conditions--including low rates of resource utilization and a subdued outlook for inflation over the medium run--are likely to warrant exceptionally low levels for the federal funds rate at least through late 2014.

The Committee also decided to continue its program to extend the average maturity of its holdings of securities as announced in September. The Committee is maintaining its existing policies of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. The Committee will regularly review the size and composition of its securities holdings and is prepared to adjust those holdings as appropriate to promote a stronger economic recovery in a context of price stability.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Dennis P. Lockhart; Sandra Pianalto; Sarah Bloom Raskin; Daniel K. Tarullo; John C. Williams; and Janet L. Yellen. Voting against the action was Jeffrey M. Lacker, who does not anticipate that economic conditions are likely to warrant exceptionally low levels of the federal funds rate through late 2014.

State Unemployment Rates "generally lower" in January

by Calculated Risk on 3/13/2012 12:19:00 PM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally lower in January. Forty-five states and the District of Columbia recorded unemployment rate decreases, New York posted a rate increase, and four states had no change, the U.S. Bureau of Labor Statistics reported today. Forty-eight states and the District of Columbia registered unemployment rate decreases from a year earlier, while New York experienced an increase and Illinois had no change.

...

Nevada continued to record the highest unemployment rate among the states, 12.7 percent in January. California and Rhode Island posted the next highest rates, 10.9 percent each. North Dakota again registered the lowest jobless rate, 3.2 percent, followed by Nebraska, 4.0 percent. ...

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). Every state has some blue - indicating no state is currently at the maximum during the recession.

The states are ranked by the highest current unemployment rate. Only four states still have double digit unemployment rates: Nevada, California, Rhode Island and North Carolina. This is the fewest since January 2009. In early 2010, 18 states and D.C. had double digit unemployment rates.

BLS: Job Openings unchanged in January

by Calculated Risk on 3/13/2012 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings in January was 3.5 million, unchanged from December. Although the number of job openings remained below the 4.3 million openings when the recession began in December 2007, the number of job openings has increased 45 percent since the end of the recession in June 2009.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

In January, the hires rate was essentially unchanged at 3.1 percent for total nonfarm. ... The quits rate can serve as a measure of workers’ willingness or ability to change jobs. In January, the quits rate was unchanged for total nonfarm, total private, and government. ... The number of quits (not seasonally adjusted) in January 2012 increased from January 2011 for total nonfarm, total private, and government.

This is a new series and only started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for January, the most recent employment report was for February.

Click on graph for larger image.

Click on graph for larger image.Notice that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings were unchanged in January, and the number of job openings (yellow) has generally been trending up, and are up about 21% year-over-year compared to January 2011.

Quits declined slightly in January, and quits are now up about 9% year-over-year. These are voluntary separations and more quits might indicate some improvement in the labor market. (see light blue columns at bottom of graph for trend for "quits").

Retail Sales increased 1.1% in February

by Calculated Risk on 3/13/2012 08:30:00 AM

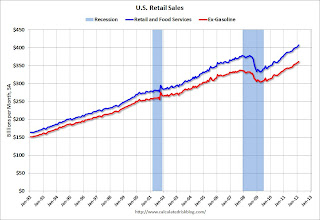

On a monthly basis, retail sales were up 1.1% from January to February (seasonally adjusted, after revisions), and sales were up 6.5% from February 2011. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for February, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $407.8 billion, an increase of 1.1 percent (±0.5%) from the previous month and 6.5 percent (±0.7%) above February 2011. ... The December 2011 to January 2012 percent change was revised from 0.4 percent (±0.5)* to 0.6 percent (±0.2%).Ex-autos, retail sales increased 0.9% in February.

Click on graph for larger image.

Click on graph for larger image.Sales for January were revised up from a 0.4% increase to a 0.6% increase.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 22.6% from the bottom, and now 7.8% above the pre-recession peak (not inflation adjusted)

The second graph shows the same data since 2006 (to show the recent changes). Excluding gasoline, retail sales are up 18.8% from the bottom, and now 6.9% above the pre-recession peak (not inflation adjusted).

The second graph shows the same data since 2006 (to show the recent changes). Excluding gasoline, retail sales are up 18.8% from the bottom, and now 6.9% above the pre-recession peak (not inflation adjusted).The third graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 6.0% on a YoY basis (6.5% for all retail sales). Retail sales ex-gasoline increased 0.8% in February.

This was below the consensus forecast for retail sales of a 1.2% increase in February, but above the consensus for a 0.8% increase ex-auto.

This was below the consensus forecast for retail sales of a 1.2% increase in February, but above the consensus for a 0.8% increase ex-auto. NFIB: Small Business Optimism increases slightly in February

by Calculated Risk on 3/13/2012 07:45:00 AM

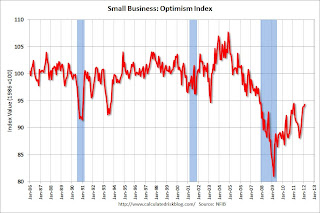

From the National Federation of Independent Business (NFIB): Historically Low Business Confidence Begins to Edge Up, Ever so Slightly

The Small-Business Optimism Index gained 0.4 points in February to 94.3 marking the sixth consecutive month of gains. While still historically low, the latest increase is a sign that the recovery is likely to continue, albeit at a glacial pace. The Index is lower than that of February 2011 but is the second highest reading since December 2007, the beginning of the recession.Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

...

While the fog over Main Street appears to be lifting to some degree, confidence in the economy remains fragile. Twenty-two (22) percent of small-business owners report “poor sales” as their top business problem, unchanged from January. February’s report suggests cautious optimism ...

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986. The index increased to 94.3 in February from 93.9 in January. This is the sixth increase in a row after for the index, and the index is now at second highest level since December 2007 (the index was slightly higher - at 94.5 - in February 2011).

This index is still low - probably due to a combination of sluggish growth, and the high concentration of real estate related companies in the index.