by Calculated Risk on 1/20/2012 03:35:00 PM

Friday, January 20, 2012

Hotels: Occupancy Rate back to pre-recession levels

From HotelNewsNow.com: STR: US results for week ending 14 January

The U.S. hotel industry experienced increases in all three key performance metrics during the week of 8-14 January 2012, according to data from STR.This is the weak season for hotel occupancy, but this is a fairly strong improvement over the same period last year. Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

In year-over-year comparisons for the week, occupancy was up 4.9 percent to 52.1 percent, average daily rate increased 5.6 percent to US$102.99 and revenue per available room was up 10.8 percent to US$53.65.

The following graph shows the seasonal pattern for the hotel occupancy rate using a four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2012, yellow is for 2011, blue is "normal" and black is for 2009 - the worst year since the Great Depression for hotels).

Hotels have seen a solid start to 2012. The 4-week average of the occupancy rate is back to normal.

Looking forward, February and March are the next key period - that is when business travel usually picks up.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Earlier:

• Existing Home Sales in December: 4.61 million SAAR, 6.2 months of supply

• Existing Home Sales: Inventory and NSA Sales Graph

• Existing Home Sales graphs

Existing Home Sales: Inventory and NSA Sales Graph

by Calculated Risk on 1/20/2012 12:35:00 PM

The NAR reported inventory fell to 2.38 million in December. This is down 21.2% from December 2010, and this is about 16% below the inventory level in December 2005 (2005 was when inventory started increasing sharply). Inventory is about 7% above the level in December 2004. This decline in inventory was a significant story in 2011.

The following graph shows inventory by month since 2004. In 2004 (black line), inventory was fairly flat and declined at the end of the year. In 2005 (dark blue line), inventory kept rising all year - and that was a clear sign that the housing bubble was ending.

Click on graph for larger image.

Click on graph for larger image.

This year (dark red) inventory is at the lowest level since 2004. Inventory is still elevated - especially with the much lower sales rate - but lower inventory levels put less downward pressure on house prices (of course the level of distressed properties is still very high, and there is a significant shadow inventory).

Note that inventory usually starts increasing in February and March, and peaks in July and August. The seasonal increase in inventory will be something to watch this spring and summer.

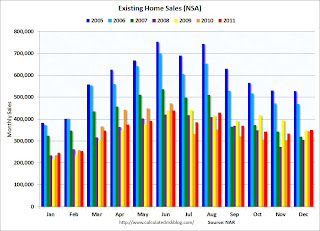

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

The red columns are for 2011.

The red columns are for 2011.

Sales NSA are slightly above December 2009 and December 2010, but sales are far below the bubble years of 2005 and 2006.

The level of sales is still elevated due to investor buying. The NAR noted:

All-cash sales accounted for 31 percent of purchases in December, up from 28 percent in November and 29 percent in December 2010. Investors account for the bulk of cash transactions.Earlier:

Investors purchased 21 percent of homes in December, up from 19 percent in November and 20 percent in December 2010.

• Existing Home Sales in December: 4.61 million SAAR, 6.2 months of supply

• Existing Home Sales graphs

Existing Home Sales in December: 4.61 million SAAR, 6.2 months of supply

by Calculated Risk on 1/20/2012 10:00:00 AM

The NAR reports: December Existing-Home Sales Show Uptrend

The latest monthly data shows total existing-home sales rose 5.0 percent to a seasonally adjusted annual rate of 4.61 million in December from a downwardly revised 4.39 million in November, and are 3.6 percent higher than the 4.45 million-unit level in December 2010.

...

Total housing inventory at the end of December dropped 9.2 percent to 2.38 million existing homes available for sale, which represents a 6.2-month supply at the current sales pace, down from a 7.2-month supply in November.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in December 2011 (4.61 million SAAR) were 5.0% higher than last month, and were 3.6% above the December 2010 rate.

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory decreased to 2.38 million in December from 2.62 million in November. This is the lowest level of inventory since March 2005.

The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 21.2% year-over-year in December from December 2010. This is the tenth consecutive month with a YoY decrease in inventory.

Inventory decreased 21.2% year-over-year in December from December 2010. This is the tenth consecutive month with a YoY decrease in inventory.Months of supply decreased to 6.2 months in December, down from 7.2 months in November. This is still a little higher than normal.

These sales numbers were right at the Tom Lawler's estimate of 4.64 million.

More on Greek Debt Deal

by Calculated Risk on 1/20/2012 09:01:00 AM

Landon Thomas at the NY Times DealBook has some details: Greece Inches Toward a Deal With Its Bondholders

[A] compromise seems to be at hand, with the Greeks close to locking in an interest rate just below 4 percent on the new bonds, according to officials involved in the negotiations. ... In a concession to creditors, the coupon is expected to escalate beyond 4 percent over time, linked to the growth of the Greek economy.And from the AthensNews: Debt swap talks to continue in the evening

Assuming all goes according to plan, investors would be offered the opportunity to exchange their old bonds for new ones carrying the agreed-upon terms in early to mid-February.

Bankers say that the creditors believe 50 to 60 percent of private sector bond holders might accept the proposal ... The challenge for Greece and the creditor group is to persuade investors on the fence to join in the deal in order to reach a figure of about 75 percent.

With a 75 percent participation rate, Greece could well be in a position to take advantage of the collective-action clauses that are set to be attached to the Greek law bonds, forcing the terms of the agreement on all bondholders.

The government will continue debt swap negotiations with private sector bondholders at around 7.30pm, Finance Minister Evangelos Venizelos said after concluding a first round of talks with Institute of International Finance (IIF) chief Charles Dallara.

...

Investors have also bridled at the government’s threat to enforce losses if not enough bondholders sign up to the deal.

Thursday, January 19, 2012

Europe Update: Greek Debt Deal Talks continue Friday

by Calculated Risk on 1/19/2012 10:35:00 PM

It sounds like they need a deal in the next few days.

From Reuters: Greece, Creditors Move Closer to Deal in Race Against Time

Greece and its private bondholders resume debt swap talks on Friday amid signs they are inching closer to a long-awaited deal ... A large chunk of the bond swap must be agreed by noon on Friday and formalized before Monday's meeting of euro zone finance ministers, [Finance Minister Evangelos Venizelos] has said.Earlier:

Adding to the pressure, officials from the "troika" of foreign lenders are due to begin meetings with the Greek government on Friday to discuss reforms and plans to finalize that bailout package.

"Now is the crucial moment in the final battle for the debt swap and the crucial moment in the final and definitive battle for the new bailout," Venizelos told parliament. "Now, now! Now is the time to negotiate for the sake of the country."

• Housing Starts declined in December

• Housing: Record Low Total Completions in 2011

• Weekly Initial Unemployment Claims decline to 352,000

• Key Measures of Inflation moderate in December

• Philly Fed: "Regional manufacturing activity continued to expand at a moderate pace in January"

Lawler: Housing Forecast for 2012

by Calculated Risk on 1/19/2012 05:26:00 PM

From economist Tom Lawler:

At the beginning of 2011, the “consensus” forecast for total housing starts was in the 690,000 to 700,000 range, with most analysts looking for an increase in both Single Family (SF) and Multifamily (MF) starts. Early last year one well-respected analysts who regularly surveys SF builders said that on average builders planned to increase SF starts by 15-20% in 2011. As I noted at the time, however, such an increase seemed highly unlikely given new and existing inventories, distressed sales, and pricing relative to where builders were willing to sell homes. It turned out, of course, that new home sales in the early months of last year were “quite disappointing” in aggregate, and builders in aggregate quickly changed their “plans.”

MF starts, in contrast, exceeded “consensus” forecasts, as the combination of very low completion rates (completions lag starts considerably), a moderate rebound in household growth, and a shift toward more renters than buyers (both voluntary and involuntary) resulted in a sharp reduction in apartment rental vacancy rates, as well as rising rents.

While the labor market has shown some signs of improving, household growth is highly likely to be faster in 2012 than 2011, active government intervention has pushed mortgage rates to yet new lows (AND with a record low “handle”), new and existing home inventories are down significantly from a year ago, last year’s subdued housing production helped further reduce the “excess” supply of housing, and last year’s SF activity was still depressed by the earlier and ill-conceived home buyer tax credits, this year’s “consensus” forecast for housing starts in 2012 appears to be lower than last year’s forecast for 2011 – especially on the SF side!

Quite frankly, that doesn’t seem to make a lot of sense to me.

So ... just like a year ago I thought the consensus forecast for housing starts was too high, this year I believe it is too low.

Right now, my “best guess” for housing starts, new SF home sales, existing home sales, and housing completions, would be as follows.

| Housing Starts and Home Sales (000s) | ||||||||

|---|---|---|---|---|---|---|---|---|

| Housing Starts | Single Family | Multifamily (2+) | ||||||

| Total | Built for Sale | SF | Built for Sale | MF | Built for Sale | New SF Home Sales | Existing Home Sales | |

| 2010 | 587 | 321 | 471 | 306 | 116 | 15 | 323 | 4,182 |

| 2011 | 607 | 315 | 429 | 295 | 178 | 20 | 305 | 4,272 |

| 2012(F) | 740 | 385 | 515 | 360 | 225 | 25 | 365 | 4,550 |

Note: My 2010 existing home sales numbers is the sum of the NAR’s NOT SEASONALLY ADJUSTED sales figures from its re-benchmarking release. In the past the NAR’s annual number always “footed” to the sum of the NSA numbers, but that was not the case when it released its benchmark revisions.

And for completions in 2012:

| Housing Completions (000s) | ||||||||

|---|---|---|---|---|---|---|---|---|

| Housing Completions | Single Family | Multifamily (2+) | ||||||

| Total | Built for Sale | SF | Built for Sale | MF | Built for Sale | Mfg. Housing Placements | Total | |

| 2010 | 652 | 362 | 496 | 331 | 155 | 31 | 50 | 702 |

| 2011 | 584 | 309 | 445 | 294 | 139 | 15 | 46 | 630 |

| 2012(F) | 635 | 359 | 470 | 340 | 165 | 19 | 60 | 695 |

CR Note: The following table shows several forecasts for 2012:

| Some Housing Forecasts for 2012 (000s) | |||

|---|---|---|---|

| New Home Sales | Single Family Starts | Total Starts | |

| Merrill Lynch | 330 | 713 | |

| Fannie Mae | 336 | 473 | 704 |

| Wells Fargo | 350 | 457 | 690 |

| John Burns | 359 | 717 | |

| NAHB | 360 | 501 | 709 |

| Tom Lawler | 365 | 515 | 740 |

| Moody's | 530 | 687 | |

| 2011 Actual | 302 | 431 | 609 |

CR Note: table updated on Feb 16, 2012 (Merrill's actual forecast added)

Key Measures of Inflation moderate in December

by Calculated Risk on 1/19/2012 03:08:00 PM

Earlier today the BLS reported:

The Consumer Price Index for All Urban Consumers (CPI-U) was unchanged in December on a seasonally adjusted basis ... The index for all items less food and energy increased 0.1 percent in December after rising 0.2 percent in November.The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.9% annualized rate) in December. The 16% trimmed-mean Consumer Price Index increased 0.1% (1.5% annualized rate) during the month.Note: The Cleveland Fed has the median CPI details for December here.

...

The CPI less food and energy increased 0.1% (1.8% annualized rate) on a seasonally adjusted basis.

Over the last 12 months, the median CPI rose 2.3%, the trimmed-mean CPI rose 2.5%, the CPI rose 3.0%, and the CPI less food and energy rose 2.2%.

On a monthly basis, the rate of increase is mostly below the Fed's target (Median is above, trimmed-mean and core are below).

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.3%, the trimmed-mean CPI rose 2.5%, and core CPI rose 2.2%. Core PCE is for November and increased 1.7% year-over-year. On a monthly basis, the median Consumer Price Index increased 2.9% at an annualized rate, the 16% trimmed-mean Consumer Price Index increased 1.5% annualized, and core CPI increased 1.8% annualized.

These measures show inflation has moderated.

Housing: Record Low Total Completions in 2011

by Calculated Risk on 1/19/2012 12:22:00 PM

A few key points for 2011:

• There were a record low number of total completions.

• There were a record low number of single family completions.

• There were a record low number of housing units added to the housing stock, and this suggests the excess vacant inventory declined significantly.

• Multifamily starts were up 60%. This will probably increase further in 2012.

• Single family starts were down 9% to a new record low. This looks to rebound in 2012.

Multifamily starts were up 60% in 2011 over 2010 - from 104,300 in 2010 to 167,400 in 2011. This will probably increase further in 2012 since 167 thousand is still a fairly low level of starts. Single family starts were down 9% in 2011 to 428,600. This is the lowest level of single family starts since the Census Bureau started tracking starts in 1959!

Since it typically takes over a year to complete a multifamily building, and since multifamily starts were are record lows in 2009 (and close in 2010), there were a near record low number of multifamily completions in 2011.

The following graph shows the lag between multi-family starts and completions using a 12 month rolling total. The blue line is for multifamily starts and the red line is for multifamily completions.

Click on graph for larger image.

Click on graph for larger image.

The rolling 12 month total for starts (blue line) increased all year. Multifamily starts were at 167.4 thousand units in 2011.

Completions (red line) appear to have bottomed. This is probably because builders rushed some projects to completion because of the strong demand for rental units. Multifamily completions were at 130.5 thousand in 2011, just above the record low of 127.1 thousand in 1993.

Total completions were at a record low in 2011 (as were single family completions), and the U.S. added the fewest net housing units to the housing stock since the Census Bureau started tracking completions in the '60s.

Below is a table of net housing units added to the housing stock since 1990. Note: Demolitions / scrappage estimated.

This means that the overhang of excess inventory probably declined significantly in 2011.

| Housing Units added to Stock (000s) | ||||||

|---|---|---|---|---|---|---|

| 1 to 4 Units | 5+ Units | Manufactured Homes | Sub-Total | Demolitions / Scrappage | Total added to Stock | |

| 1990 | 1010.8 | 297.3 | 188.3 | 1496.4 | 200 | 1296.4 |

| 1991 | 874.4 | 216.6 | 170.9 | 1261.9 | 200 | 1061.9 |

| 1992 | 999.7 | 158 | 210.5 | 1368.2 | 200 | 1168.2 |

| 1993 | 1065.7 | 127.1 | 254.3 | 1447.1 | 200 | 1247.1 |

| 1994 | 1192.1 | 154.9 | 303.9 | 1650.9 | 200 | 1450.9 |

| 1995 | 1100.2 | 212.4 | 339.9 | 1652.5 | 200 | 1452.5 |

| 1996 | 1161.6 | 251.3 | 363.3 | 1776.2 | 200 | 1576.2 |

| 1997 | 1153.4 | 247.1 | 353.7 | 1754.2 | 200 | 1554.2 |

| 1998 | 1200.3 | 273.9 | 373.1 | 1847.3 | 200 | 1647.3 |

| 1999 | 1305.6 | 299.3 | 348.1 | 1953 | 200 | 1753 |

| 2000 | 1269.1 | 304.7 | 250.4 | 1824.2 | 200 | 1624.2 |

| 2001 | 1289.8 | 281 | 193.1 | 1763.9 | 200 | 1563.9 |

| 2002 | 1360.1 | 288.2 | 168.5 | 1816.8 | 200 | 1616.8 |

| 2003 | 1417.8 | 260.8 | 130.8 | 1809.4 | 200 | 1609.4 |

| 2004 | 1555 | 286.9 | 130.7 | 1972.6 | 200 | 1772.6 |

| 2005 | 1673.4 | 258 | 146.8 | 2078.2 | 200 | 1878.2 |

| 2006 | 1695.3 | 284.2 | 117.3 | 2096.8 | 200 | 1896.8 |

| 2007 | 1249.8 | 253 | 95.7 | 1598.5 | 200 | 1398.5 |

| 2008 | 842.5 | 277.2 | 81.9 | 1201.6 | 200 | 1001.6 |

| 2009 | 534.6 | 259.8 | 49.8 | 844.2 | 150 | 694.2 |

| 2010 | 505.2 | 146.5 | 50 | 701.7 | 150 | 551.7 |

| 2011 | 453.5 | 130.5 | 46 | 630 | 150 | 480 |

Philly Fed: "Regional manufacturing activity continued to expand at a moderate pace in January"

by Calculated Risk on 1/19/2012 10:10:00 AM

From the Philly Fed: January 2012 Business Outlook Survey

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, edged up slightly from a revised reading of 6.8 in December to 7.3 in January. ... The new orders index remained positive for the fourth consecutive month but declined from a revised reading of 10.7 in December to 6.9 this month.This indicates expansion in January, at a slower pace than in December, but below the consensus forecast of +11.0.

...

The current employment index has now been positive for five consecutive months

but was virtually unchanged from last month’s reading. The percentage of firms

reporting an increase in employment (21 percent) was higher than the percentage

reporting a decline (10 percent). Firms reporting a longer workweek (23 percent) only narrowly outnumbered those reporting a shorter one (18 percent).

...

The future general activity index increased from a revised reading of 40 in December to 49 this month. The index has increased for five consecutive months and is now at its highest reading in 10 months.

The six month outlook improved again, and employment increased (number of employees was at 11.6, up slightly from 11.5 last month, and the average workweek was at 5.0, up from 2.8).

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through January. The ISM and total Fed surveys are through December.

The average of the Empire State and Philly Fed surveys increased again in January, and is at the highest level since early 2011.

Earlier:

• Weekly Initial Unemployment Claims decline to 352,000

• Housing Starts decline in December

Housing Starts decline in December

by Calculated Risk on 1/19/2012 08:55:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in December were at a seasonally adjusted annual rate of 657,000. This is 4.1 percent below the revised November estimate of 685,000, but is 24.9 percent (±18.3%) above the December 2010 rate of 526,000.

Single-family housing starts in December were at a rate of 470,000; this is 4.4 percent above the revised November figure of 450,000. The December rate for units in buildings with five units or more was 164,000.

An estimated 606,900 housing units were started in 2011. This is 3.4 percent above the 2010 figure of 586,900.

Building Permits:

Privately-owned housing units authorized by building permits in December were at a seasonally adjusted annual rate of 679,000. This is 0.1 percent below the revised November rate of 680,000, but is 7.8 percent above the December 2010 estimate of 630,000.

Single-family authorizations in December were at a rate of 444,000; this is 1.8 percent above the revised November figure of 436,000. Authorizations of units in buildings with five units or more were at a rate of 209,000 in December.

Click on graph for larger image.

Click on graph for larger image.Total housing starts were at 657 thousand (SAAR) in December, down 4.1% from the November rate of 685 thousand (SAAR). The decline in December was related to the volatile multifamily sector. Most of the increase this year has been for multi-family starts, but single family starts have been increasing recently too.

Single-family starts increased 4.4% to 470 thousand in December - the highest level in 2011, and the highest since the expiration of the tax credit.

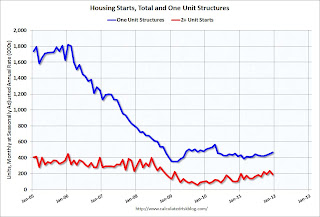

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing a little lately, but have mostly moved sideways for about two years and a half years..

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing a little lately, but have mostly moved sideways for about two years and a half years..Multi-family starts increased in 2011 - although from a very low level. Single family starts appear to be increasing lately, but are still mostly "moving sideways".

This was below expectations of 680 thousand starts in December. I'll have more on housing starts and completions later.