by Calculated Risk on 2/10/2012 06:21:00 PM

Friday, February 10, 2012

Bank Failures #8 &9 in 2012: Illinois and Indiana

Forest Lake Friday failure

A quickening pace.

by Soylent Green is People

From the FDIC: Barrington Bank & Trust Company, National Association, Barrington, Illinois, Assumes All of the Deposits of Charter National Bank and Trust, Hoffman Estates, Illinois

As of December 31, 2011, Charter National Bank and Trust had approximately $93.9 million in total assets and $89.5 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $17.4 million. ... Charter National Bank and Trust is the eighth FDIC-insured institution to fail in the nation this year, and the first in IllinoisFrom the FDIC: First Merchants Bank, National Association, Muncie, Indiana, Assumes All of the Deposits of SCB Bank, Shelbyville, Indiana

As of December 31, 2011, SCB Bank had approximately $182.6 million in total assets and $171.6 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $33.9 million. ... SCB Bank is the ninth FDIC-insured institution to fail in the nation this year, and the first in Indiana.It is Friday.

The pace of closures has slowed. At this point in 2010 and 2011, there were 16 and 14 failures already, respectively.

Greece Update: More Delays and Demonstrations

by Calculated Risk on 2/10/2012 03:52:00 PM

Update: from CNBC: Greek Cabinet Approves Reform Bill; Parliament Expected to Vote on Sunday

From the NY Times: Greece Plunged Into Political Turmoil Over Austerity Measures

Political turmoil deepened here Friday as Prime Minister Lucas Papademos threatened to eject from his fragile interim coalition government any ministers who objected to the country’s new austerity deal withFrom the Athens News: Parties delay crisis meetings, but Venizelos meets minister

“It goes without saying that whoever disagrees and does not vote for the new program cannot stay in the government,” he said in a televised speech to his cabinet following the resignation of several ministers and their deputies.

...

According to local news media outlets, Mr. Papademos plans to announce a reshuffled cabinet on Monday, putting in doubt a parliamentary vote on the new measures that was scheduled for Sunday.

Pasok and New Democracy pushed crisis meetings at their parties back by a day to Saturday, as the coalition government grappled with cabinet resignations and a fierce backlash against minimum wage cuts and other new austerity measures.

...

The finance minister got a hostile reception in Brussels on Thursday, when top eurozone officials told Greece to finalize austerity measures, provide written commitments from the three coalition parties, and push the new measures through parliament before the 130bn deal is approved.

Bernanke: "Housing Markets in Transition"

by Calculated Risk on 2/10/2012 12:30:00 PM

Here is the transcript of Fed Chairman Ben Bernanke's speech at the National Association of Homebuilders International Builders' Show, Orlando, Florida: "Housing Markets in Transition". The speech is being streamed live at www.nahb.org/Bernanke

Excerpt:

One way to understand conditions in the housing market is to focus on the balance of supply and demand. For the past few years, the actual and potential supply of single-family homes has greatly exceeded the effective demand. The elevated number of homes that are currently vacant instead of owner occupied reflects the imbalance. According to the most recent estimate, about 1-3/4 million homes are currently unoccupied and for sale. While this figure has declined slightly during the past few years, it is nonetheless up dramatically from the first half of the 2000s, when readings of about 1-1/4 million vacant homes were the norm. Of course, housing conditions vary by region, and vacancy rates in some locations are substantially higher than the national average....

Moreover, a very large number of additional homes are poised to come on the owner-occupied market. In each of the past few years, roughly 2 million homes have entered the foreclosure process, and many of these homes have been put up for sale, crowding out much of the need for new building. Looking ahead, the relatively high rate of foreclosures is likely to continue for a while, putting additional homes on the market and dislocating families and disrupting communities in the process.

At the same time, a number of factors are constraining demand. Household formation has been down, particularly among young adults. High unemployment and uncertain job prospects may have reduced the willingness of some households to commit to homeownership. Availability of mortgage credit is an important constraint, to which I will return later. Additionally, housing may no longer be viewed as the secure investment it once was thought to be, given uncertainty about future home prices and the economy more generally.

Not surprisingly, the large imbalance of supply and demand has been reflected in a drop in home values of historic proportions. ...

To recap, the housing sector continues to suffer from serious imbalances--a marked excess supply for owner-occupied housing accompanied by a stronger rental markets. The narrative of the housing market over the next several years will revolve around the resolution of those imbalances.

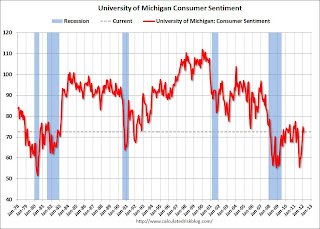

Consumer Sentiment declines in February to 72.5

by Calculated Risk on 2/10/2012 09:55:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for February declined to 72.5, down from the January reading of 75.0.

Overall sentiment is still fairly weak, although sentiment has rebounded from the decline last summer. This was below the consensus forecast of a decline to 74.3.

Trade Deficit increased in December to $48.8 Billion

by Calculated Risk on 2/10/2012 08:50:00 AM

The Department of Commerce reports:

[T]otal December exports of $178.8 billion and imports of $227.6 billion resulted in a goods and services deficit of $48.8 billion, up from $47.1 billion in November, revised. December exports were $1.2 billion more than November exports of $177.5 billion. December imports were $3.0 billion more than November imports of $224.6 billion.The trade deficit was slightly above the consensus forecast of $48.5 billion.

The first graph shows the monthly U.S. exports and imports in dollars through November 2011.

Click on graph for larger image.

Click on graph for larger image.Both exports and imports increased in December. Imports stalled in the middle of 2011, but increased towards the end of the year (seasonally adjusted). Exports are well above the pre-recession peak and up 9% compared to December 2010; imports are up about 11% compared to December 2010.

The second graph shows the U.S. trade deficit, with and without petroleum, through December.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil averaged $104.13 per barrel in December. The trade deficit with China declined to $23 billion, but hit an annual record in 2011.

Exports to eurozone countries increased slightly in December after declining sharply in November.

Thursday, February 09, 2012

NAHB: Bernanke speaks on Friday, Multifamily and Remodeling expected to increase in 2012

by Calculated Risk on 2/09/2012 09:41:00 PM

The NAHB 2012 International Builders’ Show is currently being held in Orlando.

On Friday, Fed Chairman Ben Bernanke will speak at 12:30 PM ET: "Housing Markets in Transition". The speech will be streamed live at www.nahb.org/Bernanke

And the NAHB is expecting continued growth in 2012 for two components of residential investment: Multifamily and remodeling.

From the NAHB Multifamily Industry Stages Strong Recovery but Still Limited by Credit Constraints, Says NAHB

The apartment sector is a bright spot in the overall housing market leading the industry’s path to recovery. ... “[W]e are forecasting construction of 208,000 multifamily residences in 2012 ...” said Sharon Dworkin Bell, NAHB senior vice president for multifamily and 50+ housing.There were 167,400 5+ unit starts in 2011, and only 130,500 completions. 2012 will be another strong year. Economist Tom Lawler is forecasting 225,000 multifamily starts this year.

From the NAHB today: NAHB Foresees Measured Growth in Residential Remodeling

The residential remodeling market will continue to experience measured growth in 2012 after the Remodeling Market Index (RMI) rose to a five year-high at the end of 2011, according to panelists at a press conference held today at the National Association of Home Builders (NAHB) International Builders' Show (IBS) in Orlando, Fla.

...

“Spending on improvements to owner-occupied housing is nearly equal to that of new residential construction,” said Paul Emrath, NAHB’s vice president for survey and housing policy research. “NAHB predicts that residential remodeling will rise 8.9 percent in 2012.”

Mortgage Settlement and Negative Equity

by Calculated Risk on 2/09/2012 05:24:00 PM

I don't think the mortgage servicer settlement alone will have a huge impact on housing or the economy, but I do think the settlement will lead to an increase in the number of modifications, and also an increase in the pace of completed foreclosures.

I've seen several people argue the settlement is too small to have much of an impact on housing. They compare the size of the settlement to overall negative equity. As an example from the Financial Times:

The trouble is that the $32bn is small relative to estimates of a $700bn gap between house values and underwater mortgages: it is just 5 per cent of that total.Note: the $700 billion estimate comes from CoreLogic's Q3 negative equity report.

If we compare the principal reductions to total negative equity, it does seem like a drop in the bucket. However if we think of it terms of a reduction in the number of loans that are 90+ days delinquent and in the foreclosure process, this could be significant.

The FHFA estimates approximately 1 million borrowers will be offered principal reduction modifications, although that estimate may be a little high. Perhaps 500 thousand is a better estimate, and some of them would have received modifications anyway - but the overall number of principal reduction modifications will probably increase by several hundred thousand with the settlement.

Currently, according to LPS, there are 1.79 million loans 90+ days, and 2.07 million in the foreclosure process - or about 3.86 million total seriously delinquent. A few hundred thousand extra modifications would reduce the number of seriously delinquent loans, maybe by 10% (of course some will then re-default).

Also, since there are about 10.7 million borrowers with negative equity, this suggests around 7 million borrowers with negative equity are not seriously delinquent. And that brings us to HARP ...

With the new HARP automated refinancing program coming in March, the borrowers with negative equity and GSE loans will be able to refinance into lower rate mortgages. There borrowers are already current, and if they get a lower mortgage rate (with a faster amortization schedule), they will probably stay current. Not all borrowers with negative equity will eventually default - most won't - and one of the keys to HARP is the shorter amortization schedule that will reduce negative equity fairly quickly. From the FHFA last year:

An important element of these changes is the encouragement, through elimination of certain risk-based fees, for borrowers to utilize HARP to refinance into shorter-term mortgages. Borrowers who owe more on their house than the house is worth will be able to reduce the balance owed much faster if they take advantage of today’s low interest rates by shortening the term of their mortgage.So I expect the number of borrowers with negative equity to decline fairly quickly over the next several years. This will be combination of modifications, foreclosures and refinancing programs.

Another question is: Will the mortgage settlement lead to a flood of foreclosures? It does appear the number of completed foreclosures will increase following this settlement - especially in some judicial states with large backlogs - so there will probably be more REOs (lender Real Estate Owned) for sale. Some of the REO might be sold in bulk as rentals (REO-to-rental program), and the Fed will probably issue guidance to allow servicers to rent REO in heavily impacted areas. It isn't clear how many more REOs will be on the market, but I don't expect a flood of REO as happened in late 2008 and early 2009.

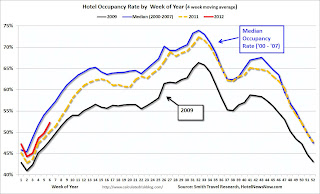

Hotels: RevPAR increases 8.7% compared to same week in 2011

by Calculated Risk on 2/09/2012 01:07:00 PM

From HotelNewsNow.com: STR: Upper-midscale hotels top weekly gains

Overall, the U.S. hotel industry’s occupancy was up 5.5% to 51.7%, its ADR increased 3.1% to US$100.45 and RevPAR was up 8.7% to US$51.98.This is the weak season for hotel occupancy, but this is solid improvement over the same week last year. Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

The following graph shows the seasonal pattern for the hotel occupancy rate using a four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2012, yellow is for 2011, blue is "normal" and black is for 2009 - the worst year since the Great Depression for hotels.

Hotel occupancy is running above 2011, but the 4-week average of the occupancy rate is still below normal. Looking forward, business travel usually increases in the March to May period, and it will be interesting to see if the occupancy rate gets close to 64% for that period.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Policy Updates: Mortgage Settlement Reached, Greek politicians agree on Debt Deal

by Calculated Risk on 2/09/2012 10:28:00 AM

Back in January I listed several policies and agreements that were expected soon.

There were several key announcements today:

• From the WSJ: U.S., Banks Agree on Foreclosure Pact

The agreement covers five banks: Ally Financial Inc., Bank of America Corp.,Citigroup Inc., J.P. Morgan Chase & Co., and Wells Fargo & Co. Together, the five handle payments on 55% of all outstanding home loans ...Following this agreement, I expect the lenders to start reducing the foreclosure backlog. This will be a combination of more modifications (with principal reductions) and more foreclosures. In some states - especially judicial states like New York and Florida - this will probably lead to more REO sales (lender Real Estate Owned), but overall I don't think there will be a large flood of REOs on the market.

The agreement will include at least 49 states, and officials were finalizing a separate accord with one remaining holdout, Oklahoma.

Here is the press release from the Dept of Justice: Federal Government and State Attorneys General Reach $25 Billion Agreement with Five Largest Mortgage Servicers to Address Mortgage Loan Servicing and Foreclosure Abuses

• From the WSJ: Greek Political Leaders Reach Austerity Deal

Leaders of political parties backing Greece's caretaker government agreed Thursday on an austerity package to comply with demands set by international creditors for another bailout deal ... Euro-zone finance ministers were set to meet here late Thursday to take stock of the latest political talks in Athens to decide whether to push ahead with new aid for Greece.It seems likely that Greece will receive another round of financing.

• And on the ECB's 3 year Long Term Refinancing Operation (LTRO) from the Financial Times Alphaville: Here be Draghi, on ECB collateral

RTRS-DRAGHI-NEW COLLATERAL RULES WILL BE MORE RISKYThis means more collateral will be acceptable for the second LTRO on Feb 29th. The first 3 year LTRO was for €489 billion, and the second one could be over €1 trillion.

RTRS-DRAGHI=BUT RISK IS BEING MANAGED VERY WELL

RTRS-ECB’S DRAGHI – HAIRCUTS WILL REDUCE NEW COLLATERAL BY TWO-THIRDS

RTRS-ECB’s DRAGHI – EXPECT SUBSTANTIAL TAKEUP IN SECOND 3-YR TENDER, AROUND SAME AS DEC ONE

A few other policies to come:

• A surge in refinance activity in March. Not a new policy - this was announced last October when the FHFA made changes to Home Affordable Refinance Program (HARP) to allow more homeowners with GSE loans and with negative or near negative equity - and who are current on their mortgages - to refinance into lower interest rate loans. But as I mentioned in the January post, the elimination of Reps and warrants for the original loans applies to Desktop Underwriter® (DU) and that will not be updated until March.

• Extension of payroll tax cut and extended unemployment benefits: The two month extension expires Feb 29th, and I expect these two programs will be extended through the end of the year.

Weekly Initial Unemployment Claims decline to 358,000

by Calculated Risk on 2/09/2012 08:30:00 AM

The DOL reports:

In the week ending February 4, the advance figure for seasonally adjusted initial claims was 358,000, a decrease of 15,000 from the previous week's revised figure of 373,000. The 4-week moving average was 366,250, a decrease of 11,000 from the previous week's revised average of 377,250.The previous week was revised up to 373,000 from 367,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 366,250.

The 4-week moving average is at the lowest level since May 2008.

And here is a long term graph of weekly claims:

The 4-week average of weekly claims is still moving down and is now well below 400 thousand.