by Calculated Risk on 2/27/2012 10:07:00 AM

Monday, February 27, 2012

NAR: Pending home sales increase in January

From the NAR: January Pending Home Sales Rise, Market on Uptrend

The Pending Home Sales Index, a forward-looking indicator based on contract signings, rose 2.0 percent to 97.0 in January from a downwardly revised 95.1 in December and is 8.0 percent higher than January 2011 when it was 89.8. The data reflects contracts but not closings.December was revised down from 96.6, so most of the 2% increase was due to the downward revision. Without the downward revision, this was below the consensus of a 1.5% increase.

The January index is the highest since April 2010 when it reached 111.3 as buyers were rushing to take advantage of the home buyer tax credit.

Contract signings usually lead sales by about 45 to 60 days, so this is for sales in February and March.

Consensus Housing Forecast for 2012: 700,000 starts

by Calculated Risk on 2/27/2012 08:55:00 AM

I guess we can call this the "consensus" forecast for housing starts, from the NABE: NABE Outlook February 2012

Housing starts are expected to increase 19 percent in 2012. The economists surveyed expect housing starts to reach 700,000 units in 2012, up from 610,000 in 2011 and an upward revision from the November forecast. The forecast for 2013 shows continued improvement, with housing starts reaching 850,000 units. Correspondingly, real residential investment is forecast to increase 6.6 percent in 2012, slightly higher than the 4.3 percent predicted in November, and then strengthen further, rising 10 percent in 2013. The projection for home prices in 2012 was lowered slightly from a projected increase in the FHFA index of 0.9 percent (Q4/Q4) in the November survey to home prices remaining unchanged in the February survey. In 2013 home prices are expected to increase slightly more than 2 percent.Here was housing economist Tom Lawler's forecast for 2012.

The following table shows several forecasts for 2012:

| Some Housing Forecasts for 2012 (000s) | |||

|---|---|---|---|

| New Home Sales | Single Family Starts | Total Starts | |

| Consensus (NABE) | 700 | ||

| Merrill Lynch | 330 | 713 | |

| Fannie Mae | 336 | 473 | 704 |

| Wells Fargo | 350 | 457 | 690 |

| John Burns | 359 | 717 | |

| NAHB | 360 | 501 | 709 |

| Tom Lawler | 365 | 515 | 740 |

| Moody's | 530 | 687 | |

| 2011 Actual | 304 | 431 | 609 |

Sunday, February 26, 2012

Question Contest, iPad Update, RSS and Twitter

by Calculated Risk on 2/26/2012 09:23:00 PM

• For fun I've added a monthly question contest on the right sidebar. It takes a Facebook login right now. The contest has two parts: 1) every day, before 9:30 AM ET, you can enter whether you think the S&P 500 will be up or down that day, and 2) I'll ask some economic predictions (for March 1st, I'm asking: Will light vehicle sales increase in February compared to January?)

Contestants receive 1 point for each correct answer (either stocks or economic predictions). At the end of the month, starting in March, I'll list the leaders in a post on the blog. For February, I'm the leader (just a few friends entered). Hey, play along and beat CR!

• iPad layout. Based on feedback, I've switched the iPad layout back to the standard blog layout. For those who liked the touch layout, use this URL touch.calculatedriskblog.com

• RSS Feed: For those interested, here is the RSS feed for Calculatedrisk.

• on Twitter @calculatedrisk (My family friend Sasha Cohen, Olympic skater, economics student at Columbia and future hedge fund manager is on twitter @SashaCohenNYC)

Join the contest - beat CR!

Yesterday:

• Summary for Week ending February 24th

• Schedule for Week of February 26th

Europe: A few key dates

by Calculated Risk on 2/26/2012 07:17:00 PM

This will be another busy week in Europe. Germany and Finland will vote on the new Greek bailout, the ECB will conduct the second LTRO, and EU leaders will meet in Brussels at the end of the week.

Feb 27th: Germany's Bundestag votes on Greek Bailout deal.

Feb 29th: ECB three year Long Term Refinancing Operation (LTRO)

Feb 29th: Finland lawmakers vote on Greek Bailout deal.

March 1st and 2nd: EU leaders meet in Brussels.

March 8th: €200bn private sector bond swap is scheduled. From the Financial Times Alphaville: A special invitation from the Hellenic Republic ... "The invitation will expire at 9:00 P.M. (C.E.T.) on 8 March 2012, unless extended, re-opened, amended or terminated ..."

March 8th: ECB holds rate meeting

March 12th: Euro-area finance ministers meet in Brussels

March 20th: €14.4bn of Greek bonds scheduled to mature.

March 30th: Euro-area finance ministers meet in Copenhagen.

Late April: Proposed date for Greek general election.

April 22nd: France election.

Yesterday:

• Summary for Week ending February 24th

• Schedule for Week of February 26th

2011: Record Low Placements of Manufactured Homes, and Record low Total Completions

by Calculated Risk on 2/26/2012 02:03:00 PM

Last week the Census Bureau released the placements of manufactured homes in December and for all of 2011. Placements were at 3.4 thousand in December, and at a record low of 46.0 thousand for all of 2011.

Although the manufactured home data only goes back to 1980, it is pretty clear that total housing completions (single and multi-family) and manufactured home placements were at record low levels since at least the early '60s. Here is a table of the worst years on record:

| Worst Years for Housing Completions and Placements | |

|---|---|

| Year | Total Completions (000s) |

| 2011 | 631.2 |

| 2010 | 701.6 |

| 2009 | 848.9 |

| 2008 | 1,200.2 |

| 1982 | 1,239.4 |

| 1991 | 1,265.3 |

Unfortunately there is no timely count of household formation, so it is hard to tell how quickly the excess supply of housing is being absorbed.

Note: Household formation is a function of changes in population, and also of changes in household size. During the '70s, the baby boomers started moving out of their parents' homes, and there was a dramatic decrease in the number of persons per household and that led to a huge demand for apartments. We can't directly compare the level of total completions in the '00s to the '70s or '80s - we need to know the number of households being formed.

Click on graph for larger image.

Click on graph for larger image.This graph shows total housing completions and placements since 1980. The net additional to the housing stock is less because of demolitions and destruction of housing units.

Although we don't know the exact number, it is pretty clear that there are more households being formed than housing units completed last year - and the excess supply is being absorbed.

Yesterday:

• Summary for Week ending February 24th

• Schedule for Week of February 26th

Unofficial Problem Bank list increases to 960 Institutions

by Calculated Risk on 2/26/2012 09:18:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Feb 24, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

As anticipated, the FDIC released its enforcement actions for January 2012 this Friday. Moreover, after playing footsie with community bankers last week as part of an effort to stem proposed Congressional action to broaden the examination appeal process, the FDIC got back to closing a couple this week. The release of these actions and closings contributed to many changes in the Unofficial Problem Bank List. In all, this week there were four removals and eight additions, which leave the list at 960 institutions with assets of $389.7 billion. A year ago, the list held also held 960 institutions but assets were higher at $413.8 billion.

With this being the last Friday of the month, it is time to review changes for the month. After experiencing declines in the number of institutions each month since July 2011, the list count increased by four institutions during February 2012. While the increase in assets of $649 million during the month was small, it was the first increase in total assets since October 2011. Other interesting factoids include the absence of any unassisted mergers during the month, which has not happened since November 2010; and the monthly additions of 16 are the highest since 18 institutions were added in October 2011.

Removals this week include two rehabilitations -- Ridgestone Bank, Brookfield, WI ($423 million) and Fireside Bank, Pleasanton, CA ($278 million Ticker: KMPR); and two failures -- Home Savings of America, Little Falls, MN ($440 million) and Central Bank of Georgia, Ellaville, GA ($276 million).

Among the eight additions are Britton & Koontz Bank, N.A., Natchez, MS ($371 million Ticker: BKBK); Crown Bank, Edina, MN ($258 million); Rabun County Bank, Clayton, GA ($248 million); and Farmers & Merchants Bank, Statesboro, GA ($231 million). After 76 failures, inclusive of the one tonight, many might think there are not any banks left in Georgia to turn bad.

Other changes to the list include the FDIC issuing Prompt Corrective Action orders against 1st Commerce Bank, North Las Vegas, NV ($32 million); First Carolina State Bank, Rocky Mount, NC ($90 million); Pisgah Community Bank, Asheville, NC ($30 million); Sunrise Bank, Valdosta, GA ($86 million); and Sunrise Bank of Albuquerque, Albuquerque, NM ($61 million). All five banks are controlled by Capitol Bancorp, Ltd., which has divested or merged 45 institutions that were under its control during the crisis. Capitol has pending sale agreements for two of the banks just issued PCA orders. Should any bank controlled by Capitol fail, the other 18 banks controlled by Capitol could be liable for the resolution cost should the FDIC decide to apply cross guaranty. The FDIC did not apply cross guaranty to Capitol back in November 2009, when Commerce Bank of Southwest Florida failed, which cost the FDIC insurance fund approximately $31 million.

Next week, the FDIC will likely release its quarterly financial performance report for the fourth quarter of 2010, which will include an update on the Official Problem Bank List figures.

Click on graph for larger image.

Click on graph for larger image.This graph shows the cumulative bank failures for each year starting in 2008. There have been 425 bank failures since the beginning of 2008, and so far, closings this year are running at about half the rate of 2010.

Yesterday:

• Summary for Week ending February 24th

• Schedule for Week of February 26th

Saturday, February 25, 2012

Buffett's Views on Housing

by Calculated Risk on 2/25/2012 06:44:00 PM

In Feb 2010, Warren Buffett wrote:

[W]ithin a year or so residential housing problems should largely be behind us, the exceptions being only high-value houses and those in certain localities where overbuilding was particularly egregious.Of course I disagreed with his timing.

Then in Feb 2011, Buffett wrote:

A housing recovery will probably begin within a year or so. In any event, it is certain to occur at some point.As I noted last year, the key word was "begin" and sure enough - based on housing starts and new home sales - it appears a modest recovery has begun.

Today Buffett wrote:

Last year, I told you that “a housing recovery will probably begin within a year or so.” I was dead wrong.Really? And I was going to give him a little credit this time. Oh well.

More from Buffett:

Housing will come back – you can be sure of that. Over time, the number of housing units necessarily matches the number of households (after allowing for a normal level of vacancies). For a period of years prior to 2008, however, America added more housing units than households. Inevitably, we ended up with far too many units and the bubble popped with a violence that shook the entire economy. That created still another problem for housing: Early in a recession, household formations slow, and in 2009 the decrease was dramatic.Buffett makes several key points:

That devastating supply/demand equation is now reversed: Every day we are creating more households than housing units. People may postpone hitching up during uncertain times, but eventually hormones take over. And while “doubling-up” may be the initial reaction of some during a recession, living with in-laws can quickly lose its allure.

At our current annual pace of 600,000 housing starts – considerably less than the number of new households being formed – buyers and renters are sopping up what’s left of the old oversupply. (This process will run its course at different rates around the country; the supply-demand situation varies widely by locale.) While this healing takes place, however, our housing-related companies sputter, employing only 43,315 people compared to 58,769 in 2006. This hugely important sector of the economy, which includes not only construction but everything that feeds off of it, remains in a depression of its own. I believe this is the major reason a recovery in employment has so severely lagged the steady and substantial comeback we have seen in almost all other sectors of our economy.

1) Housing completions have been at record lows.

2) There are currently more households being formed than new housing units completed, and this is decreasing the excess supply.

3) The excess supply will be "sopped up" at different rates across the country.

4) Housing is a key reason for the sluggish economy (not the only reason).

Earlier:

• Summary for Week ending February 24th

• Schedule for Week of February 26th

Schedule for Week of February 26th

by Calculated Risk on 2/25/2012 01:15:00 PM

Earlier:

• Summary for Week ending February 24th

The key reports this week are the January Personal Income and Outlays report, and the ISM Manufacturing survey - both will be released on Thursday. Other key reports include the Case-Shiller house price index on Tuesday, vehicle sales on Thursday, and the second estimate of Q4 GDP on Wednesday.

On Wednesday and Thursday, Fed Chairman Ben Bernanke provides the Fed's Semiannual Monetary Policy Report to the House and Senate respectively.

NOTES: The February employment report will be released the following week on Friday March 9th. Also both Fannie Mae and Freddie Mac are expected to report results this week.

10:00 AM ET: Pending Home Sales Index for January. The consensus is for a 1.5% increase in the index.

10:30 AM: Dallas Fed Manufacturing Survey for February. The consensus is for 15.0 for the general business activity index, down slightly from from 15.3 in January.

11:00 AM: New York Fed to release Q4 2011 Report on Household Debt and Credit

8:30 AM: Durable Goods Orders for January from the Census Bureau. The consensus is for a 1.0% decrease in durable goods orders.

9:00 AM: S&P/Case-Shiller House Price Index for December. Although this is the December report, it is really a 3 month average of October, November and December.

9:00 AM: S&P/Case-Shiller House Price Index for December. Although this is the December report, it is really a 3 month average of October, November and December. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes (the Composite 20 was started in January 2000).

The consensus is for a 0.7% decrease in prices (NSA) in December. I expect these indexes to be at new post-bubble lows, both seasonally adjusted (SA) and not seasonally adjusted (NSA). The CoreLogic index declined 1.4% decrease in December (NSA).

10:00 AM: Conference Board's consumer confidence index for February. The consensus is for an increase to 64.0 from 61.1 last month.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for February. The consensus is for an increase to 13 for this survey from 12 in January (above zero is expansion). This is the last of the regional Fed manufacturing surveys for February, and the other surveys have indicated stronger expansion in February.

10:00 AM: Testimony, Fed Governor Elizabeth A. Duke, "The Housing Market", Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been weak this year, although this does not include all the cash buyers.

8:30 AM: Q4 GDP (advance release). This is the second estimate from the BEA. The consensus is that real GDP increased 2.8% annualized in Q4 (same as advance estimate).

8:30 AM: Q4 GDP (advance release). This is the second estimate from the BEA. The consensus is that real GDP increased 2.8% annualized in Q4 (same as advance estimate).This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years.

The Red column is the advance estimate for Q4 GDP.

9:45 AM: Chicago Purchasing Managers Index for February. The consensus is for an increase to 61.0, up from 60.2 in January.

10:00 AM: Testimony, Fed Chairman Ben S. Bernanke, Semiannual Monetary Policy Report to the Congress, Before the Committee on Financial Services, U.S. House of Representatives

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 355,000 from 351,000 last week.

8:30 AM ET: Personal Income and Outlays for January. The consensus is for a 0.5% increase in personal income in January, and a 0.4% increase in personal spending, and for the Core PCE price index to increase 0.2%.

10:00 AM: Construction Spending for January. The consensus is for a 1.0% increase in construction spending.

10:00 AM ET: ISM Manufacturing Index for February.

10:00 AM ET: ISM Manufacturing Index for February. Here is a long term graph of the ISM manufacturing index. The consensus is for a slight increase to 54.6 from 54.1 in January.

All day: Light vehicle sales for February. Light vehicle sales are expected to decline slightly to 14.0 million from 14.13 million in January (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the January sales rate.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the January sales rate. TrueCar is forecasting:

The February 2012 forecast translates into a Seasonally Adjusted Annualized Rate (SAAR) of 14.3 million new car sales, up from 13.3 million in February 2011 and up from 14.2 million in January 201210:00 AM: Testimony, Fed Chairman Ben S. Bernanke, Semiannual Monetary Policy Report to the Congress, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate (repeat of previous day testimony).

No Releases Scheduled.

Summary for Week ending February 24th

by Calculated Risk on 2/25/2012 08:18:00 AM

There were few economic releases last week, but once again most of the data suggested some increase in economic activity. Of course the better than normal weather helped again, especially for housing.

The key economic release last week was new home sales. Although the Census Bureau report showed a small decline in sales from December, this was because December was revised up from a 307 thousand sales rate (Seasonally Adjusted Annual Rate) to 324 thousand. After averaging a 300 thousand sales rate for the 18 months following the expiration of the tax credit, new home sales have averaged a sales rate over 320 thousand for the last 3 months. Not much of an increase from a historical perspective, but it appears new home sales have bottomed. Of course it is just 3 months of better sales, and the critical selling months are coming up.

For existing home sales, the key number is inventory - and the NAR reported inventory declined 20.6% year-over-year in January. The sharp decline in inventory has lead to a scramble to explain the decline. Both Tom Lawler and I posted some thoughts on the decline (something we've been tracking all year, so we weren't surprised), see: Comments on Existing Home Inventory and Lawler: Declining Inventory of Existing Homes for Sale: Don’t Forget Conversion to Rentals

Other positive data included another drop in the four week average of initial weekly unemployment claims, an increase in consumer sentiment, and another positive reading for the Architecture Billings Index, and for manufacturing, an increase in Kansas City (10th District) manufacturing survey showing faster expansion in February.

Overall this was another solid week. Here is a summary in graphs:

• New Home Sales in January at 321,000 Annual Rate

Click on graph for larger image.

Click on graph for larger image.

The Census Bureau reports New Home Sales in January were at a seasonally adjusted annual rate (SAAR) of 321 thousand. This was down from a revised 324 thousand in December (revised up from 307 thousand).

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate. This was below the revised December rate of 324,000 and is 3.5 percent above the January 2011 estimate of 310,000.

On inventory, according to the Census Bureau:

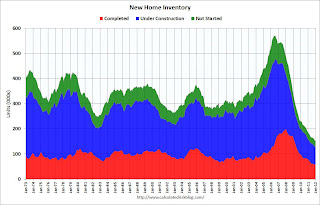

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale was at 57,000 units in January. The combined total of completed and under construction is at the lowest level since this series started.

This was above the consensus forecast of 315 thousand, and sales for October, November and December were revised up. With the record low levels of inventory, any pickup in sales should translate into more construction.

• Existing Home Sales in January: 4.57 million SAAR, 6.1 months of supply

The NAR reported: Existing-Home Sales Rise Again in January, Inventory Down

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in January 2012 (4.57 million SAAR) were 4.3% higher than last month, and were 0.7% above the January 2011 rate.

But the key number in the report was inventory.

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory decreased to 2.31 million in January from 2.32 million in December. This is the lowest level of inventory since March 2005.

The next graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply.

Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.Inventory decreased 20.6% year-over-year in January from January 2011. This is the eleventh consecutive month with a YoY decrease in inventory.

Months of supply decreased to 6.1 months in January, down from 6.4 months in December.

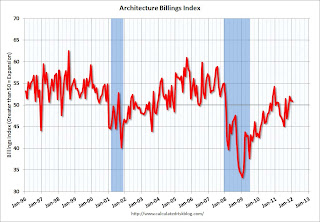

• AIA: Architecture Billings Index indicated expansion in January

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

From AIA: Architecture Billings Index Remains Positive for Third Straight Month

This graph shows the Architecture Billings Index since 1996. The index was at 50.9 in January (slight expansion). Anything above 50 indicates expansion in demand for architects' services.

This graph shows the Architecture Billings Index since 1996. The index was at 50.9 in January (slight expansion). Anything above 50 indicates expansion in demand for architects' services.Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So this suggests further declines in CRE investment in early 2012, but perhaps stabilizing later in 2012.

• Weekly Initial Unemployment Claims unchanged at 351,000

The DOL reports:

The DOL reports:In the week ending February 18, the advance figure for seasonally adjusted initial claims was 351,000, unchanged from the previous week's revised figure of 351,000. The 4-week moving average was 359,000, a decrease of 7,000 from the previous week's revised average of 366,000.This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 359,000.

The 4-week moving average is at the lowest level since early 2008.

Note: Nomura analysts argue some of the recent improvement is related to seasonal distortions, see Financial Times Alphaville: US jobs and seasonality: the DeLorean edition.

• Other Economic Stories ...

• From the Chicago Fed: Index shows economic growth in January again above average

• DOT: Vehicle Miles Driven increased 1.3% in December

• LPS: Number of delinquent mortgage loans declined in January, In foreclosure increases slightly

• Kansas City Fed: Tenth District Manufacturing Activity Increased Further in February

Friday, February 24, 2012

Oil Prices and the Economy

by Calculated Risk on 2/24/2012 10:18:00 PM

Once again we have to consider the impact of high oil prices on the US economy. Bloomberg reports brent crude futures are up to $125.47 per barrel, and WTI is up to $109.77.

From the WSJ: Gas Prices Annoy Consumers but Don't Dim Outlook Yet

Prices at the pump have risen in recent weeks as tensions with Iran have sparked fears of a supply disruption, driving up the cost of crude oil. Prices of crude hit a nearly 10-month high on Friday, rising $1.94 a barrel to close at $109.77 on the New York Mercantile Exchange, their highest level since early May. Nationally, the average price of a gallon of regular gasoline hit $3.647 on Friday, according to the auto club AAA, up nearly 27 cents from a month earlier and up 11.8 cents in the past week.When oil prices are increasing, I usually turn to Professor Hamilton's blog. In earlier research, Dr. Hamilton showed that prices had to rise above previous prices to be a significant drag on the economy. Last August he wrote: Economic consequences of recent oil price changes

...

"Consumers are not as concerned with the current level of gas prices as they were in past episodes," said Jonathan Basile, an economist with Credit Suisse.

In my 2003 study, I found the evidence favored a specification with a longer memory, looking at where oil prices had been not just over the last year but instead over the last 3 years. My reading of developments during 2011 has been that, because of the very high gasoline prices we saw in 2008, U.S. car-buying habits never went back to the earlier patterns, and we did not see the same shock to U.S. automakers as accompanied some of the other, more disruptive oil shocks. My view has been that, in the absence of those early manifestations, we might not expect to see the later multiplier effects that account for the average historical response summarized in the figure above. If one uses the 3-year price threshold that the data seem to favor, the inference would be that we'll do just fine in 2011:H2, because oil prices in 2011 never exceeded what we saw in 2008.So far gasoline prices aren't above the 2011 peak levels, although they are getting close. I'm not sure 2008 counts since that is more than 3 years ago.

Another post from Hamilton two days ago: Crude oil and gasoline prices. Just something to think about ...

Note: The graph below shows oil prices for WTI; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |