by Calculated Risk on 1/24/2012 03:58:00 PM

Tuesday, January 24, 2012

DataQuick: California Foreclosure Activity declines in Q4

From DataQuick: California Foreclosure Activity Drops

The number of California homes going into foreclosure dropped in the fourth quarter of 2011 to the second-lowest level in more than four years, the result of evolving lender and mortgage servicer policies as well as shifting market conditions, a real estate information service reported.As Walsh noted, some of the decline is probably due to process issues. California is a non-judicial state, and it still takes an average of 9.7 months to foreclose after the Notice of Default is filed (the shortest possible period is 3 months and 21 days).

A total of 61,517 Notices of Default (NODs) were recorded at county recorders offices during the fourth quarter. That was down 13.7 percent from 71,275 for the prior three months, and down 11.9 percent from 69,799 in fourth-quarter 2010, according to San Diego-based DataQuick.

Last quarter's 61,517 NODs marked the lowest level since 56,633 NODs were filed in second-quarter 2011, and the second-lowest since 53,943 NODs were recorded in second-quarter 2007. New foreclosure filings (NODs) peaked in first-quarter 2009 at 135,431.

"We are certainly seeing a lower level of foreclosure activity than a year or two ago. The question is, how much of that decline is due to market conditions, and how much is due to policy changes that try to address economic distress and lower home values," said John Walsh, DataQuick president.

"Five years ago almost all mortgage payment delinquencies would have triggered a default notice after a certain amount of time. Strategies now include short sales, refinances, interest rate changes, principal reduction as well as just plain waiting longer. It will be interesting to see how this plays out as the economy improves and the housing market finds its footing," Walsh said.

Click on graph for larger image.

Click on graph for larger image.This graph shows the annual Notices of Default (NODs) filed in California.

California had a significant housing bust in the early '90s, with defaults peaking - and prices bottoming - in 1996. That bust was mild compared to the recent housing bust - and defaults are still way above the 1996 peak.

ATA Trucking Index increased sharply in December

by Calculated Risk on 1/24/2012 01:15:00 PM

From ATA: ATA Truck Tonnage Index Posts Largest Annual Gain in 13 Years

The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index jumped 6.8% in December after rising 0.3% in November 2011. The latest gain put the SA index at 124.5 (2000=100) in December, up from the November level of 116.6.

For all of 2011, tonnage rose 5.9% over the previous year – the largest annual increase since 1998. Tonnage for the last month of the year was 10.5% higher than December 2010, the largest year-over-year gain since July 1998. November tonnage was up 6.1% over the same month last year.

...

“While I’m not surprised that tonnage increased in December, I am surprised at the magnitude of the gain,” ATA Chief Economist Bob Costello said.

...

“Not only did truck tonnage increase due to solid manufacturing output in December, but also from some likely inventory restocking. Inventories, especially at the retail level, are exceedingly lean, and I suspect that tonnage was higher than expected as the supply chain did some restocking during the month.” he said.

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index. This index stalled early in 2011, but increased sharply at the end of the year. From ATA:

Trucking serves as a barometer of the U.S. economy, representing 67.2% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9 billion tons of freight in 2010. Motor carriers collected $563.4 billion, or 81.2% of total revenue earned by all transport modes.

State Unemployment Rates "slightly lower" in December

by Calculated Risk on 1/24/2012 10:55:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were slightly lower in December. Thirty-seven states and the District of Columbia recorded unemployment rate decreases, 3 states posted rate increases, and 10 states had no rate change, the U.S. Bureau of Labor Statistics reported today. Forty-six states registered unemployment rate decreases from a year earlier, while four states and the District of Columbia experienced increases.

...

Nevada continued to record the highest unemployment rate among the states, 12.6 percent in December. California posted the next highest rate, 11.1 percent. North Dakota again registered the lowest jobless rate, 3.3 percent ...

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). Every state has some blue - indicating no state is currently at the maximum during the recession.

The states are ranked by the highest current unemployment rate. Only four states and the District of Columbia still have double digit unemployment rates. This is the fewest since early 2009. At the end of 2009, 18 states and D.C. had double digit unemployment rates.

Richmond Fed: Manufacturing Activity Picks Up the Pace in January

by Calculated Risk on 1/24/2012 10:00:00 AM

From the Richmond Fed: Manufacturing Activity Picks Up the Pace in January; Expectations Upbeat

In January, the seasonally adjusted composite index of manufacturing activity — our broadest measure of manufacturing — increased nine points to 12 from December's reading of 3.This was above the consensus of a reading of 6. This follows the reports of somewhat faster expansion from the Philly Fed and Empire State surveys.

Labor market conditions at District plants strengthened in January. The manufacturing employment index moved up eight points to end at 4, and the average workweek indicator added one point to 4. Wage growth remained modest, matching its three-month average of 10.

In our January survey, our contacts were more bullish about their business prospects for the next six months. The index of expected shipments increased nine points to 36, expected orders gained eleven points to finish at 32, and backlogs added eight points to 14. The capacity utilization and vendor delivery times indexes each rose nine points to finish at 11 and 20, respectively. Moreover, readings for planned capital expenditures moved up eight points to finish at 15.

District manufacturers' hiring plans in January were somewhat more optimistic as well. The expected manufacturing employment index edged up three points to 20, while the average workweek indicator held steady at 7. The index of expected wages was virtually unchanged at 19.

Greece: Eurozone finance ministers push for lower rates on private sector involvement

by Calculated Risk on 1/24/2012 08:39:00 AM

From the Athens News: Eurogroup rejects PSI deal

Eurozone finance ministers on Monday gave the thumbs-down to a plan for private sector involvement (PSI) in the writedown on Greek debt.From the WSJ: EU Ministers Resume Crisis Talks

...

"We told him [Venizelos] to continue the negotiations [with Dallara] until the interest rate comes down below 4 percent," Eurogroup chairman Jean-Claude Juncker told a news conference in Brussels late on Monday.

Juncker was referring to the average interest rate (annual coupon) of the new 30-year bonds that will be issued to bondholders after the haircut of 50 percent on the face value of their portfolio.

The International Monetary Fund and the euro zone's four triple-A-rated countries—Germany, the Netherlands, Finland and Luxembourg—are pushing for a low average interest rate on new bonds to be issued as part of the restructuring ...Of course Greece is a small part of the problem, also from the WSJ: Fears Mount That Portugal Will Need a Second Bailout

"Obviously Greece and the banks have to do more in order to reach a sustainable debt level," Dutch Finance Minister Jan Kees de Jager said ... He said debt restructuring terms that ensure a sustainable debt level is "absolutely a precondition" for a second EU bailout package for Greece.

Monday, January 23, 2012

FHFA Analysis on Principal Forgiveness

by Calculated Risk on 1/23/2012 08:46:00 PM

The FHFA released their analysis on the effectiveness of principal reductions for Fannie and Freddie loans. The FHFA analysis showed that principal reductions would be more costly for taxpayers than other alternatives.

Here is the letter: FHFA Releases Analysis on Principal Forgiveness As Loss Mitigation Tool

Here is the analysis: FHFA Analyses of Principal Forgiveness Loan Modifications.

In considering principal forgiveness, FHFA compared taxpayer losses from principal forgiveness versus principal forbearance, which is an alternate approach that the Enterprises currently undertake to fulfill their mission at a lower cost to the taxpayer. FHFA based its conclusion that principal forgiveness results in a lower net present value than principal forbearance on an analysis initially prepared in December 2010, which is attached, along with updated analyses produced in June and December 2011, which are also attached.This is reminder that Fannie and Freddie loans were much better than the private label loans.

Putting this determination in context, as of June 30, 2011, the Enterprises had nearly three million first lien mortgages with outstanding balances estimated to be greater than the value of the home, as measured using FHFA’s House Price Index. FHFA estimates that principal forgiveness for all of these mortgages would require funding of almost $100 billion to pay down mortgages to the value of the homes securing them. This would be in addition to the credit losses both Enterprises are currently experiencing.

Another factor to consider is that nearly 80 percent of Enterprise underwater borrowers were current on their mortgages as of June 30, 2011. (Even for more deeply underwater borrowers – those with mark-to-market loan-to-value ratios above 115 percent, 74 percent are current.) This trend contrasts with non-Enterprise loans, where many underwater borrowers are delinquent.

Given that any money spent on this endeavor would ultimately come from taxpayers and given that our analysis does not indicate a preservation of assets for Fannie Mae and Freddie Mac substantial enough to offset costs, an expenditure of this nature at this time would, in my judgment, require congressional action.

...

While it is not in the best interests of taxpayers for FHFA to require the Enterprises to offer principal forgiveness to high LTV borrowers, a principal forgiveness strategy might reduce losses for other loan holders. Indeed, in several of the examples cited, such as Ocwen and Wells Fargo, principal forgiveness is being offered to borrowers whose loans the investor or servicer purchased at a discount, which would likely change the analytics significantly. ... Additionally, less than ten percent of borrowers with Enterprise loans have negative equity in their homes (9.9 percent in June 2011), whereas loans backing private label securities were more than three times more likely to have negative equity (35.5 percent in June 2011).

As an aside: Here is a table from the report (as of June 30, 2010). This shows the total loans, the UPB (Unpaid Principal Balance) and the number of loans current. Of course house prices have fallen over the last 18 months, and there have been other changes (refinances, foreclosures, home sales), but this gives an idea of the number of HARP eligible loans for refinancing once the program becomes automated in March. HARP will apply to all current loans with LTV greater than 80% (about 7 million loans).

Note: There are just over 50 million first mortgage liens, so as of June 2010, Fannie and Freddie held about 60% of the mortgages - but a much smaller percentage of the delinquent loans.

| Fannie and Freddie: MTM LTV Distribution June 30, 2010 | |||||

|---|---|---|---|---|---|

| UPB ($ Billions) | Total Loans (000s) | Percent of UPB | Current (000s) | Percent Current | |

| LTV Missing | $27.5 | 346 | 1.1% | 315 | 91.0% |

| LTV <= 80% | $2,994.4 | 21,547 | 71.2% | 20,821 | 96.6% |

| 80 < LTV < 105 | $1,206.5 | 6,461 | 21.4% | 5,801 | 89.8% |

| 105 < LTV < 115 | $140.2 | 704 | 2.3% | 512 | 72.8% |

| 115 < LTV <= 150 | $235.9 | 1,069 | 3.5% | 804 | 75.2% |

| LTV > 150% | $29.6 | 135 | 0.4% | 43 | 31.8% |

| Total | $4,634.1 | 30,262 | 100.0% | 28,296 | |

| Source: Historical Loan Performance dataset. Excludes modifications and foreclosure alternatives. LTVs updated using FHFA's Monthly Purchase Only House Price Index. | |||||

DOT: Vehicle Miles Driven declined 0.9% in November

by Calculated Risk on 1/23/2012 06:58:00 PM

The Department of Transportation (DOT) reported:

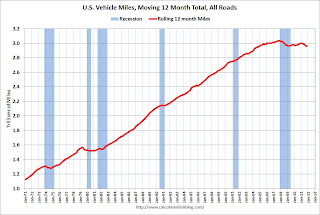

• Travel on all roads and streets changed by -0.9% (-2.1 billion vehicle miles) for November 2011 as compared with November 2010.The following graph shows the rolling 12 month total vehicle miles driven.

• Travel for the month is estimated to be 240.9 billion vehicle miles.

• Cumulative Travel for 2011 changed by -1.4% (-38.3 billion vehicle miles).

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 48 months - and still counting! And not just moving sideways ... the rolling 12 month total is still declining.

The second graph shows the year-over-year change from the same month in the previous year.

This is the ninth straight month with a year-over-year decline in miles driven, although this is the smallest decline for 2011.

This is the ninth straight month with a year-over-year decline in miles driven, although this is the smallest decline for 2011. The decline in miles driven is probably due to a combination of high gasoline prices, a sluggish economy and some changes in driving habits.

Hotels: STR on 2011 results, 2012 forecast

by Calculated Risk on 1/23/2012 03:21:00 PM

A few numbers and a forecast from STR Chairman Randy Smith: Operating margins expected to rise in 2012

2011 numbers:

Demand increased 5%.

Supply (room available) increased 0.6%.

ADR (average daily rates) increased 3.8%.

RevPAR (Revenue per available room) increased 8.2%

2012 forecast from STR:

Demand: "We are currently forecasting room demand to grow about 1.3% during 2012."

Supply: "At this time, we are forecasting a modest increase in room supply for 2012 of 0.8%, which should not impact occupancy significantly."

ADR (average daily rates): 3.8% increase

RevPAR (Revenue per available room): "With modest gains in occupancy and stronger increases in room rates, we expect RevPAR to increase about 4.3% during 2012."

STR expect hotel construction to pickup soon with more deliveries in 2013: "As we enter 2012, room supply barely is keeping pace with room closures, and it could be the beginning of 2013 before we start seeing significant growth in room supply."

Since it takes some time to build hotel rooms, it might take until 2014 or later to see "significant growth in room supply".

Click on graph for larger image.

Click on graph for larger image.

This graph shows investment in lodging as a percent of GDP. There was a sharp boom in lodging investment during the bubble, and lodging investment peaked at 0.32% of GDP in Q2 2008. However investment has fallen over 80% since then and investment is now near historic lows. With limited supply, increased demand translates to a higher occupancy rate, higher room rates and improved margins for hotels - and eventually more new construction and jobs.

It is still far from rosy for hotel owners, as Smith mentions RevPAR and occupancy are still below the pre-recession levels. And there are still plenty of distressed hotels since a number of investors bought at the top, see: California hotel foreclosures jump in 2011

Lenders foreclosed on 230 hotels in 2010, up from 138 the year before, Atlas Hospitality Group said in a report.

AP reports $25B Mortgage Settlement goes to states for review

by Calculated Risk on 1/23/2012 12:27:00 PM

From the AP: $25B US mortgage deal goes to states (ht Terry)

The AP reports that a draft settlement "has been sent to state officials for review".

The agreement could be a adopted within "weeks".

As I noted over the weekend, President Obama will probably mention several housing initiatives - including this settlement - in the SOTU address tomorrow night.

There are some details in the article.

Weekend:

• Summary for Week ending January 20th

• Schedule for Week of Jan 22nd

• FOMC Meeting Preview

Morning Greece: Euro Zone Finance Ministers discuss possible debt deal

by Calculated Risk on 1/23/2012 09:09:00 AM

The new goal is to have a deal by next Monday, January 30th, when the EU leaders meet in Brussls.

From Reuters: Euro Zone Finance Ministers to Rule on Glacial Greek Debt Talks

Euro zone finance ministers will decide on Monday what terms of a Greek debt restructuring they are ready to accept as part of a second bailout package for Athens after negotiators for private creditors said they could not improve their offer.Here are a few key dates in Europe:

...

"We will listen to the report on the negotiations, see how far they have gotten and have the ministers say what is acceptable and what is not in terms of outcome of the negotiations," one Eurogroup official said.

Once the guidance from the finance ministers, known as the Eurogroup, is clear, talks on the restructuring could be finalized later in the week.

Jan 30th: European Union leaders meet in Brussels on debt crisis.

Feb 9th: ECB holds rate meeting.

Feb 20th: Euro-area finance ministers meet in Brussels.

Feb 29th to March 1st: Italy redeems 46.5 billion euros of bonds.

March 1st and 2nd: EU leaders meet in Brussels.

March 8th: ECB holds rate meeting

March 12th: Euro-area finance ministers meet in Brussels

March 20th: Greece redeems 14.4 billion euros of bonds.

March 30th: Euro-area finance ministers meet in Copenhagen.

Late April: Proposed date for Greek general election.

April 22nd: France holds a presidential election.

Weekend:

• Summary for Week ending January 20th

• Schedule for Week of Jan 22nd

• FOMC Meeting Preview