by Calculated Risk on 2/21/2012 10:03:00 AM

Tuesday, February 21, 2012

Lawler: Number of Seriously-Delinquent FHA-Insured SF Loans Jumped Again in January

From economist Tom Lawler: Number of Seriously-Delinquent FHA-Insured SF Loans Jumped Again in January; HUD Secretary “Fiddles” as FHA Burns

Data from the FHA’s Neighborhood Watch Early Warning System indicate that the number of FHA-insured loans that were seriously delinquent jumped again in January. According to report on the EWS for servicers who combined have an “active” FHA servicing portfolio of over 7.33 million loans, 732,775 of these loans were seriously delinquent at the end of January. While this report does not exactly match the SDQ numbers reported in various monthly FHA reports (which have not yet been released in January, it tracks the “official” numbers pretty closely. These data, combined with other data from the EWS (not shown here), suggest that the performance of the FHA’s pre-2010 book has continued to deteriorate significantly.

Based on this report, I estimate that the serious delinquency rate on FHA’s SF book in January (as measured by the FHA Monthly Outlook and/or FHA Monthly Report to the FHA commissioner) jumped to around 9.9% last month, up from 9.59% in December, 8.18% last June, and 8.89% last January.

As I noted last week, the pace of FHA loan modifications slowed dramatically in the latter part of last year, while the pace of property “conveyances” was shockingly low given the large number of seriously delinquent/in-foreclosure loans. Obviously, the slow pace of problem-loan “resolutions” has been at least partly behind the sharp increase in the number of seriously-delinquent FHA loans.

Many find it moderately disturbing that HUD Secretary Donovan has of late been working mainly on the big “mortgage settlement” -- and even worked to have part of the mortgage settlement money go to FHA – and has been “jawboning” Fannie and Freddie to “embrace” principal write-downs, while at the same time FHA’s problem-loan resolution activity plunged and the number of seriously delinquent FHA loans has surged. However, headlines such as “Donovan Fiddles as FHA Burns” seem a bit strong – but I used it anyway!

Chicago Fed: Economic Growth in January above Average

by Calculated Risk on 2/21/2012 08:30:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows economic growth in January again above average

The Chicago Fed National Activity Index decreased to +0.22 in January from +0.54 in December, but remained positive for the second straight month for the first time in a year. ...This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, increased from +0.06 in December to +0.14 in January, reaching its highest level since March 2011. January’s CFNAI-MA3 suggests that growth in national economic activity was slightly above its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests limited inflationary pressure from economic activity over the coming year.

Click on graph for larger image.

Click on graph for larger image.This suggests growth slightly above trend in January - but still not strong growth.

According to the Chicago Fed:

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Monday, February 20, 2012

Report: Greek Debt Deal Reached

by Calculated Risk on 2/20/2012 10:01:00 PM

Reuters (via Peter Spiegel) Euro zone finance ministers strike deal on second Greek package. Financing of 130 bln euros, debt-to-GDP of 121 pct by 2020

Update: From Reuters: Euro zone strikes deal on second Greek bailout package

Euro zone finance ministers struck a deal ... that includes new financing of 130 billion euros and aims to cut Greece's debt to 121 percent of GDP by 2020, two EU officials said.Press conference soon

"The financial volume (of the Greek package) is 130 billion euros and debt-to-GDP (will be) 121 percent. Now it's down to work on the statement," one official involved in the negotiations told Reuters.

...

Private sector holders of Greek debt are expected to take losses of up to 53.5 percent on the nominal value of their bonds as part of a debt exchange that will reduce Greece's debts by around 100 billion euros.

EU Press Releases (no statement yet)

Lawler: Update on Expectations for Existing Home Sales Report

by Calculated Risk on 2/20/2012 08:16:00 PM

While we wait for news from Europe, here is an update from economist Tom Lawler:

Several of the home sales reports I’ve seen since early last Friday showed materially stronger YOY growth than I had expected, especially in a number of Midwest markets. As a result, I have upped my estimate for January existing home sales as measured by the National Association of Realtors. Right now my regional tracking suggests that the NAR will report that existing home sales ran at a seasonally adjusted annual rate of about 4.76 million, up about 3.3% from December’s pace, and up about 2.6% from last January’s pace. Note that January is seasonally the weakest month of the year in terms of closed home sales. (The weakest month for contracts signed from a seasonal perspective is December).

On the inventory front, it is pretty clear that existing home listings fell again nationally last month, though various “trackers” differ on how much. In addition, the NAR’s reported monthly inventory drop of 9.2 in December was significantly larger than listings data seemed to suggest. My “best guess” is that the NAR will report a monthly inventory drop of about 2.2%, which would be a YOY drop of 20.0%. While most realtor groups/associations reported a decline in active listings from December to January, there were several that reported increases.

CR Note: This sales rate, combined with a decline in inventory, could put months-of-supply under 6 months for the first time since early 2006. Some of the decline is seasonal (inventory is always low in January and months-of-supply uses NSA inventory numbers). The NAR is scheduled to report existing home sales on Wednesday.

Eurogroup - press conference at 5 PM ET

by Calculated Risk on 2/20/2012 04:17:00 PM

Update2: Live video of meeting room (empty are 5 PM ET). A Greek site is reporting the main meeting has concluded, but they are still working on the Private Sector haircuts.

Resources here (Update: delayed as usual ...)

Press conference soon

This webcast is scheduled to start on 20 February 2012 23:00 CETEU Press Releases (no statement yet)

STARTING TIME SUBJECT TO CHANGE.

Mortgage Delinquencies by Loan Type

by Calculated Risk on 2/20/2012 12:54:00 PM

By request, the following graphs show the percent of loans delinquent by loan type: Prime, Subprime, FHA and VA. First a table comparing the number of loans in 2007 and Q4 2011 so readers can understand the shift in loan types.

Both the number of prime and subprime loans have declined over the last four years; the number of subprime loans is down by about one-third. Meanwhile the number of FHA loans has increased sharply.

Note: There are about 49 million total first-lien loans - the MBA survey is about 88% of the total.

| MBA National Delinquency Survey Loan Count | ||||

|---|---|---|---|---|

| Q2 2007 | Q4 2011 | Change | Q4 2011 Seriously Delinquent | |

| Prime | 33,916,830 | 30,660,085 | -3,256,745 | 1,631,117 |

| Subprime | 6,204,535 | 4,178,732 | -2,025,803 | 1,017,521 |

| FHA | 3,030,214 | 6,611,396 | 3,581,182 | 596,348 |

| VA | 1,096,450 | 1,442,416 | 345,966 | 69,813 |

| Survey Total | 44,248,029 | 42,892,629 | -1,355,400 | 3,314,799 |

Click on graph for larger image.

Click on graph for larger image.First a repeat: This graph shows the percent of loans delinquent by days past due. Loans 30 days delinquent increased to 3.22% from 3.19% in Q3. This is at about 2007 levels. Delinquent loans in the 60 day bucket decreased to 1.25% from 1.30% in Q4. This is the lowest level since Q4 2007.

There was a decrease in the 90+ day delinquent bucket too. This decreased to 3.11% from 3.50% in Q3 2011. This is the lowest level since 2008, but still way above normal (probably around 1% would be normal). The percent of loans in the foreclosure process declined slightly to 4.38% from 4.43%.

Note: Scale changes for each of the following graphs.

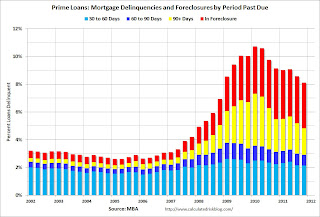

The second graph is for all prime loans.

The second graph is for all prime loans. This is the key category now ("We are all subprime!", Tanta).

Since there are far more prime loans than any other category (see table above), about half the loans seriously delinquent now are prime loans - even though the overall delinquency rate is lower than other loan types.

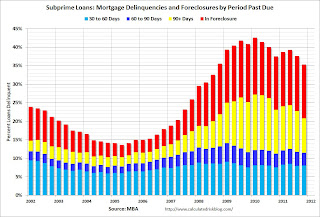

This graph is for subprime. This category gets most of the attention - mostly because of all the terrible loans made through the Wall Street "originate-to-distribute" model and sold as Private Label Securities (PLS). Not all PLS was subprime, but the worst of the worst loans were packaged in PLS.

This graph is for subprime. This category gets most of the attention - mostly because of all the terrible loans made through the Wall Street "originate-to-distribute" model and sold as Private Label Securities (PLS). Not all PLS was subprime, but the worst of the worst loans were packaged in PLS.Although the delinquency rate is still very high, the number of subprime loans has declined sharply.

This graph is for FHA loans. The delinquency rate increased in Q4. Most of the FHA loans were made in the last few years, not in the 2004 to 2006 period like subprime - but as those loans season, the delinquency rate is expected to increase.

This graph is for FHA loans. The delinquency rate increased in Q4. Most of the FHA loans were made in the last few years, not in the 2004 to 2006 period like subprime - but as those loans season, the delinquency rate is expected to increase.The earlier improvement was a combination of the increase in number of loans (recent loans have lower delinquency rates) and eliminating Downpayment Assistance Programs (DAPs). These were programs that allowed the seller to give the buyer the downpayment through a 3rd party "charity" (for a fee of course). The buyer had no money in the house and the default rates were absolutely horrible.

The last graph is for VA loans. This is a fairly small category (see table above).

The last graph is for VA loans. This is a fairly small category (see table above).There are still quite a few subprime loans that are in distress, but the real keys are prime loans and FHA loans.

Morning Greece: Eurozone finance ministers meet at 9 AM ET

by Calculated Risk on 2/20/2012 08:46:00 AM

From the Athens News: Venizelos: Bailout uncertainty to end

Finance Minister Evangelos Venizelos said on Monday technical issues on the country's new bailout package were still being discussed but that he expected the uncertainty to end at a meeting of eurozone finance ministers in Brussels.From the WSJ: Finance Ministers Look to Sign Off on Greek Deal

"We expect today the long period of uncertainty – which was in the interest of neither the Greek economy nor the euro zone as a whole – to end," Venizelos was quoted as saying in a finance ministry statement.

Finance ministers from the 17 euro-zone countries will meet in Brussels at 2 p.m. GMT on Monday, looking to sign off on a deal worth at least €130 billion ($170.9 billion) that will slash Greece's debt burden and allow it to stay in the euro zone, albeit under a degree of external control and scrutiny never witnessed in Europe in modern times.From the Financial Times: Eurozone crisis: live blog

Weekend:

• Summary for Week ending February 17th

• Schedule for Week of February 19th

Sunday, February 19, 2012

WSJ: IMF report shows Greek Debt situation worse than expected

by Calculated Risk on 2/19/2012 04:46:00 PM

Not a surprise ... from the WSJ: IMF Draft Sees Greek Debt Reaching 129% of GDP in 2020

The International Monetary Fund now expects Greece's debt to reach 129% of the country's gross domestic product in 2020 ... That is even further above the level most economists consider sustainable than previously thought, making it more difficult than ever to argue that the country can ever repay its debts.It still sounds like something will be worked out. We will know soon. Here are a few key dates for Greece.

Despite this, a number of signs last week had indicated that there was still enough political will in the euro zone to go ahead with a new, enhanced rescue package.

Yesterday:

• Summary for Week ending February 17th

• Schedule for Week of February 19th

How can builder confidence improve, single family starts increase sharply, and new home sales be unchanged?

by Calculated Risk on 2/19/2012 12:44:00 PM

The Census Bureau will report new home sales on Friday, and the consensus is for sales of 315 thousand on a seasonally adjusted annual rate (SAAR) basis. This is up less than 2% from the 310 thousand SAAR sales reported in January 2011.

That seems a little puzzling. Consider the following ...

First, look at the NAHB builder Housing Market Index. More builders still view sales as "poor" as opposed to "fair" or "good", but the HMI - and all of the components - are up sharply from a year ago (the most recent report was for February, but compare January 2012 to January 2011):

| Housing Market Index | Traffic of Prospective Buyers | Current Sales | |

|---|---|---|---|

| Jan-11 | 16 | 12 | 15 |

| Jan-12 | 25 | 21 | 25 |

| Feb-12 | 29 | 22 | 30 |

This would seem to suggest more than a 1% or 2% increase in sales.

Second, look at the recent builder reports (from Tom Lawler):

| Settlements | Net Orders | Backlog | |||||||

|---|---|---|---|---|---|---|---|---|---|

| End 2011 | End 2010 | End 2009 | End 2011 | End 2010 | End 2009 | End 2011 | End 2010 | End 2009 | |

| D.R. Horton | 4,118 | 3,637 | 5,529 | 3,794 | 3,363 | 4,037 | 4,530 | 3,854 | 4,136 |

| PulteGroup | 4,303 | 4,405 | 6,200 | 3,084 | 3,044 | 3,748 | 3,924 | 3,984 | 5,931 |

| NVR | 2,391 | 2,639 | 2,550 | 2,158 | 1,765 | 2,000 | 3,676 | 2,916 | 3,531 |

| The Ryland Group | 1,040 | 909 | 1,666 | 915 | 775 | 969 | 1,514 | 1,187 | 1,732 |

| Meritage Homes | 894 | 837 | 1,202 | 749 | 713 | 621 | 915 | 778 | 1,095 |

| Beazer Homes | 882 | 549 | 961 | 724 | 553 | 728 | 1,309 | 800 | 950 |

| MDC Holdings | 950 | 865 | 1,109 | 523 | 519 | 637 | 1,043 | 842 | 826 |

| Standard Pacific | 782 | 619 | 943 | 615 | 428 | 547 | 681 | 414 | 599 |

| M/I Homes | 667 | 650 | 858 | 505 | 460 | 448 | 676 | 532 | 650 |

| Total | 16,027 | 15,110 | 21,018 | 13,067 | 11,620 | 13,735 | 18,268 | 15,307 | 19,450 |

| YoY % Change | 6.1% | -28.1% | 12.5% | -15.4% | 19.3% | -21.3% | |||

From economist Tom Lawler on February 7th:

The latest Census report on new SF sales showed a YOY increase in Q4/2011 sales of just 3%, and a YOY decline in Q4/2010 sales of 20.5%.

The nine-builder group’s order backlog at the end of 2011 was up 19.3% from the end of 2010.

As I’ve noted many times, Census’ methodology for measured new SF sales is not directly comparable to reports from builders. I’m guessing that part of the “stronger than Census” builder reports reflect gains in market share, but I’m also guessing that overall new home sales were a bit better than preliminary Census data suggested.

The combination of higher order backlogs, stronger sales, and unusually mild weather in much of the country is likely to result in single-family starts numbers in the first few months of 2012 that are significantly higher than “consensus.”

Click on graph for larger image.

Click on graph for larger image.Sure enough. Single family housing starts were revised up sharply for December and were above 500 thousand SAAR in January. As Lawler notes, some of this was probably weather related, but some of the pick up was evident in the builder reports.

So if the builders are reporting a “stronger than Census” increase in sales (even accounting for market share gains), confidence is up (actually less pessimism), and single family starts are up sharply from a year ago, it seems surprising that new home sales were essentially unchanged in January.

Goldman Sachs is forecasting sales of 310 thousand SAAR in January 2012 (no change year-over-year), and Merrill Lynch is forecasting 315 thousand. I think I'll take the over.

Percent Job Losses: Great Recession and Great Depression

by Calculated Risk on 2/19/2012 09:58:00 AM

The causes of the Great Recession were similar to the Great Depression - as opposed to most post war recessions that were caused by Fed tightening to slow inflation - and I'm frequently asked if we could compare the percent job losses during the two periods. Unfortunately there is very little data for the Great Depression, although there are some annual estimates.

From BLS economist Steven Haugen: Measures of Labor Underutilization from the Current Population Survey

It is estimated that in 1933, at the depth of the Great Depression, about 13 million persons in the U.S. were unemployed, which translates into an unemployment rate of about 25 percent.1 However, those estimates were not available at the time. Throughout the Great Depression, there was little information on the extent of unemployment in the country. More important, there was no good way to assess whether the situation was getting better or worse. The wealth of timely statistical information on the labor market that we now take for granted simply didn’t exist.1 Stanley Lebergott, “Labor Force, Employment, and Unemployment, 1929-39: Estimating Methods,” Monthly Labor Review, July 1948.

However we can use some of the annual estimate to get a rough idea of the comparison to the current recession:

Click on graph for larger image.

Click on graph for larger image. This graph compares the job losses from the start of the employment recession, in percentage terms for the Great Depression (rough estimate) and the 2007 recession.

Although the 2007 recession is much worse than any other post-war recession, the employment impact was much less than during the Depression. Note the second dip during the Depression - that was in 1937 and the result of austerity measures.

This graph shows the job losses from the start of the employment recession, in percentage terms for the post war recessions. This shows the depth of the employment recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis - similar to the lingering effects of the Depression.

This graph shows the job losses from the start of the employment recession, in percentage terms for the post war recessions. This shows the depth of the employment recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis - similar to the lingering effects of the Depression.Yesterday:

• Summary for Week ending February 17th

• Schedule for Week of February 19th