by Calculated Risk on 2/03/2012 03:28:00 PM

Friday, February 03, 2012

Construction Employment, Duration of Unemployment, Unemployment by Education and Diffusion Indexes

The first graph below shows the number of total construction payroll jobs in the U.S. including both residential and non-residential since 1969.

Construction employment increased by 21 thousand jobs in January, after increasing by 74 thousand jobs in all of 2011. Last year was the first year with an increase in construction employment since 2006, and the first with an increase in residential construction employment since 2005.

Unfortunately this graph is a combination of both residential and non-residential construction employment. The BLS only started breaking out residential construction employment fairly recently (residential specialty trade contractors in 2001).

Usually residential investment (and residential construction) leads the economy out of recession, and non-residential construction usually lags the economy. Because this graph is a blend, it masks the usual pickup in residential construction following previous recessions. Of course there was no pickup for residential construction this time because of the large excess supply of vacant homes.

Click on graph for larger image.

Click on graph for larger image.

Construction employment is now increasing and construction will add to both GDP and employment growth in 2012.

As I've noted for years, there are usually two bottoms for housing following a bubble: 1) when housing starts, new home sales, and residential construction bottoms, and 2) when house prices bottom. The bottom is in for construction and we are getting close on prices.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.All categories are moving down (the less than 5 week category is back to normal levels). The other categories are still high.

The the long term unemployed declined to 3.6% of the labor force - this is still very high, but the lowest since September 2009.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This is a little more technical. The BLS diffusion index for total private employment was at 64.1 in January, up from 62.4 in December. For manufacturing, the diffusion index increased to 69.1, up from 64.2 in December.

This is a little more technical. The BLS diffusion index for total private employment was at 64.1 in January, up from 62.4 in December. For manufacturing, the diffusion index increased to 69.1, up from 64.2 in December. Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.It appears job growth was spread across more industries in January (good news).

We'd like to see the diffusion indexes consistently above 60 - and even in the 70s like in the '1990s.

Earlier Employment posts:

• January Employment Report: 243,000 Jobs, 8.3% Unemployment Rate

• Graphs: Unemployment Rate, Participation Rate, Jobs added

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• All Employment Graphs

ISM Non-Manufacturing Index indicates faster expansion in January

by Calculated Risk on 2/03/2012 12:56:00 PM

Catching up: The January ISM Non-manufacturing index was at 56.8%, up sharply from 53.0% in December. The employment index increased in January to 57.4%, up from 49.8% in December. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: December 2011 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in January for the 25th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI registered 56.8 percent in January, 3.8 percentage points higher than the seasonally adjusted 53 percent registered in December, and indicating continued growth at a faster rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index registered 59.5 percent, which is 3.6 percentage points higher than the seasonally adjusted 55.9 percent reported in December, reflecting growth for the 30th consecutive month. The New Orders Index increased by 4.8 percentage points to 59.4 percent, and the Employment Index increased by 7.6 percentage points to 57.4 percent, indicating substantial growth in employment after one month of contraction. The Prices Index increased 1.5 percentage points to 63.5 percent, indicating prices increased at a slightly faster rate in January when compared to December. According to the NMI, 12 non-manufacturing industries reported growth in January. Respondents' comments are mostly positive about business conditions. There is concern about cost pressures and the sustainability of the recent spike in activity.

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was well above the consensus forecast of 53.3% and indicates faster expansion in January than in December.

Earlier Employment posts:

• January Employment Report: 243,000 Jobs, 8.3% Unemployment Rate

• Graphs: Unemployment Rate, Participation Rate, Jobs added

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• All Employment Graphs

Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

by Calculated Risk on 2/03/2012 10:54:00 AM

This was a solid report and well above expectations. However there is still a long ways to go for a healthy labor market with solid wage gains.

There were 243,000 payroll jobs added in January, with 257,000 private sector jobs added, and 14,000 government jobs lost. The unemployment rate fell to 8.3% from 8.5% in December. U-6, an alternate measure of labor underutilization that includes part time workers and marginally attached workers, declined to 15.1%. This remains very high - U-6 was in the 8% range in 2007.

The annual benchmark revision indicated 165,000 more payroll jobs in March 2011; the first positive benchmark revision since 2006. The BLS also adjusted the population control by the Census 2010 data. This resulted in a large increase in the labor force and an even larger increase in the "not in the labor force" category.

However - in the not good news category - the participation rate declined to 63.7% and the employment population ratio was unchanged in January at 58.5%.

The average workweek was unchanged at 34.4 hours, and average hourly earnings increased 0.2%. "The average workweek for all employees on private nonfarm payrolls was unchanged in January. ... In January, average hourly earnings for all employees on private nonfarm payrolls rose by 4 cents, or 0.2 percent, to $23.29. Over the past 12 months, average hourly earnings have increased by 1.9 percent." This is sluggish earnings growth, and earnings are still being impacted by the large number of unemployed and marginally employed workers.

There are a total of 12.8 million Americans unemployed and 5.5 million have been unemployed for more than 6 months. Still very grim.

Overall this was a solid report, but still not enough given the slack in the economy.

Percent Job Losses During Recessions

Click on graph for larger image.

Click on graph for larger image.

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses.

In the previous post, the graph showed the job losses aligned at the start of the employment recession.

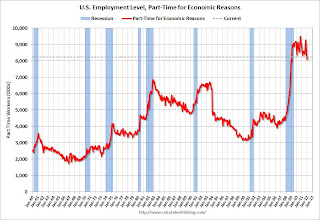

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons, at 8.2 million, changed little in January. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of part time workers increased slightly in January and is still very high.

These workers are included in the alternate measure of labor underutilization (U-6) that declined to 15.1% in January from 15.2% in December.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 5.518 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 5.588 million in November. This is very high, but this is the lowest number since September 2009. Long term unemployment remains a serious problem.

More graphs coming ...

Graphs: Unemployment Rate, Participation Rate, Jobs added

by Calculated Risk on 2/03/2012 09:24:00 AM

There were some revisions this morning to previous employment reports. This included the annual benchmark revision to state unemployment insurance (UI) records, and benchmarking the population controls to the 2010 Census data and an update to seasonal factors.

The benchmark revision increased total employment in March 2011 by 165,000 jobs - the first positive benchmark revision since 2006.

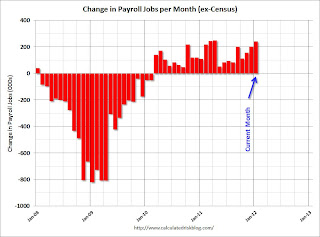

This graph shows the jobs added or lost per month (excluding temporary Census jobs) since the beginning of 2008.

Click on graph for larger image.

Click on graph for larger image.

Job growth started picking up early last year, but then the economy was hit by a series of shocks (oil price increase, tsunami in Japan, debt ceiling debate) - and now it appears job growth is picking up again.

The second graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate declined to 8.3% (red line).

The Labor Force Participation Rate declined to 63.7% in January (blue line). This is the percentage of the working age population in the labor force and is at the lowest since the early '80s. The decline in the participation rate is not good news even though it is pushing down the unemployment rate. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although some of the decline is due to the aging population.

The Labor Force Participation Rate declined to 63.7% in January (blue line). This is the percentage of the working age population in the labor force and is at the lowest since the early '80s. The decline in the participation rate is not good news even though it is pushing down the unemployment rate. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although some of the decline is due to the aging population.

The Employment-Population ratio was unchanged at 58.5% in January (black line).

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

This shows the depth of the recent employment recession - much worst than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

This was a relatively strong report and well above consensus expectations. I'll have much more soon ...

January Employment Report: 243,000 Jobs, 8.3% Unemployment Rate

by Calculated Risk on 2/03/2012 08:30:00 AM

From the BLS:

Total nonfarm payroll employment rose by 243,000 in January, and the unemployment rate decreased to 8.3 percent, the U.S. Bureau of Labor Statistics reported today. Job growth was widespread in the private sector, with large employment gains in professional and business services, leisure and hospitality, and manufacturing. Government employment changed little over the month. ... Private-sector employment grew by 257,000 ...This was the first positive benchmark revision since 2006. There were several revisions, and I'll have graphs soon, but this was solidly above expectations.

The change in total nonfarm payroll employment for November was revised from +100,000 to +157,000, and the change for December was revised from +200,000 to +203,000.

[and on benchmark revision] The total nonfarm employment level for March 2011 was revised upward by 165,000.

Thursday, February 02, 2012

Mortgage Rates fall to record low

by Calculated Risk on 2/02/2012 10:21:00 PM

Probably worth a mention - especially since refinance activity will probably pick up soon (I expect HARP to increase in March) ...

From Freddie Mac: Average Mortgage Rates Ease Setting New Record Lows

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average mortgage rates dropping to new all-time record lows as data on economic growth fell short of market projections. All products in the PMMS survey, except the 1-Year ARM, averaged new lows.This is the lowest 30 year fixed rate since Freddie Mac started tracking rates in 1971. Rates were pretty low in the early 50s too - if anyone has a source for mortgage rates back then, please let me know.

...

30-year fixed-rate mortgage (FRM) averaged 3.87 percent with an average 0.8 point for the week ending February 2, 2012, down from last week when it averaged 3.98 percent. Last year at this time, the 30-year FRM averaged 4.81 percent.

...

5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.80 percent this week, with an average 0.7 point, down from last week when it averaged 2.85 percent. A year ago, the 5-year ARM averaged 3.69 percent.

Lawler: Home Builder Results for Last Quarter

by Calculated Risk on 2/02/2012 06:31:00 PM

From economist Tom Lawler:

Of the nine large publicly traded home builders whose fiscal quarters end on the same day as calendar quarters, eight have published earnings and operating stats. I don’t comment on earnings, put below are some selected stats on orders, settlements, and order backlogs.

Pulte, of course, noted that in the quarter ended December 31, 2010 there was a “one-time pickup” of about 200 net orders “associated with a change in the Company’s order recognition process,” and that as of result a “like-to-like” comparison of the latest quarter vs. the comparable year-ago quarter would show a YOY gain of “about” 8%. Adjusting the totals for all eight builders for the “Pulte shift,” the YOY gain in net orders for the above group would be 13.3% (and the YOY decline for the previous year would be 16.7%). For these eight companies combined, the backlog of orders at the end of last year was up 18.1% from the end of 2010, though it was little changed from the end of 2009.

| Settlements | Net Orders | Backlog | |||||||

|---|---|---|---|---|---|---|---|---|---|

| End 2011 | End 2010 | End 2009 | End 2011 | End 2010 | End 2009 | End 2011 | End 2010 | End 2009 | |

| D.R. Horton | 4,118 | 3,637 | 5,529 | 3,794 | 3,363 | 4,037 | 4,530 | 3,854 | 4,136 |

| PulteGroup | 4,303 | 4,405 | 6,200 | 3,084 | 3,044 | 3,748 | 3,924 | 3,984 | 5,931 |

| NVR | 2,391 | 2,639 | 2,550 | 2,158 | 1,765 | 2,000 | 3,676 | 2,916 | 3,531 |

| The Ryland Group | 1,040 | 909 | 1,666 | 915 | 775 | 969 | 1,514 | 1,187 | 1,732 |

| Meritage Homes | 894 | 837 | 1,202 | 749 | 713 | 621 | 915 | 778 | 1,095 |

| Beazer Homes | 882 | 549 | 961 | 724 | 553 | 728 | 1,309 | 800 | |

| MDC Holdings | 950 | 865 | 1,109 | 523 | 519 | 637 | 1,043 | 842 | 826 |

| M/I Homes | 667 | 650 | 858 | 505 | 460 | 448 | 676 | 532 | 650 |

| Total | 15,245 | 14,491 | 20,075 | 12,452 | 11,192 | 13,188 | 17,587 | 14,893 | 17,901 |

| YoY % Change | 5.2% | -27.8% | 11.3% | -15.1% | 18.1% | -16.8% | |||

MDC Holdings, by the way, reported that January 2012 net sales were up “about 30%” from January 2011 sales.

Census new SF home sales data showed a YOY increase in sales for the fourth quarter of 2011 (NSA, of course), of just 3.0%, while the YOY % decline for Q4/10 was 20.5%. Unfortunately, the Census new SF sales data are not directly comparable to reports from home builders, partly because of the treatment of sales cancellations, and partly because the timing of a “sale” can differ slightly. As such, it’s difficult to ascertain the degree to which “large” builder sales gains have exceeded Census’ gains reflects market share gains, different reporting, or “bad” Census data!

Net, though, my gut is that the large builders were seeing better net orders last quarter than Census new home sales data might have suggested.

January Employment Report Revisions and Issues

by Calculated Risk on 2/02/2012 03:55:00 PM

Tomorrow (Friday) the BLS will release the January Employment Situation Summary at 8:30 AM ET. Bloomberg is showing the consensus is for an increase of 135,000 payroll jobs in January, and for the unemployment rate to remain unchanged at 8.5%.

Here are a few revisions and issues to look for tomorrow:

• Establishment Data: "With the release of January 2012 data on February 3, 2012, the Current Employment Statistics (CES) survey will introduce revisions to nonfarm payroll employment, hours, and earnings data to reflect the annual benchmark adjustment for March 2011 and updated seasonal adjustment factors. Not seasonally adjusted data beginning with April 2010 and seasonally adjusted data beginning with January 2007 are subject to revision."

The preliminary benchmark was for an increase of 192,000 total nonfarm payroll jobs, and 140,000 private sector jobs as of March 2011. The annual revision is benchmarked to state tax records, and usually the preliminary estimate is pretty close to the final benchmark estimate.

This will be the first upward revision since 2006.

• Household Survey: "Effective with the release of The Employment Situation for January 2012 scheduled for February 3, 2012, population controls that reflect the results of Census 2010 will be used in the monthly household survey estimation process. Historical data will not be revised to incorporate the new controls; consequently, household survey data for January 2012 will not be directly comparable with that for December 2011 or earlier periods. A table showing the effects of the new controls on the major labor force series will be included in the January 2012 release."

• Issue: Several analysts have noted that it appears the seasonal adjustment for "Transportation and warehousing" over-counted employment in December by about 42,000 and this should be unwound in January. So December payroll growth was probably overstated, and January will be understated.

• And on the unemployment rate from Gallup:

The U.S. government's January unemployment rate that it will report Friday morning will be based largely on mid-month conditions. At mid-month, Gallup reported that its unemployment rate had declined to 8.3%, based on data collected through the 15th of the month.The Gallup survey hasn't predicted the BLS "not seasonally adjusted" unemployment rate very well, but this suggests a possible unemployment rate surprise. January has the largest downward seasonal adjustment, and usually the seasonally adjusted rate is 0.5% to 0.7% lower than the NSA rate. If the headline unemployment rate is 8.5% (as analysts expect) then I'd expect the NSA rate to be in the 9.1% range - not 8.3% as the Gallup survey found.

The mid-month reading normally provides a pretty good estimate of the government's unadjusted unemployment rate for the month. However, the government is revising its methodology beginning with the January 2012 report. As a result, the government notes, "household survey data for January 2012 will not be directly comparable with that for December 2011 or earlier periods." In turn, this makes estimating the government's unemployment rate for January even more difficult than usual.

NMHC Apartment Survey: Market Conditions Tighten in Recent Survey

by Calculated Risk on 2/02/2012 01:25:00 PM

From the National Multi Housing Council (NMHC): Apartment Industry Continues Recovery, Survey Says

Market conditions continued to improve for the multifamily industry across all areas, according to the latest National Multi Housing Council (NMHC) Quarterly Survey of Apartment Market Conditions. For the seventh time in the last eight quarters, all four indexes reflecting Market Tightness, Sales Volume, Equity Financing and Debt Financing were at or above 50 – indicating growth from the previous quarter.

"In the face of an unprecedented virtual shutdown of development, the apartment market continues its strong recovery as developers play catch-up to the growing demand for rental housing," said NMHC Chief Economist Mark Obrinsky.

...

The Market Tightness Index rose to 60 from 52, marking the eighth straight quarter with the index at or above 50.

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tightening from the previous quarter. The index has indicated tighter market conditions for the last eight quarters and suggests falling vacancy rates and or rising rents.

This fits with the recent Reis data showing apartment vacancy rates fell in Q4 2011 to 5.2%, down from 5.6% in Q3 2011, and 9.0% at the end of 2009.

New multi-family construction remains a bright spot for the U.S. economy and this survey indicates demand for apartments is still strong.

A final note: This index helped me call the bottom for effective rents (and the top for vacancy rate) early in 2010.

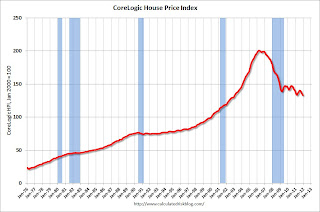

CoreLogic: House Price Index declined 1.4% in December to new post-bubble low

by Calculated Risk on 2/02/2012 11:08:00 AM

Notes: This CoreLogic House Price Index report is for December. The Case-Shiller index released last week was for November. Case-Shiller is currently the most followed house price index, however CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average of September, October and November (November weighted the most) and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® Prices fell by 4.7 percent nationally in 2011

The CoreLogic HPI shows that, including distressed sales, home prices in the U.S. decreased 4.7 percent in 2011 compared with December 2010. This year-end report shows that home prices continued the trend of year-end decreases—this is the fifth consecutive year with a decrease in the HPI. The HPI excluding distressed sales shows that home prices decreased by 0.9 percent in 2011, giving an indication of the impact of distressed sales on home prices in 2011.

The report also shows that national home prices including distressed sales decreased 1.4 percent on a month-over-month basis, the fifth consecutive monthly decline. However, the HPI excluding distressed sales posted its first month-over-month gain since July 2011, rising 0.2 percent.

“While overall prices declined by almost 5 percent in 2011, non-distressed prices showed only a small decrease. Until distressed sales in the market recede, we will see continued downward pressure on prices,” said Mark Fleming, chief economist for CoreLogic.

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was down 1.4% in December, and is down 4.7% over the last year.

The index is off 33.7% from the peak - and is now at a new post-bubble low.

Some of this decline was seasonal (the CoreLogic index is NSA) and month-to-month price changes will probably remain negative through March 2012. Last year prices fell about 4% from December 2010 to March 2011, and there will probably be a similar decline this year.