by Calculated Risk on 3/09/2012 09:18:00 PM

Friday, March 09, 2012

Lawler: Hovnanian says Spring Selling Season “Off to a Good Start”

From housing economist Tom Lawler:

Hovnanian Enterprises, the struggling New Jersey based builder that was the 7th largest US home builder in 2010, reported that net home sales (excluding joint ventures) in the quarter ended January 31, 2012 totaled 940, up 18.7%, up from the comparable quarter a year ago. Including joint ventures, net home sales totaled 1,079, up 26.9% from a year ago. Hovnanian also reported that net home sales in February (including joint ventures) were up 37.5% from last February pace.

Home closings in the latest quarter (including joint ventures) totaled 1,012, a YOY gain of 13.5%, while Hov’s order backlog on January 31, 2012 (including joint ventures) totaled 1,730, up 28% from last January.

Chairman of the Board Ara Hovnanian said that “the spring selling season is off to a good start...,” which is consistent with other anecdotal reports from home builders.

CR note: I'm hearing similar comments from private sources.

Earlier on Employment:

• February Employment Report: 227,000 Jobs, 8.3% Unemployment Rate

• Employment Summary and Discussion

• All Employment Graphs

Note: I'm frequently asked how the Great Depression would look on the percent job losses graph, here it is: Percent Job Losses: Great Recession and Great Depression

Bank Failure #13 in 2012: New City Bank, Chicago, Illinois

by Calculated Risk on 3/09/2012 06:24:00 PM

... Playing corporation games

Write us off the page”

Excerpted by Soylent Green is People from M.Page, B. Taupin, D. Lambert, and P.Wolf.

From the FDIC: FDIC Approves the Payout of the Insured Deposits of New City Bank, Chicago, Illinois

As of December 31, 2011, New City Bank had $71.2 million in total assets and $72.4 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $17.4 million. New City Bank is the thirteenth FDIC-insured institution to fail in the nation this year, and the second in Illinois.No one wanted this one!

Freddie Mac: REO inventory declines 16% in 2011

by Calculated Risk on 3/09/2012 04:27:00 PM

This morning Freddie Mac reported results for Q4 and all of 2011. Freddie reported that they acquired 98,631 REO in 2011 (Real Estate Owned via foreclosure or deed-in-lieu), down from a record 128,238 in 2010.

Fannie disposed of a record 110,175 REO, up from 101,206 in 2010. Since Freddie disposed of more REO than they acquired, Freddie's REO inventory fell 16% in 2011.

Here is a table for the last two years:

| Freddie Mac REO Acquisitions and Dispositions | ||

|---|---|---|

| 2011 | 2010 | |

| Acquisitions | 98,631 | 128,238 |

| Dispositions | 110,175 | 101,206 |

| Net | -11,544 | 27,032 |

This has been true for most lenders - they sold more REO than they acquired in 2011 - not just Fannie, Freddie and the FHA.

The following graph shows REO inventory for Fannie, Freddie and the FHA.

Click on graph for larger image.

Click on graph for larger image.REO inventory for Freddie increased slightly in Q4, but declined 16% in 2011. The combined REO inventory for Fannie, Freddie and the FHA declined 28.5% in 2011.

A few comments from Freddie:

Our single-family REO acquisitions in 2011 were most significant in the states of California, Michigan, Georgia, Florida, and Arizona, which collectively represented 43% of total REO acquisitions based on the number of properties. These states collectively represented 48% of total REO acquisitions in 2010. The states with the most properties in our REO inventory as of December 31, 2011 were Michigan and California. At December 31, 2011, our REO inventory in Michigan and California comprised 12% and 10%, respectively, of total REO property inventory, based on the number of properties.And on the REO-to-rental program:

On August 10, 2011, FHFA, in consultation with Treasury and HUD, announced a request for information seeking input on new options for sales and rentals of single-family REO properties held by Freddie Mac, Fannie Mae and FHA. According to the announcement, the objective of the request for information was to help address current and future REO inventory. The request for information solicited alternatives for maximizing value to taxpayers and increasing private investment in the housing market, including approaches that support rental and affordable housing needs. We are participating in discussions with FHFA and other agencies with respect to this initiative. It is too early to determine the impact this initiative may have on the levels of our REO property inventory, the process for disposing of REO property or our REO operations expense.

Trade Deficit increased in January to $52.6 Billion

by Calculated Risk on 3/09/2012 01:52:00 PM

Catching up: The Department of Commerce reports:

[T]otal January exports of $180.8 billion and imports of $233.4 billion resulted in a goods and services deficit of $52.6 billion, up from $50.4 billion in December, revised. January exports were $2.6 billion more thanThe trade deficit was above the consensus forecast of $49 billion.

December exports of $178.2 billion. January imports were $4.7 billion more than December imports of $228.7 billion.

The first graph shows the monthly U.S. exports and imports in dollars through January 2012.

Click on graph for larger image.

Click on graph for larger image.Both exports and imports increased in January. Imports stalled in the middle of 2011, but increased towards the end of the year (seasonally adjusted). Exports are well above the pre-recession peak and up 8% compared to January 2011; imports just passed the pre-recession high and imports are up about 8% compared to January 2011.

The second graph shows the U.S. trade deficit, with and without petroleum, through December.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil averaged $103.81 per barrel in January, down slightly from December.

Both exports and imports to the European Union were up year-over-year in January, with imports increasing faster.

Employment Summary and Discussion

by Calculated Risk on 3/09/2012 10:22:00 AM

This was a solid report, especially considering the upward revisions to payrolls for December and January. The better than normal weather helped, and there is still a long ways to go for a healthy labor market with solid wage gains.

Some analysts are comparing the last three months of payroll growth to early 2011, and arguing job growth will disappoint in the coming months. I also expect some slowing in employment growth since nice weather helps the most during the winter months. But there are reasons to expect better job growth overall this year - remember 2011 was negatively impacted by the tsunami, bad weather, high oil prices and the debt ceiling debate. We can't predict the weather, and oil prices are high again - but hopefully there will be no natural disasters, and also no threats of defaulting on the debt.

Plus housing has made the bottom turn, and even with a sluggish housing recovery, residential investment will add to economic growth in 2012. Also, the employment losses from state and local governments will probably end mid-year. In the last 6 months of 2011, there were 119,000 government jobs lost. This year, in the second half, job losses will probably be close to zero. As the BLS noted:

Government employment was essentially unchanged in January and February. In 2011, government lost an average of 22,000 jobs per month.On to the report: There were 227,000 payroll jobs added in February, with 233,000 private sector jobs added, and 6,000 government jobs lost. The unemployment rate was unchanged at 8.3%. U-6, an alternate measure of labor underutilization that includes part time workers and marginally attached workers, declined to 14.9% from 15.1% in January. This remains very high - U-6 was in the 8% range in 2007 - but this is the lowest level of U-6 since January 2009.

The participation rate increased to 63.9% (from 63.7%) and the employment population ratio increased slightly to 58.6%.

The change in December payroll employment was revised up from +203,000 to +223,000, and January was revised up from +243,000 to +284,000.

The average workweek was unchanged at 34.5 hours, and average hourly earnings increased 0.1%. "The average workweek for all employees on private nonfarm payrolls was unchanged at 34.5 hours in February. ... In February, average hourly earnings for all employees on private nonfarm payrolls rose by 3 cents, or 0.1 percent, to $23.31. Over the past 12 months, average hourly earnings have increased by 1.9 percent." This is sluggish earnings growth, and earnings are still being impacted by the large number of unemployed and marginally employed workers.

There are a total of 12.8 million Americans unemployed and 5.4 million have been unemployed for more than 6 months. Still very grim.

But overall this was a solid report.

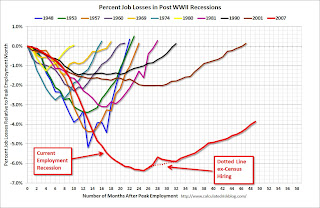

Percent Job Losses During Recessions

Click on graph for larger image.

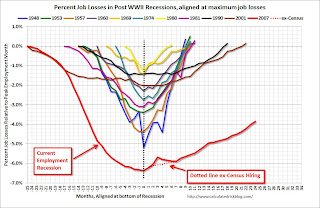

Click on graph for larger image.This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses.

In the previous post, the graph showed the job losses aligned at the start of the employment recession.

Part Time for Economic Reasons

From the BLS report:

From the BLS report: The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was essentially unchanged at 8.1 million in February. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of part time workers decreased slightly in February and is still very high.

These workers are included in the alternate measure of labor underutilization (U-6) that declined to 14.9% in February from 15.1% in January.

Unemployed over 26 Weeks

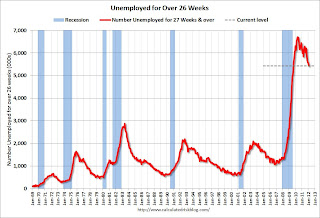

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 5.426 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 5.518 million in January. This is very high, but this is the lowest number since January 2009.

When the number of long term unemployed and part time workers (for economic reasons) starts to fall sharply, and wages increase faster than inflation, this will feel much more like a recovery.

More graphs coming ...

February Employment Report: 227,000 Jobs, 8.3% Unemployment Rate

by Calculated Risk on 3/09/2012 08:30:00 AM

From the BLS:

Nonfarm payroll employment rose by 227,000 in February, and the unemployment rate was unchanged at 8.3 percent, the U.S. Bureau of Labor Statistics reported today.This graph shows the jobs added or lost per month (excluding temporary Census jobs) since the beginning of 2008.

...

Both the labor force and employment rose in February. The civilian labor force participation rate, at 63.9 percent, and the employment-population ratio, at 58.6 percent, edged up over the month.

...

The change in total nonfarm payroll employment for December was revised from +203,000 to +223,000, and the change for January was revised from +243,000 to +284,000.

Click on graph for larger image.

Click on graph for larger image.Job growth started picking up early last year, but then the economy was hit by a series of shocks (oil price increase, tsunami in Japan, debt ceiling debate) - and now it appears job growth is picking up again.

The second graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate was unchanged at 8.3% (red line).

The Labor Force Participation Rate increased to 63.9% in February (blue line). This is the percentage of the working age population in the labor force. The slight increase in the participation rate is a little good news. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although most of the decline is due to demographics.

The Labor Force Participation Rate increased to 63.9% in February (blue line). This is the percentage of the working age population in the labor force. The slight increase in the participation rate is a little good news. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although most of the decline is due to demographics.The Employment-Population ratio increased to 58.6% in February (black line).

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.This shows the depth of the recent employment recession - much worst than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

This was another solid report, especially considering the upwards revisions to payrolls for December and January. More later ...

A few Greek Debt Deal Details

by Calculated Risk on 3/09/2012 07:43:00 AM

From the Financial Times: Investors back historic Greek debt swap

Participation in the €206bn debt exchange would reach 95.7 per cent, up from 85.8 per cent, if so-called collective action clauses are used ...Next: There will be a conference call today of eurozone finance ministers to approve the use of the "collective action clauses". And then later today a decision is expected on if this will trigger CDS insurance (probably).

excerpt with permission

The completion of the swap deal means Greece will receive additional bailout funds and avoid default this month. But there are still many hurdles ahead.

Some analyst commentary from FT Alphaville: Greek PSI — the analyst reaction and Greek PSI — the implications.

Thursday, March 08, 2012

PIMCO's Taj Mahal

by Calculated Risk on 3/08/2012 06:39:00 PM

While we wait for the offical Greek announcement of the bond swap participation at 1 AM ET Friday (Reuters is reporting: Nearly 95% of Greek Creditors Agree to Bond-Swap Deal), and for the February employment report (preview here), and for Freddie Mac to finally release their Q4 results (what is taking so long?), below is a picture of the new PIMCO tower being built in Newport Center.

Pacific Investment Management Co. will lease the 20 story, 380,000-square-foot building, from the Irvine Company. The building is expected to be completed next year.

They have the structure in place for the 6th floor (of 20).

Not tall by New York standards, but this building will have a great ocean view.

Hmmm ... another typical California day ... sunshine and palm trees.

Employment Situation Preview

by Calculated Risk on 3/08/2012 03:30:00 PM

Tomorrow (Friday) the BLS will release the February Employment Situation Summary at 8:30 AM ET. Bloomberg is showing the consensus is for an increase of 204,000 payroll jobs in February, and for the unemployment rate to remain unchanged at 8.3%. The consensus has probably moving up a little this week based on recent reports.

Notes:

• The Atlanta Fed has a new jobs calculator to answer the question: How many jobs does it take ...? Here is a description. You can enter different assumptions for the participation rate and population growth, and the tool will estimate how many jobs are needed to lower the unemployment rate to some target over a certain period. Very cool.

• The economic question for tomorrow (see pickem game on top right sidebar) is to take the over or under on the consensus for payroll jobs. Right now I'm in the lead for March with 6 correct answers - there is a four way tie for 2nd.

Here is a summary of recent data:

• The ADP employment report showed an increase of 216,000 private sector payroll jobs in February. Although ADP seems to track the BLS over time, the ADP report hasn't been very useful in predicting the BLS report. Also note that government payrolls declined by about 15,000 on average over the last couple of months so this suggests around 216,000 private nonfarm payroll jobs added, minus 15,000 government workers - or around 201,000 total jobs added in February (close to the consensus).

• The ISM manufacturing employment index decreased to 53.2% from 54.3% in January. A historical correlation between the ISM index and the BLS employment report for manufacturing, suggests that private sector BLS reported payroll jobs for manufacturing were unchanged in February.

The ISM service employment index decreased to 55.7% from 57.4% in February. Based on a historical correlation between the ISM non-manufacturing employment index and the BLS employment report for service, this reading suggests the gain of around 210,000 private payroll jobs for services in February.

Somewhat mixed, but overall the ISM surveys suggest an employment report at close to the consensus.

• Initial weekly unemployment claims averaged about 355,000 in February, down from 377,000 average in January and December.

For the BLS reference week (includes the 12th of the month), initial claims were at the lowest level since early 2008. This is a very positive sign.

• The final February Reuters / University of Michigan consumer sentiment index increased to 75.3, up slightly from the January reading of 75.0. This is frequently coincident with changes in the labor market, but also strongly related to gasoline prices and other factors. This suggests a weak but improving labor market. This is close to the same level as last month, and also in February 2011 (before the tsunami). The BLS reported jobs gain over over 200 thousand for both months.

• And a little pessimism from the NFIB: NFIB Jobs Statement: Job Creation Breaks Even in February; Hiring Plans Look Grim

“February was a ‘break-even’ month for job creators on Main Street. For small employers, the net change in employment per firm (seasonally adjusted) was 0.04. While this is better than January’s net zero report, it’s certainly nothing to get excited about."The participants in the NFIB surveys aren't doing much hiring, however a small business report from Intuit was more upbeat.

• And on the unemployment rate from Gallup: U.S. Unemployment Up in February

The February unemployment rate the U.S. government reports on Friday morning will be based largely on mid-month conditions. In mid-February, Gallup reported that its U.S. unemployment rate had increased to 9.0% from 8.3% in mid-January. The mid-month reading normally provides a relatively good estimate of the government's unadjusted unemployment rate for the month.NOTE: The Gallup poll results are Not Seasonally Adjusted (NSA), so use with caution. This does suggest some increase in the headline seasonally adjusted unemployment rate.

Assuming the government's unadjusted rate increases -- from its 8.8% in January -- to at least match Gallup's mid-month measurement for February, then the government should also report an increase in the seasonally adjusted unemployment rate for February.

...

Last February, the U.S. Bureau of Labor Statistics applied a seasonal adjustment factor of 0.5 points to its unadjusted unemployment rate for the month. If that same seasonal adjustment is applied to Gallup's mid-month unemployment rate of 9.0%, it would produce a seasonally adjusted unemployment rate of 8.5%. ... Gallup therefore forecasts an increase in the unemployment rate.

There always seems to be some randomness to the employment report, but the overall situation has improved (lower initial weekly unemployment claims, more job openings). The ADP and ISM reports suggest the consensus is close, however since most of the recent data has been "better than expected" - and the weather was better than normal in February - I'll once again take the over (above 204,000).

Fed's Flow of Funds: Household Real Estate Value declined $213 billion in Q4

by Calculated Risk on 3/08/2012 12:31:00 PM

The Federal Reserve released the Q4 2011 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth peaked at $66.8 trillion in Q2 2007, and then net worth fell to $50.4 trillion in Q1 2009 (a loss of $16.4 trillion). Household net worth was at $58.5 trillion in Q4 2011 (up $8.0 trillion from the trough, but still down $8.4 trillion from the peak).

The Fed estimated that the value of household real estate fell $213 billion to $15.96 trillion in Q4 2011. The value of household real estate has fallen $6.75 trillion from the peak - and was still falling at the end of 2011.

Click on graph for larger image.

Click on graph for larger image.

This is the Households and Nonprofit net worth as a percent of GDP.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This ratio was relatively stable for almost 50 years, and then we saw the stock market and housing bubbles.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952.

Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q4 2011, household percent equity (of household real estate) was at 38.4% - down slightly from Q3, and only up slightly from the all time low of 37.2% in Q1 2009.

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 52+ million households with mortgages have far less than 38.4% equity - and, according to CoreLogic, about 11.1 million households have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

Mortgage debt declined by $42 billion in Q4. Mortgage debt has now declined by $777 billion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

Asset prices, as a percent of GDP, have fallen significantly and are only slightly above historical levels. Also the value of real estate, as a percent of GDP, is near the lows of the last 30 years - just above the low in 1997 following the previous housing (and much smaller) housing bust. However household mortgage debt, as a percent of GDP, is still historically very high, suggesting more deleveraging ahead for households.