by Calculated Risk on 2/07/2012 08:51:00 AM

Tuesday, February 07, 2012

Short Sales: $35 Thousand Cash-for-keys

Here is a serious incentive to do a short sale ... from Bloomberg: Banks Paying U.S. Homeowners to Avoid Foreclosures(ht Mike in Long Island)

Banks ... are offering as much as $35,000 or more in cash to delinquent homeowners to sell their properties for less than they owe.Unfortunately it seems there are still many suspicious short sales. It is common to see a home initially listed as "contingent" or "pending" at a price well below market - meaning the agent or seller already had a buyer lined up. If the banks are paying an incentive for those deals, they are losing twice!

...

Karen Farley hadn’t made a mortgage payment in a year when she got what looked like a form letter from her lender.

“You could sell your home, owe nothing more on your mortgage and get $30,000,” JPMorgan Chase & Co. (JPM) said in the Aug. 17 letter obtained by Bloomberg News.

...

Farley ... said the New York-based bank agreed to let her sell her San Marcos, California, home for $592,000 -- about $200,000 less than what she owes. The $30,000 will cover moving costs and the rental deposit for her next home. Farley, who is also approved for an additional $3,000 through a federal incentive program, is scheduled to close the deal Feb. 10.

...

JPMorgan, the biggest U.S. bank, approves about 5,000 short sales a month. It generally offers $10,000 to $35,000 in cash payments at settlement, real estate agents said. Not all of the sales include incentives.

Monday, February 06, 2012

Mortgage Settlement: More than 40 states have agreed

by Calculated Risk on 2/06/2012 10:12:00 PM

But none of the key holdout states have signed on yet ...

From Bloomberg: Mortgage Accord Has More Than 40 States Signed On, Iowa Says

More than 40 states have signed on to a settlement over mortgage-servicing practices ... This enables us to move forward into the very final stages of remaining work,” Iowa Attorney General Tom Miller said in a statement today ...Makes me wonder: Will the Greek debt deal or the mortgage servicer settlement be announced first (or collapse first)?

Nevada Attorney General Catherine Cortez Masto said today she wouldn’t decide whether to sign in time for the deadline, which was extended by the parties from Feb. 3. ... Masto said in a statement she was reviewing the settlement and “advocating for improvements to address Nevada’s needs.”

Existing Home Inventory declines 21% year-over-year in early February

by Calculated Risk on 2/06/2012 04:58:00 PM

Another update: I've been using inventory numbers from HousingTracker / DeptofNumbers to track changes in inventory. Tom Lawler mentioned this last year.

According to the deptofnumbers.com for monthly inventory (54 metro areas), listed inventory is probably back to early 2005 levels. Unfortunately the deptofnumbers only started tracking inventory in April 2006.

This graph shows the NAR estimate of existing home inventory through December (left axis) and the HousingTracker data for the 54 metro areas through February.

Click on graph for larger image.

Click on graph for larger image.

Since the NAR released their revisions for sales and inventory, the NAR and HousingTracker inventory numbers have tracked pretty well.

Seasonally housing inventory usually bottoms in December and January and then starts to increase again in February. So inventory should increase over the next 6 months.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the February listings - for the 54 metro areas - declined 21% from the same month last year. The year-over-year decline will probably start to slow since listed inventory is getting close to normal levels. Also if there is an increase in foreclosures (as expected), this will give some boost to listed inventory.

HousingTracker reported that the February listings - for the 54 metro areas - declined 21% from the same month last year. The year-over-year decline will probably start to slow since listed inventory is getting close to normal levels. Also if there is an increase in foreclosures (as expected), this will give some boost to listed inventory.

This is just inventory listed for sale, sometimes referred to as "visible inventory". There is also a large "shadow inventory" that is currently not on the market, but is expected to be listed in the next few years.

However listed inventory has clearly declined in many areas. And it is the listed months-of-supply (6.2 months as of December) combined with the number of distressed sales that mostly impacts prices.

Housing: The Two Bottoms

by Calculated Risk on 2/06/2012 02:47:00 PM

After my post this morning, The Housing Bottom is Here I was asked to update two graphs from 2009.

It is worth repeating: There are usually two bottoms for housing, the first for new home sales, housing starts and residential investment. The second bottom will be for house prices.

For the first bottom, we have several possible measures - the following graph shows three of the most commonly used: Starts, New Home Sales, and Residential Investment (RI) as a percent of GDP.

Click on graph for larger image.

Click on graph for larger image.

The arrows point to some of the earlier peaks and troughs for these three measures.

The purpose of this graph is to show that these three indicators generally reach peaks and troughs together. Note that Residential Investment is quarterly and single-family starts and new home sales are monthly.

For the current housing bust, the bottom was spread over a few years from 2009 into 2011.

We could use any of these three measures to determine the first bottom, and then use the other two to confirm the bottom. But this says nothing about prices.

The second graph compares RI as a percent of GDP with the real Case-Shiller National house price index through Q3 2011. Prices continued to fall in Q4 and probably into 2012 too.

The second graph compares RI as a percent of GDP with the real Case-Shiller National house price index through Q3 2011. Prices continued to fall in Q4 and probably into 2012 too.

Although the Case-Shiller data only goes back to 1987, look at what happened following the early '90s housing bust. RI as a percent of GDP bottomed in Q1 1991, but real house prices didn't bottom until Q4 1996 - more than 5 years later!

Something similar will most likely happen again. But note this is REAL prices (adjusted for inflation). If the current price pattern follows the previous bust, real prices will gradually decline for a few years - however most homeowners care about nominal prices, and there is a good chance nominal Not Seasonally Adjusted (NSA) national prices will bottom in March - and then start moving mostly sideways.

No one has a crystal ball, and I provided the reasons for this forecast in the previous post.

The Housing Bottom is Here

by Calculated Risk on 2/06/2012 12:13:00 PM

There have been some recent articles arguing the “housing bottom is nowhere in sight”. That isn’t my view.

First there are two bottoms for housing. The first is for new home sales, housing starts and residential investment. The second bottom is for prices. Sometimes these bottoms can happen years apart.

For the economy and jobs, the bottom for housing starts and new home sales is more important than the bottom for prices. However individual homeowners and potential home buyers are naturally more interested in prices. So when we discuss a “bottom” for housing, we need to be clear on what we mean.

Click on graph for larger image.

Click on graph for larger image.

For new home sales and housing starts, it appears the bottom is in, and I expect an increase in both starts and sales in 2012.

As the first graph shows, housing starts, both total and single family, bottomed in 2009 and have mostly moved sideways since then - with some distortions due to the ill-conceived housing tax credit.

New Home sales probably bottomed in mid-2010 and have flat lined since then.

New Home sales probably bottomed in mid-2010 and have flat lined since then.

Back in 2009, when I first wrote about the two bottoms, I thought we were close on housing starts and new home sales - but that it was "way too early to try to call the bottom in prices." In real terms, house prices have fallen another 10% to 15% since I wrote that post according to the CoreLogic and Case-Shiller house price indexes.

And it now appears we can look for the bottom in prices. My guess is that nominal house prices, using the national repeat sales indexes and not seasonally adjusted, will bottom in March 2012.

The problem with using the house price indexes to look for a bottom is that they are reported with a significant lag. As an example, the recently released Case-Shiller index was for November and the index is an average of September, October and November - so it is a report for several months ago. The CoreLogic index is a little more current - the recent release was for December, and CoreLogic uses a weighted average for prices (December weighted the most) - but that is still quite a lag.

Both of those indexes will bottom seasonally around March, and then start increasing again.

There are several reasons I think that house prices are close to a bottom. First prices are close to normal looking at the price-to-rent ratio and real prices (especially if prices fall another 4% to 5% NSA between the November Case-Shiller report and the March report). Second the large decline in listed inventory means less downward pressure on house prices, and third, I think that several policy initiatives will lessen the pressure from distressed sales (the probable mortgage settlement, the HARP refinance program, and more).

Of course these are national price indexes and there will be significant variability across the country. Areas with a large backlog of distressed properties - especially some states with a judicial foreclosure process - will probably see further price declines.

And this doesn't mean prices will increase significantly any time soon. Usually towards the end of a housing bust, nominal prices mostly move sideways for a few years, and real prices (adjusted for inflation) could even decline for another 2 or 3 years.

But most homeowners and home buyers focus on nominal prices and there is reasonable chance that the bottom is here.

CRE: Another Half Off Sale

by Calculated Risk on 2/06/2012 08:52:00 AM

Just a reminder that there are still quite a few commercial real estate (CRE) properties that are deep underwater:

From Bloomberg: Atlanta BofA Tower Auction Highlights Foreclosures (ht Mike In Long Island)

Atlanta’s 55-story Bank of America Plaza, the tallest tower in the Southeast, is set to be sold at an open outcry auction on the steps of the Fulton County Courthouse tomorrow after landlord BentleyForbes missed mortgage payments. It bought the skyscraper in 2006 for $436 million ... the 1.25 million-square-foot building has lost 54 percent of its value ...

The $363 million Bank of America Plaza loan became delinquent in December ... was appraised in March at $202 million

“We’re hitting a tremendous amount of that debt coming due,” William Yowell, a vice chairman with CBRE Group Inc. in Atlanta, said in a telephone interview. That will cause “more distressed assets that come to market this year” and may lower the price per square foot on buildings, he said.

Sunday, February 05, 2012

NY Times: California might join mortgage settlement

by Calculated Risk on 2/05/2012 11:01:00 PM

From the NY Times: Deal Is Closer for a U.S. Plan on Mortgage Relief

With a deadline looming on Monday for state officials to sign onto a landmark multibillion-dollar settlement to address foreclosure abuses, the Obama administration is close to winning support from crucial states that would significantly expand the breadth of the deal.I expect most states (if not all) to join the settlement.

The biggest remaining holdout, California, has returned to the negotiating table ... in the last few days, differences have narrowed in negotiations that one participant described as round the clock, with California officials in direct communication with bank representatives for the first time in months. ... Officials involved in the negotiations cautioned that broader state support could still be days away.

Yesterday:

• Summary for Week ending February 3rd

• Schedule for Week of February 5th

Greek talks end without agreement, will meet again on Monday

by Calculated Risk on 2/05/2012 03:06:00 PM

From the Athens News: Lengthy and difficult negotiations

A five-hour meeting between prime minister Lucas Papademos and the leaders of the three parties supporting the government ended without agreement on Sunday.More from the Financial Times: Deadlock for Greek austerity talks

Pasok leader George Papandreou, main opposition New Democracy party leader Antonis Samaras and Popular Orthodox Rally (Laos) party leader George Karatzaferis failed to reach agreement with Papademos concerning the demands of the EU-IMF troika for private-sector wage cuts, further pension cuts, large-scale firing of public-sector staff and major downsizing of the public sector.

...

Main opposition New Democracy leader Antonis Samaras made no statements as he left the meeting but indicated the deadlock reached during the meeting during a brief statement to television cameras when he returned to ND's headquarters.

"For the first time, a negotiation is taking place. The country cannot stand more recession. I am fighting with every means to prevent this," he said, confirming that the negotiations will continue on Monday.

Yesterday:

• Summary for Week ending February 3rd

• Schedule for Week of February 5th

Recovery Measures

by Calculated Risk on 2/05/2012 10:13:00 AM

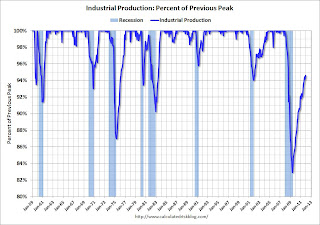

By request, here is an update to four key indicators used by the NBER for business cycle dating: GDP, Employment, Industrial production and real personal income less transfer payments.

Note: The following graphs are all constructed as a percent of the peak in each indicator. This shows when the indicator has bottomed - and when the indicator has returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%.

These graphs show that several major indicators are still significantly below the pre-recession peaks.

Click on graph for larger image.

Click on graph for larger image.

This graph is for real GDP through Q4 2011. Real GDP returned to the pre-recession in Q3 2011, and Gross Domestic Income (not shown) returned to the pre-recession peak in Q2 - GDI for Q4 will be released with the 2nd estimate of GDP. (For a discussion of GDI, see here).

At the worst point, real GDP was off 5.1% from the 2007 peak. Real GDI was off 5.7% at the trough.

Real GDP has performed better than other indicators ...

Real GDP has performed better than other indicators ...

This graph shows real personal income less transfer payments as a percent of the previous peak through December.

This measure was off 10.7% at the trough.

Real personal income less transfer payments is still 4.8% below the previous peak.

This graph is for industrial production through December.

This graph is for industrial production through December.

Industrial production was off over 17% at the trough, and has been one of the stronger performing sectors during the recovery.

However industrial production is still 5.4% below the pre-recession peak, and it will probably be some time before industrial production returns to pre-recession levels.

The final graph is for employment. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

The final graph is for employment. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

Payroll employment is still 4.1% below the pre-recession peak.

If the economy adds 243 thousand payroll jobs per month on average (the January report), it will take another 2 years to get back to the pre-recession employment peak. And that doesn't count growth of the working age population over the last 4+ years.

Yesterday:

• Summary for Week ending February 3rd

• Schedule for Week of February 5th

Saturday, February 04, 2012

Greece: Key meeting on Sunday

by Calculated Risk on 2/04/2012 09:56:00 PM

From the Athens News: Crucial meeting of coalition partners

The crucial negotiation of the coalition political party leaders over the EC-ECB-IMF troika's ultimatums and shock measures has been set for 13:00 on Sunday.From Reuters: Euro zone loses patience with Greece

In this new meeting of the leaders of three parties backing the interim government led by Lucas Papademos which will take place on Sunday, the prime minister is expected to present them with a document detailing the rigid positions of the troika. ... [reports are] the prime minister is thinking of resigning if the three do not manage to come to an agreement.

Euro zone finance ministers told Greece on Saturday it could not go ahead with an agreed deal to restructure privately-held debt until it guaranteed it would implement reforms needed to secure a second financing package from the euro zone and the IMF.From the NY Times: Greek Talks at a Delicate Point, Official Says

The Greek finance minister, Evangelos Venizelos, said on Saturday that talks between the government and its foreign creditors on a second rescue deal were “on a razor’s edge,” adding that though progress had been made on some levels, crucial issues were unresolved.Earlier:

“Two major, interrelated issues remain unresolved — labor relations and wages in the private sector, and the fiscal measures that must be taken to ensure we are within the target for 2012,” Mr. Venizelos said after a two-hour conference call with euro zone officials. Despite the barriers, a deal must be reached in bailout talks by Sunday night, he said.

• Summary for Week ending February 3rd

• Schedule for Week of February 5th